Coinranger|GBPUSD. Potential for a decline to 1.35800🔹DXY fell even more overnight than on Friday. It could go even lower, but it's unlikely to reverse.

🔹No interesting news for the pound today.

🔹Earnings season is starting in the US, but there's nothing particularly interesting there today.

Current levels:

Below:

Preliminary downward wave set on M15

1.36030

1.35800

1.35360

Above:

1.36568 - the end of the upward wave set

1.37105 - the end of the first upward extension (we may finish it off)

After a significant rise, we'll likely correct today, most likely to 1.35800

-------------------

Share your thoughts in the comments!

Pound

GBPCHF LONGS - RANGE TRADEThe pair has revisited the bottom on the range at 1.06005 area highlighting that this support area is holding strong, we can see multiple attempts to try and break lower but buyers come back into the market.

Expecting the trade to revisit last highs with TP1 at 1.07201 and if the bullish momentum holds strong TP2 - 1.07585

GBPNZD NEXT MOVEGBPNZD is showing a clear bearish reversal setup after breaking down from an ascending channel and losing key trendline support, signaling a shift in market structure toward sellers. The strong impulsive bearish candle indicates increasing downside momentum, with price now targeting the major demand zone below where previous accumulation and strong buying reactions occurred. Fundamentally, the New Zealand dollar is gaining relative strength on expectations of tighter monetary conditions and stable economic outlook, while the British pound remains pressured by growth concerns, inflation sensitivity, and policy uncertainty. As long as price remains below the broken trendline and fails to reclaim prior resistance, rallies are likely to be corrective, favoring continuation toward lower liquidity zones, making short-side positioning aligned with trend, structure, and macro flow for profit-focused trading.

GBPCAD - SHORTS BEGIN AFTER FAILED UPSIDE PUSH We can see yesterdays attempt to break higher was met with swift resistance at 1.86661 resulting in a bearish close of the candle on the daily.

I am expecting the pair to begin to break lower and sweep recent lows 1.85652 if this downside push breaks this I am expecting. TP1 - 1.84606 - TP2 1.8400

GBPAUD - END OF THE RANGE THE SELL OF BEGINS?As per previous posts - GBPAUD is struggling to hold within the range above - we can see yesterdays daily candle reject the of the support now turned resistance, todays price action we made a second attempt to break higher but failed and are continuing to trade out of the range.

I am expecting a huge drop in the pair towards TP - 1.97831

GBPCAD LONG CONTINUATIONGBPCAD has seemed to found support above 1.8600 .

The recent swing low at 1.85646 i am anticipating this to be the end of the downside retrace and now buyers resume to continue the pair higher.

On the daily we can see the strength in buyers with the formation of a bullish hammer of the support zone at 1.8600

TP1: 1.87000

TP2: 1.87595

GBPUSD BULLISH MOVEGBPUSD is developing a bullish reversal setup after compressing inside a falling wedge structure, with price now breaking above the upper trendline and signaling a shift in short-term momentum. This type of breakout typically reflects seller exhaustion and increasing buying pressure, especially when it aligns with improving market sentiment. Fundamentally, the British pound is finding support from stabilizing UK economic data and expectations that the Bank of England will remain cautious on aggressive rate cuts, while the US dollar is facing pressure from softer yield expectations and a more balanced Federal Reserve outlook. As long as price holds above the broken wedge resistance and maintains higher lows, continuation toward upside liquidity zones becomes the higher probability scenario, offering a favorable trend-following opportunity with strong risk-to-reward aligned with structure, momentum, and current macro flows.

XAUUSD Next MoveXAUUSD continues to trade in a strong bullish continuation structure after a clean breakout and hold above the prior supply turned demand zone, confirming sustained institutional buying interest. The higher highs and higher lows on the daily timeframe reflect strong trend momentum, with price acceptance above the key consolidation range signaling trend continuation rather than exhaustion. Fundamentally, gold remains supported by persistent safe-haven demand, ongoing geopolitical uncertainty, central bank gold accumulation, and expectations around easing monetary policy and lower real yields, all of which favor upside pressure. As long as price holds above the reclaimed demand zone and maintains bullish structure, the market bias remains firmly bullish, with momentum favoring continuation toward higher psychological levels and offering strong trend-following opportunities aligned with smart money flow and broader macro strength.

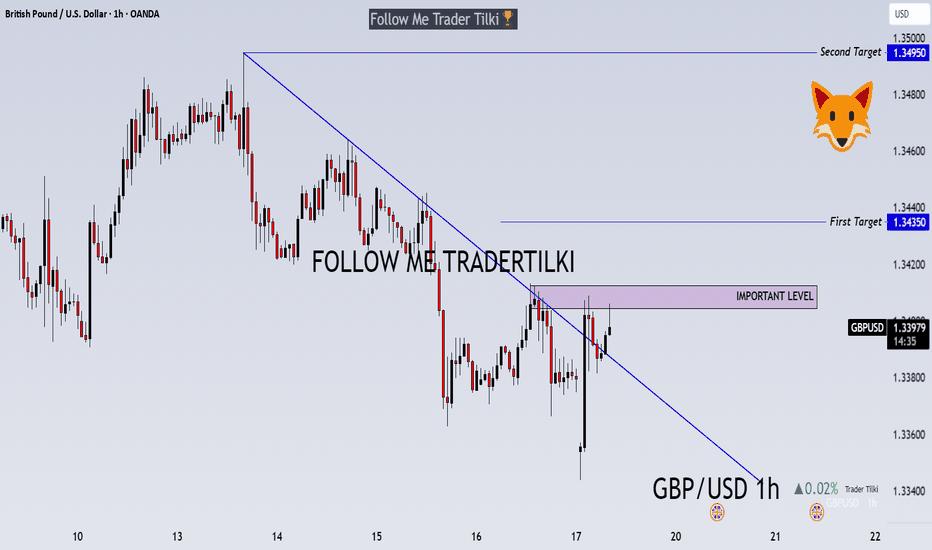

GBPUSD – 1-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a GBPUSD analysis for you.

My friends, if GBPUSD closes a candle above the levels of 1.34125-1.34045 on the 1-hour timeframe, I will open a buy position.

My targets:

1st Target: 1.34350

2nd Target: 1.34950

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

GBPAUD LONGS - RANGE TRADE

GBPAUD has found support at the 2.0000 zone, this is in confluence with the price stabilising above the weekly 100MA.

Given this areas level of strong support I am anticipating buyers to enter the market with TP 1 @ 2.012 & TP2 @ 2.01800 if the range is completed with the expected buy pressue

Coinranger| GBPUSD: Pullback and fall to 1.33237🔹The DXY has faded a bit in its rise, but there's no clear indication of a significant reversal on the elder timeframes yet. So, it's very likely that after the pullback is realized, we'll continue to rise to the 99.23 area and higher, to 99.44.

🔹No news today, except for the International Economic Forum in Davos.

🔹The pound reached its second extension on h1, so the rally on the pullback was (or still may be) aggressive. But overall, we're continuing to decline.

Levels:

Below:

1.33626 - a full set of downward waves

1.33406 - first extension

1.33237 - second extension

Above:

1.34300 - possible continuation of the pullback, but no guarantees. We'll watch the DXY here.

The overall sentiment is still down. We're keeping an eye on DXY

-------------------

Share your thoughts in the comments

Coinranger|GBPUSD: Pullback and fall to 1.33723🔹The DXY continues to rise and will likely continue without significant pullbacks for some time. Prospects: at least 99.1. Then the movement will need to be recalculated.

🔹Today at 16:30 (UTC+3) will issue data on PPI for December and October. Retail sales data will also be released at the same time.

🔹The pound is drawing a pullback, but if the DXY rises, it will continue to decline.

Levels

Below:

1.34282 - first wave of downtrend after the pullback

1.34083 - full set of downward waves

1.33723 - first set extension

Above:

1.134694 - most likely the end of the pullback, but we may not reach it and fall from the current levels. How the DXY will fare.

After the DXY begins to rise confidently, the pound will continue to fall.

-------------------

Share your thoughts in the comments

GBPUSD - From Bullish to Bearish, keeping it simpleGBPUSD has shifted gears.

After losing its bullish structure, price is now trading inside a falling red channel, keeping the broader bias bearish.

As GBPUSD retests the upper bound of the falling channel, and that retest lines up perfectly with the orange supply zone. This is a classic area where sellers tend to step back in.

As long as this intersection holds, the plan is simple:

wait for lower timeframe confirmation and look for trend-following short setups, aiming for continuation back toward the lower side of the channel.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPUSD - Right Into Resistance… Again!GBPUSD is now trading at a very important intersection.

Price is pressing right into the upper red trendline, while also sitting inside the green resistance zone. This is not a random area... it’s a level that has already rejected price multiple times in the past.

From a bigger-picture perspective, the structure remains overall bearish, with price still respecting the descending channel. The recent push higher looks more like a corrective move rather than a true trend reversal.

As long as this trendline + resistance intersection holds, my focus stays clear:

I’ll be looking for trend-following shorts, preferably after lower-timeframe confirmation and signs of bearish control.

Only a strong and clean break above this zone would force a reassessment. Until then, sellers still have the edge.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EURGBP - When Structure Breaks, Bias FollowsFor a while, EURGBP was respecting a rising blue broadening wedge, keeping the overall momentum bullish. That changed.

📉 Momentum has now shifted from bullish to bearish after price broke below the blue rising structure, signaling a clear loss of upside control.

Since then, price has been trading inside a falling red channel, confirming that sellers are in control for now.

🔍 What matters next:

As long as EURGBP remains below the broken structure and continues to trade within the falling channel.

Any pullback toward the upper bound of the red channel, and the previous structure low marked in red, will be considered a sell zone!

I’ll then be zooming into lower timeframes and looking for trend-following short setups.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

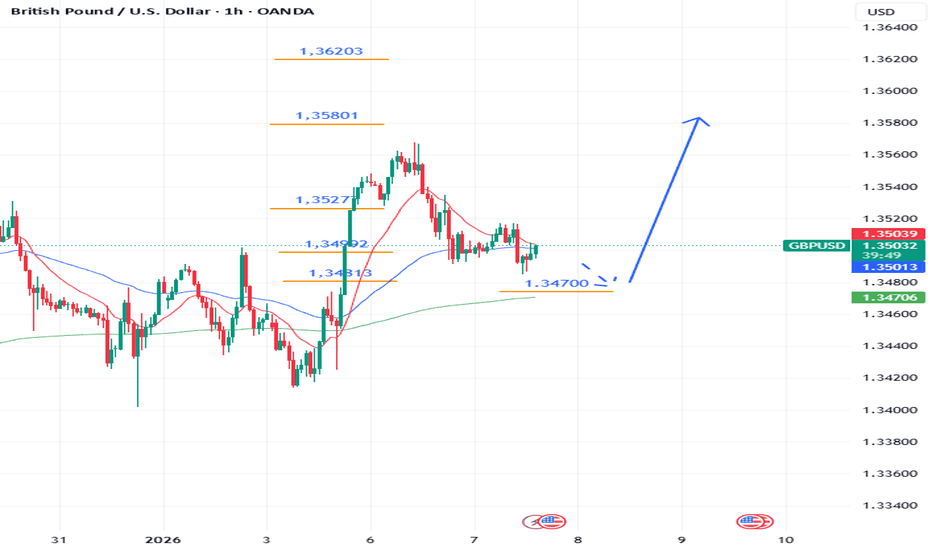

Coinranger| GBPUSD. Attempting to rise to 1.35801🔹The DXY has completed its full set of upward waves, though it went through suffering during the process. But there's still a chance of completing an extension upward wave for DXY at 98.333, but it's not a given that this will happen. The priority is down for now.

🔹The pound, unlike the euro, didn't hold back and immediately completed the main set of upward waves. Now, taking into account the DXY's yet-to-be-realized pullback potential, the pound could complete the missing extension to a minimum level of 1.35801. However, everything depends on the DXY's behavior. By levels:

1️⃣Below

1.34700 - more likely the +-150 pip range, where the pound could still fall if the DXY tries to complete its extension on h1. There's no point in considering price levels down further for now. 2️⃣Above:

1.35801 - the first extension of the h1 ascending wave set

1.36203 - the second extension of the h1 ascending wave set

Сonclusion: for now, I expect the fund to rise as the DXY declines.

Elise | GBPUSD 8H —Weak High Target in Sight | Channel StructureFX:GBPUSD

Price behavior suggests institutional accumulation after a trend rejection and channel retest. As long as price remains above channel midline and reclaim structure, bullish continuation is favored toward the major liquidity grab zone. Retracement into the demand region around 1.3100–1.3200 may occur before continuation.

Key Scenarios

✅ Bullish Continuation (Primary Case)

A correction into the 1.3100–1.3200 demand zone followed by bullish rejection would support the upward flow.

🎯 Target: 1.3460 → 1.3520 (Liquidity sweep zone)

🟢 Buy Zone: 1.3100–1.3200

❌ Invalidation: Break and close below 1.3015

📉 Bearish Breakdown (Secondary + Lower Probability)

A failure to hold structure and close below trend support may trigger deeper correction toward 1.3015 and below.

Current Levels to Watch

Liquidity Target: 1.3460–1.3520

Demand Zone: 1.3100–1.3200

Major Support: 1.3015

Invalidation: 1.3015 break and hold

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice

GBPUSD 4H — Short Setup Near Premium ZoneFX:GBPUSD

Price is approaching a high-value supply zone where previous rejections occurred. Structure remains bearish with lower highs and lower lows, suggesting continuation unless price breaks above the invalidation level.

A rejection from the 1.3300–1.3350 zone gives a high-probability short opportunity toward the next major liquidity level.

Key Scenarios

❌ Bearish Case (Primary Bias) 📉

Entry Zone: 1.3300 – 1.3350

🎯 Target: 1.3020 – 1.2950

🛑 Stop Loss: Above 1.3461 (Invalidation Zone)

Confirmation Improvement:

• Rejection wicks

• Bearish engulfing

• Break and retest of minor support

Important Levels

Type Level

Entry Zone 📍 1.3300–1.3350

Target 🎯 1.3020 → 1.2950

Stoploss ❌ 1.3461

Invalid Zone ⚠️ Above 1.3461

⚠️ This analysis is for educational purposes only — not financial advice.

FTSE100 post-Budget rally: Inverse Head & Shoulders eyes 9800Chancellor Reeves unveiled tax rises worth £26 billion annually by 2029-30 but showed fiscal discipline by committing to reduce government spending as a share of GDP each year and more than doubling the fiscal headroom buffer to £21.7 billion, reassuring bond markets still scarred by the Liz Truss mini-budget crisis.

With gilt yields falling, sterling at its best level since October, and a Bank of England rate cut expected in December, the macro backdrop supports further upside for Footsie, though sticky inflation and OBR growth downgrades remain headwinds.

Key drivers:

UK Budget introduces tax rises totalling £26bn annually by 2029-30 via threshold freezes, mansion tax, and dividend levies, but spending will decline as a share of GDP each year, calming government borrowing concerns and sending gilt yields lower.

Fiscal headroom buffer more than doubled to £21.7bn (from £9.9bn last year), giving bond vigilantes confidence that the debt trajectory is sustainable.

Sterling rallied above 1.32 towards 1.33 on lower borrowing risks, while FTSE 100 gained, led by financials.

Bank of England expected to cut rates 25bp in December, supporting equities, though sticky inflation and OBR growth downgrades are headwinds.

Technical setup : inverse head and shoulders with neckline/support at 9,630 (38.2% Fib), measured move and Fib confluence target 9,800 (between 61.8% and 78.6% retracement).

Trade idea : Entry on pullback to 38.2% Fib (9,630), stop below previous low (9,434), target 9,800, for 2:1+ risk-to-reward.

Trading the FTSE bounce? Drop your setups in the comments and follow for more high-action technical and macro trade ideas.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.