NVDA Bullish Setup | Structure, Momentum & Risk Defined🔥 NVDA Bullish Layered Accumulation Playbook (Swing Trade)

Asset:

NVDA – NVIDIA Corporation

NASDAQ Exchange | US Equities

🧭 Trade Thesis (Bullish Bias)

NVDA remains structurally strong within the broader AI, data-center, and semiconductor leadership cycle. Price action shows healthy pullback behavior within a dominant bullish trend, offering swing traders an opportunity to accumulate via layered entries instead of chasing breakouts.

This plan is designed using a layered limit-order approach (“thief-style accumulation”), allowing flexibility and improved average pricing during volatility.

🟢 Entry Strategy – Layered Accumulation (Thief Style)

Instead of a single entry, this plan uses multiple buy-limit layers to manage volatility and avoid emotional entries.

📌 Layered Buy Zones (example):

Buy Limit 1: $190.00

Buy Limit 2: $185.00

Buy Limit 3: $180.00

👉 Traders may add or adjust layers based on their own risk tolerance, timeframe, and volatility expectations.

👉 This structure allows participation from any price level, while improving cost basis if price dips.

🔴 Risk Management – Stop-Loss Zone

🛑 Protective Stop-Loss: $175.00

⚠️ Important Note (Risk Awareness):

Dear Ladies & Gentlemen (Thief OGs), this stop-loss level is not mandatory. Risk management is a personal decision — manage size responsibly and secure profits according to your own trading plan.

🎯 Target Zone – Profit Protection Area

🚧 Target: $205.00

This level aligns with:

Prior strong resistance (police barricade zone)

Signs of potential overbought conditions

Possible liquidity traps near highs

📌 The plan is to escape with profits, not to predict tops. Partial profit-taking is encouraged as price approaches resistance.

⚠️ TP Reminder:

This take-profit level is guidance only. Traders are free to secure gains based on their own strategy and market conditions.

📊 Technical Context (Clean & TradingView-Friendly)

Bullish higher-timeframe structure intact

Pullback within trend = accumulation opportunity

Layered entries reduce timing risk

Resistance overhead justifies disciplined exits

🌍 Fundamental & Economic Factors Supporting NVDA

Fundamental Drivers:

NVIDIA remains a core leader in AI chips, data centers, and accelerated computing

Strong demand from cloud providers, AI infrastructure, and enterprise compute

Ongoing investment in next-gen GPUs and AI platforms

Macro & Economic Considerations:

US tech sector strength tied to AI capex cycles

Market sensitivity to interest-rate expectations and inflation data

Risk-on sentiment generally benefits high-growth semiconductor leaders

📌 Watch upcoming:

US CPI / PPI inflation data

Federal Reserve rate guidance

Earnings or forward-looking statements impacting AI demand expectations

🔗 Related Symbols to Watch (Correlation Check)

NASDAQ:SOXX / NASDAQ:SMH – Semiconductor ETFs (sector health confirmation)

NASDAQ:QQQ / NASDAQ:NDX – Nasdaq strength supports NVDA momentum

NASDAQ:AMD – Peer comparison and sentiment gauge

NASDAQ:MSFT / NASDAQ:GOOGL – AI infrastructure demand correlation

📈 Strength in these symbols often confirms bullish continuation in NVDA.

🧠 Master Trader Note (Correction & Guidance)

You’re not “wrong” in asking for layered entries at any price level — this is a valid accumulation methodology. The key improvement is clarity, structure, and risk framing, which ensures the idea remains educational, compliant, and professional rather than promotional or misleading.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a thief-style trading strategy just for fun. This analysis is for educational purposes only and does not constitute financial advice. Trade responsibly.

Nvdastock

Nvidia: New Low ExpectedNvidia should soon develop further downward momentum to carve out the low of the beige wave IV. Nevertheless, price should pivot upward before dropping below the support at $145.50 and rise into our red Target Zone between $227.38 and $260.60. This is where the waves V in beige, (V) in blue, and in lime green are expected to find their common peak, followed by a new, significant correction phase. Consequently, we consider the red zone a suitable range to enter on the short side, with a stop set 1% above the zone's upper edge to aid in risk management. We also consider a 33% probability that the lime green wave alt. already completed at $212.16. This alternative scenario would be confirmed by direct sell-offs below the $145.50 support.

Can NVDA Hold the Pullback Zone and Extend the Uptrend?🔥 NVDA Bullish Pullback Playbook – Thief-Style Swing Setup 🚀🕵️♂️

Hey traders & my fellow Thief OG’s 😎🕶️ — here’s a clean, polished, TradingView-friendly version of my NVDA Swing Trade Playbook with a professional + funny touch. Let’s get to the setup 👇🔥

📌 Asset

NVDA – NVIDIA Corporation (NASDAQ)

Swing Trade | Momentum | Trend-Following Setup

📈 Plan: Bullish Pullback Strategy (Pending Orders Active)

The trend is strong, the buyers are steady, and NVDA is still delivering clean higher-lows. We're waiting for either a breakout continuation or a discounted pullback entry. 📊⚡

🎯 Entry Zones

1️⃣ Breakout Entry – Momentum Thief Mode 🥷⚡

Enter after clearing the nearest resistance at $191.00

• Clean breakout

• Volume confirmation

• Trend continuation strength

2️⃣ Pullback Entry – SuperTrend ATR Sniper Entry 🎯📉

Watch for a discounted pullback near $170.00 around the SuperTrend ATR zone.

• Trend support retest

• Lower-risk entry

• Ideal for swing traders who wait for “patience-pays entries” 😎

🛡️ Stop-Loss (Thief Style – Risk First)

Breakout Entry SL → $180.00

SuperTrend Pullback SL → $160.00

Note: Dear Ladies & Gentlemen (Thief OG’s) ❤️

I’m NOT recommending you use only my SL. Choose your own levels — you make the money, you protect the money. Trade at your own risk 🔐⚠️

🎯 Target (Take-Profit Zone)

Our target → $210.00

Why?

• Strong resistance zone

• Overbought region historically

• Buyer trap zone where police force 🚔👮♂️ usually waits — so escape with profits early 😂💨

Note: Dear Ladies & Gentlemen (Thief OG’s) 🙌

I’m NOT recommending you set my TP only. Choose your own TP — your money, your exit. Trade with responsibility 💼💰

🔍 Related Pairs to Watch (Correlation Insights + Key Notes)

NASDAQ:AMD

• High positive correlation with NVDA

• When AMD shows volume expansion, NVDA often follows

• Good for momentum confirmation 🔥

NASDAQ:SOXX (iShares Semiconductor ETF)

• NVDA is a major weighted component

• ETF direction confirms big-money flow 🧠💸

• Great for spotting sector-wide risk-on / risk-off shifts

NASDAQ:QQQ (NASDAQ 100 ETF)

• NVDA is one of the heaviest weights

• If QQQ trends strongly → NVDA often mirrors

• Macro sentiment index for tech strength 📊⚡

NASDAQ:SMH (VanEck Semiconductor ETF)

• Clean supply/demand signals

• NVDA mirrors SMH breakouts frequently

• Helps confirm breakout validity before taking the trade

All these help you avoid fakeouts and align with overall semiconductor market strength.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ This is a thief-style trading strategy created just for fun. Trade responsibly.

NVIDIA (NVDA): Where Are We in the Cycle?Ticker: NVDA

Category: Market Structure / Elliott Wave Analysis

Author’s note: Educational analysis — not financial advice.

🧠 Market Context

NVIDIA has been one of the strongest growth stories in the last market cycle. However, after such a powerful move, many traders are now asking: Where are we in the broader structure — and what could come next?

From a structural perspective, NVDA appears to have completed its third Elliott Wave, with the fourth wave currently in progress. This phase often reflects a period of consolidation, where the market digests previous gains before potentially starting the fifth wave.

📊 Elliott Wave Structure

Through the lens of Elliott Wave theory:

Wave 3 — likely completed after the parabolic advance that marked NVIDIA’s latest all-time highs.

Wave 4 — a corrective phase, potentially forming a sideways or slightly downward structure.

Wave 5 (ahead?) — may still occur, possibly extending above the upper boundary of the current price channel.

However, once the fifth wave completes, markets typically enter a longer consolidation or corrective phase — often retracing 50–60% of the total move from the highs.

⚙️ Volatility and Price Range

Currently, NVDA is trading within a broad channel, roughly between $100 and $400+.

Volatility remains elevated — which suggests that the sideways phase could persist for several months, or even longer.

Such behavior is common in late-cycle stages when large market participants distribute part of their holdings while retail interest remains high.

📈 Key Takeaways

The main impulsive move seems to have already played out.

The market may enter a range-bound or sideways phase, with local rallies still possible.

Correction risks are gradually increasing, especially if the fifth wave develops and fails to sustain new highs.

In short, this might not be the best time to chase — but rather to observe how price behaves within the current channel.

💬 Final Thoughts

This analysis is purely educational and reflects one possible scenario based on market structure.

No one can predict the exact timing or depth of the next move — the market always decides.

👉 What do you think?

Are we already in the correction phase, or is there still one more leg up left for NVDA?

Share your view in the comments below 👇

NVDA Setup Explained: Layered Entry + Clear SL/TP Levels😎 NVDA Thief’s Wealth Heist: Swing/Day Trade Blueprint 🚀

Asset: NVIDIA Corporation (NVDA) 📈Vibe: Bullish, sneaky, and ready to snatch profits with style! 💰

Welcome, ladies and gentlemen, to the Thief’s OG Wealth Strategy Map for NVDA!

This is a fun swing/day trading plan designed to grab liquidity like a master thief. Let’s break down this bullish setup with a double bottom pullback, layered entries, and a cheeky escape plan. Ready to outsmart the market? 🕵️♂️

📊 Market Analysis: Why NVDA?

NVDA is riding a bullish wave 🌊, confirmed by a double bottom pullback pattern and a sneaky liquidity grab at key support levels. The stock’s momentum is screaming “UP!” as buyers step in to defend the price. This setup is perfect for swing or day traders looking to capitalize on NVIDIA’s tech-fueled surge. 💻

🗺️ The Thief’s Plan: Bullish Heist Strategy

🎯 Entry Strategy:Deploy the Thief’s Layering Tactic with multiple buy limit orders to maximize your entry precision.

Suggested price levels:

$172.00

$174.00

$176.00

$178.00

Pro Tip: Feel free to add more layers based on your risk appetite and market conditions. The more, the merrier! 🧑💼

🛑 Stop Loss (SL):Set a Thief’s SL at $168.00 to protect your loot.

Note: Dear Thief OGs, this SL is my suggestion, but you’re the boss of your trades! Adjust based on your risk tolerance and let the profits roll. 💸

🎉 Take Profit (TP):Aim for the juicy $195.00 target, where we expect strong resistance, potential overbought conditions, and a possible trap for the unprepared. Lock in those hard-earned gains and escape like a pro! 🏃♂️

Note: This TP is my call, but you do you! Take profits at your own pace and keep the cash flowin’. 😎

🔗 Related Pairs to Watch (in USD)

To boost your market awareness, keep an eye on these correlated assets:

NASDAQ:AMD (Advanced Micro Devices): NVDA’s chipmaking cousin often moves in tandem. A bullish NVDA could signal strength in AMD. 📡

NASDAQ:SMH (VanEck Semiconductor ETF): This ETF tracks the semiconductor sector, including NVDA. Watch for sector-wide momentum. 📊

NASDAQ:QQQ (Invesco QQQ Trust): NVDA’s a heavy hitter in this tech-heavy ETF. QQQ’s trend can confirm NVDA’s direction. 🚀

Key Correlation Point: NVDA’s performance is tied to the broader semiconductor and tech sector. If AMD or SMH shows bullish patterns, it reinforces NVDA’s upside potential. Conversely, weakness in QQQ could signal caution. Stay sharp, thieves! 🕵️

🛠️ Why This Setup Rocks

Double Bottom Pullback: A textbook bullish reversal pattern, signaling strong buying interest. 📉➡️📈

Liquidity Grab: The market’s attempt to shake out weak hands before the real move up. We’re smarter than that! 😏

Layered Entries: Spread your risk across multiple price levels for a smoother ride. 🎢

Risk Management: Clear SL and TP levels keep your heist disciplined and profitable. 🧠

⚠️ Disclaimer

This Thief Style Trading Strategy is just for fun and educational purposes! I’m not a financial advisor, and trading involves risks. Make your own decisions, manage your risk, and trade responsibly. Let’s keep the vibes high and the losses low! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NVIDIA #NVDA #Trading #SwingTrading #DayTrading #ThiefStrategy #StockMarket #Bullish #TechnicalAnalysis

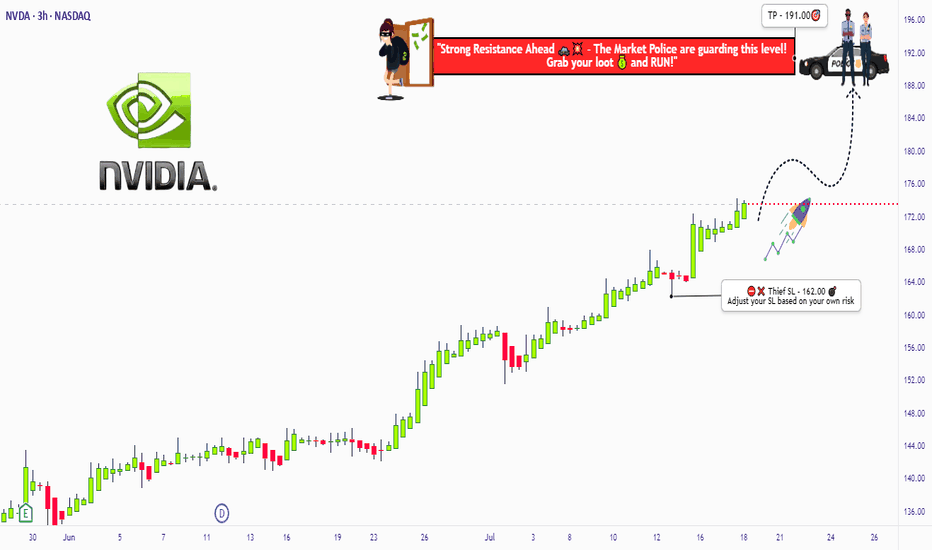

Bullish Pullback Attack – NVIDIA Heist Plan for Escape Loot!🚨💻 NVIDIA (NVDA) Stock Heist Plan 🎭 | Swing & Day Trade Robbery 💰⚡

🌟 Hey Money Makers & Market Robbers! 🌟

Welcome back to the Thief Trading Den where we don’t trade… we steal from the market vaults! 🏦💸

🔥 Asset: NVIDIA (NVDA)

🎭 Heist Type: Swing / Day Trade

🔑 Plan: Bullish Pullback Robbery

🗝️ Entry (Breaking into the Vault)

First lockpick entry above 167.00+ 🔓

Retest & pullback = perfect robbery spot

Thief layering strategy: stack multiple buy limit orders (layered entry like robbers tunneling from multiple sides 🛠️).

Any price level? Yes, thieves adapt—grab loot wherever the window cracks open! 🏃♂️💨

🛑 Stop Loss (Escape Route 🚪)

Official Thief SL: @ 161.00 ⚠️

But dear Thief OG’s, adjust based on your risk appetite, loot bag size & startergy 🎭

Remember, no thief survives without an escape route! 🚁

🎯 Target (The Electric Fence Escape ⚡)

The High Voltage Electric Shock Fence is guarding the treasure @ 196.00 ⚡⚡

Snatch your profits before the fence fries the loot 🔥

Escape fast, spend faster, rob smarter 💸🍾

⚠️ Thief Alert 🚨

The market guards (short sellers) are patrolling heavy—don’t get caught in their traps 🕵️♂️

Use layered limit orders, scale out profits, and keep your SL tight!

A true thief never overstays at the crime scene 👀

💥 Boost this Robbery Plan 💥

Every like & comment powers the Thief Trading Family 🏆

Stay sharp, stay sneaky & let’s rob NVIDIA together! 🤑🎭

NVDA Showdown:Will Bulls Charge to $204 or Bears Drag Us to $163If NVDA falls under $179, it might quickly drop to $176.70. If it keeps falling, the next stop could be $163. But if NVDA goes up and closes above $188, we could see it reach $199 or even $204.

Why do these levels matter? Because a big move could happen soon; either a big fall or a strong jump up. What would you do if NVDA hit these prices? Have you seen this happen before?

If you’re wondering what these moves could mean for you, or if you have questions, just send me a message. Sometimes one good question leads to your best trade ever. What would you ask if you could get a clear answer?

Mindbloome Exchange/ Trade What You See

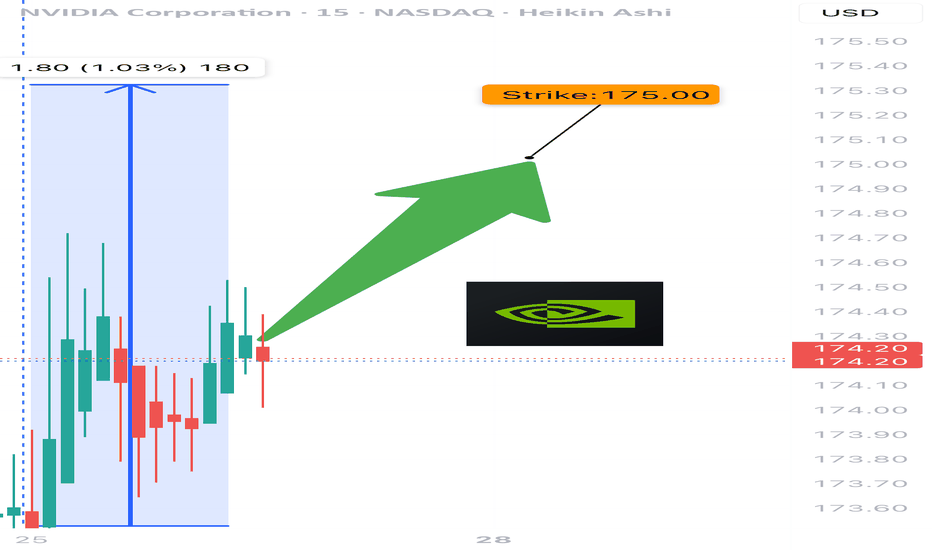

NVDA $182 Weekly CALL Setup – Cheap Premium, Big Upside?

# 🚀 NVDA Weekly Options Trade Idea (2025-09-03)

### 📊 Multi-Model Recap

* **Daily RSI**: 📉 34.3 (weak)

* **Weekly RSI**: 🔻 73.2 (falling)

* **Volume**: +1.3x → institutional distribution signs

* **Options Flow**: 🔥 C/P = 1.96 (bullish skew)

* **Gamma/Theta**: ⚡ High risk (2 DTE)

👉 Models Split:

* 🐻 Bearish: Claude, Gemini → favor \$165 PUT

* 🐂 Bullish: Llama, Grok → favor \$175 CALL

* 😶 Neutral/No Trade: Claude (low confidence)

---

### 🧭 Consensus Read

* Price & volume = bearish ⚠️

* Options flow & VIX = bullish 📈

* Net: **Mixed bias → tactical bullish bounce possible**

---

### ✅ Trade Setup (Viral Play)

```json

{

"instrument": "NVDA",

"direction": "CALL",

"strike": 175,

"expiry": "2025-09-05",

"entry_price": 0.68,

"profit_target": 1.36,

"stop_loss": 0.34,

"size": 1,

"confidence": 0.65,

"entry_timing": "market open"

}

```

---

### 🎯 Trade Details

* 📌 **Strike**: \$182 CALL

* 💵 **Entry**: 0.68 (ask, open)

* 🎯 **Target**: 1.36 (+100%)

* 🛑 **Stop**: 0.34 (-50%)

* 📅 **Expiry**: Sep 5 (2 DTE)

* 📈 **Confidence**: 65%

* ⏰ **Hold Policy**: Close by Thu EOD (don’t ride Friday gamma bomb)

---

⚠️ **Risks**:

* 2 DTE = 🔥 high gamma / fast theta decay

* Divergent signals → whipsaws possible

* Tight stop discipline required 🚨

NVDA Earnings Play | \$190C– Don’t Miss Out

# 🚀 NVDA Earnings Play | \$190C @ 2.49 | 200–400% Target 🎯

### 📝 Quick Take (TL;DR)

* **Bias:** Moderate-Bullish (78% confidence).

* **Rationale:** Fundamentals 🔥 + Options flow skewed bullish 📈 + Technicals constructive.

* **Main Risk:** China export \~\$8B headwind in guidance.

---

### 🎯 Trade Idea

* **Buy** NVDA **2025-08-29 \$190 Call**

* 📌 Entry: \$2.49 (ask) — enter **pre-earnings close** (Aug 26 AMC).

* 🛑 Stop: \$1.25 (−50%).

* 🎯 Targets:

* +200% → \$7.47

* +300% → \$9.96

* ⏳ Exit Rule: If neither stop/target hit, **close within 2h post-earnings open**.

* ⚖️ Risk: \$249 per contract (max loss).

---

### 📊 Why This Setup?

**Fundamentals (9/10)**

* Revenue growth: +69% TTM 🚀

* Margins elite (gross 70%, net 52%) 💰

* Beat history: 8/8 last quarters ✅

* Balance sheet strong (cash \~\$54B).

**Options Flow (8/10)**

* Implied move ~~5.9% (~~\$10.5).

* Call OI heavy @ \$185–\$200 (gamma cluster).

* Liquidity excellent at \$190 strike (OI >64k).

**Technicals (8/10)**

* Price \$179.83, holding above 20/50/200 MAs.

* RSI neutral (53).

* Resistance: \$184.5 / \$190 / \$200.

* Coiling under highs 🔄.

**Macro (6/10)**

* AI/data center demand = secular tailwind.

* China ban risk headline.

* VIX \~15 → complacency = bigger gap risk.

---

### ⚠️ Risks

* Guidance may highlight China hit (\$8B) → bearish gap.

* IV crush 30–50% post-print.

* Gap risk may bypass stop.

* Single-leg naked = high variance → **size small (≤2% portfolio).**

---

### 📌 Execution Checklist

✅ Confirm ask = 2.49 @ close.

✅ Expiry = 2025-08-29 (weekly).

✅ Size ≤ 2% acct.

✅ Close within 2h post-earnings if no trigger.

---

### 📊 TRADE JSON

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 190.0,

"expiry": "2025-08-29",

"confidence": 78,

"entry_price": 2.49,

"stop_loss": 1.245,

"profit_target": 7.47,

"size": 1,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-26",

"earnings_time": "AMC",

"expected_move": 5.9,

"iv_rank": 0.75,

"signal_publish_time": "2025-08-26 14:00:37 UTC-04:00"

}

```

---

### 🔖 Hashtags

\#NVDA #EarningsPlay #OptionsTrading #CallOptions #StockMarket #AIStocks #Futures #SwingTrade #TradingSignals #RiskReward #OptionsFlow #SP500 #TechStocks

NVDA \$200C→ Big Move Loading?

# 🚀 NVDA Weekly Options Setup | \$200 Call 🎯 (High Risk / High Reward)

📊 **TRADE SNAPSHOT**

* **Ticker**: NVDA

* **Direction**: 📈 CALL (LONG)

* **Strike**: \$200

* **Entry Price**: \$1.44

* **Profit Target**: \$2.16 (50% gain)

* **Stop Loss**: \$0.58 (40% risk)

* **Expiry**: 2025-08-29

* **Confidence**: 65%

* **Timing**: Enter at Open

* **Signal Time**: 2025-08-23 11:11 EDT

---

### 🔎 Market Analysis

✅ **Weekly RSI**: 87.2 (RISING → Strong Bullish)

⚠️ **Daily RSI**: 63.3 (FALLING → Short-term caution)

📉 **Volume**: 0.9x last week (Weak confirmation)

🔥 **Options Flow**: Calls 617k vs. Puts 383k → **1.61 ratio (Bullish Bias)**

---

### 📈 Bias & Strategy

* **Overall Sentiment**: **Moderate Bullish** 🚀

* Bullish institutions loading Calls → supports upside.

* Weak daily momentum + low volume = ⚠️ caution.

* High gamma risk → manage tight with stop loss.

🏷 **Tags**:

\#NVDA #OptionsTrading #SwingTrade #WeeklyOptions #TradingView #StockMarket #EarningsPlay #MomentumTrading #OptionsFlow #GammaRisk

Strong Bullish Flow in NVDA: $180 Calls Primed for Breakout! 🚀 NVDA Weekly Options Bullish Flow – Aug 19, 2025

**Market Sentiment:**

📈 Total calls: **632,689** | Total puts: **334,721**

💥 **Call/Put Ratio: 1.89 → Strong Weekly Bullish Flow**

⚠️ Gamma Risk: Moderate – watch volatility closely.

**Technical Indicators:**

* **Daily RSI:** 63.3 → slight pullback signs

* **Weekly RSI:** 87.2 → 🚀 strong weekly momentum

* **Weekly Volume Ratio:** 0.9x → weak institutional activity, caution advised

**Options Highlights:**

* Key strikes: **\$180** (OI: 65,649), **\$187.50** (liquid and premium-friendly)

* Expiration in **3 days** → time decay accelerating

**Risks to Monitor:**

* Weak weekly volume

* Daily RSI trending down

* Price support at **\$175.90–\$176.00**

**Consensus & Trade Setup:**

* **Overall Bias:** Moderate Bullish

* **Recommended Trade:** **Single-leg Call**

* **Strike:** \$180.00

* **Entry:** \$3.60

* **Stop Loss:** \$1.80

* **Profit Target:** \$6.00–\$7.50 (80%-100% potential)

* **Confidence:** 65%

**Trade JSON Snapshot:**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 180.0,

"expiry": "2025-08-22",

"confidence": 0.65,

"profit_target": 6.00,

"stop_loss": 1.80,

"size": 1,

"entry_price": 3.60,

"entry_timing": "open",

"signal_publish_time": "2025-08-19 13:15:57 EDT"

}

NVDA Ready to Break Higher – $187.50 Calls Flashing Opportunity!

# 🚀 NVDA Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Model Insights Recap

**Grok/xAI Report**

* 📊 RSI: Falling (daily & weekly → potential exhaustion)

* 📈 Call/Put Ratio: **2.00 (Bullish flow)**

* 🔊 Volume: Weak

* ✅ Decision: Moderate bullish → suggested **\$190 Call**

**Gemini/Google Report**

* 📊 RSI: Declining

* 📈 Options Flow: Strong, but weak trend & volume

* 🛑 Decision: **Pass** (low confidence)

**Claude/Anthropic Report**

* 📊 Technical: Overbought with negative divergence

* 🔊 Volume: Flat weekly

* 🛑 Decision: **No trade** (bearish momentum indicators)

**Llama/Meta Report**

* 📊 Bias: Neutral-bullish (options flow positive)

* 🔊 Volume: Weak

* ✅ Decision: **\$187.50 Call** with caution

**DeepSeek Report**

* 📊 Market: Bearish divergence despite bullish flow

* 🔊 Volume: Weak institutional support

* 🛑 Decision: **No trade**

---

### 📌 Key Agreements

✔️ Declining daily & weekly RSI = potential momentum exhaustion

✔️ Strong call/put ratio = bullish sentiment from options traders

✔️ Weak volume = lack of support for sustained upside

### 📌 Key Disagreements

⚖️ Grok/xAI & Llama/Meta → potential bullish calls

⚖️ Gemini/Claude/DeepSeek → caution/pass

⚖️ Bullishness varies depending on options flow vs volume

---

## 📊 Recommended Trade Setup

* **Direction:** CALL (Long)

* **Strike:** \$187.50

* **Expiry:** 2025-08-22

* **Entry Price:** \$0.85

* **Stop Loss:** \$0.34 – \$0.425 (40-50% of premium)

* **Profit Target:** \$1.50 (50-100% return)

* **Entry Timing:** Market Open

* **Confidence:** 65%

---

### ⚠️ Key Risks

* **Momentum Exhaustion:** Falling RSI could signal reversals

* **Weak Institutional Support:** Volume may limit upside

* **Event Risk:** Upcoming earnings may introduce volatility

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 187.50,

"expiry": "2025-08-22",

"confidence": 0.65,

"profit_target": 1.50,

"stop_loss": 0.34,

"size": 1,

"entry_price": 0.85,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 09:26:30 EDT"

}

```

NVDA Gamma Showdown: Will Bulls Break $185 Before Time Runs Out? 🚀 NVDA Gamma Showdown: Will Bulls Break \$185 Before Time Runs Out?

**Sentiment:** ⚖️ *Moderate Bullish, High Risk*

* **Call/Put Ratio:** 1.78 📈

* **Daily RSI:** Mixed → Losing momentum

* **Weekly RSI:** Still bullish

* **Volume:** Weak → Low institutional conviction

* **Gamma Risk:** 🔥 HIGH — expiry in 1 day

* **Time Decay:** Accelerating ⚡

---

### 📊 **Consensus Highlights**

✅ Bullish options flow supports upside potential

⚠️ Weak volume + gamma risk = cautious sizing

💡 Tight stop loss and fast profit-taking advised

---

### 🎯 **Trade Setup**

* **Type:** CALL (Naked)

* **Strike:** \$185.00

* **Expiry:** 2025-08-15

* **Entry:** \$0.62

* **Profit Target:** \$0.86 (+30%)

* **Stop Loss:** \$0.31 (–50%)

* **Confidence:** 65%

* **Entry Timing:** Market open

---

💬 *This is a high-risk, high-reward expiry play — watch it like a hawk.*

📌 *Not financial advice. DYOR.*

---

**#NVDA #OptionsTrading #GammaSqueeze #DayTrading #StocksToWatch #OptionsFlow #TradingSignals #StockMarket**

Nvidia (NVDA) Share Price Growth SlowsNvidia (NVDA) Share Price Growth Slows

Equity markets are on the rise:

→ The S&P 500 index (US SPX 500 mini on FXOpen) has reached a new all-time high;

→ The Nikkei 225 (Japan 225 on FXOpen) hit a fresh record high yesterday;

→ Gains are also seen across other assets — for example, Ethereum has climbed to its highest level since November 2021.

The CNN Fear & Greed Index indicates market “greed”, but it is worth noting that one of the market leaders, Nvidia (NVDA), is not matching the broader bullish momentum.

Technical Analysis of Nvidia (NVDA)

Although NVDA’s share price remains within a long-term ascending channel (shown in blue), holders have valid reasons for concern.

The NVDA chart shows that price growth is capped by the $183 resistance level, with a series of bearish signals emerging (as indicated by the arrows):

→ Following a bullish gap in late July, the price failed to sustain its highs and quickly retreated, erasing the upbeat sentiment;

→ A bearish engulfing pattern on 7 August suggests that the median line of the ascending channel is acting as resistance;

→ The RSI indicator peaked on 29 July, but subsequent price increases have not been accompanied by higher RSI highs — a sign of bearish divergence.

As a result, NVDA price is consolidating within a narrowing triangle:

→ On the one hand, higher lows indicate that buyers are still supporting the price;

→ On the other hand, the $183 level continues to cap the advance of this market leader despite the broader bullish environment.

Bulls need to show determination soon to break through the key $183 resistance; otherwise, the ascending channel in place since early July risks being breached. In that scenario, the August low near $172 could be retested.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA don’t Miss Out--$190 Call Target, Momentum on Fire## 🚀 NVDA Weekly Options Breakdown (Aug 11, 2025) 🚀

### 🔥 Market Sentiment: Bullish Bias Across Models

* **Grok/xAI**: Strong Bullish — rising RSI & bullish flow, but *watch weak volume*.

* **Claude/Anthropic**: Moderate Bullish but *no trade* due to policy risks & volume doubts.

* **Gemini/Google**: Moderate Bullish, recommends **\$192.5 calls** with stop loss — volume risk noted.

* **Llama/Meta**: Bullish — buy **\$190 calls**, manage volatility & premium decay.

### ✅ Consensus Trade Setup:

**Buy \$190 Calls** expiring Aug 15 @ \$0.70 premium

* 🎯 Profit Target: \$0.91

* 🛑 Stop Loss: \$0.35

* 📊 Confidence: 70%

* ⏰ Entry: Market Open Next Trading Day

### ⚠️ Key Risks:

* Policy/news impact on semiconductor sector

* Moderate gamma risk & possible volatility spikes near expiry

---

### 🔍 Model Insights Breakdown

| Model | Sentiment | Trade Idea | Confidence |

| ---------------- | ---------------- | ------------------------------ | ---------- |

| Grok/xAI | Strong Bullish | Buy \$190 Calls | 70% |

| Claude/Anthropic | Moderate Bullish | No trade (high news risk) | 45% |

| Gemini/Google | Moderate Bullish | Buy \$192.5 Calls w/ stop loss | 65% |

| Llama/Meta | Bullish | Buy \$190 Calls w/ risk mgmt | 70% |

---

### 💡 Why This Matters

* RSI and options flow point strongly bullish — calls dominate puts 1.2+ ratio

* Volume confirmation weak, so *manage risk tightly*

* Position best for aggressive traders ready to manage fast moves

---

📈 **NVDA Weekly Options Trade Summary**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 190.0,

"expiry": "2025-08-15",

"confidence": 0.70,

"profit_target": 0.91,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.70,

"entry_timing": "open",

"signal_publish_time": "2025-08-11 10:33:48 UTC-04:00"

}

```

NVDA Don't Miss Out !!!!

**NVDA \$185C Weekly Momentum Surge ⚡ All Models Aligned – 75% Confidence Setup 🔥**

---

### 📊 **Post Body (Optimized for TradingView):**

**NVDA Weekly Call Play — Aug 8 Expiry (3 DTE) 🔥**

📈 **Momentum Snapshot:**

* **Weekly RSI:** 🔼 Above 50 and climbing

* **Daily RSI:** 🔻 Falling — short-term caution

* **Volume:** 1.2x previous week (🟢 Institutional flow)

* **Volatility (VIX):** <22 — favorable setup

* **Gamma Risk:** 🟠 Moderate

---

🧠 **Model Scorecard Summary:**

* **Grok / xAI:** 4/5 Bullish 🟢

* **Gemini (Google):** 3/5 Bullish with 80% confidence 🟢

* **Claude (Anthropic):** 5/5 Bullish 💯

* **LLaMA (Meta):** 4/5 Bullish 💪

* **DeepSeek:** 5/5 Bullish 🚀

✅ **Consensus:** Strong Bullish 🔥

---

### 💡 **Trade Setup:**

* 🎯 **Strategy:** Long CALL

* 🟢 **Strike:** \$185

* 📅 **Expiry:** Aug 8, 2025

* 💵 **Entry Price:** \$0.96

* 📈 **Target Exit:** \$1.90 (100% gain)

* 🛑 **Stop Loss:** \$0.48 (50% risk cap)

* 📏 **Size:** 1 contract

* ⏰ **Timing:** Market Open

* 📊 **Confidence Level:** 75%

---

⚠️ **Key Risks to Watch:**

* Time decay – Only 3 DTE ⏳

* Daily RSI divergence 😬

* Gamma risk & market volatility (track \ TVC:VIX )

---

### 🧾 **Auto-Logger JSON (for tracking):**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 185.00,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.90,

"stop_loss": 0.48,

"size": 1,

"entry_price": 0.96,

"entry_timing": "open",

"signal_publish_time": "2025-08-05 09:43:22 UTC-04:00"

}

```

---

### 🏷️ **Suggested Hashtags (TradingView Style):**

`#NVDA #OptionsTrading #WeeklyOptions #CallOptions #MomentumStocks #AIStocks #TechLeaders #TradingSetup #RSISignal #GammaSqueeze #NVIDIA #OptionAlert #HighConviction #TradeIdeas #TechBreakout`

NVDA Weekly Trade Setup (2025-08-02)

### 🟢 NVDA Weekly Trade Setup (2025-08-02)

🚀 **BULLISH CONSENSUS** across 5 top-tier models

📉 Daily RSI: Weak — but weekly trend is STRONG

💼 Institutional Volume: Confirmed accumulation

📊 Options Flow: Call/Put leaning bullish

---

### 🎯 TRADE SETUP

**💥 Direction:** CALL (LONG)

**📍 Strike:** \$182.50

**📅 Expiry:** 2025-08-08

**💵 Entry:** \$0.73

**🎯 Target:** \$1.46 (100% gain)

**🛑 Stop:** \$0.36 (50% risk cap)

**✅ Confidence:** 75%

**🕒 Entry Timing:** At market open

---

### 🧠 Model Breakdown:

✅ **Grok/xAI:** Weekly bullish, 4/5 signals green

✅ **DeepSeek:** Volume confirms; cautious on daily RSI

✅ **Google/Gemini:** Bullish weekly > bearish daily

✅ **Claude:** Weekly momentum + rising options flow

✅ **Meta/Llama:** All signals aligned for \$182.50 call

---

### ⚠️ Risk Watch:

* Falling Daily RSI = short-term drag risk

* Key Support: Watch for \$178 breakdown

* Earnings/events could spike volatility

---

### 📦 TRADE JSON (for tracking):

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.46,

"stop_loss": 0.36,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-08-03 00:54:05 UTC-04:00"

}

```

---

🔥 *“Smart money is circling. Ride the wave, not the noise.”*

💬 Drop your thoughts below. Will NVDA break \$185 next week?

NVDA 0DTE TRADE SIGNAL – JULY 25, 2025

⚡ NVDA 0DTE TRADE SIGNAL – JULY 25, 2025 ⚡

🚀 Strong Bullish Momentum – But Friday Expiration = Gamma Trap?

⸻

📊 Market Stats:

• 💰 Call Volume: Strong

• 🔻 Weak Volume Overall

• ⚖️ Call/Put Ratio: Bullish

• 📈 RSI: Overbought but still pushing

• ⏳ Time Decay: Accelerating

• ☠️ Gamma Risk: 🔥 MAX today (0DTE)

⸻

🧠 Model Summary:

• Grok/xAI: 🔒 NO TRADE today – wait for Monday

• Claude: 🛑 Caution – avoid entries today

• DeepSeek: ⏸️ 4/5 Bullish, wait for cleaner setup

• Gemini: 💡 Suggests $180C next week

• Llama: ✅ Bullish bias, but gamma risk = no go for Friday

⸻

📌 TRADE IDEA: Wait for Monday

📍 Strike: $175 Call

📆 Expiry: Today (0DTE)

💵 Entry Price: $0.56

🎯 Target: $0.95

🛑 Stop: $0.30

📈 Confidence: 65%

🕒 Entry Timing: Monday open IF support holds

⸻

⚠️ Key Warning:

Don’t get trapped by 0DTE gamma swings. Momentum says yes, time decay says no…

✅ Best move? Watch NVDA closely, then strike on Monday if volume confirms.

⸻

👍 Like & save if you’re tracking NVDA.

🔁 Repost if you’re waiting for the perfect Monday setup!

#NVDA #OptionsTrading #0DTE #GammaRisk #BullishSetup #TradingView #TechStocks #WeeklyOptions

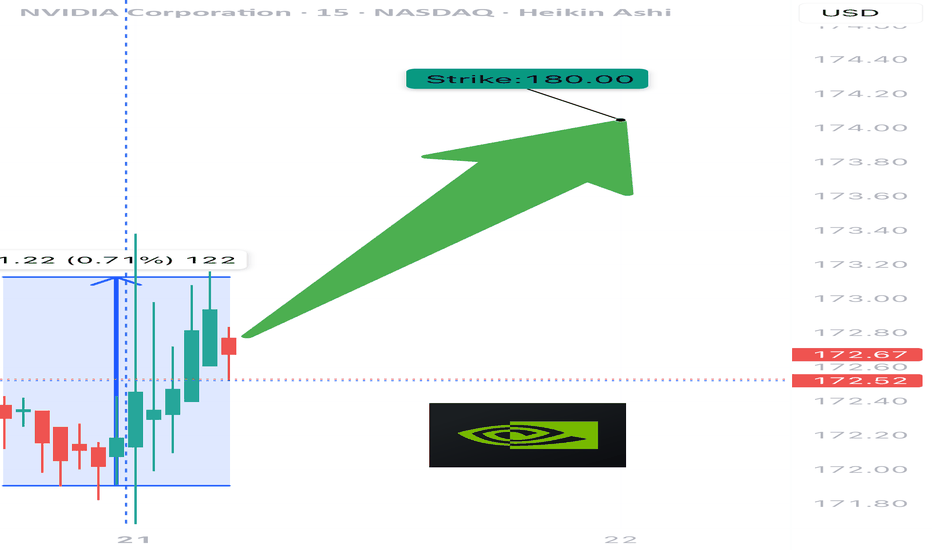

$NVDA WEEKLY TRADE IDEA – JULY 21, 2025

💥 NASDAQ:NVDA WEEKLY TRADE IDEA – JULY 21, 2025 💥

🔥 Bullish Options Flow + Weekly RSI Strength = Controlled Momentum Play

⸻

📊 Trade Details

🔹 Type: Long Call

🎯 Strike: $180.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry: $0.51

🎯 Target: $1.02 (💯% Gain)

🛑 Stop: $0.20 (~40% Risk)

📈 Confidence: 65%

🕰️ Timing: Monday Open

📦 Size: 1 Contract (Adjust based on risk tolerance)

⸻

📈 Why This Trade?

✅ Call/Put Ratio = 1.48 → Bullish bias confirmed

📈 Weekly RSI = 77.0 → Strong momentum

🔻 Daily RSI = 80.8 (falling) → Short-term pullback risk

📉 Volume = flat (1.0x) → Weak confirmation = tighter risk mgmt

🧠 Strike Clustering: $177.50 & $180 = strong OI zones

🌬️ VIX = 16.7 → Favorable for long premium plays

⸻

⚠️ Risks & Strategy Notes

❗ Daily RSI = caution: short-term exhaustion possible

📉 Weak volume = lack of institutional chase

⏳ Exit before Friday – avoid IV crush and gamma slam

🔐 Set alerts at $178.75 and $179.80 – pre-breakout signals

⸻

🎯 Plan:

• Enter Monday open

• Scale partials if price hits +30–50%

• Full exit by Thursday unless price is breaking through $180 early with strong volume

⸻

🏁 Quick Verdict:

This is a momentum continuation setup, not a fresh breakout.

Play the trend, respect RSI signals, and cut fast if flow dries up.

NASDAQ:NVDA 180C — Risk $0.20 to Target $1.02

Let the call ride… just don’t overstay.

⸻

#NVDA #OptionsTrading #CallOption #WeeklyPlay #MomentumTrade #FlowBasedSetup #TradingViewIdeas #GammaPlay #BullishBias #NVIDIA

NVIDIA Robbery Plan: Bullish Swing Trade to Millions!🔥 NVIDIA (NVDA) Stock Heist Blueprint: Unlock Bullish Profits with Thief Trading Style! 🚀💰

🌟 Greetings, Wealth Warriors! 🌟

Hello, Ciao, Salaam, Bonjour, Hola, and Hallo to all you savvy traders and market masterminds! 🤑💸 Get ready to execute a high-octane trading plan with our Thief Trading Style—a bold fusion of technical precision and fundamental insights designed to crack the NVIDIA (NVDA) stock market vault! 💥📈

📝 The NVIDIA Heist Plan: Swing & Day Trading Mastery 🏆

Based on our proprietary Thief Trading Style, this plan targets NVIDIA (NVDA), currently riding a bullish wave fueled by strong fundamentals and technical setups. Follow the strategy outlined below to navigate the high-risk Red Zone—where overbought conditions, consolidation, and potential trend reversals create opportunities for sharp traders. 💪 Stay alert, as bearish players may set traps at key levels! 🕵️♂️

Entry Strategy: Crack the 🙂Vault! 🏦

Go long with confidence! The market is primed for a bullish breakout. Enter at current prices or set buy limit orders near recent swing lows/highs on the 15-minute or 30-minute timeframe. 📅

Pro Tip: Set price alerts on your chart to catch the optimal entry. Timing is everything in this heist! ⏰

Swing Traders: Look for pullbacks to key support levels for safer entries.

Scalpers: Focus on quick long-side trades with tight stops to maximize gains. 💨

Stop Loss: Protect Your Loot! 🔒

Place your stop loss (SL) below the recent swing low on the 30-minute timeframe (e.g., $162.00 for swing trades).

Adjust your SL based on your risk tolerance, position size, and number of orders. For larger accounts, consider tighter stops to lock in gains early. 🛡️

Scalpers: Use a trailing stop to secure profits while riding short-term momentum.

Take Profit Target: Cash Out Big! 💰

Aim for $191.00 as the primary target, or exit early if momentum slows.

Swing Traders: Hold for the full target if the trend remains strong.

Scalpers: Grab quick profits on smaller price spikes and re-enter on dips.

Pro Move: Use a trailing stop to let profits run while safeguarding gains. 🚀

📌Key Levels & Risk Management

Entry Zone: Market price or swing low – ideal for long positions. 📈

Stop Loss: $162.00 – based on 30m timeframe swing low. 🛑

Take Profit Target: $191.00 – primary target for swing/day trades. 🎯

Risky Red Zone: Overbought levels – watch for consolidation or reversal traps. ⚠️

💡 Why NVIDIA? The Bullish Case 📡

NVIDIA (NVDA) is powering through a bullish phase, driven by:

Fundamentals: Strong demand for AI, gaming, and data center chips. 📊

Macro Factors: Positive market sentiment and tech sector momentum. 🌍

COT Data (Latest Friday Update, UTC+1): Large speculators are increasing bullish positions, signaling confidence in NVDA’s upside (data sourced from reliable platforms). 📅

Geopolitical & News: Monitor upcoming earnings and industry developments for catalysts. 📰

Intermarket Analysis: Tech-heavy indices like the NASDAQ are trending higher, supporting NVDA’s rally. 📈

For a deeper dive, check fundamental reports, COT data, and sentiment analysis to align your trades with the bigger picture. 🔍

⚠️ Trading Alert: Navigate News & Volatility 🗞️

News releases can spark sharp price swings. To protect your capital:

Avoid new trades during major news events (e.g., earnings or Fed announcements). 🚫

Use trailing stops to lock in profits and limit downside risk. 🔐

Stay updated with real-time market developments to adjust your strategy dynamically. 📡

🚀 Boost the Heist! Support the Thief Trading Community 🤝

Love this plan? Hit the Boost Button to amplify our Thief Trading Style and empower our community to conquer the markets! 💥 Every like and share fuels our mission to make money with precision and style. 💪 Join us daily to unlock more high-profit heist plans! 🏴☠️

📌 Important Disclaimer

This analysis is for educational purposes only and not personalized investment advice. Always conduct your own research, assess your risk tolerance, and verify market conditions before trading. Markets move fast—stay sharp and adapt! ⚡

🌟 Stay tuned for the next heist plan, traders! Let’s keep stealing profits together! 🤑🐱👤🎉

$NVDA - $270 PT in BULL ChannelThe stock is currently bouncing off of the lower channel line of the rising Bull Channel. Price action has created a Cup and Handle. The projected Price Objective sits at around $270. Remember, the height of the cup is the project target which from current stock price extends to around $270.

Nvidia Market Capitalisation Reaches $4 TrillionNvidia Market Capitalisation Reaches $4 Trillion

Yesterday, Nvidia’s (NVDA) share price surpassed $162 for the first time in history. As a result, the company’s market capitalisation briefly exceeded $4 trillion during intraday trading (according to CNBC), making Nvidia the first publicly listed company to reach this milestone.

The rise in NVDA’s share price is being driven by both bullish sentiment across the broader equity market—which appears optimistic ahead of the upcoming Q2 earnings season—and evidence of sustained demand for Nvidia’s products, as artificial intelligence technologies continue to gain widespread adoption.

Noteworthy developments include:

→ Nvidia may begin producing a specialised AI chip for the Chinese market this autumn, potentially circumventing current export restrictions;

→ Perplexity, a company backed by Nvidia, is launching an AI-powered browser aimed at competing with Google Chrome.

Technical Analysis of NVDA Chart

In our previous analysis of NVDA’s price action, we:

→ Drew an ascending channel;

→ Highlighted bullish conviction in overcoming the $145–150 resistance zone.

The channel remains valid, with the current price trading near its upper boundary. However, the RSI indicator is showing signs of bearish divergence, suggesting that the stock may be vulnerable to a near-term correction—potentially towards the median line of the existing upward channel.

At the same time, a major shift in the prevailing bullish trend appears unlikely. The $145–150 range may serve as a key support zone for NVDA in the foreseeable future.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nvidia (NVDA) Share Price Soars to Record HighNvidia (NVDA) Share Price Soars to Record High

Yesterday, Nvidia’s (NVDA) share price surged by over 4%, with the following key developments:

→ It broke through the psychological $150 per share level;

→ It reached a new all-time high;

→ It also contributed to the Nasdaq 100 index hitting a record peak, as we reported earlier this morning.

As a result, Nvidia has reclaimed its status as the world’s most valuable company. Demand for its shares is being fuelled by the CEO’s optimism.

“We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity,” said Jensen Huang at Nvidia’s annual investor conference.

Technical Analysis of the NVDA Chart

The last three candlesticks reflect strong demand, as:

→ There are bullish gaps between the candles;

→ Lower wicks are either absent or minimal;

→ Candles are closing near their highs with progressively widening spreads.

This suggests strong momentum as the price confidently breaks through the key $150 resistance level. It is reasonable to assume that the current imbalance in favour of buyers around the $146–150 area (highlighted in purple) may form a support zone in the event of a pullback — for instance, within the existing upward channel (shown in blue).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.