Sideways movement and stable recovery above 5000GOLDEN INFORMATION:

US Nonfarm Payrolls (NFP) increased by 130,000 in January, above the market consensus of 70,000, according to the Bureau of Labor Statistics on Wednesday. This figure was an improvement over December, which saw a gain of 48,000 after a slight downward revision.

Meanwhile, the Unemployment Rate edged lower to 4.3% in January from 4.4% in December, below the forecast to stay unchanged at 4.4%. The upbeat report provides some relief to concerns about the state of the US labor market, which could lift the US Dollar (USD) and weigh on the USD-denominated commodity price.

⭐️Personal comments NOVA:

Gold prices are stable and the price range is narrowing as they consolidate. Buyers are maintaining a strong position above 5000.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5138 - 5140 SL 5145

TP1: $5120

TP2: $5100

TP3: $5080

🔥BUY GOLD zone: 4972- 4970 SL 4965

TP1: $4985

TP2: $5000

TP3: $5020

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Longsignal

Major volatility is coming with NFP.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) attracts some dip-buyers following the previous day's modest slide and climbs back above the $5,050 level during the Asian session on Wednesday. Prospects for lower US interest rates keep the US Dollar (USD) depressed near its lowest level in over a week and act as a tailwind for the non-yielding yellow metal. However, the underlying bullish sentiment might cap the upside for the safe-haven commodity. Traders might also opt to wait for the release of the US Nonfarm Payrolls (NFP) report before placing fresh directional bets

⭐️Personal comments NOVA:

Gold prices are consolidating and compressing strongly around 5000-5090. There will be significant volatility awaiting the NFP news results.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5236 - 5238 SL 5243

TP1: $5220

TP2: $5200

TP3: $5178

🔥BUY GOLD zone: 4897- 4895 SL 4890

TP1: $4918

TP2: $4940

TP3: $4965

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices recover from resistance at 5095.Related Information:!!! ( XAU / USD )

XAU/USD mounts a strong rebound toward the $4,950 region as softer-than-expected US labor data reignites expectations of Federal Reserve policy easing.

The non-interest-bearing precious metal has staged a solid recovery since Thursday, benefiting from early weakness in the US Dollar on Friday. The greenback came under pressure after disappointing US labor market figures released on Thursday, which revived market speculation that the Federal Reserve could deliver additional monetary easing. Against this backdrop, investors moved to buy gold on dips, despite tentative signs of stabilization in US Treasury yields.

personal opinion:!!!

The gold market is stabilizing and beginning to accumulate more. Expectations are for a recovery back to 5095.

Important price zone to consider : !!!

Resistance zone point: 5095 , 5240 zone

Follow us for the most accurate gold price trends.

Continued consolidation next week below 5250✍️ NOVA hello everyone, Let's comment on gold price next week from 02/09/2026 - 02/13/2026

⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rallies more than 3% on Friday, poised for a decent weekly gain as dip buyers emerged, following a session that pushed the yellow metal below the $4,800 mark. Worth noting that Friday has been a volatile session, with the non-yielding metal falling to a three-day low of $4,655 before erasing those previous losses. At the time of writing, XAU/USD trades at $4,963.

XAU/USD stages a sharp rebound toward $4,950 as soft US labor data revives Fed easing bets

The non-yielding metal is enjoying a healthy recovery from Thursday. Greenback’s initial weakness on Friday reflected worse-than-expected US labor market data on Thursday, which fueled speculation for further easing by the Federal Reserve (Fed). This prompted traders to buy bullion’s dip even though US Treasury yields began to show signs of life.

⭐️Personal comments NOVA:

Gold prices broke the trendline and showed signs of recovery next week, continuing to consolidate below 5250.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $5100, $5242

Support: $4655, $4402

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Correction - Accumulation below 5000⭐️GOLDEN INFORMATION:

Gold (XAU/USD) retreats more than 4% on Monday after the US President Donald Trump announced his pick to lead the Federal Reserve (Fed) in succession to the Fed Chair Jerome Powell. Economic data in the US paint an optimistic outlook as manufacturing activity improves. At the time of writing,XAU/USD trades at $4,681.

XAU/USD sinks below $4,700 as markets reprice a firmer Fed outlook and US manufacturing hits multi-year highs

Since last Friday, Gold price tumbled by over 14%. Although the nomination of Kevin Warsh was seen as one of the catalysts behind the precious metals rout. Economic activity in the manufacturing sector improved the most, reaching levels last seen in 2022, according to the Institute for Supply Management (ISM).

⭐️Personal comments NOVA:

Gold prices continue to consolidate below 5000 - selling pressure cools down the market, leading to greater stability.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 4996 - 4998 SL 5003

TP1: $4980

TP2: $4965

TP3: $4950

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4415

TP2: $4444

TP3: $4470

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction - Gold begins to fall✍️ NOVA hello everyone, Let's comment on gold price next week from 02/02/2026 - 02/06/2026

⭐️GOLDEN INFORMATION:

Since the announcement, Gold prices have reaccelerated their losses, while the Greenback recovered, despite being poised to sustain losses of over 1.42% in January, based on the US Dollar Index (DXY).

The DXY, which measures the US currency performance versus six peers, surges 0.74% to 96.87, a headwind for Bullion prices.

Long-dated US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up one-and-a-half basis points at 4.247% as of writing.

⭐️Personal comments NOVA:

Gold prices have begun a major downward correction, falling below 5000 due to profit-taking pressure.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4995, $5164, $5453

Support: $4675, $4532

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Buy Signal Given on HOODTrading Fam,

Keeping this trade simple here with low risk. Received a "BUY" signal from my Pivot Zones Indicator and I'm entering the trade. We are above the 200-day SMA. I want to shoot for that fairly recent gap down that was made at the end of last year as a target. I will exit if we drop much below that 200-day SMA. At entry, this trade was a 1:5.4 rrr.

✌️Stew

Prices are constantly rising - 5652⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) surges to a fresh record high of $5,579 before retreating to around $5,500 in early Asian trading on Thursday. The rally of the precious metal is bolstered by strong safe-haven demand amidst persistent geopolitical tensions, economic uncertainty, and a weaker US Dollar (USD).

Geopolitical tensions persisted after US President Donald Trump issued fresh warning to Iran on Wednesday. Trump urged Iran to “come to the table” and negotiate a “fair and equitable deal” that would prohibit the development of nuclear weapons or the next US attack would be far worse. Meanwhile, Iran responded with a threat to strike back against the US, Israel and those who support them.

⭐️Personal comments NOVA:

With tariffs combined with the risk of another US government shutdown, gold continues to show its current overwhelming appeal. The price increase is too sharp.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5652 - 5654 SL 5659

TP1: $5640

TP2: $5620

TP3: $5600

🔥BUY GOLD zone: 5402 - 5400 SL 5395

TP1: $5420

TP2: $5440

TP3: $5460

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC recovery - above 90kBTC Daily (D1) – Short Analysis

Bitcoin is in a corrective phase after being rejected from the 95,000–96,000 resistance zone.

Price is trading below the daily EMAs (34/89/200) → EMAs now act as resistance.

Market structure shows a lower high, keeping the short-term bias bearish to neutral.

Key Levels

Support: 88,500 – 89,000

→ Breakdown may lead to 86,000 – 85,500

Resistance: 91,300 – 92,000

→ Stronger resistance at 93,800 – 95,300

Bias

Below 92K: bearish / consolidation

Daily close above 93.8K: bullish recovery toward 96K+

Conclusion: BTC is at a decision zone. The next daily breakout will define the next major move.

The upward trend is above 5300, gold is rising sharply.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) prolongs its record-setting rally for the eighth consecutive day and surges past the $5,200 mark during the Asian session on Wednesday. Economic and geopolitical uncertainties on the back of US President Donald Trump's decision turn out to be a key factor that continues to drive flows towards the safe-haven commodity. Apart from this, renewed worries about the US Federal Reserve's (Fed) independence and prospects for lower interest rates in the US provide an additional boost to the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold surged in early 2026, tariffs and territorial issues destabilized global finance, continuing its trajectory towards 5314.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5314 - 5316 SL 5321

TP1: $5300

TP2: $5280

TP3: $5260

🔥BUY GOLD zone: 5182 - 5180 SL 5175

TP1: $5200

TP2: $5220

TP3: $5240

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices consolidate above 5000.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) extends its upside to around $5,050 during the early Asian session on Tuesday. The precious metal gains momentum amid growing concerns about financial and geopolitical uncertainty. The US ADP Employment Change and Consumer Confidence reports will be published later on Tuesday.

Traders rushed to the safe-haven asset as concern spread that US President Donald Trump is upending relations with key allies, from Europe to Canada. Trump on Saturday threatened to slap 100% tariffs on Canadian goods if the country strikes a trade deal with China, raising fears of a renewed trade war.

⭐️Personal comments NOVA:

Safe-haven assets – gold and silver – continue to surge due to global instability, accumulating and sustaining price increases.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5140 - 5142 SL 5147

TP1: $5125

TP2: $5110

TP3: $5085

🔥BUY GOLD zone: 4992 - 4990 SL 4985

TP1: $5008

TP2: $5025

TP3: $5040

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Prices continue to rise - significant growth⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rises to a fresh record high near $5,090 during the early Asian session on Monday. The precious metal extends its upside amid geopolitical risks and concerns over the US Federal Reserve (Fed).

The first three-way peace talks between Russia, Ukraine, and the US have concluded in Abu Dhabi with no apparent breakthrough, as fighting continues, according to the BBC. Ukrainian President Volodymyr Zelensky proposed a second meeting as early as next week, while a US official said that a fresh round will begin on February 1.

⭐️Personal comments NOVA:

The buying pressure in the gold market is too strong - investors are focusing on safe-haven assets, causing gold prices to rise almost continuously.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5135 - 5137 SL 5142

TP1: $5120

TP2: $5100

TP3: $5085

🔥BUY GOLD zone: 4990 - 4988 SL 4983

TP1: $5008

TP2: $5025

TP3: $5040

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continued growth - gold rises sharply⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) extends the rally to around $4,950 during the early Asian session on Friday. The precious metal gains momentum as geopolitical risk and threats to the US Federal Reserve’s (Fed) independence boost the safe-haven demand.

The yellow metal is set to reach a fresh all-time high and is on track for a weekly gain of more than 7%. Traders flock to traditional safe-haven assets such as Gold after tensions in Venezuela, Iran and Greenland.

⭐️Personal comments NOVA:

Political tensions and tariffs have led to gold's breakthrough, approaching $5000. Strong buying pressure is expected.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5000 - 5002 SL 5007

TP1: $4980

TP2: $4965

TP3: $4950

🔥BUY GOLD zone: 4890 - 4888 SL 4883

TP1: $4902

TP2: $4920

TP3: $4935

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure - gold corrects to 4713⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is seen extending the previous day's modest pullback from the vicinity of the $4,900 mark, or a fresh all-time peak, and drifting lower through the Asian session on Thursday. This marks the first day of a negative move in the previous four and is sponsored by a combination of negative factors. US President Donald Trump pulled back from his threat to slap additional tariffs on eight European nations and ruled out seizing Greenland by force, triggering a fresh wave of the global risk-on trade and undermining the safe-haven precious metal.

⭐️Personal comments NOVA:

Gold prices correct downwards - accumulating liquidity around 4713 to continue the upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4852 - 4854 SL 4859

TP1: $4840

TP2: $4825

TP3: $4810

🔥BUY GOLD zone: 4714 - 4712 SL 4707

TP1: $4732

TP2: $4745

TP3: $4760

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PayPal Long Trading Fam,

Because I kept my stops fairly tight on my last entry into PYPL, I was stopped out. I was okay with that. However, since that time, I have received two more buy signals with my Pivot Zones indicator. I can't ignore these signals. I have re-entered at a price of $59.53 with a 1:4 rrr. Same target, but the stop is just below that last pivot low rn.

✌️Stew

Buy DellHey Trading Fam,

Pretty simple. My Pivot Zones indicator has given me a "BUY" signal here, and so, I am buying. The technicals do support the indication. You can see, we are very oversold into that orange 350 SMA. Additionally, high-volume trading days have been supporting price moves to the upside. These are very good signs that support another great "BUY" alert from my indicator. The indicator will be released for use once beta testing is completed by the end of February.

✌️Stew

The current buying pressure on gold is unstoppable.⭐️GOLDEN INFORMATION:

Gold price ( XAU/USD) climbs to near $4,775 during the early Asian trading hours on Wednesday. The precious metal extends the rally and is poised for another record high amid a time of political and economic uncertainty. The speech by US President Donald Trump at the World Economic Forum in Davos, Switzerland, will be in the spotlight later on Wednesday.

Traders continue to pile into safe-haven assets amid tensions between the US and Europe over Greenland. US President Donald Trump over the weekend threatened to impose tariffs on eight European nations that oppose his plans to take control of Greenland.

⭐️Personal comments NOVA:

Incredible growth, gold price reaches 4850. Strong buying pressure in the market. Expect 4900 soon.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4905 - 4907 SL 4912

TP1: $4885

TP2: $4870

TP3: $4865

🔥BUY GOLD zone: 4748 - 4746 SL 4741

TP1: $4760

TP2: $4780

TP3: $4803

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

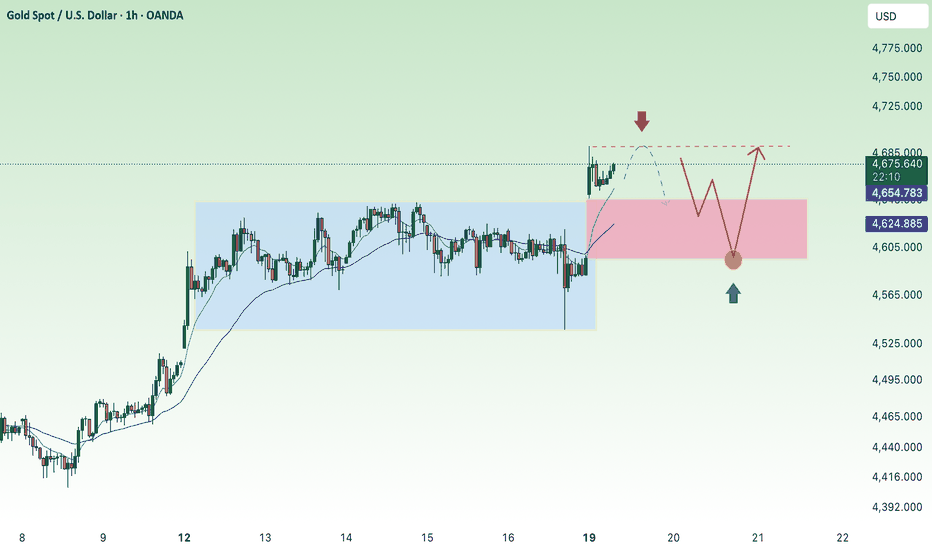

Sideways movement and waiting for a new ATH of 4724.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to near $4,670 during the early Asian session on Tuesday. The precious metal is set to hit a fresh record high as traders flock to safe-haven assets amid a persistent geopolitical and economic outlook.

US President Donald Trump said on Saturday that he would impose new tariffs on goods from eight European countries that reject his plan to acquire Greenland. The countries affected include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and the United Kingdom (UK).

⭐️Personal comments NOVA:

Gold prices are trading sideways, consolidating and recovering around 4680 in the Asian session, awaiting a breakout and further highs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4724 - 4726 SL 4731

TP1: $4710

TP2: $4690

TP3: $4675

🔥BUY GOLD zone: 4617 - 4615 SL 4610

TP1: $4630

TP2: $4645

TP3: $4660

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

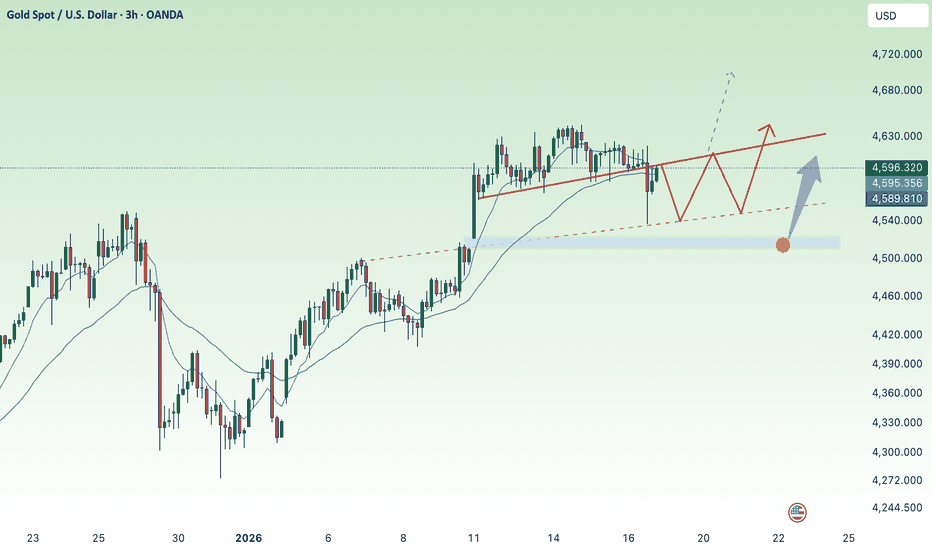

Tariff impact - gold breaks record high at 4690⭐️GOLDEN INFORMATION:

Gold (XAU/USD) catches aggressive bids at the start of a new week and jumps to the $4,700 neighborhood, or a fresh all-time peak, during the Asian session amid the global flight to safety. US President Donald Trump threatened to impose new tariffs on eight European countries that opposed his plan to acquire Greenland. The announcement drew criticism from European officials and raised concerns about a broader transatlantic trade dispute. This comes on top of heightened geopolitical risk and triggers a fresh wave of the global risk-aversion trade, prompting investors to seek refuge in the traditional safe-haven commodity.

⭐️Personal comments NOVA:

US and European tariff pressures were the main factor driving the sharp rise in gold prices, reaching 4690.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4690 - 4692 SL 4697

TP1: $4675

TP2: $4660

TP3: $4645

🔥BUY GOLD zone: 4597 - 4595 SL 4590

TP1: $4610

TP2: $4625

TP3: $4640

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction - Gold prices decline and consolidate.✍️ NOVA hello everyone, Let's comment on gold price next week from 01/19/2026 - 01/23/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) registers losses of over 0.70% on Friday as traders take profits, as in the last two weeks, data in the US has shown the labor market is not as weaker as expected. Therefore, traders are turning skeptical that the Federal Reserve (Fed) might go for two cuts, as reflected by the swaps markets. XAU/USD trades at $4,580 at the time of writing.

Bullion retreats as resilient US data, easing geopolitical risks push traders to cut aggressive Fed easing bets

Market mood is turning negative as US President Donald Trump shook the markets, as he seems reluctant to nominate the National Economic Council Director Kevin Hassett for the Fed Chair post. “I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

⭐️Personal comments NOVA:

Pay attention to the 4515 gap, liquidity is supporting it. Gold prices are correcting downwards. Tariffs are returning, still a major driver for the upward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4618, $4640, $4700

Support: $4536, $4515, $4477

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold prices have adjusted slightly around 4575.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) loses ground after hitting a fresh record high of $4,643 in the previous session, trading around $4,600 per troy ounce on Thursday. The non-interest-bearing Gold lost ground as a stronger-than-expected United States (US) Producer Price Index (PPI) and Retail Sales, along with last week’s easing Unemployment Rate, reinforced the case for the US Federal Reserve (Fed) to keep interest rates on hold for the coming months.

Safe-haven Gold prices also weaken, partly reflecting easing geopolitical concerns. US President Donald Trump said reports indicated Iran’s crackdown-related killings were subsiding and that no large-scale executions were planned, though he did not rule out potential US military action, noting Washington would continue to monitor developments, according to Reuters.

⭐️Personal comments NOVA:

Gold prices are adjusting and consolidating around 4575, but still maintaining an upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4575 - 4573 SL 4568

TP1: $4588

TP2: $4602

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

CADJPY Forex Analysis – Bullish Continuation After ReversalCADJPY Forex Analysis – Bullish Continuation Setup

CADJPY remains bullish after a healthy pullback on the 1H chart. The correction is confirmed by breaking below the Asian range and a positive skew on the 5-pip range bar, signalling bullish intent.

This move represents Wave 2 in a bullish market structure. A break above 114.75 will confirm continuation to the upside.

Trade Levels

Buy: Above 114.32

Stop Loss: 114.15

Target: GM4A Russell Wave – 115.78

Trade with the trend and manage risk.

👍 Like and follow for more forex trading analysis.

PPI - economic data against the backdrop of gold's ATH.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) rebounds toward the record high of $4,634.64 reached in the previous session, trading around $4,620.00 per troy ounce on Wednesday. Precious metals, including Gold, attract buyers amid growing bets on Federal Reserve (Fed) rate cuts following the softer inflation in the United States (US).

US inflation data for December signaled easing underlying US inflation, strengthening views that price pressures are gradually cooling. Rate futures showed investors divided between expectations of two or three Fed rate cuts this year, well above policymakers’ median projection of one.

⭐️Personal comments NOVA:

The bulls continue their uptrend - consolidating around the ATH price of 4630 and waiting for new highs to be established.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4684 - 4686 SL 4691

TP1: $4670

TP2: $4655

TP3: $4630

🔥BUY GOLD zone: 4565 - 4563 SL 4558

TP1: $4580

TP2: $4600

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account