YATEC (MOEX:YAKG) - THE POTENTIAL UNICORN AT THE LNG MARKETI`m always on the lookout for unicorn companies that can have significant capitalization growth. I`m particularly interested in the oil and gas sector, as it is currently undergoing a dramatic transition from oil to liquefied natural gas. Observing all the projects being implemented for the LNG, I found a company that is located in a rather interesting place relative to the key sales markets - Asian markets.

YATEC – is a leading Russian independent gas company that operating in the Republic of Sakha (Yakutia), Russian Federation.

YATEC engages in the exploration, extraction, processing, and sale of natural gas and gas condensate. Its products include stable gas condensate, heavy heating oil, gasoline, and diesel fuel. It also involves ingeneration and sale of electricity and heat. The company was founded in 1963 and is headquartered in Yakutsk, Russia

Currently YATEC implementing Yakutsky LNG project that is quiet similar to Novatek projects.

If we compare the dynamics of changes in the value of YATEC shares with Novatek shares, we can clearly see the correlation. YATEC is actively implementing the LNG project.

According to newsroom:

BRIEF-Russia's Yatek Increases Area Of Subsoil Use In Yakutia By 23 Times

Russia's Federal Agency for Subsoil Management Rosnedra says:

* ENERGY COMPANY YATEK WON 3 ROSNEDRA AUCTIONS AND INCREASED AREA OF SUBSOIL USE IN YAKUTIA BY 23 TIMES - ROSNEDRA

* YATEK OBTAINED RIGHT TO USE SUBSOIL IN NORTH, SOUTH AND MAYSKY BLOCKS WITH TOTAL AREA OF 43.5 THOUSAND SQUARE KM - ROSNEDRA

I suppose that its a good trigger for buying the shares. YATECs total resources with increased area of subsoil are more than 800 billion cubic meters of naatural gas.

I suppose its enough for LNG Project.

So, I`m in, buying for long.

My first target is 10x - 500 - 600 RUB/share

LNG

MNRL-LNG, Long the pair Long MNRL and short LNG. This is a correlated and co-integrated pair . We are trading the spread , exit will be median band .

Cheniere (LNG)$LNG trying to break out of its consolidation after a nice move off of their 2020 lows. Could see a move back to the $70s

Gas-LONGCompany just made some major moves and technicals looking promising. If you believe in LNG shipping this ship is on serious discount

* I would suggest you do your own research and have a deep look on balance sheet

Tell Breaks 2 BucksTELL is a LNG company that has engaged in the largest natural contract ever done. The contract has been pushed off and redated several times due COVID and market conditions. Trump is meeting Modi, this will be apart of their discussion. Driftwood project will be redated and signed this time. As India is trying to secure a great future for their Energy production. India is now the fast economic growth sector as China slows down. TELL is currently highly sought by companies for purchase. The managers are excellent and put company first so great long term success. This will go to 3 dollars very soon. Get in now. My original post of this was broken by powell speech but now its formed double bottom and has found a price agreement.

TELL - LNG Season with broken cup handleTELLURIAN LNG is poised for a come back, if not for recent oil glut with no where to store it leading to negative prices. This shows a broken cup handle as well failing to break resistance up. Watching and waiting as LNG will recover and still lower CO2 emissions and cleaner than OIL (WTI) for most countries. New super carriers awaiting back to new normal.

LNG

NYSE:DLNG

NASDAQ:GLNG

AMEX:CQP

Resistance Broken + Gap FillIn addition to the technicals... Iran has been hit harder than most countries by COVID-19 and its economy is creaking under merciless U.S. sanctions. With nowhere else to turn, the Iranian President, Hassan Rouhani has been forced to cede ground to hardliners. And these hardliners are determined to force Trump into a long and costly war.

Just last week, missiles were fired at a U.S. oil project in Iraq.

Then, earlier this week, a group of unidentified armed men, believed to be Iranian commandos, seized a Hong Kong-flagged tanker and escorted it into Iranian waters.

We’re long $LNG PT $42 short-term is conservative.

Will Natural Gas futures continue to fall? Here is my viewTable of contents:

§ 1 Chart analysis

§ 2 Fundamentals

§ 3 My plan to enter

§ 1 Chart analysis

Looking at the NG!1(LNG futures) price, it's quite easy spotting the giant downward channel that price has been moving within for a while now.

As you likely already know, if you are a conservative trader like I am you would look only to take shorts at this point at the top of the channel, but in this case, things might be a bit different...

§ 2 Fundamentals

Now although looking strictly at the chart you would of course look to take shorts on the top of the channel, however, as I have mentioned in my FLNG analysis, China and India are planning on going from Coal heating to Natural Gas heating .

With that said, as we are currently moving away from summer and I predict colder weather will hit these countries within the next month, we might see a change in direction of price in NG as demand rises. Historically we have seen up to a 100% price increase during the winter, as that is when we have the most demand for heating.

§ 3 My plan to enter

I will be looking to enter short if price rejects upper channel and creates a regular divergence with the RSI, and I will enter if the price closes below the 50 EMA.

I will be looking to enter long if price breaks trough the upper channel, and we are met with a hidden divergence.

Another possibility is price retracing partly downward after rejecting top channel but not reaching the bottom of the channel, in which case if we get a regular divergence close to a previous support I will be looking to go long again, or atleast exit my trade.

Hope you found this helpful and good luck with your trading, although, if you trade based on luck you are already screwed.

Have a good day everyone

China concessions, oil and IMO 2020, BoA listYesterday was not that eventful for financial markets.

As for the general background, the Chinese state media that Sino is ready to make concessions to the United States (mainly, it is about importing food from the United States) and is preparing for “personal” negotiations with the United States instead of current telephone diplomacy.

In the oil market, despite the external calm, everything is quite alarming. Theresa May convened an emergency meeting in response to Iran seizure of a British tanker in the Strait of Hormuz that have led to an increase in tension. However, the effect was limited in forcing price levels, as the markets do not want to develop a conflict.

Today we want are writing about the upcoming revolution in the oil market and the IMO 2020 standard. One of the main oil consumers are ships that burn 3 million barrels per day. So from January 1, 2020, the International Maritime Organization (IMO) tightens standards, reducing the maximum sulfur content in marine fuels (from 2.7-3% to 0.5%). Shipowners will begin to reorient their ships to such clean fuels as LNG, which could significantly reduce the oil demand.

And more about the prospects. Bank of America identified the most “overheated” markets and assets, as well as identified positions that look most threatening in case of problems or force majeure. These are US treasury bonds purchases, the US technology sector shares purchases, and purchases of investment-grade bonds. So if you have such positions you should think about whether it’s time to close them or replace.

As for our trading recommendations for today, they are unchanged. We will continue to look for opportunities for selling the dollar, buying the pound against the dollar as well as against the euro, selling oil and the Russian ruble, and also buying the Japanese yen against the dollar. As for gold, considering how high it climbed, for the time being, we will trade it with no clear preference, buying from oversold and selling from overbought zones.

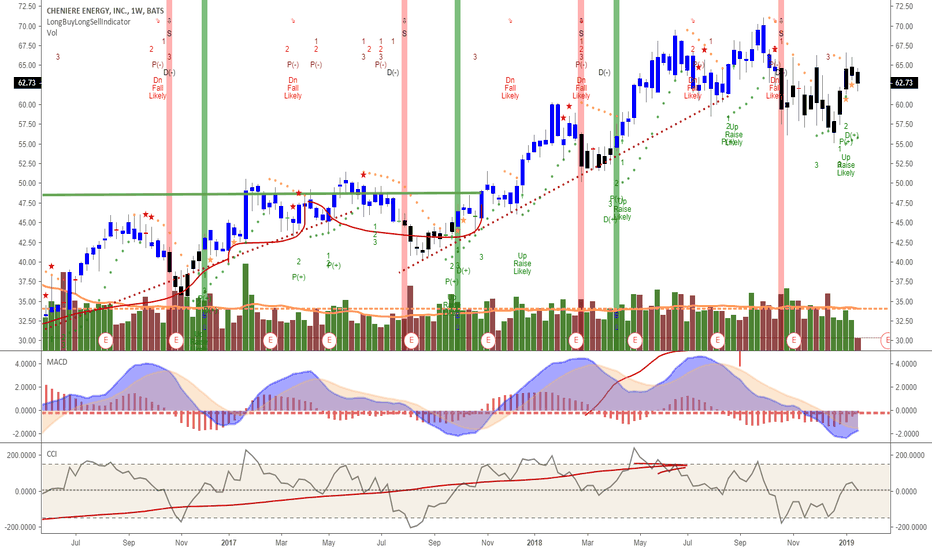

BUY LNG Asc Tri & PinBar Weekly ChartAMEX:LNG

BUY on Ascending Triangle convergence with a good squeeze, accompanied with 3 consolidated candles making a strong bullish pinbar

On longer term also, LNG has been in a rising wedge kind of formation ready to break.

Buy at 65.7, Tight SL at 60

Tellurian LNG - Good short or longTELL is showing MACD cross on 4h and near on day. LNG gas prices ready for winter spike as prices have been down. Earnings still negative for Tellurian, but LNG is much better than coal and key is west coast distributions hubs for asia for growth vs CQG/LNG (Cheniere). Delivery on larger tankers also helping lower cost. $10 entry with another half as lower limit.

Let me know your energy thoughts. Anyone up on LENR investments to look at?

Post a like @Pokethebear (I'm not supposed to be here). Back to my real work at batman.

LNG winter fuel use time: MACD and CCI entry signalsOn weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73.

Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2.

Nuclear and solar are only better ones and solar equipment costs not net zero CO2. Nuclear has proven solid long term CO2 near zero source (add CO2 output to make plant, deliver fuel).

Conoco Phillips cranking oil and gas - 1M chartCOP riding the cheap energy supply of LNG with technology and gas sales (LNG, CNG).

Looks like good buy based on trend and MACD for next year for those looking for safe haven. Dividend could be 4x higher. 1.5% Dividend

LNG DLNG SHI NEXT TELL CLNE

LNG expands to 600 x its volume to make natural gas, so as compressed liquid cheap to transport provided storage insulation, most good for 6-8 mo.

LNG offers 30% reduction in CO2 over coal and oil energy fuel sources, so developing countries will be using for forseeable decade until solar, wind, EV, hydro, wavepower are utilized.

EU will be sourcing more LNG per recent trade discussions. Safe from US-CH. China just signed agreement with QATAR Gas and another buy if it goes IPO. QATAR wanted

to be more public since 2014, but haven't seen it.