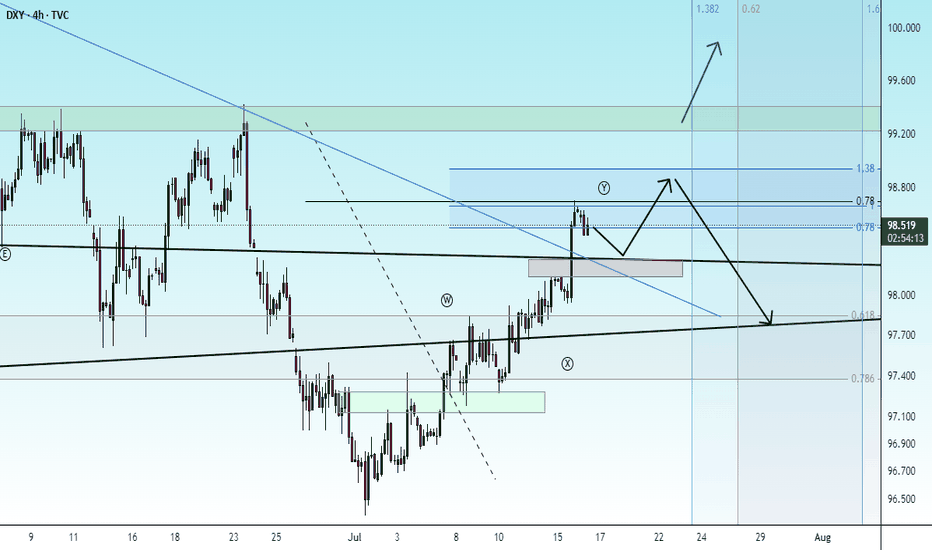

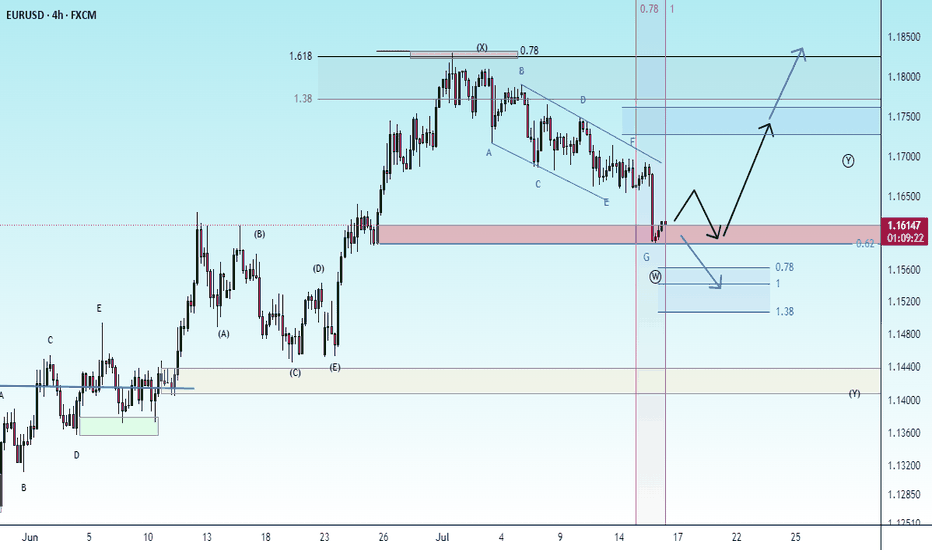

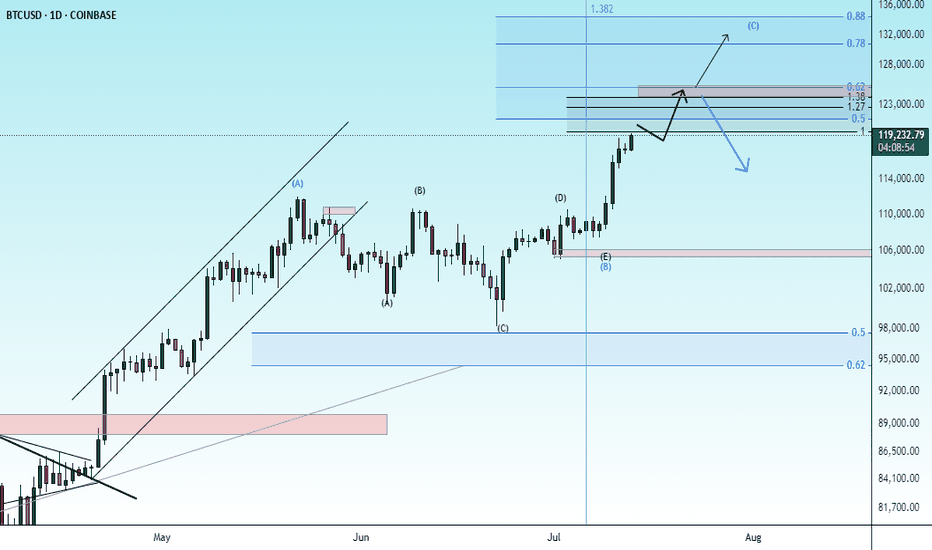

Neo Wave

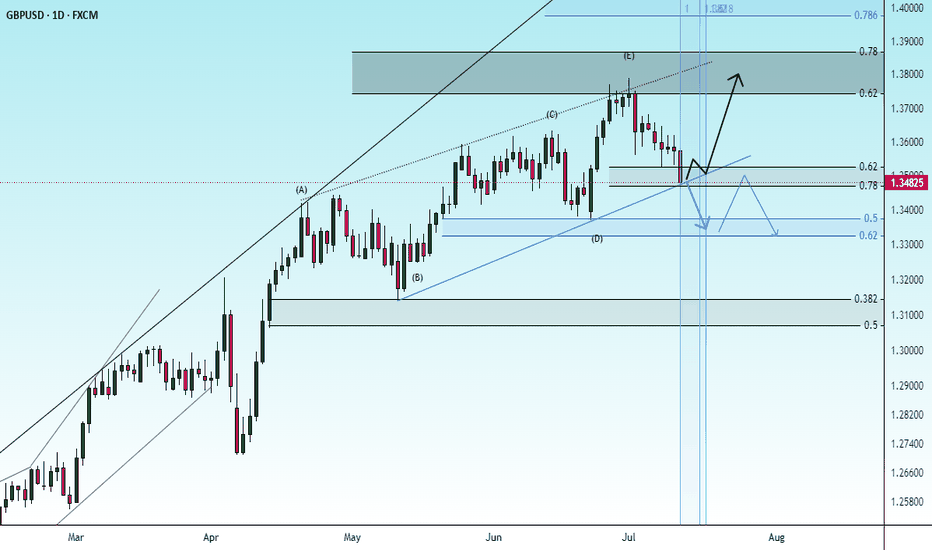

check the trendIt is expected that a trend change will form within the current support area and we will witness the beginning of the upward trend.

If the price breaks through the support zone, the continuation of the correction is likely.

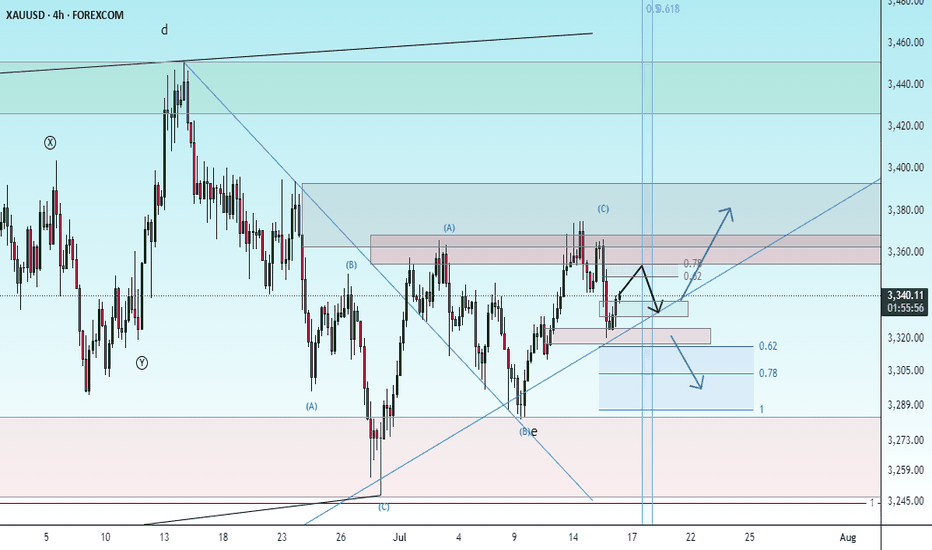

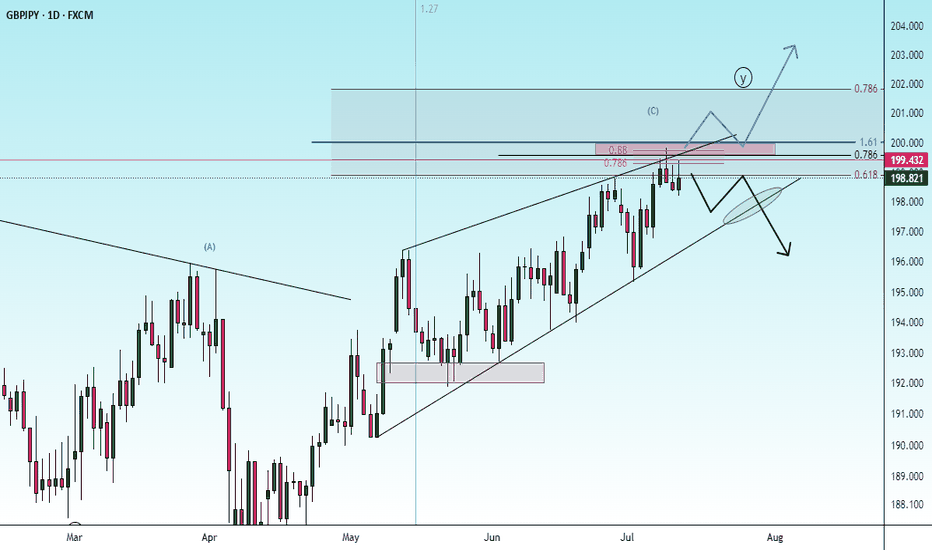

If the price breaks through the support levels, the continuation of the downtrend is likely.

check the trendConsidering the price behavior in the current support area, possible scenarios have been identified. It is expected that a trend change will form in the current support area and we will see the start of an upward trend.

If the price passes the support area, the continuation of the downward trend will be likely.

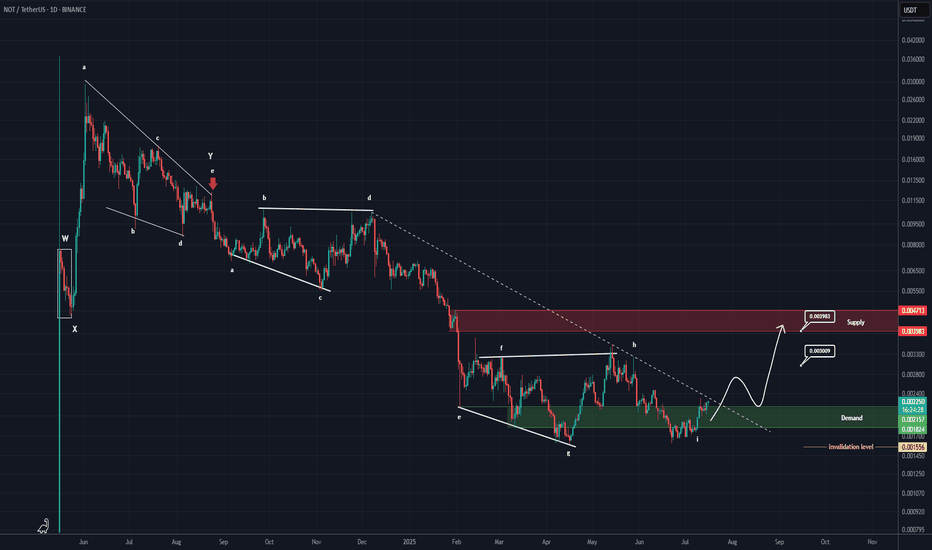

NOTCOIN New Update (1D)From the point where the red arrow is placed on the chart, the correction labeled as NOT has started.

The correction appears to be a symmetrical one, which now seems to be coming to an end. The current upward wave could be the X wave.

In previous analyses, we had also considered the structure to be symmetrical, but on a larger degree. However, based on the data currently available, it seems that the degree of this symmetrical structure is smaller.

If the price holds above the green zone, it may move toward the targets and the red box. The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

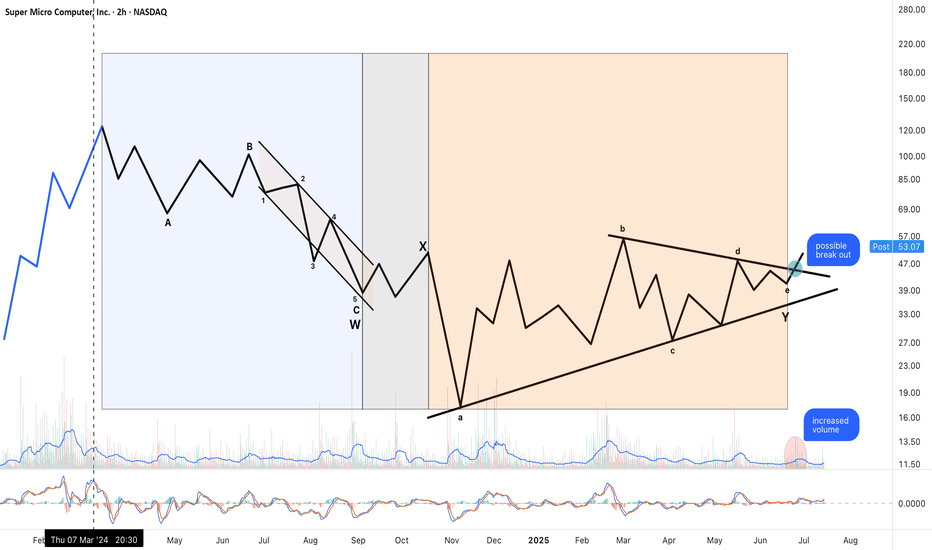

NeoWave Structure: Flat–X–Triangle Combination - break outThis chart illustrates a possible NeoWave-style corrective combination: a Flat–X–Triangle structure, likely completed and followed by a breakout.

W Wave: A well-structured Flat correction (labeled A–B–C) with a clean internal 5-wave impulse in C. Balanced time and volume across subcomponents suggest structural completion.

X Wave: A simple, proportionally shallow X connector, in line with NeoWave time and price minimums.

Y Wave: A textbook contracting triangle (labeled a–b–c–d–e), with near-perfect Fibonacci relationships between legs:

• Wave b retraces approximately 61.8% of wave a

• Wave d retraces approximately 78.6% of wave c

• Time symmetry is preserved

• Volume compresses into the apex, a classic triangle behavior

Breakout Observed:

• Price has moved above triangle resistance

• Volume increased at breakout

• MACD shows positive crossover and rising momentum

Interpretation:

This may mark the end of a prolonged corrective structure and the beginning of a new impulsive sequence. Triangle projection targets suggest the $77–80 area as a minimum, with higher Fibonacci extensions possible (e.g., 1.618 or 2.618 of prior moves) if this evolves into a 3rd wave.

Technical Approach:

This analysis follows NeoWave principles (Glenn Neely), emphasizing structural clarity, wave proportion, time-price balance, and breakout behavior.

Will Solana reach $1400?After analyzing Solana’s complete data, it appears that a large diametric pattern is forming in the long term.

Currently, it seems we are in wave c of C.

If the key level of $187 is broken and price consolidates above it, we can be much more confident that we are indeed in wave c of C, confirming this scenario.

However, if the price fails to break and hold above $186 on higher timeframes like the 3D or weekly, and gets rejected downward, this scenario will be invalidated.

If confirmed, the targets for wave c of C are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

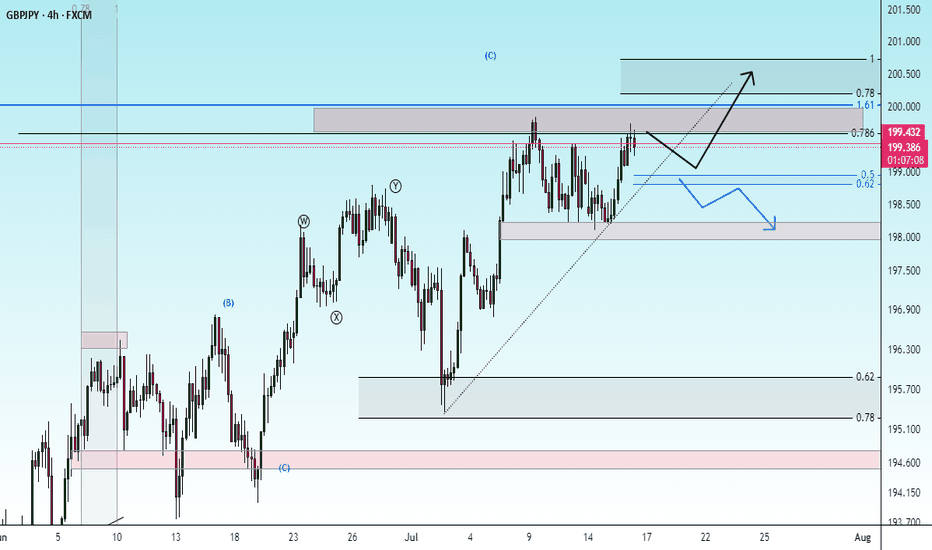

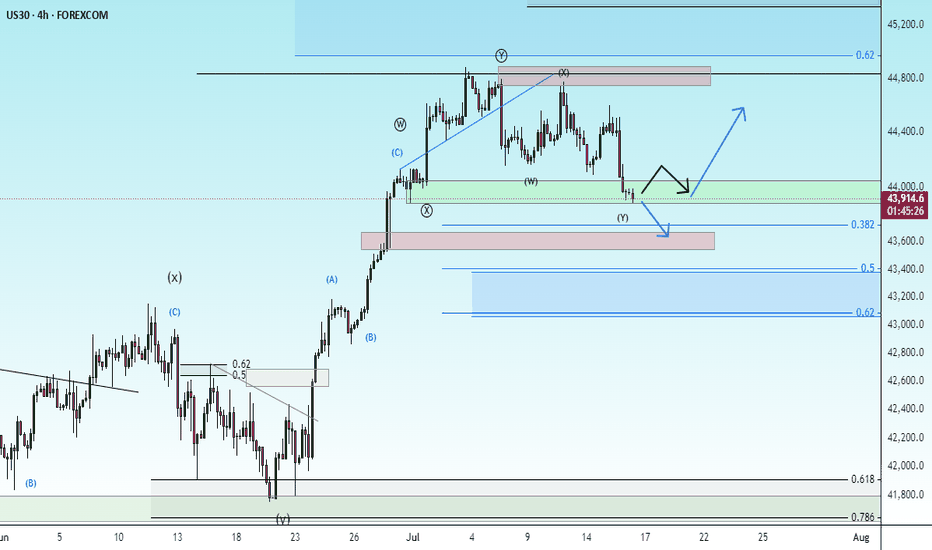

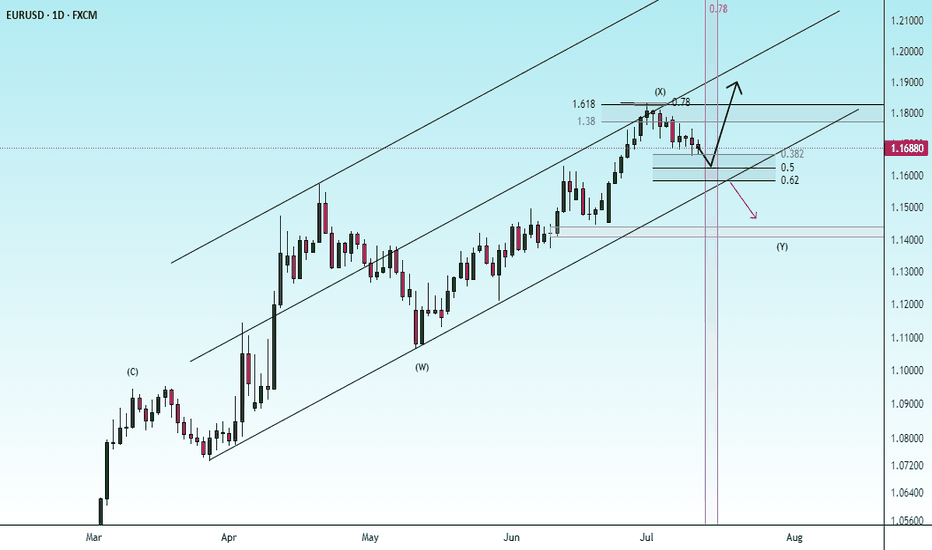

possibility of downtrendIt is expected that the upward trend will advance to the specified resistance range and then we will see a change in trend and the beginning of the downtrend.

If the index crosses the resistance range and consolidates above this range, the continuation of the upward trend will be likely.

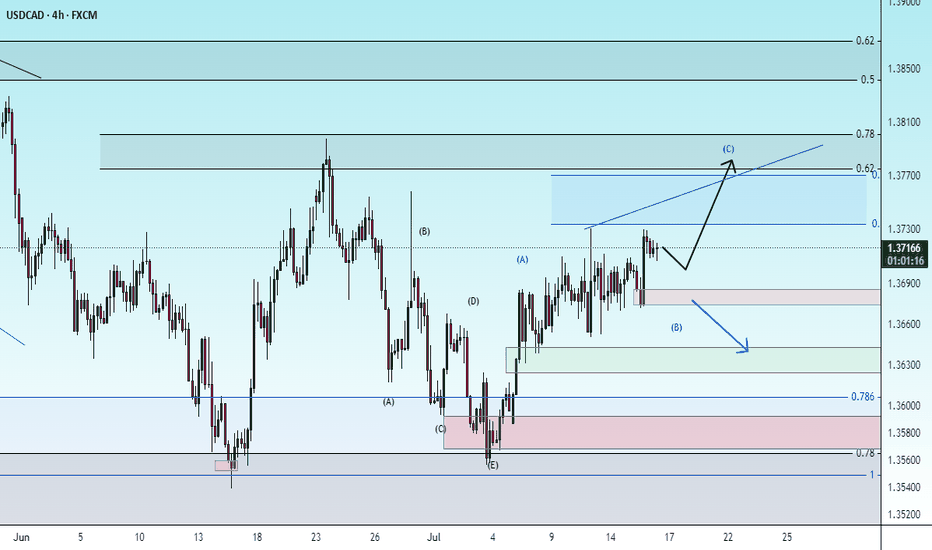

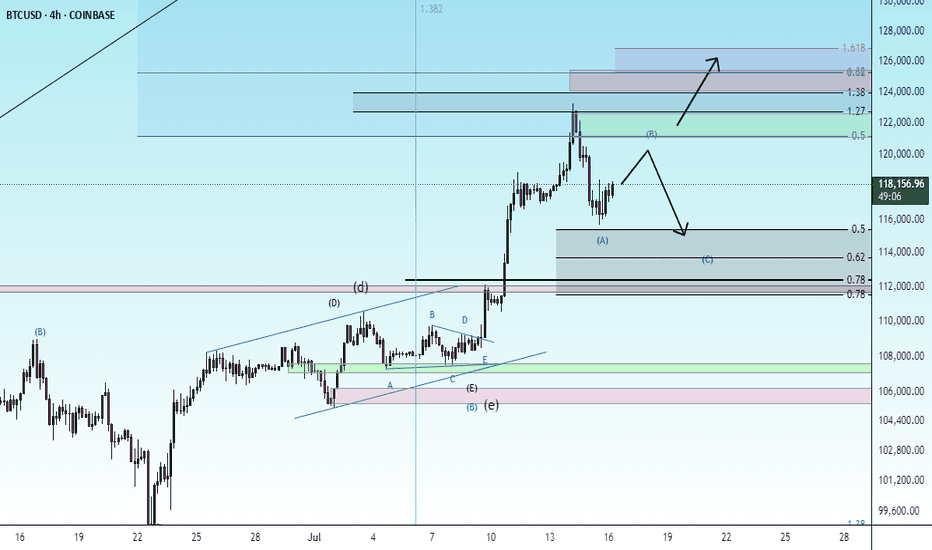

check the trendIt is expected that the upward trend will pass the resistance range and with the stabilization above this range, we will see the continuation of the upward trend.

If the price crosses the support trend line, the continuation of the correction will be formed. And with the failure of the support range, the beginning of the downtrend of the scenario will be likely.

Neowave Structural Outlook – Complex Correction: W–X–Y–X–ZThis analysis interprets the ongoing structure as a Complex Correction in the form of a W–X–Y–X–Z pattern. Here's a breakdown of the logic behind the wave labeling and key observations:

Overall Structural Summary:

W wave (M1–M5): Though M1 is labeled as ":5", a closer examination of its internal structure reveals corrective characteristics. Therefore, the entire M1–M5 segment is best interpreted as a complex corrective structure, possibly a double three or flat.

X wave 1 (M6–M8): A clear Zigzag, fulfilling the requirements for a valid X. All relevant time and price criteria are met, forming a neat connector after W.

Y wave (M9–M13):

M9–M10: A Zigzag formation.

M11–M12–M13: M12 serves as an x-wave, and M13 unfolds as a simple corrective move in three waves, completing the Y wave. Though M13 is a single-leg visually, the internal structure confirms a three-part move.

The Y wave is longer in both time and complexity, appropriate for its position in the sequence.

X wave 2 (M14): Despite appearing as a short single move, it satisfies the X criteria in the context of the ongoing correction. The small size is acceptable as per rule allowances for connectors in Z formations.

Z wave (M15–ongoing):

M15–M17: Another Zigzag, forming the first leg of Z.

M18: Likely the X connector within Z.

M19: Assumed to be the beginning of the final leg of Z. The structure from here forward will determine whether Z completes as a triangle, zigzag, or another combination.

Supporting Rule Applications:

Several Neowave rules were cross-verified:

- Rule 2a and 5a were referenced to validate corrections that exceed the 61.8% retracement and duration benchmarks.

- Rule 7c and 4 supported impulse invalidations and corrections involving running structures.

Time symmetry across connectors and leg duration was considered to maintain wave consistency.

Visual Channels:

All W, Y, and Z legs are progressing within clearly defined channels.

The Z leg is currently within a steep rising channel. If Z completes as a non-triangular formation, a reversal might follow.

Conclusion & Risk Notes:

This structure, though corrective in nature, contains strong upward segments — especially within Z — making it tradable for bullish swings.

Given that Z is the final leg, caution is warranted. Once Z completes (especially if M19 develops into a three-wave structure), the larger correction may terminate, potentially leading to a larger trend reversal.

Position management (e.g., scaling out or using stop-losses) is advised as the structure evolves.