LONG

XAUUSD Buyers Step In at Key Level - Momentum StabilizesHello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a broader bullish structure after a strong impulsive rally from lower levels. Earlier, price moved inside a consolidation range, signaling accumulation before breaking out to the upside and confirming renewed buyer control. This breakout initiated a sharp bullish leg, forming a sequence of higher highs and higher lows. Following the impulsive move, XAUUSD reached the Seller Zone around the 4,400 Resistance Level, where strong selling pressure appeared. Price dropped aggressively from this area, confirming supply dominance at higher levels. After the drop, gold broke below the resistance, then performed a test and retest of the same zone, which now acts as resistance. This behavior confirms a short-term structural shift while the broader bullish trend remains intact. Currently, price is reacting around the Buyer Zone near 4,310–4,320, which aligns with a key Support Level and a previous breakout area. This zone has already shown a clear reaction, with price turning around and forming a higher low above the rising Trend Line. The recent move into support appears corrective rather than impulsive, suggesting a pause within the larger bullish structure rather than a full reversal. My scenario: as long as XAUUSD holds above the Buyer Zone and respects the rising Trend Line, the bullish structure remains valid. A strong reaction from this area could lead to a move back toward the 4,400 Resistance Level (TP1). A confirmed breakout and acceptance above resistance would signal bullish continuation. However, a decisive breakdown below the Buyer Zone would weaken the structure and signal a deeper corrective move. For now, price is at a key decision area, with buyers actively defending support while consolidation continues. Please share this idea with your friends and click Boost 🚀

Bitcoin Is Still Trapped — H1 Box Accumulation Has Not Resolved Hello everyone,

On the H1 timeframe, the key focus right now is not the recent push higher, but the fact that Bitcoin remains locked inside a clearly defined box accumulation structure. Despite several directional attempts, the market has not achieved acceptance beyond the range boundaries.

Structurally, BTC continues to rotate between the 87,100–87,300 support band and the 90,300–90,400 resistance zone. The latest advance stalled exactly near the upper half of the box around 89,100–89,200, where selling pressure has consistently appeared in previous rotations. This confirms that supply remains active before the range high, preventing a clean breakout.

Price action inside the box remains overlapping and corrective. Higher lows are forming, but they are doing so within the range, not above it. This tells us that buyers are active, yet still operating in absorption mode rather than trend-expansion mode. The market is building pressure, but has not released it.

The projected paths on the chart reflect two realistic outcomes that are fully aligned with current structure:

- A short-term rejection from the upper range, followed by a pullback toward the 88,000–88,200 area, which would represent a normal rotation inside accumulation.

- Alternatively, a continued grind higher, but only a clean break and acceptance above 90,400 would confirm that accumulation has completed and open the door for upside expansion.

As long as price remains inside the box, directional conviction is premature. This is not a trending environment; it is a liquidity-building phase, where false breaks and rotations are part of the process.

Only two things matter from here:

- Acceptance above resistance → bullish expansion.

- Acceptance below support → failed accumulation and deeper correction.

Until one of those conditions is met, Bitcoin is not breaking out. It is waiting.

Wishing you all effective and disciplined trading.

Bitcoin at the Edge: Breakout Incoming or Another Trap $89000BTCUSD H1 chart, price is currently testing a key resistance zone around 88,800 – 89,000, an area that has previously triggered multiple rejections. The recent upward move represents a recovery leg within a broader range, rather than a confirmed breakout.

As price reaches this resistance, buying momentum is clearly slowing, with smaller bullish candles and immediate selling pressure appearing at the zone. This behavior suggests that sellers are still active, and the market has not yet accepted higher prices. Without a strong H1 close above this resistance, the current move lacks technical breakout confirmation.

The more probable short-term scenario is a rejection from resistance, followed by a pullback toward nearby support levels. Initial support is located around 88,200 – 88,000, with a deeper support zone near 87,700, where buyers previously stepped in. As long as price remains capped below resistance, the market structure continues to reflect a range-bound / consolidation environment.

In summary, this is not a confirmed breakout. Bitcoin is trading at a decision area where price must either produce a clean, impulsive close above resistance to confirm continuation, or face rejection and rotate back into the range. Until that clarity appears, bias remains neutral, with focus on price reaction rather than directional anticipation.

Ethereum Near Major Resistance: Structure StrengtheningEthereum is currently trading just below a strong resistance zone around 3,050–3,070, where multiple prior rejections have occurred. Price is advancing within a clearly defined ascending price channel, indicating controlled bullish pressure rather than impulsive expansion. The recent sequence of higher lows suggests buyers are active, but the lack of strong follow-through near resistance highlights hesitation.

From a technical structure perspective, ETH is transitioning from a recovery phase into a potential range environment. The upper boundary of the rising channel aligns closely with horizontal resistance near 3,030–3,050, creating a confluence zone where profit-taking is likely. Momentum candles are slowing, and price is beginning to overlap, which typically precedes either consolidation or a corrective pullback rather than an immediate breakout.

If ETH fails to reclaim and hold above 3,050 on a clean H1/H4 close, the higher-probability scenario is a rotation back toward the mid-range, with downside targets around 3,000 → 2,970, and potentially deeper into the 2,950–2,930 support cluster. This would keep Ethereum locked in a sideways range, rather than confirming a trend continuation.

From a macro perspective, the environment remains mixed. While expectations of future rate cuts in 2026 provide medium-term support for risk assets, near-term USD stability and restrictive financial conditions continue to cap aggressive upside moves. Additionally, flows into crypto remain selective, favoring short-term rotations rather than sustained breakouts. Without a clear macro catalyst (such as dovish Fed signaling or a strong risk-on impulse), upside attempts near resistance are vulnerable to rejection.

Summary:

Ethereum is technically constructive but not in breakout conditions yet. As long as price remains below the strong resistance zone, the market should be treated as range-bound, with upside capped and pullbacks toward support remaining a valid and healthy scenario. Patience is required until either structure breaks decisively higher—or the range resolves with confirmation.

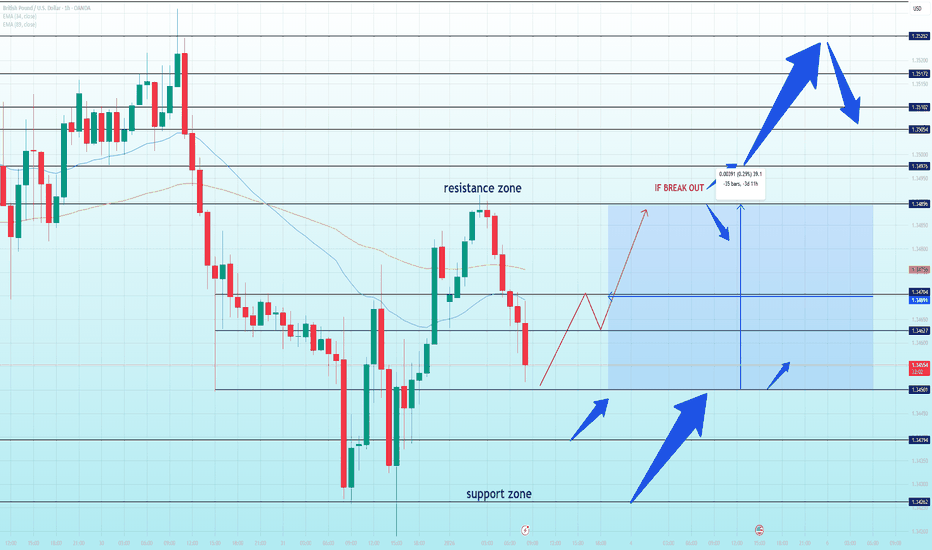

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

EURUSD Is Not Reversing — This Is a Pullback Into H1 SupportHello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish candles, but how EURUSD is reacting after rejecting from a descending resistance and pulling back into a well-defined support zone.

Structurally, the market remains capped by a descending resistance trendline, with price consistently forming lower highs beneath it. The most recent push higher stalled precisely at the EMA cluster and the resistance zone, where sellers stepped in aggressively. This rejection confirms that upside attempts are still being sold and that bullish momentum has not yet regained control.

Following that rejection, EURUSD is now rotating lower toward the 1.1720–1.1730 support zone, which has already acted as a strong reaction base in previous sessions. This area is technically important: it marks prior demand and has previously absorbed selling pressure before producing sharp rebounds. The current move lower appears orderly and corrective, rather than an impulsive breakdown.

From a price action perspective, there is no confirmed trend reversal at this stage. The decline into support fits well with a pullback within a broader corrective structure, not a fresh bearish expansion. As long as price holds above the support zone, downside follow-through remains limited.

The projected path on the chart reflects this logic:

A test or sweep of the 1.1720 support zone to check demand

A technical rebound back toward the mid-range

Potential continuation higher toward the descending resistance if buyers regain strength

Only a clean breakdown and acceptance below the support zone would invalidate this pullback scenario and open the door for deeper downside. Conversely, a reclaim above the EMA cluster and descending trendline would be the first signal that bearish pressure is fading and that a larger recovery toward resistance is possible.

Until confirmation appears, EURUSD is not trending aggressively in either direction. It is rebalancing after rejection, and patience around key levels remains critical.

Wishing you all effective and disciplined trading.

EURUSD Under Structural StressHello Traders,

On the H1 timeframe, EURUSD is currently trading in a corrective-to-bearish structure after failing to hold above the previously marked resistance zone. Price was repeatedly rejected from this supply area, confirming it as an active distribution zone rather than a continuation base.

Following the rejection, price expanded lower and is now rotating toward the lower range, approaching a clearly defined support zone. The recent downside impulse shows increasing bearish pressure, suggesting that sellers remain in control in the short term.

This support zone now represents a critical decision area. If price stabilizes and holds above this level, a corrective rebound toward the prior intraday targets becomes possible. Such a move would be classified as a pullback within a broader range, not an immediate trend reversal.

However, failure to hold this support — especially with acceptance below the zone — would signal further structural weakness. In that scenario, downside continuation becomes the dominant path, invalidating any short-term bullish recovery expectations.

From a structural perspective, EURUSD is currently not offering a clean entry. Price is transitioning between resistance rejection and support testing. The next directional move will be defined by whether the market defends this support or breaks through it with conviction.

At this stage, patience is required. Let price confirm its reaction at the support zone before committing to directional bias.

Share your view below.

Ethereum at a Critical Inflection Zone, Breakout Acceptance or..Hello Traders,

Ethereum on the H1 timeframe is currently trading within a clearly defined short-term bullish structure, supported by a rising curved trendline that reflects sustained higher lows and controlled upside momentum. Price has been respecting this dynamic support while gradually pushing higher, indicating that buyers remain in control in the short term.

At the same time, price is now approaching a major horizontal resistance zone, which has previously acted as a supply area and is marked clearly on the chart. This zone represents a key decision point, where upside continuation requires strong acceptance rather than a simple liquidity sweep.

If price manages to break above this resistance and hold above it with clean structure, continuation toward higher levels becomes a valid scenario. In this case, the preferred execution is not chasing the breakout, but waiting for a pullback that successfully retests the broken level and holds above it. This confirms acceptance and offers a more favorable risk-to-reward profile.

On the other hand, failure to hold above the resistance would likely trigger a corrective rotation. A rejection from this zone could lead price back toward the rising trendline and the nearby support levels. As long as these supports hold, such a move would still be classified as a healthy pullback within a broader bullish structure rather than a trend reversal.

The bullish outlook becomes invalid if price decisively breaks below the rising structure and accepts beneath the marked support zone. That would signal a structural shift and open the door for deeper downside rotations.

At this stage, Ethereum is not at an entry point but at a decision area. Patience and confirmation are critical here. Let the market reveal whether it chooses continuation or correction before committing capital.

Share your view in the comments.

EURAUD Is Very Bullish! Buy!

Please, check our technical outlook for EURAUD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.750.

Considering the today's price action, probabilities will be high to see a movement to 1.758.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

EUR/GBP SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

The BB lower band is nearby so EUR-GBP is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 0.872.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUSD Holding Buyer Zone - Rebound Toward 1.1780 in FocusHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD is trading within a broader bullish structure after a strong upside move from the lower levels. Earlier, price advanced inside an ascending channel, confirming sustained buyer control and a sequence of higher highs and higher lows. Following this impulsive rally, EURUSD broke above a key structure level and transitioned into a consolidation phase near the highs. Currently, price is reacting around the Buyer Zone near 1.1740, which aligns with a key Support Level and a previous breakout area. This zone has already shown multiple reactions, indicating active demand. Above, the market remains capped by a descending Resistance Line and the Seller Zone around 1.1780, where selling pressure previously caused a rejection. The recent move into support appears corrective rather than impulsive, suggesting a pause within the broader bullish trend. My scenario: as long as EURUSD holds above the 1.1740 Buyer Zone, the bullish structure remains intact. A strong reaction from this area could lead to another push toward the 1.1780 Resistance Level (TP1). A confirmed breakout and acceptance above resistance would open the door for further upside continuation. However, a decisive breakdown below the buyer zone would weaken the bullish setup and signal a deeper corrective move toward lower support levels. For now, price remains at a key decision area, with buyers defending structure while consolidation continues. Please share this idea with your friends and click Boost 🚀

EURCAD Will Go Up From Support! Long!

Please, check our technical outlook for EURCAD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.609.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.624 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

GOOGLE WHERE THE MONEY IS### 🚨 GOOG Technical Analysis: Is Google Ready to Blast Off in 2026? 🚀

Hey traders! As of **January 4, 2026**, Alphabet (GOOG) sits at **$315.32** (up ~0.48% recently), fresh off a monster **65% rally in 2025** – its best year since 2009. Your TradingView chart nailed the long-term uptrend perfectly: from 2022 lows around $80-100, through a sharp 2025 dip, to new highs near $328. That green ascending trendline is pure gold, projecting toward **$400+** by 2027 if bulls stay in control.

THAT MEANS, IF YOU POSITION WELL, ARE PATIENT, FOLLOW TRENDS AND INDICATORS, and time it correctly (Which is difficult, meaning watch the numbers and indicators to time the move), you can ride the down wave, into the up wave long. AND MANY TRADES ALONG THE WAY!! This means there is a LOT of money for well placed trades.

But is this the calm before another moonshot... or a sneaky top? Let's break it down **clearly and step-by-step** – no fluff, just actionable insights to hook you in and keep you reading.

#### 1. **Current Price Snapshot** (As of Jan 4, 2026)

- **Price**: $315.32

- **Recent Range**: High ~$328 (Nov 2025), Low ~$310

- **52-Week Range**: ~$143 to $329

- **Market Mood**: Neutral sentiment, but AI hype is strong after 2025's blowout performance.

#### 2. **The Big Trend: Bullish Ascent Intact**

- **Primary Trend**: Strong uptrend since 2022 bear market bottom.

- **Key Driver**: That green ascending support line (from ~$83 in 2022) has held every major dip, including the 2025 pullback to ~$156-210.

- **Current Status**: Price hugging resistance at ~$315-322. Break above = acceleration; hold = consolidation.

- **Projection Match**: Your chart's line points to ~$380-400 by mid-2027 – aligns with optimistic analyst views if AI (Gemini, Cloud) delivers.

#### 3. **Critical Support & Resistance Levels** (Watch These Like a Hawk)

- **Immediate Resistance**: $322 (recent high) → $328-329 (all-time high)

- **Key Resistance**: $340-350 (next upside targets on breakout)

- **Immediate Support**: $310 → Green trendline (~$300 near-term)

- **Major Supports**: $262 (38.2% Fib), $220-240 (prior consolidation), $181 (deeper retrace)

- **Breakdown Risk**: Below $290-300 trendline = potential drop to $262 or lower (bear warning!).

#### 4. **Chart Patterns & Signals**

- **Overall Structure**: Series of higher highs/lows with bullish flags and V-bottom reversals (e.g., 2025 dip).

- **Recent Action**: Zigzag consolidation near highs – possible ascending triangle forming.

- **Earnings Markers**: Mostly green "E" beats in 2025 fueled rallies; watch Feb 3, 2026 report for the next catalyst.

- **Volume Note**: Low volume on recent moves – needs spike for conviction breakout.

#### 5. **Bull Case: Why GOOG Could YOLO to $400+**

- AI dominance (Gemini, Cloud growth >30%)

- Strong fundamentals: Search engagement up, massive Cloud backlog

- Analyst Consensus: Median target ~$330-340 (up 5-8% from here), some as high as $385-400

- Momentum: Best Mag7 performer in 2025 – carryover potential huge

#### 6. **Bear Case: Risks That Could Trigger a Crash Scenario**

- Heavy 2026 capex (~$114B on AI/data centers) pressuring margins

- Antitrust heat & competition (e.g., OpenAI, Bing threats)

- Valuation: ~30x forward P/E – rich if growth slows

- Technical Risk: Failure at $329 high = double-top, potential pullback to $280-300

#### 7. **Quick Trade Ideas**

- **Bullish Play**: Buy dip to green trendline (~$300-310), target $340-350. Stop below $290.

- **Bearish Play**: Short on failed breakout above $329, target $262.

- **Safe Play**: Wait for volume breakout – add alerts on TradingView!

This chart screams **uptrend with upside bias**, but respect the resistance – 2026 could be epic if AI pays off, or choppy if capex bites. What's your take: Moon or correction? Drop your thoughts or another chart – let's discuss! 📈🔥

Ghost feed may not be accurate, please only use as a projected guideline.

*(Not financial advice – DYOR, markets can moon or crater anytime.)*

NEAR - spot, long term.BINANCE:NEARUSDT.P

Throughout 2025, the coin remained within its range.

I consider exiting the range a deviation, and we will get the same deviation on the other side of the range.

Good luck with your trading! Use your risk management strategy.

The ideal entry point will be: $1.4 and $1.25.

The targets on the chart are a minimum of $3.2.

EURGBP Will Go Up! Buy!

Take a look at our analysis for EURGBP.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.870.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.874 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN BULLS WILL DOMINATE THE MARKET|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 87,599.76

Target Level: 90,106.43

Stop Loss: 85,916.50

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUSD is Nearing an Important Support!Hey Traders, in tomorrow's trading session we are monitoring EURUSD for a buying opportunity around 1.17000 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.17000 support and resistance area.

Trade safe, Joe.

BTCUSDT Long: Demand Support Intact, Next Test at $89,000Hello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish impulse, Bitcoin was trading inside a well-defined descending channel, reflecting sustained seller control. This bearish phase ended with a clear breakdown and a sharp reaction from a key pivot low, where buyers stepped in aggressively, marking an important structural shift. From this pivot point, BTC transitioned into a consolidation phase, forming a broad range, which signals balance between buyers and sellers after the impulsive move. Price respected both the upper and lower boundaries of this range multiple times, confirming it as a valid accumulation zone. Eventually, Bitcoin broke below the range briefly, but this move was quickly absorbed by buyers near the Demand Zone around 86,800, leading to a strong recovery and reclaim of structure.

Currently, BTCUSDT is trading above the rising Demand Line, having confirmed a breakout and subsequent retest. Price is gradually moving higher toward the Supply Zone near 89,000, where multiple tests and rejections have already occurred. This area represents a key resistance, with sellers actively defending it, as shown by repeated reactions and failed continuation attempts.

My scenario: as long as BTCUSDT holds above the 86,800 Demand Zone and respects the rising demand line, the bias remains bullish and corrective pullbacks are likely to attract buyers. A clean breakout and acceptance above the 89,000 Supply Zone would confirm bullish continuation and open the door for further upside. However, failure to hold demand and a breakdown below the demand line would invalidate the bullish scenario and shift focus back toward range lows. For now, price is compressing between demand and supply, and a decisive move is likely ahead. Manage your risk!

EURUSD Long: Demand at 1.1720 Sets Up a Push Toward 1.1770Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. After forming a solid pivot low, EURUSD transitioned into a bullish trend, supported by a rising trend line that guided price action higher. Following this move, the market entered a consolidation range, signaling temporary balance before the next expansion phase. Price later broke out of the range to the upside, confirming renewed buyer strength. However, upon reaching the upper Supply Zone near 1.1770–1.1780, EURUSD experienced a fake breakout, followed by rejection and increased selling pressure. This rejection highlighted active sellers defending supply. Despite this, buyers managed to push price higher again, leading to another breakout attempt above supply, though momentum remained limited.

Currently, EURUSD is pulling back from the supply area and is trading near the Demand Zone around 1.1720, which aligns with the rising demand line and prior breakout structure. This zone represents a key decision area, where buyers may attempt to defend the bullish structure.

My scenario: as long as EURUSD holds above the 1.1720 Demand Zone, the broader bullish structure remains intact, and the pullback can be considered corrective. A strong reaction from demand could lead to another test of the 1.1770 Supply Zone. However, a decisive breakdown below demand would signal a loss of bullish control and open the door for a deeper corrective move. For now, price is at a critical level, with demand acting as the key area to watch. Manage your risk!

BTCUSDT: Range Compression Signals Potential Break Above $90,100Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader consolidation after a strong bearish impulse earlier in the chart. Following the sell-off, price found a key support base around the 87,300 Support Zone, from which buyers stepped in and stabilized the market. Since then, Bitcoin has been moving inside a series of well-defined ranges, indicating compression and balance between buyers and sellers. Structurally, price is capped by a descending triangle resistance line, while at the same time respecting a rising trend line from below. This creates a tightening structure, suggesting a potential directional move ahead.

Currently, BTC is consolidating above the support zone and just below the 90,100 Resistance Zone, which has repeatedly rejected price in recent attempts. The latest pullbacks remain shallow and corrective, showing that sellers are struggling to push price back below support.

My Scenario & Strategy

My primary scenario as long as BTCUSDT holds above the 87,300 Support Zone, the structure remains constructive and biased toward a bullish resolution. A sustained hold above support could allow price to build momentum for another push toward the 90,100 Resistance Zone. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside.

However, a decisive breakdown below the support zone would invalidate the bullish scenario and shift focus toward lower levels. For now, BTC remains compressed between support and resistance, with buyers defending structure and pressure building for a potential breakout.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

Ethereum Is Not Chasing — It’s Compressing Beneath Resistance Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but how Ethereum is steadily rebuilding structure while pressing into a major resistance zone. The market is transitioning from range rotation into controlled compression, a typical pre-expansion behavior.

Structurally, ETH has respected the 2,880–2,920 support zone multiple times, producing higher reaction lows and preventing any downside follow-through. Each sell-off into this area has been absorbed, while rebounds have grown progressively stronger. This establishes a defended base rather than a distribution floor.

From a technical standpoint, price is now holding above EMA34 and EMA89, with both averages beginning to slope upward. The recent pullbacks have been shallow and orderly, indicating that buyers are maintaining positions rather than exiting. This is not impulsive buying; it is acceptance at higher prices.

Overhead, the 3,060–3,090 resistance zone remains the key obstacle. Previous approaches into this zone resulted in sharp rejections, which explains the current hesitation. However, the difference this time is structure: higher lows into resistance and tightening ranges suggest pressure building, not exhaustion.

The projected path on the chart reflects this logic:

Continued consolidation just below resistance

A brief pullback to retest dynamic support (EMA cluster)

A renewed push higher, with a clean break and acceptance above resistance opening the door toward the next upside extension

Only a decisive loss of the EMA cluster and acceptance back below 2,950 would weaken this constructive setup. Until then, ETH is not overextended. It is compressing beneath resistance, and the market is preparing for resolution rather than reversal.

Wishing you all effective and disciplined trading.