Community ideas

Gold is in strong bullish Gold is trading in a bullish structure, respecting an ascending trendline. Price is currently consolidating above the marked support zone around 5235, showing strong buyer interest on dips. The recent range suggests accumulation before the next move.

If price holds above support and breaks the intraday resistance near 5297–5311, we can expect a continuation toward the 5350 target as highlighted. A pullback toward the trendline may offer a buy-on-dip opportunity as long as the bullish structure remains intact.

Bias: Bullish

Support: 5235

Resistance: 5297 – 5311

Target: 5350

JPYUSD 1H Analysis Today: Bullish Trendline HoldsJPYUSD 1H Analysis Today: Bullish Trendline Holds, Weak High Liquidity Target Ahead (Key Levels + Trade Setups)

JPYUSD on the 1H timeframe is maintaining a bullish structure after a strong impulsive leg. Price is currently trading near 0.006552, consolidating under a marked Weak High zone. This is a classic “pause-before-expansion” environment where the market often runs liquidity above the high, then either continues trending or rotates for a cleaner reload.

This plan focuses on practical execution using trendline, Fibonacci retracements, EMA, RSI, plus clear support and resistance levels for intraday trading.

1H Market Structure: Higher Highs, Controlled Consolidation

The recent breakout created a clear bullish displacement.

Price is now forming a tight consolidation under the top, which typically signals either:

A continuation push to take the Weak High liquidity, or

A brief pullback to rebalance before the next leg.

As long as price holds above the nearest demand support, the higher-probability bias remains bullish continuation.

Key Resistance Levels (Upside Targets)

R1: 0.00657 – 0.00658 (Weak High / liquidity top)

Main magnet. Expect wick behavior and stop-runs here.

R2: 0.00660 – 0.00662 (extension zone)

If price breaks and holds above the Weak High, this becomes the next upside objective.

R3: 0.00665+ (momentum continuation area)

Only relevant if the breakout is clean and the market accepts above 0.00660.

Key Support Levels (Where Bulls Must Defend)

S1: 0.00652 – 0.00650 (first pullback support)

Ideal “dip-buy” zone if the trend remains strong.

S2: 0.00648 (nearest demand band on chart)

A critical structure level. If price taps this area and holds, continuation setups improve.

S3: 0.00631 – 0.00630 (major demand shelf)

This is the deeper reload area. If S2 fails, the market often seeks this zone for re-accumulation.

S4: 0.006285 – 0.006260 (strong low support)

If price reaches here, the bullish leg is likely shifting into a broader correction rather than a simple intraday pullback.

Fibonacci Framework (Intraday Precision)

Fib A: Most recent push (approx. 0.00647 → 0.00657)

Key retracements:

0.382: ~0.006532

0.50: ~0.006520

0.618: ~0.006508

0.786: ~0.006491

How to use:

In healthy trends, price commonly respects 0.382–0.618 before continuing.

If volatility spikes, 0.786 becomes the last “shallow trend” defense before deeper support.

Fib B: Larger impulse (approx. 0.00630 → 0.00657)

Key retracements:

0.382: ~0.006467

0.50: ~0.006435

0.618: ~0.006403

This aligns well with the idea of a deeper reload toward the mid-zone if the market rejects the top.

EMA + RSI Filters (Quality Control)

EMA (suggestion: EMA20 and EMA50 on 1H)

Bullish behavior: price stays above EMA20 during pullbacks; EMA20 remains above EMA50.

Warning sign: repeated 1H closes below EMA50 and failed reclaim attempts, increasing odds of a deeper drop toward 0.00631–0.00630.

RSI (14)

In strong uptrends, RSI tends to hold above 50.

If price sweeps above 0.00657–0.00658 but RSI fails to confirm (bearish divergence), expect a pullback even if the larger bias stays bullish.

High-Probability Trade Setups for Today

Setup 1: Breakout Buy Above the Weak High (Continuation Play)

Condition:

1H closes above 0.00658 with a strong body (not only a wick).

Prefer a retest that holds the broken level.

Execution:

Entry: after retest confirmation above 0.00657–0.00658

Stop loss: below the retest swing low (or back under 0.00655 depending on structure)

Take profit: 0.00660 – 0.00662, then trail under higher lows / EMA20

Best for: momentum sessions where price accepts above the liquidity top.

Setup 2: Pullback Buy Into Fib Support (Best Risk/Reward With Trend)

Condition:

Price retraces into 0.00652–0.00650 (Fib 0.382–0.618 area) and prints bullish confirmation.

Execution:

Entry: reclaim + bullish candle confirmation

Stop loss: below the pullback low (keep it logical, not tight)

Take profit: first at 0.00657–0.00658, then partial for 0.00660+

Best for: traders who want cleaner entries without chasing the top.

Setup 3: Deep Reload Buy at Demand (If the Market Sweeps and Drops)

Condition:

Price loses the shallow supports and taps 0.00648, or deeper 0.00631–0.00630, then shows strong rejection.

Execution:

Entry: only after clear bullish response (reclaim / strong rejection candle)

Stop loss: below the demand low

Take profit: back to 0.00652, then 0.00657–0.00658

Best for: higher patience, higher conviction dip buying at structure zones.

Setup 4: Failed Breakout Sell (Countertrend Scalp Only)

Condition:

Price wicks above 0.00658 and closes back below with strong rejection.

Stronger if RSI shows divergence.

Execution:

Entry: after rejection confirmation

Stop loss: above sweep high

Take profit: 0.00652, then 0.00650 if momentum continues

Note: This is countertrend. Keep it tactical and manage aggressively.

Bullish Invalidation (What Changes the Plan)

A sustained breakdown below 0.00648 with failure to reclaim it on pullbacks.

A clean move below 0.00631–0.00630 increases the probability of a deeper correction toward 0.006285–0.006260.

Bottom Line

JPYUSD on 1H remains bullish, consolidating under a clear Weak High liquidity zone (0.00657–0.00658). The best execution comes from:

Breakout with confirmation and retest, or

Pullback entries into 0.00652–0.00650 and 0.00648 using Fib + EMA + RSI alignment.

Gold Decision Map – XAUUSD Structured Expansion & Decision Zones🟡 Gold Decision Map – XAUUSD

TradingView | Daily Decision Framework

🔹 Fundamental Context

Gold’s sharp rise was not news-driven, but the result of a structural release of accumulated pressure.

The move unfolded in a risk-off geopolitical environment, allowing price to expand without meaningful resistance.

This created a controlled expansion, not a random spike.

🔹 Current Market State

Structured Expansion – Managed Pullback

Primary structure: Bullish

Current behavior: Cooling phase after strong expansion

No confirmed reversal signals at the time of publishing

🔴 Upper Decision Zone

5275 – 5295

Primary rejection / acceptance area

Suitable for:

Short-term selling

Profit-taking

Position reduction

Continuation requires clear acceptance above 5295

🟡 Balance Zone – No Trade Area

5205 – 5245

Neutral price behavior

No directional edge inside this range

Trading inside the balance is methodologically rejected

🟢 Repricing Zones (Buy on Behavior)

5145 – 5185

Primary repricing area

Suitable for rebuilding long exposure

Requires:

Stabilization

Downside rejection

Absorption behavior

5075 – 5110

Deep repricing zone

Defensive buy only

A break below weakens the short-term bullish scenario

🚫 No-Trade Conditions

Any price action inside 5205 – 5245

Entries taken without price reaching a defined decision zone

🔺 Upper Expansion Levels (Reference – Not Daily Targets)

5310

5340

5385 – 5400

Used for structural assessment and scenario planning, not execution.

🧭 Execution Framework

Sell / reduce: 5275 – 5295

Buy (conditional): 5145 – 5185

No trade: 5205 – 5245

Acceptance above 5295 → expansion continuation

Break below 5145 → invalidate short-term buy

🧠 Core Rule

Decisions at zones, not in the middle.

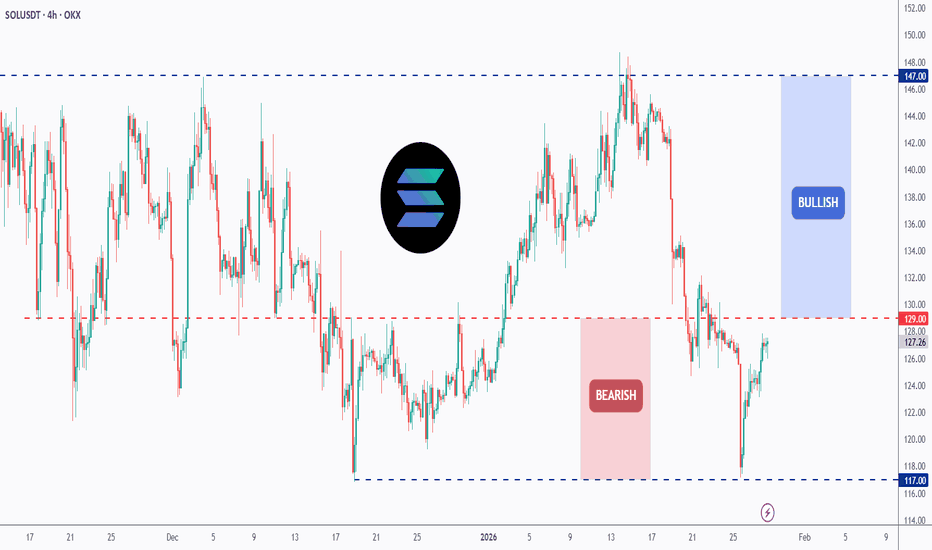

SOL - The Building Block!I call this area the Building Block, and it’s doing exactly what it’s supposed to do.

Right now, CRYPTOCAP:SOL is trading below the $129 structure, and as long as price stays under this level, the bias remains bearish. No guessing, no forcing it. Structure is structure.

That said, this level is important.

👉 A clean break and hold above $129 would change the picture completely and mark the start of a bullish phase, opening the door for higher prices.

Until that happens, patience is key. Let CRYPTOCAP:SOL prove itself before switching bias.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

APEX - 10x | 100x potential on this altcoin!APEX is a very promising professional decentralized exchange / platform that's why I share with you this technical analysis! I am not really encouraging people to buy the top, don't do that! Always wait for a pullback. As we can see on the weekly chart, APEX made a pretty significant pullback and filled the previous FVG (Fair Value Gap). That's, from a technical point of view a very important event!

To be precise, we have a 91% correction from the all-time high on this coin. That's a very good correction that is buyable. Usually you don't want to buy coins that dropped 99% or more; that's a sign of a scam. The coin has been trading in this wide range on the weekly chart for 1327 days and soon we should see an explosive price action.

There are 2 profit targets that you can use. The first is at the top of the range, around 3.8 USDT (10x profit). The second profit target is way above the range, but to reach this level we need an altcoin season. Altcoin seasons are often easy to predict if you know how to read the BTC.D chart. In short, take your profit at the top of the range, and if during this time we have an altcoin season, you can extend your profit target. Or take only 50% profit there.

ApeX Protocol is a decentralized, non-custodial, permissionless, censorship-resistant perpetual derivatives protocol that enables the introduction of perpetual swap markets (perpetual futures) for any token pairs. The protocol allows users to relegate crypto derivatives on the Ethereum blockchain with no intermediaries involved while maintaining total control over their private keys.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! I am very transparent with my trades. Thank you, and I wish you successful trades!

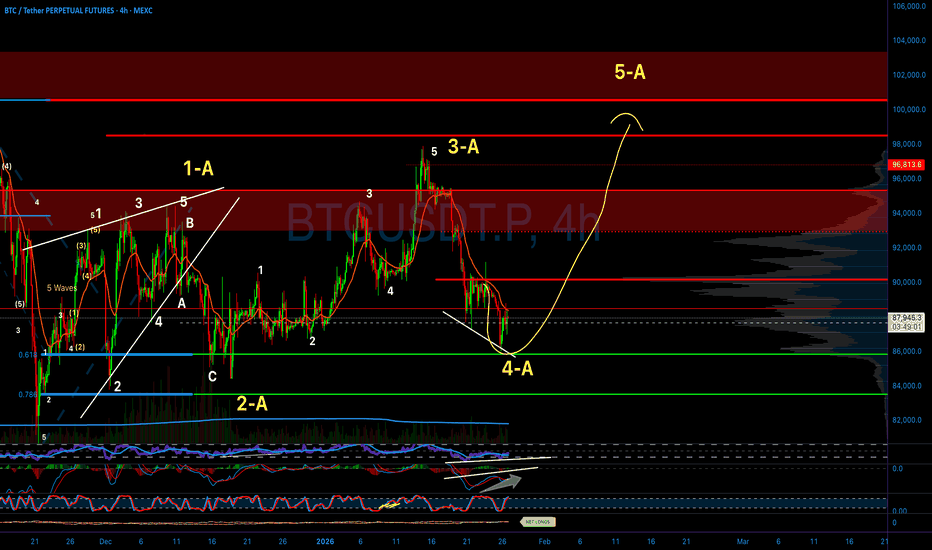

Bitcoin SMC Strategy: 15m Breakout Success & 4H Trend ForecastMarket Update:

We just officially hit our Take Profit target on the 15m timeframe! The market followed the Smart Money Concepts (SMC) structure perfectly, but now the 4H chart is showing signs of a potential reversal.

Trade Breakdown:

• The Setup (15m): Price was consolidating in a descending wedge before a clear CHoCH (Change of Character) signaled a bullish shift.

• The Execution: Entry was taken near the Strong Low, riding the momentum through the $90,000 psychological level.

• The Result: TP was smashed at $90,567 with precision.

Looking Ahead (4H Analysis):

• While the 15m trend was bullish, the 4H timeframe shows price reaching a major resistance zone.

• The current rejection suggests a potential pullback toward the $88,000 liquidity zones.

• I am now watching for a bearish BOS (Break of Structure) on lower timeframes to confirm a short entry.

Strategy Used:

• Indicator: LuxAlgo Smart Money Concepts

• Concepts: CHoCH, BOS, Strong Low/Weak High detection.

Follow for more high-probability setups! 🚀

GOLD Price Update – Clean & Clear ExplanationGold is currently respecting an ascending trendline, showing overall bullish structure. Price has reacted strongly from the demand zone near 5045, creating a higher low and pushing back toward resistance.

Technical Overview

Depend on the price closes above 5105, buying momentum may accelerate toward the upper resistance zone around 5125–5150. This area is marked as the primary target for longs Failure to hold above the trendline and rejection from resistance may lead to a pullback toward:

“If you come across this post, please like, comment, and share. Thanks!”

SUIUSDT 1,760% profits potential with 5X leverage —LONG tradeYou know the very famous saying, "buy when the market is red." It is good to buy when the market is red but we have to take into consideration the context of this buying, the broader market.

Is the market bullish as a whole? Does the chart in question have bullish potential?

SUIUSDT is now moving within the "opportunity buy-zone." This is what I call a really good entry zone or great prices. This is the best ever when it comes to a possible entry for a leveraged trade. Not only the price is right but the timing, timing is truly great.

This chart setup has a very strong bullish bias and we expect very strong growth, and fast; within days.

Here you have the full trade-numbers:

_____

LONG SUIUSDT

Leverage: 5X

Potential: 1760%

Allocation: 4%

Entry zone: $1.26 - $1.45

Targets:

1) $1.77

2) $2.05

3) $2.50

4) $2.87

5) $3.24

6) $3.77

7) $4.44

8) $5.55

9) $6.38

Stop: Close weekly below $1.25

_____

Thanks a lot for your continued support.

I will continue to share more as this type of opportunity doesn't repeat very often. The time is now to take action.

If you are reading this now, you have really good timing. You are well aligned. Keep up the good work.

I am wishing the best for you.

Namaste.

BTCUSD- Final Shake-out to the 58K Zone Before a New ATHFinal Shake-out to the 58K Zone Before a New All-Time High?

- Market Overview

Bitcoin is trading around $88,800 and is facing corrective pressure after failing to break above a high-liquidity resistance area. The current wave structure suggests the market may be entering a complex correction phase, designed to shake out weak hands before the next major expansion leg.

- Technical Analysis & Key Levels

Resistance (High Liquidity Zone):

The $108,000 – $110,000 region is identified as a major liquidity zone, where sellers appear dominant and have capped upside momentum.

Near-Term Support (Key Support Zone):

Price is rotating toward the first key support at $76,000 – $78,000. Based on the scenario on the chart, BTC could see a brief rebound here (a potential bull trap) before continuation lower.

Long-Term Buy Zone (Core Focus):

The main zone in this analysis is $56,000 – $60,000, aligning with deeper Fibonacci extensions (1.618 – 2.618). This area is viewed as a potential “Spring” (final shake-out) to fully flush late longs before BTC reverses into a strong uptrend.

- Trading Scenarios (Trading Plan)

Short-Term:

Look for short setups or stay sidelined if price breaks smaller bullish micro-structures. The short-term target is the $76,000 region.

Mid-Term:

Be cautious of a fake rebound around 76K. Avoid FOMO dip-buying too early.

Long-Term:

Stay patient and wait for clear reversal signals inside the $56K – $60K long-term buy zone. This is considered the lowest-risk, highest-upside area for the next major wave.

Conclusion

The chart suggests BTC may need a deeper correction to rebuild momentum. Stay patient and watch how price reacts at the marked key levels.

Gold at ATH before FOMC shakeout first or straight breakout?🧭 Macro Snapshot

Donald Trump maintains a hardline stance, increasing military presence in the Middle East → geopolitical risk remains elevated.

Tonight’s key focus: Federal Reserve

Political pressure and questions around Fed independence.

DXY continues to weaken, retesting major historical support (2020–2022) → supportive for gold.

👉 Conclusion: Geopolitics + a weaker USD set the bullish bias, while the Fed determines short-term volatility.

📊 Intraday Range to Watch

Upper range: 5,280 – 5,305

Lower range: 5,190 – 5,160

→ High probability of range trading and liquidity absorption ahead of the Fed decision.

🟢 Support

5,220–5,225 | 5,150–5,165 | 5,080–5,085 | 5,050–5,060

🔴 Resistance

5,280–5,294 | 5,300 | 5,315 | 5,380–5,385

⚠️ Strategy Notes

Expect possible fake moves / stop hunts within the range.

Avoid chasing highs or catching tops without confirmation.

Focus on price reaction at key levels and stay disciplined.

Summary: Gold is fundamentally supported, but today the key is how price reacts within 5,160–5,305.

Be patient — wait for confirmation — trade the reaction.

XRP Dips UNDER $2 - Are we Heading BACK TO $1 ??Have you been watching XRP lately?

I was quite surprised that it held above the $2 as long as it did, to be honest.

But now, as the entire market dips, XRP drops... and it is notoriously know to dump and lose all bullish season gains.

Apart from all the controversy, if and I say IF you managed to held the $1 bag up until now - you would be in profit. Buying over $2 would have been high risk, and now we are likely approaching another few key buy zones, depending on where the price finds a bounce. The questions is.... worth it to accumulate or not?

Seeing price action in the 4h under the moving averages is always bearish for the SHORT term, which we do:

The massive wick in July 2025 already indicated the beginning of the bear market, and the lower moving averages is likely where we will find major support - 1.40 ish.

AUDNZD Setup: Symmetrical Triangle + Bullish FundamentalsToday, I want to share a long idea on AUDNZD ( OANDA:AUDNZD ) with you.

Let’s walk through the fundamental and technical picture step by step.

From a fundamental perspective, AUDNZD maintains a mild bullish bias.

Australia’s monetary policy remains slightly more restrictive compared to New Zealand’s.

Persistent inflation pressures keep the RBA cautious about rate cuts, while recent inflation data in New Zealand has largely been priced in and has not provided a fresh advantage for the NZD.

Additionally, Australia continues to benefit from relatively stronger growth support driven by the commodity sector, which adds to AUD resilience.

Overall, the fundamental balance currently favors AUD over NZD, making a long AUDNZD position reasonable — though, as always, not without risk.

AUDNZD is currently trading near key support lines.

From a classic technical analysis perspective, the pair is consolidating inside a symmetrical triangle, signaling compression and a potential expansion phase ahead.

From an Elliott Wave perspective, AUDNZD appears to have completed the main wave 4, suggesting the market may be preparing for the next impulsive move.

If price breaks above the upper line of the symmetrical triangle, I expect AUDNZD to push at least toward the 1.16370 NZD as an initial upside target.

First Target: 1.16370 NZD

Second Target: 1.1668 NZD

Stop Loss(SL): 1.1547 NZD

Points may shift as the market evolves

Do you think AUDNZD can resume its upward trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/New Zealand Dollar Analysis (AUDNZD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Lingrid | AUDCAD 2023 High Rejection Short TradeFX:AUDCAD has stalled at the 2023 high zone near 0.9550, where price met strong supply and reacted sharply after an extended impulsive rally. The advance into this area unfolded as an A-B-C move, suggesting the move lacked continuation strength. Price is now losing momentum just below the upper resistance zone while remaining capped beneath the channel broader.

If buyers fail to regain acceptance above the 2023 high, the structure could rotate lower toward the rising trendline support around 0.9420. That zone also aligns with prior breakout support, making it a natural downside magnet should selling pressure accelerate.

➡️ Primary scenario: rejection from 0.9550 → pullback toward 0.9420.

⚠️ Risk scenario: a sustained close above 0.9560 could invalidate the rejection and open the door toward higher resistance.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

NZDJPY: Manipulation Risk – Triangle Break Will DecideNZDJPY: Manipulation Risk Remains High – Triangle Break Will Decide

We are in a very risky position with NZDJPY. The price is rallying. As I explained in my previous analysis, the JPY remains heavily manipulated by the Bank of Japan.

It started with Forex Intervention on Friday and the downward moves were very aggressive.

So far we are in a downward correction and not a bullish trend after the BOJ warned of more intervention.

If the price moves below the Triangle pattern, it could fall further with the bearish scenario as shown in the chart.

If the price moves above the Triangle pattern, we will only be in a larger correction but with a possible bearish base. There is a high risk.

A comment from the BOJ and it could easily push everything down. There is a very high risk in a trade.

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️

Whale Watching 101: How to Use Exchange Inflow/Outflow DataIn the ocean of cryptocurrency, Retail Traders are the plankton, and Institutions are the Whales. When a Whale moves, the water displaces, and the plankton get pushed around. If you want to survive in 2026, you must stop swimming against the current and start tracking the Whales.

But how do you see them? They don't post their trades on Twitter. They leave On-Chain Footprints. The biggest footprint they leave is moving money in and out of Exchanges.

Today, we are mastering the most fundamental On-Chain metric: Exchange Netflow.

1. The Golden Rule of Flows

To understand this data, you must understand the psychology of a Whale. A Whale (holding 1,000+ BTC) does not keep their money on an exchange like Binance or Coinbase unless they are planning to do something.

Exchange INFLOW (The Bearish Signal)

The Logic: Why would a Whale move 5,000 BTC from a secure Cold Wallet (Ledger/Trezor) to an Exchange?

The Intent: They are likely preparing to SELL.

The Trading Signal: If you see a massive spike in "Exchange Inflow" while price is hitting a Resistance level, it is a massive warning sign. The Whales are loading their guns to dump on the retail breakout.

Exchange OUTFLOW (The Bullish Signal)

The Logic: Why would a Whale withdraw 5,000 BTC from an Exchange to a Cold Wallet?

The Intent: They have finished buying. They are removing the supply from the market to hold for the long term.

The Trading Signal: If price is dumping, but "Exchange Outflows" are hitting record highs, this is Accumulation. The Whales are buying the dip and removing the coins from circulation. This is how "Supply Shock" happens.

2. The Nuance: Stablecoins vs. Bitcoin

This is where 90% of rookie traders get it wrong. You must distinguish what is flowing in.

BTC Moving to Exchange = Sell Pressure (Bearish)

Interpretation: Supply is increasing.

Stablecoins (USDT/USDC) Moving to Exchange = Buy Power (Bullish)

Interpretation: This is "Dry Powder." When Whales move millions of USDT to an exchange, they are preparing to BUY the dip.

The "Ultimate Bull Signal": High BTC Outflows (Supply Shock) + High Stablecoin Inflows (Buying Power) = Parabolic Price Action.

3. Case Study: The "Fakeout" Trap

Let’s apply this to a real trading scenario.

The Scenario: Bitcoin is trading at $98,000. It looks bullish. Suddenly, a breakout occurs to $100,000. Retail traders start longing with 50x leverage.

The On-Chain Reality: You check the data. You see that 1 hour before the breakout, 10,000 BTC flowed INTO Coinbase Pro.

The Trade:

The Trap: The breakout is likely a "Bull Trap." The Whales moved that BTC to sell into the liquidity provided by the retail longs.

Your Move: Instead of longing the breakout, you Short the rejection, knowing that massive sell pressure is sitting on the order book.

4. Tools of the Trade

You cannot trade this without data. Here are the industry standards for 2026:

Glassnode: The gold standard for "Exchange Net Position Change" charts.

CryptoQuant: Excellent for real-time "Exchange Inflow" alerts.

Whale Alert (Twitter/X): Good for spotting individual massive transactions, but be careful—sometimes these are just internal transfers (exchange wallet to exchange wallet). Always verify if it is an actual inflow.

Conclusion: Context is King

Exchange flows are powerful, but they are not a crystal ball.

Low Volatility + Inflows = Preparing for a big move (likely down).

High Volatility + Inflows = Panic selling (Capitulation).

Use Fundamental Analysis to see Where the money is going, and Technical Analysis to time When to enter.

Stop guessing. Start tracking.

-Tuffycalls (Team Mubite)

Trading Weekends Is a Dead-Man ZoneWeekend trading in crypto looks active on the surface, but the structure underneath is fragile. Liquidity thins, participation drops, and price becomes easier to move with relatively small orders. What appears to be opportunity is often noise amplified by absence of depth. This is why weekends quietly drain accounts rather than build them.

Institutional participation is minimal during weekends.

Many large players reduce exposure or remain inactive, which removes the stabilizing force that normally absorbs volatility and validates structure. Without that participation, levels lose reliability. Breakouts occur without follow-through. Reversals happen without warning. The market is not directional; it is reactive.

Spreads widen and order books thin. This increases slippage and distorts risk. Stops that would survive during active sessions are easily tagged. Entries that look precise on the chart fill poorly in reality. Execution quality degrades, even if the setup appears valid in hindsight.

Another issue is narrative vacuum. During the week, price responds to macro flows, funding dynamics, and session-based participation. On weekends, these drivers are largely absent. Price often rotates aimlessly or runs obvious liquidity pools without establishing commitment. Traders mistake movement for intent and become the liquidity that others exit against.

Psychology also shifts. Weekends invite boredom trading.

Without a structured routine, traders lower standards, widen assumptions, and take setups they would normally ignore. Losses feel smaller individually, but they accumulate through frequency and poor sequencing.

There are exceptions. High-impact events or structural carryover from a strong weekly close can create opportunity. These situations are rare and require reduced size and stricter confirmation. For most traders, restraint is the edge.

The market will still be there on Monday with clearer structure, deeper liquidity, and better execution conditions. Survival in trading is not about participation at all times. It is about choosing when conditions justify risk. Weekends rarely do.

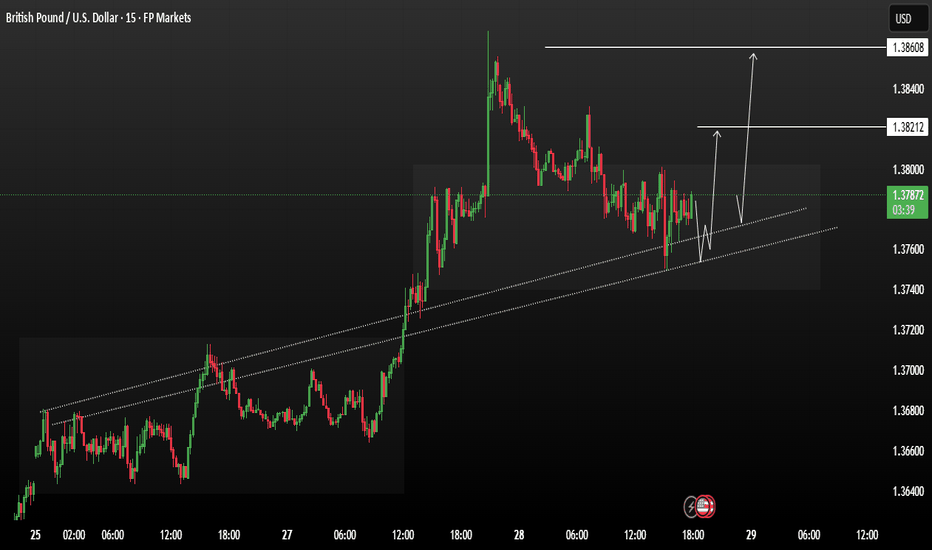

GBPUSD Consolidation Bullish remains validGBPUSD is moving in a clear bullish trend. Price has been respecting an ascending trendline, which indicates strong buying interest from lower levels. After a strong impulsive move upward, the market entered a consolidation phase, forming higher lows while staying above trend support — a healthy sign in an uptrend.

Currently, price is pulling back toward the rising trendline, which acts as dynamic support. This pullback looks corrective rather than bearish, suggesting buyers are still in control. As long as price holds above this support zone, the bullish structure remains valid then upside target will be 1.38608 to 1.38212

Bullish continuation is favoured while price remains above the ascending trendline. A strong bullish reaction from support could trigger the next upward leg toward the marked resistance zones.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis thanks for Supporting.

XAUUSD (Gold) – 30M Trendline Support & Breakout ContinuationPrice is holding above the rising trendline and support zone, forming a bullish continuation structure. A successful hold or breakout above the range opens the path toward higher targets.

Immediate Support: 4960 – 4975

Range High / Resistance: 4985 – 4990

First Target: 5025 – 5045

Extended Target: 5070 – 5100

Bullish bias remains valid above trendline support. Look for retest confirmation or clean breakout before entries and manage risk accordingly.

Lingrid | GOLD Trend Continuation Pattern Taking ShapeOANDA:XAUUSD remains anchored within a well-defined rising channel, with price consolidating above the ascending trendline after printing another higher high. The current pause appears constructive, as pullbacks stay shallow and buyers continue to defend area above the 5,020 demand. Structure suggests the market is absorbing supply rather than distributing.

If price continues to hold above the trendline and avoids slipping back into the prior range, upside momentum could reaccelerate. A sustained push through the consolidation ceiling may allow price to challenge the 5,190 level, where the upper channel boundary aligns with psychological resistance.

➡️ Primary scenario: higher low holds → continuation toward 5,190.

⚠️ Risk scenario: a breakdown below 5,020 may trigger a deeper retracement toward the mid-channel support before bullish structure is reassessed.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

BITCOIN IS ABOUT TO PENETRATE BEARS!!!!!? (hard)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.