Bearish Divergence -GUN🐻 SHORT – GUN

A clear bearish divergence has formed on the 1H chart, while the 4H timeframe is distinctly overbought, signaling momentum exhaustion. This is a setup I strongly favor: stretched price, weakening momentum, and elevated risk of a swift sell-off.

🎯 TP: 0.01405

🛡️ SL: 0.02857

📊 RR: 1 : 5.82

A high-quality short: HTF overbought + bearish divergence → strong downside potential with attractive risk–reward.

Scalptrading

US500 Long Setup – Inverse H&S + Key Support📈 US500 Long Setup – Inverse H&S + Key Support

The US500 4H chart is shaping up for a bullish continuation, with multiple technical signals aligning. Price has recently formed a potential inverse head and shoulders pattern, suggesting a reversal from the recent downtrend. With Break of Structure (BOS) confirmed and price holding above the Support Level at 6914.4, bulls are gaining control.

🟢 Trade Setup Details

- Support Level: 6914.4

- Key Levels to Watch: 6895.4 and 6824.8

- Maximum Stop Loss: 6868.2

- Take Profit Targets:

- 🎯 TP1: 6962.1

- 🎯 TP2: 6971.7

The current price action around 6925.9 shows strength, with volume supporting the bullish breakout.

🔍 Technical Highlights

- Two Break of Structure (BOS) points confirm bullish momentum.

- The inverse head and shoulders pattern adds confluence to the long bias.

- Price is holding above key support and reclaiming higher ground.

- Volume shows increasing interest on bullish candles, suggesting accumulation.

📈 Bullish Scenario

If price continues to hold above 6914.4, we could see a push toward TP1 and TP2. Watch for:

- Retest of neckline with bullish confirmation

- Momentum indicators crossing into bullish territory

- Volume spike on breakout above 6930–6940

⚠️ Risk Management

- SL below 6868.2 protects against invalidation of the inverse H&S pattern.

- Consider scaling out at TP1 and TP2 to lock in gains.

- Avoid chasing if price moves too far—wait for pullbacks or confirmation candles.

💡 Summary: US500 is showing a textbook bullish reversal setup, with inverse head and shoulders, Break of Structure, and strong support at 6914.4. With layered TP targets and a tight SL, this trade offers a clean structure and solid risk/reward.

🚀 Whether you're trading the breakout or riding the momentum toward 6970+, this setup deserves your attention.

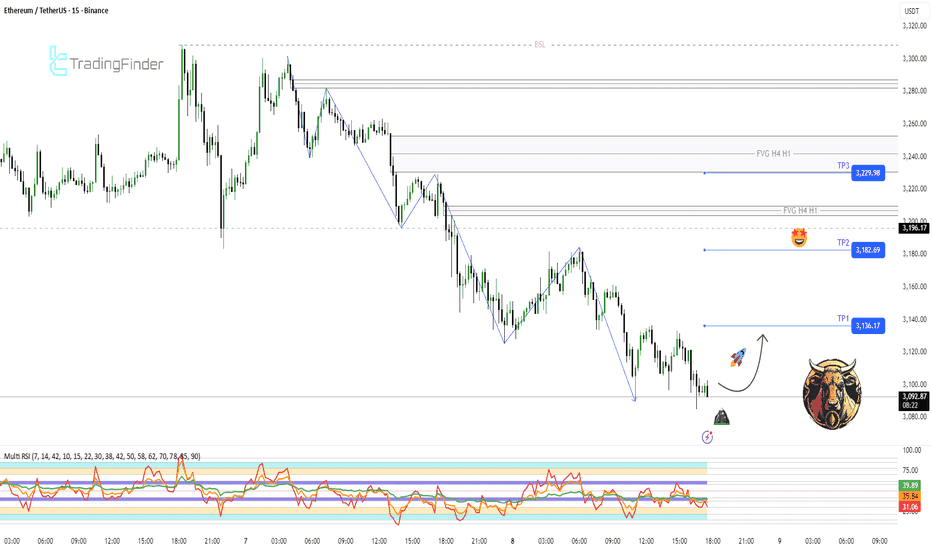

ETH M15 RSI Exhaustion and Mean Reversion Bounce Setup📝 Description

After a clear bearish leg, ETH has swept sell-side liquidity below recent lows and is now consolidating in a discount zone. The downside move looks liquidity-driven and corrective, not continuation. Price reaction at the lows suggests seller exhaustion and a short-term reversal potential.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish (Mean Reversion)

Preferred Setup:

• Entry: 3,090

• Stop Loss: Below 3,070

• TP1: 3,136

• TP2: 3,182

• TP3: 3,230

________________________________________

🎯 ICT & SMC Notes

• Clean SSL sweep of prior lows

• Price trading in HTF discount

• H4/H1 FVGs acting as upside magnets

________________________________________

🧩 Summary

Given the RSI condition and decreasing sell pressure, a short-term bullish reaction is expected. Risk management around the current low is key, and continuation depends on price reaction at higher PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

With no major high-impact news ahead, the market is mainly driven by technical flows. This environment supports a short-term technical bounce based on RSI and liquidity behavior.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

SOLUSD: Deciphering the Neutral Zone with Intrabar⚠️ ANALYTICAL METHODOLOGY: READ FIRST ⚠️

This analysis utilizes a 100% VOLUME-BASED ALGORITHM powered by Lower Timeframe (LTF) intrabar data . unlike standard Price Action, we are scanning the internal structure of every candle to pinpoint liquidity.

📊 DATA PRECISION USED:

For this specific SOL/USD reading, the system is running on 1S (1-Second) data resolution. This ensures that the Support/Resistance zones shown below are derived from real-time volume distribution, not just visual highs and lows.

💡 WHY THIS MATTERS:

Standard charts hide the battle between buyers and sellers. By using intrabar volume geometry, we filter out the noise and only focus on where the "Smart Money" is actually defending positions.

SOLUSD: Trapped in the "Dead Center" Liquidity Void 📉

Most traders guess where the breakout will happen. The math suggests we are currently in a "No-Trade Zone."

Using the DSRTL-ML engine, we have identified a "Neutral / Choppy" regime (S3-D3 State).The price is literally sitting in the dead center of the structure, sandwiched between dynamic buying and selling pressure.

1. The Structural Squeeze

The market is compressing. We are seeing a classic "Energy Build-up."

The algorithm flags this area as Low Probability for trend setups. Why? Because we are far from the "Iron Floor" (Value) and equally far from the "Iron Fortress" .

📐 CRITICAL LIQUIDITY LEVELS:

Static Resistance (Supply Wall):

Dynamic Control Zone (Immediate Cap):

Static Support (Demand Floor):

2. Order Flow & Delta Divergence

Total Volume: 43.24K

Net Delta: -10.45K (Sellers Dominant)

The Trap: Although price is trading ABOVE the Point of Control (POC at 133.08), the negative Delta indicates that every small rally is being sold into. The buyers are not aggressive here; they are merely absorbing. This divergence often precedes a liquidity flush or a fake-out.

🧠 The Smart Play (Scenario Logic)

We do not predict; we react to confirmed structure breaches.

🐂 Bull Confirmation: Price must reclaim 142.69 with positive Delta to prove buyers have absorbed the supply.

🐻 Bear Confirmation: A loss of the dynamic floor at 135.95 validates the negative delta and likely targets the 131.00 demand zone.

Current Verdict: Patience. Let the liquidity reveal its hand before committing capital.

⚠️ DISCLAIMER:

This reading is generated entirely by the algorithmic calculations and outputs of DSRTL-ML; it is absolutely NOT financial advice . Always Do Your Own Research (DYOR).

⏱️ REAL-TIME DATA SNAPSHOT:

Please note that the Volume, Delta, and Level figures presented below are captured at the exact moment of analysis . Since the DSRTL-ML algorithm processes live intrabar ticks in real-time, these numbers will naturally evolve and update on your chart as new market activity occurs from the time of writing to publication.

Strong bearish divergences All Time - RIVER🐻 SHORT – RIVER

RIVER is severely overbought across all timeframes. Strong bearish divergences are present on 15m, 1H, 4H, and 1D, with the 1H setup being exceptionally rare, signaling extreme momentum exhaustion. Price is attempting to push higher in an unnatural manner, which often precedes a sharp and rapid sell-off.

🎯 TP: 3.7

🛡️ SL: 15.79

📊 RR: 1 : 9

A high-risk, high-reward short: multi-timeframe overbought + broad bearish divergence → elevated probability of a fast downside move.

Strong bearish divergence - RIVER🐻 SHORT – RIVER

Strong bearish divergence is confirmed across 15m, 4H, and 1D, while RSI shows extreme overbought conditions on all these timeframes. Price has expanded aggressively, signaling momentum exhaustion and a structurally unhealthy move. With multi-timeframe confluence, the probability of a sharp mean reversion and sell-off is high.

🎯 TP: 3.986

🛡️ SL: 11.607

📊 RR: 1 : 6.42

A textbook short setup: multi-timeframe divergence + extreme overbought → high downside potential with asymmetric reward.

Extreme Bearsish Divergence - LIGHT🐻 SHORT – LIGHT

LIGHT is showing clear overbought conditions across multiple timeframes. On the 1H chart, the combination of extreme overbought RSI and a rare bearish divergence signals momentum exhaustion. Price is rising and holding in an unnatural, unstable manner, which significantly increases the risk of a sharp sell-off.

🎯 TP: 0.2881

🛡️ SL: 2.5894

📊 RR: 1 : 6.5

A high-conviction short setup: multi-timeframe overbought + strong bearish divergence → elevated probability of a fast downside move.

Corrective pullsback - XPL🐻 SHORT – XPL

Price is facing a major resistance on the 4H timeframe, while RSI is strongly overbought on 15m, signaling short-term exhaustion. This technical alignment suggests a necessary corrective pullback before any further upside. Momentum is weakening near resistance, increasing the probability of rejection.

🎯 TP: 0.1619

🛡️ SL: 0.1809

📊 RR: 1 : 2.2

A clean short setup: higher-timeframe resistance + lower-timeframe overbought → controlled correction with defined risk.

Bearish Divergence - PIERVESE🐻 SHORT – PIEVERSE

Strong bearish divergence is forming on the 15M timeframe, while RSI remains heavily overbought on both the 1H and 4H charts. Price has extended far beyond fair value, signaling exhaustion and an unhealthy rally. This multi-timeframe confluence significantly increases the probability of a sharp sell-off.

🎯 TP: 0.4867

🛡️ SL: 0.7005

📊 RR: 1 : 7.15

A high-conviction short: multi-timeframe overbought conditions + bearish divergence → elevated reversal risk with asymmetric reward.

Bullish – SQD🐂 LONG – SQD

Price is accelerating on the 15m timeframe, accompanied by a clear expansion in trading volume—confirming strong short-term buying pressure. On the 1h timeframe, this move still appears to be a healthy pullback within a broader structure rather than a distribution phase. As long as price holds this level, the probability of a momentum continuation to the upside remains high.

This setup reflects a classic pullback + volume expansion scenario, where buyers are stepping in early ahead of the next impulsive leg.

🎯 TP: 0.0934

🛡️ SL: 0.05463

📊 RR: 1 : 7.58

A high-RR momentum long: intraday strength + higher-timeframe structure support → asymmetric upside potential.

Breakout - XPIN🐂 LONG – XPIN

XPIN has broken out of its short-term downtrend on the 15M timeframe, confirmed by a bullish pin bar rejection. Buying pressure is accelerating, signaling a clear shift in momentum from sellers to buyers. This price action suggests growing demand and sets the stage for a continuation push to the upside.

The setup fits a trend-break + bullish pin bar + momentum expansion profile, suitable for a tactical long.

🎯 TP: 0.0027

🛡️ SL: 0.002317

📊 RR: 1 : 2.66

A clean momentum long: trend break confirmed, buyers in control, risk well-defined.

Bullish - LSK🐂 LONG – LSK

LSK has decisively broken out of its prior downtrend and successfully completed a retest on the 1H timeframe, confirming a valid trend shift. Volume has been steadily accumulating across previous candles, indicating institutional participation and strong absorption at support. This structure favors a continuation move to the upside as bullish momentum builds.

The setup aligns with a breakout–retest + volume accumulation model, offering a clean long with controlled risk.

🎯 TP: 0.2434

🛡️ SL: 0.19

📊 RR: 1 : 3

A disciplined trend-reversal long: structure confirmation + volume support → favorable continuation odds.

BIG PUMP - POWER🐂 LONG – POWER

Price is accelerating strongly on the 15m timeframe, supported by a clear expansion in trading volume—confirming aggressive buyer participation. This combination of momentum + volume often precedes an impulsive continuation move. The structure suggests accumulation has completed and POWER is entering a markup phase, with a high probability of a sharp upside expansion.

🎯 TP: 0.41229

🛡️ SL: 0.21291

📊 RR: 1 : 5.3

A momentum-driven long setup: rising price + volume confirmation → strong upside potential with attractive risk–reward.

Bearish Divergence - ZBT🐻 SHORT – ZBT

A strong bearish divergence is confirmed on the 15m timeframe, while price remains overbought on both the 1H and 4H charts—most notably the 4H RSI reaching 95. This overextended rally signals momentum exhaustion. Such an unhealthy structure typically precedes distribution and a sharp sell-off. I am confident in a downside move.

🎯 TP: 0.0743

🛡️ SL: 0.1646

📊 RR: 1 : 5.35

A high-quality short setup: multi-timeframe overbought conditions + bearish divergence → elevated probability of a strong correction.

Scalp SHORT – CC🐻 Scalp SHORT – CC

One of my favorite setups. Strong bearish divergence is confirmed on both the 15m and 1h timeframes after an excessive price expansion into overbought territory. Price is now trading below a major resistance, with repeated upper wicks signaling rejection and failed breakout attempts. This unhealthy structure suggests distribution is underway, increasing the probability of a sharp sell-off.

🎯 TP: 0.08461

🛡️ SL: 0.11983

📊 RR: 1 : 5

A high-quality short setup: multi-timeframe bearish divergence + strong resistance rejection → asymmetric downside potential.

Scalp SHORT – NIGHT🐻 Scalp SHORT – NIGHT

This is one of my preferred setups. Hidden bearish divergence is confirmed on the 15m timeframe, while the 1h RSI has reached extreme conditions, signaling exhaustion. After a sharp and extended drop in LIGHT, NIGHT is likely to follow a similar path. The recent aggressive price expansion has pushed the market into an unhealthy overbought state, increasing the probability of distribution and a sharp sell-off.

🎯 TP: 0.07392

🛡️ SL: 0.1215

📊 RR: 1 : 3.82

A clean short setup: divergence + overextension + momentum exhaustion → high probability of downside continuation.

Scalp SHORT – LIGHT🐻 Scalp SHORT – LIGHT

A textbook setup: a strong bearish divergence on the 15-minute timeframe while price has accelerated excessively into overbought territory. This parabolic advance reflects unhealthy price action and weakening momentum, a classic precursor to a sharp distribution phase. Probability favors a downside correction.

🎯 TP: 1.409

🛡️ SL: 3.28

📊 RR: 1 : 3.7

A clean short thesis: 15m bearish divergence + extreme overbought conditions → elevated risk of a sell-off with favorable risk-to-reward.

Scalp SHORT – FHE🐻 Scalp SHORT – FHE

The bullish structure has been decisively broken. Price is now trading within a clear descending channel, confirming a shift in market structure. RSI is rolling over into bearish territory, indicating increasing downside momentum and seller control. The technical context favors continuation to the downside rather than a recovery.

🎯 TP: 0.01596

🛡️ SL: 0.05016

📊 RR: 1 : 2.58

A clean short setup: structure breakdown + bearish channel + RSI weakness → downside continuation favored.

Scalp LONG – SUN🐂 Scalp LONG – SUN

SUN is deeply oversold on the 1h timeframe, signaling exhaustion on the sell side. Price action is compressing and approaching a classic breakout structure, suggesting momentum is building for a sharp upside expansion. A strong bullish breakout is anticipated.

🎯 TP: 0.02088

🛡️ SL: 0.01993

📊 RR: 1 : 3.75

A high-quality long setup: 1h oversold conditions + breakout structure → strong rebound potential with attractive risk-to-reward.

Scalp SHORT – FOLK🐻 Scalp SHORT – FOLK

Price is extremely overbought across all lower timeframes, with the 4h RSI reaching as high as 95 — a clear sign of excessive euphoria. A strong bearish divergence has formed on the 15m chart, indicating weakening momentum and a high probability of a pullback.

🎯 TP: 15.66

🛡️ SL: 40

📊 RR: 1 : 3.07

A clean short setup: multi-timeframe overbought conditions combined with bearish divergence → elevated correction risk and favorable risk-to-reward.

Scalp SHORT – FHE🐻 Scalp SHORT – FHE

“The market climbs the stairs but takes the elevator down” perfectly reflects FHE’s current structure.

The price is heavily overbought across all timeframes, with extremely strong bearish divergences appearing simultaneously on the 15m, 1h, and 4h charts — signaling exhausted buying pressure and a high risk of reversal. Price action also shows fading bullish momentum, suggesting that a deep correction is likely.

🎯 TP: 0.016

🛡️ SL: 0.05129

📊 RR: 1 : 5.06

A textbook short setup: multi-timeframe overbought conditions + confluence of strong bearish divergences → high probability of reversal with an attractive profit margin.