Community ideas

Buy XRPUSD Crypto currency XRPUSD (4H) – Technical Chart Observation

An interesting technical development is forming on the XRPUSD 4-hour chart.

Price recently executed a clear liquidity sweep near the $87.1 level, taking out the recent lows before showing a sharp reversal. This move often precedes a shift in momentum as trapped positions are cleared.

The subsequent bounce has been notable, with price now challenging the structure above. A clear fair value gap or imbalance zone is visible on the ascent, which could act as a natural magnet for price if the bullish reaction continues.

This presents a classic price action scenario: a sweep of lows followed by a reclaim, suggesting a potential shift in near-term market structure. The reaction around the current zone will be key for determining the next leg.

#XRP #XRPUSD #Crypto #TechnicalAnalysis #PriceAction #LiquiditySweep #TradingView #Chart

US100 (Nasdaq) – H1 Market Structure & Liquidity AnalysisPrice has delivered a strong corrective push into a higher-timeframe premium imbalance area, where multiple technical factors align. Current location suggests a decision zone rather than continuation certainty.

🔍 Key Technical Observations

Sell-Side Liquidity (SSL) Taken

Previous equal lows were swept, triggering a strong bullish displacement. This move appears liquidity-driven rather than trend continuation.

Reaction Into H1 Fair Value Gap (FVG)

Price is now trading inside an H1 imbalance zone, an area often associated with mitigation and short-term rebalancing.

Confluence With Prior Structure

The current H1 FVG aligns closely with a previous structure level, increasing the probability of a technical reaction.

Higher-Timeframe Premium Zone (FVG + OB)

Above price lies a higher-timeframe FVG + Order Block cluster, reinforcing overhead supply and limiting immediate upside acceptance.

🧠 Scenarios to Monitor (No Forecasting)

Rejection from the H1 FVG

Failure to hold above the imbalance may open space toward lower inefficiencies.

Acceptance Above Imbalance

Sustained price acceptance could indicate further consolidation within the range rather than immediate reversal.

Mean Reversion Behavior

With liquidity already taken, price may rebalance toward discounted areas before forming a clearer directional bias.

⚠️ Important Notes

This analysis is for educational and technical discussion only.

No buy/sell signals or financial advice are provided.

Always wait for confirmation and manage risk independently.

US30 Consolidation Growth momentumUS30 trading within a well-defined ascending channel, confirming a medium-term bullish trend. Price has consistently respected both the upper resistance and lower support boundaries of the channel, indicating strong trend structure and controlled momentum.

Recently, price produced a strong impulsive bullish breakout from the mid-range consolidation zone, pushing above prior resistance around the 49,600–49,800 area. This move suggests renewed buying strength and continuation intent.

Tecnically the breakout, price is currently consolidating just below the upper channel resistance, forming a short-term pullback this behaviour is typical of bullish continuation, where the market digests gains before the next directional move.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis Thanks for Supporting.

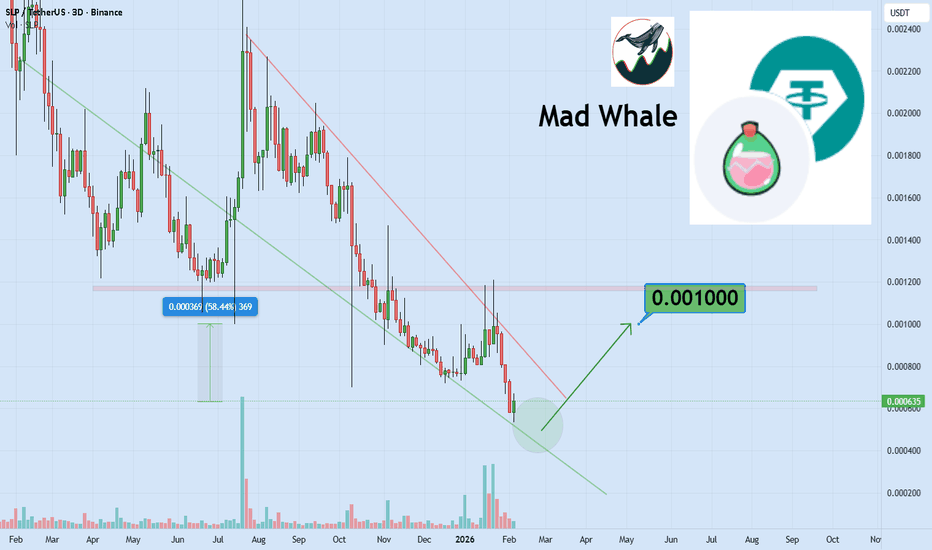

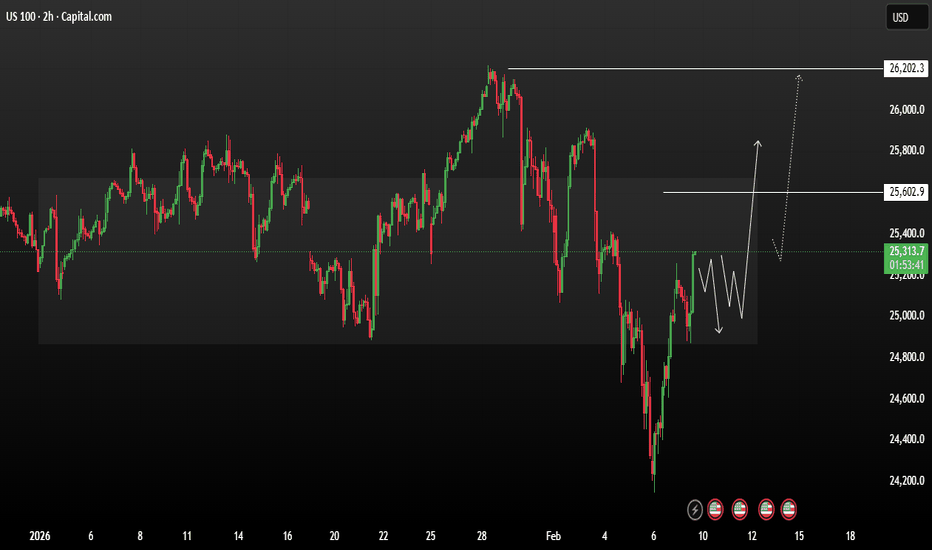

USNAS100 consolidation bullish range formationUS100 trading in a broad consolidation a rebound Price recently formed a strong bullish recovery from the February low near 24,300, followed by a corrective pullback and short-term range formation.

Tecnically Price is currently trading around 25,260, consolidating above the lower support zone near 25,000, which is acting as a key demand area. The structure suggests a potential accumulation phase, highlighted by choppy price action and higher lows inside the range.

A clear resistance zone is marked around 25,600, which aligns with prior structure and supply a successful breakout and hold above this level could open the path toward the next major resistance near 26,200, which represents the previous swing high and range top.

You may find more details in the chart,

Trade wisely best of luck buddies,

Ps; Support with like and comments and comments for btter analysis Thanks for Supporting.

$ALAB - Long term tradeContext: Astera makes the "connectivity" chips that allow massive clusters of GPUs to talk to each other.

The Setup: A Triple Bottom recovery on strong volume.

⚠️ Earnings Alert: Earnings are in 2 days. Stocks showing volume before earnings often know something. Watch, but be careful holding through the event.

Bitcoin Faces Key Test as Macro Pressures Influence Price ActionRecent Market Forces Shaping Bitcoin’s Direction

Bitcoin sentiment has shifted noticeably since late 2025 as optimism about greater institutional adoption met a more challenging macroeconomic environment. The most important headline for Bitcoin has been the change in expectations around global liquidity. Since November 2025, markets have repriced the path of rate cuts as US inflation data re-accelerated and labor markets remained resilient. This pushed bond yields higher and strengthened the US dollar, creating a headwind for Bitcoin and other risk assets.

Another specific driver has been ETF related flows. Spot Bitcoin ETF inflows slowed materially through November and December after a strong first half of the year. Several weeks of flat to negative net flows reduced the marginal bid that had supported higher prices earlier in 2025. At the same time, miners increased hedging activity into year end, adding incremental supply during a period of weaker demand.

Across the broader crypto complex, performance has been mixed to weak. Large cap altcoins have underperformed Bitcoin, while smaller tokens saw sharper drawdowns as liquidity thinned. This has reinforced a defensive tone within crypto, with capital rotating back toward Bitcoin dominance rather than expanding risk. Overall sentiment can best be described as cautious and reactive rather than outright bearish, with participants focused on where longer term value may re-emerge.

What the market has done

• Since the end of October 2025, buyers lost control of 110000, which aligned with the 2025 developing VPOC. Sellers were then able to take control and offer prices back down toward the 87700 to 83100 area, which corresponds with the 2024 VAH and a key yearly level.

• From November 2025 through January 2026, the market balanced between 98600 and 83100 as buyers and sellers fought for control. This period reflected uncertainty around macro policy direction, slower ETF inflows, and reduced risk appetite across global markets.

• In the past week, buyers failed to defend the 83100 area. Price auctioned aggressively through the 2024 value area and reached the 60200 area, which marks the 2024 VAL. Buyers have responded at this level, suggesting responsive demand at longer term value.

• The broader decline since November 2025 has occurred alongside tighter financial conditions, a firmer US dollar, and fading expectations for near term monetary easing, all of which historically pressure Bitcoin valuations.

What to expect in the coming weeks

Key levels to watch are 82000, which aligns with a yearly level and offer block 2 low, and 60200, which represents the 2024 VAL.

Neutral scenario

• Expect the market to consolidate and auction two way between 82000 and 60200 as value is rebuilt.

• This scenario would likely align with stable macro data, no major policy surprises from central banks, and muted ETF flows that neither add nor remove significant demand.

Bullish scenario

• If buyers are able to step up bids within the current range, it may be an early signal that the bullish scenario is developing.

• A break and acceptance above 82000 would open the door for a move back through offer block 2 toward the 100000 area, which aligns with the 2025 LVN, where sellers are expected to respond.

• A bullish outcome would likely require renewed ETF inflows, easing financial conditions, or a clear shift toward more accommodative monetary policy.

Bearish scenario

• If sellers begin to step down offers within the range and compress price toward the 60000 area, it would hint that the bearish scenario is in play.

• A break and acceptance below 60000 would suggest continuation lower toward the 40000 area, which aligns with the 2023 VAL, where buyers are expected to respond.

• This path would likely coincide with further tightening in financial conditions, stronger dollar trends, or renewed risk off behavior across global markets.

Conclusion

Bitcoin is currently trading at a critical inflection point where longer term value is being tested against a challenging macro backdrop. Technically, the response at the 2024 VAL near 60200 is constructive, but acceptance back above 82000 is needed to shift the balance in favor of buyers. Fundamentally, the next sustained move will depend on liquidity conditions, ETF flows, and how global markets price the path of monetary policy. Until clarity emerges, Bitcoin is likely to remain in an environment where patience and level awareness matter most.

Let me know how you are positioning around these key levels and which scenario you think is most likely to play out.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

C - Composite

w - Weekly

m - Monthly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

Gold resistance retest at 5,057The Gold remains in a neutral trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 4,517 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 4,517 would confirm ongoing upside momentum, with potential targets at:

5,057 – initial resistance

5,135 – psychological and structural level

5,227 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 4,517 would weaken the bullish outlook and suggest deeper downside risk toward:

4,400 – minor support

4,310 – stronger support and potential demand zone

Outlook:

Neutral bias remains intact while the Gold trades around pivotal 4,517 level. A sustained break below or abve this level could shift momentum.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SELL GBPCAD now for bullish trend Reversal ..........SELL GBPCAD now for bullish trend Reversal ..........

STOP LOSS: 1.8605

This sell trade setup is based on divergence for trend reversal trading pattern on the 4h time frame ...

Always remember, the trend is your friend until it reverses against you , so whenever you can get a signal that the trend is about to come to and end is good for you to be part of it...

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with...

DogeCoin...When you look at the chart, the main thing every trader wants to know is whether the price has taken support. Or it will fall further. The answer is that the price has tested the strong support, which is a triple bottom, and now it is trying to move up.

From which level can we expect good movement?

0.110 is one of the important level and the price should gain strength around it to give trending movement.

Will the price bounce now itself?

I am expecting some range movement before the breakout, but who knows it can happen any time.

Always do your analysis before taking any trade.

Dow Surpasses 50,000 Milestone Amid Futures SlipDow Surpasses 50,000 Milestone Amid Futures Slip

The Dow Jones Industrial Average's historic close above 50,000 on Friday up 1,200 points or 2.5% marks a recovery from AI-tech routs, but futures are dipping 0.1% pre-market, signaling caution.

S&P 500 and Nasdaq futures are down 0.3% and 0.5%, respectively, ahead of delayed jobs and CPI reports.

Key facts: The surge reflects broadening earnings beyond tech, with small caps gaining traction. International boosts, like Nikkei's 3.9% rally, add global context.

Implications: Opportunities in value rotations 📈, but risks from China-US bond tensions and inflation data could trigger pullbacks ⚠️. Ties to commodities (gold up, nat gas down) and sectors (AI, energy) suggest interconnected volatility.

Bigger picture: This milestone may fuel IPO surges to $160 billion, benefiting diversified portfolios. Monitor for trading reports on take-profit levels.

USOIL Analysis: Oil Testing Critical 63.85 Pivot Zone!Crude Oil (USOIL) Technical Analysis

Date: February 9, 2026

Pivot Point: 63.85

The price is currently hovering around the 63.85 level. This is the decisive zone for the next market move.

📉 Bearish Scenario (Main Outlook):

As long as the price remains below the 63.85 pivot point, the downward trend prevails:

First Target: A decline toward the support level at 62.40.

Second Target: Breaking below this level will drive the price further down to 61.40.

Bullish Scenario (Alternative Outlook):

If the price manages to break above the 63.85 pivot and stabilizes, the trend will flip to bullish:

First Resistance: The target will be 64.65.

Further Gains: A breakout above this resistance will push the price toward 65.20 and potentially reach 65.95.

Key Summary:

Below 63.85: Bearish momentum dominates.

Above 63.85: Bullish reversal confirmed.

Support & Resistance Levels:

Resistance: 64.65 | 65.20 | 65.95

Support: 62.40 | 61.40

This Is Not a Reversal: #XMR’s Structure Signals downside

Yello Paradisers! Are you aware that #XMRUSDT is currently in one of the most deceptive Elliott Wave phases, where the price looks stable, but the structure strongly suggests another sharp downside move is still ahead?

💎#XMR after the sharp decline from the all-time high, has been unfolding a textbook structure inside a dominant descending channel. From a higher-timeframe Elliott Wave perspective, the market is clearly positioned within wave 4 of the larger impulsive decline. This is a critical phase, as wave 4 corrections are designed to exhaust late participants before the final continuation leg unfolds.

💎The current price action is forming an ascending corrective channel, but it is important to understand that this move is not impulsive. Structurally, this advance fits perfectly as an ABC/WXYXZ complex correction, developing entirely within the boundaries of the broader bearish descending channel. This tells us that the market is correcting in time and structure, not reversing the trend. In professional Elliott Wave terms, this is a classic setup before wave 5 continuation to the downside.

💎Market participation further validates this count. Volume has been consistently decreasing throughout the ascending channel, indicating a lack of real buying interest. This contrasts sharply with the previous sell-offs, which were accompanied by expanding volume, confirming that sellers remain in control of the primary trend. Corrective advances with declining volume are a strong hallmark of wave 4 behavior.

💎Momentum also aligns perfectly with this interpretation. RSI is showing a hidden bearish divergence between the last two swing highs, a signal that momentum is resetting in favor of the prevailing downtrend rather than building strength for a reversal. Hidden divergence in wave 4 environments typically precedes strong trend continuation moves.

💎From a structural level perspective, $420 remains the key resistance zone and aligns with the upper boundary of the corrective formation. On the downside, $277 acts as an important interim support, while $230 is the major support area and a logical downside objective once wave 5 begins. A decisive breakdown of the ascending corrective channel would confirm the completion of wave 4 and activate a high-probability wave 5 continuation scenario.

If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest-probability trading opportunities. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you can get inside the winner circle of Paradisers.

MyCryptoParadise

iFeel the success🌴

EURUSD 4H: Likely Pullback Into 1.1796–1.1776EURUSD on the 4H is in a recovery phase after the sharp selloff from the 1.20 area, but price is now pressing into a key overhead pivot around 1.1870–1.1871. That level is acting as near-term resistance, so this is less of a chase zone and more of a decision area where the market typically either accepts for continuation or rotates lower to rebalance.

The structure on your chart supports a corrective dip first scenario. A rejection from current levels can pull price back into the marked demand block around 1.17958–1.17758, which is the most important support zone in this setup. If buyers defend that area and we see bullish confirmation, the path back toward 1.1870+ opens again, with extension potential toward 1.19188 if momentum follows through.

In other words, the bullish idea remains valid as long as pullbacks are held above the highlighted demand region on a closing basis. A clean loss of 1.17758 would weaken the recovery structure and shift focus to lower supports near 1.17319, with deeper risk toward 1.16985 if selling pressure persists. Until that breakdown happens, this still reads as a retracement-then-continuation framework rather than a fresh bearish trend leg.

Can Capital Efficiency Win Against Billion-Dollar Bets?Vertical Aerospace presents a striking paradox in the electric aviation sector. The company operates at the forefront of Urban Air Mobility (UAM) development, achieving consistent technical milestones while maintaining a disciplined approach to capital expenditure. Its flagship aircraft, the Valo, represents a mature evolution of eVTOL design with a flexible 4-6 passenger configuration, 150 mph cruise speed, and 100-mile range. Unlike American competitors Joby and Archer, which pursue vertically integrated "operator models" requiring billions in funding, Vertical has adopted an "Airbus model"—focusing on design, certification, and final assembly while partnering with aerospace giants such as Honeywell and Aciturri for components. This asset-light strategy has resulted in a quarterly cash burn of approximately $30-40 million, compared to competitors' losses of $100-400 million. The company holds strategic partnerships across India, Japan, and Singapore, and has secured £37 million in UK government grants, positioning itself as Britain's national champion in zero-emission aviation.

Despite these operational achievements, the market values Vertical at just $500 million, less than 4% of Joby's $14 billion valuation. This disconnect stems from immediate concerns about dilution, as the company requires approximately $700 million to reach certification and recently authorized 1 billion shares for potential equity raises. The critical near-term catalyst is Phase 4 transition testing, scheduled for early 2026, which will validate the aircraft's most complex maneuver: converting from helicopter to airplane mode. The company has completed 90% of the transition envelope and expects full piloted transition imminently. Success in this phase would demonstrate technical viability and potentially unlock more favorable financing terms, while delays could trigger further share price pressure. The Valo platform's advanced Honeywell Anthem avionics suite, incorporating AI-driven navigation and zero-trust cybersecurity frameworks, positions it as a software-defined aircraft for the digital age.

The fundamental question for investors is whether Vertical's capital-efficient path will yield superior returns compared to the high-spend strategies of American rivals. If the company achieves type certification in 2028 at its projected $700 million total cost, a fraction of competitors' multi-billion-dollar requirements, the return on investment could be exceptional. The firm's $6 billion order book would convert to revenue without the operational risks inherent in running an airline. However, the financing gap remains the primary risk. With cash extending into mid-2026 and certification still two years away, the company must execute a significant equity raise. The macroeconomic environment is becoming more favorable, with interest rates declining and venture capital showing renewed appetite for pre-revenue growth companies. Vertical stands at a crossroads: its disciplined engineering and partnership strategy could vindicate a contrarian investment thesis, or near-term financing pressures could result in massive dilution that undermines long-term value creation.

Bitcoin Showing Bearish Continuation Toward 52KBTC is not showing convincing signs of a reversal yet. Instead of sweeping the sellside liquidity and reclaiming it, price has closed below the key sellside zone, which in most cases signals continuation toward the next liquidity pool.

The main level in focus now sits around $52,533, which aligns with the next major sellside target on the chart. Without a proper sweep and strong displacement back above the current POI, the structure remains bearish.

What I’m watching this week:

- A failure to reclaim the 74k–76k area keeps the downside narrative intact.

- Any minor retrace into internal FVG/POI could offer continuation lower.

- A clean sweep + reclaim would be the only early hint of reversal — we haven’t seen that yet.

Until proven otherwise, the path of least resistance looks to be down toward the 52k region.

Disclaimer: This is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) and manage risk accordingly.

Selena | USDJPY – 4H – Bullish Structure Under CorrectionFX:USDJPY

The recent drop represents a liquidity-driven correction rather than confirmed trend reversal. Price is now testing a critical support zone aligned with previous demand and the lower boundary of the broader structure. Holding this region keeps the bullish continuation scenario valid.

Key Scenarios

✅ Bullish Case 🚀 →

Sustained support above 151.00–150.60 may trigger a corrective bounce

🎯 Target 1: 154.00

🎯 Target 2: 156.50

🎯 Target 3: 159.00–160.00 (HTF Liquidity)

❌ Bearish Case 📉 (Invalidation) →

Acceptance below 150.00 would weaken bullish structure and open deeper downside.

Current Levels to Watch

Resistance 🔴: 154.00 – 157.50

Support 🟢: 151.00 – 150.00

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice