DeGRAM | GOLD will retest the support line📊 Technical Analysis

● XAU/USD is holding above the rising support line inside an ascending channel, with buyers defending pullbacks after a strong impulsive breakout.

● Price has consolidated below minor resistance near 5,530 and is attempting continuation toward the upper channel boundary around 5,595–5,650, confirming bullish short-term structure.

💡 Fundamental Analysis

● Ongoing geopolitical uncertainty and expectations of eventual monetary easing continue to support demand for gold on intraday dips, favoring upside continuation.

✨ Summary

● Gold remains supported within a rising channel.

● Short-term upside toward 5,595–5,650 is favored while price holds above 5,500.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Community ideas

Gold Is Holding the Channel - How Price Reacts at SupportHello traders,

Gold is currently trading near $5,560, holding firmly within a well-defined ascending channel after a strong impulsive expansion. The breakout that pushed price into all-time high territory around $5,550–$5,580 was clean and decisive, confirming that buyers remain in control of the broader structure.

Following the breakout, price has transitioned into a controlled consolidation phase near the upper portion of the channel. This slowdown is not a sign of weakness. In strong bullish environments, markets often pause to rebalance liquidity and allow late participants to reposition. The projected pullback toward the gap and demand area around $5,430–$5,480, aligned with the rising trendline, represents a logical zone for buyers to defend.

Structurally, the bullish case remains intact as long as price continues to respect the ascending channel support and the higher low structure above $5,280–$5,320. Pullbacks that remain shallow and corrective would favor continuation toward the upper channel boundary near $5,800, which stands out as a key technical reference and potential reaction zone rather than a guaranteed target.

Invalidation is clear and objective. A decisive breakdown below the support zone around $5,280 and sustained acceptance outside the channel would force a reassessment of the bullish bias and open the door for a deeper corrective phase.

For now, gold is not reversing, it is digesting gains within structure.

Trend respected. Structure intact. Let behavior confirm the next expansion.

GBPJPY: Double Top Signals Potential Trend ReversalGBPJPY: Double Top Signals Potential Trend Reversal

GBPJPY is showing clear signs of exhaustion after an extended bullish move, with a well-defined Double Top pattern forming near the recent highs.

Price was rejected twice from the same resistance zone, indicating strong selling pressure and weakening bullish momentum. Following the second rejection, the pair broke below the short-term support area, confirming bearish movement.

From a technical perspective:

The double top highlights a possible trend reversal

Bearish continuation could target 208.60, followed by 206.90, and potentially 204.65 if selling pressure accelerates

From a fundamental angle, JPY remains highly sensitive to Bank of Japan commentary and intervention risk, while GBP strength has started to fade after an aggressive rally. Any renewed risk-off sentiment or BOJ signals could further support downside continuation.

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️

Rest in piecesUnfortunately, I was recently banned by tradingview for posting bearish minds, they told me to stop spreading FUD...so this might be my last call. Enjoy.

Looks like we are headed down there, once we test that MA I expect very strong bounce. Very. This will play out over the next week. The wick is getting filled.

Originally I expected us to make a fake out over 2.10$ first but the bulls can't get it up. Bitcoin is looking at 70k.

Wave guy, where is your wave 5 to 2.80? You can only count to 4 huh? Well this is it for me, I am probably getting banned permanently for this post, there is also a group of people who is reporting every post I make so...

Just remember, we are in the bear market right now. So when we pump hard, do not start dreaming, stick to the fibs, confluences and resistances. Pay attention to moving averages and have patience. Good luck!

EURJPY H1 | Bullish Bounce Off Key SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 182.836

- Pullback support

- 78.6% Fib retracement

- 100% Fib projection

Stop Loss: 182.123

- Multi-swing low support

Take Profit: 183.602

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Still I believe on thisNo matter what till we don’t find a support on the daily and weekly timeframe above, 100-102 k I still remain bearish because I find more weakness in the price action than the bullish sign

I have talked about this potential head and shoulder pattern since long time ago and what we can see here look like it’s really happening. So be careful guys unless we can take over the support above 102K and from there we can analyze the market one more time be Patient and trade smart guys. Best of luck be preferable.

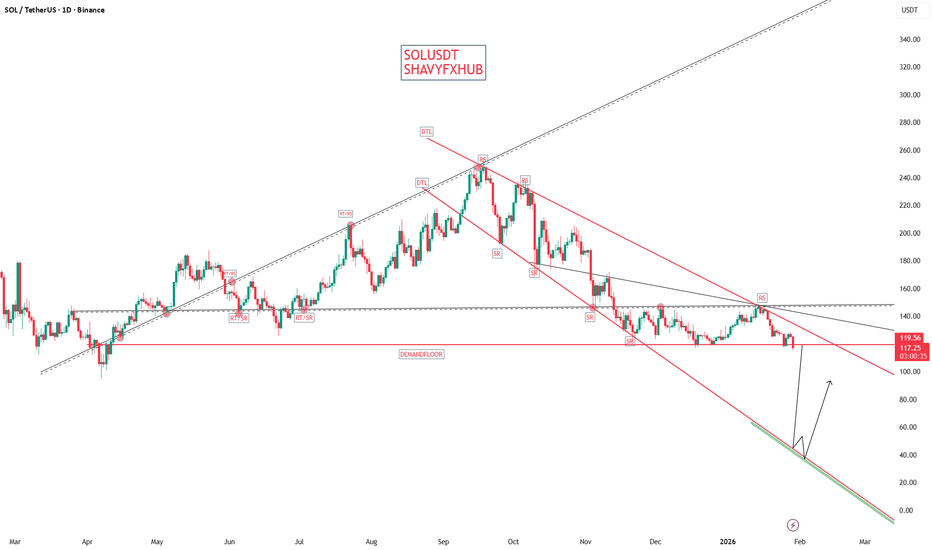

SOLANA ON DISCOUNT PRICE BASED ON STRUCTURESolana is a high-performance blockchain platform designed for speed, scalability, and low transaction costs, using a hybrid Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus. Its ecosystem supports a wide range of decentralized applications (dApps) across DeFi, NFTs, gaming, DePIN, and AI.

Core Technology

Solana processes thousands of transactions per second (TPS) at sub-second finality and minimal fees, making it ideal for high-volume apps. PoH timestamps transactions for efficient ordering, combined with PoS for validation and staking rewards via SOL tokens. This addresses the blockchain trilemma of decentralization, security, and scalability.

Key Ecosystem Areas

DeFi: Hosts DEXs like Raydium and Orca, lending protocols like Kamino, and derivatives like Drift; over 80 projects enable yield farming and trading.

NFTs and Gaming: Supports marketplaces and games like Aurory (MMORPG) and Honeyland (farming sim) with fast, cheap NFT minting.

DePIN and AI: Includes Weather XM (weather data), Hivemapper (mapping), SHDW (storage), and AI platforms for on-chain data.

Infrastructure: Features oracles (Pyth, Chainlink), bridges (Wormhole), and staking (Jito, Marinade).

Top Projects by Activity and Market Cap

Active development leaders include Chainlink, Solana core, Wormhole, Drift, and Jito. Ecosystem market cap exceeds $200 billion, with prominent tokens like JUP, BONK, JTO, and MET.

DeGRAM | BTCUSD broke down through the triangle📊 Technical Analysis

● BTC/USD remains in a long-term bearish structure, trading below a descending resistance line that has capped multiple recovery attempts since August, confirming sustained selling pressure.

● The latest triangle consolidation resolved lower, with price slipping back toward the major horizontal support zone near 85,000–80,000, signaling continuation of the falling trend.

💡 Fundamental Analysis

● Tight global financial conditions, reduced liquidity, and cautious institutional positioning continue to weigh on Bitcoin, limiting upside despite periodic rebound attempts.

✨ Summary

● BTC stays below key descending resistance.

● Long-term downside risk remains dominant, with a move toward 85,000–80,000 favored while below 96,000.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

BTCUSD 84K BUY LIMIT (Bitcoin -Btcusd) nice buy limit awaiting to be triggered on 84K I will be scalping and trailing my stop , make sure to always secure profits , reason for this trade is because Btcusd has been dropping consistently and for this reason it should reverse to a certain price point before dropping any further, we can expect a 3 white soldiers to appear within this price pattern

GBP/USD | Moving forward (READ THE CAPTION)As you can see in the hourly chart of GBPUSD, it is now being traded in the highest price ever since October 2021! currently being traded at 1.38130, showing no indication of a bearish turn.

It has gone through today's NDOG several times but it returned to it every time.

Should it touch the NDOG again, if it fails to hold above it, it may fall down further to 1.37640 again.

Bullish Targets: 1.38340, 1.38490, 1.38640 and 1.38750.

Bearish Targets: 1.38100, 1.37950 and 1.37800.

Bitcoin (BTC/USD) – Key Level Watch Signal Bullish Scenario Break & close above 90,000 resistance → targets ~93,300 (upper target zone marked)

Bearish Scenario Break & close below lower trendline support → targets ~86,000 (lower target zone)

Current price action consolidating around 89k–90k — waiting for decisive breakout either way. High volatility expected.#Bitcoin #BTCUSD #Crypto #Trading #Breakout #BTC #Investing #Investor #CryptoTradingNot financial advice — Purely technical observation from the chart. Crypto trading carries very high risk of loss. Always DYOR and manage risk properly.

EUR/USD Bearish Rejection at Resistance – Downside Targets AheadEUR/USD is showing clear signs of exhaustion after a strong bullish move. Price has reached a key resistance zone near the top, where multiple rejections are visible, indicating strong selling pressure. The break below the rising trendline suggests a shift in momentum from bullish to bearish. Volatility is increasing, and buyers are struggling to maintain control above resistance. The overall structure now favors a corrective move to the downside as sellers step in aggressively. If price continues to trade below resistance, further downside is likely. The first bearish target is 1.19094, where minor support is expected. A continuation move can push price toward the second target at 1.18456. If selling momentum remains strong, the final target lies near 1.17732, aligning with previous support and demand areas. Risk management is essential in current conditions.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT 💬!

Gold faces the 361.8% barrier at $5,608; continues to post higheThe relentless push higher in Gold continues with 8 daily all-time highs in succession.

Although we remain at overbought extremes in every time frame, dips continue to find buyers.

From a technical standpoint, we have a 361.8% Fibonacci target at $5,608. We have seen a stalling in bullish momentum overnight

Gold has broken out of the channel formation to the upside. Reverse trend line support is located at $5,360. Deeper support is located at $4,954, close to the psychological $5,000 big figure

Conclusion: we face a technical barrier at $5,608. With the safe haven product continuing to make higher highs and higher lows, the preferred stance is to buy into dips.

Gold Is Breaking a 50 Year Pattern And It’s Not by ChanceGold Is Doing Something It Hasn’t Done in Nearly 50 Years And It’s Not Random

Gold is not just “going up.”

What we’re witnessing right now is a structural shift in global capital behavior something that only shows up once every few decades.

Over the past few weeks, gold has accelerated into a price zone that markets have not seen in nearly half a century, breaking multiple psychological levels in rapid succession and establishing a new range around 5,500–5,600 USD/oz. The speed and consistency of this move alone already set it apart from a normal bullish cycle.

But the real story isn’t the price it’s why the price is behaving this way.

This rally is not isolated to gold. Other precious metals such as silver and platinum have also surged aggressively, signaling a broader shift toward hard assets. When multiple metals move together, it usually reflects a macro driven reallocation, not speculative hype.

One of the strongest forces behind this move is the rapid weakening of the US dollar. The USD has been sold heavily, while US Treasuries are also under pressure, pushing yields higher. This combination sends a clear message: capital is starting to question the safety and stability of traditional US assets.

At the same time, global uncertainty is expanding rather than contracting.

Geopolitical tensions across Europe and the Middle East remain unresolved. Strategic competition between major powers continues to intensify. Supply chains are becoming more fragmented. These are long-cycle risks, not short-term headlines.

Debt levels in major economies especially the United States are climbing to new historical extremes. In response, many countries continue to rely on monetary expansion and policy flexibility. In this environment, gold naturally regains its role as a store of value, not because of fear alone, but because of mathematics.

Risk sentiment elsewhere is also deteriorating. The crypto market has shown increasing instability, with sharp drawdowns and renewed questions around long-term security and technological risk. When speculative assets wobble, capital often rotates back into instruments with thousands of years of monetary history.

Another key factor is policy uncertainty. Markets are closely watching the Federal Reserve, leadership expectations, and the probability of multiple rate cuts in 2026. Add to this growing concerns about central bank independence, and it becomes clear why central banks, institutions, and private capital are increasing gold exposure simultaneously.

This doesn’t mean gold will move in a straight line forever. After such a sharp acceleration, technical pullbacks are normal and healthy. However, most institutional outlooks remain aligned on one point: the medium- to long-term trend is still supported, because the forces driving this move are structural, not temporary.

Final Thought

Gold isn’t rallying because traders are optimistic.

It’s rallying because capital is repositioning in a world that feels increasingly unstable.

Understanding this context matters far more than guessing the next short-term price swing.

If this perspective helped you understand XAUUSD more clearly, feel free to leave a comment or follow.

Let’s keep the discussion focused on simple, practical ways to read the market.

USNAS100 | Tariff Headlines & Fed Risk Keep Bulls in ControlUSNAS100 | Policy Noise & Fed Risk Keep Bulls Active

U.S. markets remain reactive to political headlines after President Donald Trump announced a surprise tariff increase on South Korea to 25% from 15%, citing non-compliance with a trade deal agreed last July. The move impacts key sectors including autos, lumber, and pharmaceuticals.

Despite the headline risk, South Korean equities jumped nearly 2% to record highs, highlighting resilient risk appetite.

The global economic calendar remains relatively light until Wednesday’s Federal Reserve policy decision, where no rate change is expected. However, the meeting may be overshadowed by a DOJ investigation involving Chair Jerome Powell, potentially adding volatility during the press conference. Any signals regarding Powell’s future at the Fed could trigger sharp market reactions.

Technical Outlook

The price has stabilized above the 25860 pivot, keeping the bullish structure intact.

As long as price holds above 25860, upside momentum is expected toward 25985.

A confirmed 1H close above 25985 would strengthen bullish continuation toward the ATH at 26170, with extended upside risk toward 26500.

On the downside, a move below 25860 would shift momentum bearish, opening a corrective move toward 25600, followed by 25450 and 25250.

⚠️ Ongoing geopolitical tensions remain a direct volatility risk for the index.

Key Levels

• Pivot: 25860

• Support: 25600 – 25450 – 25250

• Resistance: 25985 – 26170 – 26500

USDJPY DAY TRADING SETUPOn this Pair, We are BULLISH, after a Drastic fall on the JPY INDEX, and a sharp buying momentum on the DXY, Now USDJPY as shown us a sign of strength, breaking previous high, whilst it trend as also shifted to the UPSIDE, we have a refined KEY LEVEL on the 30minutes timeframe we an inducement created, solidifying our entry. this is a 1R - 5.03R, We will give update as price continues to play forward.

BA – Daily Technical AnalysisBoeing is testing a major long-term descending trendline, acting as a strong supply zone.

Price is reacting right at this resistance, making this a critical decision area.

Technical Structure

• Overall structure: Wide range with descending ceiling

• Price at dynamic resistance

• Moving average is flattening → momentum slowing

• Initial rejection visible

Key Levels

• Major Resistance:

242 – 246

• Breakout Targets:

260 → 280

• Near Support:

228 – 230

• Key Support:

215

• Lower Support:

200

Bullish Scenario (Breakout)

If:

• Daily close above 246

• Successful retest of the trendline

➡️ Confirms a long-term breakout.

Upside Targets:

260 → 280 → 300

Bearish Scenario (Rejection)

If:

• Price fails to hold above resistance

• Loses the moving average

➡️ A corrective move is likely.

Downside Targets:

230 → 215 → 200

Final Takeaway

BA is at a make-or-break level.

This is either the start of a multi-month breakout,

or another rejection into range.

MIDHANI | Buy @LTP | SL below 360 | 1st Target 445, 2nd 533MIDHANI | Buy @LTP | SL below 360 | 1st Target 445, 2nd 533

**************************************************************************

Disclaimer (Please Read Carefully):

This is not investment advice. The stocks shared here are purely for educational and informational purposes. Please do your own research or consult with a financial advisor before making any investment decisions.

******************************************************************************************************************

Stock market में सिर्फ risk ही risk होता है। Market में survive करने का एक ही तरीका है, stop loss को पूरी discipline के साथ accept करना। अपनी capital को protect करने का इससे बेहतर कोई तरीका नहीं है।

मैं जो भी stock यहाँ शेयर करता हूँ, वो या तो मेरी existing holding में होता है, या फिर मैं उसी level पर fresh buying या add on करता हूँ जिसे मैं mention करता हूँ।

मैं हमेशा buy करते समय अपने system में stop loss ज़रूर लगा देता हूँ, और मेरे लिए stop loss, target से भी ज़्यादा important होता है।

Target achieve होने के बाद मैं पहले profit book करता हूँ और फिर retest या fresh breakout का इंतज़ार करता हूँ।

मैं सिर्फ breakouts पर buy करता हूँ, कभी भी support पर नहीं। और मैं resistance पर sell भी नहीं करता।

******************************************************************************************************************

The stock market involves risk, risk, and only risk. To survive in the market, accepting stop-loss with discipline and without hesitation. There is no other way to protect you capital.

Any stock I share is either already part of my existing holding or I take a fresh entry at the same level I mention. I always place the stop-loss in my system at the time of buying, and I give the highest importance to stop-loss more than the target. Once the target is achieved, I usually book profit once and then wait for either a retest or a fresh breakout.

I buy only on breakouts, never on supports. I also do not sell at resistance levels.

That is simply my trading style.