How AI is Revolutionizing Risk ManagementIn a world where bots can fire off hundreds of orders in the time it takes you to sip your coffee, risk management isn't a checkbox at the end of your plan it's the core operating system.

AI has given traders incredible leverage:

Faster execution than any human

Exposure to more markets and instruments

Complex position structures that would be impossible to manage manually

But that same leverage cuts both ways. When something breaks, it doesn't trickle it cascades.

The traders who survive this era won't be the ones with the most aggressive models. They'll be the ones whose risk frameworks are built to handle both human mistakes and machine speed.

Why Old-School Risk Rules Aren't Enough Anymore

For years, the standard advice looked like this:

"Never risk more than 1–2% per trade"

"Always use a stop loss"

"Diversify across assets"

Those principles still matter so much. But AI and automation helped improve and changed the landscape:

Orders can hit the market in microseconds your "mental stop" is useless

Correlations spike during stress what looked diversified suddenly moves as one

Multiple bots can unintentionally stack risk in the same direction

Feedback loops between algos can turn a normal move into a cascade

In other words: the classic rules are the starting point , not the full playbook.

How AI Supercharges Risk Management (If You Let It)

Used well, AI doesn't just place trades it monitors and defends your account in ways a human never could.

Dynamic Position Sizing

Instead of risking a flat 1% on every trade, AI can adjust size based on:

Current volatility

Recent strategy performance

Correlation with existing positions

Market regime (trend, range, chaos)

When conditions are favorable, size can step up modestly.

When conditions are hostile, size automatically steps down.

The goal isn't to swing for home runs.

It's to press when the wind is at your back, and survive when it's in your face.

Smarter Stop Placement

Fixed stops at round numbers are magnets for liquidity hunts.

AI can analyze:

ATR-based volatility bands

Clusters of swing highs/lows

Liquidity pockets in the book

Option levels where hedging flows are likely

Stops get placed where the idea is broken, not where noise usually spikes.

Portfolio-Level Heat Monitoring

Most traders think in single trades. AI thinks in portfolios.

It can continuously measure:

Total percentage of equity at risk right now

Sector and theme concentration

Correlation clusters (everything tied to the same macro factor)

Worst-case scenarios under shock moves

If your "independent" trades are all secretly the same bet, a good risk engine will tell you.

The 4-Layer Risk Stack for AI Traders

Think of your protection as layered armor:

Trade Level

Clear stop loss

Defined target or exit logic

Position size tied to account risk, not feelings

Strategy Level

Max number of open positions per strategy

Daily loss limit per system

"Three strikes" rules after consecutive losing days

Portfolio Level

Total open risk cap (for example: no more than 2% at risk at once)

Limits by asset class, sector, and narrative

Rules to prevent over concentration in one theme (AI stocks, crypto, etc.)

Account Level

Maximum drawdown you're willing to tolerate

Hard kill switch when that line is crossed

Recovery plan (size reductions, pause period, review process)

AI can monitor all four layers at once every position, every second and trigger actions the moment a rule is violated.

Kelly, Edge, and Why "More" Is Not Always Better

The Kelly Criterion is a famous formula that tells you how much of your account you could risk to maximize long‑term growth.

Kelly % = W - ((1 - W) / R)

Where:

W = Win probability

R = Average Win / Average Loss

Example:

Win rate (W) = 60%

Average win is 1.5× average loss (R = 1.5)

Kelly = 0.60 - (0.40 / 1.5) ≈ 0.33 → 33%

On paper, that says "risk 33% of your account each trade." In reality, that's a fast path to a margin call.

Serious traders and any sane AI risk engine treat Kelly as the ceiling , then scale it down:

Half‑Kelly (≈ 16%)

Quarter‑Kelly (≈ 8%)

Or even less, depending on volatility and confidence

AI can recompute W and R as fresh trades come in, adjusting risk when your edge is hot and cutting risk when your edge is questionable.

Designing Your AI‑Era Risk Framework

You don't need hedge‑fund infrastructure to think like a pro. Start with five questions:

What is my absolute pain threshold?

At what drawdown (%) would I stop trading entirely?

Write that number down. Build backwards from it.

How many consecutive losses can I survive?

If you want to survive 10 straight losses at 20% max drawdown, your per‑trade risk must be ~2% or less.

How will I shrink risk when volatility spikes?

Tie your size to ATR, VIX‑style measures, or your own volatility index.

What are my circuit breakers?

Daily loss limit

Weekly loss review trigger

Conditions where all bots shut down automatically

Is everything written down?

If it's not in rules, it's just a wish.

Rules should be clear enough that a bot could follow them.

Four AI Risk Mistakes That Blow Accounts Quietly

Over‑optimization - Training models until the backtest is perfect… and live trading is a disaster.

Ignoring tail risk - Assuming the future will look like the backtest, and underestimating rare events.

No true kill switch - Letting a "temporary" drawdown turn into permanent damage.

Blind trust in the model - Assuming "the bot knows best" without understanding its logic.

AI should be treated like a high‑performance car: powerful, fast, and absolutely deadly if you drive it without brakes.

Discussion

How are you handling risk in the age of automation?

Do you size positions dynamically or use fixed percentages?

Do you cap total portfolio risk, or just think trade by trade?

Do your bots or strategies have clear kill switches?

Drop your thoughts and your best risk rules in the comments. In the future of trading AI will be the one watching your back.....

Risk!!!

Halloween Special: The Risk “Treats” That Keep You Alive!🧠 If October has a lesson, it’s this: fear is useful, panic is fatal. Great traders don’t fight the monsters; they contain them.

Here’s my Halloween mindset & risk playbook:

🧪 Keep your “lifeline” small: Risk a fixed 1% per trade until your balance moves ±10%, then recalibrate. This makes loss streaks survivable and hot streaks meaningful.

⏰ Set a nightly curfew: a max daily loss (e.g., 3R or 3%). Hit it? Close the platform. No “one last trade.” Curfews save accounts.

🛑 Define your invalidation before you enter: If that level prints, you’re out, no arguments, no “maybe it comes back.” Plans beat feelings.

🎯 Hunt asymmetry: If you can’t see at least 2R cleanly (preferably 3R), pass. You don’t need more trades; you need better trades.

🧟 Kill the zombie trade: the one you’re babysitting, nudging stops, praying. If you’re managing hope more than risk, exit and reset.

🧘 Protect your mind equity: Two back-to-back losses? Take a 20-minute break. After a big win? Journal before you click again. Calmness compounds.

📜 Make a ritual: pre-trade checklist → position size → entry → stop → targets → log. Rituals turn uncertainty into routine, and routine into consistency.

What’s your #1 rule that keeps the “revenge-trading demon” out of your account❓

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Position Sizing: The Math That Separates Winners from LosersMost traders blow up their accounts not because of bad entries, but because of terrible position sizing. You can have a 60% win rate and still go broke if you risk too much per trade.

The 1-2% Rule (And Why It Works)

Never risk more than 1-2% of your account on a single trade.

Here's why this matters:

Risk 2% per trade → You can survive 50 consecutive losses

Risk 10% per trade → 10 losses = -65% drawdown (you need +186% just to break even)

Risk 20% per trade → 5 losses = game over

The Position Sizing Formula

Position Size = (Account Size × Risk %) / (Entry Price - Stop Loss)

Real Example:

Account: $10,000

Risk per trade: 2% = $200

Entry: $50

Stop loss: $48

Risk per share: $2

Position Size = $200 / $2 = 100 shares

If stopped out → You lose exactly $200 (2%)

If price hits $54 → You make $400 (4% gain, 2:1 R/R)

Different Risk Frameworks

Conservative (1% risk)

Best for: Beginners, volatile markets, high-frequency trading

Survivability: Can take 100+ losses

Growth: Slower but steady

Moderate (2% risk)

Best for: Experienced traders, tested strategies

Survivability: 50 consecutive losses

Growth: Balanced risk/reward

Aggressive (3-5% risk)

Best for: High conviction setups, smaller accounts trying to grow

Survivability: 20-33 losses

Growth: Faster but dangerous

Warning: Never go above 5% unless you're gambling, not trading.

The Kelly Criterion (Advanced)

For traders with significant backtested data:

Kelly % = Win Rate -

Example:

Win rate: 55%

Avg win: $300

Avg loss: $200

Win/Loss ratio: 1.5

Kelly % = 0.55 - = 0.55 - 0.30 = 25%

But use 1/4 Kelly (6.25%) or 1/2 Kelly (12.5%) - Full Kelly is too aggressive for real markets.

Common Position Sizing Mistakes

❌ Revenge trading larger after a loss

✅ Keep position size constant based on current account value

❌ Risking the same dollar amount regardless of setup quality

✅ Risk 0.5% on B-setups, 2% on A+ setups

❌ Ignoring correlation risk

✅ If you have 5 tech stocks open, you're really risking 10% on one sector

❌ Not adjusting after drawdowns

✅ If account drops 20%, your 2% risk should recalculate from new balance

The Volatility Adjustment

In high volatility (VIX > 30):

Cut position sizes by 30-50%

Widen stops or risk less per trade

Market can gap past your stops

In low volatility (VIX < 15):

Can use normal position sizing

Tighter stops possible

More predictable price action

My Personal Framework

I use a tiered approach:

High conviction setups (A+): 2% risk

Good setups (A): 1.5% risk

Decent setups (B): 1% risk

Experimental/learning: 0.5% risk

Maximum combined risk: Never more than 6% across all open positions.

The Bottom Line

Position sizing is the only thing you have complete control over in trading. You can't control:

Where price goes

Market volatility

News events

But you CAN control how much you risk.

The traders who survive long enough to get good are the ones who master position sizing first.

What's your current risk per trade? Drop it in the comments. If it's above 5%, we need to talk.

Position Sizing: The Math That Separates Winners from LosersMost traders blow up their accounts not because of bad entries, but because of terrible position sizing. You can have a 60% win rate and still go broke if you risk too much per trade.

The 1-2% Rule (And Why It Works)

Never risk more than 1-2% of your account on a single trade.

Here's why this matters:

Risk 2% per trade → You can survive 50 consecutive losses

Risk 10% per trade → 10 losses = -65% drawdown (you need +186% just to break even)

Risk 20% per trade → 5 losses = game over

The Position Sizing Formula

Position Size = (Account Size × Risk %) / (Entry Price - Stop Loss)

Real Example:

Account: $10,000

Risk per trade: 2% = $200

Entry: $50

Stop loss: $48

Risk per share: $2

Position Size = $200 / $2 = 100 shares

If stopped out → You lose exactly $200 (2%)

If price hits $54 → You make $400 (4% gain, 2:1 R/R)

Different Risk Frameworks

Conservative (1% risk)

Best for: Beginners, volatile markets, high-frequency trading

Survivability: Can take 100+ losses

Growth: Slower but steady

Moderate (2% risk)

Best for: Experienced traders, tested strategies

Survivability: 50 consecutive losses

Growth: Balanced risk/reward

Aggressive (3-5% risk)

Best for: High conviction setups, smaller accounts trying to grow

Survivability: 20-33 losses

Growth: Faster but dangerous

Warning: Never go above 5% unless you're gambling, not trading.

The Kelly Criterion (Advanced)

For traders with significant backtested data:

Kelly % = Win Rate -

Example:

Win rate: 55%

Avg win: $300

Avg loss: $200

Win/Loss ratio: 1.5

Kelly % = 0.55 - = 0.55 - 0.30 = 25%

But use 1/4 Kelly (6.25%) or 1/2 Kelly (12.5%) - Full Kelly is too aggressive for real markets.

Common Position Sizing Mistakes

❌ Revenge trading larger after a loss

✅ Keep position size constant based on current account value

❌ Risking the same dollar amount regardless of setup quality

✅ Risk 0.5% on B-setups, 2% on A+ setups

❌ Ignoring correlation risk

✅ If you have 5 tech stocks open, you're really risking 10% on one sector

❌ Not adjusting after drawdowns

✅ If account drops 20%, your 2% risk should recalculate from new balance

The Volatility Adjustment

In high volatility (VIX > 30):

Cut position sizes by 30-50%

Widen stops or risk less per trade

Market can gap past your stops

In low volatility (VIX < 15):

Can use normal position sizing

Tighter stops possible

More predictable price action

My Personal Framework

I use a tiered approach:

High conviction setups (A+): 2% risk

Good setups (A): 1.5% risk

Decent setups (B): 1% risk

Experimental/learning: 0.5% risk

Maximum combined risk: Never more than 6% across all open positions.

The Bottom Line

Position sizing is the only thing you have complete control over in trading. You can't control:

Where price goes

Market volatility

News events

But you CAN control how much you risk.

The traders who survive long enough to get good are the ones who master position sizing first.

What's your current risk per trade? Drop it in the comments. If it's above 5%, we need to talk.

Patience - When Calm Feels WrongNOTE – This is a post on mindset and emotion. It is not a trade idea or strategy designed to make you money. My intention is to help you preserve your capital, focus, and composure — so you can trade your own system with calm and confidence.

Markets quiet down.

Price moves slow.

Everything looks still, maybe too still.

Part of you relaxes.

Another part tenses.

It’s that sense that something’s coming.

And sometimes, it is.

But here’s the hard part

Your body doesn’t always know the difference between anticipating danger and feeling unsafe.

For traders, the nervous system reads uncertainty like threat.

Even a normal pause in volatility can trigger the same internal siren:

Something’s wrong. Do something.

You start scanning: news, charts, signals

anything to justify the unease.

But often, the danger isn’t out there.

It’s inside you... a learned association between stillness and not knowing what's going to happen next

Which causes restlessness, uncertainty and a need to fidget and meddle.

The skill isn’t in shutting that instinctive unease down.

It’s in listening without reacting impulsively.

Ask yourself - what is really going on right here, right now?

The point here is:

Patience isn’t passive.

It’s regulated awareness.

It’s being alert, not alarmed.

Ready, but not restless.

Sometimes there is indeed a risk out there.

We are trading the financial markets after all.

However. You have a trading plan.

You know to be risk measured.

All that is needed now is the ability to regulate yourself

Stay calm and patient so you can execute your plan as intended.

Trading Crude Oil and the Geopolitical Impact on PricesIntroduction

Crude oil is one of the most strategically significant commodities in the global economy. It fuels transportation, powers industries, and serves as a critical input for countless products ranging from plastics to fertilizers. Because of its universal importance, crude oil trading is not just a financial endeavor—it is a reflection of global political stability, economic growth, and international relations. The price of crude oil is highly sensitive to geopolitical events, including wars, sanctions, alliances, and policy changes. Understanding how geopolitical dynamics affect oil trading and pricing is vital for traders, investors, and policymakers.

1. The Fundamentals of Crude Oil Trading

Crude oil trading involves the buying and selling of oil in various markets, primarily through futures contracts on exchanges such as the New York Mercantile Exchange (NYMEX), Intercontinental Exchange (ICE), and Dubai Mercantile Exchange (DME). These contracts allow traders to speculate on the future price of oil, hedge against risks, or facilitate physical delivery. Two main benchmark grades dominate the market: West Texas Intermediate (WTI) and Brent Crude.

WTI Crude Oil is primarily sourced from the U.S. and traded in dollars per barrel.

Brent Crude Oil is produced in the North Sea and serves as the global benchmark for pricing.

Oil prices are influenced by multiple factors, including supply and demand fundamentals, global economic growth, production levels, inventory data, transportation costs, and geopolitical events. Among these, geopolitical tensions often have the most immediate and dramatic impact.

2. Geopolitics as a Determinant of Oil Prices

The global oil market is uniquely vulnerable to geopolitical developments because a significant portion of reserves and production is concentrated in politically sensitive regions such as the Middle East, North Africa, and Russia. Around 60% of proven oil reserves lie in OPEC (Organization of Petroleum Exporting Countries) member nations, many of which have experienced conflict, sanctions, or regime instability.

Geopolitical risk refers to the potential disruption in oil supply or transportation routes due to international conflicts, political upheaval, or policy decisions. When such risks escalate, traders often bid up oil prices in anticipation of supply shortages—even before any actual disruption occurs.

3. Historical Perspective: Major Geopolitical Events and Oil Prices

a. The 1973 Arab Oil Embargo

One of the earliest and most significant examples of geopolitically driven oil price shocks occurred in 1973 when Arab OPEC members imposed an oil embargo against the United States and other nations supporting Israel during the Yom Kippur War. Oil prices quadrupled within months, leading to inflation, recession, and a global energy crisis. The embargo demonstrated the power of oil as a political weapon and the vulnerability of consumer nations.

b. The Iranian Revolution (1979)

The overthrow of the Shah of Iran and the subsequent decline in Iranian oil production reduced global supply by nearly 5%. This shortage, coupled with the Iran-Iraq War (1980–1988), sent prices soaring again. The resulting volatility highlighted how political instability in a single oil-producing nation could ripple through the entire global economy.

c. The Gulf War (1990–1991)

Iraq’s invasion of Kuwait disrupted nearly 5 million barrels per day of oil production. The U.S.-led coalition’s response and the ensuing war created massive uncertainty in the Middle East, briefly pushing oil prices above $40 per barrel—a significant level for that time.

d. The Iraq War (2003)

The U.S. invasion of Iraq reignited geopolitical fears about supply disruptions. Although global production eventually stabilized, the war contributed to sustained higher oil prices in the early 2000s, further compounded by rapid industrialization in China and India.

e. The Arab Spring (2010–2011)

The wave of protests across the Middle East and North Africa led to regime changes and unrest in key producers such as Libya and Egypt. The civil war in Libya, in particular, cut oil output by over one million barrels per day, causing Brent crude prices to exceed $120 per barrel.

f. Russia-Ukraine Conflict (2014 and 2022)

Russia’s annexation of Crimea in 2014 and its full-scale invasion of Ukraine in 2022 significantly disrupted global energy markets. As one of the world’s largest oil and gas exporters, Russia faced Western sanctions that restricted exports, insurance, and financing. In early 2022, Brent crude spiked above $130 per barrel, reflecting fears of prolonged supply shortages and energy insecurity across Europe.

4. Channels Through Which Geopolitics Impacts Oil Prices

Geopolitical events influence oil prices through several interconnected channels:

a. Supply Disruptions

Conflicts or sanctions can directly reduce oil supply by damaging infrastructure, limiting production, or restricting exports. For example, sanctions on Iran in 2012 and again in 2018 led to significant declines in its oil exports, tightening global supply.

b. Transportation and Shipping Risks

Chokepoints such as the Strait of Hormuz, Suez Canal, and Bab el-Mandeb Strait are vital for global oil transportation. Any military conflict or threat in these areas immediately raises concerns about shipping disruptions, leading to higher prices. Nearly 20% of global oil passes through the Strait of Hormuz daily.

c. Speculative Reactions

Traders and hedge funds respond quickly to geopolitical news, often amplifying price movements. Futures markets price in expected risks, causing volatility even when actual supply remains unaffected.

d. Strategic Reserves and Policy Responses

Nations often release oil from strategic reserves or negotiate production increases through OPEC to stabilize markets. For example, the U.S. and IEA (International Energy Agency) coordinated strategic reserve releases in 2022 to offset supply disruptions caused by the Russia-Ukraine conflict.

e. Currency Movements

Since oil is traded in U.S. dollars, geopolitical tensions that weaken the dollar or create global uncertainty can influence oil prices. A weaker dollar often makes oil cheaper for non-U.S. buyers, boosting demand and raising prices.

5. OPEC and Geopolitical Strategy

The Organization of Petroleum Exporting Countries (OPEC), formed in 1960, and its extended alliance OPEC+, which includes Russia, play a pivotal role in determining oil supply and prices. The organization uses coordinated production quotas to manage global prices, often aligning decisions with geopolitical interests.

For instance:

In 2020, during the COVID-19 pandemic, OPEC+ cut production by nearly 10 million barrels per day to support collapsing prices.

In 2023, Saudi Arabia and Russia announced voluntary cuts to maintain price stability amid slowing demand and Western sanctions.

OPEC’s policies are inherently geopolitical, balancing the economic needs of producers with the political relationships among member states and major consumer nations.

6. Energy Transition and the New Geopolitics of Oil

The growing global emphasis on renewable energy and decarbonization is reshaping the geopolitical landscape of oil trading. As nations transition to cleaner energy, oil-producing countries face the challenge of maintaining revenue while managing political stability.

However, this transition also introduces new geopolitical dependencies—for example, on lithium, cobalt, and rare earth metals used in electric vehicle batteries. While demand for oil may gradually plateau, geopolitical risks remain as nations compete over new energy supply chains.

Additionally, U.S. shale production has transformed the country from a net importer to a major exporter, reducing its vulnerability to Middle Eastern geopolitics but also introducing new market dynamics. Shale producers can ramp up or scale down production relatively quickly, acting as a “shock absorber” to global price swings.

7. The Role of Technology and Market Transparency

Technological advancements in trading—especially algorithmic and data-driven models—have increased market liquidity but also heightened sensitivity to news. Real-time tracking of geopolitical developments via satellites, social media, and analytics platforms allows traders to react instantly.

For example, satellite data showing tanker movements or refinery fires can trigger immediate price adjustments. The intersection of AI, big data, and geopolitics now defines modern oil trading strategies, with traders assessing both quantitative signals and qualitative geopolitical intelligence.

8. Managing Geopolitical Risk in Oil Trading

Professional oil traders and corporations employ various strategies to manage geopolitical risks:

Diversification: Sourcing oil from multiple regions to minimize reliance on unstable producers.

Hedging: Using futures, options, and swaps to lock in prices and reduce exposure to volatility.

Scenario Analysis: Running stress tests based on potential geopolitical outcomes (e.g., war, sanctions, embargoes).

Political Risk Insurance: Protecting investments against losses due to government actions or conflict.

Strategic Reserves: Governments maintain emergency stockpiles to stabilize supply during crises.

In addition, diplomatic engagement and international cooperation—such as IEA coordination or U.N.-mediated negotiations—can help mitigate disruptions and maintain market balance.

9. The Future Outlook: Geopolitics and the Oil Market

As of the mid-2020s, the global oil market faces a new era of geopolitical uncertainty. Key issues shaping the future include:

The U.S.-China rivalry, which may influence energy trade routes and technological access.

Middle Eastern realignments, including normalization of relations between former rivals and shifting alliances.

Climate policy conflicts, as nations balance carbon reduction commitments with economic growth needs.

Sanctions regimes on Russia, Iran, and Venezuela, which continue to restrict global supply flexibility.

The digitalization of trading, which increases speed and transparency but also amplifies volatility.

Although long-term demand growth may slow due to renewable energy adoption, oil will remain a central geopolitical and economic asset for decades. The world’s dependence on energy ensures that geopolitics will continue to shape price trends, investment decisions, and market psychology.

Conclusion

Crude oil trading is not merely a reflection of supply and demand; it is a barometer of global stability and geopolitical tension. From the 1973 oil embargo to the ongoing Russia-Ukraine conflict, political decisions have repeatedly proven capable of reshaping energy markets. For traders and policymakers alike, understanding the geopolitical dimensions of oil is crucial for navigating price volatility and maintaining economic resilience.

As the energy transition accelerates, the nature of geopolitical risk will evolve—but it will not disappear. The intersection of oil, politics, and global economics will continue to define international relations and financial markets, ensuring that crude oil remains one of the world’s most geopolitically sensitive and closely watched commodities.

Position Sizing and Risk ManagementThere are multiple ways to approach position sizing. The most suitable method depends on the trader’s objectives, timeframe, and account structure. For example, a long-term investor managing a portfolio will operate differently than a short-term trader running a high-frequency system. This chapter will not attempt to cover all possible methods, but will focus on the framework most relevant to the active trader.

Equalized Risk

The most practical method for position sizing is known as equalized risk per trade. This model ensures that each trade risks the same monetary amount, regardless of the stop loss distance. The position size will be calculated based on the distance between the entry price and the stop loss, which means a closer stop equals more size, where a wider stop equals less size. This allows for a more structured and consistent risk control across various events.

Position Size = Dollar Risk / (Entry Price − Stop Price)

Position Size = Dollar Risk / (Entry Price × Stop in %)

For example, an account size of $100,000 and risk amount of 1% will be equivalent to $1,000. In the scenario of a $100 stock price, the table below provides a visual representation of how the position size adapts to different stop loss placements, to maintain an equalized risk per trade. This process can be integrated into order execution on some trading platforms.

The amount risked per trade should be based on a fixed percentage of the current account size. As the account grows, the dollar amount risked increases, allowing for compounding. If the account shrinks, the dollar risk decreases, which helps reduce the impact of continued losses. This approach smooths out the effect of random sequences. A percentage-based model limits downside exposure while preserving upside potential.

To better illustrate how position sizing affects long-term outcomes, a controlled simulation was conducted. The experiment modeled a system with a 50% win rate and a 1.1 to 1 average reward-to-risk ratio. Starting with a $50,000 account, the system executed 500 trades across 1000 separate runs. Two position sizing methods were compared: a fixed dollar risk of $1000 per trade and a dynamic model risking 2% of the current account balance.

Fixed-Risk Model

In the fixed-risk model, position size remained constant throughout the simulation. The final outcomes formed a relatively tight, symmetrical distribution centered around the expected value, which corresponds to consistent variance.

Dynamic-Risk Model

The dynamic-risk model produced a wider and more skewed distribution. Profitable runs experienced accelerated increase through compounding, while losing runs saw smaller drawdowns due to self-limiting trade size. Although dynamic risk introduces greater dispersion in final outcomes, it allows scalable growth over time. This compounding effect is what makes a dynamic model effective for achieving exponential returns.

A common question is what percentage to use. A range between 1–3% of the account is generally considered reasonable. Too much risk per trade can quickly become destructive, consider that even profitable systems may experience a streak of losses. For instance, a series of five consecutive losses at 10% risk per trade would cut the account by roughly 41%, requiring over a 70% return to recover. In case catastrophic events occur; large position sizing makes them irreversible. However, keeping position size and risk too small can make the entire effort unproductive. There is no such thing as a free trade, meaningful reward requires exposure to risk.

Risk Definition and Stop Placement

Risk in trading represents uncertainty in both the direction and magnitude of outcomes. It can be thought of as the potential result of an event, multiplied by the likelihood of that event occurring. This concept can be formulated as:

Risk = Outcome × Probability of Outcome

This challenges a common assumption that using a closer stop placement equals reduced risk. This is a common misconception. A tighter stop increases the chance of being triggered by normal price fluctuations, which can result in a higher frequency of losses even when the trade idea is valid.

Wide stop placements reduce the likelihood of premature exit, but they also require price to travel further to reach the target, which can slow down the trade and distort the reward-to-risk profile. An effective stop should reflect the volatility of the instrument while remaining consistent with the structure of the setup. A practical guideline is to place stops within 1–3 times the ATR, which allows room for price movement without compromising the reward-risk profile.

When a stop is defined, the distance from entry to stop becomes the risk unit, commonly referred to as R. A target placed at the same distance above the entry is considered 1R, while a target twice as far is 2R, and so on. Thinking in terms of R-multiples standardizes evaluation across different instruments and account sizes. It also helps track expectancy, maintain consistency, and compare trading performance.

In summary, risk is best understood as uncertainty, where the outcome is shaped by both the possible result and the probability of it occurring. The preferred approach for the active trader is equalized risk per trade, where a consistent percentage of the account, typically 1–3%, is risked on each position regardless of the stop distance. This allows the account to develop through compounding. It also reinforces the importance of thinking in terms of sample size. Individual trades are random, but consistent risk control allows statistical edge to develop over time.

Practical Application

To simplify this process, the Risk Module has been developed. The indicator provides a visual reference for position sizing, stop placement, and target definition directly on the chart. It calculates equalized risk per trade and helps maintain consistent exposure.

Risk Management Rules That Save AccountsSummary

You lower impulsive errors at the open by running a one minute pre market checklist that begins with a threat label. You then walk five gates for news, volatility, risk, size, and stop. The routine is simple, fast, and repeatable. It creates a small pause that shifts you from emotional reaction to planned execution. This is education and analytics only.

Decision architecture under stress . Name it to tame it. A short written label reduces limbic reactivity and gives the planning system a window of control.

Why this matters

Most bad sessions begin before the first click. Fatigue, caffeine spikes, fear of missing out, and a cluttered screen push the brain toward shortcuts. The checklist gives you a tiny container of time where you look at the day with clear eyes. One minute is enough. The goal is not perfection. The goal is a stable entry state and a hard off switch when risk boundaries are reached.

The one minute routine

Threat label . Write one sentence that names your current state in plain language. Example: Slept five hours, feel rushed, second coffee, mild anxiety. This is affect labeling.

News gate . Scan the calendar for high impact items. Decide if size is reduced or if a filter is active around event times.

Volatility gate . Classify the regime as normal or high by reading average true range or a recent range. High regime shrinks size and widens stop distance inside your plan.

Risk gate . Confirm risk per trade, the max daily loss, and the rule that stops new entries for the day.

Session gate . Choose your focus window. Define a time box. Write one line that states your setup and the review point.

Principle one — the threat label

The label is short, neutral, and written. You are not trying to be poetic. You are moving the experience from the body into words so that attention can be allocated with intent. Include four elements.

Sleep . Hours and quality. Broken sleep counts as low quality.

Fatigue . Subjective rating from 1 to 5 where 3 is workable.

Stimulants . Caffeine count and timing. Early heavy intake tends to raise urgency.

Emotion . One word such as calm, rushed, irritated, fearful, confident.

Add a mood score from 1 to 5. If the score is 1 or 2 you move to simulation or wait fifteen minutes after the open. If the score is 3 or higher you can proceed with the five gates at reduced size when the day feels heavy. The act of naming is not a cure. It is a lever that opens a window where better choices are available.

Principle two — breathing as a switch

Use a physiological sigh or box breathing for sixty seconds when arousal is high.

Physiological sigh: inhale through the nose, take a short second inhale to top off, then exhale slowly through the mouth. Repeat five times.

Box breathing: inhale for four, hold for four, exhale for four, hold for four. Repeat for one minute.

This is not about relaxation. It is about coming back to a steady baseline so that the gates can be applied without haste.

Principle three — time boxing and two strike control

Time without boundaries invites drift. Choose a primary window. Add a two strike rule. Two avoidable mistakes or two full stops and you switch to review mode. This is a hard rule. You can always restart in simulation. The account does not need you to win today. It needs you to preserve optionality for tomorrow.

The five gates in depth

Gate 1. Threat label details

Format . One sentence. Neutral tone. No judgment.

Signal . If the label uses words like frantic, desperate, angry, or invincible you reduce size or you step back. Extreme emotion is a red flag.

Action . If the label is heavy, attach a micro plan. Example: Watch the first range print, take one A quality setup only, then review.

Why it works. The label hijacks the loop that pairs sensation with urgency. By assigning words you create distance. Distance allows choice. Choice reduces error.

Gate 2. News gate details

Scan . Look for clustered items such as inflation prints, policy statements, or employment data.

Filter . If an item is imminent you set a no trade buffer around it. Five minutes is a good default for the day session. Longer buffers can be used when events are central to the day.

Size . On days with dense events you run smaller. Your goal is survival and clarity, not heroics.

Reasoning. Event periods change the distribution of short term outcomes. The checklist assumes there are times to engage and times to wait. Waiting is a skill.

Gate 3. Volatility gate details

Classification . Use a simple rule such as normal regime when the rolling range is near its median and high regime when it is in the upper quartile. You do not need complex math here.

Translation . High regime implies half size and wider stops within your plan. Normal regime allows baseline size and standard stops.

Exit awareness . Volatility is not a gift and not a threat. It is a condition. When it is extreme your first task is to avoid clips that come from noise.

The psychology note. When volatility rises your heart rate rises and the mind searches for action. The gate reminds you that you do not need to swing at every pitch. You need to scale your effort to the environment.

Gate 4. Risk gate details

Risk per trade . Choose a range that respects your current skill. Many traders use values between 0.25 percent and 0.50 percent while they build consistency. Use your data.

Max daily loss . Choose a hard cap between 1.5 percent and 2.5 percent. The exact figure is less important than the enforcement.

Stop trading rule . When the max is reached you stop. You move to review mode. You do not attempt a last minute rescue. You treat tomorrow as a fresh session.

Psychology note. Most blowups do not come from one bad idea. They come from the refusal to stop when the day is off. The risk gate eliminates that refusal by binding action to a predefined boundary.

Gate 5. Session gate details

Focus . Choose one session. Focus beats breadth. Split focus is a silent drain.

Window . Define the first hour as your primary window and stick to it. The goal is quality not quantity.

Written micro plan . One line that states what you are allowed to take. One line that states when you stand down.

Time discipline creates high quality boredom. High quality boredom is where patience grows.

The one minute card

Copy this card and keep it next to your screen.

Threat label: Today I feel … because …

Mood 1 to 5: __

Sleep hours: __

Caffeine cups: __

Five gates

News: list items and times.

Volatility: normal or high.

Risk: risk per trade and max daily loss.

Size: full or half.

Stop: exit rule and stop trading rule.

Session plan

Primary session: __

Window: first sixty minutes

Setup: described in one line

Review: five notes after the first trade

Bias management

Your checklist doubles as a bias tracker. Below are common traps and their counters.

Fomo . The urge to enter early because price is moving. Counter : read your session plan line out loud and wait for the condition that defines your setup.

Revenge . The urge to win back a loss. Counter : two strike rule. After two avoidable errors you switch to review.

Confirmation . The habit of seeking only data that supports the current idea. Counter : write one invalidation condition in your micro plan before each entry.

Sunk cost . Staying with a poor position because time and effort were invested. Counter : use structure based exits and honor them without debate.

Outcome bias . Judging process by result. Counter : score the decision quality in your journal independent of profit and loss.

Recency . Overweighting the last outcome. Counter : review three prior similar sessions before the open.

Anchoring . Fixating on a number seen early. Counter : update levels using the most recent structure and ranges.

Gambler fallacy . Expecting balance in small samples. Counter : treat each setup as independent and sized by plan.

Environment design

Your surroundings push behavior. Design them on purpose.

Screen hygiene . Close unrelated tabs. Remove flashing items. Keep only the chart, the calendar, and your checklist.

Desk card . Print the one minute card. Physical presence increases compliance.

Timer . Use a simple timer for your first window. When it ends you review by default before you extend.

Journal access . Keep the journal one click away. Reduce friction to writing.

Standing rule sheet . Place the two strike rule and the max daily loss in large font at eye level.

Journal method

A short consistent journal beats a long sporadic one. Use five lines per session.

Threat label . Copy the exact sentence you wrote.

Gate notes . News, volatility classification, risk settings, session window.

Two key decisions . What you took and why.

Discipline score . Rate from 1 to 5 based on process quality.

Next session intent . One line that you can act on tomorrow.

Once a week add a short review.

Count how many times the max daily loss was hit.

Count how many sessions began with a score of 1 or 2 and what you did in response.

Note one pattern you want more of and one behavior you want less of.

Comparator — checklist day versus reactive day

A checklist day has five visible differences.

Entries occur inside the written setup line rather than outside of it.

Size reflects volatility classification rather than emotion.

News windows are respected rather than ignored.

The two strike rule switches you to review rather than escalation.

Post session notes exist and inform the next session.

A reactive day shows the opposite pattern. You can measure this. Track three numbers for a month.

Number of impulsive entries per session.

Number of max daily loss hits per week.

Average emotional intensity rating captured in the first five minutes of the session.

Expect the checklist month to show fewer impulsive entries, fewer max loss days, and lower opening intensity. The goal is stable execution and preserved capital for learning.

Scenarios and how to apply the gates

Low sleep morning

Threat label notes low sleep and mild irritability. Mood 2.

Action is simulation or a fifteen minute wait after the open. Coffee is delayed. You observe the first range and journal one line without taking risk.

Outcome is a cleaner state for the second half of the hour or a full stand down without regret.

Clustered event day

Threat label notes excitement and urgency.

News gate shows several items within the first hour. Filter is applied. Size is reduced.

Two strike rule is activated with extra caution due to the environment.

High volatility regime

Volatility gate classifies the day as high using a simple rolling range rule.

Size is cut in half. Stops are placed at a distance that matches the regime inside your plan.

You aim for one A quality setup and then you review.

Emotional drift after early win

Threat label catches the rise of euphoria and the phrase I can push it.

Risk gate reminds you that risk per trade remains constant. Size does not increase without a monthly review and data.

You write a single intent line to protect the day from giving back an early gain.

Emotional drift after early loss

Threat label captures frustration and the urge to get it back.

You pause for a breathing cycle. You re read the setup line. You allow the next clean condition or you stop.

If you reach two avoidable errors you switch to review mode by rule.

Building the habit

Habits form when three conditions exist. A cue, a simple action, and a visible reward.

Cue . The first launch of your platform is the cue. The card sits in front of the keyboard.

Action . You write the threat label and walk the five gates. It takes one minute.

Reward . You check off a visible box on a small tracker. Ten sessions completed equals a micro reward of your choice that does not increase arousal.

Use streak tracking. Breaking a streak is a useful signal. Ask why with curiosity, not shame.

Risk of ruin as a psychological anchor

Ruin is the end of the game. You reduce ruin probability by keeping the max daily loss small, by sizing positions inside your plan, and by cutting activity when the state is poor. The checklist operationalizes this. You do not need to compute formulas every morning. You need to enforce boundaries in real time.

Plain language rules you can post above your monitor

Write a threat label before the open.

Respect event windows without exception.

Match size to volatility.

Stop at the max daily loss.

Run a small time box and review by default when it ends.

Metrics that keep you honest

Track the following numbers each week.

Sessions with the card completed.

Sessions that reached the max daily loss.

Impulsive entries per session.

Average mood score at the open.

Average discipline score at the close.

Make a tiny table with ten rows that covers two weeks. This takes five minutes and will reveal whether the checklist is real or theater.

Frequently asked questions

Can I apply this to longer timeframes

Yes. The gates do not change. Only the windows change. The principle remains the same. Protect the mind, protect the account, and execute the plan.

Should I scale size after a win

No, not inside the day. Size changes are a monthly decision informed by data and by a stable discipline score. Day level changes usually reflect emotion rather than edge.

What if fear is very high

Use one cycle of the physiological sigh and one cycle of box breathing. Write the label. If the score remains 1 or 2 your best decision is to observe and learn without risk.

What if I fail the routine for a week

Do a small reset. Print a fresh card. Shorten the window. Reduce goals. Your only task is to complete the card for three sessions in a row.

What about accountability

Share your five line journal with one trusted peer. No opinions. No trade calls. Only the five lines. This light social pressure improves compliance.

Risks and failure modes

Liquidity pockets . Thin periods can distort short term structure. The solution is to reduce activity rather than to force entries.

Event clusters . When several items land in the same session, conditions can whipsaw. The solution is to go smaller or to wait for the post event phase.

Emotional drift . After two losses the urge to fight rises. The solution is the two strike rule and a physical walk away trigger.

Overfitting the checklist . A card with twenty questions will not be used. Keep it at one minute.

Rationalization . The mind can twist rules in real time. The solution is to write numbers before the session and follow them when it is hardest.

From routine to identity

Behavior sticks when it becomes who you are. You can call yourself a routine first trader. That means you respect the card before you respect your opinions. You can call yourself a review first trader. That means you treat the journal as part of the session rather than an afterthought. Identity makes rules easier to keep because breaking them feels like breaking character.

Closing summary

The pre market checklist is a small lever with large impact. You begin with a written threat label that pulls emotion into words. You pass five gates that cover news, volatility, risk, size, and stop. You work inside a time box and you accept the two strike rule. You record five lines and you adjust week by week. There is no promise of profit. There is only the reliable reduction of avoidable errors and the protection of your decision making capacity. The rest follows from consistent behavior over time.

Education and analytics only. Not investment advice. No performance promises.

Risk On/Off: How Global Correlations Tell You Money Flow🔵 Risk On / Risk Off: How Global Correlations Tell You Where Money Is Flowing

Difficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is for traders who want to understand how global capital flow affects market behavior — from equities and crypto to gold and bonds. Learning to read “Risk On” and “Risk Off” regimes helps you anticipate big shifts before they hit your chart.

🔵 INTRODUCTION

Markets are not independent islands — they are connected by one universal force: liquidity flow .

When investors feel confident, they move capital into riskier assets like stocks and crypto — this is called Risk On .

When fear dominates, capital flows back into safety — bonds, gold, and the U.S. dollar — known as Risk Off .

Recognizing this rotation allows traders to align their bias with the flow of global capital rather than fighting it.

🔵 WHAT IS “RISK ON”

Risk On is a market environment where investors seek higher returns, volatility is subdued, and capital flows into assets with greater reward potential.

Typical Risk-On behavior:

S&P 500, Nasdaq, and other equities trend higher

Bitcoin and crypto assets outperform traditional markets

U.S. Dollar Index (DXY) weakens as money moves abroad

Bond yields rise moderately as investors leave safe assets

Gold often consolidates or declines

In simple terms: Money chases opportunity.

🔵 WHAT IS “RISK OFF”

Risk Off describes defensive conditions — fear rises, volatility expands, and liquidity seeks safety.

Typical Risk-Off behavior:

S&P 500 and risk assets decline

Bitcoin and altcoins drop sharply

DXY strengthens as investors move into USD

Bond yields fall as money enters treasuries

Gold rallies as a safe-haven hedge

In simple terms: Money runs to safety.

🔵 HOW TO DETECT RISK SHIFTS

Market regimes don’t flip instantly — they rotate through correlated behavior.

To identify the shift between Risk On and Risk Off, monitor key macro instruments together:

DXY (Dollar Index): Rising DXY = Risk Off sentiment, Falling DXY = Risk On.

SPX / NASDAQ: Strong uptrends = Risk On, persistent weakness = Risk Off.

BTC vs DXY: Inverse correlation; BTC strength with DXY weakness = liquidity expansion.

Bond Yields (US10Y): Rising = optimism, Falling = risk aversion.

VIX Index: Below 15 = complacent Risk On, Above 25 = fearful Risk Off.

🔵 THE GLOBAL LIQUIDITY CYCLE

Liquidity always moves in phases — expansion, acceleration, contraction, and reset.

Phase 1 – Liquidity Expansion: Central banks inject liquidity → Risk On begins.

Phase 2 – Overextension: Assets rally strongly, leverage increases, volatility stays low.

Phase 3 – Liquidity Contraction: Monetary tightening or policy shocks trigger Risk Off.

Phase 4 – Repricing & Reset: Markets bottom as new liquidity returns.

Understanding this rhythm helps traders avoid confusion when markets seem “irrational” — because they’re not, they’re simply rotating through the liquidity cycle.

🔵 USING RISK ON/OFF IN TRADING

Even technical traders benefit from recognizing global risk regimes.

By aligning with the dominant liquidity direction, setups gain higher probability.

Crypto traders: Use SPX, DXY, and VIX correlations to confirm momentum.

Stock traders: Track gold and yields to gauge investor confidence.

Forex traders: Trade USD pairs according to global sentiment.

Swing traders: Filter trade bias by checking the current global regime.

Tip: When correlations align (e.g., DXY up, SPX down, BTC down), expect trend continuation.

When they diverge, volatility or reversals are likely.

🔵 ADVANCED TOOLS TO WATCH

Global Liquidity Index: Track combined balance sheets of the Fed, ECB, BOJ, and PBC.

Stablecoin Supply (Crypto): Expanding supply = liquidity entering market.

Yield Curve (10Y–2Y spread): Falling = caution, Rising = recovery.

Funding Rates: Confirm risk sentiment via leverage buildup.

🔵 CONCLUSION

All markets are connected through liquidity.

Risk On and Risk Off regimes describe how that liquidity rotates between return and safety. By tracking global correlations — equities, bonds, gold, DXY, and crypto — traders gain a powerful macro filter to stay on the right side of momentum.

Liquidity creates direction. Correlation confirms conviction.

If you learn to read the global flow, your technical analysis will finally make sense in the bigger picture.

Do you track global correlations in your analysis? What’s your favorite Risk-On or Risk-Off indicator?

Why Most Traders Blow Their Accounts?

It’s not bad strategy; it’s bad risk.

Most traders break before their accounts do. They revenge trade, double down, or skip stops because they can’t stand being wrong.

Here’s the truth: Discipline beats setups every time in my perspective.

Try this today →

Risk 0.5% per trade for one week.

If you can’t follow that rule, it’s not the market that’s broken; it’s your system of control.

I’ve been testing something that helps traders stay inside their limits when emotions spike.

Want me to share how it works?

Trading Psychology Bias Lesson: BTCUSD 1D ATR Position SizeSummary

Bias shifts judgment under stress and often decides outcomes before the order ticket. This idea converts trading psychology into rules you can apply on BTCUSD now. It uses fixed ATR stops, pre defined entries and exits, a written disconfirming note before any order, and decision grades based on rule adherence. The goal is tighter drawdowns and consistent execution across regimes.

Live context

Price 123,102

SMA 50 114,314

EMA 200 106,289

ATR 14 daily 2,882.52 which is 2.34% of price

Distance to SMA 50 is 8,788 which is 7.14%

Distance to EMA 200 is 16,813 which is 13.66%

2 x ATR equals 5,765.04 which is 4.68%

Why psychology decides the trade before entry

Real trading includes noise, limited attention, and emotion. The result is bias, a stable tendency that pulls choices away from the written rule. Bias creeps into 4 moments: setup definition, entry trigger, position size, exit and review. The fix is structure. Use 5 blocks: a 1 sentence setup, entry and stop and trail defined with ATR, a written disconfirming note, a higher timeframe check, and a post trade grade by rule adherence rather than outcome.

Theory. Core biases you must neutralize

Loss aversion . Loss pain exceeds gain pleasure and leads to widening stops or cutting winners early. Fix . Initial stop equals 2 x ATR. Trail equals 1 x ATR or a close through a moving reference. Never widen stops.

Confirmation bias . You search for evidence that agrees with your idea. Fix . Write 1 disconfirming fact before any order. Check the next higher timeframe. If it disagrees, cut size by 50% or skip.

Anchoring . You fixate on entry or a round level. Fix . Define exits on structure with ATR or a moving average close. Name the anchor in notes to reduce its pull.

Recency and availability . You overweight the last 1 to 3 candles. Fix . Use a 20 bar context rule and a weekly system review.

Overconfidence . After a win trade count and size increase without any change in edge. Fix . Cool down 2 minutes after every exit and halve next size after a large winner.

Herd and gambler’s fallacy . Late entries on wide candles and belief that streaks must continue or must reverse. Fix . Only take trades with projected reward to risk at least 2 to 1 at the planned stop and avoid high impact events.

Hindsight and outcome bias . You judge by result and rewrite rules after 1 loss. Fix . Save entry and exit screenshots and grade by rule adherence.

Status quo and endowment . You sit in positions you already own while better setups exist. Fix . Monthly retest of every holding against current rules.

Three guardrail rules for BTCUSD

Stop discipline. Initial stop equals 2 x ATR. Trail winners by 1 x ATR or by a daily close through SMA 50. Do not widen stops.

Decision hygiene. Before every order write 1 disconfirming fact and check the next higher timeframe. If the higher timeframe disagrees, cut size by 50% or skip.

Quality floor. Projected reward to risk is at least 2 to 1 at the initial stop distance.

BTCUSD 1D continuation plan with exact math

This plan assumes a breakout continuation and uses your live ATR 14. All digits are based on ATR 2,882.52 and a price above SMA 50 and EMA 200.

Setup in 1 sentence . Trend continuation long on a daily close above the recent swing with SMA 50 rising and 20 bar context bullish.

Entry trigger . Close above 124,200 confirms continuation.

Initial risk . 2 x ATR equals 5,765.04. Stop equals entry minus 5,765.04. For 124,200 the stop is 118,434.96.

Targets . 1R target equals entry plus 5,765.04 which is 129,965.04. 2R target equals entry plus 11,530.08 which is 135,730.08.

Sizing example . Equity 20,000. Risk per trade 1% equals 200. Position size equals risk divided by stop distance which is 200 ÷ 5,765.04 equals 0.0347 BTC. Notional at 124,200 is about 4,308.

Management . Trail by 1 x ATR which is 2,882.52. Move the stop only with the trail. Ignore the first single red candle to reduce recency effects.

Exit logic . Exit on a daily close below the 1 x ATR trail or use a time stop after 12 bars if 2R is not reached.

Journal cue . Before entry write 1 disconfirming fact. After exit save 2 screenshots and grade by rule adherence.

Why each step neutralizes bias in real time

Loss aversion is capped because the stop distance is fixed by ATR and never widened. The trail is mechanical.

Confirmation is checked by the written disconfirming fact and the higher timeframe review that can force a skip or a 50% position cut.

Anchoring is reduced because exits reference ATR and structure instead of entry or round numbers.

Recency is filtered by the 20 bar rule and by a weekly system review that ignores single outcomes.

Overconfidence is constrained by a 2 minute cool down and 50% next size after a large winner.

Mean reversion companion inside an uptrend

Use this only while SMA 50 and EMA 200 slope up and price trades above both averages.

Context . Pullback forms inside the 20 bar range toward short term support while SMA 50 rises above EMA 200.

Entry . Bullish rejection from a prior swing zone or a daily close back above the intraday pivot after a 2 to 3 day pause.

Risk . Initial stop equals 1.5 x ATR which is 4,323.78.

Sizing . Risk per trade 1%. Position size equals risk divided by 4,323.78. With equity 20,000 and risk 200 the size equals 0.0463 BTC.

Exit . First scale at 1.5 R. Stop to break even only after a daily close above SMA 50. Final exit at 2 R or on a daily close back into the pullback range.

Bias note . Write 1 anchor you feel and 1 disconfirming fact that would cancel the setup.

Decision checklist to paste into chart notes

Setup in 1 sentence written before entry

Entry level, initial stop, trail method defined

1 disconfirming fact written and verified

Higher timeframe checked and size adjusted if needed

Projected reward to risk is at least 2 to 1

Screenshots saved at entry and exit

Decision grade recorded by rule adherence

Position size rule you can audit weekly

Account equity E. Risk per trade equals 1% of E by default.

Stop distance equals the ATR multiple from the plan.

Position size equals risk divided by stop distance. If required size is not tradable, skip the trade.

Bias symptoms you will see on the BTCUSD chart and the fix

Loss aversion . Stops drift lower while price falls. Winners are cut early. Fix . 2 x ATR hard stop and 1 x ATR trail.

Confirmation . Indicators are added until they agree with your view. Fix . 1 written disconfirming note and a higher timeframe check.

Anchoring . Waiting to exit when price returns to entry or to a round level. Fix . Structure based exits and naming the anchor in notes.

Recency . Judgment based on the last 2 candles. Fix . 20 bar context rule and a weekly system review.

Overconfidence . Trade count jumps after a win. Fix . 2 minute cool down and 50% next size after a large winner.

Herd and gambler’s fallacy . Late entries on wide candles and streak thinking. Fix . 2 to 1 minimum reward to risk and a news ban during known high impact windows.

Hindsight and outcome bias . Rewriting rules after 1 result. Fix . Grade by rule adherence and keep entry plus exit screenshots.

Status quo and endowment . Sitting in flat positions you already own. Fix . Monthly retest of every holding against current rules.

Worked example with our numbers

Assuming a daily close above 124,200 triggers the continuation. Initial stop equals 2 x ATR which is 5,765.04. Stop equals 118,434.96. 1R target equals 129,965.04. 2R target equals 135,730.08. Equity equals 20,000. Risk equals 200. Position size equals 0.0347 BTC. As price advances you trail by 1 x ATR which is 2,882.52 and you move the stop only when the trail shifts. If the trail is hit you exit. If 12 bars pass without the 2R target you exit on time and log the decision. You do not widen the stop. You do not add size after a win. You grade the decision by rule adherence.

If momentum stalls

If a daily close rotates down toward 121,000 to 121,500 and momentum weakens, shift to neutral. Wait for a fresh setup that passes the 2 to 1 test at the planned stop.

Do not react to a single candle. The plan lives on the daily chart.

Comparator and scorecard

Use simple Buy and Hold on BTCUSD as the baseline. Score the plan by Return divided by Drawdown, Max Drawdown, and percent of trades executed exactly as written. A smaller drawdown with steady execution beats a higher raw return with poor adherence. Your best forward indicator is the discipline metric you log each week.

Education and analytics only. Not investment advice. Test any rule with historical data before risking capital.

Risk-to-Reward and Journaling : Track, analyze, and evolve

📈 Mastering the Markets: Why Risk-to-Reward and Journaling Are Every Trader’s Edge

In trading, profitability isn't just about making winning trades — it's about managing risk smartly and learning from every position. Two of the most underrated habits that separate amateurs from consistent traders are:

1. Understanding Risk-to-Reward (R:R)

The risk-to-reward ratio is the foundation of trade planning. It's a simple calculation of how much you're willing to risk versus how much you aim to gain. A ratio of 1:2 means you risk $1 to potentially make $2.

✅ Why it matters:

Even with a 40% win rate, a positive R:R can still yield profitability.

It disciplines your entries, stops, and targets — no more emotional exits.

It forces you to filter out trades that don’t offer enough upside.

📊 For example, if you take 10 trades risking $100 each with a 1:2 R:R:

Win 4 = $800 gain

Lose 6 = $600 loss

Net Profit = $200 despite winning less than half.

2. The Power of Journaling

Trading without a journal is like flying blind. Your memory fades, but data doesn’t lie. A trading journal helps you:

🧠 Improve strategy by analyzing what works (symbols, timeframes, setups)

📉 Spot patterns in losses — overtrading? wrong R:R? bad timing?

📈 Stay disciplined — journaling enforces accountability

📒 Capture emotions — was it fear or FOMO? A journal tracks mindset too.

In my experience, journaling alone can boost a trader’s edge more than tweaking indicators. It turns experience into insight.

🎯 Final Word

The market rewards preparation, not prediction. A solid risk-to-reward framework keeps you in the game. Journaling turns your trades into tuition. Together, they compound your growth.

Happy Trading

Mastering Risk Management: The Trader’s Real EdgeYou’ve all heard it,

“Cut your losses and let your winners run.”

Simple words — but living by them is what separates survivors from blown accounts.

Here’s some tips on how to approach risk management when trading:

☑️ Risk is always predefined: Before I click Buy or Sell, I know exactly how much I’m willing to lose. If you don’t define risk upfront, the market will do it for you.

☑️ Position sizing: Never risk more than 1–2% of your account per trade. Small losses mean you can keep taking high‑probability setups without fear.

☑️ Always use a stop‑loss: No stop? You’re not trading — you’re gambling.

☑️ Stop‑loss discipline: Place stops where the market proves you wrong — not where it “feels comfortable.” Then leave them alone.

☑️ Focus on risk/reward, not win rate: A 40% win rate can still be profitable if your average reward outweighs your risk.

☑️ Risk/reward ratio: Only take trades with at least a 2:1 or 3:1 potential. You don’t need to win every trade — your winners should pay for your losers (and more).

Remember:

“It’s not about being right all the time. It’s about not losing big when you’re wrong.”

Risk management won’t make your trades perfect — but it will keep you trading tomorrow.

And in this game, staying in the game is everything.

💭 How do you handle risk in your trading? Drop your strategy or tip in the comments — let’s share and learn together! 👇

Thanks again for all the likes/boosts, we appreciate the support!

All the best for a good week ahead. Trade safe.

BluetonaFX

Crypto Risk Management: The Most Overlooked EdgeIn the thrilling yet unforgiving world of crypto, profit potential is massive—but so is the risk. Every trader or investor enters the space with dreams of 10x gains, but without a solid risk management strategy, many exit just as fast—with a trail of losses.

Risk management is the art of protecting your capital while giving yourself the best shot at long-term profitability. It’s not just a skill; it’s a survival strategy.

What Are the Risks in Crypto?

Crypto markets are unique—24/7, global, and driven by emotion, hype, and tech disruption. With that come several risk categories:

Market Risk – Volatile price swings can wipe out unprepared traders.

Liquidity Risk – Low-volume coins can be hard to exit during dumps.

Regulatory Risk – Government crackdowns or bans (e.g., Binance or XRP cases).

Security Risk – Hacks, rug pulls, phishing scams, and smart contract bugs.

Operational Risk – Mistakes like sending funds to the wrong address or using faulty bots.

These risks aren’t just theoretical—think of the LUNA/UST collapse or the FTX debacle. Billions were lost due to poor risk management at multiple levels.

🧠 Core Principles of Risk Management

To stay in the game long-term, you need to adopt some fundamental principles:

Preserve capital first, profit later.

Risk small, aim big.

Never risk more than you can afford to lose.

Think in probabilities, not certainties.

Be consistent, not lucky.

Even the best traders lose—but they survive because they manage their downside better than the rest.

🛠️ Tools & Techniques That Can Save Your Portfolio

1. ✅ Position Sizing

Don’t bet your whole stack on one trade. A common approach is to risk 1–2% of your portfolio per trade. That way, even a streak of bad trades won’t destroy your capital.

2. 🛑 Stop-Loss & Take-Profit

Always have predefined stop-loss levels to cut losses, and take-profit targets to lock in gains. Trading without a stop-loss is like driving without brakes.

3. 📊 Diversification

Spread your investments across different sectors (DeFi, AI, Layer 1s, etc.). Don’t rely on one narrative or one coin.

4. ⚖️ Leverage Control

Leverage can amplify gains—and losses. Avoid high leverage unless you’re an experienced trader with a tight plan.

5. 🔁 Portfolio Rebalancing

Adjust your allocations periodically. If one asset balloons in value, rebalance to lock in gains and manage exposure.

6. 💵 Using Stablecoins

Stablecoins like USDT, USDC, or DAI are great for hedging during volatility. Park profits or prepare dry powder for dips.

🧠 Psychological Risk: The Silent Killer

Many traders don’t lose due to bad analysis—they lose to emotions.

FOMO leads to buying tops.

Fear leads to panic selling bottoms.

Revenge trading after losses leads to bigger losses.

Greed blinds you from taking profits.

The key is discipline. Create a plan, follow it, and review your mistakes objectively.

🚫 Common Mistakes to Avoid

Going all-in on one trade or coin

Holding through massive drawdowns hoping for a recovery

Ignoring stop-losses

Overleveraging small positions to “win it all back”

Risk management is about avoiding unnecessary pain, not killing your gains.

🧭 Final Thoughts

The best traders in crypto aren't those who win big once—they're the ones who survive long enough to win over and over. Risk management is your edge in a market that respects no one.

Whether you’re a scalper, swing trader, or long-term HODLer, never forget: capital is your lifeline. Guard it with your strategy, protect it with your plan, and grow it with patience.

✍️ By Green Crypto

Empowering traders with analysis, tools, and education. Stay sharp. Stay profitable.

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

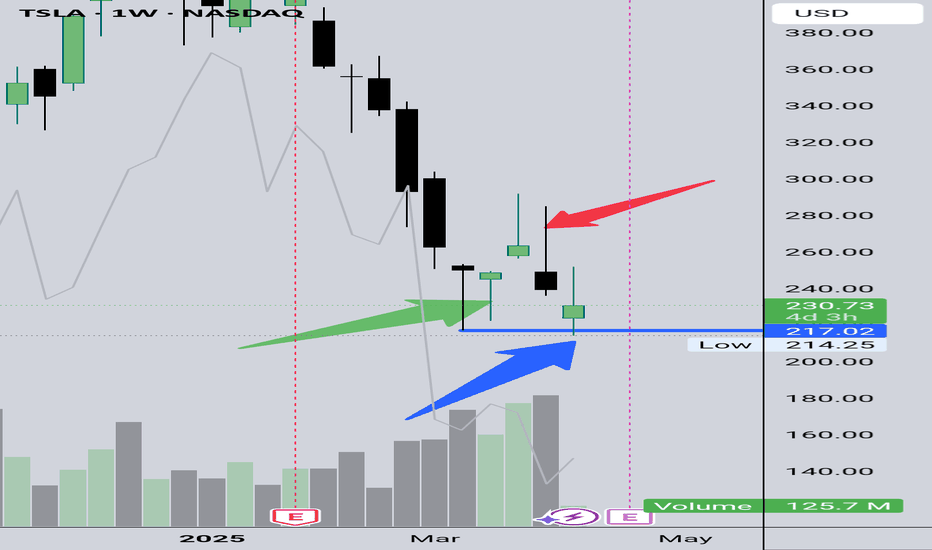

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

Leverage Your Way to Trading SuccessGood morning traders!

Today we're breaking down one of the most powerful yet misunderstood concepts in trading - leverage and margin. Think of this like the gym; leverage is your workout equipment, allowing you to lift more than you could with just your body weight. Margin, on the other hand, is like your gym membership fee; it's what you pay to access that equipment.

Understanding Leverage and Margin

-Leverage: In trading, leverage is about using a small amount of capital to control a much larger position. It's like using a barbell - it amplifies your strength, but if you're not careful, you can hurt yourself.

-Margin: This is the initial deposit required to borrow the "barbell." It's your skin in the game, ensuring you don't just run off with the equipment without working out.

The Power of Leverage

-Amplified Returns: Just like lifting weights can give you bigger muscles faster, leverage can significantly increase your returns if the market moves in your favor.

-Access to Bigger Plays: With leverage, you can dive into opportunities that would otherwise be out of your financial reach, like taking on a much heavier weight than you could lift solo.

The Risks You Must Navigate

-Magnified Losses: Here's where the gym analogy gets real - if you drop that heavy barbell, you're going to feel it. In trading, leverage can make small losses big ones if the market goes against you.

-Margin Calls: If your account balance dips below the required level, it's like the gym calling you to say, "Hey, you need more money for that membership!" You either add funds or have to stop using the equipment (close positions).

-The Temptation to Overdo It: Just like in the gym, where you might want to lift too much too soon, in trading, leverage can tempt you to overtrade, leading to exhaustion or injury (financial losses).

How to Lift with Leverage Smartly

-Set Stop-Loss Orders: This is like having a spotter in the gym. Decide beforehand how much weight (loss) you can handle before you need help (exit the trade).

-Only Use What You Can Afford to Lose: Never work out with weights that could crush you if they fall. Only use leverage on money you're prepared to part with.

-Know Your Limits: Understand how much margin you need to keep your positions open without getting a surprise bill from the gym.

-Position Sizing: Start small, like beginning with lighter weights before moving to the heavy stuff. Even with leverage, manage your trade sizes wisely.

-Keep Educating Yourself: Just as you'd learn new exercises or techniques in the gym, keep learning about markets and trading strategies.

A Gym Session Example

Imagine you've got $1,000 to invest, but with leverage, it's like you're trading with $10,000. If the market moves up by 5%, you're not just making a small profit; you're looking at a 50% return on your initial investment. But if it drops by 5%, you're facing a 50% loss, which could knock you out of the gym if you're not ready.

Wrapping Up

Leverage and margin are like your gym gear - they can make you stronger but only if used correctly.

If you're struggling to understand this concept, send me a DM - more than happy to help. If this article helped you, please boost, share, and comment; I truly appreciate it.

Kris/Mindbloome Exchange

Trade What You See

Understanding Risk Asymmetry in a Table▮ Introduction

With TradingView's new table creation feature , you can easily create and customize tables to enhance your trading analysis and presentations.

In this article I'll use it to explain Risk Asymmetry .

Trading involves a constant evaluation of risk and reward .

One of the critical concepts that traders need to understand is risk asymmetry .

This concept highlights how losses and gains are not symmetrical.

In other words, the percentage gain required to recover from a loss is greater than the percentage loss itself.

This article explores risk asymmetry and illustrates it with a practical example.

▮ What is Risk Asymmetry?

Risk asymmetry refers to the disproportionate relationship between losses and the gains required to recover from those losses.

For instance, if you lose 10% of your investment, you need to gain more than 10% to get back to your original amount.

This is because the base amount has decreased after the loss.

Understanding risk asymmetry is crucial for traders because it affects their risk management strategies.

Knowing that larger losses require exponentially larger gains to recover can help traders make more informed decisions about their trades and risk exposure.

▮ Illustrating Risk Asymmetry

To illustrate risk asymmetry, let's consider an initial investment of $1000.

The table below shows the required gain to recover from various percentage losses:

Explanation:

- Loss (%): The percentage loss from the initial amount.