XAUUSD — The Easiest Trade Today Was Doing NothingFUSIONMARKETS:XAUUSD

Look at the panel — the decision was already made:

NY Behavior: CLOSED

Regime: INVALID

Outcome: No Trade

No indicators to interpret.

No lower-timeframe hunting.

Just one rule:

If the session is closed, the market has not invited you.

Most losses come from trading outside permission.

Today was not a “missed move” — it was a correct skip.

Discipline isn’t dramatic.

It’s boring, repeatable, and visible on the chart.

RegimeWorks Reading

London Behavior: closed

NY Behavior: closed

Permission layer: inactive

Outcome: No Trade

Edge = knowing when to do nothing.

— RegimeWorks

Follow for daily permission checks, not daily predictions.

Session

What RegimeWorks Means – And Why I Often Don’t TradeMost traders start with entries.

I start with permission.

RegimeWorks is not a signal method – it is a decision filter built on three questions:

Is the market currently behaving in a defined regime?

Is the active session appropriate for participation?

Is today’s quality high enough to justify risk?

If any answer is “no” → the correct trade is to do nothing.

That is why many of my ideas show no-trade outcomes.

Not because the market is “bad,” but because discipline is part of edge.

Good trading is not about finding reasons to click buy or sell.

It is about filtering conditions where behavior and liquidity disagree.

If this page looks boring, that is intentional.

Professional process usually is.

What you will NOT find here

• No signals

• No hindsight entries

• No prediction contests

• No hype

What you WILL find

• Context before action

• Session awareness

• Risk-first thinking

• One behavior at a time

The indicator shown on my charts is a framework tool only – it defines when to be cautious before when to participate.

When Crypto Actually MovesCrypto trades around the clock, but the market doesn’t behave the same way at every hour. Volume, liquidity, and volatility cluster around predictable windows, and those windows shape how setups form and how price reacts. When you understand these shifts, you stop taking trades randomly and start aligning execution with the moments when the market truly moves.

Why Sessions Matter

Even though crypto never sleeps, human traders and institutional desks still operate in cycles. Liquidity providers adjust during business hours. Market makers re-balance at session opens. Macro news is released on a fixed schedule. These patterns create recurring volatility signatures.

Ignoring sessions means you treat every candle as equal. Understanding sessions means you add a layer of context that improves timing, risk control, and win rate.

Asia Session (00:00–06:00 UTC)

The Asia window tends to be slower and more range-bound.

Characteristics include:

– Moderate liquidity

– Clean consolidations

– Accumulation before Europe

– Fewer impulsive moves unless driven by news from Asia-Pacific regions

This period often sets the initial range of the day. Liquidity begins to cluster above highs and below lows, creating the conditions for later sweeps.

Europe Session (07:00–12:00 UTC)

Liquidity expands significantly as London opens. You often see the first engineered move of the day.

Key behaviors:

– Early sweeps of the Asia range

– Strong breakouts from overnight compression

– Directional push before New York volatility

This session frequently defines the directional bias into US hours. It’s a prime window for structured setups because market participation rises sharply.

US Session (13:00–20:00 UTC)

This is the most active window. The highest liquidity and most decisive moves occur here.

Typical features:

– Strong continuation or full reversal of the London move

– Reaction to economic news

– Trend acceleration during peak overlap hours

This is where major breakouts, deep liquidity hunts, and high-powered moves happen. If you trade momentum or breakout strategies, this session offers the cleanest conditions.

Weekend Behavior

Weekends operate on thin liquidity. Order books are lighter, market makers are less active, and volatility behaves differently.

Common outcomes:

– Sharp wicks that violate structure

– Sudden spikes without follow-through

– False breakouts with immediate reversals

Weekend moves often distort technicals. They can be useful for narrative-driven positions but carry higher risk for intraday traders.

How to Integrate Sessions Into Your Trading

Use sessions to filter when you participate and when you avoid noise.

Practical adjustments:

– Execute momentum setups during Europe or US hours.

– Treat Asia session as a range-building phase suitable for scouting zones.

– Avoid taking aggressive positions during weekend chop.

– Use session opens as key decision points for liquidity grabs.

When you layer session timing on top of structure, you refine entries and eliminate trades that lack the environment for follow-through.

The Strategic Advantage of Session Awareness

Session timing gives you clarity. You start anticipating where liquidity is likely to be engineered, where volume will enter, and when the market is likely to trend or stall.

This transforms your approach.

Instead of reacting to candles, you plan around expected volatility cycles.

Instead of forcing trades, you wait for session transitions that historically produce reliable movement.

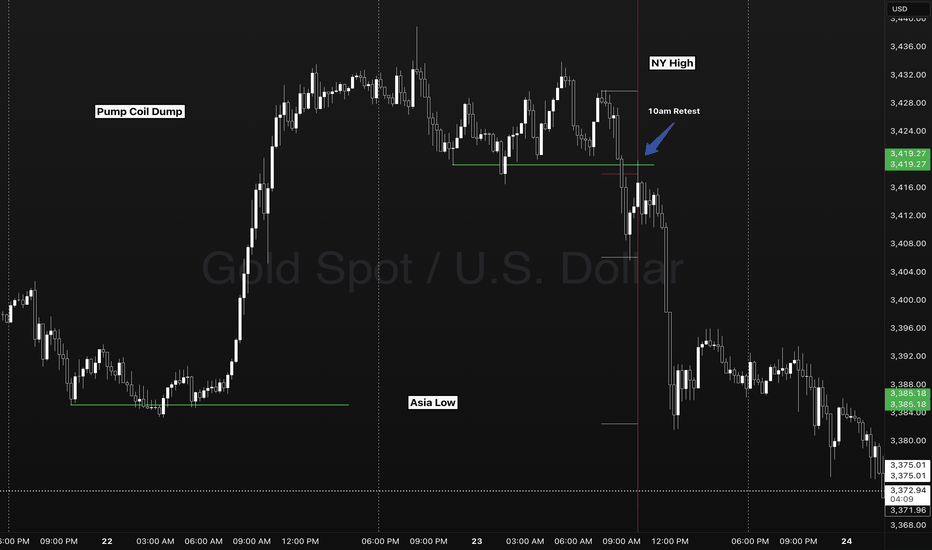

Gold two session setups - Timings Levels Behavior of PriceIn this example we see FOREXCOM:XAUUSD forming a simple and scalable setup interacting with key session levels and key times of day.

- 4HR OPEN CLOSE (10:00am)

- SESSION TIME RANGES

- DAILY HIGH/LOW

- SESSION HIGH/LOW

Here on my chart I use no lagging indicators. A previous session ranges high and low represents the major liquidity levels. A classic break and retest going into the NY session took place at 10:00am offering a parabolic opportunity back to a previous days session low.

SIMPLICITY IS KEY. Stay away from trading gaps, sweeps, hunts, soups on the inside of a high and low. The market only does two things.

- Breakout, fail, reverse.

- Breakout, pullback, continue.

Its important to be on a higher time frame to capture multiple sessions of liquidity areas. As a new trader I found looking to take a trade instead of waiting for a setup. 1 minute charts with multiple moving averages, oscillators, macd. Essentially a science project! Keep it simple traders. Patience pays. Timing, levels, behavior of price.

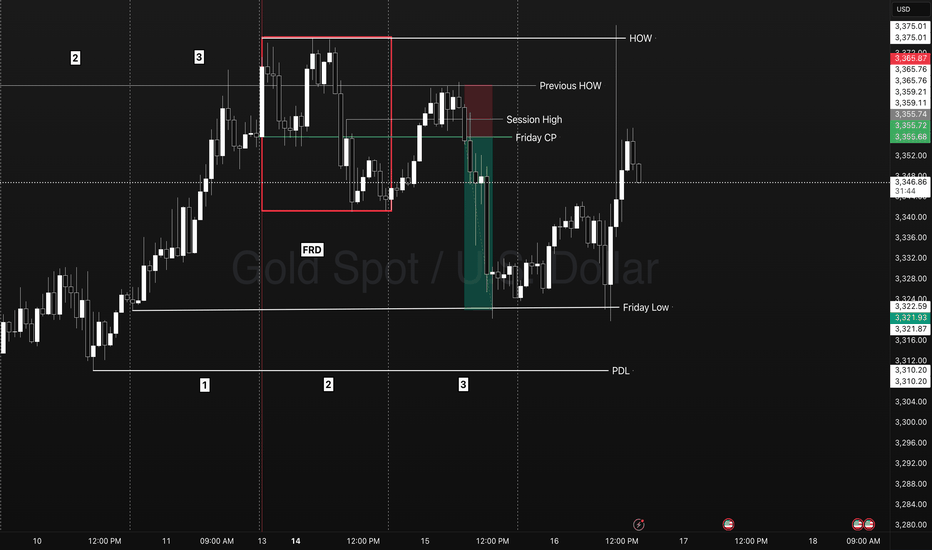

XAUSD - Using HOW levels for a break and retest!Identify what signal a market is showing you.

TYPES IOF SIGNAL DAYS

- First red/green day

- Dump/Pump

- Inside day

Frame the Trade play

- Reversal

- Continuation

Identify the Levels

- HOW/LOW

- Session High/LOW

- Friday Closing Price.

Trade Explanation

On the previous week FOREXCOM:XAUUSD triggered 3 days of breakout traders into the market closing in breakout. On Monday we have a FRD signal that sets up a next day trade opportunity. A retest of a previous weeks high gave us an indication of a retest/reversal trade on day 3 below Fridays closing price. Into the NY session this market quickly displaced back to Friday day 1 LOD level. Going into Tuesday day 2 we had the test of a weekly level and reversal above a session high closing below the Friday closing price. The break of a previous weeks high triggered more breakout traders into the market however it failed. We know day 2 typicall expands the range on Monday for a great parabolic trade setup right to as previous days low.

NO GUESSING, NO FOMO, NO FEAR, NO STRESS!

- Friday Closing Price (Entry)

- Previous HOW (Stop)

- PDL (Target)

Short Setup Limit order GBPUSD day trade before news👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 timeframe ICT Short setup in

GBPUSD for session trade (a couple of Hours)

Here is a session trade idea Sell limit order level for reference, TP and SL in pips

Cancel limit order before any great news in Forex.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

Session trade, XAUUSD, Short setup in H4👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 timeframe ICT Short setup in

XAUUSD for session trade (a couple of hours)

Basically it is in ranging market in D1 chart.

So our idea, today will touch the middle zone of the Daily Range.

Range: $2658 to $2665

Here is a swing trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Supply Zone,open for take profit.

Next Short entry after retracement in any session.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

GBPJPY, H4 ICT Longsetup, Swing Trade and Session Trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 timeframe ICT Long setup in

GBPJPY for session trade (a couple of Hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

Next Long entry after retracement in any session.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

XAUUSD, H4, Long setup, session trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 timeframe ICT Long setup in

XAUUSD for session trade (a couple of Hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

Next Long entry after retracement in any session.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

SOLUSDT Market Structure Update👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

SOLUSDT for session trade (a couple of Hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

Next Long entry after retracement in any session.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

ICT Long setup session trade, NOT swing trade NZDUSD👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

NZDUSD for session trade (a couple of Hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

Next Long entry after retracement in any session.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

ICT Long setup EURCHF session trade and swing trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

EURCHF for session trade (a couple of hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

ICT Long setup on NZDJPY👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

NZDJPY for session trade (a couple of hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

Session Trade Long setup NZDJPY👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

NZDJPY for session trade (a couple of hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, Buy Zone,open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

QQQ, ICT Short Setup, small lot👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Short setup in

QQQ for session trade (a couple of hours)

Here is a session trade idea (since it is near support surface, we should use small lot size)

Please refer to the details Stop loss, FVG(Sell Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

ICT Long setup NZDCHF H1 chart👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in

NZDCHF for session trade (a couple of hours)

Please refer to the details Stop loss, FVG(Buy Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

Ultimate Trading Strategy: Reaction to Supply and Demand Levels!🔍 Identifying Potential Buy or Sell Zones: In this step, you need to identify the zones that are likely to react and wait for the price to potentially reach them. ⏳📊

🌟 With the reaction to the first area, a buy trade is activated. 🌟

📝 Confirmations:

📉 Reaction to the expected area – Watch for a price movement hitting our anticipated zone!

🛠️ Formation of a combined hammer pattern – Look out for this powerful reversal signal!

📈 Formation of a bullish engulfing pattern – A strong indicator of upward momentum!

🔍 Trading Tips:

💡 High-risk stop-loss location:

👉 Place it below the candlestick pattern. At least twice the spread to ensure you're covered! 📏🔒

💡 Lower-risk stop-loss location:

👉 Place it below the expected area. Again, at least twice the spread for extra safety! 📏🔒

💰 Take-profit strategy:

👉 Base it on risk management mathematics, such as risk-reward ratios of 2, 4, and 6.

👉 Alternatively, observe reactions to past market areas, especially near important market highs and lows. 📊📈

🎯 Entry point strategies:

👉 Enter at the close of the confirmation candle.

👉 Or, set a limit order around 50% of the confirmation candle for a bigger volume opportunity! 📉📈

🌟 Buying in Two Phases: A Smart and Exciting Strategy! 🌟

🔹 Phase One:

When you reach a profit of twice the risk, exit the trade. Why? Because the Asian high has been hunted and the candlestick formed has a long upper shadow. 🌄💹

💡 Analysis:

The price hasn’t reached other zones yet and has risen in reaction to the first expected zone. Therefore, we expect a pullback and continued upward movement. 💪📈 So, I’ll place a second buy trade. 🚀💵

🔍 Confirmations for the Second Buy Trade:

A double bottom has formed, marked with an X. ❌❌

A small hammer candlestick has swept the double bottom. 🔨

A long positive shadow candlestick has swept the bottom and reacted to a small order block on the left. 🌟

💡 Tips for the Second Buy Trade:

Enter at the close of the long-shadowed doji candlestick or place a stop limit order above the long-shadowed doji candlestick. 📉📈

The stop loss should be below this candlestick. 📏🔒

🔹 Phase Two:

Next, the price has reached an expected reaction zone from where we expected a price drop. 🌐💡

🔍 Confirmations for the Sell Trade:

Reaction to the expected zone. 🔍

An inverse hammer candlestick reacting to the zone. 🔨

💡 Tips for the Sell Trade:

The entry point should be in a candlestick with a negative signal indicating a price drop. This hammer candlestick can indicate a decline. 📉🔻

The target can be a reward of 2 or the last price bottom. 🎯💰

The stop loss should preferably be behind the expected zone. 📏🔒

🔥 Important Points!!:

Since the price hasn’t deeply penetrated the zones, there’s a chance it might go higher or even mitigate this zone twice, ultimately turning it into a pullback for a further price rise. 🚀📈

Continuing on, the price reached the upper zone area.

We expected a price drop from this zone, but it reached at 03:15,

which is outside our trading session. However, we could have traded on it.

🔍 Sell Confirmations:

The price has reached the expected zone.

An inverse hammer candlestick pattern.

💡 Interesting Fact:

If you had placed a limit order around the midpoint of the previous two zones,

you would have profited by now. So, for this zone, you can also place

a limit order around 50% of it.

Continuing further, other zones have formed below that could be useful

for new trades.

✨ Successful Sell Trade Achieved, Reaching a Reward of 4 Times the Risk.

📉 During the session continuation, the trend line was broken, triggering an upward price pullback.

🔹 Now, at the beginning of the session, we have a new zone, likely a selling order placement area. We're taking the risk on this zone. This time, we can place the trade around 50% of it. 🚀💼

🔥 Alright, what's your take now? 🔥

🌟 Is the price reacting to this level or not? 🌟

🚀📈 or 📉💥

Where are the upper zones located?

What do you think? 🤔💬

ICT short setup GBPCHF Session trade and Swing trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 or higher timeframe ICT Short setup in GBPCHF for Swing trade.

Please refer to the details Stop loss, FVG(Sell Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

ICT Short setup GBPCHF, session trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 or higher timeframe ICT Short setup in GBPCHF for Swing trade.

Please refer to the details Stop loss, FVG(Sell Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!