EUR/USD eyes bullish breakout

The EUR/USD chart looks like it is about to stage a bullish breakout, despite the political situation in France where the government looks like it is about to collapse. The pair has been consolidating inside a triangle pattern for several days now, holding its overall bullish structure. Following a negative dollar reaction to the NFP data on Friday, that may well have been the fundamental trigger which is why they are largely ignoring the likely loss of confidence vote for French PM.

In terms of levels to watch, short-term support now comes in 1.1700, a prior resistance level. Below that, the next zone is situated around the 1.1560-1.1620 area. Below that rage, 1.1500 is the next key support that will need to hold to keep the bulls happy and still interested.

On the upside, resistance around 1.1700 has now been taken out. This is also where the short-term resistance trend was situated - now broken. If we can hold the breakout, the next logical target is the July high of 1.1830.

Eventually, the focus will then turn to the next psychologically important 1.20 handle should the macro backdrop continues to favour a bullish EUR/USD forecast. Only a strong US CPI report this week, and a hot set of PPI data, could change that. I don’t think the ECB will be dovish enough to send the euro tumbling.

By Fawad Razaqzada, market analyst with FOREX.com

Search in ideas for "FOREX"

USD/JPY in focus as ADP disappointsThe USD/JPY has tested the 200-day average twice in as many days and has failed to break above it on both occasions. With resistance around the 148.50-149.00 area holding, could we see a break lower in the coming days?

Well, a lot now depends on data. The ADP private payrolls report has missed the mark at just 54K vs. 73K expected. Shortly, we will get more updates on the jobs market with the release of weekly unemployment claims and the employment component of the ISM Services PMI. Friday’s non-farm payrolls report will be quite important in as far as expectations for the Fed’s future policy is concerned.

What the UJ bears would want to see now is some downside follow-through below Wednesday's inverted hammer candle. So far, we haven't had any downside but if rates turned lower again then that could mark the start of a major shift.

By Fawad Razaqzada, market analyst with FOREX.com

EUR/USD eyes rebound ahead of Powell speechThe euro has come under mild pressure in recent days, weighed down by the dollar’s rebound and the lack of progress on Ukraine. Today’s spotlight is firmly on Powell. If he manages to steer market expectations back toward a coin-flip for a September rate cut, EUR/USD could slip towards the 1.1500 support zone — a key level that i think is unlikely to give way in the near term.

However, a clear shift in Powell’s tone toward the dovish side could lift EUR/USD back into the 1.18s, eventually opening the path towards 1.20.

Over the longer run, the outlook for the euro remains constructive. The ECB is largely finished with rate cuts, while Germany is rolling out a sizeable fiscal programme. Although the stimulus may only begin to show modest results later this year, its full impact is expected to become more meaningful in 2026 and beyond.

By Fawad Razaqzada, market analyst with FOREX.com

CAD/JPY in focus ahead of Canadian inflation data

Canada publishes its July inflation numbers shortly. The market’s looking for 0.3% MoM on the headline CPI. Median measure of CPI is expected to hold around 3.1% y/y with trimmed CPI seen steady at 3.0%.

Numbers lower than those would likely support the idea that the Bank of Canada will resume cutting before long, especially because growth risks are piling up. Only 15bp of easing is priced for October, with a full cut not seen until January. Weakening activity and labour markets at home, coupled with Fed potentially easing in September, could well force the BoC’s hand. A move in October would become more likely if data rolls over.

The CAD/JPY is an interesting CAD pair to watch given that it has recently broken a bullish trend line. Key resistance that now needs to hold is between 107.20 to 107.50 (shaded on the chart). However, it would be a bullish scenario if rates were to climb above this zone and reclaim the broken trend line.

By Fawad Razaqzadam market analyst with FOREX.com

GBP/JPY breaks 200 barrierThe GBP/JPY has just broken above the 200.00 mark for first time since July 2024. The pounds has been boosted by a hawkish BoE rate cut last week, and mixed UK data underpins, while rising global yields and rallying equity markets are undermining the low-yielding Japanese yen.

With the pair now above the 200.00 level, the key question now is whether the breakout will hold. Assuming it does, we could see a continuation of the rally towards the 202.00 level, which is now the next big resistance above here. Interim resistance comes in at 201.00 level.

In terms of support 199.00 is a clear support level, marking the high from the day before and the middle trend of the bullish channel, which the pair has just reclaimed. Below that? 197.50 is the next stop in the event we see a sudden drop.

UK wages fall more than expected

Earlier today, we had some mixed data from the UK following last week’s Bank of England rate cut, which was a very close call when policymakers were sharply divided but ultimately agreed to cut rates.

Today’s data showed average earnings increased by 4.6% in the three months to June compared to a year ago — weaker than the 5.0% rise we saw the previous month. On the jobs front, employment has now fallen eight times in the past nine months. However, the latest drop of 8,000 jobs is the smallest decline so far, suggesting the labour market may be stabilising.

A weakening jobs market could ease wage inflation pressures and open the door to further rate cuts, but whether this happens at November’s meeting remains uncertain following that hawkish cut last week, meaning the chance of another cut in November is now lower.

Meanwhile, a UK data dump is scheduled for Thursday when we will have Q2 GDP as well as monthly data on construction output, manufacturing production and a few other indicators to look forward to. The odds of a further BoE rate cut this year will continue to tumble in the event we see stronger data from the UK this week.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY bounced off key support ahead of ISM surveyAfter Friday's weak jobs report and the downward revisions to prior readings, the mood shifted towards the dollar, with markets leaning towards the Fed delivering more than a couple of rate cuts this year. But we have seen a bit of a recovery in the USD since, suggesting investors are either expecting employment to pick up again or inflation to remain sticky amid higher tariffs.

Today’s attention turns to the ISM services report for July, where a modest uptick is expected. Should that materialise, it could give the dollar some further support following Friday’s wobble. We’ll also be hearing from Fed officials Susan Collins and Lisa Cook on Wednesday – and their comments may well shape expectations heading into the autumn.

Ahead of these events, the USD/JPY has bounced off the key support range we highlighted yesterday, between 146.00-147.00 area. A close below this zone would be a bearish outcome, but while it continues to hold we would favour looking for bullish trades than bearish ones. 148.60 then 150.00 are the next key levels to watch on the upside.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY testing key support after Friday's dropThe USD/JPY fell sharply Friday in reaction to the weak US jobs data. But it is now testing the upside of a massive short-term support area, between 146.00-147.00. Can we see a bounce here towards 148.60 zone initially?

By Fawad Razaqzada, market analyst with FOREX.com

DXY testing 100.00 resistanceThe US dollar index has risen to rest a key resistance area around the 100.00 level. Previously a key support and resistance zone, what happens here could determine the near-term technical direction for the US dollar.

Key support below this zone is at 98.95, marking a prior resistance. Given the short-term bullish price structure, I would expect this level to hold if the greenback were to ease back from here.

If the bullish momentum gathers pace, then 101.00 could be the next stop, followed by the recent high of 101.97.

From a macro point of view, resilient economic data and persistent core inflation concerns continue to support the Federal Reserve’s cautious policy approach. Today’s core PCE inflation reading came in slightly above forecast, at 2.8% year-over-year versus the expected 2.7%. In addition, jobless claims were better than anticipated, registering 218,000 compared to the 224,000 forecast. The Q2 Employment Cost Index also surprised to the upside, rising 0.9% quarter-on-quarter.

These figures follow yesterday’s stronger-than-expected GDP report and a solid ADP private payrolls release, further underscoring the strength of the U.S. economy.

Attention now turns to Friday’s nonfarm payrolls report, which could have a meaningful impact on rate expectations. Fed Chair Jerome Powell has emphasized the importance of the unemployment rate as a key metric, so any upside surprise could reinforce the Fed’s current position.

However, expectations are not very high for the non-farm payrolls report. Current forecasts suggest an increase of 106,000 jobs, with average weekly earnings rising 0.3% month-over-month, and the unemployment rate edging up to 4.2%. Yet, the scarcity of strong leading indicators this month adds a layer of uncertainty to the outlook.

By Fawad Razaqzada, market analyst with FOREX.com

EUR/USD testing bull trend after 1% dropThere are multiple factors weighing on the EUR/USD today. We have seen a broad dollar rally, suggesting that the trade agreements are seen as net positive for the US economy, even it means rising inflation risks. With higher tariffs and Trump’s inflationary fiscal agenda, interest rates in the US are likely to remain elevated for longer.

As far as the euro itself is concerned, the single currency fell all major currencies, which suggests investors were not impressed by the EU’s negotiation tactics. Accepting a 15% tariff on most of its exports to the US while reducing levies on some American products to zero, means the deal will make companies in Europe less competitive. Still, it could have been a far worse situation had we seen a trade war similar to the US-China situation in April. It means that there is now some stability and businesses can get on with things. On balance, though, European leaders will feel that they may have compromised a little too much.

Technically, the EUR/USD is still not in a bearish trend despite today’s sizeable drop. But that could change if the bullish trend line breaks now. If that happens 1.15 could be the next stop. Resistance is now 1.1650 followed by 1.1700.

By Fawad Razaqzada, market analyst with FOREX.com

EUR/USD drops post US CPI reportAfter gaining ground last week, the US dollar initially came under slight pressure earlier today. However, it regained momentum in the aftermath of a mixed US inflation report. Despite the nuanced inflation print, market expectations around interest rate policy remained largely unchanged. Investors continue to anticipate a slower pace of rate reductions, a sentiment that could further weigh on the EUR/USD pair—provided confidence in the Federal Reserve’s monetary approach remains intact.

Mixed Signals from US Inflation Data

The consumer price index for June presented a mixed picture. Headline CPI increased by 0.3% month-over-month and 2.7% year-over-year, surpassing both the previous 2.4% figure and the 2.6% forecast. However, core CPI (which excludes food and energy) showed a slightly softer reading, rising by only 0.2% month-on-month—below the expected 0.3%. The annual core rate stood at 2.9%, in line with expectations.

This mixed data has not allayed fears that inflation could remain sticky for longer. As a result, the Fed may hold off on aggressive rate cuts, although a possible move in September remains on the table.

Adding to the dollar’s bullish case, President Trump has proposed aggressive tariffs—35% on select Canadian goods and up to 30% on imports from Mexico and the EU—if no agreements are reached by August 1. These protectionist threats, combined with his expansive fiscal agenda, could drive inflation higher and bolster the dollar if market faith in US policy stays strong.

Euro Zone Data Shows Resilience, But the Euro Falters

Despite some encouraging macroeconomic indicators from the Eurozone, the euro slipped. Germany’s ZEW economic sentiment index rose to 52.7, outperforming both expectations (50.8) and the previous reading (47.5). Additionally, industrial production climbed 1.7% month-on-month, beating forecasts.

While these positive data points reflect a degree of resilience in the euro area, trade tensions are looming. The European Union has said it will retaliate on US products—ranging from aircraft to alcohol—should trade talks collapse or fail to yield agreements by the August 1 deadline.

Technical Outlook

Technically, EUR/USD breached the bullish trendline established since Q1, a development that bears are watching as the session wears on. Currently, the pair is testing a key support zone between 1.1570 and 1.1630—an area that served as resistance in both April and mid-June before the rally that followed.

Should prices fall decisively below this support today or in the coming days, the technical bias could shift bearish. On the upside, resistance lies at 1.1700 and 1.1750. A break above these levels would clear the way for bulls to target a fresh 2025 high above 1.1830.

By Fawad Razaqzada, market analyst with FOREX.com

GBP/USD still under pressure despite slightly weaker US core CPIThe US dollar, which had gained ground last week, was under a bit of pressure earlier today. And following a mixed inflation report, the greenback spiked before returning to pre-CPI levels. The inflation report hasn’t changed market’s perception about the likely path of interest rates.

US CPI comes in mixed

June’s CPI rose 0.3% MoM and 2.7% YoY—hotter than the prior 2.4% and above the 2.6% consensus. However, core CPI was a touch weaker, rising 0.2% m/m instead of 0.3%, while the y/y rate was 2.9% as expected.

The mixed CPI report means concerns that inflation may persist longer haven’t changed. The Fed may still delay or reduce the scope of any rate cuts, even if a September move is still on the table.

Adding to the dollar’s appeal, President Trump floated steep tariffs—35% on some Canadian goods and up to 30% on imports from Mexico and the EU—if deals aren’t reached by August 1. These protectionist signals and Trump’s expansive fiscal stance could further stoke inflation, supporting the greenback if confidence in US monetary policy holds.

Pound under pressure

Sterling has had a rough start to the week, extending last week’s 1% drop in GBP/USD before rebounding slightly earlier today. The pound's slide follows a run of soft UK economic data, boosting expectations for a Bank of England rate cut—likely in August. On Friday, data confirmed a second consecutive monthly contraction in the UK economy, driven by a worsening manufacturing slump. This has added to speculation that weakening growth and a stronger pound could help ease imported inflation, especially ahead of Wednesday’s UK CPI release.

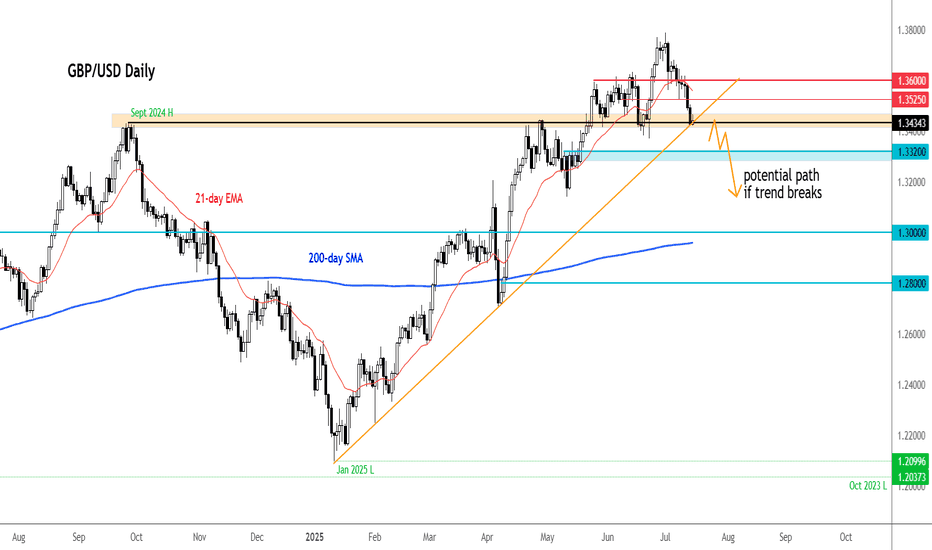

Technical picture and key data ahead for GBP/USD

GBP/USD has broken below important support zones (1.3630 and 1.3530–1.3550), now turned resistance. It is currently testing the 1.3434 level, aligned with a key trendline. A breakdown here could open the door to deeper losses toward 1.3370 and potentially the low 1.30s.

Two major data points will guide the pair this week:

• UK CPI (July 16): A soft print would likely reinforce rate cut bets.

• US Retail Sales (July 17): After a May decline, a rebound could highlight US resilience and strengthen the dollar further.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY bears getting trapToday's main data release was the weekly jobless claims figures, which came out better than expected at 227K vs. 236K eyed, down from 232K the week before.

In response, the dollar extended its rebound, and the USD/JPY has turned positive on the day after yesterday's reversal.

In recent days the UJ has been pushing higher, thanks to a weakening JPY amid threats of tariffs from the US. But we have also seen some support for the dollar owing to expectations that the tariffs will prove inflationary and that could limit Fed rate cuts.

The UJ has been forming a few bullish price signals and now finds itself above the 21-day exponential average. Stops resting above those inverted hammer candles from yesterday and June 23 could be in trouble. Can we see price rally towards those liquidity pools?

Support at 146.00 held firm after a brief dip below it. Next support is around 145.00 then 144.25 and 144.00 thereafter.

By Fawad Razaqzada, market analyst with FOREX.com

USD/CAD carving out a bottom?The USD/CAD is poking its head above a bearish trend line that has been in place since mid-May, in one of the first signs that suggests we may have seen a low in the Loonie. As well as the trend line, the 21-day exponential is also now below price, further suggesting that the tide is turning.

Key levels

Support levels off this daily chart are seen around 1.3695 then 1.3617

Resistance seen around 1.3750 next, followed by the next round handles like 1.38, 1.39 etc.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY loses bulk of NFP-related gainsThe USD/JPY has given back a bulk of yesterday's NFP-driven gains. Although the data was not as strong as the headlines suggested, the fact that we saw decent moves in bond and equity markets suggests investors were overall impressed by the figures. So it seems the market is preparing itself for some more tariff-related volatility as we approach the 9 July deadline, when 'Liberation Day' tariffs will revert. Trump has suggested letters are being sent out to trading partners over the next few days, informing them of their new tariff rate. If you recall, during the worst of April's volatility, the likes of the franc, euro and yen were all outperforming. Could we see a similar pattern this time?

Well, looking at the USD/JPY, traders have certainly sold into yesterday's rally. But we need a more decisive breakdown of support between 140.00-140.25 now to trigger some long side liquidation. Below this area, key support comes in around 142.50. Resistance comes in at 145.00, followed by 146.00.

By Fawad Razaqzada, market analyst with FOREX.com

USD/CNH coiling for a breakdown?Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it can take out support at 7.1700 on a daily closing basis then this could potentially pave the way for more technical selling towards 7.1500 initially, ahead of potentially lower levels next. But if risk appetite sours again, or we otherwise see a breakout above the bearish trend line, then in that case all bearish bets would be off the table again.

By Fawad Razaqzada, market analyst with FOREX.com

AUD/USD finally ready to take off?Following the collapse in oil prices and the rally in all risk assets, the AUD/USD created a hammer candle on the daily time frame yesterday as it held key support and the 200-day average in the shaded blue area on the chart. We have seen some further upside so far today, suggesting that the AUD/USD may finally be ready to lift off from the congestion zone it has been stuck inside for several weeks now. Immediate upside target is the liquidity resting above 0.6552. Break that then 0.6600 handle will come into focus next. Bias will turn bearish if we close below the shaded blue area in the coming days.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY bounces off trend but risks tilted to downsideWith equity markets well off their earlier lows, the USD/JPY is also bouncing back, although it is not out of the woods yet with risks remaining tilted to the downside amid signs of weak inflation data and Trump's tariff threats.

Technically, the USD/JPY has been in consolidation mode, but a potential break of the trend line could trigger a sharp drop towards 142.00 and then 140.00.

For now, the trend line is providing support, but with the dollar slumping against other currencies, the USDJPY could also take a tumble should we see renewed weakness in stocks.

Resistance comes in at around 144.00.

By Fawad Razaqzada, market analyst with FOREX.com

GBP/USD eases off highs again after poor UK dataAfter an initial tumble to just shy of 1.3450 in response to this morning’s disappointing UK jobs and wages print, the pound staged a spirited recovery, climbing back to a high of 1.3536. However, that rebound appears to be fading, with sterling once again drifting lower as the US dollar finds its footing across the board.

The underwhelming labour market data has bolstered expectations for a Bank of England rate cut in August, with a second move potentially on the cards in November, should incoming data allow. With rate cut probabilities on the rise, the pound’s four-month rally could be running out of steam.

June remains in positive territory for GBP/USD, which raises the prospect of a fifth consecutive monthly gain. But that run may be living on borrowed time. Any further deterioration in UK data—or even a modest pick-up in risk appetite favouring the dollar—could well tip the scales back in favour of the greenback.

From a technical standpoint, cable is beginning to look somewhat top-heavy. The key support zone between 1.3430 and 1.3450 has held up thus far, but a clean break below this region would mark a bearish shift in sentiment. Should that occur, a retreat towards the low 1.30s could swiftly come back into play.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY holds key support ahead of US dataThe USD/JPY direction has turned somewhat bullish in recent days as improving risk appetite and optimism over US-China trade talks lifted the dollar and pressurized the safe-haven yen.

The pair held firm above key support at 142.50, with sentiment-driven flows favoring the greenback. This week’s focus shifts to key US data releases—CPI on Wednesday and UoM Consumer Sentiment on Friday—which could influence Fed policy expectations and the USD’s trajectory.

A stronger dollar, supported by macro data and fading trade tensions, may push USD/JPY higher, especially as global equities rally and investor confidence improves.

Short-term resistance is seen around the 145.00 handle. The next upside targets are at 146.00, and then 148.00.

All bullish bets would be off, however, should support at 142.50 give way eventually. At the time of writing price was testing interim support around 144.00.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY back at neckline as soft US data narrows yield spreadToday's soft US data releases weighed on US yields, which helped to further narrow the US-Japan spreads on the long dated bond yields. In turn, the USD/JPY gave up its entire gains from the day before when it was boosted by the JOLTS data. Next move could be defendant on the nonfarm payrolls report on Friday.

From a technical point of view, this is text book stuff. Price is testing a key area of support at the time of writing, between 142.00 to 142.70, as marked in grey on the chart. This zone has provided strong support on multiple occasions, preventing rates from sliding towards 140.00 zone. Now the more a level or an area is tested, the more likely it will break down. Will we see a break here in the next few days? Or will support continue to hold, as improving risk appetite gives US dollar some breathing space?

Well, the pair is down quite a lot on the session, so i wouldn't rule out a bounce here heading into US close. But the trend direction is clear: bearish.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY takes fresh dip on renewed trade uncertaintyThanks to ongoing trade uncertainty and troubles in the bond market, the USD/JPY looks like is going to end the week on a negative note, after coming down sharply in the last day and a half, which means the weekly gains have more than halved.

The US dollar had actually clawed back a bit of ground in early Friday trading after taking a hit the day before. The rebound came despite fresh drama around Donald Trump’s tariff policies, which—unsurprisingly—are once again stirring the pot. A federal appeals court gave the president a temporary lifeline, pausing a ruling that could have derailed much of his economic agenda.

The White House team wasted no time doubling down: Trump, they insist, isn’t backing off. Tariffs are sticking around. But the mood got murkier when Treasury Secretary Scott Bessent admitted that US-China trade talks are “a bit stalled.” Then came Trump’s latest post on Truth Social, where he accused China of “totally violating” the trade deal with the US.

Markets didn’t take it well. US indices dipped, USD/JPY slid, and even the euro managed to push the dollar back a touch.

As well as well as trade uncertainty eyes will turn to incoming US data next week, among them the monthly jobs report on Friday.

The US jobs report is always important as it could impact the Fed’s future policy decisions. Traders will want to see whether the trade war uncertainty is negatively impacting the jobs market too, after several macro data, including consumption data in GDP report and consumer sentiment surveys, have come out weaker in recent weeks. JOLTS jobs data and ISM PMIs are also due out earlier in the week.

The US dollar has been under pressure in the last three months or so, with the euro performing admirably during this time despite US tariffs.

With the US recently losing its final top-tier credit rating at the hands of Moody’s a couple of weeks ago, investors are worried that debt concerns and government spending will push yields even higher and thus they are shorting Treasuries and the dollar, buying foreign currencies, including the euro. This makes the EUR/USD outlook remain fairly resilient around the 1.12-1.15 range.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY key levels to watch after powerful rallyThe USD/JPY has rallied decisively today, aided by the shift in Japanese bond sentiment.

The pair has broken several short-term levels and moving averages. At the time of writing, it was trading bang in the middle of the 144.00 -144.80 resistance area, formerly support. We also have the 21-day exponential moving average residing here.

As things stand, the next key upside target for the USD/JPY is now positioned near the 145 mark. Should price approach or breach it, we might begin to see growing confidence among longer-term bulls.

On the downside, key support is seen around the 142.50 level. Bearish below towards 140.00 next.

By Fawad Razaqzada, market analyst with FOREX.com

EUR/USD attempting to break higherThe EUR/USD is looking quite interesting as it tries to break out from a continuation pattern to the upside. So far, we haven't seen strong upside follow-through, which could be concerning for the bulls. Nevertheless, if it manages to break above the trend line of the falling wedge pattern, then this would suggest that the short-term path of least resistance is again to the upside, following a period of consolidation. From there, we could be heading up towards 1.1380, which is the next level of resistance on the daily chart. Above that, 1.1500 is the most significant resistance to watch on EUR/USD.

By Fawad Razaqzada, market analyst with FOREX.com