CRWD Earnings Sniper | $400P Weekly Play

# 🚨 CRWD Earnings Setup (AMC 8/28) 🚨

💥 Bearish Lean | 🎯 \$400 Put | Exp 8/29

📊 **Setup Overview**

* Mixed model signals → leaning bearish

* Institutional volume spike ⚡

* Options flow: Neutral (C/P \~1.0)

* Risk: high (earnings whipsaw potential)

🎯 **Trade Idea**

* Buy \$400 Put (8/29 expiry)

* Entry: \$4.20

* Profit Target: \$12.60 (3x)

* Stop: \$2.10 (50%)

* Confidence: 65%

🕒 **Timing**

* Entry: at open (8/28)

* Exit: by Thursday close

⚠️ **Key Risks**

* Post-earnings IV crush

* Earnings surprise vs. consensus

* Pinning around \$400 strike

---

🔥 Tags for reach:

\#CRWD #EarningsPlay #OptionsTrading #WeeklyOptions #PutOptions #MarketSetup #EarningsTrade #ShortTrade #VolatilityPlay #Cybersecurity #TradingSignals #StocksToWatch

Shorttrade

ETH - High Risk ShortPer my BTC analysis, I expect the market to crash very hard and quickly, timed with the US dollar bearish retest on major weekly breakdown.

Entry in green, targets marked and path shown.

ETH fell below this major series of bearish trendlines, targets marked by analyzing liquidity and volume profile levels.

BTC adjusts down, market suspects interest rate cut💎 BTC PLAN UPDATE – Early Week (08 / 25 )

🔎 BTC Analysis

After retesting the 117k resistance zone (117,566 USD), the price reacted with a sharp drop. This indicates that the selling pressure in this area remains very strong.

Currently, the price is falling near the EMA200 (red line ~111,664) – which is a key short-term support level.

📌 Key Reaction Zones

111k – 110k:

This is the confluence of EMA200 + Fib 0.5.

If the price holds, there’s potential for a rebound back to 113k–115k.

109k – 108k:

Next strong support.

If 111k breaks, this zone will be the next critical reaction point.

105k – 104k:

Major long-term support (confluence of Fib extension + old demand zone).

In a bearish scenario, the price could test this zone before bouncing back up.

🌐 Market Sentiment & Expectations

After BTC was rejected at 117k, market sentiment has turned cautious and somewhat bearish in the short term.

However, many traders still expect BTC to hold above the EMA200 to trigger a rebound → if this level holds, sentiment may shift back to bullish, targeting 115k–117k again.

On the contrary, if the price breaks deep below 110k, the market may enter short-term panic and shift focus toward the strong support at 104k.

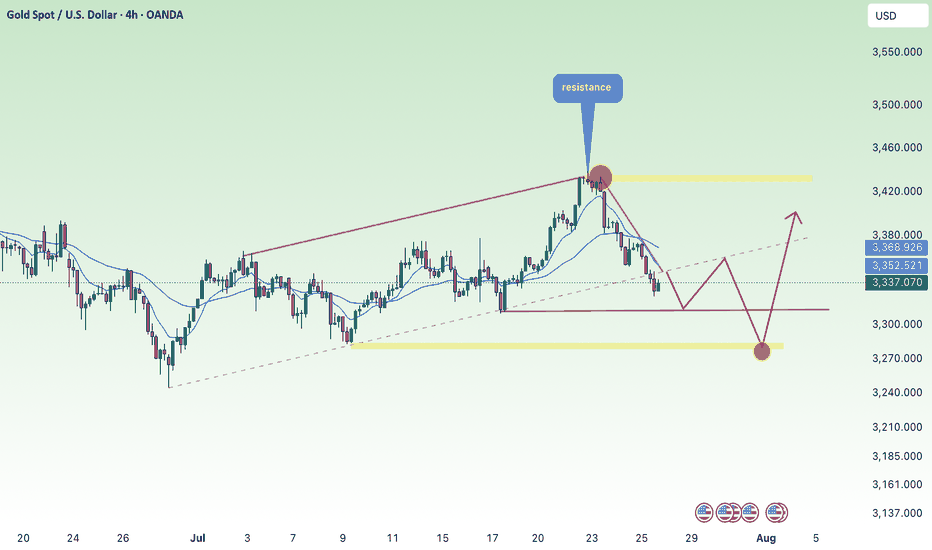

Slight decrease in the new week, accumulation above 3330⭐️GOLDEN INFORMATION:

Fed Chair Jerome Powell signaled openness to a rate cut at the September meeting, though persistent inflation pressures could complicate that outlook. Powell described the US economy as facing a “challenging situation,” noting inflation risks remain skewed to the upside while employment risks lean to the downside.

Following his remarks, traders boosted their bets on a 25 basis-point cut next month to nearly 85%, up from 75% prior to the speech, according to the CME FedWatch tool. Powell’s dovish tone could lend support to gold prices, as lower interest rates diminish the opportunity cost of holding the non-yielding metal.

⭐️Personal comments NOVA:

Gold price decreased and adjusted, pay attention to liquidity zones 3351, 3330

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3388

TP2: $3373

TP3: $3360

🔥BUY GOLD zone: $3330-$3328 SL $3323

TP1: $3340

TP2: $3350

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

short term adjustment, accumulation for uptrend ETH💎 ETH WEEKEND PLAN UPDATE (August 22 , 2025 )

ETH is in a medium-term uptrend, having just completed wave (5) according to Elliott Wave, and is now undergoing a slight correction.

The current price zone around 4,200 – 4,300 USD is a key area to watch:

• If it holds, ETH may rebound higher.

• If it breaks down, it could retreat to deeper support levels.

Key Levels

Near Resistance:

• 4,500 – 4,600 USD: Strong resistance zone, aligning with wave (5) and Fibonacci 1.618.

• If this level is broken, the next target is 6,000 USD (Fibo 2.618).

Near Support:

• 3,800 – 3,900 USD: Confluence with EMA34 and an intermediate support zone.

• 3,200 – 3,250 USD: Strong support, intersecting EMA200 and key Fibonacci cluster.

• 2,500 – 2,600 USD: Final support, a solid base before the last strong rally.

Trend Outlook

• Short-term: ETH may continue correcting towards support to accumulate before forming a new rally.

• Medium-term: The main trend remains bullish as long as ETH holds above 3,200 USD.

• Long-term: If ETH breaks above 4,600 USD, it is highly likely to target 6,000 USD.

👉 Summary:

ETH is in a consolidation phase after a strong rally. Investors should watch the 3,800 – 3,900 USD zone closely. If it holds, the chance of retesting 4,600 USD and potentially 6,000 USD remains strong.

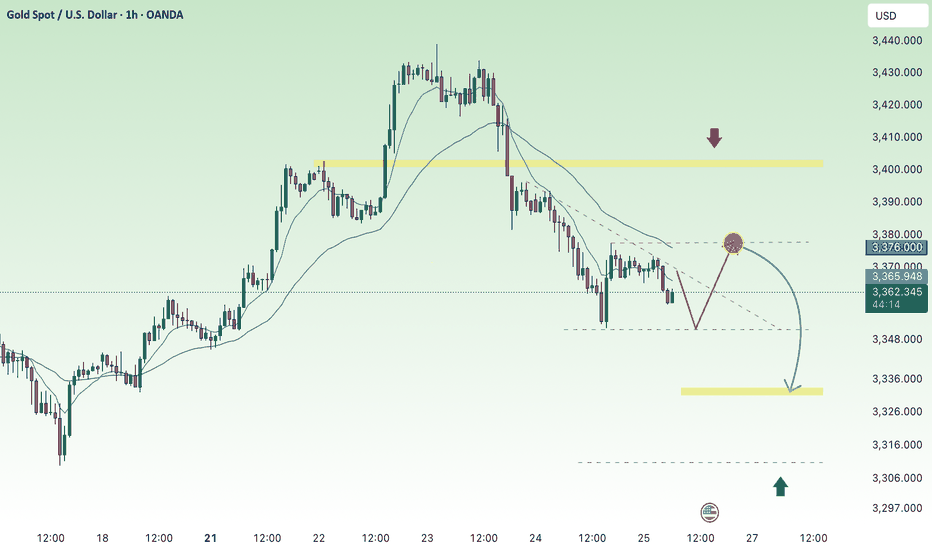

Recovered and traded below 3374 , XAU today⭐️GOLDEN INFORMATION:

Gold (XAU/USD) came under renewed selling pressure in Thursday’s Asian session, stalling Wednesday’s solid rebound from the $3,311–3,312 zone, its lowest level in nearly three weeks. The release of the late-July FOMC minutes revealed a hawkish tilt, with policymakers voicing greater concern over inflation than labor market conditions. This has tempered expectations for a jumbo Fed rate cut in September, bolstered the U.S. Dollar, and diverted flows away from the non-yielding metal.

Further weighing on gold, optimism surrounding a potential resolution to the Russia–Ukraine conflict has dampened safe-haven demand. At the same time, political noise added uncertainty after President Donald Trump called for Fed Governor Lisa Cook to resign amid mortgage fraud allegations, raising questions over the central bank’s independence. This could limit aggressive USD buying and lend some support to bullion. Looking ahead, traders will eye global flash PMI readings for fresh cues before Fed Chair Jerome Powell’s highly anticipated remarks at the Jackson Hole Symposium.

⭐️Personal comments NOVA:

Short-term downtrend line, gold price maintains accumulation at 3300 - 3374, use fibo to find support reaction points

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3366

TP2: $3354

TP3: $3344

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3313

TP2: $3325

TP3: $3337

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

REGN Weekly Trade Setup – High Conviction Put Play

🎯 **REGN Weekly Trade Setup – High Conviction Put Play**

📌 **Instrument:** REGN

📉 **Direction:** PUT (SHORT)

💵 **Strike:** \$580

💰 **Entry Price:** \$5.20

🏹 **Profit Target:** \$10.40

🛑 **Stop Loss:** \$7.80

📅 **Expiry:** 2025-08-20

📏 **Size:** 1

💪 **Confidence:** 65%

⏰ **Entry Timing:** Market Open

⚠️ **Key Risks:**

* Only 2 days to expiry → high gamma risk

* Rapid price swings possible due to institutional activity or news

* Mixed signals on options flow & volume

✅ **Rationale:**

* Bullish RSI momentum tempered by bearish options flow

* High put activity supports short positioning

* Risk/reward favors aggressive yet measured play

🔥 **TradingView / Social Tags:**

\#REGN #OptionsTrading #PutOptions #WeeklyOptions #ShortTrade #BearishSetup #TechnicalAnalysis #HighConvictionTrade #GammaRisk #PriceAction #TradingSignals #MarketAnalysis #RiskManagement #OptionsFlow #TradingStrategy

Gold price drops to 3300, accumulation⭐️GOLDEN INFORMATION:

Gold prices fell on Tuesday as the U.S. Dollar extended modest gains for a second session, while geopolitical optimism weighed on safe-haven demand. XAU/USD is trading near $3,317, with markets eyeing the potential for progress in peace talks following U.S. President Donald Trump’s meetings with Vladimir Putin, Volodymyr Zelenskiy, and European leaders.

Speculation over a possible de-escalation of the Ukraine–Russia conflict has pressured bullion, which typically benefits during times of heightened uncertainty. Last Friday’s Trump-Putin talks laid the groundwork for further dialogue, and on Monday Trump met with Zelenskiy and European counterparts to push for a ceasefire and set the stage for trilateral negotiations between Kyiv and Moscow.

⭐️Personal comments NOVA:

Gold prices under selling pressure ahead of today's FOMC meeting, aiming to fall back to psychological support zone 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3339- 3341 SL 3346

TP1: $3330

TP2: $3320

TP3: $3310

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3313

TP2: $3325

TP3: $3337

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure continues to return to 3300Plan XAU day: August 20, 2025

Related Information:!!!

Gold (XAU/USD) slid to its lowest level in nearly three weeks during the Asian session on Wednesday, with bearish sentiment prevailing as market participants await a decisive break below the 100-day Simple Moving Average (SMA) to confirm prospects for further downside. The US Dollar (USD) extended its steady ascent for a third consecutive session, supported by fading expectations of more aggressive monetary easing by the Federal Reserve (Fed), which remains a primary headwind for the non-yielding precious metal.

In addition, renewed optimism over a potential Russia–Ukraine peace agreement has added to the downward pressure on safe-haven gold. Looking ahead, investors will turn their attention to the release of the FOMC meeting minutes, while Fed Chair Jerome Powell’s upcoming remarks at the Jackson Hole Symposium may provide further clarity on the central bank’s policy trajectory. These developments are poised to play a pivotal role in shaping near-term USD demand and guiding the next directional move for the commodity

personal opinion:!!!

Gold price recovered to break through 3327 to gain liquidity and continue the downtrend

Important price zone to consider : !!!

Resistance zone point: 3330 zone

Sustainable trading to beat the market

Accumulate, price range 3341 decreases along the trend linePlan XAU day: August 19, 2025

Related Information:!!!

Gold (XAU/USD) has surrendered part of its intraday advance and moved lower during the American session on Tuesday, as the resilience of the US Dollar (USD) weighs on the precious metal. Earlier in the day, Gold rebounded from an overnight dip triggered in the wake of Monday’s White House summit between US President Donald Trump, Ukrainian President Volodymyr Zelenskyy, and key European leaders. Although the talks underscored diplomatic alignment, the absence of a ceasefire has sustained elevated geopolitical uncertainty, thereby offering a degree of support to safe-haven assets.

As of writing, XAU/USD is trading near $3,335, retreating from an intraday peak of approximately $3,345. A stronger US Dollar continues to cap bullish momentum, while slightly softer US Treasury yields—following three consecutive sessions of gains—provide only limited relief for the metal. Looking ahead, market participants will turn their focus to the Jackson Hole Symposium and Wednesday’s release of the FOMC meeting minutes for clearer guidance on the Federal Reserve’s policy outlook. With markets still pricing in a September rate cut, any dovish signals could help re-energize demand for Gold in the sessions to come.

personal opinion:!!!

Support zone 3327, gold price reacted to recover showing that gold trend today is still mainly accumulating and decreasing according to the formed H1 trend line

Important price zone to consider : !!!

Resistance zone point: 3341 zone

Sustainable trading to beat the market

continue to accumulate waiting for FOMC, above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found dip-buying interest in Tuesday’s Asian session, rebounding from the more than two-week low hit a day earlier. Support for the non-yielding metal comes largely from rising expectations that the Federal Reserve will restart its rate-cutting cycle in September. In addition, a cautious tone across broader markets is fueling safe-haven flows into bullion.

⭐️Personal comments NOVA:

Gold price continues to maintain the accumulation zone above 3300, the market moves sideways waiting for FOMC information

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3311-$3309 SL $3304

TP1: $3322

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAU recovers, mostly sideways below 3375⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped toward $3,330 in early Asian trading on Monday, pressured by stronger-than-expected U.S. Producer Price Index (PPI) data. Investors now turn their attention to the meeting later today between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy for potential market-moving headlines.

Thursday’s hotter inflation print forced traders to scale back expectations for a September Federal Reserve rate cut, weighing on the yellow metal. The U.S. PPI rose 3.3% year-on-year in July, sharply above June’s 2.4% increase and well beyond the 2.5% forecast, reinforcing headwinds for bullion.

⭐️Personal comments NOVA:

Gold price recovers around 3353, downtrend line. Maintain accumulation below strong resistance zone 3375

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3322

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

UPST Bear Breakdown Incoming! Put Strike $58

# ⚡ UPST Swing Alert – 2025-08-15 ⚡

**Sentiment:** Moderate Bearish

**Setup:** Put Option Trade

---

## 📉 Market Snapshot

* **Daily RSI:** <45 → Bearish momentum

* **5 & 10-Day Trend:** Negative → Confirmed downtrend

* **Volume:** Avg (1.0x) → Weak breakout confirmation

* **Call/Put Ratio:** 1.00 → Neutral

* **VIX:** Favorable low volatility for controlled downside

---

## ⚖️ Consensus & Conflicts

**Agreement:**

* Bearish momentum confirmed across models

* Structural weakness supported by multi-timeframe negative performance

* VIX favors swing execution

**Disagreement:**

* Timing & execution vary: some models recommend immediate puts, others await volume confirmation or breakdown

* Strike selection differs slightly (\$58 vs \$61)

---

## 🎯 Trade Setup – UPST PUT

**Entry Condition:** Confirm bearish breakdown at market open

**Strike:** \$58.00

**Expiration:** 2025-08-29

**Entry Price:** \$1.00

**Confidence:** 72%

**Profit Target:** \$2.00 (100% gain)

**Stop Loss:** \$0.60 (≈40% of premium)

**Key Risks:**

* Corporate developments (e.g., convertible notes) may alter price direction

* Sudden bullish reversals or volume spikes

---

## 📝 TRADE DETAILS (JSON)

```json

{

"instrument": "UPST",

"direction": "put",

"strike": 58.0,

"expiry": "2025-08-29",

"confidence": 0.72,

"profit_target": 2.00,

"stop_loss": 0.60,

"size": 1,

"entry_price": 1.00,

"entry_timing": "open",

"signal_publish_time": "2025-08-15 16:14:27 UTC-04:00"

}

```

---

## 📊 Quick Reference – TradingView Ready

🎯 **Instrument:** UPST

🔀 **Direction:** PUT (Short)

💵 **Entry Price:** \$1.00

📈 **Profit Target:** \$2.00

🛑 **Stop Loss:** \$0.60

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

⏰ **Entry Timing:** Market Open

🕒 **Signal Time:** 2025-08-15 16:14 EDT

---

### Suggested Viral Title & Tags:

**🔥 UPST Bearish Swing Alert: Put Strike \$58 Ready ⚡**

\#UPST #SwingTrade #OptionsTrading #Bearish #PutOption #Momentum #TradeSetup #TechnicalAnalysis #StockAlerts #Finance #TradingSignals #MarketWatch #ShortTrade

Gold price pressure down, DXY recovers⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found some buying interest in Friday’s Asian session, rebounding from the two-week low near $3,330 hit the day before. Thursday’s data showed that U.S. producer prices rose in July at the fastest monthly pace since 2022, prompting markets to scale back expectations for a jumbo 50-basis-point Federal Reserve rate cut in September. This has emerged as a major headwind for the non-yielding metal.

Additionally, a generally upbeat risk tone is limiting safe-haven demand, capping gold’s upside. However, fresh selling pressure on the U.S. Dollar has provided some support to the Dollar-denominated commodity.

⭐️Personal comments NOVA:

Gold prices fall after ppi news, negative market sentiment as fears of inflation return will affect September rate cut decision

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3389- 3391 SL 3396

TP1: $3380

TP2: $3367

TP3: $3350

🔥BUY GOLD zone: $3311-$3309 SL $3304

TP1: $3324

TP2: $3333

TP3: $3348

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulation, cash flow through altcoin💎 MIDWEEK BTC PLAN UPDATE (August 13, 2025 )

1. Market Structure & Wave Pattern

The chart is applying the Elliott Wave theory with a completed 5-wave upward structure (1 → 5) and is currently correcting in an ABC pattern.

The current zone is in corrective wave C, with a likely retest of a key support area before bouncing back upward.

2. Key Price Levels

• Short-term resistance: 120,500 – 120,700 (previous breakout zone).

• Nearest support: 118,800 – 119,000 (EMA34 zone + retest of the broken downtrend line).

• Stronger support: 117,500 – 117,800 (EMA200 zone + long-term trendline).

• Major resistance above:

• 122,770 (Fib 2.618, short-term take-profit zone).

• 127,260 – 127,480 (Fib 3.618, strong resistance zone).

3. EMA & Trend

• EMA34 (gold) is above EMA89 and EMA200 → medium-term trend remains bullish.

• EMA200 (red) acts as dynamic support during the correction.

4. Trend Outlook

• Main scenario: Price may continue corrective wave C toward 118,800 – 119,000, possibly testing deeper at 117,500 – 117,800, then sharply rebound in line with the main trend toward targets at 122,770 and 127,260+.

• Alternative scenario: If the 117,500 support breaks, the short-term bullish structure will be invalidated, and BTC could retreat to 115,800 – 116,000 before recovery signals appear.

BTC - Short Plan UpdateAs per previous warning of the possibility of upwards liquidity grab first, here are updated details and a better entry for this trade.

Entry - 118,500-119,000

Stop Loss - 122,000

Target 1 - 62,000

Target 2 - 35,000

Target 3 - 8,000

- Note that per my plan we would drop to 35,000 and retrace (long) back up to 84,000 to 90,000 to form a 3 wave corrective drop.

- Note that the ultimate bottom could also sit between 17,000 to 19,000, however per my years of work, I believe 7,000 to 8,000 will be hit.

NOTE THIS IS NOT FINANCIAL ADVICE NOR IS IT A SUGGESTION ON HOW TO MANAGE YOUR MONEY. THIS IS MY PERSONAL TRADE ONLY.

Happy Trading.

BTC - Short Trade / Crash Update and DetailsPer my previous post here are the details on my personal trade. Note this is NOT financial advice, and this is my own personal trading plan only. Please use your own judgement.

Entry - 116,300 to 116,600

Stop Loss - 121,800

Target 1 - 95,700

Target 2 - 61,500

Target 3 - 35,000

Target 4 - 8,000

Note that Bitcoin should move up from the 35,000 target to 88,000 making a corrective wave on HTF.

At this point I will post an update and advise my own strategy and if I long 35,000 to 88,000.

Happy trading

continue to maintain gold purchase, 3400⭐️GOLDEN INFORMATION:

Gold prices edged higher on Monday, supported by growing expectations of a Federal Reserve rate cut following last Friday’s disappointing U.S. Nonfarm Payrolls report. XAU/USD is trading around $3,375, up 0.39% on the day.

Speculation over a potential policy shift has strengthened, with markets now pricing in an 87% chance of a rate cut at the Fed’s September 17 meeting — a boost for the non-yielding yellow metal.

Last week’s labor data revealed early signs of weakness in the job market. The U.S. Bureau of Labor Statistics (BLS) revised May and June payrolls down by a combined 258,000 jobs, reinforcing dovish remarks from Fed Governor Christopher Waller, who downplayed tariff-driven inflation and emphasized concerns about the Fed’s full employment mandate.

⭐️Personal comments NOVA:

Uptrend, gold price is maintaining stability. Heading towards 3400, before the expectation of interest rate cut is becoming more and more obvious.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3415- 3417 SL 3422

TP1: $3405

TP2: $3394

TP3: $3380

🔥BUY GOLD zone: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

NF news, can gold selling pressure drop to 3240?⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is trading lower, around $3,285 in early Asian hours on Friday, as a firmer U.S. dollar weighs on the non-yielding metal following new tariff measures announced by President Donald Trump.

The White House said late Thursday that Trump will set a 10% baseline tariff, stepping back from earlier speculation about hikes to 15% or higher, according to Bloomberg. He also signed an executive order raising the tariff on Canada from 25% to 35%, effective August 1, 2025, while extending Mexico’s current tariff rates for another 90 days to allow more time for negotiations.

⭐️Personal comments NOVA:

large frame, gold price is still moving in the downtrend line. will wait for NF result to have strong selling force again 3240

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3242-$3240 SL $3235

TP1: $3255

TP2: $3268

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

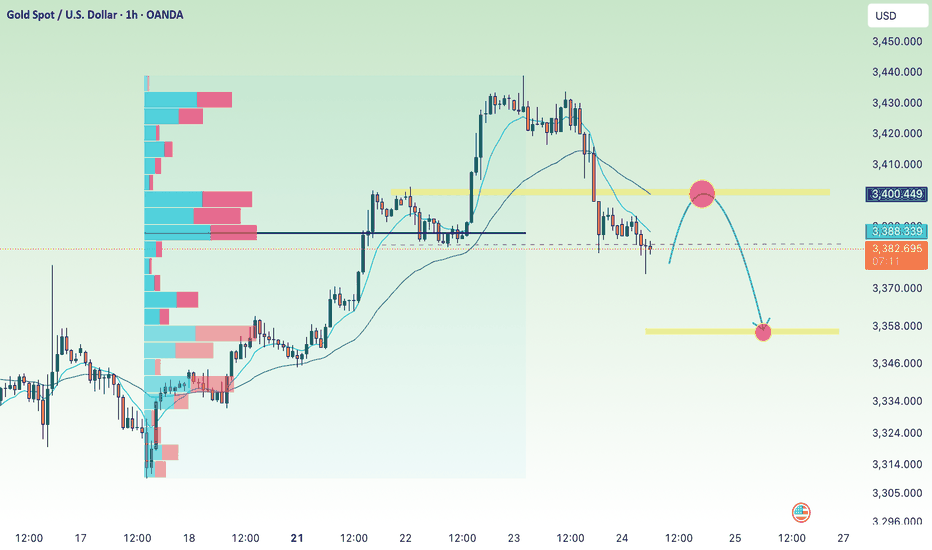

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

downtrend, gold price below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) remain under pressure during Wednesday’s Asian session, slipping below the $3,300 level and hitting their lowest point in over a week. The decline comes amid growing consensus that the Federal Reserve (Fed) will maintain interest rates at elevated levels for an extended period, especially as expectations rise that aggressive US tariffs could fuel inflation in the months ahead.

This outlook has driven US Treasury yields higher and kept the US Dollar (USD) anchored near a two-week high reached on Tuesday — a key headwind for the non-yielding precious metal, which continues to face downward pressure as a result.

⭐️Personal comments NOVA:

Gold price breaks support, DOW H1 formation, gold downtrend below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3344- 3446 SL 3351

TP1: $3335

TP2: $3320

TP3: $3302

🔥BUY GOLD zone: $3256-$3254 SL $3249

TP1: $3268

TP2: $3280

TP3: $3298

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account