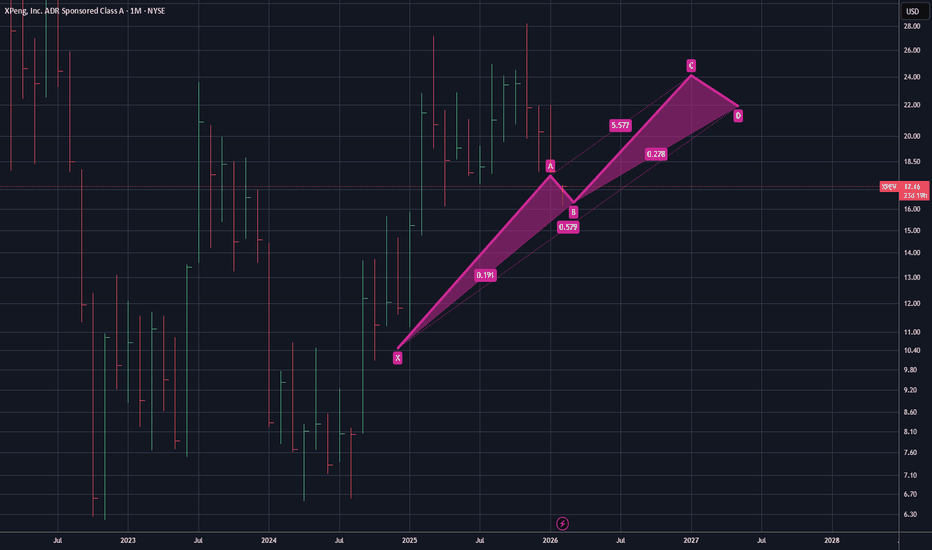

$XPEV - Next Leg Up? $24 Target by 2027XPEV's correlation seems to be bottoming out the bearish leg. I believe that with enough bullish support, the next wave up seems to be trending to $24 by the year 2027. If that is true, that sets up a decent step-in for a long. As always, none of this is investment or financial advice. Please do your own due diligence and research.

LONG

GBPAUD: Bulls Will Push Higher

The analysis of the GBPAUD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCHF Set To Grow! BUY!

My dear friends,

USDCHF looks like it will make a good move, and here are the details:

The market is trading on 0.7750 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.7781

Recommended Stop Loss - 0.7733

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

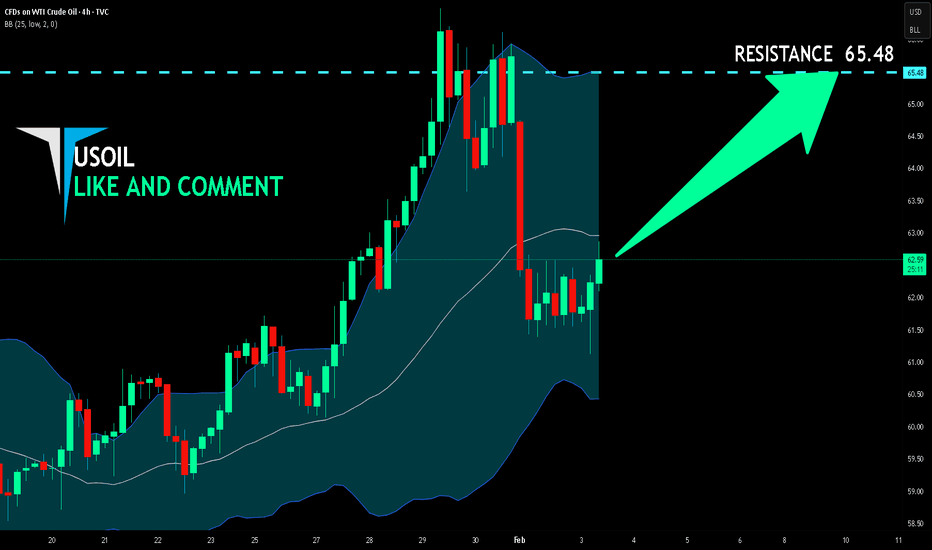

USOIL BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

Bullish trend on USOIL, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 65.48.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPUSD: Growth & Bullish Forecast

Looking at the chart of GBPUSD right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD Will Explode! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1795

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1868

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSDT Long: Breakdown, Fakeout & Potential Rebound To $79,300Hello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT was previously trading within a well-defined ascending channel, where price consistently respected rising support and resistance, printing higher highs and higher lows. This structure confirmed strong bullish control and healthy trend continuation. However, as price reached the upper boundary of the channel near the pivot point, buying momentum started to fade. After failing to sustain above the channel resistance, BTC broke below the lower channel boundary, marking the first clear breakdown of bullish structure and signaling a potential trend shift. Following the channel breakdown, price entered a consolidation range, where the market paused and volatility compressed. This range acted as a distribution phase rather than accumulation, as buyers failed to reclaim previous highs. Eventually, BTC broke down from the range, confirming bearish continuation and accelerating the move to the downside. The sell-off gained strength with successive breakdowns, pushing price toward the lower part of the chart.

Currently, BTCUSDT is reacting around a key Demand Zone near 75,700, where a fake breakout below demand suggests that selling pressure is temporarily weakening. Buyers have stepped in aggressively from this area, triggering a short-term rebound. Above the current price, the 79,300 Supply Zone stands out as a major resistance level, aligning with previous support turned resistance and acting as a critical decision point for the market.

My primary scenario favors a corrective bullish rebound as long as price holds above the 75,700 Demand Zone. A sustained defense of this level could allow BTC to recover toward the 79,300 Supply Zone as a first upside target, representing a technical pullback within a broader bearish structure. However, strong rejection from the 79,300 supply would likely confirm that sellers remain in control, potentially leading to another bearish continuation leg. A decisive breakdown and acceptance below the Demand Zone would invalidate the bounce scenario and open the door for further downside expansion. For now, BTC is at a key reaction area, and confirmation from price behavior near supply and demand will be crucial. Manage your risk!

EURCAD The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for EURCAD below:

The price is coiling around a solid key level - 1.6121

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.6151

Safe Stop Loss - 1.6102

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCAD - NEXT LEG UP UPDATE ( RE POSITIONED)We can see that GBPCAD found support on the ascending trendline, creating a third bounce and failing to break lower- on the daily this area is the 100MA last Friday and formed a bullish hammer candle.

The pair is still making higher highs and higher lows on the 4H, I am expecting this to continue with this next leg going to TP1 1.8875 zone.

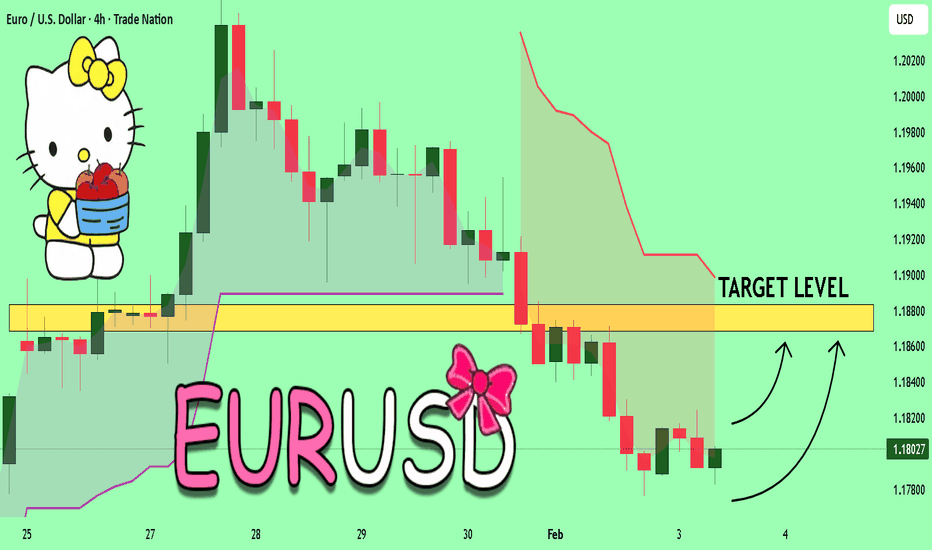

EURUSD Is Very Bullish! Long!

Take a look at our analysis for EURUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.179.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.188 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

CHF/JPY LONG FROM SUPPORT

CHF/JPY SIGNAL

Trade Direction: long

Entry Level: 199.294

Target Level: 200.072

Stop Loss: 198.773

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/CHF BEST PLACE TO BUY FROM|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.568

Target Level: 0.570

Stop Loss: 0.567

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

A Supply-and-Demand View of the Japanese YenPattern recognition and technical analysis are the foundations of price action in forex trading. Supply and demand dictate that for markets to be in equilibrium, demand must equal supply. Excessive supply without compensatory demand causes prices to crater, vice versa is true.

Post Covid, the Japanese Yen has been on a steady decline mimicking the Yen futures. The price decline for the 5-year period caused a price imbalance that markets must correct via bullish price action targeting the supply zone at 0.0089 price handle.

Presently, on the daily charts, we have a confirmed signal of bullish reversal. Once price contacts the short-term imbalance/fair value gap at 0.0064 we will be on the look out for buying opportunities at the liquidity levels of 0.0063 price handle.

Silver After the Liquidity Flush: Bounce or Trap?Silver has just completed a sharp liquidity driven selloff, collapsing from the one hundred twelve to one hundred sixteen zone down into the seventy-two to seventy-five area, where aggressive buy-side reaction appeared. This move clearly violated the long-held EMA ninety-eight near one hundred one, confirming a structural shift from bullish continuation into bearish expansion. The violent downside impulse suggests forced liquidation and stop cleansing rather than a healthy correction, with weak hands flushed out below prior swing lows. The current rebound toward eighty to eighty-three is best classified as a technical reaction, not a confirmed trend reversal.

From a market structure and psychology standpoint, price is now attempting to retest a former breakdown area around eighty-two to eighty-four, where trapped longs and overhead supply are likely concentrated. If this zone fails to reclaim, silver risks forming a lower high, opening the door for another leg lower or extended consolidation. Only a clean acceptance back above ninety-eight to one hundred, followed by sustained trading above the EMA ninety-eight, would signal that buyers have regained real control. Until then, this bounce remains corrective, and liquidity will continue to dictate the next decisive move.

Bitcoin Is Not Bouncing — It’s Sliding Inside a Bearish ChannelBitcoin remains firmly trapped inside a well-defined descending channel, and the structure is doing exactly what a controlled bearish market is supposed to do: lower highs, lower lows, and weak corrective bounces.

From a price structure standpoint, the recent sell-off was impulsive, breaking multiple short-term supports and accelerating price into the lower half of the channel. The bounce we are seeing now is purely corrective, capped below the descending channel resistance and the dynamic EMA, which is acting as active supply, not support.

The orange projection highlights the most probable path:

- A weak relief rally toward channel mid / EMA resistance

- Followed by continuation lower, targeting the next liquidity pocket

The highlighted horizontal zone around 74,500–75,000 is not strong demand, it is a reaction zone, already tested and partially consumed. Once price revisits this area again, the probability favors acceptance below, opening the door toward the next major liquidity magnet near 71,900.

Trend & Momentum Context:

Trend bias: Bearish (lower timeframe)

Market behavior: Controlled distribution, not capitulation

No structural sign of accumulation (no base, no absorption, no higher low)

Macro & Liquidity Logic:

Risk assets are currently repricing under tighter financial conditions and reduced speculative appetite. Until Bitcoin reclaims the upper boundary of the descending channel with acceptance, any bounce should be treated as sell-side liquidity, not trend reversal.

Key Takeaway:

This is not a dip to buy blindly. As long as Bitcoin remains inside this descending channel, rallies are reactions, and continuation risk points lower. The market is leaking liquidity patiently, structurally, and without panic.

Hate to crash the bear party, but Bitcoin is primed to explode.Bitcoin is following the same growth pattern Apple did as it established its massive uptrend. Many investors are bearish, calling for low targets like $50K or even $30K—but most don’t realize Bitcoin is likely to rally all the way to a new all-time high.

The trend is your friend, and Bitcoin is in a monstrous uptrend. Don’t fight it. Work with it.

As always, stay profitable.

— Dalin Anderson

EURGBP: Bullish Continuation & Long Trade

EURGBP

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long EURGBP

Entry Point - 0.8654

Stop Loss - 0.8650

Take Profit - 0.8661

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

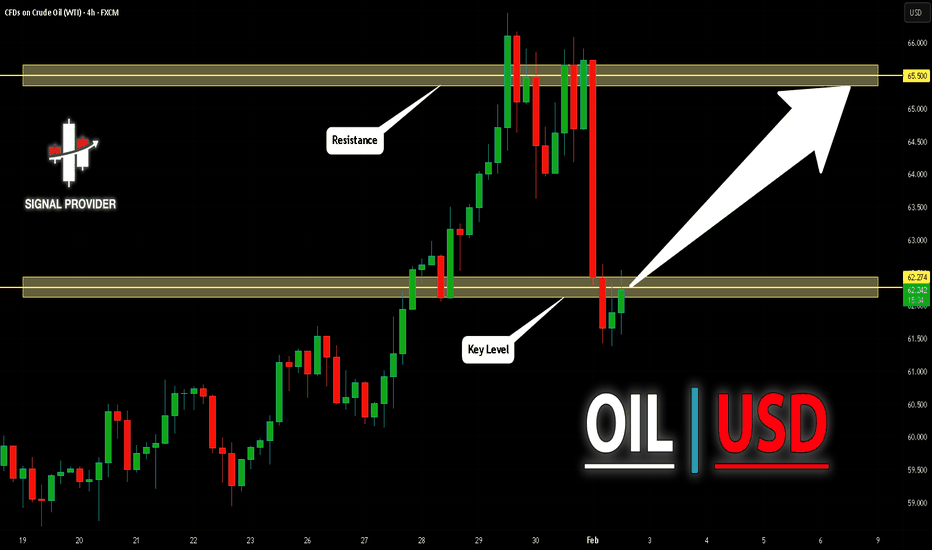

USOIL Is Going Up! Buy!

Here is our detailed technical review for USOIL.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 62.274.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 65.500 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

SILVER BULLS ARE STRONG HERE|LONG

Hello, Friends!

SILVER pair is in the downtrend because previous week’s candle is red, while the price is obviously falling on the 4H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 10,123.0 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

#052: Long Investment Opportunity on USD/JPY

The USD/JPY exchange rate is experiencing a particularly interesting market phase, where underlying bearish pressure coexists with technical signals of a possible short-term reaction. After a sharp decline, the price showed signs of slowing, suggesting the entry into a consolidation phase, typical of markets absorbing directional excess.

From a structural perspective, the main trend remains down, consistent with a sequence of lower highs and lower lows on higher time frames. However, this very trend has favored a progressive accumulation of speculative positions in the same direction, creating the conditions for a potential technical rebound. In such environments, the market often tends to move against the grain, hitting areas of liquidity before deciding on the next direction.

Price action analysis highlights how the latest phases of decline have been accompanied by increased volatility and impulsive movements, elements that often herald a phase of rebalancing. The appearance of candlesticks with pronounced wicks and less directional closes suggests that selling pressure is gradually diminishing, leaving room for corrective reactions.

From a volume perspective, the market is also showing signs of absorption. After the initial push, volumes tend to stabilize, indicating that the most aggressive traders have already taken positions. In these environments, subsequent movements are often driven by technical re-entries and position coverings, rather than new directional initiatives.

On the macroeconomic front, the monetary policy differential continues to support the dollar in the medium to long term, while the yen remains structurally weak. However, in the short term, this imbalance does not prevent the market from experiencing temporary rebounds, especially when positioning becomes excessively unbalanced. It is precisely in these phases that the exchange rate tends to move more technically than fundamentally.

The intermarket picture is currently not showing signs of strong risk aversion that would favor a decisive flow towards the yen. This reduces the likelihood of immediate downward accelerations and strengthens the hypothesis of a price breathing space. Bond and currency markets appear to be moving in a more orderly fashion, without sudden shocks.

In summary, USD/JPY is in an unstable equilibrium: the main trend remains bearish, but the market is showing signs of a corrective phase. In these contexts, patience and a good understanding of the structure become crucial, as the most interesting moves often emerge precisely when consensus appears excessively biased in one direction.

As always, the price will provide clarity. The market's ability to sustain any rebounds or, conversely, decisively resume its main direction will offer valuable insights into institutional investors' intentions in the coming sessions.

A Nasdaq Scalp With 2 Opposing ForcesWhat I'm looking for is a simple daily Bread & Butter Trade.

My RealSwings show me the Trend. The Orange Fork is projecting it to the downside too.

Notice the touches at the orange Center-Line.

Price respects the Pitchfork.

I'm stalking a long Trend.

It's a counter Trend trade and I know that probabilities are somewhat lower than I could trade with the direction of the Trend.

Here's the 5min. where I enter the trade:

My target is the Pullback of the white Centerline, which gives me a good Risk/Reward Ratio.

Let's see if we get stopped-in to the Trade.

EURUSD: Growth & Bullish Forecast

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURUSD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD Massive Long! BUY!

My dear friends,

My technical analysis for GOLD is below:

The market is trading on 4708.4 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4829.8

Recommended Stop Loss - 4622.8

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK