The Bullish Counter-Strike: Can EURUSD Break the Shackles Hello everyone,

On the H1 timeframe, the key focus right now is not the volatility seen in the previous sessions, but how EURUSD is reacting after a strong rejection from the lower support zone and its subsequent push into a cluster of intermediate supply levels.

Structurally, the market has transitioned from a sharp impulsive decline into a potential trend reversal phase, marked by a V-shaped recovery off the 1.1670 lows. Currently, price is consolidating just below the 1.1730 mark, attempting to establish a higher low. The most recent candle price action shows a consolidation phase where buyers are absorbing the remaining sell-side pressure before attempting the next leg higher.

Following the aggressive bounce from the primary Support Zone, EURUSD is now rotating toward the first major hurdle around the 1.1742–1.1754 range. This area is technically important: it represents a prior breakdown point where the previous bearish momentum accelerated. The current price action suggests that the bulls are in control of the short-term narrative, but they face a series of "step-like" resistance zones that must be reclaimed to confirm a structural shift.

From a price action perspective, we are observing a classic accumulation pattern. The move higher appears impulsive, while the minor pullbacks are corrective and shallow, which is a hallmark of budding bullish strength. As long as price holds above the newly formed local support at 1.1723, the immediate bias remains skewed toward a breakout.

The projected path on the chart reflects this logic:

- A successful retest of the 1.1723–1.1730 level to confirm a solid base.

- An impulsive breakout through the 1.1750 resistance tier.

- A technical rally toward the primary Resistance Zone near the 1.1790–1.1800 psychological level.

Only a clean breakdown and acceptance back below the 1.1710 support zone would invalidate this recovery scenario and suggest that the bearish trend is resuming. Conversely, a reclaim of the 1.1760 level would be the first definitive signal that the mid-term bearish pressure has faded and a larger recovery is underway.

Until the breakout through the upper resistance tiers occurs, EURUSD is in a rebalancing phase. Patience around these intermediate supply zones remains critical to avoid being caught in a range-bound trap.

Wishing you all effective and disciplined trading.

LONG

Mid-Pullback or Momentum Reset? BTC Holds a Critical Bullish Market Context & Structure

Bitcoin remains in a well-defined bullish market structure following a strong impulsive expansion from the prior accumulation phase. The sequence of higher highs and higher lows is still intact, confirming that the broader trend remains constructive despite recent volatility.

After printing a local high near the upper resistance zone, price has transitioned into a corrective phase. This pullback is occurring within structure, not as a reversal signal. Current price action reflects short-term distribution and profit-taking rather than aggressive selling pressure.

Technical Confluence

The recent sell-off failed to break the most critical higher low, indicating that buyers are still defending key structural levels. Price is currently consolidating between a well-defined support zone and overhead resistance, forming a mid-range equilibrium typical after a strong impulse leg.

This consolidation sits above the previous breakout area, suggesting the market is rebalancing before the next directional move. As long as price holds above the structural support zone, the bullish framework remains valid.

Resistance: 94,200 – 94,800 (distribution / rejection zone)

Support:

92,200 – 92,600 (structural demand)

90,400 (major invalidation level)

Scenarios

➡️ Primary Scenario:

Price holds above the 92.2k–92.6k support zone and forms a higher low. A bullish reaction from this area opens the path for continuation toward the 94.8k resistance, with potential extension into new highs if acceptance occurs above supply.

⚠️ Risk Scenario:

A clean breakdown and acceptance below the support zone would invalidate the immediate bullish continuation. In that case, BTC may enter a deeper corrective phase toward the 90.4k level before any meaningful upside attempt resumes.

AUDUSD Will Go Up From Support! Long!

Take a look at our analysis for AUDUSD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 0.668.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 0.670 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD Defends Demand — Is a Bullish Reversal Setting Up?EURUSD on H1 has been trading under sustained bearish pressure, forming a clear descending trendline that has capped price action over the past sessions. Lower highs remain intact, confirming that sellers are still in control of the broader short-term structure.

However, the recent sell-off has now pushed price into a well-defined support zone around 1.1665–1.1680, where downside momentum has started to slow. The sharp reaction from this area suggests active buyer participation and hints at a potential short-term corrective rebound rather than immediate continuation lower.

At the moment, price is consolidating just above this support zone, while still trading below the descending trendline. This creates a compression scenario: buyers are defending demand from below, while sellers remain positioned at trendline resistance.

This is a key decision area. As long as the support zone holds, the market has room to attempt a recovery toward the upper structure. A failure here, however, would reopen downside risk.

Bullish scenario: If price holds above the 1.1665–1.1680 support zone and breaks above the descending trendline with acceptance, a corrective move toward 1.1720, followed by 1.1760–1.1770, becomes likely.

Bearish scenario: A confirmed breakdown and close below the support zone would invalidate the bullish recovery idea and expose further downside toward 1.1630 and potentially 1.1600.

For now, patience is essential. The market is sitting at a high-impact support level, and the next high-probability trade will come from confirmation, not anticipation.

EURUSD at Major Support — Hold for Reversal or BreakPrice is testing a well-defined support zone around 1.1670–1.1680, where selling pressure has slowed after an extended bearish move. This area represents a critical decision point for short-term direction.

A strong hold above support could trigger a corrective recovery toward 1.1700–1.1725, with further upside potential toward 1.1740–1.1780 if buyers regain momentum and reclaim the moving average.

However, a clean break and close below 1.1670 would confirm bearish continuation, exposing downside liquidity toward 1.1650 → 1.1630, with extension risk toward 1.1600. Price reaction at this support will define the next directional move.

Are Lower Highs Setting Up a Deeper Sell-Off?Hello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Ethereum has transitioned from a previously bullish environment into a clear bearish market structure, defined by a sequence of lower highs (LH) and lower lows (LL). After failing to sustain price above the recent swing highs, sellers stepped in aggressively, forcing a breakdown through multiple structure levels.

The sharp impulsive move lower confirms bearish momentum, while subsequent pullbacks have remained corrective, consistently forming lower highs beneath prior support now acting as resistance. This price behavior reflects a market that has shifted control decisively to sellers.

Key Supply / Structure Resistance:

The 3,130–3,150 region now acts as a critical supply zone, where previous support was broken and sellers have defended retracement attempts. This area is also aligned with the EMA, reinforcing bearish pressure.

Intermediate Resistance:

The 3,090–3,100 level represents a minor structure cap. Any pullback into this zone that fails would likely form another lower high.

Major Downside Demand / Liquidity Target:

The 3,020 area is the next significant demand zone, aligning with projected structure continuation and liquidity resting below recent lows.

Currently, ETH is trading after printing a fresh lower low, placing the market in continuation mode rather than exhaustion. Price is attempting a minor bounce, but as long as retracements remain capped below supply, this move should be treated as bearish corrective price action.

Momentum remains with sellers unless structure is reclaimed.

As long as Ethereum remains below the 3,130–3,150 supply zone, the bearish structure stays valid. Any pullback that stalls below this area is likely to form a lower high, opening the door for continuation toward the 3,020 demand zone and potentially lower if sell-side momentum accelerates.

A structural invalidation would only occur if price reclaims and holds above the broken resistance with strong bullish acceptance. Until then, rallies should be viewed as sell-side corrective moves, not reversals.

For now, the trend is down and controlled by sellers.

GBP/USD BULLS ARE GAINING STRENGTH|LONG

GBP/USD SIGNAL

Trade Direction: long

Entry Level: 1.341

Target Level: 1.344

Stop Loss: 1.339

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bitcoin Remains Under Pressure — Sellers Still in Full ControlPrice is trending firmly below the descending trendline and the EMA50, confirming a sustained bearish market structure with lower highs and lower lows intact. Recent pullbacks are being sold aggressively, showing no meaningful sign of demand stepping in.

A minor bounce toward the 90,800–91,000 area is likely to act as a corrective retest of structure rather than a reversal, where sellers may re-enter positions.

As long as price remains below the trendline, downside continuation is favored, exposing key liquidity targets at 89,300, followed by 88,800–88,400. Only a strong reclaim and close above 91,300 would invalidate the bearish scenario and signal a shift in short-term momentum.

Reversal Opportunity or Bearish Continuation Trap?EURUSD on the H1 timeframe continues to trade under sustained bearish pressure, with price respecting a well-defined descending trendline that has guided the market lower over recent sessions. The broader structure remains corrective to bearish, as successive lower highs and lower lows confirm that sellers are still in control of momentum.

Price is now pressing directly into a key support area where the descending trendline intersects horizontal structure. This zone represents a critical inflection point, as it has previously acted as a reaction base during earlier consolidation. The recent break and hold below this support highlights weakening buyer commitment and signals that the market is testing whether this level will flip into resistance.

From a bullish perspective, a recovery scenario remains possible but requires confirmation. If price is able to reclaim the broken support and regain acceptance above the trendline, the current move could be interpreted as a false break or liquidity sweep. In that case, a corrective rebound toward higher resistance zones would be favored, opening the path for a short-term reversal scenario as outlined by the first upside projection.

However, failure to reclaim the trendline keeps the bearish continuation scenario firmly in play. As long as price remains capped below descending resistance, any pullback is likely to be corrective and vulnerable to renewed selling pressure. In this case, downside continuation toward lower liquidity pools becomes the higher-probability outcome, aligning with the second projected path that extends deeper into bearish territory.

Overall, EURUSD is at a structural decision point where confirmation matters more than anticipation. The market is currently positioned between a potential false-break recovery and a continuation of the prevailing downtrend, making price acceptance around this support–trendline confluence the key driver for the next impulsive move.

Ethereum Breaks Structure — Is This the Start of a Deeper SellPrice has broken below the key support around 3,120–3,130, confirming a short-term bearish shift after failing to hold above the moving average cluster. Momentum is now favoring sellers as prior support turns into resistance.

A pullback toward 3,130–3,160 is likely to be corrective and may offer selling pressure if price fails to reclaim structure.

Sustained weakness below 3,100 opens the path toward 3,060–3,040, with a deeper liquidity target near 2,980–2,920. A strong reclaim and close back above 3,180 would invalidate the bearish setup and signal stabilization.

Bitcoin Is Building a Base — Accumulation Before the Next Push Price is consolidating above the key support zone around 89,800–90,000, showing clear signs of selling pressure absorption after the recent sell-off. Volume behavior suggests potential accumulation rather than aggressive distribution.

As long as price holds above 89,800, the bullish scenario remains favored. A clean break and acceptance above 91,200–91,500 would confirm upside momentum, opening the path toward 93,000, followed by the major target near 94,700–95,000.

Only a decisive breakdown below 89,800 would invalidate the bullish setup. For now, buyers appear to be positioning for the next expansion leg to the upside.

USD/JPY(20260109)Today's AnalysisMarket News:

On Tuesday, both the Dow Jones Industrial Average and the Dow Jones Transportation Average hit record closing highs, marking the first buy signal from Dow Theory in over a year.

Technical strategists believe this confirms the bull market that began in late 2022 remains firmly established, even as some previously high-performing AI-related stocks have recently faced pressure.

The Dow Jones Industrial Average's last record closing high was on January 5th, while the Dow Jones Transportation Average's record high was even further back. Dow Jones market data shows that the index's last record closing high was on November 25th, 2024.

Technical Analysis:

Today's Buy/Sell Threshold:

156.79

Support and Resistance Levels:

157.40

157.17

157.02

156.55

156.41

156.18

Trading Strategy:

If the price breaks above 157.02, consider buying with a first target price of 157.1.

If the price breaks below 156.79, consider selling with a first target price of 156.55.

GBPUSD: Growth & Bullish Forecast

Balance of buyers and sellers on the GBPUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURJPY: Great Trading Opportunity

EURJPY

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long EURJPY

Entry Point - 182.73

Stop Loss - 182.60

Take Profit - 182.95

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD Will Go Higher From Support! Buy!

Here is our detailed technical review for NZDUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.574.

The above observations make me that the market will inevitably achieve 0.578 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

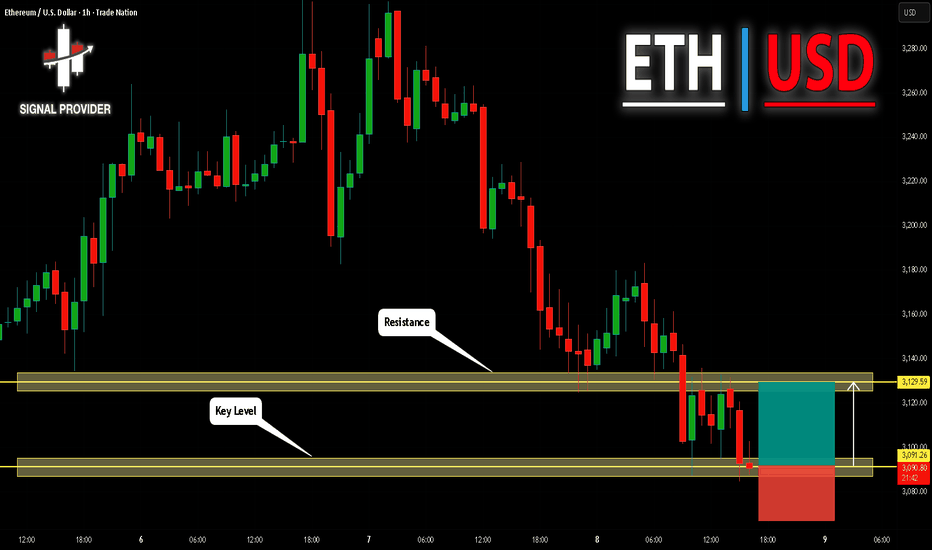

ETHUSD Will Go Up From Support! Long!

Take a look at our analysis for ETHUSD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 3,091.26.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,129.59 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

NZDUSD: Bullish Continuation is Expected! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the NZDUSD pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Long Trade with Entry/SL/TP

EURUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry - 1.1676

Sl - 1.1671

Tp - 1.1685

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD Expected Growth! BUY!

My dear subscribers,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 4426.8 pivot level.

Bias - Bullish

My Stop Loss - 4420.0

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4441.8

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD: Fake Breakdown from Support Signals Potential ReversalHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded inside a clearly defined range, where price moved sideways and showed equilibrium between buyers and sellers. From this range, price attempted a bullish breakout, but the move resulted in a fake breakout into the upper area, signaling strong selling pressure inside the Resistance Zone around 1.1750–1.1760. This zone was tested multiple times, and each attempt to hold above it failed, confirming it as a strong supply area.

Currently, price is trading below the key resistance and remains structurally bearish. The highlighted move suggests a potential corrective pullback from support toward the descending channel resistance, which aligns closely with the horizontal resistance zone around 1.1750.

My Scenario & Strategy

My primary scenario: as long as EURUSD holds above the 1.1680 Support Zone and no strong bearish acceptance occurs below it, the bullish bias is favored in the short term. I expect buyers to push price higher toward the descending channel resistance and horizontal Resistance Zone around 1.1740, which acts as TP1. A clean breakout and acceptance above the 1.1750 Resistance Zone would confirm stronger bullish continuation and open the door for a move toward higher highs.

However, a decisive breakdown and close below the support zone would invalidate the long scenario and signal renewed bearish continuation. For now, the market is at a key reaction area, and the long setup depends on buyers continuing to defend support.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTCUSD Technical Analysis! BUY!

My dear subscribers,

BTCUSD looks like it will make a good move, and here are the details:

The market is trading on 87461 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 87892

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF Massive Long! BUY!

My dear friends,

My technical analysis for EURCHF is below:

The market is trading on 0.9283 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.9328

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.16600 zone, EURUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.16600 support and resistance area.

Trade safe, Joe.