Rangebound

ETHUSD Perspective And Levels: Trading Consolidations Like This.ETHUSD Update: After pulling back to 275, price bounces back up establishing a double bottom and making it crystal clear that this market is in a range within a larger range.

In my previous ETH report I mentioned the 355 to 198 range, and within that broad range this market is now consolidating between 270 and 315. I explained how I raised my stop on my small position to 286 and got stopped out for a small loss. When markets don't cooperate. I get smaller and reduce risk, because preserving capital is more of a priority for me.

Range bound markets such as these are not obvious in the beginning and need to unfold in order to make the boundaries clear. Eventually this market will break out one way or the other, but until that happens, the range must be recognized and expected.

IF I am going to put a trade on, it will have to be at the lower boundary of the range only, until it breaks out and begins a new trend. Since I am not shorting these markets, that means reversal structures that form in the low 270s or high 260s are what I will need to see in order to take a position. The 310 area will serve as the target which can make for attractive reward/risk ratios of 3:1 at least if I am using a relatively small stop around the low 260s

Range bound markets offer plenty of opportunity for swing trades and day trades as well. IF price revisits the lower support and it holds, you have a high probability trade opportunity, even more so on the smaller time frames since your targets will be even smaller. (A day trade target would be high 270s or low 280s which can be reached in a matter of hours). The key to trading these markets is waiting for that price area and not giving in to the temptation of getting into the mid range prices.

Buying anywhere above the low 270s and you are in a 50/50 trade. That is the problem with buying in the middle, price action is very random. When the market reestablishes a short term trend, whether it is bullish or bearish, THEN I can reevaluate and determine other levels that would make sense for a long swing trade (if the trend happens to be bullish).

What about shorts? Again I do not short, BUT if you do, then the resistance to wait for is the 310 to 315 area. Even as a day trade, reward/risk makes the most sense there. If you get a confirmation to sell at 309 for example, and you set your stop at 316 with a target in the mid 290s, you are getting at least 2:1 reward/risk, and you can reach that target within a half a day.

Playing ranges is a simple strategy that works until the market breaks out, and it will break out. If you happen to be on the wrong side when it does, the stop is what saves you because whether it is a day trade or swing trade, the stop should be relatively small.

The free money that the BTC fork offers is attracting all the liquidity away from the alt coins in my opinion. Call it manipulation, or whatever you want, we must accept it and adjust. This fundamental condition will only add to the random price action that we are seeing in this market on the larger time frames.

In summary, trading within a consolidation is different from trading a trend. It's normal to assume a market is in a trend, BUT occasionally, a range becomes established and offers some attractive opportunities as long as you keep your expectations inline. Range support and resistance levels are great areas to find high probability setups, the key of course, is WAITING for a level. If it happens to breakout the one time you get involved, you just have to accept that as part of the game. The advantage to this condition is both entry and target levels are clearly defined. Whether you are going long or short, you enter on the boundaries and you exit in the middle. In contrast, entering in the middle is the lowest probability trade that can be taken at the moment. My plan is to buy the bottom of the range as long as there is some form of confirmation there.

Comments and questions welcome.

EURUSD 4H How to use the 50/100 sma as your Price Action GuideThe 50 and 100 sma are my guides for price movement on my charts. Price trends, ranges or consolidates. When price moves in between the 50 and 100 sma I call that my in side range. Price can move quickly through both or mostly it will consolidate. If I enter an inside range trade I do not expect to have price momentum going through that space. Also many times price will move from one ma to the middle of the inside range and then return to that original ma and either cross back over that ma and continue moving away. Or price will make a second attempt to cross through the inside range to the other ma and complete it this time. When price is in a trend or a larger range it can be far away from these two ma's. Price will want to return to these ma's . Price will either bounce off the first ma and continue the trend or return to the range res/sup line. Or price will go through the inside range and continue on. In this case when price crosses the last ma it will move with momentum. I always look for the 800 ma on a 15m chart and see how long price has not touched it. So if price structure looks like the 800 sma could be a TP I use it. I also try to see if there is a larger range box price is moving back and forth in and use those sup/res lines as TP. If price moves up to the top of the larger range and makes new highs then possibly a new trend is starting. Watch for fake break outs from the range box so I usually will wait on the breakout for a break of the trendline - a hook back toward the trendline - and a go with continuation candle patterns with the new trend.

BCH 4H RangeboundPair is rangebound between 100 sma and 50 sma. Breakout TP will previous support and resistance levels.

ETHUSD Perspective And Levels: Market Must Choose.ETHUSD Update: 303 to 308 minor resistance prevents any upside progress, but the 280 support has not been taken out which puts this market in a range. Most likely price action will stay this way until the highly anticipated fundamental events are out of the way.

Even as BTC almost reached 5k and retraced, this market has not made any moves that are worth the risk from a swing trade perspective. As far as day trading levels, again if you are up for that (I do not day trade these), the 286 area is supportive, while the low 300s is your minor resistance. If you have the time, patience and system to help you navigate that range, small profits can be extracted, but you seriously need to make sure your risk is small. If the 280 support breaks for any reason, it will most likely trigger more selling because of the double top that has been established at the 315 level.

With that being said the 303 to 308 minor resistance (.618 of recent bullish swing) can also establish itself as a lower high since price has tested it twice without making any progress. This type of lower high is a bearish sign and can lead to the support breaks mentioned in the above paragraph and in previous reports. The lower high is not in play until the 280 area support is taken out.

Often range bound markets can break out either way, it really is all dependant on the perception of the outcome of what ever event this market is waiting for. Taking any positions ahead of time in anticipation of a break out is not worth the risk. And if anything, the top of this range is a lower high compared to the 400 level, along with the 320 to 350 resistance zone (.618 of bearish swing) which has not even been touched, the bias continues to be bearish in the short term. Since I am not shorting these markets, I have no choice but to stay out and let the market decide.

In summary, if you zoom out and look at this market from a broader perspective, you can argue that the current price structure is forming a lower high which can eventually become a higher low. This can be confusing and again is better left to the market to ultimately decide. Remember, there is nothing to miss out on. If the market breaks higher, there will be plenty of opportunities to get onboard. If it breaks lower, it will eventually offer buying opportunities at great prices which is in line with buying as an investment (core position). In my experience, it is always better to let the market choose because it won't cost you anything, and when conditions are clear, you will be much more prepared and more confident to participate.

Comments and questions welcome.

ETHUSD Perspective And Levels: Range Bound Above Key Support.ETHUSD Update: The 310 buy trigger has been activated and price has retraced back into the support zone. At the moment this market is range bound and in order to show progress, the 313 to 325 resistance zone has to be taken out.

It is situations like this that especially require having a well defined plan and knowing your risk. I am long from 310, but not with an uncomfortable position. As long as this market can stay above the 276 support, it is still proving some stability. If price breaks below, which is possible, that will open the door for a revisit to the 260 and 230 support zones which I have been writing about.

My plan is to get out if price pushes below the mid 270s, and wait for stability to return before doing anything else. And if price pushes higher instead, I will look to add to my long position upon a break of the 330 resistance. Like I have written about before, I may not get the best prices, but I would rather have momentum going my way.

If you are a long term investor, and plan to hold and accept the risks involved, then building a position as price goes lower isn't unreasonable since none of the major supports like 208 have been taken out. If instead you are looking to capitalize on short term fluctuations. then you have to stick to your plan. This is why I calculate my risk/reward and my levels to add to the position if the market offers the opportunity and also why I add while momentum is in my favor and not against me.

An interesting note is that the two zones that price is stuck between, the 282 to 293 support and the 313 to 330 resistance happen to both be .618 areas relative to the recent bullish and bearish price swings. This is very typical of range bound price action. Also the ETHBTC market has not made a new high or new low, but I watch carefully because clues can appear on this chart first.

In summary, price needs to choose a direction and soon. A break below the 268 low will confirm bearish momentum and most likely push prices into the lower supports while a break above the 330 resistance zone will confirm bullish momentum and most likely retest the 350 area. The first sign of this would be a break above the 300 level. The big picture still has a bullish bias, so that may help price action along a more bullish path. The important thing to remember in situations like this, whether you are in a position or not, is the market must choose, not me or you. There is an element of randomness to all financial markets, and during times of indecision, there is little else we can do. Once the market offers a clearer picture, then it is all a matter of adjusting to the new information.

Comments and questions welcome.

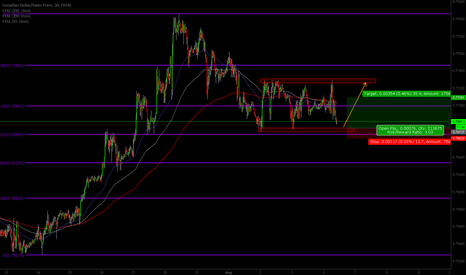

Reversal on Round Number for EURCADSince end of March 2017, 1.45000 price level has become and important key level as there was a shift from resistance to become support line. Another important level is 1.50000 because it is a round number and again, an important resistance level. For the past 2.5 months, EURCAD has been ranging in these 2 important level.

Price is now nearing support level, and I believe it may still go down slightly before giving a sign of a reversal. If price can indicates a reversal near 1.45400 level, then it will be good entry for a long trade, since 1.45400 was a resistance line at 28th of March (shown by blue arrow). Partial profit can be taken at 1.48000 with the rest of the quantity, I believe can roam even further to 1.5000 price level. Stop loss will be when price managed to reach 1.44300 price level.

GBPJPY 4H Range BoundThis chart shows projections of possible moves for the GBPJPY 4 H this week. It is currently range bound. Looks like it may drift back to the bottom of the range. There it can bounce back into the range or make a possible breakout short. If a bounce then a move back to the top. At the top of the range box price can 1 - bounce back into the range if the timing for a trend continuation is not there yet. 2 -

It can break the top of the range but fail to progress the trend continuation of making higher highs and higher lows and fall back into the range box. 3 - If the market is ready for a bullish continuation then higher highs and higher lows will progress to be made.

LTC = Long term coin - Predictions for next move LTC has been on an uptrend since April and doesn't seem to be breaking it soon. Price has currently retraced by 0.382 and looking at past history it will range trade at the fibo 0.382 support till it meets the trendline again which is projected to be somewhere around November. Expect trades to be long on LTC, the last All time high was 2 months ago, the next one will be too. Seems like a good opportunity to use Range trading based indicators to scalp till then.