Bulls prepare for a strong breakout, 3747⭐️GOLDEN INFORMATION:

Uncertainty over global growth and ongoing geopolitical risks keep haven demand elevated, though gold’s rally is fueled mainly by expectations of aggressive Fed rate cuts,” noted Zain Vawda, analyst at OANDA. Meanwhile, markets are watching the US-China talks led by Treasury Secretary Scott Bessent, Trade Representative Jamieson Greer, and Vice Premier He Lifeng. Any breakthrough in trade negotiations or improved risk appetite could dampen demand for safe-haven assets like gold.

⭐️Personal comments NOVA:

Interest rate announcement time is approaching, the market is waiting for a new ATH milestone, the tariff and political instability context makes gold prices expected to continue to increase in late 2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3745- 3747 SL 3752

TP1: $3730

TP2: $3720

TP3: $3710

🔥BUY GOLD zone: $3622-$3624 SL $3617

TP1: $3635

TP2: $3648

TP3: $3660

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Longposition

GBPUSD - BUY OPPORTUNITYLooking to BUY GU in BUY AREA and PROFIT in TP AREA.

Entry Criteria:

Will be looking for Signs of reversals, rejections at Buy Area.

Do not enter Buy Area 1 if strong bearish break of Buy Area 1.

Will look for entry in Buy Area 2 on signs of reversal and or rejections etc.

Trade Safe

growth, towards new ATH 3715⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased slightly on Tuesday after hitting a new record high near $3,690, as traders adjusted positions ahead of key central bank events. The Fed is widely expected to cut rates by 25 bps on Wednesday amid signs of labor market weakness, though attention will center on updated projections and Chair Powell’s remarks for clues on the policy outlook. These signals are likely to shape USD moves and set the next direction for bullion.

⭐️Personal comments NOVA:

Gold price continues to increase, market continues to fomo. Big buying force waiting for interest rate results to pump strongly

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3713- 3715 SL 3720

TP1: $3703

TP2: $3692

TP3: $3680

🔥BUY GOLD zone: $3656-$3654 SL $3649

TP1: $3666

TP2: $3678

TP3: $3690

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Interest rate cut, can gold reach 3700?✍️ NOVA hello everyone, Let's comment on gold price next week from 09/15/2025 - 09/19/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) climbed 0.44% in Friday’s North American session, trading near $3,649 after rebounding from $3,630, as weak US labor and sentiment data strengthened expectations of a Fed rate cut next week. Softer University of Michigan Consumer Sentiment, rising jobless claims, and a steep payrolls revision overshadowed this week’s inflation figures, reinforcing the view that the labor market is cooling. Markets now widely anticipate the first rate cut at the September 17 FOMC meeting, following Chair Powell’s signal at Jackson Hole that policy adjustments may be needed.

⭐️Personal comments NOVA:

Financial markets await the outcome of interest rate cuts next week. Gold prices are expected to continue rising, reaching 3700.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3674, $3700

Support: $3612, $3578

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold price accumulates in uptrend above 3574⭐️GOLDEN INFORMATION:

Gold (XAU/USD) extends Thursday’s rebound, climbing past $3,650 in Friday’s Asian trade and staying close to this week’s record high. Weaker US jobs data overshadowed hotter inflation, reinforcing Fed rate-cut bets, pressuring the Dollar to its lowest since late July and lifting demand for the metal. Political unrest in France and Japan, persistent trade frictions, and rising geopolitical risks further support safe-haven flows. Despite overbought conditions and a risk-on mood in equities, Gold remains on track for a fourth straight weekly gain, with momentum favoring the upside.

⭐️Personal comments NOVA:

Gold prices continue to recover, accumulating in an uptrend. The market is still very excited because of the interest rate cut on September 17.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3674- 3676 SL 3681

TP1: $3666

TP2: $3650

TP3: $3640

🔥BUY GOLD zone: $3573-$3575 SL $3568

TP1: $3588

TP2: $3600

TP3: $3610

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

TREE Stock Long Position Confirmed Monday 8/4/25Hello,

Ayrfolio trade ideas are based on weekly charts and momentum, so remember to be patient! No day trades here unless the stock soars up intraday! Today we’re covering:

STOCK SYMBOL: TREE

POSITION: Long

TP1 Risk-Reward Ratio: 1.39

TP2 Risk-Reward Ratio: 2.79

Stop Loss: must wait AFTER daily candle closes to exit trade (regular candle, NOT Heiken Ashi)

Ultimate Stop Loss: can exit IMMEDIATELY if price reaches this level during any trading hours

EXPLANATION: Weekly momentum increased and confirmed on Monday 8/4/25 at $54.17/share. Although the stop losses are listed on the chart, if momentum has been lost then we can exit before the price reaches the stop loss.

DISCLAIMER: Please do your own due diligence before making any decisions.

P.S. - Stocks can soar. YOU can soar. Soaring is possible!

-Ayrfolio

Sep 2, 2025 - SOLUSDT Long Position ReviewFollowing up on yesterday’s analysis, with each reaction to the 204.34 level, I became more confident about the presence of sellers above this zone. At the same time, since every rejection off this level was also creating a higher low , I decided to treat it as a risky long trigger.

After the breakout of this line and the 15m and 1H candle closing above it, I was still cautious, suspecting that the main sellers might be sitting around 206.24 .

At that point, as the RSI also reached its resistance line, I placed a buy stop order at 207 , just above the highest previous wick. I intentionally set the buy stop at the highest possible point to ensure that both price and RSI had convincingly broken their resistances.

This position is still open, and I’m now waiting for higher targets to be reached.

Gold price continues to find new ATH⭐️GOLDEN INFORMATION:

Gold (XAU/USD) extends its two-week rally, surging to a fresh record high near $3,546 in Wednesday’s Asian session as expectations of a Fed rate cut and lingering trade tensions boost safe-haven demand. However, a stronger US Dollar, overbought technical conditions, and caution ahead of Friday’s US Nonfarm Payrolls (NFP) report limit further gains.

⭐️Personal comments NOVA:

gold price fomo continues to look for new ATH in September. 3600 mark becomes gold's next target

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3596- 3598 SL 3603

TP1: $3585

TP2: $3568

TP3: $3552

🔥BUY GOLD zone: $3484-$3486 SL $3479

TP1: $3494

TP2: $3508

TP3: $3520

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

keep growing, old ATH 3500✍️ NOVA hello everyone, Let's comment on gold price next week from 09/01/2025 - 09/05/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) rebounded sharply Friday, erasing early losses to hit $3,447—its highest since June 16—after PCE inflation data met expectations and the Dollar softened. The metal is up 0.85%, supported by Fed rate-cut bets, safe-haven demand, and lingering geopolitical uncertainty, with dips seen as buying opportunities in a strong bullish trend..

⭐️Personal comments NOVA:

Gold price breaks out, market grows thanks to expectations of interest rate cut in September, gold price waits to reach old ATH 3500

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3451, $3482 , $3538

Support: $3397, $3363

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Uptrend, gold price back above 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) finds renewed buying interest around $3,375 during Tuesday’s Asian session, supported by concerns over the Federal Reserve’s independence following reports that US President Donald Trump plans to remove Fed Governor Lisa Cook. Adding to the upside, growing expectations that the Fed will resume its rate-cutting cycle are providing further support, as lower interest rates reduce the opportunity cost of holding the non-yielding metal.

⭐️Personal comments NOVA:

Gold prices show sustained buying power, along with President Trump's moves to pressure the FED to lower interest rates immediately. Heading towards over 3400 new long-term price increases

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3429- 3431 SL 3436

TP1: $3420

TP2: $3410

TP3: $3400

🔥BUY GOLD zone: $3350-$3352 SL $3345

TP1: $3360

TP2: $3370

TP3: $3380

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices continue to be positive as interest rates cut soon✍️ NOVA hello everyone, Let's comment on gold price next week from 08/25/2025 - 08/29/2025

⭐️GOLDEN INFORMATION:

Gold prices extended their upward momentum on Friday after Federal Reserve Chair Jerome Powell struck a dovish tone, warning that “downside risks to the labor market are rising.” XAU/USD is currently trading around $3,371, recovering from an earlier dip to $3,321.

In his remarks, Powell suggested there is a “reasonable base case” that tariffs could cause a “one-time” spike in prices. However, he admitted the outlook remains complex, with inflation risks skewed to the upside and employment risks leaning lower—a combination he described as a “challenging situation.”

Following Powell’s comments, gold initially surged toward the $3,350 region before climbing to a session high of $3,378. Prices have since eased slightly but remain elevated near current levels.

⭐️Personal comments NOVA:

Gold prices increased, positive after the FED chairman voiced that he would cut interest rates in September.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3387, $3400 , $3417

Support: $3351, $3330

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

KERNEL / USDT : Breakout confirmed with strong potentialKernel (USDT) Breakout: Short-Term Rally Ahead

Kernel (USDT) has broken out and is now showing strong momentum. With current bullish momentum, we’re expecting a rally towards $0.28 in the short term. Keep an eye on this one – potential for quick gains.

Remember to manage your risk and stay updated on market conditions. Markets are dynamic, and it’s crucial to stay informed and agile.

Globant 4H Double BottomGlobant posted a positive earnings report. On the 4-hour chart, a double bottom can be observed. Considering the recent decline in the stock, applying a Fibonacci retracement followed by an extension shows the lowest extension level at 1.618, which acted as support. Today, the price broke to the upside. It will be important to analyze with caution whether it starts gaining volume to return to previous levels, while adjusting the stop-loss as a precaution.

Globant, Bright Future or Total Darkness?📊 Technical Analysis – Globant (GLOB) – Weekly

The price of Globant (NYSE: GLOB) remains under strong bearish pressure, approaching a key long-term support area.

🔑 Fibonacci Levels

0.618 (61.55 USD): critical zone currently being tested. A clear breakdown could open the door to further declines.

0.5 (77.15 USD): first major resistance in case of a rebound.

0.382 (92.75 USD): secondary resistance, aligned with previous supply zones.

0.236 (112.04 USD): stronger resistance level; a breakout above would suggest a trend reversal.

📉 Support and Resistance

Main Support: 65–61 USD, which acted as a strong base during 2019–2020.

Immediate Resistance: 77 USD, followed by 93 USD.

🔄 Volume

Volume has increased significantly over the past weeks, indicating strong institutional activity around this support area. This could hint at a potential technical rebound if the level holds.

📌 Conclusion

As long as GLOB holds above 61 USD, there is room for a rebound toward 77–93 USD.

A breakdown below 61 USD would open a more bearish scenario with medium-term targets around 50–45 USD.

Current bias remains bearish, but we are at a key decision zone.

FBP Stock Long Position Confirmed Monday 7/7/25Hello,

Ayrfolio trade ideas are based on weekly charts and momentum, so remember to be patient! No day trades here unless the stock soars up intraday! Today we’re covering:

COMPANY: First BanCorp

STOCK SYMBOL: FBP

POSITION: Long

TP1 Risk-Reward Ratio: 2.0

TP2 Risk-Reward Ratio: 4.0

Stop Loss: must wait AFTER daily candle closes to exit trade (regular candle, NOT Heiken Ashi)

Ultimate Stop Loss: can exit IMMEDIATELY if price reaches this level during any trading hours

EXPLANATION: Weekly momentum increased and confirmed on Monday 7/7/25 at $20.84/share. Although the stop losses are listed on the chart, if momentum has been lost then we can exit before the price reaches the stop loss.

DISCLAIMER: Please do your own due diligence before making any decisions.

P.S. - Stocks can soar. YOU can soar. Soaring is possible!

-Ayrfolio

MSTR Holding the Line: Support Tested AgainMSTR (MicroStrategy) continues to respect its ascending trendline, a bullish sign showing buyers remain in control.

Technical Points:

Price tapped the trendline support for the fourth time and bounced, confirming its strength.

Volume remains stable during pullbacks, suggesting these dips are being absorbed by buyers rather than panic selling.

As long as MSTR holds above $1,400 (trendline + previous support zone), the bullish structure remains intact.

Next targets: $1,600, then $1,750, with potential for new highs if Bitcoin strength continues.

Bottom line:

Repeated successful tests of the trendline show strong market confidence. Unless this trendline breaks with conviction, the path of least resistance is still up.

GPC Stock Long Position Confirmed Monday 7/28/25Hello,

Ayrfolio trade ideas are based on weekly charts and momentum, so remember to be patient! No day trades here unless the stock soars up intraday! Today we’re covering:

STOCK SYMBOL: GPC

POSITION: Long

TP1 Risk-Reward Ratio: 1.82

TP2 Risk-Reward Ratio: 3.63

Stop Loss: must wait AFTER daily candle closes to exit trade (regular candle, NOT Heiken Ashi)

Ultimate Stop Loss: can exit IMMEDIATELY if price reaches this level during any trading hours

EXPLANATION: Weekly momentum increased and confirmed on Monday 7/28/25 at $133.70/share. Although the stop losses are listed on the chart, if momentum has been lost then we can exit before the price reaches the stop loss.

DISCLAIMER: Please do your own due diligence before making any decisions.

P.S. - Stocks can soar. YOU can soar. Soaring is possible!

-Ayrfolio

Cipla Break out📊 1–2 Days Technical Call

📌 Stock: CIPLA Ltd

💵 Buy Above: 1519.0

🎯 Target Price: 1557.0 (Upside: +2.50%)

🛑 Stop Loss: 1500.0 (Downside: -1.25%)

⚖ Risk–Reward Ratio: ~1 : 2.0

📅 Holding Period: 1–2 trading days

📌 Rationale: Positive technical setup; breakout expected above 1519 with momentum likely to push towards 1557 in short term.

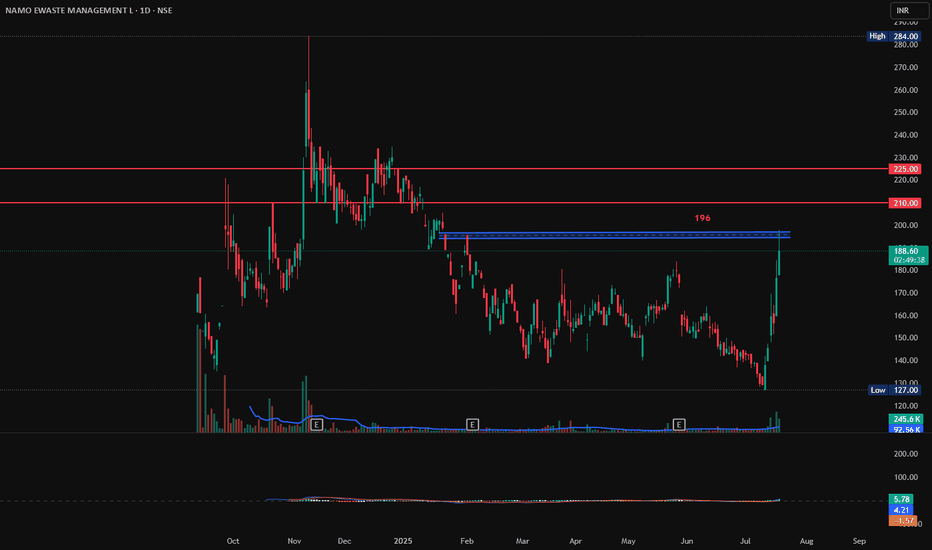

NAMO EWASTE MANAGEMENT, Long, Breakout, 1DNAMO EWASTE MANAGEMENT has gain 6% today with good volumes. If it breaks and sustains 196 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then there are good chances for it to go further up from here. First target will be 210 and second target 225.

Entry: 196 (on Bullish candlestick pattern)

Target1: 210

Target2: 225.

SL: 185

Gold price accumulates above 3340⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased toward $3,390 in early Asian trading on Monday, as a modest rebound in the U.S. Dollar weighed on the precious metal ahead of Tuesday’s U.S. inflation report.

A firmer Greenback, coupled with a broader risk-on mood, kept prices capped below the key $3,400 psychological level. However, growing expectations for a Federal Reserve rate cut in September continue to offer underlying support for the non-yielding asset.

On Saturday, Fed Governor Michelle Bowman noted that recent soft employment data reinforced her concerns about labor market fragility and bolstered her view that three rate cuts could be appropriate in 2025. Markets are now pricing in an 89% probability of a September rate cut, with at least two reductions expected by year-end.

⭐️Personal comments NOVA:

At the beginning of the week, gold price slightly decreased below 3380. It is still mainly accumulating, waiting for an increase reaction to return to 3400 and move sideways.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3336-$3338 SL $3331

TP1: $3345

TP2: $3357

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

The top of the bull market may be nearWe have strong resistance above us that Bitcoin must overcome. There is also strong support below, which determines the boundaries of the range. I see it this way: if the market remains positive for a while longer and no unexpected fundamentals come, we could overcome that resistance over time. Then I see the next ATH and strong resistance at the level between 131,000 and 132,000 USD. I have drawn exactly where I think it works out on the chart. However, it is possible that this will also be the top of this year's bull market.

I have also drawn a possible swing trade that could work with this setup.