Gold prices hit a record high ahead of the interest rate decisio1️⃣ Trendline

Price is moving clearly within an ascending channel.

The Higher High – Higher Low structure remains intact → the main trend is still BULLISH.

The most recent strong rally was a breakout from a consolidation zone, confirming that buyers are in control.

2️⃣ Resistance

🔵 5,278 – 5,280 (Strong Resistance Zone)

Confluence of: channel top + previous supply zone + trendline + Fibonacci level.

Profit-taking and short-term pullbacks are likely to appear here.

To confirm further upside → price needs a clear breakout and candle close above this zone.

3️⃣ Support

🟢 5,200 (Near-term Support)

The most recent breakout area → first technical support.

If price pulls back and holds here, the uptrend remains valid.

🟢 5,105 (Strong Support)

Recent structural low + lower boundary of the ascending channel.

If price drops deeper into this area and shows a buying reaction → potential continuation of the medium-term uptrend.

4️⃣ Main Scenario

✔ The trend still favors buying the dip while price holds above 5,200.

✔ A strong break above 5,280 → opens room for further upside within the channel.

⚠ A break below 5,105 → warns of a short-term structure breakdown and a deeper correction.

📌 Trading Plan

BUY GOLD: 5,200 – 5,202

Stop Loss: 5,190

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 5,278 – 5,280

Stop Loss: 5,288

Take Profit: 100 – 300 – 500 pips

Resistence

Will gold prices return to a liquid state and continue to rise? 📈 1️⃣ Trendline

Primary Trend: BULLISH

Price is moving within a medium-term ascending channel

Market structure continues to form Higher Highs – Higher Lows

The recent decline is only a technical pullback to the rising trendline

No structural breakdown → no confirmed reversal

➡️ The lower trendline is currently acting as dynamic support

🟦 2️⃣ Support Zones

🔹 4,996 – 4,994 → Near-term support

Confluence of ascending trendline + recent demand zone

If price reacts positively here → high probability of bullish continuation

🔹 4,974 – 4,976 → Stronger support + structure retest

Aligns with Fibonacci level + previous structural low

A break below this zone would signal weakening bullish momentum

🟥 3️⃣ Resistance Zones

🔸 5,109 – 5,111 → Near-term resistance / recent high

Price has reacted multiple times at this level

A clear breakout and close above is needed to confirm bullish continuation

🔸 5,148 – 5,150 → Major resistance / supply zone

Next upside target if breakout occurs

Strong profit-taking pressure may appear here

🎯 Trading Plan

🟢 BUY GOLD: 4,996 – 4,994

Stop Loss: 4,989

Take Profit Targets: +100 / +300 / +500 pips

🔴 SELL GOLD: 5,148 – 5,150

Stop Loss: 5,155

Take Profit Targets: +100 / +300 / +500 pips

LTC/USDT 30M Short-Term📊 1) Market Structure (Price Action)

The market is consolidating/accumulating between ~67.2 and ~70.1.

Previously, there was a strong decline, then range trading with false breakouts.

Currently, the price has rebounded from the ~66 low and is making a higher low → short-term bullish.

👉 This looks like a retest of the range bottom → a push to the middle of the range.

🧱 2) Key Levels (Your lines are well marked)

🔴 Support Levels

67.20 – the most important local support (range low).

64.89 – a strong swing low (if 67 breaks → decline here).

63.14 – the bulls' last defense.

🟢 Resistance

69.37 – mid-range, local S/R flip.

70.11 – key range high.

71.60 – strong HTF resistance (if it breaks 70 → target).

📈 3) Trend (moving average)

The green MA (probably the 200 EMA/SMA) has been acting as dynamic resistance previously, and now the price is starting to hold above it → bullish short-term.

Structure:

low → higher low → test resistance = breakout potential.

⚡ 4) RSI + Stoch RSI

RSI (lower panel)

RSI ~55–60 → bullish momentum (above 50).

No overbought → room for further upward movement.

Stoch RSI (middle panel)

Oscillates, but not to an extreme → no dump signal.

If it crosses upwards >80 → a scalp short signal (at 30m).

🧠 5) Scenarios (most important)

🟢 BULLISH SCENARIO

Condition:

Close of the 30m candle above 69.40

Targets:

70.11

71.60

73+ (if a breakout range on HTF)

👉 This will be a consolidation breakout → an impulsive move.

🔴 BEARISH SCENARIO

Condition:

Rejection of 69.4 + return to below 67.9

Targets:

67.20

64.89

63.14

👉 This will be a classic range fake breakout → dump to the lower zone.

🧨 6) What do I see as smart money?

A liquidity grab above 69.5–70 is very likely, followed by a dump.

Market makers like to:

break resistance

collect longs

dump to range low

💰 7) Trading setup (pro)

📌 LONG scalp

Entry: 69.4 breakout retest

SL: 68.8

TP1: 70.1

TP2: 71.6

📌 SHORT swing (better R:R)

Entry: 70–71 rejection

SL: 71.8

TP1: 67.2

TP2: 64.9

What will the new ATH level be? 26/01/20261️⃣ Trendline

Main trend: BULLISH (UPTREND).

Price remains above the long-term ascending trendline → Higher High – Higher Low structure is still valid.

The current move is a technical pullback after a strong bullish wave, with no reversal signal confirmed yet.

2️⃣ Resistance

5,138 – 5,140: Strong resistance (target peak + upper boundary of the channel).

Scenario: Profit-taking / price congestion is likely to appear.

Bullish continuation condition: Clear break & close above this zone.

3️⃣ Support

5,021 – 5,019: Nearest support (confluence of ascending trendline + horizontal support).

If held → prefer buying in line with the trend.

If broken → price may pull back deeper toward the lower trendline / EMA.

4,967 – 4,965: Deeper support + EMA zone + liquidity sweep area (backup support).

📈 Trade Plan

BUY GOLD: 5,021 – 5,019

Stop Loss: 5,011

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 5,138 – 5,140

Stop Loss: 5,148

Take Profit: 100 – 300 – 500 pips

XRP/USDT 1D Chart Review🔎 Market Structure (Most Important)

The market is in a clear downtrend.

The price is moving within a descending channel (the upper and lower boundaries are well respected).

Each uptrend ends with a lower high.

➡️ The trend remains bearish until the channel breaks out to the upside.

📐 Downtrend Channel

Upper channel line = dynamic resistance

Lower channel line = demand/bounce zone

Price:

has been rejected from the upper band of the channel

is currently moving back down.

This is classic behavior in a downtrend.

🟢 / 🔴 Key Levels

🟢 Resistance (sell zone)

2.38 USDT – very strong resistance (previous support)

2.26 USDT

2.10 USDT

👉 Any return to these areas = potential short/distribution

🔴 Support (buy reaction, not long confirmation)

1.91–1.89 USDT – current fight zone

1.80 USDT

1.76 USDT

1.57 USDT – last strong base (capitulation if broken)

⚠️ These are reaction zones, not automatic longs.

📊 Stochastic RSI

Oscillator has broken out of overbought

Direction: down

No bullish divergence

➡️ Momentum favors continued declines

🧠 Scenarios (specific)

🔻 Baseline scenario (most likely)

Price loses 1.90 USDT

Test:

1.80

then 1.76

If there is no strong volume, a drop to as low as 1.57

➡️ Continuation of the downtrend

🔄 Corrective scenario (short-term bounce)

Bounce from 1.89–1.80

Pullback to a maximum of:

2.10

2.26 (ideal short zone)

BNB/USDT 4H Chart📌 Market Structure

• The uptrend has been broken – a clear breakout of the black trend line + an impulsive decline.

• Currently consolidating after a drop → a classic bear flag/base after a downward impulse.

• The market is in a decision phase, not in a trend.

⸻

🟥 Key Levels

🔴 Support

• 890–888 → current fighting zone (local HL after dump)

• 872 → very important support (if broken → acceleration of the decline)

• 849 → last line of defense for the bulls

🟢 Resistance

• 901 → first resistance (local LH)

• 923 → strong S/R flip (this is where the avalanche began)

• 958 → key structural resistance (return to bullish scenario)

⸻

📉 Momentum & RSI

• Stochastic RSI:

• High/overbought → weak fuel for growth

• Typical spot for a recoil or false breakout

• No bullish divergence → no signal yet Reversals

⸻

🎯 Scenarios

🐻 Baseline Scenario (more likely)

• Recoil from 890–901

• Pullback to 872

• If 872 breaks on volume → quick move to 849

➡️ This is a classic pullback → continuation

⸻

🐂 Alternative (conditional) Scenario

• Defense 888–890

• Breakout of 901 + close of the 4-hour candle

• Retest of 901 as support

• Target: 923, and only then consider 958

➡️ Without a breakout of 901, there is no way the uptrend will resume

Continuously setting new ATH records, getting closer to the 50001️⃣ Trendline

Primary trend: BULLISH

Price is still moving within a long-term ascending channel.

The most recent move broke the short-term rising trendline → this signals a technical correction, not a trend reversal, as the major trendline remains intact.

2️⃣ Resistance

5,000 – 5,005: Strong resistance (channel top + distribution zone).

→ Profit-taking pressure is likely to appear. A clear break & close above this zone is required to confirm further upside.

3️⃣ Support

4,888 – 4,890: Near-term support (pullback area to the channel trendline).

4,840 – 4,845: Strong support (correction low + demand zone).

→ If this zone holds, the bullish trend remains valid.

4️⃣ Main Scenarios

Preferred scenario: Pullback into support → bullish reaction in line with the trend.

Risk scenario: A break below 4,840 → bullish structure weakens, market may shift into short-term consolidation or bearish movement.

📈 Trading Plan

BUY GOLD: 4,888 – 4,890

Stop Loss: 4,880

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 5,000 – 5,002

Stop Loss: 5,010

Take Profit: 100 – 300 – 500 pips

Will there be a correction today, January 22nd, 2026?1️⃣ Trendline

Main trend: BULLISH.

Price is still holding above the long-term ascending trendline → the Higher High – Higher Low structure remains intact.

The current move is a pullback / consolidation after a strong rally, with no confirmed trend reversal yet.

2️⃣ Resistance

4,855 – 4,888: Strong resistance zone (previous high + distribution area).

→ Profit-taking and false breakouts are likely in this zone.

→ Bullish continuation only if price breaks and closes clearly above 4,888.

3️⃣ Support

Ascending trendline: Key dynamic support, focus on price reaction here.

4,755: Strong support (structural low + demand zone).

→ Losing this level would break the short-term bullish structure, increasing the risk of a deeper correction.

4️⃣ Main Scenarios

Primary scenario: Price pulls back to the trendline → holds → rebounds to retest resistance.

Risk scenario: Break below the trendline and lose 4,755 → market shifts to sideways or short-term bearish.

👉 Strategy: Look for trend-following buys at support, avoid FOMO entries at resistance.

📈 Trade Plan

BUY GOLD: 4,755 – 4,757

Stop Loss: 4,747

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,854 – 4,856

Stop Loss: 4,866

Take Profit: 100 – 300 – 500 pips

ETH 4H Chart1️⃣ Market Structure (HTF – 4H)

We had a clear uptrend in the channel (black lines).

A breakout from the channel occurred at the bottom → this is a break of structure.

The decline was impulsive, without any major corrections → supply prevailed.

➡️ Medium-term bias: bearish/corrective

2️⃣ Key price levels

🔴 Supports

$2,938 – currently the closest technical support

$2,862 – a very important zone (strong reaction, long wick)

$2,740 – next HTF support (if the market collapses)

➡️ 2,862 = key decision level

Loss → high chance of a breakout to 2,740

🟢 Resistances

$3,081 – local resistance/flip after a breakout

$3,215 – former support, now resistance (ideal for shorts)

$3,430 – upper HTF resistance (only after a structure change)

3️⃣ Price Action (what we're seeing now)

After a strong dump, an impulsive downward wick appeared → Possible short-term relief (dead cat bounce).

The current bounce looks corrective, not impulsive.

Not yet:

higher low

4-hour candlestick closes above 3,081

➡️ This could still be just a pullback for further declines.

4️⃣ RSI Stochastic

RSI was heavily oversold → a technical bounce is normal.

Now a quick return to the upper regions → watch out for a bearish cross.

In downtrends, the Stoch RSI often:

Quickly reaches 80–100

and immediately reverses

➡️ RSI does not yet confirm a trend change

5️⃣ Scenarios

🟡 Scenario A – correction and further decline (more likely)

Bounce to 3,080–3,215

Rejection

Return to 2,860 → 2,740

📉 Short setup:

Reaction below 3,080 / 3,215

Weak volume, pin bar / bearish engulfing

🟢 Scenario B – return to growth (less likely)

Conditions:

4-hour close above 3,215

Hold as support

Only then target: 3,430

📈 Without this → longs are counter-trend

Gold prices continue to set all-time highs (ATH).1️⃣ Trendline

Main trend: BULLISH

Price remains above the ascending trendline → the Higher High – Higher Low structure is still valid.

The current move is a consolidation / technical pullback, with no signs of a structural breakdown yet.

2️⃣ Resistance

4,900 – 4,905: Strong resistance (target peak + confluence with the upper trendline) → profit-taking pressure is likely.

Condition for continuation: A clear break and close above 4,900.

3️⃣ Support

4,816 – 4,814: Near-term support (consolidation / pullback zone).

4,766 – 4,768: Strong support (Higher Low + demand zone). Holding above this area keeps the bullish trend intact.

4️⃣ Main Scenario

Priority: BUY with the trend as long as price holds above 4,768, target 4,900.

Warning: A break below 4,766 increases the risk of a deeper correction and requires close price action monitoring.

Trading Plan

BUY GOLD: 4,816 – 4,814

Stop Loss: 4,804

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,900 – 4,902

Stop Loss: 4,912

Take Profit: 100 – 300 – 500 pips

BTC/USDT 1D Chart Review📉 MARKET STRUCTURE

The price is moving within an ascending channel, but:

The last candle is a strong rejection of the upper levels.

We have a clear downward impulse from the ~97.6k area.

The price is currently testing the lower line of the ascending channel.

➡️ Short-term trend: correction / weakness.

➡️ Medium-term trend: still up, BUT at risk.

🔑 KEY LEVELS

🟢 RESISTANCES

97,642 – local high / strong rejection.

94,465 – 94,400 – zone from which the downward impulse occurred.

👉 After a downward breakout, it now acts as resistance.

🟡 DECISION ZONE

92,370 – 93,400

The price is currently below.

A return above this zone = a chance for continuation. Channel

🔴 SUPPORT

89,500 – 88,960 – a very important zone

local demand

currently being tested

84,411 – key structural support

80,710 – the last line of defense of the uptrend

📊 STOCH RSI

strongly downward

no bullish divergence

there is still room for further decline

➡️ momentum = bearish

🧠 SCENARIOS

🟥 SCENARIO 1 (more likely)

Continuation of correction

Loss of 89,000

Descent to:

84,400

and with panic even 80,700

➡️ Healthy correction in the uptrend

🟩 SCENARIO 2 (less likely) (likely)

Defense of the lower channel line

Demand reaction to 88.9k – 89.5k

Return above 92.3k

Retest 94.4k

➡️ Requires strong volume (not visible yet)

🎯 WHAT IS KEY NOW

Close of the daily candle

Price reaction to:

88.9k

Ascending channel line

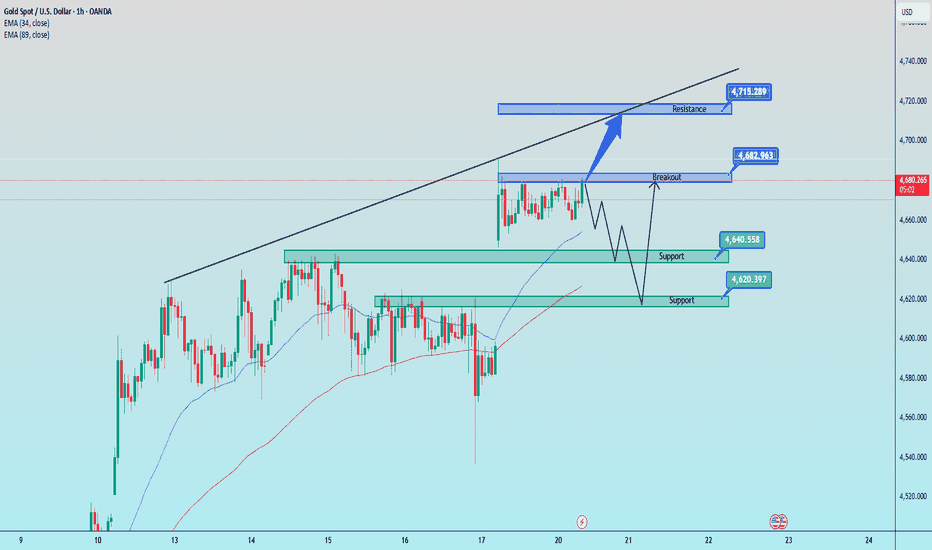

Gold continues to be a safe haven 20/01/261️⃣ Trendline

Main trend: BULLISH

Price is moving above the long-term ascending trendline → Higher High – Higher Low structure remains intact.

The current pullback is only a technical correction within an uptrend, with no signs of structure breakdown yet.

2️⃣ Resistance

4,680 – 4,682: Short-term resistance, previous consolidation zone → requires a clear break and close to confirm bullish continuation.

4,715 – 4,717: Strong resistance, confluence of previous high + upper trendline → high probability of profit-taking reaction.

3️⃣ Support

4,640 – 4,642: Near-term support, technical pullback zone.

4,620 – 4,622: Strong support, demand zone + EMA confluence + GAP → ideal trend-following buy zone if price shows holding signals.

4️⃣ Preferred Scenarios

Priority: Buy with the trend at support zones.

Break and hold above 4,690 → confirms bullish continuation, target 4,715.

Loss of 4,620 → short-term trend weakens, wait for a retest of the lower ascending trendline.

Trading Plans

BUY GOLD (Scalp): 4,640 – 4,642

Stop Loss: 4,635

Take Profit: 50 – 100 – 150 pips

BUY GOLD: 4,620 – 4,622

Stop Loss: 4,610

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,715 – 4,717

Stop Loss: 4,727

Take Profit: 100 – 300 – 500 pips

ETH/USDT 4H chart🧭 Trend Context

• Main Trend: Up – clear HH/HL breakout.

• Price respects the uptrend line (orange).

• The last upward impulse was very strong (dynamic breakout to ~3400).

⸻

📊 Key Horizontal Lines

🔴Supports

• 3188–3200 – local support + prior S/R flip

• 3130 – strong structural support

• 3052 – last line of trend defense (critical)

🟢 Resistances

• 3232 – current resistance (price reaction now)

• 3317 – important resistance/consolidation

• 3404 – high impulse (local ATH)

⸻

📐 Price Structure

• The drop from ~3360 to ~3188 looks like an impulse correction, not a trend reversal.

• Currently, the price:

• has rebounded from support

• is above the trend line

• is fighting against 3232

👉Into the decision zone.

⸻

📉 Stochastic RSI

• Was oversold (0–20)

• Now retracing upward

• Potential for an uptrend, but no confirmed breakout

⸻

🔮 Scenarios

✅ Baseline scenario (bullish – more likely)

Conditions:

• Hold >3188

• Breakout and 4-hour close above 3232

Targets:

• 3317

• 3400–3420

⸻

⚠️ Corrective scenario

If:

• Rejection from 3232

• Reversion to the downtrend

Targets:

• 3188

• 3130

• Extreme: 3050 (still uptrend)

ADA/USDT 12h🔍 Market structure

Medium-term trend: corrective / sideways after an upward impulse

Price is moving in a narrowing channel (descending wedge/triangle)

Lower highs + held support → pressure before breakout

📐 Key levels

🟢 Resistances

0.407–0.410 – local resistance + upper structure line

0.426 – very important level (previous high + price reactions)

0.451–0.452 – strong HTF resistance (if an impulse occurs)

🔴 Support

0.384–0.385 – key support (if it falls → weak)

0.371

0.352

📊 Price Action

The last upward impulse was rejected exactly at the resistance of 0.426

Currently, the price is consolidating just above 0.384

Every move lower is bought, but there is no strong volume for growth

👉 The market is in compression - the breakout is getting closer.

📉 Stochastic RSI

Oscillator close to the oversold zone

No clear bullish crossover yet

This favors a rebound, but is not a confirmation of the long

🧠 Scenarios

✅ Bullish scenario (more technically correct)

Conditions:

Defense 0.384

Breakout above 0.407–0.410 (preferably close 12h candle)

Goals:

0.426

0.451

➡️ This would be a breakout from the wedge + continuation of the impulse

❌ Bear scenario

Conditions:

Candle close below 0.384

Goals:

0.371

0.352

➡️ This means negating the structure and returning to the range

Beautifully made HH and then HL.QUICE Analysis

Closed at 38.93 (16-01-2026)

Beautifully made HH and then HL.

Crossing & Sustaining 46 may lead it towards 59 - 60.

Immediate Support seems to be around 35.

However, it should not break 31 now else we

may witness more selling pressure towards 28 initially.

Gold price movements at the end of the week, January 16, 2026.1️⃣ Trendline

Main trend: BULLISH.

Price remains above the long-term ascending trendline → the Higher High – Higher Low structure is still intact.

Current phase: sideways consolidation below resistance within an ascending channel → the market is building pressure.

2️⃣ Resistance

4,640 – 4,642: Major resistance.

Confluence: previous high + upper trendline.

Scenarios:

Rejection → high probability of a corrective pullback.

4,668 – 4,670:

New ATH zone + break of previous high + trendline extension.

3️⃣ Support

4,578 – 4,580:

Near-term support, equilibrium zone within the range.

4,515 – 4,517:

Strong support / breakout retest + previous GAP.

Loss of this zone → short-term bullish structure weakens, downside risk increases.

4️⃣ Preferred Trading Scenarios

Sell on reaction at 4,640 – 4,645 if clear rejection signals appear.

Buy with the trend at 4,515 – 4,520 once strong holding signals are confirmed.

Primary Trade Setups

SELL GOLD: 4,668 – 4,670

Stop Loss: 4,678

Take Profit: 100 – 300 – 500 pips

BUY GOLD (Scalp): 4,578 – 4,580

Stop Loss: 4,574

Take Profit: 50 – 100 – 200 pips

BUY GOLD: 4,515 – 4,517

Stop Loss: 4,505

Take Profit: 100 – 300 – 500 pips

LTC is in a clear downward trend📉 MARKET STRUCTURE

Main Trend: Down

Sequence: Lower High → Lower Low

Price is moving in a clear downward channel.

Any upward breakout = correction, not a trend change.

📐 KEY LEVELS

🟩 RESISTANCES (sell zones)

84.50 – current S/R flip (was support → now resistance)

94.50 – strong HTF level, where the market has been rejected multiple times

107.50 – key trend reversal level (BOS)

🟥 SUPPORT

72.00–72.50 – key support, currently being tested

63.10 – next strong HTF support

Below → empty space to ~55–58

🔎 PRICE ACTION – WHAT YOU CAN SEE

Recent Bounce:

Weak HH

No volume

Strong rejection from:

Upper channel line

Level ~84.5

Current candle:

Aggressive supply

No demand response

👉 Sellers in full control

📊 STOCH RSI

Turnover from the upper zones

Bearish momentum

No bullish divergence

👉 Oscillator confirms continuation of the downtrend

🧠 SCENARIOS

🔴 BASELINE SCENARIO (60–65%)

Descent lower

Condition:

Close D1 below 72

Target:

63.1

Possible breakout to 60–61

🟡 CORRECTIVE SCENARIO (25–30%)

Bounce Technical

Condition:

Holding 72

Demand candle + follow-up

Target:

84.5

Maximum 94.5

DOES NOT change the trend

🟢 TREND REVERSE SCENARIO (<10%)

Condition:

Close D1 > 94.5

Then reclaim 107.5

👉 Only then can we talk about a bull market

🎯 HOW TO PLAY IT (technically)

Short:

Retest 84–85 or 94–95

SL: above the structure

TP: 72 → 63

Long:

Only a reaction to 63

Short-term scalp / swing

No forcing the low

XAUUSD (Gold) – 1H Chart | Price Action Analysis**XAUUSD (Gold) – 1H Chart | Price Action Analysis**

**Current price:** ~4,610

### 📊 Market Structure

* Gold is moving **sideways within a defined range** after a strong prior bullish move.

* Price recently bounced from the lower range and is now **testing the upper boundary (resistance)**.

### 📉 Moving Averages

* **EMA 9 & EMA 21:** Closely aligned and flat → short-term consolidation.

* **EMA 50 (≈4,607):** Holding as **key dynamic support**.

* Price above EMA 50 keeps the **overall bias neutral to bullish**.

### 🟥 Support Zones

* **Immediate support: 4,590 – 4,585**

* Strong demand zone where buyers stepped in previously.

* **Lower support:** 4,560 – 4,540

* Breakdown below this area may weaken bullish structure.

### 🟩 Resistance Zones

* **Immediate resistance: 4,620 – 4,625**

* Price is currently reacting here.

* **Upper resistance / breakout zone:** 4,650 – 4,670

* A sustained break could open further upside.

### 🔁 Scenarios

* **Bullish scenario:**

A **clean hourly close above 4,625** may trigger upside continuation toward **4,650+**.

* **Bearish scenario:**

Rejection from resistance and a **break below 4,585** could lead to a deeper pullback.

### 🧠 Summary (Mind-Safe)

* Gold is **range-bound between support and resistance**

* **Breakout above resistance = bullish continuation**

* **Rejection + support break = corrective move**

* Wait for **clear confirmation on H1**

*Educational purpose only – not financial advice.*

Following yesterday's PPI report, what will the gold price be li1️⃣ Trendline

Main trend: BULLISH

Price is moving inside an Ascending Channel → the Higher High – Higher Low structure is still intact.

Currently, price is trading in the upper half of the channel, meaning buyers remain in control, but the market has started to consolidate / correct after a strong bullish impulse.

2️⃣ Resistance

📍 4,683 – 4,685

Major supply zone + top of the ascending channel

📍 4,640 – 4,642

Price has been rejected multiple times here → Smart Money distribution + trendline resistance

➡ Only look for short (SELL) trades if rejection signals appear

(e.g., pin bar, bearish engulfing, strong rejection wick)

3️⃣ Support

📍 4,548 – 4,550

Strong confluence zone:

Bottom of the ascending channel

Previous breakout zone

EMA + major trendline

This is a BUY zone in line with the trend

➡ If price pulls back to this area and holds, the probability is high for a continuation toward 4,685

📈 Trading Plan

BUY GOLD

Entry: 4550 – 4548

Stop Loss: 4538

Take Profit: 100 – 300 – 500 pips

SELL GOLD

Entry: 4683 – 4685

Stop Loss: 4693

Take Profit: 100 – 300 – 500 pips

Gold surged and continued to rise on January 12, 2026.1️⃣ Trendline

Short-term structure: Bullish after the breakout.

Price has broken above the descending trendline → sellers have lost control.

The current move is a bullish impulse, and the market is waiting for a pullback to form a higher low.

2️⃣ Key Support Zones

4,550 – 4,548

Nearest support (breakout retest zone)

If this zone holds → the bullish trend remains intact.

4,515 – 4,513

Strong support zone

Confluence of:

Old resistance → new support

Rising trendline

EMA & price structure

👉 This is the best buy zone

If this area is broken → the short-term bullish structure is invalidated.

3️⃣ Resistance

4,640 – 4,642

Major resistance

Fibonacci 2.618 extension

Supply zone

👉 This is the main target of the current bullish wave

4️⃣ Price Scenarios

Bullish scenario (priority)

Price pulls back to 4,550 → 4,515

Holds support

Forms a higher low

→ Then continues higher toward 4,640

Bearish scenario (structure failure)

Price closes clearly below 4,515

→ Short-term uptrend is broken

→ Price may drop toward 4,480 – 4,440

📈 Trading Plan

BUY GOLD: 4,513 – 4,515

Stop Loss: 4,503

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4,640 – 4,642

Stop Loss: 4,650

Take Profit: 100 – 300 – 500 pips

BTC/USD 4H Chart Review🔎 Market Structure

Medium-term trend: up

The price is moving within an ascending channel (the lower and upper limits are nicely respected).

Last move = upward impulse from a consolidation breakout.

📈 Current Situation

The price has broken out above key resistance at ~94,600 USD (red line)

We are currently in the 97,500–98,200 USD zone (local resistance).

This is the first test of this zone from below → a natural place for reaction.

🟩 Key Levels

Resistance

98,200–98,300 USD – local resistance (green line)

103,800 USD – main channel target / ATH region

Supports

94,600 USD – most important support (flip from resistance)

89,400 USD – middle of the structure + previous accumulation

Lower channel boundary ~87–88k USD – last defense

📊 MACD

Strong bullish crossover

The histogram is rising → upward momentum is accelerating

No downward divergence (on (for now)

➡️ This supports continued growth, not a reversal.

🧠 Scenarios

🟢 Baseline scenario (most likely)

Short consolidation/pullback

Retest of USD 94,600–95,000

Continuation up → 98k → 100k → 103–104k

🟡 Alternative scenario

Rejection of USD 98k

Drop to USD 89,400

Still uptrend as long as the channel holds

🔴 Bullish negation

4-hour close below 89,400

Then the structure breaks down → drop to 86–84k

USDJPY M15 RSI Divergence and Short-Term Pullback Setup📝 Description

FX:USDJPY has extended into a local premium zone after a strong impulsive rally. Price is holding near recent highs, but momentum is slowing as RSI shows clear bearish divergence, suggesting exhaustion rather than continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the recent high and RSI divergence remains valid

Preferred Setup:

• Entry: 158.90

• Stop Loss: Above 159.11

• TP1: 158.67

• TP2: 158.50

• TP3: 158.30 (H1 FVG / liquidity draw)

________________________________________

🎯 ICT & SMC Notes

• RSI bearish divergence indicates weakening bullish momentum

• Price trading in premium after impulsive expansion

• Pullback expected toward nearby FVGs

________________________________________

🧩 Summary

Despite the strong upside move, momentum divergence suggests limited continuation. As long as price fails to push higher with strength, a corrective pullback toward lower PD arrays is favored.

________________________________________

🌍 Fundamental Notes / Sentiment

With key US CPI data today, volatility risk is elevated. Any positioning should be approached with strict risk management, as CPI outcomes can trigger sharp, two-sided moves before direction is confirmed.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.