USDCAD: Expecting Bearish Continuation! Here is Why:

The recent price action on the USDCAD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

M-signal

EURUSD: Short Signal with Entry/SL/TP

EURUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry Point - 1.1625

Stop Loss - 1.1635

Take Profit - 1.1605

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD My Opinion! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3345.0 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3351.7

Safe Stop Loss - 3341.9

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Reasons for gold price plunge in today's trading session 11/8Gold prices fell 1% on Monday as markets focused on upcoming talks between the United States and Russia over the Ukraine conflict, along with July data that could bring more concerns about the Federal Reserve's interest rate outlook.

Gold was trading at $3,363.31 an ounce at 0703 GMT, having hit its highest since July 23 on Friday. US gold futures for December delivery fell 2% to $3,423.10 an ounce.

"Easing geopolitical tensions over the Ukraine war sent gold prices lower, following Friday's announcement that US President Donald Trump will meet Russian President Vladimir Putin on US soil"

Meanwhile, US consumer price data is due on Tuesday, with recent tariffs expected to push the core index up 0.3%, taking the annual rate of growth to 3%, above the Federal Reserve’s 2% target.

“If inflation is high, the US dollar could strengthen and make it difficult for gold to rise. However, I think gold prices will still be supported as investors buy on dips.”

The recent weaker-than-expected US jobs report has increased expectations that the Fed will cut interest rates in September. Markets are pricing in about a 90% chance of easing in September and at least one more cut before the end of the year.

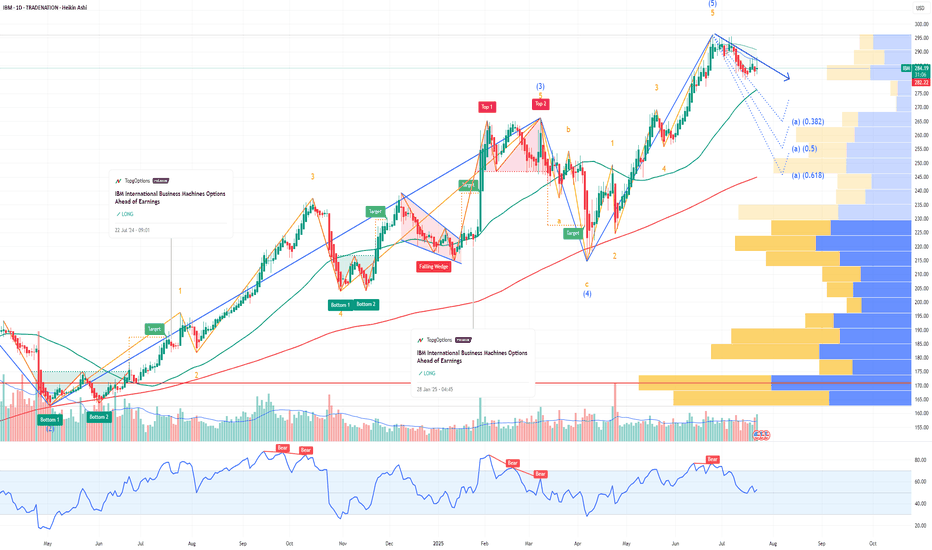

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The instrument tests an important psychological level 1.0961

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.0951

Recommended Stop Loss - 1.0967

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURJPY Buyers In Panic! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 172.25 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 171.49

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

APPLE My Opinion! SELL!

My dear friends,

Please, find my technical outlook for APPLE below:

The price is coiling around a solid key level - 229.36

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 221.47

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD: Long Trade with Entry/SL/TP

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.6016

Stop - 1.6005

Take - 1.6037

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD On The Rise! BUY!

My dear friends,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1618 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1642

Recommended Stop Loss - 1.1606

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Financial markets are set to receive a slew of important newDomestic gold prices fell due to the impact of world gold prices. In the international market, after closing the week at a high level, today's gold price suddenly reversed and plummeted when opening the new trading week.

Gold prices fell contrary to the forecast of analysts and investors when they expected the precious metal to continue to increase this week.

This week, the market is waiting for a lot of economic information such as the meeting to announce Australia's interest rate decision; the US consumer price index (CPI) report for July; the US producer price index... The data of this information is expected to affect the gold price.

This morning, the USD index (DXY) in the international market recovered to 98.1 points, also creating pressure to reduce gold prices.

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

GOLD: Bullish Continuation & Long Trade

GOLD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry Point - 3360.0

Stop Loss - 3353.1

Take Profit - 3373.4

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURGBP Set To Grow! BUY!

My dear followers,

I analysed this chart on EURGBP and concluded the following:

The market is trading on 0.8653 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.8689

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Ethereum Eth usd daily analysis

Time frame 4hours

Risk rewards ratio =2 👈👌

Technical analysis 👇👇

As you can see in the chart, Ethereum has formed a double top(peak) pattern.

The distance from the top to the bottom has dropped by about 14%.

So, according to the double top pattern, we should have the same amount of drop from the bottom of the second peak. -14%again.

This Ethereum price decline has ended with a support level. (Dark blue box )

👉Which is a very important point.👈

On the other hand, according to Elliott wave counting, the 3-point correction wave has also ended and Ethereum is starting an impulse wave. ✔️

There is also news about the start of the Alt-Season, and we know that one of the factors for the start of the Alt-Season is negative sentiment towards the market.📉📉

and now most analysts and traders expect a price decline, which can be good news for buyers.👌👍

tron (TRX)trx usdt daily analyses

time frame 4 hours

risk riwards ratio > 3.5 (woooow)

****** ( My condolences to those who lost their lives in the California fires.) *******

there is no volume in the market yet.

RSI is in the bottom of chart

price is in the down side of triangle and sellers couldn't break the support line ( 0.225$)

I set LS on the down of another support line on 0.195$

if we hear a good news about cryptocurrency market or tron , maybe a pump happens and good benefit for traders.

be careful for stop hunters. in this situations