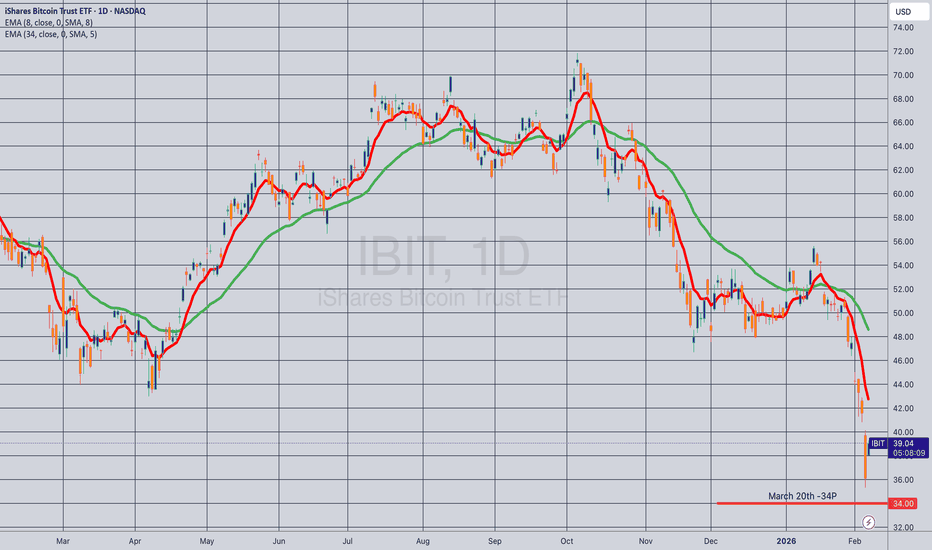

Opening (IRA): IBIT March 20th -34P... for a 1.57 credit.

Comments: Adding at intervals at strikes better than what I have on, targeting the 25 delta strike.

Metrics:

Max Profit: 1.57 ($157)

Buying Power Effect: 32.43

ROC at Max: 4.84%

Will generally look to start taking profit at 50% max or take assignment and sell call against in the event I'm assigned shares.

Premiumselling

Opening (IRA): IBIT March 20th -43P... for a 1.30 credit.

Comments: Adding at intervals at strikes/break evens better than what I currently have on.

Metrics:

Max Profit: 1.30 ($130)

Buying Power Effect: 41.70

ROC at Max: 3.12%

Will generally look to take profit starting at 50% max or take assignment of shares and sell call against in the event the short put finishes in-the-money.

Opening (IRA): IBIT March 20th -46P... for a 1.42 credit.

Comments: Adding/laddering out at intervals at the 25 delta strike, assuming I can get in at break evens/strikes better than what I currently have on.

Metrics:

Max Profit: 1.42 ($142)

BPE: 44.58

ROC at Max: 3.19%

Will generally start to look to take profit at 50% max/roll down and out if it finishes in-the-money.

Opening (IRA): TLT May 15th -83P... for a .91 credit.

Comments: I don't know that I really need more TLT shares, but wouldn't mind picking them up if they're cheap or they reduce my cost basis in the stock aspect of my covered call setup.

Here, targeting the 52-week low in the expiry that is paying around 1% of the strike price in credit. This is a bit long-dated, but I don't have much on here, so am fine with hanging out in the trade longer than I would usually.

Metrics:

Max Profit: .91 ($91)

Buying Power Effect: 82.09

ROC at Max: 1.11%

Will look to ladder out at the 83 strike, so long as it's paying >1% of the strike price in credit.

Opening (IRA): SPY January 30th 605/615/730/740 Iron Condor... for a 1.25 credit.

Comments: Structuring the setup such that the credit received is about 1/10th the width of the wings which results in the short option legs being at about their respective 10 delta strikes.

Metrics:

Max Profit: 1.25 ($125)

Max Loss/Buying Power Effect: 8.75 ($875)

ROC at Max: 14.28%

ROC at 50% Max: 7.14%

Will generally look to adjust on side test or on side approaching worthless. Am looking to take profit at .25, resulting in a 1.00 ($100) realized gain.

Opening (IRA): SPY March 20th -550P... for a 5.75 credit.

Comments: Adding at intervals, assuming I can get in at prices better than what I current have on. Targeting the strike paying around 1% of the strike price in credit.

I'm going out quite far dated here because I already have rungs on in December 31st (-642P), January (-605P, -625P), and February (-575P, -600P) expiries and didn't want to step on those as it were as I look to manage them via roll.

Opening (IRA): SPY February 20th -600P... for a 6.09 credit.

Comments: Laddering out at strikes better than what I currently have on. It would be better if I had weakness, but I've got dry powder for that should it occur.

Targeting the strike paying around 1% of the strike price in credit. Will generally roll to lock in realized gains and/or "window dress" (i.e., roll down and out to a lower strike paying approximately the same amount of credit.

Opening (IRA): SPY January 16th -575P... for a 5.94 credit.

Comments: Laddering out ... . Targeting the strike paying around 1% of the strike price in credit. Will look to add at intervals, assuming I can get in at strikes/break evens better than what I currently have on and/or roll out short put at 50% max.

Opening (IRA): SPY December 19th -605P... for a 6.47 credit.

Comments: On second thought, going to ladder out a bit here on weakness plus higher IV. Targeting the strike paying around 1% of the strike price in credit.

Will look at add at intervals, assuming I can get in at strikes better than what I currently have on and/or roll out at 50% max.

Opening (IRA): QQQ January 16th -500P... for a 5.22 credit.

Comments: My SPY position is becoming somewhat of a spaghetti works, so opting to open a run in the Q's instead, targeting the strike paying around 1% of the strike price in credit.

Will look to add/ladder out at intervals, assuming I can get in at strikes better than what I currently have on.

Opening (IRA): ETHA December 19th -21P... for a 1.06 credit.

Comments: Adding at intervals at strikes/break evens better than what I currently have on. Here, selling the 25 delta strike.

Max Profit: 1.06 ($106)

Buying Power Effect: 19.94

ROC at Max: 5.32%

Will generally look to start taking profit at 50% max, but am also okay with taking assignment of shares and then proceeding to sell call against.

Opening (IRA): IBIT January 16th -50P... for a 2.24 credit.

Comments: Laddering out at intervals, assuming I can get in at strikes/break evens better than what I currently have on. Here, targeting the 25 delta strike.

Metrics:

Max Profit: 2.24 ($224)

Buying Power Effect: 47.76

ROC at Max: 4.69%

Will generally look to start taking profit at 50% max.

USDJPY | Institutional Sells from HTF Supply Zone (Instant ExecuUSDJPY has tapped into a higher-timeframe supply zone that aligns with the weekly sweep and 4H CHoCH, confirming potential downside momentum.

After the recent BOS, price retraced back into the previous structural supply, forming an S&S pattern (sweep and shift) within the same zone.

The setup aligns with bearish intent from institutional order flow, suggesting smart-money distribution before the next leg down.

🔹 Execution: Instant market sell from 154.15–154.20

🔹 Stop-Loss: Above 154.55 (protected high)

🔹 Target: 152.80 (Realistic TP area)

🔹 Bias: Bearish continuation into lower liquidity zones

Technical Confluence:

• W1 sweep confirms distribution phase

• 4H CHoCH + BOS = structural shift bearish

• S&S rejection inside refined M30 supply

• Liquidity resting below recent lows (152.80)

This setup respects SMC principles — liquidity sweep → structural shift → premium entry — under institutional context.

💬 Monitor for a clean M15–M5 confirmation candle close to maintain precision entry and manage partials along the way.

SPY: Bears Will Push

Looking at the chart of SPY right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️