A Nasdaq Scalp With 2 Opposing ForcesWhat I'm looking for is a simple daily Bread & Butter Trade.

My RealSwings show me the Trend. The Orange Fork is projecting it to the downside too.

Notice the touches at the orange Center-Line.

Price respects the Pitchfork.

I'm stalking a long Trend.

It's a counter Trend trade and I know that probabilities are somewhat lower than I could trade with the direction of the Trend.

Here's the 5min. where I enter the trade:

My target is the Pullback of the white Centerline, which gives me a good Risk/Reward Ratio.

Let's see if we get stopped-in to the Trade.

LONG

EURUSD: Growth & Bullish Forecast

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURUSD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD Massive Long! BUY!

My dear friends,

My technical analysis for GOLD is below:

The market is trading on 4708.4 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4829.8

Recommended Stop Loss - 4622.8

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSD Long: Defends Trend Support, Targeting $5,190 SupplyHello traders! Here’s a clear technical breakdown of XAUUSD (2H) based on the current chart structure. Gold remains in a broader bullish environment after a strong impulsive move that developed from a well-defined accumulation range. Following this consolidation phase, price broke to the upside and began respecting a rising trend line, confirming sustained buyer control and healthy trend conditions. During the advance, multiple bullish breakouts occurred above prior resistance levels, each followed by continuation, reinforcing the strength of the underlying trend. This bullish leg ultimately pushed price into a major Supply Zone around 5,190, where upside momentum began to stall.

Currently, at the supply area, Gold faced strong selling pressure, leading to a sharp pullback and the formation of a descending supply line, signaling short-term corrective pressure within the broader uptrend. Price then dropped toward a key Demand Zone near 4,940, which aligns closely with the rising trend line and a previous breakout structure. This confluence of horizontal demand and dynamic trend support makes the zone technically significant. The recent decline appears corrective rather than impulsive, suggesting profit-taking and short-term distribution instead of a full trend reversal.

My scenario: as long as XAUUSD holds above the 4,940 Demand Zone and continues to respect the rising trend line, the broader bullish structure remains intact. A sustained reaction from this demand area could lead to a recovery move back toward the 5,190 Supply Level (TP1). A clean breakout and acceptance above this supply would confirm bullish continuation and open the door for further upside expansion. However, a decisive breakdown below the demand zone and trend line would invalidate the bullish bias and signal a deeper corrective phase. For now, Gold is at a key decision area, with buyers attempting to defend structure and resume the broader uptrend. Manage your risk!

02/02/26 Weekly OutlookLast weeks high: $90,610.47

Last weeks low: $75,706.32

Midpoint: $83,158.39

With January of the new year wrapped up it's been quite the opening month for Bitcoin and the broader market in general.

The loss of the yearly open ($87,500) confirmed the bears remain in control and as such, with the help of an enormous crash in metals, pushed Bitcoins price back towards 2025's Yearly low of $74,500. Now in the early hours of the weekly open that exact level has been traded with a perfect double bottom on the HTF chart. Does this mean BTC is now safe to move back up?

A relief bounce may be on the cards from here, my targets would be the inefficiency zones at 0.25 ($80,000) and if the bounce has real backing maybe $86,000. However I am not yet satisfied that the April Low has been effectively traded just yet...

For more confirmation of a bottom being in I would like to see the demand zone swept with sellers continuing to pour in but buyers soaking up the volume resulting in very little price movement. In effect this would be forced sellers (liquidations) moving their BTC to high conviction buyers in the market. I am not yet satisfied that we have had this play out.

The fear and greed index sits at 14, the same score as the Covid crash but interestingly it's a higher score than the sell-off in November of last year at a score of 11. This gives us an interesting divergence similar to that of the end of the bear market in 2022. It's also significantly lower than the April low of last year at a score of 24.

This week is about seeing where/if BTC finds strength, with BTC strength alts will follow. Also Tradfi and specifically the metals market is something to keep a eye on. It's not everyday an asset loses $4T in value in 3 days like silver did!

GBPJPY Is Going Up! Long!

Take a look at our analysis for GBPJPY.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 210.351.

The above observations make me that the market will inevitably achieve 212.357 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Gold Reclaims Support After Sharp Drop - 5,100 Resistance as TP1Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold initially traded within a clearly defined range, where price moved sideways, signaling a period of consolidation and market balance before the next impulsive move. From this range, XAUUSD broke to the upside and transitioned into a well-structured ascending channel, confirming strong buyer control with a consistent sequence of higher highs and higher lows. Price respected both the rising support line and the channel resistance, highlighting healthy bullish conditions throughout this phase. As the uptrend developed, gold eventually approached the key Resistance / Seller Zone around 5,100, where selling pressure became evident. Although price briefly broke above this level, the move lacked acceptance and resulted in a sharp rejection, forming a fake breakout and trapping late buyers. Following this rejection, XAUUSD dropped aggressively toward the Buyer Zone around 4,890–4,810, which aligns with previous resistance turned support and a key horizontal support level. The reaction from this area was strong, indicating active demand and buyer interest returning to the market. Currently, price is stabilizing above the Buyer Zone and attempting to recover after the fake breakdown. This behavior suggests a corrective rebound rather than a full trend reversal at this stage. Structurally, as long as gold holds above the Buyer Zone and maintains acceptance above support, a recovery move toward the 5,100 Resistance Level (TP1) remains possible. This area also overlaps with the Seller Zone, where selling pressure is likely to reappear. My scenario: holding above the Buyer Zone keeps the corrective bullish recovery intact, with 5,100 as the primary upside target. A strong rejection from resistance could resume downside pressure, while a decisive breakdown below the Buyer Zone would invalidate the recovery scenario and signal continuation of the broader corrective move. For now, XAUUSD is at a key decision area, with buyers attempting to defend support and build upside momentum. Please share this idea with your friends and click Boost 🚀

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

GBP/AUD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.970 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUSD Is Compressing at Demand — This Range Will Decide After a strong impulsive rally, EURUSD has transitioned into a corrective compression phase. Price is currently coiling between a descending resistance trendline and a clearly defined demand zone around 1.1900–1.1920, creating a tightening range. This is not random consolidation. It’s a classic post-impulse rebalancing structure, where liquidity is being absorbed before the next directional move.

From a technical perspective, buyers continue to defend the demand zone aggressively, with multiple higher lows forming inside the base. The EMA is flattening and running through the range, confirming balance rather than trend in the short term. Each rejection from resistance has weaker follow-through, suggesting sellers are distributing less effectively as price holds above demand.

Market logic:

Bullish scenario: As long as demand holds, a clean breakout and acceptance above the descending resistance would likely trigger a continuation toward 1.2000–1.2080, aligning with the next liquidity pool above prior highs.

Bearish invalidation: A decisive breakdown and close below the demand zone would shift control back to sellers, opening the door for a deeper retracement into the prior value area.

Summary:

EURUSD is not trending it’s compressing between supply and demand. The next impulsive leg will come from who wins this zone, not from prediction. Let price confirm.

Bitcoin Is Basing at Key Support Bitcoin has just completed a sharp impulsive sell-off from the $89,000–$90,000 region, breaking below the EMA 98 and accelerating lower with strong bearish momentum. This move flushed liquidity and forced price into a high-interest support zone between approximately $81,700 and $82,200. Since tagging this zone, price action has shifted character. Instead of continued expansion to the downside, Bitcoin is now consolidating with shorter candles, overlapping ranges, and failed follow-through by sellers. This behavior suggests selling pressure is being absorbed, not extended. From a structural standpoint, the current range is a post-impulse base, not a confirmed reversal yet. The market is transitioning from expansion into potential stabilization, and this is where direction is decided.

Key Technical Observations

Major impulsive breakdown completed below $85,900 (EMA 98)

Strong reaction and stabilization inside $81,700–$82,200 support zone

No new lower lows since the initial sell-off

Internal structure shows early higher-low attempts on lower timeframes

Primary Scenario (Relief Rally)

If Bitcoin holds above $81,700 and continues building acceptance:

A corrective push toward $83,800–$84,500 becomes likely

A sustained reclaim above $85,900 would confirm short-term trend relief and open upside rotation toward $87,500–$88,500

This would still be a corrective rally, not a full trend reversal, unless higher time-frame structure is reclaimed.

Alternative Scenario (Continuation Down)

If price fails to hold $81,700 with acceptance below:

Downside opens toward $80,000, then $78,500–$79,000

That would confirm the current consolidation as bearish continuation, not accumulation

Bitcoin is no longer selling aggressively it is testing whether buyers are willing to defend value.

This is a decision zone, not a prediction zone.

Let price confirm whether this base becomes a launchpad or a pause before continuation.

Support reaction here will define the next leg.

SILVER: Will Start Growing! Here is Why:

Balance of buyers and sellers on the SILVER pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

QQQ: Long Signal Explained

QQQ

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy QQQ

Entry Level - 621.75

Sl - 618.96

Tp - 627.24

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD Technical Analysis! BUY!

My dear followers,

I analysed this chart on EURUSD and concluded the following:

The market is trading on 1.1850 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.1935

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

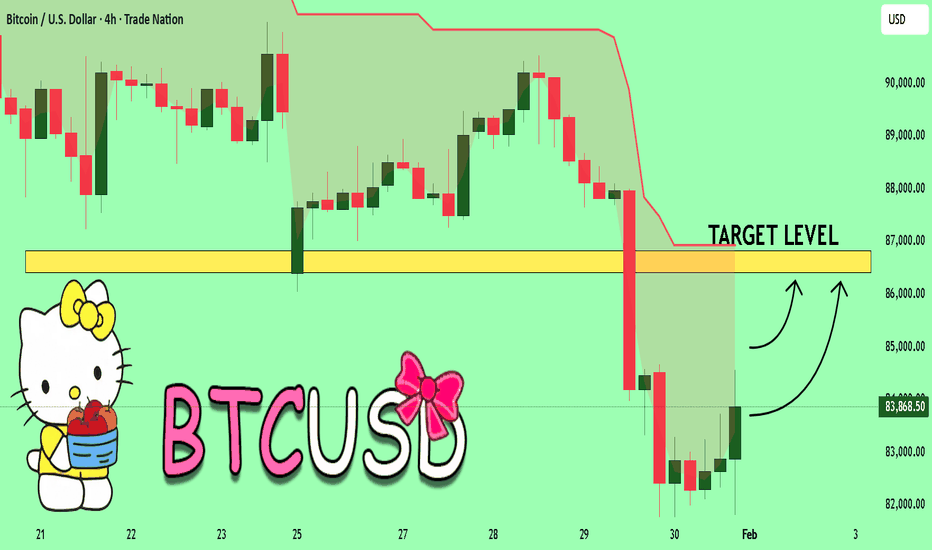

BTCUSD Expected Growth! BUY!

My dear friends,

BTCUSD looks like it will make a good move, and here are the details:

The market is trading on 83868 pivot level.

Bias -Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 86403

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

US100 On The Rise! BUY!

My dear followers,

This is my opinion on the US100 next move:

The asset is approaching an important pivot point 25520

Bias - Bullish

Safe Stop Loss - 25420

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 25687

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDJPY Uptrend in Focus | Fed Chair News Supports USDHey Traders,

In tomorrow’s trading session, we are closely monitoring USDJPY around the 154.150 zone. USDJPY remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 154.150 support-turned-resistance area, which may act as an important reaction zone for continuation.

From a fundamental perspective, the recent nomination of a new Federal Reserve Chair has helped support the US Dollar in the short term, as markets anticipate a more conventional and fiscally disciplined policy stance. This near-term USD strength could provide additional upside momentum for USDJPY, aligning well with the prevailing bullish technical structure.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

BTCUSDT Fake Breakdown Sparks Bounce from DemandHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. Bitcoin initially traded within a clearly defined range, where price moved sideways, indicating temporary balance and accumulation before the next directional move. This range eventually resolved to the upside, triggering a strong bullish impulse that pushed price sharply higher. However, this breakout failed to sustain, and BTC quickly turned around from the highs, signaling exhaustion of buyers and the start of a corrective phase. After the rejection, price transitioned into a well-defined descending channel, where it consistently respected the falling resistance line and internal support, forming a sequence of lower highs and lower lows. This structure clearly confirmed short-term bearish control. Currently, BTC is holding above the reclaimed support and stabilizing after the fake breakdown, indicating acceptance above the Buyer Zone. This behavior often precedes a corrective recovery rather than an immediate trend reversal. From a structural perspective, the area around 84,700 acts as the next Resistance / Seller Zone, which aligns with previous support turned resistance and represents a logical upside target. My scenario: as long as BTCUSDT holds above the Buyer Zone around 82,000 and continues to respect this reclaimed support, a corrective move toward the 84,700 resistance area (TP1) remains likely. This would represent a healthy pullback recovery within a broader bearish structure. However, a strong rejection from resistance could resume downside pressure, while a decisive breakdown back below the Buyer Zone would invalidate the recovery scenario and signal continuation of the downtrend. For now, price is at a key reaction zone, with buyers attempting to confirm the fake breakout and extend the rebound. Please share this idea with your friends and click Boost 🚀

EURUSD Reclaims Key Structure - Upside Toward 1.2050Hello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. After an extended consolidation phase, EURUSD initially traded within a clearly defined range, reflecting market indecision and balance between buyers and sellers. This ranging behavior laid the groundwork for a larger directional move. Eventually, price broke below the range and continued to trade inside a descending channel, confirming bearish control and a structured corrective phase. Sellers consistently defended the upper boundary of the channel, while price respected the descending resistance and support lines. As the downtrend matured, selling momentum gradually weakened, leading to a breakout above the descending channel resistance. This breakout marked a critical structural shift and the beginning of a bullish impulse. Following the breakout, EURUSD accelerated higher, breaking above the Buyer Zone around the 1.1920 area, which previously acted as a key resistance. This move confirmed a transition from bearish correction into bullish expansion, with buyers clearly regaining control of the market. Currently, price is trading above the Buyer Zone and holding above a rising triangle support line. A brief fake breakout below the ascending support was quickly absorbed by buyers, reinforcing the strength of demand and validating the support level. This price behavior suggests that the pullback was corrective rather than impulsive, allowing the market to reset before continuation. EURUSD is now approaching the Seller Zone / Resistance Level around 1.2050, which represents a major reaction area where selling pressure may increase. My scenario: as long as EURUSD holds above the Buyer Zone and continues to respect the ascending support structure, the bullish bias remains intact. A continuation toward the Resistance Level at 1.2050 is expected, with this area acting as TP1. A clean breakout and acceptance above the Seller Zone would confirm further upside continuation and open the door for higher targets. However, a strong rejection from resistance combined with a breakdown below the ascending support and Buyer Zone would signal the start of a deeper corrective phase. For now, structure, momentum, and price action favor buyers, with the current pullback behavior suggesting consolidation before a potential continuation move. Please share this idea with your friends and click Boost 🚀

ETH - at $8,000 – the biggest review on TradingView.COINBASE:ETHUSD BINANCE:ETHUSD CRYPTO:ETHUSD

Why will ETH cost $8,000? Let's figure it out.

The most comprehensive analysis of Ethereum on the TradingView platform. Cycles, metrics, patterns, technical analysis.

Let's break down the price of Ethereum by year, go back in time and use the PoC (Point of Control) tool to determine the bottom of each time period.

Let's switch to a weekly timeframe and drag the POC to April 2025 - what was the reaction from this level? Absolutely - long.

Next, we move closer to the current year. We pull up the PoC and see the following information: we are already close to the PoC level (at which there will be a 100% reaction!).

Now we start measuring everything by volatility (including time frames) and get the following picture.

I took into account all the momentum and time frames. I got a picture that, the cost of Ethereum by mid-2026 to early 2027 will be around $8,000.

ETH is currently forming a base, and it will continue to do so within this range (from $2,100 to $3,400).

Rising lows on the weekly timeframe:

Breaking through the daily downward trend line and testing it:

Bullish divergences on the daily timeframe:

Let's take a look at what Ethereum looks like on a weekly timeframe.

It's a large, huge 5-year sideways movement

Monthly timeframe:

Don't you think that the ETH has been drawing a beautiful structure for the past five years? The lows have been rising over the years! This is not a local 4-hour or daily timeframe, it is a monthly timeframe.

This tells me a lot.

A clear structure of an ascending triangle.

That's absolutely right. Important: That is not small timeframes, that is higher ones (weekly, monthly) - that says a lot! The higher timeframe always takes priority.

Let's move on to the metrics:

ETH.D - dominance, % of Ethereum's dominance over the entire crypto market.

What do we see? We are at the lower range, and there is enormous chance for growth.

ETHBTC — Ethereum/Bitcoin pair. The picture is similar. We see that we are at the lower limit. There is chance for growth.

USDT.D — stablecoin dominance in the current market phase. Weekly timeframe. Already in the overheated zone according to RSI. This means that in the coming months, the market will take a breath of fresh air, and stablecoins will pour into assets.

Conclusion:

- PoC zones. Globally, values are close to the bottom.

- Volatility confirming long-term growth prospects.

- Rising lows on the weekly TF along the trend. UP trend.

- Currently testing the daily trend (all locally).

- Bullish divergences on the daily timeframe, historically UP.

- Ascending triangle (weekly, 1-month timeframe).

- ETH dominance - practically at the bottom.

- ETH/BTC price - there is chance for growth.

- Cash dominance in the market is at a high level.

Historically, a fall in cash dominance in the market means UP (cash does not wait, cash flows into assets).

Of course, this is not financial advice or a recommendation. However, based on all the data, it is worth actively accumulating ETH at current prices ranging up to $2,100 per Ethereum coin.

As a bonus, here's a little psychology. The greed and fear index is at a critical point. Everyone is scared and uncertain. Historically, this is the best time to buy assets.

Ethereum: 2100-3000$

As a bonus, here's a little psychology. The greed and fear index is at a critical point. Everyone is scared and uncertain. Historically, this is the best time to buy assets.

Greed and Fear Index: 11

US100: Swing Trading & Technical Analysis

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the US100 pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support

BTCUSD: Bullish Continuation is Expected! Here is Why:

The price of BTCUSD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry - 1.1850

Sl - 1.1824

Tp - 1.1902

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️