Sellsetup

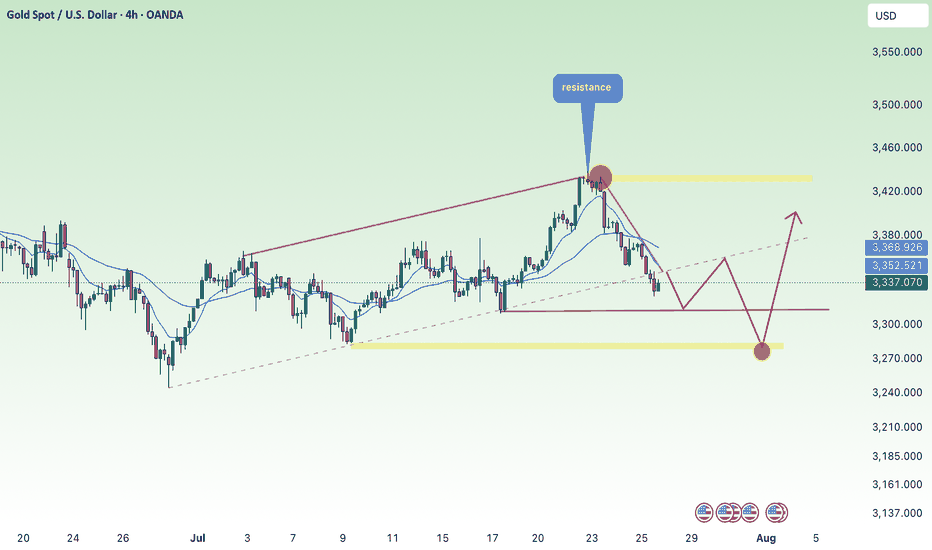

XAU recovers, mostly sideways below 3375⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped toward $3,330 in early Asian trading on Monday, pressured by stronger-than-expected U.S. Producer Price Index (PPI) data. Investors now turn their attention to the meeting later today between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy for potential market-moving headlines.

Thursday’s hotter inflation print forced traders to scale back expectations for a September Federal Reserve rate cut, weighing on the yellow metal. The U.S. PPI rose 3.3% year-on-year in July, sharply above June’s 2.4% increase and well beyond the 2.5% forecast, reinforcing headwinds for bullion.

⭐️Personal comments NOVA:

Gold price recovers around 3353, downtrend line. Maintain accumulation below strong resistance zone 3375

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3322

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

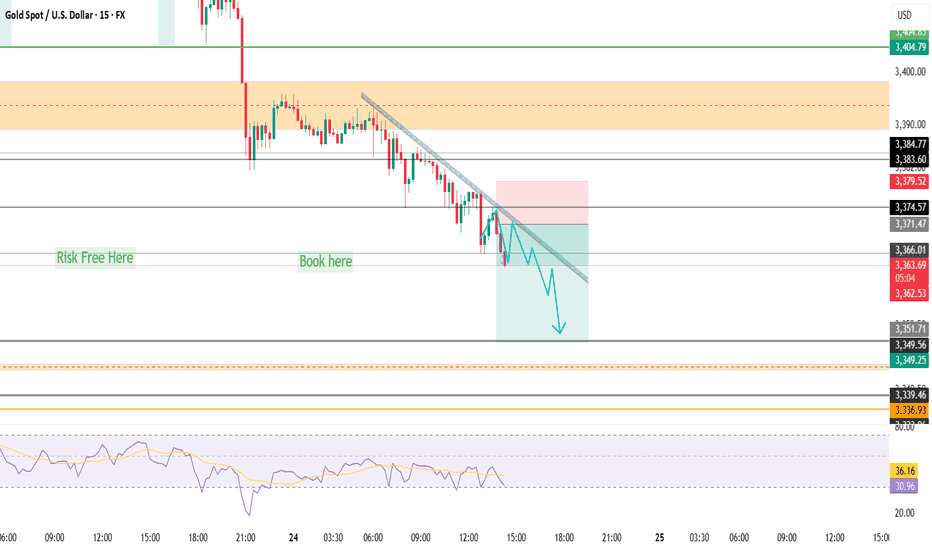

XAUUSD READY FOR DROP (READ CAPTION)Hi trader's.

current price:3357

gold today breakdown lower and H1 candle i watching sell

gold resistance zone 3358 and 33670

gold breakdown 3340 then gold fill down

resistance zone 3358_3365_3370

support zone 3340

target 3330_3325

please like comment and follow thank you

Gold price pressure down, DXY recovers⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found some buying interest in Friday’s Asian session, rebounding from the two-week low near $3,330 hit the day before. Thursday’s data showed that U.S. producer prices rose in July at the fastest monthly pace since 2022, prompting markets to scale back expectations for a jumbo 50-basis-point Federal Reserve rate cut in September. This has emerged as a major headwind for the non-yielding metal.

Additionally, a generally upbeat risk tone is limiting safe-haven demand, capping gold’s upside. However, fresh selling pressure on the U.S. Dollar has provided some support to the Dollar-denominated commodity.

⭐️Personal comments NOVA:

Gold prices fall after ppi news, negative market sentiment as fears of inflation return will affect September rate cut decision

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3389- 3391 SL 3396

TP1: $3380

TP2: $3367

TP3: $3350

🔥BUY GOLD zone: $3311-$3309 SL $3304

TP1: $3324

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulation, cash flow through altcoin💎 MIDWEEK BTC PLAN UPDATE (August 13, 2025 )

1. Market Structure & Wave Pattern

The chart is applying the Elliott Wave theory with a completed 5-wave upward structure (1 → 5) and is currently correcting in an ABC pattern.

The current zone is in corrective wave C, with a likely retest of a key support area before bouncing back upward.

2. Key Price Levels

• Short-term resistance: 120,500 – 120,700 (previous breakout zone).

• Nearest support: 118,800 – 119,000 (EMA34 zone + retest of the broken downtrend line).

• Stronger support: 117,500 – 117,800 (EMA200 zone + long-term trendline).

• Major resistance above:

• 122,770 (Fib 2.618, short-term take-profit zone).

• 127,260 – 127,480 (Fib 3.618, strong resistance zone).

3. EMA & Trend

• EMA34 (gold) is above EMA89 and EMA200 → medium-term trend remains bullish.

• EMA200 (red) acts as dynamic support during the correction.

4. Trend Outlook

• Main scenario: Price may continue corrective wave C toward 118,800 – 119,000, possibly testing deeper at 117,500 – 117,800, then sharply rebound in line with the main trend toward targets at 122,770 and 127,260+.

• Alternative scenario: If the 117,500 support breaks, the short-term bullish structure will be invalidated, and BTC could retreat to 115,800 – 116,000 before recovery signals appear.

Insiders are selling Roblox ! Heres the levels you need to knowIn this video I lay out a solid plan for a move to the downside for Roblox after a 100% move to the upside since April of this year .

I demonstrate why I believe we will take a 30% retracement and provide confluent evidence to support this theory.

There are some fundamental reasons that I also did include alongside the technical analysis which is not my regular style but important given the context.

Tools used in the video 0.382 Fib , Standard Fib pull, Trend based fib and pivots .

downtrend below 3300 , after ADP-NF⭐️GOLDEN INFORMATION:

The Federal Reserve’s policy statement noted that economic activity has slowed in the first half of the year, although the unemployment rate remains low and inflation is still “somewhat elevated.” The Fed reaffirmed its commitment to achieving maximum employment and returning inflation to its 2% target, while also acknowledging that “uncertainty around the economic outlook remains elevated.”

Earlier data showed that U.S. GDP grew in the second quarter, but underlying details painted a softer picture. Consumer spending cooled, and business investment declined significantly. According to Reuters, most economists now forecast full-year GDP growth at 1.5%, below the Fed’s 1.8% projection.

⭐️Personal comments NOVA:

Gold prices reacted negatively as the FED kept interest rates unchanged and Chairman POWELL's hawkish stance. Selling pressure below 3300 is being maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3360- 3362 SL 3367

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3249-$3247 SL $3242

TP1: $3258

TP2: $3270

TP3: $3285

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Is the market panicking over FOMC today?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) fluctuates within a narrow range during the Asian session on Wednesday, showing only modest gains and losses as traders tread carefully ahead of the Federal Reserve’s policy announcement. The metal’s recent rebound from the $3,300 area faces hesitation, with investors awaiting clearer signals on the Fed’s rate-cut trajectory before committing to new positions. As such, attention remains firmly on the outcome of the two-day FOMC meeting, set to be released later today.

In the meantime, pre-Fed uncertainty is lending some support to the safe-haven appeal of gold. Additionally, a slight pullback in the U.S. Dollar—after hitting its highest level since June 23 on Tuesday—is providing a mild lift to the metal. However, expectations that the Fed will maintain elevated interest rates for an extended period are limiting the dollar’s decline and capping upside potential for the non-yielding yellow metal. Adding to the cautious mood, recent optimism on global trade also tempers bullish momentum in XAU/USD.

⭐️Personal comments NOVA:

slight recovery, not big before FOMC news. Gold price will still be under selling pressure when interest rate stays at 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3360

TP2: $3344

TP3: $3330

🔥BUY GOLD zone: $3283-$3281 SL $3276

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

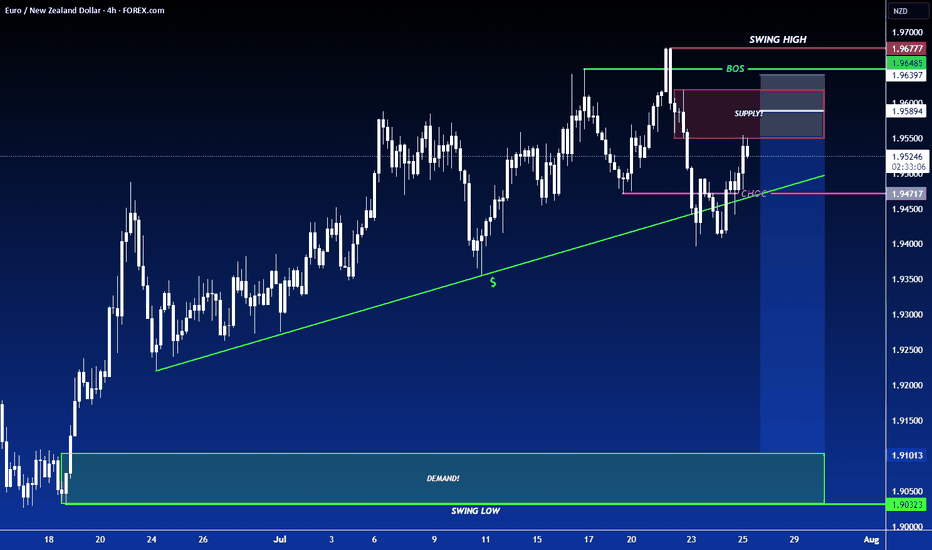

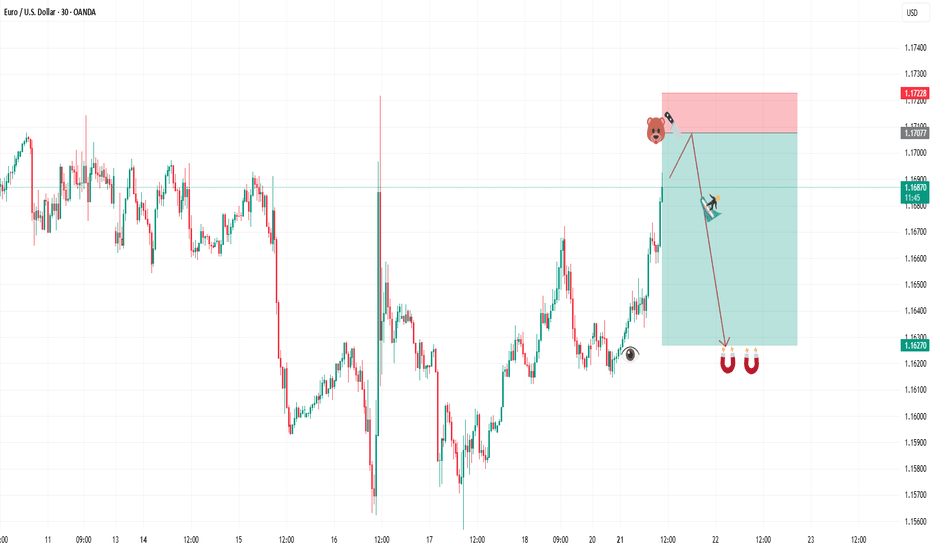

EURAUD Bearish Pullback – Short From 4hr FVG to 1.7635EURAUD – Bearish Outlook

- Key Zone: 4hr FVG (Fair Value Gap) near 1.7800 – 1.7820

- Fibonacci Levels: Retracement aligns with 0.5 – 0.618 zone, potential reaction point.

- Expected Target: 1.76350

Analysis:

1. Market shows a downward structure with lower highs and lower lows.

2. A possible pullback into the FVG zone could trigger a bearish continuation.

3. Confluence with Fibonacci levels strengthens the case for short trades targeting 1.76350.

Get liquidity at the beginning of the week, continue to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) continues to lose ground, slipping to around $3,335 in early Asian trading on Monday. The metal is on its fourth straight day of declines as easing geopolitical tensions and trade progress weaken safe-haven demand. Investors are now turning their focus to the upcoming FOMC policy decision on Wednesday.

Market sentiment has improved following a breakthrough in US–EU trade talks, with both sides agreeing to a uniform 15% tariff on traded goods, effectively ending months of stalemate. The new tariffs will come into effect on August 1. Meanwhile, the US and China are reportedly planning to extend their tariff truce for another three months, according to the South China Morning Post. The renewed risk appetite continues to pressure gold, traditionally favored in times of uncertainty.

⭐️Personal comments NOVA:

Short-term recovery in Asian session, gold price takes liquidity and continues to accumulate below 3369

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3369- 3371 SL 3376

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3305-$3303 SL $3298

TP1: $3314

TP2: $3330

TP3: $3342

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

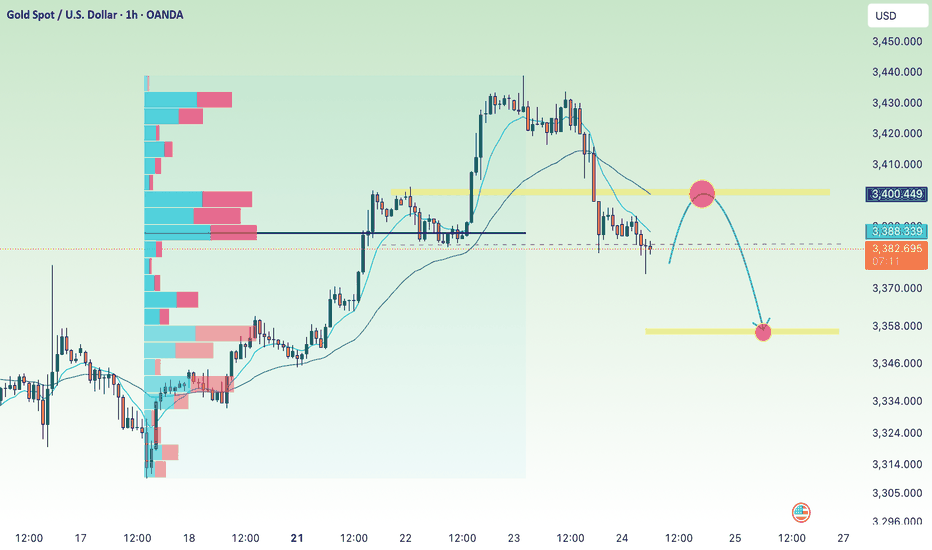

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

$OKTA Gen AI tailwinds are not materializing as of now!- I'm a seller of NASDAQ:OKTA at $124 . Company was undervalued at 70s but has run so much without tangible materializing Gen AI tailwinds.

- Theoretically, Agentic AI should have been a great tailwind for SSO but it appears that industry is not yet focussed on security aspect of it when it comes to agentic AI.

- Even on application level, companies are struggling with developing orchestration framework and deploying them at Scale.

- Risk/Reward is not suitable for me to stay long. Short or Avoid/sell $OKTA.

- I might change my mind if they prove themselves today May 27, 2025.

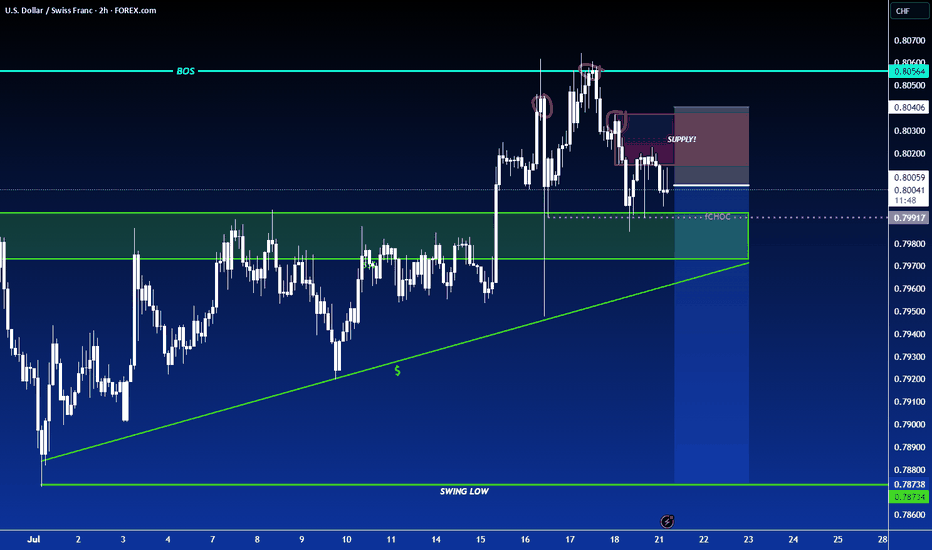

US30 Rejection at Channel Resistance US30 is showing a repeated pattern of rejection at the upper boundary of the descending channel. Price has now tapped this trendline for the fourth time, forming a consistent bearish structure.

Price rejected again at the top of the descending channel (marked by orange circles)

Clear sell setup with stop above the most recent swing high, targeting the lower channel boundary around 44,200, aligning with past demand.

Short below 44,685

Target: 44,200

Stop: Above recent highs near 44,913

Risk/Reward: Favourable if structure holds. If this pattern plays out as before, we can expect another push to the downside within the channel.

A break and retest of the midline could add extra confirmation.

#US30 #DowJones #PriceAction #SellSetup #BearishRejection #ChannelTrading #TechnicalAnalysis