ETH New Update (4H)This analysis is an update of the analysis you see in the "Related publications" section

Honestly, as you know, the market had been ranging for several days without much movement. On the chart, we had signs of a drop, but the drop didn’t happen, and instead the market dropped in a way that was shown.

Considering that the demand zone has held and the market is still ranging, we can return to the scenario of (this analysis () and expect to see some recoveries from Ethereum.

Either Ethereum can get rejected from the identified supply zone, or it can make a new all-time high afterwards.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Neo Wave

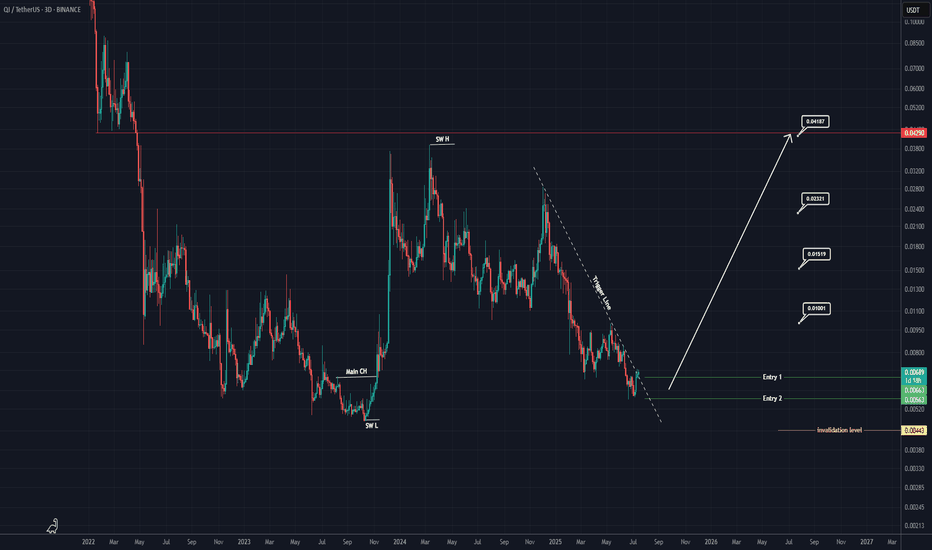

QI Looks Super Bullish (3D)The price has reached a significant zone on the higher timeframes and has failed to create a lower low. Additionally, a major Change of Character (CH) has formed on the chart.

There are signs indicating that the price is attempting to form a double bottom on the higher timeframes.

We have identified two entry points for taking a spot position.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

TRUMP COIN ANALYSIS (1D)It seems this token is risky and is currently forming a diametric pattern, where we are now in wave **e** of the structure. In the green zones marked as our entry areas, you may gradually enter in spot positions. To capture wave **f** of this diametric, you need to manage your expectations regarding its potential.

The targets are marked on the chart.

This outlook will only be invalidated if a daily candle closes below the invalidation level.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SSV Looks Bullish (12H)A supply zone has been highlighted on the chart. This supply has been consumed many times, yet no lower low has been formed. Also, from the point where we marked it on the chart, a bullish move started. After this bullish move, the price is currently forming a range. It seems that the initial move is wave A of the new pattern, and the ranging move is wave B.

As long as the green zone holds, the price can move toward the targets. Once the trigger line is broken, we will have further confirmations.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You