SUIUSDT 30m LTF BSL Reaction and Pullback Setup📝 Description

BINANCE:SUIUSDT has pushed into a local liquidity high and is reacting below the HTF range high. The current move shows exhaustion after a sharp upside leg, suggesting a corrective pullback rather than continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the LTF BSL and 30m supply

Preferred Setup:

• Entry: 1.803

• Stop Loss: Above 1.816

• TP1: 1.786

• TP2: 1.778

• TP3: 1.767

________________________________________

🎯 ICT & SMC Notes

• Reaction from LTF BSL

• No valid bullish BOS after last pullback

• Downside liquidity still untouched

________________________________________

🧩 Summary

As long as price remains capped below local highs, a corrective pullback toward lower M30 PD arrays is favored.

________________________________________

🌍 Fundamental Notes / Sentiment

Although Core CPI came in below expectations, the market quickly reversed, showing the USD has not lost meaningful strength. Risk appetite remains weak, keeping SUI biased to the downside in short-term.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Lowtimeframe

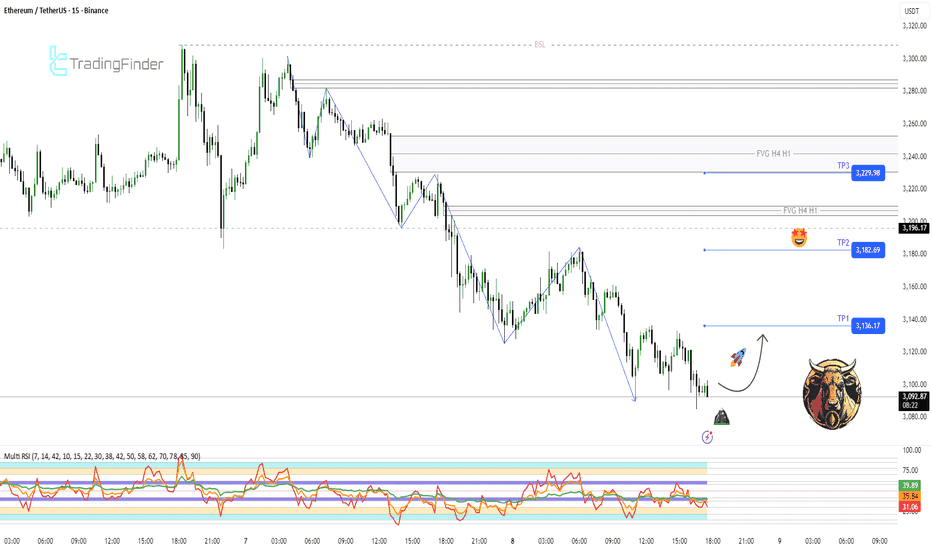

ETH M15 RSI Exhaustion and Mean Reversion Bounce Setup📝 Description

After a clear bearish leg, ETH has swept sell-side liquidity below recent lows and is now consolidating in a discount zone. The downside move looks liquidity-driven and corrective, not continuation. Price reaction at the lows suggests seller exhaustion and a short-term reversal potential.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish (Mean Reversion)

Preferred Setup:

• Entry: 3,090

• Stop Loss: Below 3,070

• TP1: 3,136

• TP2: 3,182

• TP3: 3,230

________________________________________

🎯 ICT & SMC Notes

• Clean SSL sweep of prior lows

• Price trading in HTF discount

• H4/H1 FVGs acting as upside magnets

________________________________________

🧩 Summary

Given the RSI condition and decreasing sell pressure, a short-term bullish reaction is expected. Risk management around the current low is key, and continuation depends on price reaction at higher PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

With no major high-impact news ahead, the market is mainly driven by technical flows. This environment supports a short-term technical bounce based on RSI and liquidity behavior.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

SOL M30 Previous Low Liquidity Sweep and Bullish Reversion Setup📝 Description

SOL on M30 has swept the previous low liquidity (SSL) and immediately showed a strong reaction, indicating liquidity collection rather than bearish continuation. With sell-side now cleared, price has the fuel needed for a bullish rotation toward higher levels and nearby imbalances.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish after SSL sweep

Long Setup (Preferred):

• Entry (Buy): 135.5

• Stop Loss: Below 133.8

• TP1: 136.96

• TP2: 137.97

• TP3: 139.5 (upper liquidity)

________________________________________

🎯 ICT & SMC Notes

• Previous low liquidity swept (SSL)

• Sharp reaction confirms sell-side raid

• H1 / 30M FVGs acting as upside draw

________________________________________

🧩 Summary

With sell-side liquidity cleared, SOL now has room to rebalance higher. As long as price holds above the sweep low, the higher-probability path is a move toward 137–139 liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

No immediate negative catalysts for SOL. In a neutral-to-stable market, post-liquidity sweep bounces tend to resolve to the upside. Manage risk and scale out at targets

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

How I confirm a signal and enter a tradeQuick 2:00 clip of, LTF trade signal and entry for potential short-term reversal trade.

This is a more risky version of my trading strategy which doesn't put much emphasis on the HTF trends and structure. Do not take this trade - this is just an example that if signals lined up with HTF and there was confluence, this is how I would trade it.

Happy trading :)

How To Backtest Further In The Past On Low TimeframesQuick video to show this little trick using the Replay mode that allows us to load more historical bars than real time, and thus get a better picture at how a strategy can perform over time.

The Strategy Tester re-calculate the results everytime we load new bars, as the indicator strategy is correctly applied to these new bars.

I got the confirmation from the awesome TradingView Support Team that the extra data that you get this way is real and relevant, and can be used to test your strategies.

That means we are no more limited to 15/30 days backtest data in the 5min timeframe for example.

Rejection or chop, low time BTC highlightsWe broke out of the descending broadening wedge, we confirmed resistance as support twice at B and D of the bullish harmonic pattern.

We did by my count 5 waves up and we are currently in a ABC correction.

Forming a head and shoulders pattern with a measured move below support line at around ~31.5k. That is still a higher low but that would break support.

Fib extension from A to 0 and A to B show 1.618 and 2.618 confluence at that level.

I will remain neutral until ~32.2k gets defended and turns Support.

The daily formed a double bottom with broke out but failed to keep above the neckline at ~35.3k. RSI still range bound so we will still see some chop around this area.

Bullish scenario

A head and shoulders pattern that fails to hit the target is very bullish.

Bearish scenario

A completion of the pattern and break of the support line.

Quick LTF BTC trades Short term trades

If we stay inside the triangle on the 15 minute TF, look to long a breakout with TP at the magenta trend line 11560

TP at the 23.6 fib 11750

TP at the purple trend line 11900

look for lack of volume on the breakout and use stops in case of fakeout

If we drop out of the triangle short

TP 11200

then watch for bounce and retest of 11300

If this happens and volume supports the price

I will be looking to long 11150 - 11250

watch for support on 100MA around 11170

TP where the cyan dashed line crosses fib or trend lines

11420

11480

11560

11750

11900

Not financial advice, just potential setups