UiPath automates workflows and apparently the chart tooPATH pretends nothing happened after a perfect diamond breakout

PATH is trading at 13.86 after the diamond pattern completed a clean breakout toward 18.74 and shifted into a corrective phase. The pullback landed precisely in the Fibonacci 0.786 zone between 12.00 and 12.50 where a clear demand area formed. Buyers reacted sharply and the three day chart printed a golden cross through the MA50 crossing the MA100 which strengthens the bullish scenario.

As long as price holds above 12.00 the structure remains bullish. The next confirmation level sits at 14.97. A solid close above this zone opens the path back to 18.74 and later to the extended target at 27.88 where higher timeframe liquidity is located.

Fundamentally UiPath continues to show strength as of November 29 2025. Annual revenue exceeds 1.55 billion dollars which reflects a near 15 percent year over year increase. Gross margin stays near 83 percent indicating high operational efficiency. Cash reserves are above 1.7 billion dollars which keeps the balance sheet among the strongest in the automation sector. Customer growth remains steady across banking telecommunications and public sector clients. The transition to subscription based models continues to improve the predictability of cash flows. The main risk remains sensitivity of enterprise budgets in slow economic cycles.

The reaction to the 12.00 support confirms solid demand. Holding above this zone keeps the bullish scenario active with targets at 18.74 and 27.88. If buyers reclaim 14.97 the trend could accelerate quickly.

Automation removes friction from business processes and sometimes the chart removes friction for traders. Fibonacci and MA100 hint louder than words.

Robotics

Richtech Robotics Inc. (RR) 1DRR broke the descending trendline in September 2025, followed by an impulsive upside move, and the current price action represents a corrective phase rather than a structural breakdown. Price is pulling back into a key support area where the 0.786 Fibonacci level aligns with diagonal support, the MA200 and the volume profile, making this zone technically strong and well-defined. On the monthly timeframe, indicators maintain a buy-side bias and moving averages support trend continuation, with no signs of a new downtrend forming. Fundamentally, the company remains in a growth phase, generating revenue across multiple robotics segments, paying no dividends and reinvesting cash flows into expansion, while revenue expectations for 2026 remain above current levels, consistent with a high-risk growth profile. The base scenario assumes support holding at the Fibo 0.786 zone with a continuation toward 4.85, 6.06 and 8.08, and invalidation only on a decisive break below support. The structure is already set, now the market decides the timing.

Applied Industrial Technology: Where Automation Meets RoboticsApplied Industrial Technologies delivers the automation, robotics, and industrial components that make modern industry work. From motion control to fluid power to advanced engineered systems, AIT provides the tools and expertise that help manufacturers operate faster, safer, and smarter.

AIT was founded in 1923 in Cleveland, Ohio, growing from a regional supplier into one of North America’s largest independent industrial distributors.

GreenBlue : 17/2500

GreenRed : 456/2712

Morningstar : 2 stars, Narrow moat

GuruFocus : 88/100

Competitors : GWW, FAST, WSO

ONDS:Cup & Handle Breakout | Institutional Accumulation DetectedInstitutional Accumulation Detected: ONDS is Waking Up.

We are looking at a textbook technical setup on the weekly timeframe. After a multi-year consolidation phase, ONDS has completed a massive Cup and Handle pattern. This setup offers a highly asymmetric risk/reward opportunity.

Here is the professional breakdown of why this stock is primed for a major trend reversal.

1. The Technical Thesis: "The Perfect Storm"

The Structure: The stock has spent over 24 months carving out a massive base ("The Cup"). The recent pullback was the "Handle" – a classic shakeout of weak hands before the real move.

Volume Confirmation 📊: This is the most bullish signal. The breakout is supported by massive volume bars , indicating that institutions and "Smart Money" are accumulating shares aggressively. Price confirms, but volume validates.

Trendline Support: The stock is respecting a pristine ascending trendline (Yellow Line on chart). As long as price holds above this dynamic support, the bullish trend is intact.

2. The Fundamental Catalyst

Technical breakouts rarely happen in a vacuum. The market is pricing in a major shift in ONDS's business cycle – moving from R&D to commercialization . With the growing demand for autonomous drone solutions in defense and critical infrastructure, the market is realizing that this asset is significantly undervalued relative to its growth potential.

🎯 Trade Setup & Targets

Trigger: The breakout above the $9.00 psychological level is our confirmation.

Target 1 (Conservative): $13.00 (Testing historical supply zones).

Target 2 (Pattern Projection): $18.00 - $20.00 (Measured move based on the depth of the Cup).

Stop Loss (Invalidation): A weekly close below the ascending trendline (approx $7.50 ) would invalidate the bullish thesis.

💡 Conclusion

The charts don't lie. We have Price Action + Volume + Fundamentals all aligning at the same time. This is a high-probability setup for a substantial move upward.

________________________________________

Disclaimer: This idea is for educational purposes only and does not constitute financial advice. Always manage your risk.

Can One Company Own the Ocean Floor?Kraken Robotics has emerged as a dominant force in subsea intelligence, riding three converging megatrends: the weaponization of seabed infrastructure, the global energy transition to offshore wind, and the technological obsolescence of legacy sonar systems. The company's Synthetic Aperture Sonar (SAS) technology delivers range-independent 3cm resolution, 15 times superior to conventional systems. At the same time, its pressure-tolerant SeaPower batteries solve the endurance bottleneck that has plagued autonomous underwater vehicles for decades. This technological moat, protected by 31 granted patents across 19 families, has transformed Kraken from a niche sensor manufacturer into a vertically integrated subsea intelligence platform.

The financial metamorphosis validates this strategic positioning. Q3 2025 revenue surged 60% Year-Over-Year to $31.3 million, with gross margins expanding to 59% and adjusted EBITDA growing 92% to $8.0 million. The balance sheet fortress of $126.6 million in cash, up 750% from the prior year, provides the capital to pursue a dual strategy: organic growth through NATO's Critical Undersea Infrastructure initiative and strategic acquisitions, such as the $17 million purchase of 3D at Depth, which added subsea LiDAR capabilities. The market's 1,000% re-rating since 2023 reflects not speculative excess but a fundamental recognition that Kraken controls critical infrastructure for the emerging blue economy.

Geopolitical tensions have accelerated demand, with the Nord Stream sabotage serving as an inflection point for defense procurement. NATO's Baltic Sentry mission and the alliance-wide focus on protecting 97% of internet traffic carried by undersea cables create sustained tailwinds. Kraken's technology participated in seven naval teams at REPMUS 2025, demonstrating platform-agnostic interoperability that positions it as the universal standard. Combined with exposure to the offshore wind supercycle (250 GW by 2030) and potential deep-sea mining operations valued at $177 trillion in resources, Kraken has positioned itself as the indispensable "picks and shovels" provider for multiple secular growth vectors simultaneously.

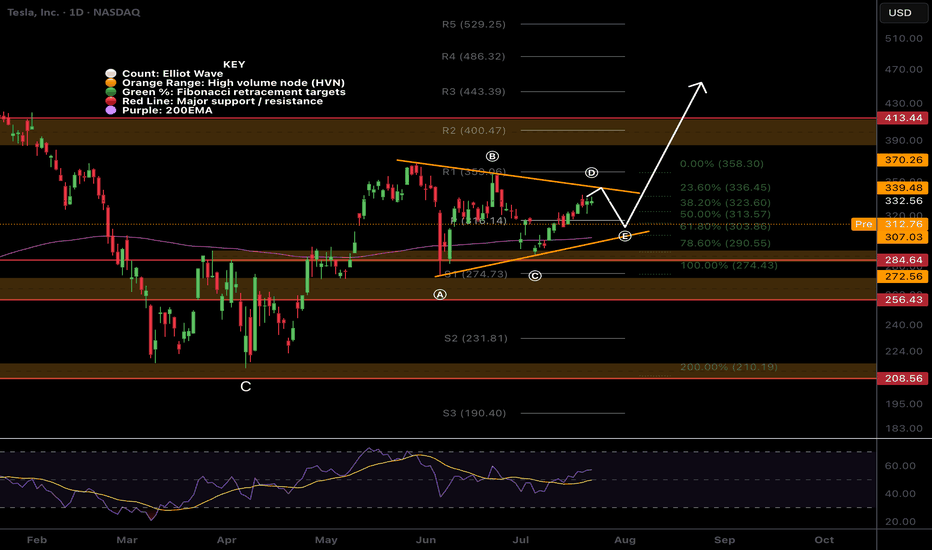

TSLA daily bullish divergenceNASDAQ:TSLA is consolidating below all-time high resistance, suggesting a breakout is coming.

Wave (2) appears complete at the High Volume Node support and 0.5 Fibonacci retracement with a bullish structre flip.

📈 Daily RSI hit oversold with bullish divergence

👉 Continued downside has a target of the daily 200EMA $362

Safe trading

Tesla preparing for all time highs?NASDAQ:TSLA Price is ranging below all all-time high, well above the weekly pivot and 200EMA, which is bullish.

Wave © of C appears to be underway into price discovery with a target of $730, the R2 weekly pivot. This is because it has been printing a series of 3 wave structures. Wave B printed a triangle, which is a pattern found before a terminal move, reinforcing the Elliot wave count.

🎯 Terminal target for the business cycle could see prices as high as $730 based on Fibonaci extensions

📈 Weekly RSI is just below overbought so has room to grow

👉 Analysis is invalidated if we close back below wave (B), $280

Safe trading

Is the Age of the Human Warehouse Over?Symbotic is no longer just a vendor; it is becoming the operating system of the industrial economy. The robotics leader saw its shares surge nearly 40% Tuesday following a fiscal fourth-quarter report that shattered expectations. With revenue hitting $618 million and system deployments doubling, Wall Street is finally waking up to a new reality. Symbotic’s entry into the $93 billion healthcare logistics market signals a structural shift. The company is transitioning from a retail solution to a critical infrastructure provider, insulating the supply chain from human volatility.

Geopolitics & Geostrategy: The Automation of Sovereignty

Symbotic’s rise is a direct play on "supply chain sovereignty." As global trade routes fracture, nations are aggressively prioritizing domestic logistics resilience. Symbotic’s technology allows the U.S. economy to maintain high-velocity distribution without relying on a fragile, shrinking labor pool. By automating the "middle mile," the company reduces exposure to demographic decline and migration policy shifts. Logistics capacity is no longer just a business metric; it is now a national security asset.

Industry Trends: The Healthcare Alpha

The partnership with Medline Industries marks a pivotal diversification moment. Healthcare logistics demands a level of precision with zero tolerance for error that general retail does not. Winning a contract with a medical supply giant validates Symbotic’s AI as "clinical grade." This move aligns with the broader "Intelligent Supply Chain" trend of 2025. Resilience and redundancy now outweigh pure just-in-time efficiency. Symbotic is positioning itself as the backbone for mission-critical distribution.

Technology & Science: Density as a Deflationary Force

Symbotic’s "Next-Generation" storage architecture is a feat of spatial physics. By reducing warehouse footprints by nearly 40%, the technology acts as a deflationary force against rising industrial real estate costs.

High-Tech Engineering: The system uses proprietary mobile bots that operate independently of specific racking, a radical departure from legacy automation.

Physics of Density: The proprietary design maximizes cubic density, allowing companies to store more inventory in smaller, cheaper spaces close to urban centers.

Macroeconomics & Economics: The Inflation Hedge

The macroeconomic thesis for Symbotic is the spread between the cost of capital and the cost of labor. Even with interest rates elevated, the long-term cost of human labor is rising faster than the cost of robot depreciation. Symbotic’s systems provide a hedge against wage inflation, offering a fixed-cost structure in an inflationary world. This creates a predictable operational expenditure model that CFOs crave in volatile economic climates.

Business Models: The "GreenBox" Evolution

Symbotic is evolving its business model from pure hardware sales to "Warehouse-as-a-Service." The company is democratizing automation, allowing diverse sectors to access enterprise-grade logistics without massive upfront complexity. This recurring revenue model creates a stickier, more predictable cash flow profile. It commands a higher valuation multiple from investors who now view the company as a software platform rather than a hardware manufacturer.

Management & Leadership: The Owner-Operator Edge

CEO Rick Cohen leads with a "three-comma" operator mindset. As the third-generation leader of C&S Wholesale Grocers, Cohen built Symbotic to solve his own problems, not just to sell a product. This "owner-operator" culture permeates the company. Their disciplined refusal to chase growth at the expense of functionality sets them apart. His focus on "monitoring speculative trading" reflects a management team focused on long-term industrial value rather than quarterly stock jukes.

Cyber & Patent Analysis: The Digital Moat

With a massive portfolio of issued and pending patents, Symbotic has built a formidable legal moat around its "structure-independent" bot technology.

Intellectual Property: The patent wall prevents competitors from easily replicating their high-density architecture.

Cyber-Physical Security: As logistics centers become digital nodes, they become targets. Symbotic’s centralized AI "brain" offers a consolidated defense point, crucial for protecting the physical flow of goods from cyber threats.

Conclusion: The Industrial Prime

Symbotic has proven it can scale beyond its largest retail patrons. The Medline deal is the "proof of concept" the market demanded. Investors are no longer buying a grocery logistics company; they are buying the premier industrial automation platform of the decade. The stock’s surge is a delayed recognition of a simple truth: in a world of labor scarcity, the robot is not a luxury; it is a necessity.

TSLA, consolidation below ATH often leads to a breakout..Tesla sentiment was very negative in April as Trump and Elon argued online causing a lot of whipsaw volatility and scaring out investors. The bottom quickly followed.

Price is ranging below all time high. Price is above the weekly pivot and 200EMA which is bullish and has momentum.

Wave © of C appears to be underway into price discovery with a target of $693 the R2 weekly pivot. This is because it has been printing a series of 3 wave structures. Wave B printed a triangle which is a pattern found before a terminal move reinforcing the Elliot wave count.

🎯 Terminal target for the business cycle could see prices as high as $690 based on weekly pivots

📈 Weekly RSI is just below oversold with no divergence and can remain here for months as price keeps increasing.

👉 Analysis is invalidated if we close back below wave (B), $280

$TSLA higher to go!Price continues towards price discovery finding resistance at the previous all time High Volume Node. Price is above the weekly pivot and 200EMA which is bullish and has momentum.

Wave © of C appears to be underway into price discovery with a target of $693 the R2 weekly pivot. This is because it has been printing a series of 3 wave structures. Wave B printed a triangle which is a pattern found before a terminal move reinforcing the Elliot wave count.

RSI is not yet overbought.

Safe trading

SYM 1D - AI with a real upgrade?Symbotic Inc. shows a clean setup: after a strong rally and breakout from a triangle, the stock is now retesting the $68–70 support zone. The 50-day moving average aligns perfectly here, strengthening the buyers’ defense.

If this level holds, the bullish structure stays intact. The first target sits around $79.50, and the second - at $97.63, matching the prior measured move. A dip below $68 could trigger a deeper pullback toward $62 before buyers regroup.

On the fundamental side, Symbotic keeps expanding its robotic warehouse automation systems - a sector still booming thanks to the AI wave. After a 100%+ rally this year, the stock deserves a coffee break before the next sprint.

Tactical plan: watch $69 carefully - if buyers defend, the uptrend continues; if not, give the robots a reboot and wait for the next entry.

Aibotics (OTC: $AIBT) Is Gearing For A Breakout- (Sponsored)The price of this AI and Robotics stock is gearing for a bullish breakout amidst breaking put from a long term falling wedge pattern.

OTC:AIBT stock has already spike almost 60% in yesterdays trading session, with the RSI at 56 Aibotics stock is poised to surge almost 3000% with increase interest in its new massage robot.

With an intraday market cap of $990k, Aibotics stock is pretty much early. Should the stock break the ceiling of the 61.5% Fib level, bullish breakout is inevitable.

About Aibotics

Aibotics Inc., together with its subsidiaries, engages in the study of psychedelics for the treatment of mental health issues in the United States.

It provides psychedelic methodologies for the treatment of palliative care, depression, and anxiety. The company was formerly known as Mycotopia Therapies, Inc. and changed its name to Aibotics Inc. in February 2025 Aibotics Inc. is based in Miami, Florida.

Serve Robotics Inc. (NASDAQ: SERV) – Bullish Setup EmergingServe Robotics NASDAQ:SERV is revolutionizing last-mile logistics with AI-powered delivery robots, offering strong exposure to the booming robotics and automation sector. The company's recent momentum and strategic partnerships signal major upside potential.

🔍 Key Drivers:

📈 Explosive Growth:

Q2 2025 revenue up 46% YoY

Deliveries jumped 80% QoQ

Clear signs of scaling and market demand

🤝 Uber Eats Partnership:

Multi-year deal to deploy 2,000 Gen3 robots in U.S. cities, including Chicago

Unlocks access to the projected $160B autonomous food delivery market by 2030

🌍 Long-Term Outlook:

Tied to ARK Invest’s $860B global robotics forecast

Targeting $60–80M annualized revenue once fully scaled

💰 Backed by Giants:

Supported by Uber and Nvidia

$167M raised in 2024 to fund expansion and AI development

📊 Trade Setup:

Bullish above: $12.00–$12.50

Upside target: $23.00–$24.00

Trend outlook: Strong momentum, backed by fundamentals and market demand

Can Kraken Robotics Dominate the Undersea Battlefield?Kraken Robotics stands at the forefront of the rapidly expanding unmanned underwater systems sector, merging technological innovation with strategic positioning. The Canadian company has built a robust competitive moat through two core technologies: its high-resolution Synthetic Aperture Sonar (SAS) and pressure-tolerant SeaPower batteries. These innovations enable superior imaging and endurance capabilities, giving Kraken a decisive edge in both defense and commercial subsea markets. By vertically integrating its components, platforms, and services, Kraken captures value across the full maritime technology spectrum, turning each innovation into a multiplier for the next.

The company's partnership with Anduril Industries, a disruptive force in modern defense technology, has become a potential game-changer. Kraken provides key sonar and energy systems for Anduril’s Dive-LD and Ghost Shark autonomous underwater vehicles, positioning itself as a strategic enabler in the race toward naval autonomy. This alliance could multiply Kraken’s revenue base several times over if Anduril scales production as planned. Yet, this same dependence also presents significant concentration risk; any delay or contract change at Anduril could sharply impact Kraken’s trajectory.

Financially, Kraken is at a critical juncture. Recent years have seen consistent double-digit revenue growth and expanding EBITDA margins, supported by strong demand for its subsea technologies. A C$115 million capital raise in 2025 strengthened its balance sheet and positioned the company for large-scale production expansion. Forward-looking models forecast revenue growth from C$128 million in 2025 to over C$850 million by 2030 in the base case, with substantial margin expansion as economies of scale take hold.

Despite its risks, operational, financial, and technological, Kraken Robotics embodies a rare pure-play exposure to the multi-decade transformation of underwater defense and exploration. For investors with the patience and tolerance for volatility, it represents a high-risk, high-reward opportunity. If the company executes on its Anduril partnership and leverages its subsea dominance effectively, it may not just participate in the next defense revolution - it could define it.

$RR - Richtech RoboticsThis one was purely a speculative scalp play, rode a nice wave over the past few weeks and now took profits. We should see a healthy pullback here.

The Q3 FY25 press coverage highlights ~$4.1M net loss for the quarter, although cash has improved. Could be a winner if you're in it for the long run, but sill unclear and currently overvalued from a value investing stand point.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.

Feel free to give us a follow and shoot us a like for more analysis updates.

Long on Warehouse AutonomationLets keep this simple.

Symbotic has supported the range of $54 multiple times. I will call the 45-54 region the supported "floor".

We saw a major tank and loss of faith for a bit due to some bad accounting.

WMT has shook hands with Symbotic to become best friends forever, with their advance systems and robotics.

www.symbotic.com

This means hundreds of Walmart Distribution centers will be fitted with an automated storage and retrieval system.

Symbotic has plans to build two sites within Mexico, further expanding its reach; which could eventually turn global.

As I see it, this is a $100 dollar value, long term hold stock. Who else is doing this besides Amazon? Amazon works internally with their own products/shipping. Walmart will never go away, and this relationship between Symbotic will continue to grow as automation begins to ramp among all fields.

Aeva Technologies (AEVA) – Pioneering Next-Gen LiDAR Company Snapshot:

Aeva NASDAQ:AEVA is revolutionizing perception systems with 4D FMCW LiDAR—offering instant velocity detection, high precision, and long-range sensing, setting a new standard for autonomous systems.

Key Catalysts:

Breakthrough Technology

AEVA’s proprietary 4D Frequency Modulated Continuous Wave (FMCW) LiDAR provides real-time velocity and depth data, outperforming traditional Time-of-Flight systems in accuracy and safety.

Automotive OEM Traction 🚗

Strategic collaborations are translating into production-stage contracts, marking a key inflection from R&D to scalable revenue generation.

Multi-Sector Expansion 🌐

AEVA’s sensing tech is penetrating robotics, aerospace, and industrial automation, significantly broadening its TAM and diversifying revenue streams.

Government & Aerospace Validation

Recent contract wins with defense and aerospace clients underscore AEVA’s technological credibility and commercial viability.

Investment Outlook:

Bullish Entry Zone: Above $22.50–$23.00

Upside Target: $39.00–$40.00, supported by production scaling, cross-sector adoption, and deep-tech differentiation.

⚙️ AEVA stands at the forefront of smart sensing innovation with strong momentum into high-growth verticals.

#AEVA #LiDAR #AutonomousVehicles #Robotics #Aerospace #IndustrialTech #SensorRevolution #4DPerception #FMCW #TechStocks #Innovation #SmartMobility

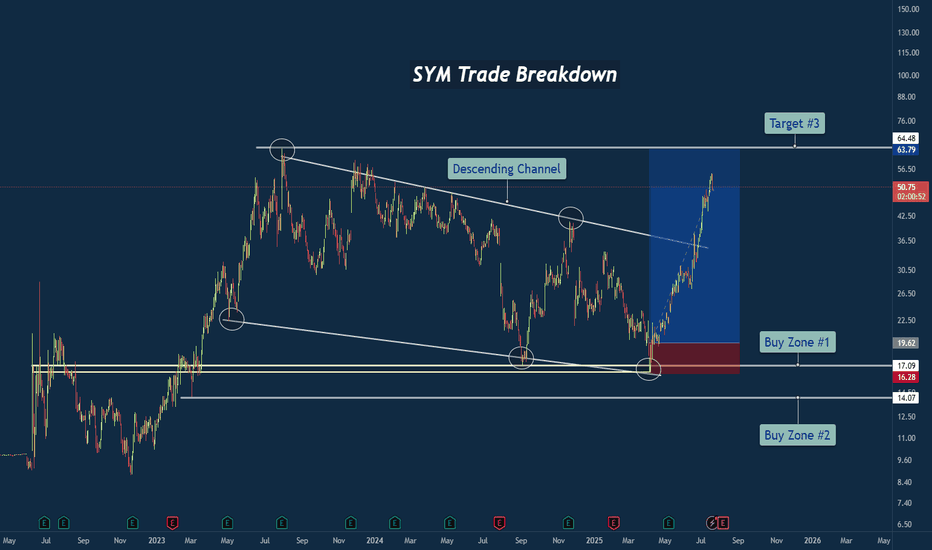

SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech