forexTrdr EURGBP - ASCENDING CHANNEL + OVERSOLD Morning traders,

Easy to read pattern on our Euro British Pound trading view chart with an ascending channel showing both support and resistance on multiple occasions since the start of August. We are looking to enter a long here for the Euro to strengthen up towards 0.933 area and potentially break out above depending on Brexit headlines at the time of meeting resistance. Our stop loss has been set just below the support line we have highlighted. Should the pair drop below that support level then the trade is nullified and the pattern is no longer relevant.

We entered at this area due to the overnight bounce in British Pound and this pair looking oversold on stochatsics.

Short and simple

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms.

If you want a free 30 day trial of our signals please get in touch.

Good luck trading

from the Team at forexTrdr

Search in ideas for "FOREX"

forexTrdr AUDUSD - CHANNEL VISION Afternoon traders

With the ECB press conference now complete the market is now cleaner to enter other trades. In this case we are looking to get long Aussie Dollar versus US dollar after the pair have settled in oversold levels at support price of 0.6970 area. As per our chart work on trading view we have an ascending channel which is allowing us to set up for a great risk reward trade with stop loss just below the rising support and an upside potential towards 0.712 area as per our predicted bar chart work.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms. Or if you want a free one month signals trial with us please get in touch.

Good luck trading

from the Team at forexTrdr

forexTrdr GBPAUD - RESISTANCE MEETS DESCENDING CHANNEL Morning traders,

Waking up to Thursday morning ECB day with a great short setup in British Pound versus Australian dollar. What we have is a descending channel being touched at the same time as the pair meets a resistance level to the upside around the psychological price point of 1.79. Compounding the trade is that as this is occuring the pair is reaching overbought levels on RSI indicator and Stochastic which is crossing over pointing to a move to the downside. Given then clear descending channel we have highlighted on our trading view chart we can see upside on this short of up to 250 pips into the high 1.76 area.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms. Or if you want a free one month signals trial with us please get in touch.

Good luck trading

from the Team at forexTrdr

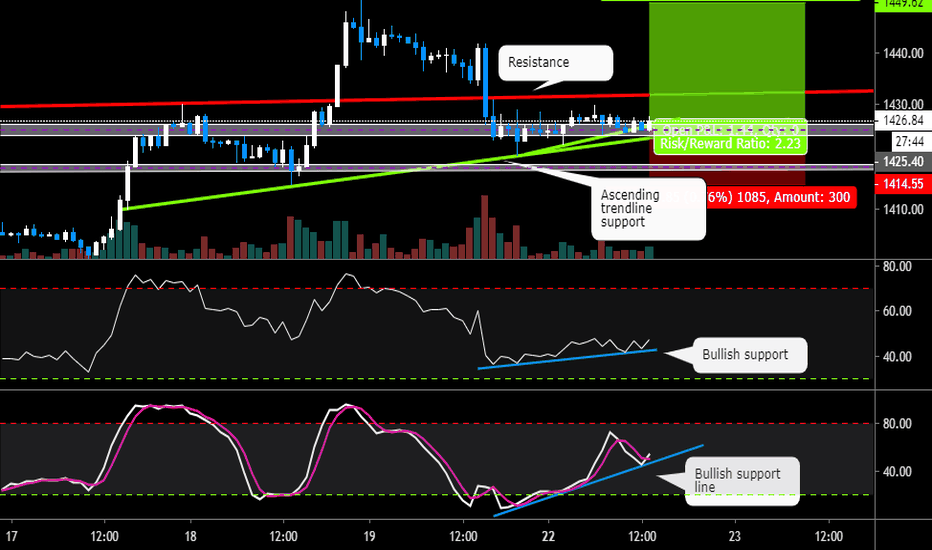

forexTrdr XAUUSD GOLD- SUPPORT SUPPORT SUPPORTAfternoon traders,

We are looking at Gold this afternoon which is looking setup for a move back towards 1440 area with multiple support levels coming into play.

As we have highlighted with our trading view chart we have two strands of an ascending support line from the 17th which has been tested on 3 occasions leading to higher lows pattern being formed. Off this longer ascending line a second branch has formed from the open overnight creating a new support branch which has also been tested on 3 occasions.

To the upside we have some resistance around 1432 highlighted in red which is where the upper bound of the channel would be prior to last weeks move up and then back down to within the channel.

Additionally we have similar bullish support structures in play on both RSI and stochastics forming higher lows.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms . Or if you want a free one month signals trial with us please get in touch.

Good luck trading

from the Team at forexTrdr

forexTrdr GBPAUD- DOUBLE BOTTOM BOUNCE?Morning traders,

On back of Aussie central bank again we have another interesting opportunity- this time in British Pound versus Aussie dollar with the pair forming a double bottom. The pair has fallen to current support levels as per our trading view chart and is allowing for a good risk to reward setup should the pair bounce and remain in the current trend channel as highlighted.

Both price patterns, resistance and support, RSI and stochastics all point to this being a good entry point for a long trade on GBP vs AUD more on Aussie dollar weakness than any GBP strength.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr AUSUSD - SHORT PLAY ON DESCENDING CHANNELMorning traders,

Overnight we had the Australian central bank cut interest rates as expected by the market and they also indicated that they were "one and done" for the time being which lead to Aussie dollar rallying overnight to the top of the descending channel highlighted in our tradingview chart.

At the same time we have the spike higher meeting an area of resistance highlighted around 0.6980 to 0.70 and both RSI and stochastics also lining up to show the pair are in extreme overbought areas on 4 hourly with stochastics already rolling over to head lower.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefing

forexTrdr USDCHF- RESISTANCE TO PERSIST?Good morning traders,

Clean setup on US dollar versus Swiss Franc with strong resistance levels keeping this pair in check and forcing it lower towards 100. Our trading view chart has highlighted the key support and resistance levels at play for this pair.

We tested resistance levels again around 1.008 to 1.01 last week before pulling back and we are now looking for the pair to head lower within the range band down to low 1.00 before breaking out sub 1.00.

On top of price action we have RSI finding resistance to moving higher and Stochastic turning lower pointing to a near term move lower. All of this adds as a back up to our view that safe havens are likely to remain bid over the coming weeks as China and US trade talks show no sign of a near term positive outcome.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr GBPAUD - LESS ABOUT THE TECHS MORE ABOUT POLITICSAfternoon traders,

British Pound breaking below support levels highlighted on our chart versus Aussie Dollar just as we head into a weekend of results on European Elections and the likely demise of May who many political commentators are suggesting will be out by Monday. Meanwhile pro Brexit Boris Johnson is gathering support among MPs which the market will take to increased chance of hard Brexit.

As per our trading view chart we are looking for a break into the lower trading channel and down to 1.818-1.82.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURUSD - LOWER HIGH DOWNTREND CONTINUEMorning traders,

Back into the market after a long weekend in both U.K. and U.S. and we are looking at the continued downtrend of Euro versus US dollar.

A series of lower highs continues to form with support around 1.11 area providing a short opportunity of 90 pips. We also have the formation of an Evening star candle or tweezer top if looking on longer time frames. Both point to a bearish pattern forming.

Additionally we have heightened tension with Italian government and the EU likely to add negative headlines over the coming trading week.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr AUDCAD LOOKING INTERESTING AT SUPPORTAfternoon traders,

Looking at Aussie dollar versus Canadian dollar as it trades around support levels from early March whilst matching up with extreme oversold levels on both RSI and stochastics.

Additionally the move lower appears to be running out stream here both on volume and on price action with the pair sticking in a 30pip range for the past 24 hours.

Our trading view chart should explain our view perhaps better than our description here. We are very mindful of the risk of Trump hitting twitter again with further hard ball talk around China and so we are positioning our lot sizes accordingly.

As always we try to keep our analysis clean and easy for anyone to be able to follow but should you want to learn more then please do get in touch.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr USDJPY- TOPPY TOPPY YEN- EXPIRY SEASONGood morning traders,

And welcome to a new week- our recent tradingview charts were unfortunately removed due to us breaking house rules of including our website in the title. So we are reposting this US dollar Japanese Yen setup from Friday which is still live. Friday was an extremely technical day with option expiry's driving Yen pricing into the end of the Asian trading week and Tokyo close and then keeping the pair on a short leash into the actual expiry deadline in early New York trading.

We have a toppy setup forming in US dollar versus Japanese Yen as the pair approach the top of their recent trend of 109 to 112. We are looking to enter a short trade here with multiple technicals lining up to confirm the naked trading view that the market should head lower after reaching resistance area at the top of the recent range.

Our TradingView charts show the resistance and support levels highlighted in purple along with various technical indicators backing up our view. Slow stochastics are at extreme levels and starting to turn lower on shorter time frames, RSI looks overbought and Bollinger bands are at the top of the range.

There is a large option expiry of around 1bn at 112 area which will expired on Friday afternoon helping the pair close above 112 on the daily but at overstretched levels points to a retreat lower as option technicals diminish.

Good luck trading

Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURCAD- ALL OF THE LIGHTS LINING UPGood morning traders,

And welcome to a new week- our recent tradingview charts were unfortunately removed due to us breaking house rules of including our website in the title. So we are reposting this Euro Canadian Dollar setup from Friday which is still live.

Looking at short setup on Euro versus Canadian dollar as multiple technical indicators line up to show this pair in overstretched, over bought territory oddly as oil continues to rally today (in Canadas favour) and Draghi reiterated the potential for using more instruments for forms of Quantitative Easing at yesterdays ECB central bank meeting.

On technicals front we have overbought levels on RSI , top of the range levels on stochastic and bollinger bands.

Quick simple technical indicator driven trade.

Good luck trading

Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

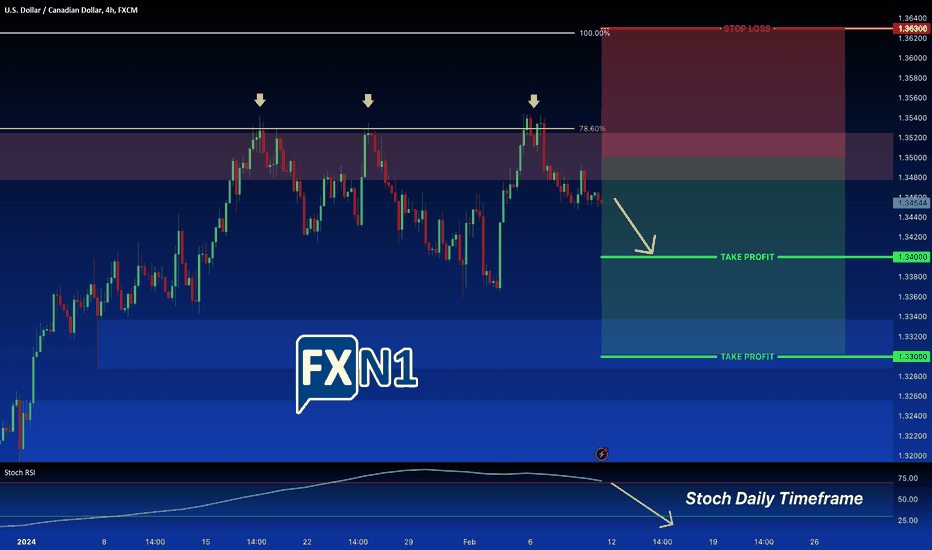

USD/CAD: CAD's Employment Change Impact on Forex MarketsAmidst the ongoing battle between the Canadian dollar (CAD) and the US dollar (USD), investors brace themselves for the impact of Canada's Employment Change economic data release. The fluctuating economic landscape, coupled with the performance of the US economy, adds layers of complexity to currency trading strategies.

With the recent news of lower-than-expected US Initial Jobless Claims bolstering the USD, attention now turns to Canada's economic docket, particularly the upcoming labor and wages figures scheduled for release on Friday. Anticipation looms as market forecasts hint at a potential uptick in the Canadian January Unemployment Rate, alongside a modest Net Change in Employment for January.

Forecasts project a noteworthy CAD Employment Change of Plus 16.0K Positions, an essential economic indicator that holds significant sway over market sentiment. As a leading indicator of consumer spending, job creation serves as a vital barometer for overall economic health, particularly in the Canadian context where consumer spending dominates economic activity.

From a technical standpoint, traders are closely monitoring the CAD's performance against the USD. Recent sessions have seen the CAD exhibiting strength, marked by a rebound from the 78% Fibonacci level. With entry points set at 1.35000, traders are positioned for further downside movement, capitalizing on the CAD's resilience against its US counterpart.

As market participants await the release of crucial economic data, the intricate dance between the CAD and USD continues to unfold. The outcome of Canada's labor figures will undoubtedly influence market dynamics, offering valuable insights into future currency movements. Amidst this uncertainty, traders remain vigilant, poised to navigate the ever-changing forex landscape with prudence and foresight.

Forex Swift IndicatorForex Swift Indicator with TP & SL for Buy and Sell

Overview:

The Forex Swift Trading Indicator is a robust tool designed for traders seeking precise buy and sell signals in the forex market. By leveraging the crossover of moving averages, this indicator provides actionable insights along with clearly defined take profit (TP) and stop loss (SL) levels to optimize trading strategies.

Key Features:

1- Moving Average Crossover Strategy

2- Take Profit and Stop Loss Levels:

.Up to five customizable TP levels for both Buy and Sell signals.

.Dedicated SL level for effective risk management.

3- Visual Alerts and Labels:

.Displays signals with clear "Buy" and "Sell" markers on the chart.

.Labels entry, TP, and SL levels directly on the chart for easy reference.

4- Alerts Integration:

.Alerts notify you of key buy or sell opportunities, ensuring you never miss a trade.

5- How to Use:

.Use the Buy Signal to enter long positions with TP levels for profit-taking and SL for risk

management.

.Use the Sell Signal to enter short positions with similar TP and SL configurations.

.Customize settings to align with your trading style and objectives.

6- Perfect for:

.Forex traders looking for a systematic approach to market entries and exits.

.Scalpers and swing traders who value precision in take profit and stop loss strategies.

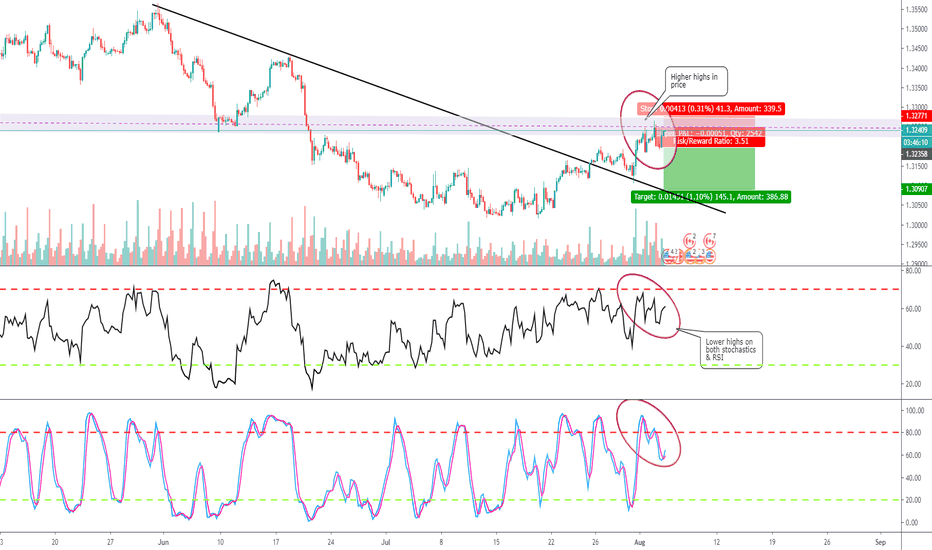

forexTrdr USDCAD - BEARISH DIVERGENCEMorning traders

New week and we are looking at a new bearish divergence setup showing up on US dollar versus Canadian dollar on the 4 hourly charts with new highs on prices being met with a combination of lower highs on both RSI and stochastics pointing to a bearish divergence and a likely fall in prices over the coming trading session.

Looking to trade this setup with a tight stop loss above just above the last high should this be a false divergence signal.

Short and simple

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms.

If you want a free 30 day trial of our signals please get in touch.

Good luck trading

from the Team at forexTrdr

forexTrdr USDCAD OVERBOUGHT + RESISTANCEMorning,

Quick trade on US dollar Canadian dollar looking for a breakout lower back towards low 1.31 area into tomorrows Fed meeting where market is expecting a rate cut. Pair are looking overbought on hourly whilst we have had a serious of three lower highs and the psychological level 1.32 was tested as a spike/wick but failed to break higher or hold near.

Trading on a tight stop loss should this pair move higher and break out of lower highs pattern.

Clean, simple tight trade

forexTrdr CADJPY- CHASING THE SUPPORT CHANNELMorning traders,

Re entering our Canadian dollar Japanese Yen long trade as the bullish price pattern continues to play out. Last week we traded it up to our take profit 1 before cashing out and now we are looking to re enter at todays pull back level. As per our trading view chart we have an ascending channel which has been tested multiple times and should the support line hold we could be looking at a retest of prices around 84. This is around a 3x risk reward setup.

Additionally on the lower panels we had the RSI forming higher highs as the price point should lower lows- a bullish signal and why we entered the trade last week and continue to look to re enter today.

any questions just let us know

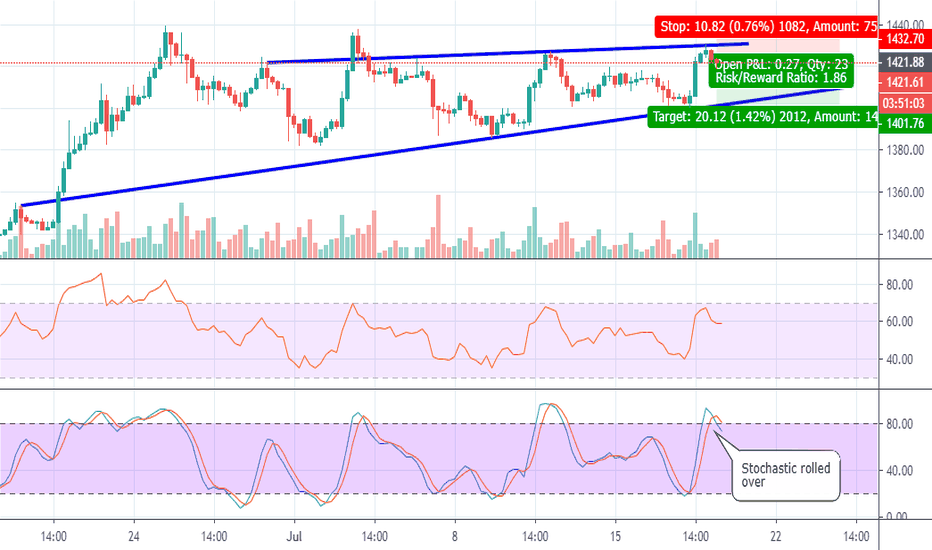

forexTrdr Gold XAUUSD CHANNEL PLAY Morning traders,

Quick look at the setup on Gold which trades under ticker XAUUSD, the pair are trading at the top end of its upward sloping channel with a range of 1430 at the top and 1400 to towards the bottom. The pair yesterday spiked to the top of the channel on Ray Dalios latest macro outlook suggesting the market should be buying gold long term.

Since then overnight the pair are off the highs and trending lower pointing to a move back within the channel towards 1415 and below. This view of a pull back is compounded by the rsi channel and stochastics crossing over and turning lower as per our trading view chart work.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms.

Good luck trading

from the Team at forexTrdr

forexTrdr GBPAUD - MULTIPLE TAPS ON ASCENDING TRENDLINE HIGHERMorning traders

We have a clean simple trade setup on long British Pound versus Australian dollar with an ascending trendline holding after multiple taps since the start of July following a Bullish Engulfing line on the daily at end of month.

Additionally we have an ascending support on RSI and a crossover on Stochastics pointing to the support line once again holding and the pattern continuing towards high 1.80 area as the higher high and higher low pattern continues.

We are offering more 4 months free signals if you sign up via the details on our profile

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms.

Good luck trading

from the Team at forexTrdr

forexTrdr GBPUSD- BREAK LOWER TO 1.25 ON THE CARDSMorning traders

British Pound versus US dollar looks set for a break lower to low to mid 1.25s over the next week. The just announced PMI data coming in below expectations and a hardening of stance from Jeremy Hunt on EU trade deal where he suggested he may withhold some of the £38 billion funds that the EU is looking for is bearish for British Pound. The positive rhetoric on a trade deal from US and China yesterday has helped the US dollar find strength which we expect to continue versus British Pound in the coming weeks.

We have also highlighted the relevant fibonacci and support and resistance zones that are coming into play on our trading view chart.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Meta trader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings