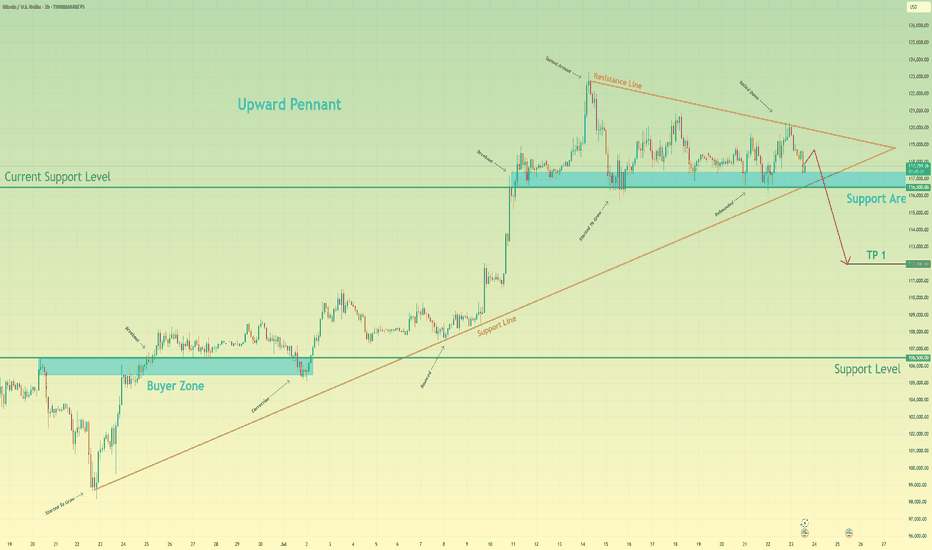

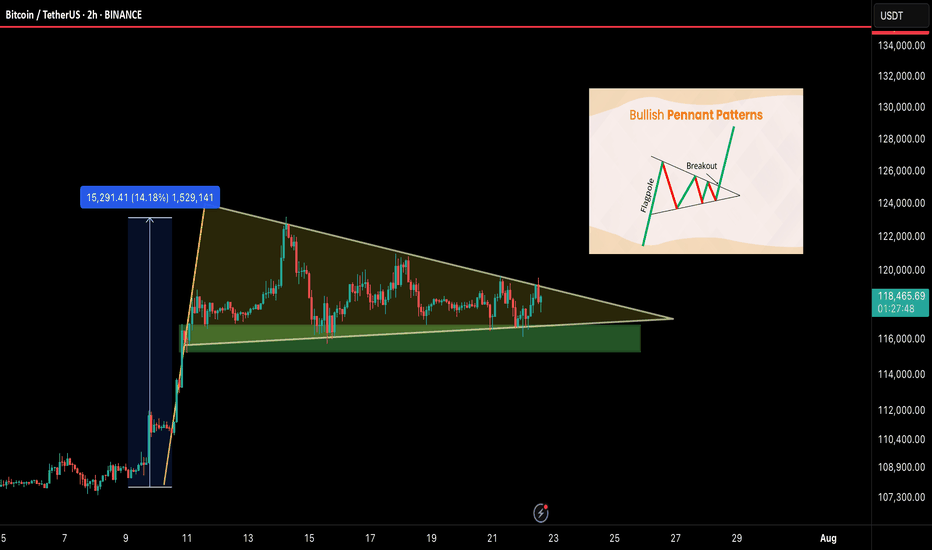

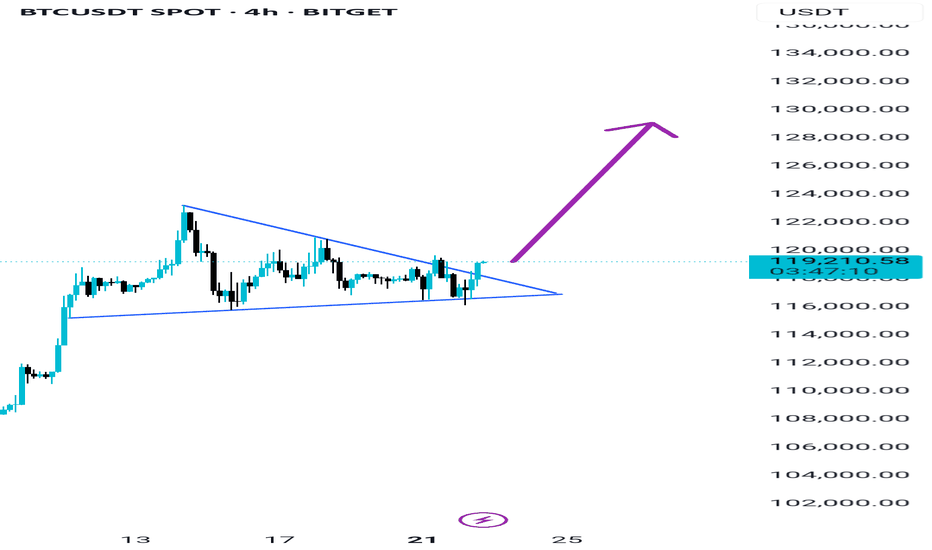

Bitcoin will rebound from resistance line and then continue fallHello traders, I want share with you my opinion about Bitcoin. After looking at the chart, we can see how the price entered an upward pennant and then at once rebounded up from the support line. Then it reached support level, which coincided with the buyer zone, and some time traded near this level, after which it made a small correction. Later it grew higher to 107800 level, breaking it and then made a retest. After this movement, BTC made an impulse up from the support level and rose to the current support level, which coincided with the support area and soon broke it. Later, it BTC rose to the resistance line of the pennant and then made a correction to the support area and started to trades inside. But later it made a fake breakout of the current support level and then tried to back up, but failed and dropped to the support line of support line of upward pennant. Then BTC turned around and started to grow, and soon broke the 116500 level one more time. After this, it reached the resistance line of the pennant, and it turned around and started to decline. In my mind, BTC will grow to the resistance line and then continue to decline 116500 support level. That's why it's my current TP. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Pennant

EUR/USD Momentum Builds After Pennant BreakAfter reversing to retest the broken double top neckline and consolidating early last week, the probabilities shifted in favour of an upside continuation.

Following this consolidation under resistance, EUR/USD broke back above, hitting a local high at 1.17 on Tuesday. A pullback followed, forming a clean pennant pattern on the lower timeframes.

The Asian open today brought a decisive breakout above that pennant’s resistance, putting the bias once again to the upside.

Upside target : 1.18 zone

Invalidation: Only if price drops back below 1.16

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

2 Ways to Trade Breakouts - Horizontal vs. Slanted StructureFX:EURUSD has put in a bullish pennant pattern. Normally with this pattern we would expect a breakout to the upside, but because we are sandwiched between two levels of previous structure, we just don't know.

Because that is the case, the best plan of action in my opinion is to wait for confirmation of the breakout & then look to get involved after the fact.

In this video we talk about 2 types of confirmation. 1) Horizontal levels of structure and 2) slanted levels of structure.

Which you use isn't as important as the consistency in which you use them.

Please leave any questions or comments below!

Akil

Potential Bullish Pennant on [EURUSD]I spotted a bullish pennant forming after a strong impulsive move upward. Price is currently consolidating in a tight range with lower highs and higher lows, forming the pennant shape.

I’m watching for a second breakout above the upper trendline with volume confirmation. My entry would be slightly above the breakout candle, with a stop loss below the pennant and TP based on the measured move from the previous impulse.

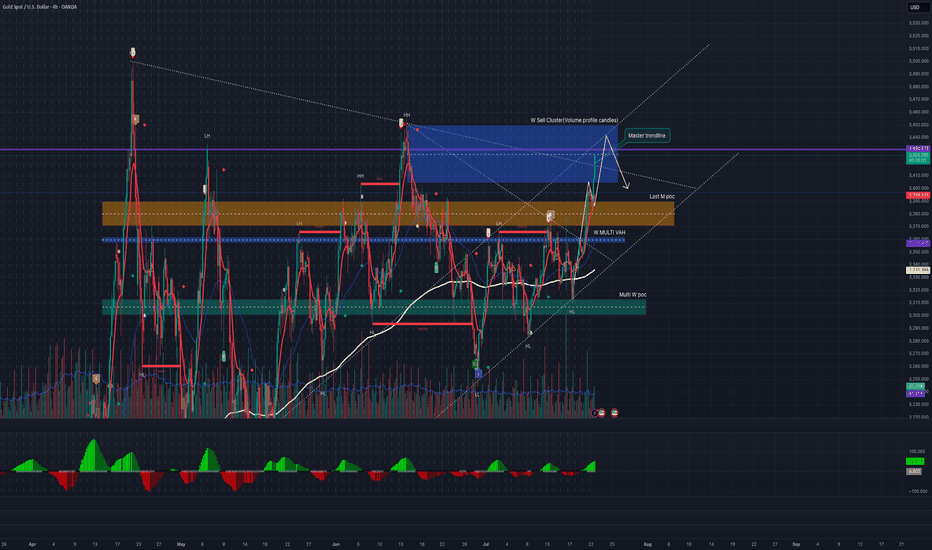

XAUUSD rises due to tariff wars and weak economic dataXAUUSD rises due to tariff wars and weak economic data

Gold climbed to 3,380.00 level on August 7, hitting a two-week high, as renewed U.S. tariff threats and expectations of Federal Reserve rate cuts in September and December boosted its appeal. President Trump announced 100% tariffs on imported semiconductors (excluding U.S.-made), 25% on Indian imports, and 50% on select Brazilian goods. Additionally, Weak U.S. economic data and a cooling labor market further support gold’s rise.

Technically, price has formed the Pennant chart pattern right below the local resistance of 3,380.00. Further breakout of the level and ascending towards 3,440.00 level is expected in short-term.

Pennant — Trend Is Your Best Friend 🚩 Pennant — Trend Is Your Best Friend 📈

drive.google.com

🔍 Introduction

The Pennant is a trend continuation pattern, resembling a small triangle that forms after a strong initial move (known as the “flagpole”). It is similar to the Flag pattern, but with one key difference: the body of the Pennant is formed by two converging trendlines, rather than parallel ones.

📐 Pattern Description

The Pennant forms after a strong, impulsive price move, indicating that the trend is likely to continue after a short pause.

Like the Flag, the Pennant consists of two main components:

The flagpole — a sharp, directional move (either bullish or bearish)

The Pennant body — a brief consolidation shaped like a symmetrical triangle 🔺

🟢 A bullish pennant forms after a strong upward move

🔴 A bearish pennant follows a strong downward move

🧠 Market psychology behind the pattern:

After a big move, many traders expect a reversal and begin taking counter-trend positions. But when the breakout occurs in the direction of the original trend, it triggers a wave of new orders, pushing price even further. That’s why the Pennant is often used to enter trades in the direction of the dominant trend.

📉 Volume behavior is also key:

High volume during the initial move

Low volume during the Pennant’s consolidation

Rising volume on the breakout

This volume pattern reflects renewed trader interest and often leads to a more explosive breakout compared to a Flag, due to the tightening nature of the consolidation.

⚠️ A weak or sloppy move before the Pennant weakens the signal and increases the risk of false breakouts.

🎯 Entry & Stop-Loss Strategy

📥 Entry: After a confirmed breakout above the Pennant’s resistance (or below it for bearish setups)

🛑 Stop-loss: Placed just below the last local low before breakout

💰 Profit Target:

Partial take profit at the top of the flagpole

Full target = the height of the flagpole projected from the breakout point (aka the Measured Move)

Always account for key support/resistance levels to define the potential range

💡 The Pennant often offers great risk/reward due to its tight structure and explosive potential.

💡 My Pro Tips for Trading Pennants

✅ Pennant Pattern Criteria

Trend continuation pattern

A strong, nearly vertical move preceding the Pennant

Triangle-shaped consolidation (two converging lines)

The Pennant body must be shorter than the flagpole

The lowest point of the Pennant should not exceed half the length of the flagpole

Breakouts should happen in the direction of the initial trend

Tight range before breakout increases accuracy

📈 What Strengthens the Signal

Sharp, clean, directional initial move (strong flagpole) ⚡

High volume on the initial move, and volume surge on breakout 💥

⚠️ What Weakens the Signal

Choppy or weak price action before the Pennant 🫤

Lack of volume during the flagpole or breakout 💤

✅ Examples of My Winning Pennant Setups

🔗 EURUSD Bearish Pennant — Ready to Drop

❌ Examples of My Losing Setups

🔗 XAUUSD Bullish Pennant — Failed Follow-through

💬 Do You Trade Pennants?

They’re one of the most powerful continuation patterns when paired with clean price action and volume confirmation. What’s your experience with Pennants? Share your wins — and fails — below 👇👇

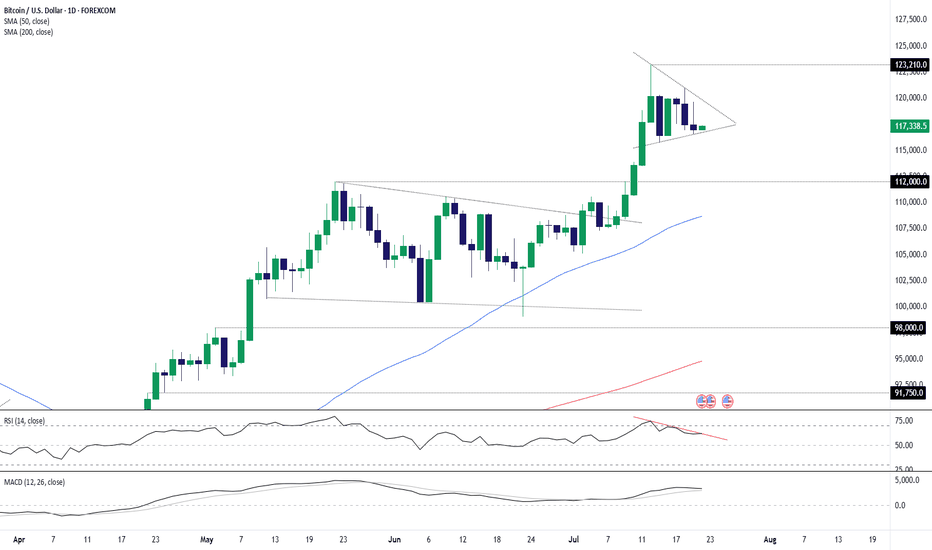

Bitcoin can continue to decline and break support levelHello traders, I want share with you my opinion about Bitcoin. Following an earlier upward trend, bitcoin entered a prolonged phase of consolidation, forming a large upward pennant where price action was tightly contested between the seller zone near 117000 and an ascending support line. This period of balance, however, has recently resolved to the downside with a significant change in market structure. A decisive breakdown has occurred, with the price breaking below the pennant's long-standing support line, signaling that sellers have ultimately gained control. Currently, after the initial drop, the asset is undergoing a minor upward correction, which appears to be a classic retest of the broken structure from below. The primary working hypothesis is a brief scenario that anticipates this corrective rally will fail upon encountering resistance from the broken trendline. A confirmed rejection from this area would validate the bearish breakdown and likely initiate the next major impulsive leg downwards. The first objective for this move is the buyer zone around the 112000 support level, but given the significance of the pattern breakdown, a continuation of the fall is expected. Therefore, the ultimate target price for this scenario is placed at the 109,000 level, representing a logical measured move target following the resolution of the large consolidation pattern. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Ethereum Rally (?) : Strong Infusion with Volume RequiredEthereum can make a very strong rally of at least 35-40 percent.

And so the same goes for the Ishares Ethereum Trust ETF. (ETHA ETF)

But it needs to break the pennant.

And we need to observe strong volume.

Also, if we stay above the 50 and 200 period moving averages while this is happening, good things can happen.

Still, I am neutral until we break the pennant.

EURUSD REACHED THE TARGET.EURUSD REACHED THE TARGET.

EURUSD has reached the 1.14500 level and even broke it down. Currently the price consolidates slightly below this level. If the price forms a false breakout of 1.14500 level, this will mean the end of short-term decline in the pair. Stay cautious.

$ETH to $6.45k USD - 2024's Crescendo CRYPTOCAP:ETH is showing strong signs of an impending breakout to the $6.4k–$8k range, backed by two key technical indicators:

Cup & Handle Formation: ETH has recently broken out of a textbook cup and handle pattern, confirming the breakout with a solid retest over this past week of VOL. This is a classic bullish signal pointing to higher targets.

Bull Pennant: Since the 2021 rally, ETH has been consolidating within a massive bull pennant. This long-term structure suggests Ethereum is coiled and ready for a significant move upward.

1.618 Fib: Also layering in a Fibonacci retrace, if ETH is indeed heading for ATHs and price discovery, the 1.618 FIB is a common level that traders are very familiar with. It just so happens to be right in the middle of our target box at ~$7k!

Momentum is building— we will need to keep an eye on volume and follow-through for confirmation.

To boot, bearish sentiment for ETH is near all time highs. I think it might be time for a most-hated rally. I have a short term allocation in AMEX:ETHT to ride this momentum, NFA DYOR

FMC Corporation Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# FMC Corporation Quote

- Double Formation

* (1st Entry Area)) - *70.00 USD | Completed Survey

* (A+ SIgnal)) - *Retest Feature | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* 119 bars, 165d, 1.5RR - Date Range Method | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 48.00 USD

* Entry At 41.00 USD

* Take Profit At 31.00 USD

* (Downtrend Argument)) & Pattern Confirmation

- Continuation Pattern | Valid

* Pennant Structure | Short Set Up

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Is altcoin season over before it even started?Guys,

Gonna break down the situation on the chart to see where we can go next with the altcoins.

We see the key resistance levels and now we moving in kinda bullish pennant, but considering descending volumes we can easily test the support line and go back to the 1.25T. (maybe even lower)

After that, seems like we can try to go back and break the 1.64T resistance zone and previous ATH.

Anyway current market is going to be way more different from previous cycles, because huge institutions can feel nice only in hyper volatile, so divide your strategy between short, mid and long term investments to take profits.

Good trades and share your thoughts down to see what others think.

$ETH - Nothing has changedEthereum is showing a significant breakout setup after years of consolidation within a large symmetrical wedge structure (A–B–C–D pattern). The price has just tested the upper boundary of the wedge, and momentum indicators suggest a potential mid-term bullish continuation.

Key Observations:

ABCD Harmonic Structure: Price has respected the harmonic range with D forming a strong higher low near $1,500–$1,600, showing buyer absorption at key demand levels.

Fibonacci Confluence:

The 161.8% extension aligns with ~$5,800, forming the first major target.

A 261.8% extension pushes towards ~$7,000, aligning with the marked "Target" zone.

Volume Profile: Heavy accumulation between $1,500–$2,500 with low resistance above $4,000 suggests a breakout could accelerate quickly.

MACD/RSI Divergence: The momentum oscillator shows a triple bullish divergence (higher lows on momentum vs. lower lows on price), and the downtrend line on the MACD histogram has been broken—often a precursor to sustained upside.

Moving Averages: The 50/100 EMA crossover on the 2-week chart is imminent, historically a strong macro signal.

Bullish Scenario:

A clear close above $4,000 confirms wedge breakout.

Short-term targets: $4,600 (weak high) and $5,800 (Fib 161.8%).

Macro target: $7,000+ if bullish momentum holds through Q4.

Bearish Risk:

Failure to hold $3,500 could lead to retests of $2,500 or even $2,000 (mid-wedge support).

Watch for macroeconomic shocks (rate cuts, liquidity shifts) which have previously caused retracements in crypto markets.

What’s next?

ETH is approaching a make-or-break moment. If the breakout holds, this could be the start of the next major leg up. A strong weekly close above $4,000–$4,200 is critical for validation.

6month log chart on xrpusd suggests crazy potential targetsThe bull pennant we are in shown here on the 6month time frame seems to have a symmetrical triangle for its flag. The breakout target for just the symmetrical triangle is in the $33 range. Factor in the pole of the flag and the potential target skyrockets to 1.2k. Definitely not financial advice and certainly no guarantee it will hit either target as it’s still up in the air if log chart targets reach their full target as reliably as linear chart patterns do. Even if it does hit these targets you can see the apex of the pennant in its current trendline trajectories doesn’t occur until 2026. The only way I see price remaining inside this triangle for that long is indeed if the SEC ripple case is extended through appeal and taken to the Supreme Court. Hopefully not but it isnt impossible. If this were to occur I would simply keep dollar cost average accumulating until it was to break out from the triangle which would give me more opportunity to take some profit at the first target but then also hold onto some of the asset in case it does indeed reach the full bullflag breakout somehow all the way up at 1.2k. Simply posting this hear so I can see how well price action chooses to follow this pattern over the next year or few. Once again *not financial advice*

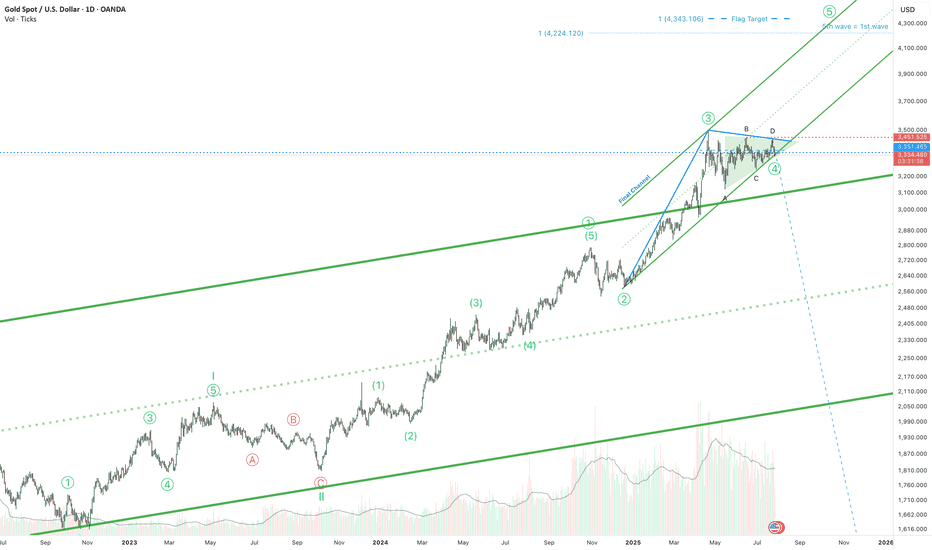

Gold is ready for the 5th wave!Hello! If you're following gold, here's some exciting news. The triangle correction phase that began in April is almost over. It's been a long journey, but we're almost there.

And guess what? The final phase is expected to reach around $4,300. But wait, there's more! The price is holding above the top of a long-term channel. This isn't just a random move; it could be a strong signal that the price could rise even higher than the $4,300 mark.

So, if you're following the gold market, keep your eyes peeled. Big moves could be just around the corner!

Bitcoin can start to decline and break support levelHello traders, I want share with you my opinion about Bitcoin. After completing a powerful upward impulse that originated from the buyer zone near 106500, the price action for BTC has transitioned into a corrective market phase. This consolidation has taken the form of an upward pennant, characterised by a narrowing trading range that suggests a significant directional move is forthcoming. Currently, the asset is undergoing a sequence of downward corrections within the pennant, exerting repeated pressure on the critical demand zone between 116500 and 117400. The importance of this zone is amplified by its confluence with the lower trend line of the formation itself. The primary working hypothesis is a bearish resolution, anticipating that persistent selling pressure will culminate in a decisive breakdown of this support. This event would act as a bearish breakout from the pennant, providing strong confirmation for the continuation of the downward impulsive momentum and shifting the local market structure. Therefore, the take-profit level is logically positioned at the 112000 mark. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

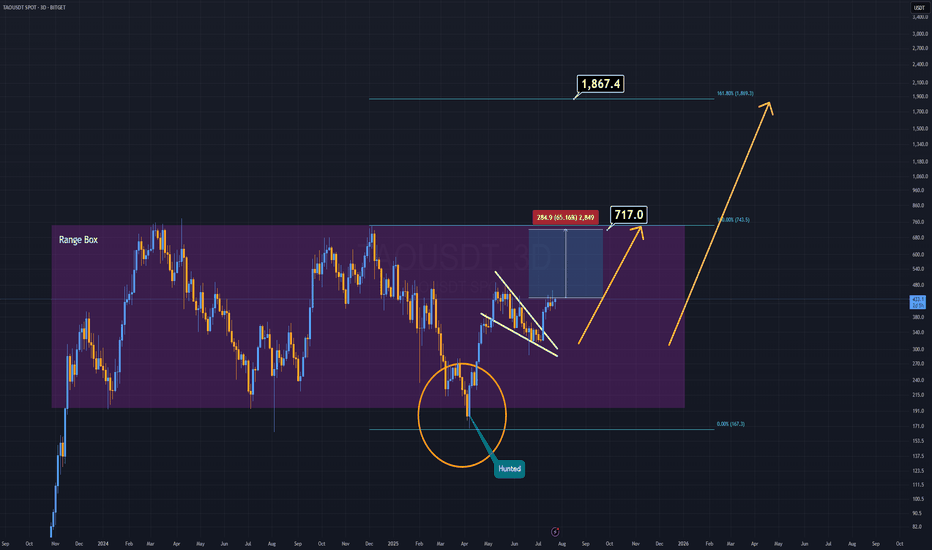

TAO Analysis (3D)Sometimes, there's no need for complex patterns or heavy indicators — and TAO is a perfect example of that.

For years, TAO has been consolidating inside a clearly defined accumulation box. Before the current bullish breakout, it liquidated all weak hands by sweeping the lows — convincing many that the project was dead.

Now, on the daily timeframe, we’re seeing a broken and active pennant formation, which is already being validated.

This structure alone is a strong technical buy signal.

With the upcoming AI-driven bull run, TAO has the potential to outperform many of its AI-sector peers.

This one might just fly ahead of the pack.

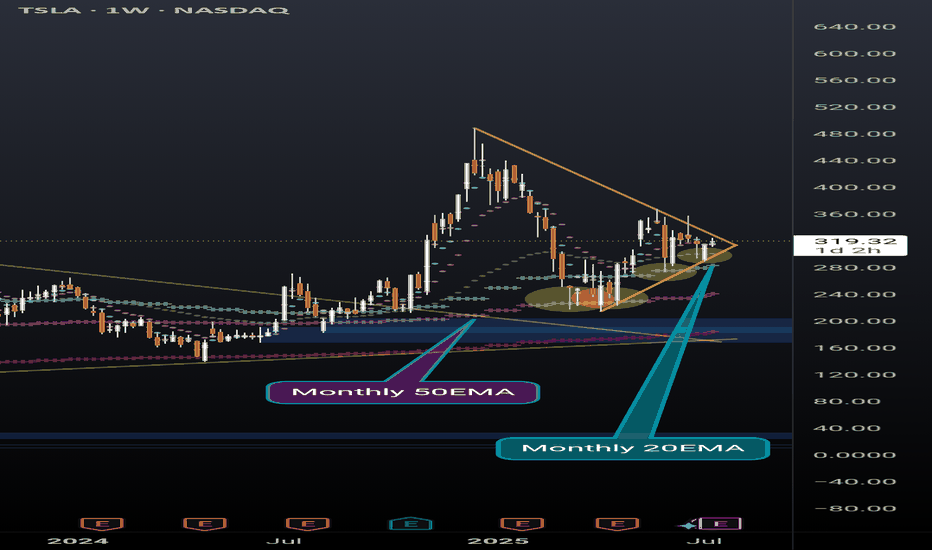

TSLA weekly coiling into something powerfulNever doubt the power of TSLA. Recently broke out of a huge pennant, and now nearing the end of another pennant while simultaneously holding support above the daily 20EMA(overlayed on this weekly chart).

Also recently found support off of the monthly 20EMA (overlayed on this weekly chart) and took 2 direct hits on the monthly 50EMA (overlayed on this weekly chart) before that and rallied up. It will take a lot to crush this setup but anything can happen. Possibly a longer pennant formation.

I'm just a cat not a financial advisor.

Short Idea possibleFollowing up from the recent run up to @ 3400, from a trend line POV there are still 2 targets that will be favourable for shorts.

These levels are 3400, 3420 to 3440.

The 3420 to 3440 range also confluences with weekly sell cluster, which means seller conviction in the past. As time went by, this level was protected by sellers, high probability they do this same this time

Looking for a slow rotation and Choch on 5 to 15 mins within the ranges of 3420 - 3440 for a strong pullback to @ 3370.

BTC/USDT – Bullish Pennant Setting Up for the Next Leg!Bitcoin is currently forming a bullish pennant — a classic continuation pattern — right after a strong 14% impulse move. This type of structure often leads to a breakout followed by another powerful rally. And it’s coiling up nicely.

🧠 Technical Breakdown:

🟢 Bullish pennant formation in progress

🔽 Support zone: $115.5K – $116.5K

📏 Flagpole projection targets $135K+ on breakout

⚠️ Currently consolidating with lower volatility — breakout could be near

🔍 What to Watch For:

Clean breakout above pennant = breakout confirmation

Daily close below $115K = invalidation zone

Volume spike will likely signal the next move

📢 Final Take:

BTC is showing healthy consolidation after a strong move, and this pennant could launch us toward $135K and beyond. Keep your eyes on the breakout and manage risk wisely.

💬 Share your thoughts below & smash that ❤️ if you’re watching this move!

Bitcoin: Setup Builds for a Run Back Towards the HighsBitcoin is coiling within what resembles a bull pennant pattern, hinting at another bout of consolidation before the rally resumes. Trading near the lower end of the recent range, Monday’s pullback offers an appealing entry point, allowing longs to be established around current levels with a stop beneath the July 15 low for protection.

The downtrend from the record highs looms as the first hurdle, sitting around $119,700 today. A break above that level could prompt an accelerated move towards the current record high just above $123,000—an appropriate target for the trade.

Good luck!

DS

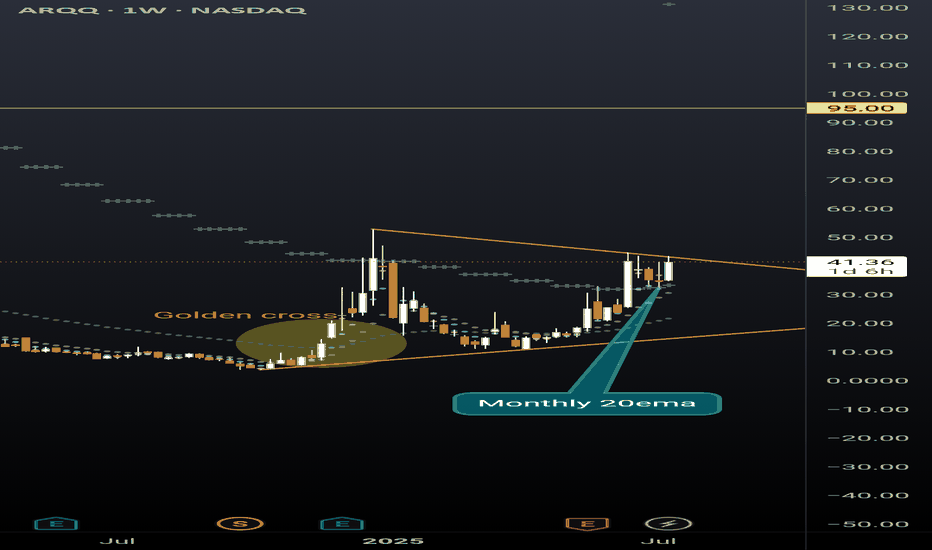

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.