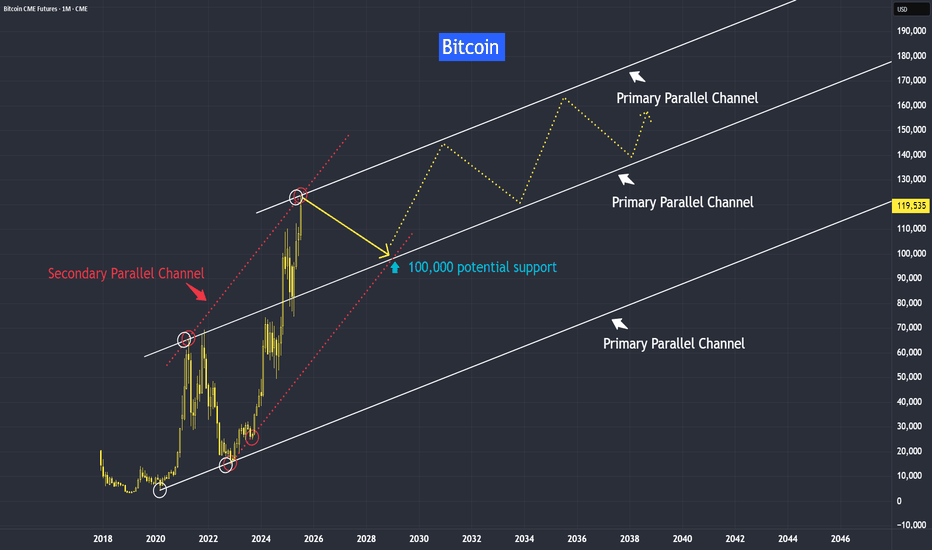

Different Timeframe Analysis - Bitcoin Back in July, I did a tutorial identifying the 120,000 level as a potential peak for Bitcoin, with the possibility of an open correction. Bitcoin subsequently formed a double top before pulling back to its recent low.

In my view, Bitcoin should continue to trend along this parallel channel.

Monthly analysis indicating support is near, I am refining it to daily analysis for more precision on its entry.

Video version on this tutorial:

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

MBT

Bitcoin Corrected, What’s Next?Back in July, I did a tutorial identifying the 120,000 level as a potential peak for Bitcoin, with the possibility of an open correction. Bitcoin subsequently formed a double top before pulling back to its recent low.

In my view, Bitcoin should continue to trend along this parallel channel.

We will discuss why this is the case, and also what may come next for Bitcoin after this correction.

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin: from Pet Rock to Loan CollateralCME: Micro Bitcoin Futures ( CME:MBT1! ) and Micro Ether Futures ( CME:MET1! )

Last week, JPMorgan Chase Chairman and CEO Jamie Dimon acknowledged that crypto, blockchain, and stablecoins are "real”, and “we’ll all use them". This marks a notable shift in tone from the longtime Bitcoin critic.

I can’t help but recall the most notable quotes over the years:

• “Cryptos are decentralized Ponzi scheme”.

• Bitcoin is “fraud” and "worse than tulip bulbs".

• “I’d fire in a second any employee trading Bitcoin”.

• "Bitcoin itself is a hyped-up fraud, it's a pet rock".

Why the big change of heart? It has a lot to do with the sweeping changes in the regulatory landscape. The biggest US bank has to adapt and meet new customer demands.

• On January 10, 2024, the SEC approved Bitcoin ETFs for the first time.

• On May 24, 2024, Ethereum ETFs were also approved by the SEC.

• On November 4, 2024, Donald Trump won the US presidential election.

• On January 21, 2025, the SEC, under a new Chairman, created a Crypto Task Force.

• In May 2025, JPMorgan announced that it would accept shares of BlackRock’s iShares Bitcoin Trust (IBIT) as loan collateral from its clients.

• On July 18, 2025, US Congress passed the “GENIUS Act”, setting up new regulatory framework for the issuance and use of stablecoins.

• On August 7, 2025, an Executive Order calls for the Department of Labor to re-examine its guidance on alternative assets like cryptocurrencies in 401(k) plans.

• Last week, JPMorgan announced that it would accept Bitcoin and Ethereum as collateral for institutional loans by the end of 2025.

The latest two events could have profound impact. Two butterflies have flapped their wings in Washington, D.C. and at Wall Street. These actions, in my opinion, will unleash the biggest tornado to sweep up the entire crypto world. So far, the market has not put much thought around it. Bitcoin lost 7% since August.

In my trade idea published on August 12th, I discussed how the crypto market would benefit from the new pool of capital infusion from the $8.7 trillion 401(k) plans.

What is Securities-based Lending?

Securities-based lending, also known as portfolio lending, enables borrowing against the value of their marketable securities without having to liquidate them. It is primarily offered to high-net-worth individuals by large financial institutions. How it works:

1. Collateral Assessment: Borrowers pledge their investment portfolios as collateral for the loan. The lender evaluates the portfolio to determine eligible securities and establishes a loan-to-value (LTV) ratio.

2. Loan Amount: The amount available for borrowing is based on LTV. For example, lenders may allow borrowing up to 70% of the value of stocks and more than 90% of certain government securities.

3. Access to Funds: Once the loan is approved, borrowers can access the funds through checks or wire transfers. The loan can be used for almost any purpose.

According to its annual report, JPMorgan has total loans outstanding of $586 billion at the end of 2024. Of which, Banking & Wealth Management accounted for $33B (5.7%).

JPMorgan accepts the following as collateral: Stocks (liquid Large-cap stocks), Bonds (U.S. Treasury securities), Mutual Funds (large mutual funds and ETFs), and Other Securities (Hedge funds, private equity positions, and certain alternative investments).

• In May, JPMorgan started accepting shares of BlackRock’s iShares Bitcoin Trust (IBIT) as loan collateral. IBIT has net asset value of $87.6B as of October 31st.

• By the end of the year, JPMorgan will accept bitcoin (market cap $2.9 trillion) and Ethereum (market cap $463 billion) as collateral for its securities-based lending.

How big is the securities-based lending market overall?

At a 2024 report, the Federal Reserve estimates the total size of securities-based lending from the Top 100 US banks at $138B by Q1 2024.

Private research (Growth Market Reports) estimates that the global securities-backed lending market size reached $540.2B in 2024. The market is currently expanding at a CAGR of 8.7%, with expectations to attain a value of $1,134.9B by 2033.

This growth is fueled by heightened demand for liquidity solutions, the proliferation of wealth management services, and the rising adoption of flexible credit facilities.

In my opinion, the JPMorgan actions will kick off a trend. As financial assets increasingly become tokenized, the demand for Bitcoin and Ethereum will grow exponentially. Securities-based lending is one of the many uses in mainstream financing.

Unlike the Fed, we can’t print new Bitcoin and Ethereum at will. New demands, from 401k and loan collateral alike, could reach hundreds of billions. This will be the catalyst to lift up the digital gold and silver to the next level.

Riding the ride with Micro Bitcoin and ETF Futures

Traders who share the bullish view on Bitcoins and Ethereum could explore CME Micro Bitcoin Futures ( PSE:MBT ) and Micro ETH Futures ( NYSE:MET ).

The MBT contract has a notional value of 0.10 bitcoin, as defined by the CME CF Bitcoin Reference Rate (BRR). On October 31st, the December contract (MBTZ5) is settled at $110,910. Each contract has a notional value of $11,091. To buy or sell one contract, CME Group requires an initial margin of $2,662. By design, this futures contract has a built-in leverage of 4.2-to-1. When bitcoin goes up, futures positions could enhance the return by four times compared to spot bitcoin positions.

MET has a notional value of 0.10 ETH. On October 31st, the December contract (METZ5) is settled at $3,932.5, putting the contract value at $393.25. The initial margin is $126, implying a built-in leverage of 3.1-to-1. When Ethereum goes up, futures positions could enhance the return by three times compared to spot ETH positions.

What happens if Bitcoin or Ethereum drops? For price protection, traders could enter a buy order with a stoploss. For example:

• A long MBTZ5 order at 110,910 with a stoploss of 95,000 limits the maximum loss to $1,591 (= (110910-95000) x 0.1).

• A long METZ5 order at 3,935.5 with a stoploss of 3,500 limits the maximum loss to $43.25 (= (3932.5-3500) x 0.1).

In addition to margin (leverage) and stoploss (loss protection), both Micro Bitcoin and Micro ETH have a daily price limit at 10%. This feature is particularly helpful when the market is panicky. Price Limit or Circuit slows down the irrational price movements until cooler heads prevail.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Why Gen X Struggles with Crypto?Why does Gen X struggle with crypto?

Because they’re used to the stock market system, where ownership is recorded by a central registry and trades that are tied to a specific exchange.

In their world, you typically should buy through Nasdaq in this example and expect to sell through Nasdaq. But with Bitcoin or other cryptocurrencies, the blockchain itself is the registry, which means you can buy on one platform and sell on another freely. That shift—from centralized exchanges to decentralized settlement—is what makes crypto hard to grasp.

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Heads Up !! BTC Long Entry Incoming, Don't Miss ItThis is yet another Volume profile VAL long entry that is in line with the LVN of the current rotation we've been in since Sept 11.

Other strong confluences for this entry i did not show on this chart to keep it clean, but visible on my personal chart are

1. Entry is at Monthly VWAP

2. Entry is also at 1 SD from Weekly VWAP

Definitions

VAL - Value Area Low

LVN - Low Volume Node or Area

SD - Standard Deviation

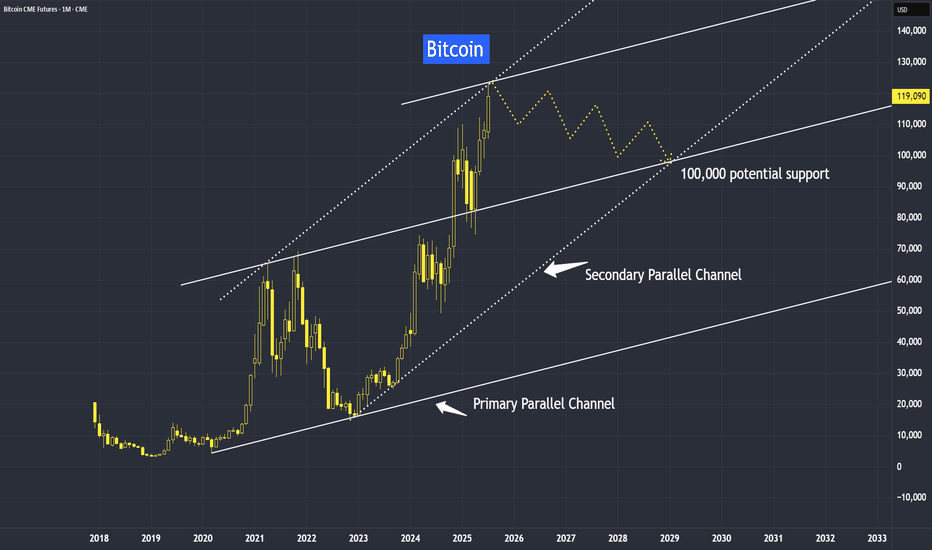

Bitcoin New Support at 100,000Bitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While both are viewed as stores of value, their long-term roles may diverge significantly.

Yes, gold and bitcoin have been moving up in near perfect synchronization with inflation.

Gold is traditionally seen as an inflation hedge, and since June 2022 — when inflation peaked at 9% — we’ve seen both gold and Bitcoin trend higher up to the present day.

Instead of asking why the Fed isn’t cutting interest rates despite the decline in CPI, perhaps we should ask: why the Fed prefers to maintain rates at the current level. What are they seeing with the data and the developments?

When both gold and Bitcoin hold steady at these elevated levels, it suggests that investors still believe the threat of rising inflation remains valid.

In all bull markets, the path is never straightforward — it’s often jagged along with volatility.

What distinguishes a continuing bull market - is the formation of higher lows along its timeline.

However, like gold which we recently discussed, Bitcoin may be approaching a medium-term resistance.

In this first week of this year tutorial, we observed an inverted hammer in the last month of 2024, suggesting a potential correction in Bitcoin, but yet seeing support at around 82,000 level.

As anticipated, the inverted hammer was followed by a correction here toward our support level at around 82,000, with some false breaks along. From that point, the market resumed its upward climb.

Now, it appears to be encountering resistance again.

Still, as long as the market continues to form higher lows, and the threat of rising inflation still remain, the bull trend should remain intact.

This is how the projection might look when mapped with a trendline.

We observed that the primary parallel trendline is reacting in relationship to each other. Next I would like to explore its secondary channel.

Please don’t interpret this as a literal path. Instead, I hope it serves as a guideline to help you form your own projections as the market evolves.

Gold is preferred by older generations, central banks, and conservative investors. Deeply entrenched in traditional finance and cultural value systems.

Cryptocurrency has a rapid adoption by younger investors, tech-native users, and institutions. Millennials and Gen Z are more likely to trust cryptographic assets than governments or fiat systems.

I will keep an open mind to both inflation hedge asset and their instruments.

Its video version for this tutorial:

Disclaimer This analysis is based on technical studies and does not constitute financial advice. Please consult your licensed broker before investing.

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin and Upcoming TrendBitcoin’s trend has been growing from strength to strength — and it’s likely to stay that way. Why?

This trend isn’t driven purely by speculation; it’s supported by strong fundamental reasons.

One of the most widely debated topics in finance today is the comparison between Bitcoin and gold. While both are viewed as stores of value, their long-term roles may diverge significantly.

Yet, they’ve been moving in near-perfect synchronization, with potential resistance ahead, but their trend still remain intact — and here’s why.

Mirco Bitcoin Futures and Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin Forecast After 2024 - Why support at 82,000?Bitcoin's price at the close of December, marked by this inverted hammer, clearly indicates that a correction is imminent. However, the overall trend remains upward.

We will discuss the fundamental reasons why Bitcoin may have temporarily peaked in December 2024, as well as the potential support level around 82,000 this year. Let’s explore how we can manage Bitcoin following its peak above 100,000 as we move into 2025.

Micro Bitcoin Futures & Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

MBT long/short if-then scenarioIf price returns to discount, then I am looking at Friday's BISI for longs. There is 1D v.POC & t.POC in proximity.

I prefer this first, as untapped t.POC at 69650 is a great initial target for longs

Stop loss near the 67100 local low upon End of Value

The higher probability, if price forces a higher high I am looking for a short

Right above this local high is a t.POC, there is also as SIBI from Thursday. Also a very large volume node & potential for RSI bear div.

I will NOT put blind limits for anything. I will be watching structure on the lower TF (5min) as we approach these key levels; among other edge, & these are just key levels N.F.A.

Bitcoin Broke New High – The Real Reasons Behind ItThe relationship between inflation and Bitcoin - they moves in tandem together, in the same direction.

We saw Bitcoin has broken above its 2021 high, and it is likely to continue this trend.

Many attribute the reason behind this rally to the approval of Bitcoin ETF by SEC in January of this year. While this approval serves an incentive, the core reason for this rally is the resilience of US inflation, meaning the inflation is still pretty stubborn, not coming down to the 2% target.

Micro Bitcoin Futures & Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50

BTIC: $1.00 per bitcoin = $0.10

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

CWBR cheap anti-aging stockCWBR CohBar is a clinical stage biotechnology company which develops mitochondria based therapeutics (MBTs) for the treatment of chronic and age-related diseases.

CWBR closed few months ago a $15.0 Million Offering of Common Stock and Warrants at $0.72, so this is a safe upside in my opinion if you want to enter now.

Cantor Fitzgerald brokerage has a $2.5 price target for it.

How To Use Bitcoin Futures To Hedge Your CryptoYou are either a trader or a HODL'er. Since I am a trader I don't like to sit in massive swings in my spot Bitcoin positions, I like to use Micro Bitcoin Futures to hedge my spot position to minimize the risk and also maximize my long position in spot. In this video I explain how I am currently hedging my long Spot Bitcoin position using Micro Bitcoin Futures, Symbol MBT.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

Futures Levels | Looks Ahead For the Week of Aug 1There is a good deal more economic news on tap this week with a jobs report Friday and PMIs mid-week. Earnings continue with 25% of the S&P still left to report. Beyond my favorites futures contracts which include stock indices, interest rates, and metals, I'll be watching the Chinese stocks and what Bitcoin wants to do around $40K.

MBT DowntrendMBT has been stuck in a downtrend since 2006, a continuation of this downtrend is most likely. However rising MACD shows promise, it may be rejected as seen before (highlighted in blue box) Gaussian channel shows a possible rejection at the middle. Blue line shows a rounded bottom which is another bullish sign, however it looks particularly bearish in these conditions.

Two double bottoms can also be observed, will the second lead to another rejection at the downward trendline?

MOBILE TELESYSTEMS - NYSE: MBT Nears Break-OutWe've been monitoring the action in shares of MOBILE TELESYSTEMS - NYSE:MBT for a while now and it appears that the stock is starting to find buyers as it approaches a significant level in order for the stock to release into higher ground.

As we can witness from the Daily chart above, MBT presently finds itself trading above all of its important moving averages 20/50/200 DMA's, suggestive of a healthy technical picture.

However, perhaps of more importance, MBT now finds itself rapidly approaching a key inflection point at the $8.75 figure. Should the stock be capable of going topside of the level and 'Stick', we suspect that further advance is in the cards and we may just see a move into the $10-$12 zone in rapid fashion.

Thus, both investors/traders may want to keep a close eye on the action and more importantly, the noted $8.75 figure for confirmation/clues that greener pastures may be in the offing.

DSKX Begins To Rally After The Conference CallShares of DSKX continues to rally from last week after they held a conference call to discuss the recently announced agreement to acquire Radiancy, Inc., a leading developer of consumer medical devices and the Neova® dermatological products.

It appears investors are beginning to notice the financial value this new deal brings and the future outlook of the company, so if you haven't already, I highly encourage you to listen to today's conference call as soon as possible. Much larger company structure overall, significant increase in revenue, assets, cash flow and working capital with a very reputable management team to move the company forward. The fact that the current market cap is only 33M is what really gets me excited. Listen to the call to learn more:

The replay of the conference call can be heard by dialing 1-888-286-8010 in the United States and Canada or +1-617-801-6888 internationally, then referencing the Conference Passcode "56187013" A recording of the call can also be heard on the company website.

In the call, the DS Healthcare Group management team shared their motivations and answered questions relating to the business fundamentals on the Radiancy & Neova® deal, explaining how natural strategy alignment and synergies will lead to significant bottom line contribution.

The call was hosted by Mark Brockelman (CFO), Manny Gonzeles (CCO) and Renee Barch-Niles (CEO) and took place on Thursday, February 25th, 2016, at 8:30 a.m. EST.

-Renee Barch-Niles (CEO), an experienced CPG Executive who drove double-digit year-over-year growth in global food, drug, mass, club and specialty channels for Global companies such as Daymon Worldwide and Emilia Personal Care.

-Mark Brockelman (CFO) who has great experience in mergers and acquisitions, systems integration expertise and highly astute financial acumen. Mr. Brockelman Brockelman served as the Chief Financial Officer for National Dentex Corporation as well as the Senior Vice President/Chief Financial and Administrative Officer of the Miami Dolphins.

-Manny Gonzalez (CCO), a former top (NASDAQ: PG) Procter & Gamble executive managing a team of 7,000 sales representatives in the U.S., who has direct access to every major retailer in the country.

Acquisition Press Release Below:

finance.yahoo.com

For full disclose please visit: www.stockpicksnyc.com