EURUSD Buyers In Panic! SELL!

My dear subscribers,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1704 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1654

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Signal

EURNZD Trading Opportunity! BUY!

My dear friends,

Please, find my technical outlook for EURNZD below:

The instrument tests an important psychological level 1.9570

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9595

Recommended Stop Loss - 1.9557

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

From FOMO to Game Over: The Witch’s Market ProphecyPolitics and market forces are cooking the soup too hot, and greed is on the menu. Investors, funds, and retail traders are ignoring the signs — and just like in the Wild West, only the weapons have changed: stocks, futures, and options. Today, we’ll peek over the witch’s shoulder to see what she sees in the chart’s shadows.

The Setup

This chart shows the market reaching the U-MLH (Upper Median Line Parallel) for the third time. Even this week, the greedy market is nibbling at that level, trying to chew its way higher. The question: does it break through — or break down?

Scenarios

(0) → Price touches the U-MLH for the third time.

Historically, repeated touches can lead to either an explosive breakout or a sharp reversal.

(2) → A momentum kick, driven by FOMO, could push price up to the Warning 1/4 line.

This would be the bulls’ dream run.

(3) → The market reaches the next pitchfork line/deviation — because that’s what markets do.

After that? Only the market gods know.

(4) → Price fails to reach WL1 (Warning Line 1), triggering a Hagopian.

This typically signals a failed breakout and a likely pullback.

Key question: Will U-MLH hold as support?

If not, expect a quick test/retest from below… then it’s Game Over.

(5) → In 80% of cases, the centerline gets tagged as Profit Target 1.

That could be the “logical” next stop.

(6) → L-MLH (Lower Median Line Parallel) — the panic zone.

This is when fear takes over, selling accelerates, and the market feels like the fan just got hit.

Final Word

Whatever happens next, the witch doesn’t care — she’ll be riding her broom into the moonrise, leaving the rest of us to trade the chaos.

#SPX500 #NASDAQ100 #TechnicalAnalysis #Pitchfork #Futures #Options #MarketOutlook #SwingTrading #FOMO

NZDUSD: Bearish Continuation & Short Trade

NZDUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell NZDUSD

Entry - 0.5955

Stop - 0.5962

Take - 0.5941

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD Massive Short! SELL!

My dear followers,

This is my opinion on the GBPAUD next move:

The asset is approaching an important pivot point 2.0688

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 2.0615

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF What Next? BUY!

My dear subscribers,

My technical analysis for USDCHF is below:

The price is coiling around a solid key level - 0.8075

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 0.8093

My Stop Loss - 0.8064

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCAD: Expecting Bearish Continuation! Here is Why:

The recent price action on the USDCAD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Short Signal with Entry/SL/TP

EURUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry Point - 1.1625

Stop Loss - 1.1635

Take Profit - 1.1605

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD My Opinion! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3345.0 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3351.7

Safe Stop Loss - 3341.9

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Reasons for gold price plunge in today's trading session 11/8Gold prices fell 1% on Monday as markets focused on upcoming talks between the United States and Russia over the Ukraine conflict, along with July data that could bring more concerns about the Federal Reserve's interest rate outlook.

Gold was trading at $3,363.31 an ounce at 0703 GMT, having hit its highest since July 23 on Friday. US gold futures for December delivery fell 2% to $3,423.10 an ounce.

"Easing geopolitical tensions over the Ukraine war sent gold prices lower, following Friday's announcement that US President Donald Trump will meet Russian President Vladimir Putin on US soil"

Meanwhile, US consumer price data is due on Tuesday, with recent tariffs expected to push the core index up 0.3%, taking the annual rate of growth to 3%, above the Federal Reserve’s 2% target.

“If inflation is high, the US dollar could strengthen and make it difficult for gold to rise. However, I think gold prices will still be supported as investors buy on dips.”

The recent weaker-than-expected US jobs report has increased expectations that the Fed will cut interest rates in September. Markets are pricing in about a 90% chance of easing in September and at least one more cut before the end of the year.

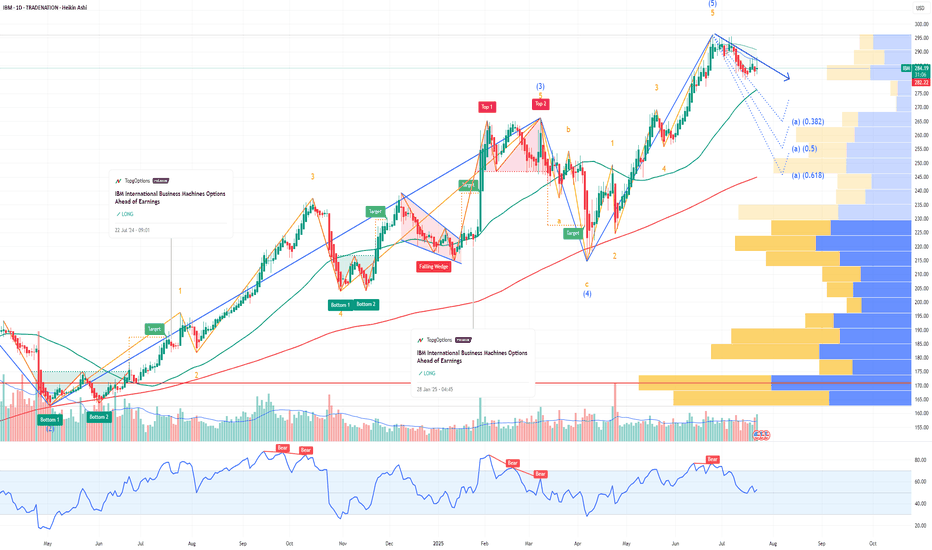

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Trading Opportunity! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The instrument tests an important psychological level 1.0961

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.0951

Recommended Stop Loss - 1.0967

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURJPY Buyers In Panic! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 172.25 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 171.49

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

APPLE My Opinion! SELL!

My dear friends,

Please, find my technical outlook for APPLE below:

The price is coiling around a solid key level - 229.36

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 221.47

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD: Long Trade with Entry/SL/TP

EURCAD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURCAD

Entry - 1.6016

Stop - 1.6005

Take - 1.6037

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD On The Rise! BUY!

My dear friends,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1618 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1642

Recommended Stop Loss - 1.1606

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Financial markets are set to receive a slew of important newDomestic gold prices fell due to the impact of world gold prices. In the international market, after closing the week at a high level, today's gold price suddenly reversed and plummeted when opening the new trading week.

Gold prices fell contrary to the forecast of analysts and investors when they expected the precious metal to continue to increase this week.

This week, the market is waiting for a lot of economic information such as the meeting to announce Australia's interest rate decision; the US consumer price index (CPI) report for July; the US producer price index... The data of this information is expected to affect the gold price.

This morning, the USD index (DXY) in the international market recovered to 98.1 points, also creating pressure to reduce gold prices.

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

GOLD: Bullish Continuation & Long Trade

GOLD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry Point - 3360.0

Stop Loss - 3353.1

Take Profit - 3373.4

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️