Hellena | EUR/USD (4H): SHORT to the MIN of wave "3" 1.14647.We continue to monitor the decline in downward momentum. In the last forecast the target was almost reached, but the correction turned out to be stronger than we thought, which does not cancel the forecast, but just gives us an opportunity to enter a short position once again quite favorably.

I expect that the small wave “b” is either over or almost over and the price is about to start its decline to the support area at 1.14647.

This movement should be a confirmation of the completion of the large correction (red) “ABC”.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Signalsservice

ZS Zscaler Options Ahead of EarningsIf you haven`t bought ZS before the rally:

Now analyzing the options chain and the chart patterns of ZS Zscaler prior to the earnings report this week,

I would consider purchasing the 260usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $11.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Below 51, Silver Remains Heavy – Watching 47.50 Next1. What Happened After Last Week’s Call

As expected — and exactly as outlined in last week’s analysis — Silver reversed sharply from the sell zone above 52, dropping nearly 4,000 pips from that level.

This was a textbook reversal from resistance, confirming that the 52+ area is a major rejection zone for the metal.

After the drop:

- Price reclaimed the 49 support, showing short-term stabilization,

- But failed to regain the 50.50 zone, which was crucial for a genuine bullish recovery.

- Instead, Silver has now slipped into a sideways consolidation, showing hesitation and lack of strong buyers.

2. Current Market Context – Not the Same as Gold, but Still Bearish

While Silver’s structure is not identical to Gold’s, it shares the same underlying message:

➡️ The market is heavy, not neutral.

Key observations:

- The rebound lacked momentum.

- Every rally since the drop has been corrective, not impulsive.

- The failure at 50.50–51.00 confirms that sellers are still defending this zone aggressively.

This leaves Silver stuck under resistance with a bearish tone, despite the temporary bounce above 49.

3. Technical Outlook – Preparing for the Next Leg Down

Resistance zone:

50.50 – 51.00

This remains the decisive ceiling.

As long as Silver stays below this band, the market structure is bearish, and every rally into this area is a sell opportunity.

Support zone:

49.00

A key reference point.

If Silver breaks below 49 again, sellers will likely push aggressively.

Downside target:

47.50 zone

This is the next major support, and the most logical destination for a completed second leg down.

Given the current rhythm of the market, a drop into this zone is highly plausible if 49 gives way.

4. Trading Plan – Clear, Simple, Disciplined

- Sell rallies into 50.50–51.00 resistance

- More confirmation if price approaches 49 again

- If 49 breaks, expect a continuation toward 47.50

Bias changes only if Silver reclaims 51 with strong buying (low probability for now)

No need to overcomplicate this setup — the market is offering clear technical boundaries.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.31.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

USD/CHF: Bears Defending the TrendlineUSD/CHF continues to respect the descending channel structure that has been in place since mid-August.

After a short-term recovery, the price is now retesting the upper trendline resistance and the 0.8000–0.8020 supply zone, where sellers have previously stepped in.

Technical Outlook

Structure: Descending channel – clear series of lower highs.

Resistance zone: 0.8000–0.8020 (channel top + previous rejection zone).

Support zone: 0.7870–0.7840 (recent demand area).

Moving averages: Both 50 and 100 MAs are flattening but still below the resistance, suggesting limited bullish momentum.

Bias: Bearish below 0.8020 — expecting rejection and continuation to the downside.

Fundamental Context

Recent U.S. data has shown mixed inflation numbers, while Swiss CPI remains stable, reducing expectations for any SNB intervention.

The stronger Swiss franc remains supported by safe-haven flows amid global uncertainty.

Unless the U.S. delivers a clear upside surprise in macro data, the pair is likely to remain under pressure in Q4.

Trade Setup (Not Financial Advice)

Entry zone: 0.79700–0.79800

Stop-loss: 0.8020

Targets:

TP1 → 0.7900

TP2 → 0.7845

🧭 A break below 0.7930 would confirm bearish continuation within the channel.

RIOT Platforms Options Ahead of EarningsIf you haven`t bought RIOT before the previous earnings:

Now analyzing the options chain and the chart patterns of RIOT Platforms to the earnings report this week,

I would consider purchasing the 12usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GER40 | 30min Double Top | GTradingMethodHello traders,

Just took a short on GER40.

Potential double top on 30min chart.

I only trade double tops that have rsi diveregnce

Risk/reward = 3.4

Entry price = 23 725.8

Stop loss price = 23 763.2

Take profit level 1 (50%) = 23 622

Take profit level 2 (50%) = 23 565

Keep to hear your thoughts on the equities markets :)

This is not financial advice but just me documenting my journey

Why BABA Alibaba Could Rebound Strongly by Year-End 2025If you haven`t bought BABA before the recent rally:

What you need to know:

BABA’s fundamentals, fueled by e-commerce, cloud, and AI, support its technical bullishness:

E-commerce and Cloud Rebound:

Q1 2025 revenue grew 7% year-over-year, with Taobao/Tmall rebounding and cloud revenue surging due to AI demand.

Alibaba’s cloud division, China’s largest, benefits from hyperscaler AI workloads, with 15% profit margin projections by 2029.

AI Leadership:

BABA’s AI assistant and generative AI tools drove a 70% stock surge in early 2025, positioning it as a leader in China’s AI race.

At 12x forward P/E with 8% revenue CAGR, BABA is undervalued (fair value ~$162).

Share Buybacks:

Aggressive share repurchasing (6% annual reduction) boosts EPS, with $1 trillion GMV reinforcing e-commerce dominance.

Macro Tailwinds:

Easing CCP regulations and China’s stimulus measures (e.g., rate cuts) support BABA’s rally.

Minimal U.S. exposure insulates BABA from trade war risks.

Conclusion: BABA’s Path to $168

BABA’s technicals, with a bullish breaker and wedge, signal a breakout above $125–$130, targeting $150–$168 by year-end 2025. Fundamentally, its e-commerce dominance, cloud/AI growth, and undervaluation make it a standout. Traders should buy dips near $110–$115 or await a $130 breakout. With stimulus and buybacks as catalysts, BABA is set to soar.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

KWEB: China’s Internet Sector - AI Catch-Up and Cheap ValuationsChina’s internet and tech stocks have been hammered for years — regulatory crackdowns, slowing growth fears, and geopolitical tension have crushed sentiment. But as investors know, the best opportunities often hide in what everyone hates.

Enter KWEB, the KraneShares CSI China Internet ETF.

It’s a diversified, liquid way to play a bounce in major names like Alibaba, Tencent, JD .com, Baidu, Meituan and PDD.

Here’s why I think the risk/reward looks compelling now — especially if you believe in AI closing the gap.

Key Bullish Points:

1) Valuations at Rock-Bottom

Many big China internet stocks are still trading at single-digit P/E ratios, even as their cash flows recover. Compared to U.S. big tech trading at 30–50x, this is a huge valuation gap.

Regulatory fears seem largely priced in — Beijing wants growth, not stagnation, and some policies are easing.

2) China’s AI Push — Just “Months Behind”

Jansen Whang recently argued that China’s generative AI development is only “months behind” the U.S. Players like Baidu, Alibaba Cloud, Tencent, and SenseTime are all racing to launch new LLMs and integrated AI tools.

If you believe the gap closes, Chinese platforms could see a major earnings rebound as they roll out AI upgrades across search, cloud, e-commerce and social media.

3) Sentiment So Bad, It’s Good

When the headlines scream “China is uninvestable,” that’s often when big mean reversion trades set up. Even a small policy pivot, stimulus plan, or positive AI news cycle can spark a sharp rally.

KWEB is one of the cleanest ways to express this view because it holds a diversified basket — you don’t have to pick a single winner.

SE Sea Limited Options Ahead of EarningsIf you haven`t bought SE before the rally:

Now analyzing the options chain and the chart patterns of SE Sea Limited prior to the earnings report this week,

I would consider purchasing the 150usd strike price at the money Calls with

an expiration date of 2025-9-12,

for a premium of approximately $9.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PSTG Pure Storage Options Ahead of EarningsIf you haven`t bought PSTG before the previous earnings:

Now analyzing the options chain and the chart patterns of PSTG Pure Storage prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $6.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BNB Strong Resistance Meets Whales Sell Orders – A Good Short BNB Current Market Update

The coin is now trading at its All-Time High , facing a very strong resistance around $900 .

This presents a great short opportunity .

After carefully monitoring buy and sell orders on-chain, I noticed a strong confirmation for the short setup:

Whales and Market Makers sell orders are clustered heavily around the $888 – $890 resistance zone.

✅ My Personal Strategy:

Short Entry: Resistance zone between $888 – $890

🎯 Target 1: $876

🎯 Target 2: $873

Please note:

This is not financial advice – I’m only sharing my personal trades.

Always do your own research before taking action.

👍 Don’t forget to like if you found this useful, and feel free to follow me for more analysis of this kind.

Best of luck 🌹

BITCOIN Quick Buy Trade with the whalesBased on my analysis of on-chain data and liquidity flow, here is what I am seeing:

I've noticed a large buy order in the green zone between 110,600 and 110,500, which may push the price higher.

Additionally, there are large whale buy orders at the strong support of 110,000, with options contracts clustered there.

This will also contribute significantly to pushing the price up.

My Strategy:

✅ I will be taking a buy position if the price drops to the green zone between 110,600 and 110,500.

I will also take another buy position if the price drops to 110,000.

Targets

🎯 TP1: 112,600

🎯 TP2: 113,400

Disclaimer

This is not investment advice. I am only sharing my personal trade setups. Please always do your own research before trading.

Regards 🌹

Bitcoin Quick Buy Opportunity for Quick TradersBTC,

Currently, Bitcoin is trading within a tight consolidation range, caught between a descending trendline and an ascending trendline on the 1-hour chart.

The price is forming a potential compression pattern, which often precedes a breakout.

while volume spikes indicate active demand around the green zone.

Additionally, there are visible whale buy orders and volume confirmation near the ascending trendline shown in the chart, strong enough to potentially push the price higher.

These orders are clustered around 110,650.

I will follow a strategy and enter from the same level.

My plan is as follows:

✅ Entry: Buy if price retraces to green line 110,650

🎯 Target 1: 111,250

🎯 Target 2: 111,600

Please keep monitoring this setup, as I use strategies based on observing supply and demand flows.

I will update you with any changes in entry points, targets, or shifts in order book dynamics.

Important Note:

This is not financial advice.

I am only sharing my own trades and personal analysis, which reflect my individual perspective.

Please always do your own research.

Good luck in your trades.

Best Regards 🌹

Bitcoin Do not buy today there is a massive sell-off.Be careful today and avoid buying Bitcoin.

A whale just sold 1,000 BTC at $113,000, causing a sudden drop in price, as shown on the chart.

Remember that the market is always driven by supply and demand, and by the large-scale buying and selling operations of whales.

⚠️ Do not buy Bitcoin currently unless new buy orders from market makers appear and there is significant buying entry from whales.

👉 Follow me to know the entry and exit points of market makers and whales.

I specialize in analyzing and tracking the orders of market makers.

Best regards to all 🌹

please note :

this is not financial advice — it reflects only my personal opinion.

PLEASE always do your own research before trading .. Good luck with your trades.

If this type of analysis interests you, feel free to follow my work. I specialize in tracking and analyzing the orders of market makers and whales. Of course, always do your own research before trading

Thank you 🌹

AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

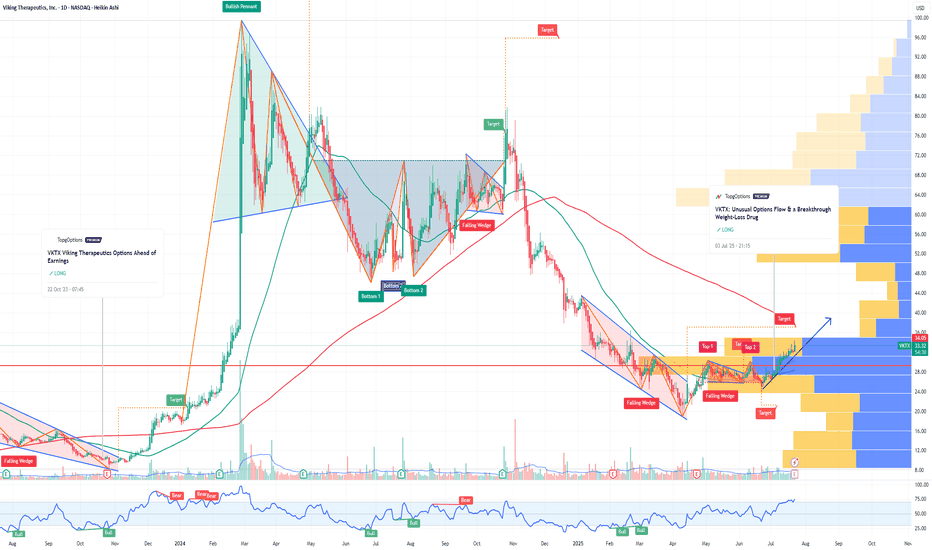

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

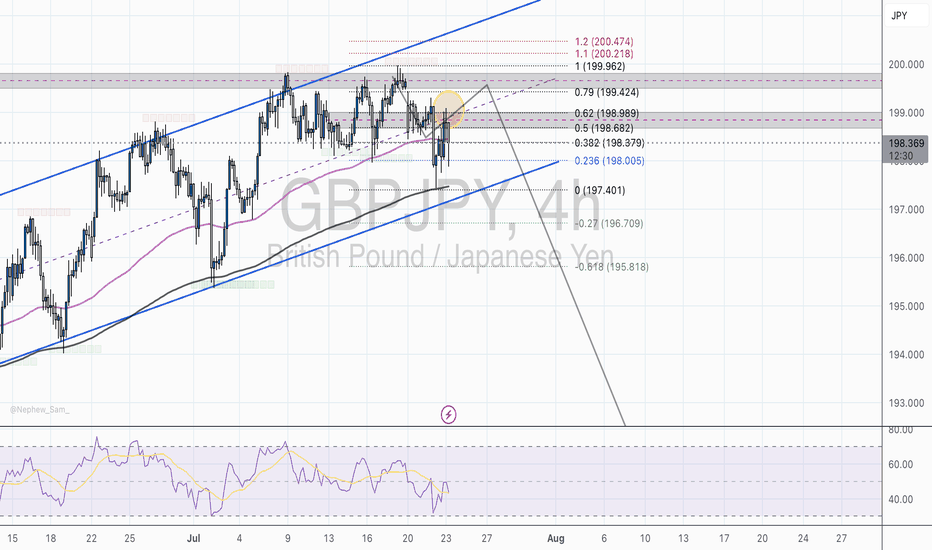

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

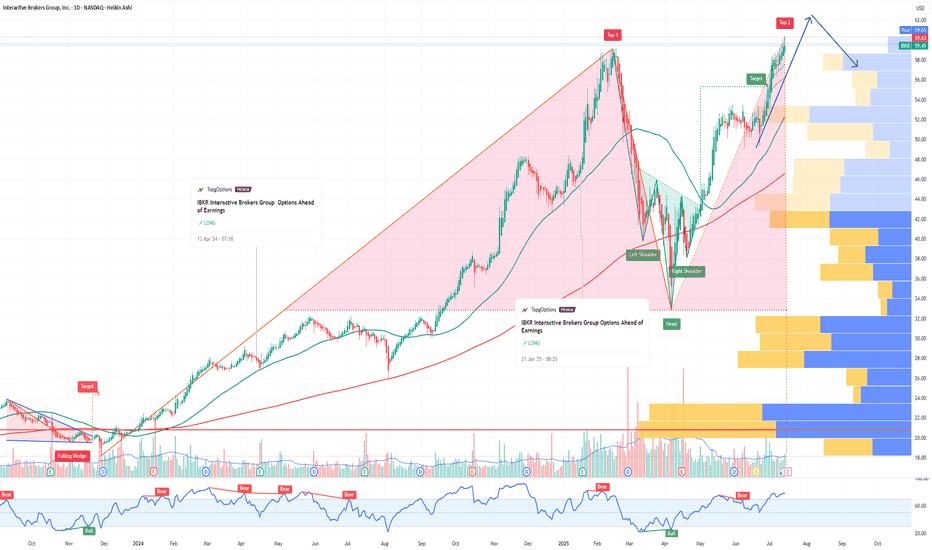

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SNAP Upside PotentialIf you haven`t bought SNAP before the previous earnings:

SNAP Key Fundamental Strengths in Q1 2025:

Metric Q1 2025 Result Year-over-Year Change

Revenue $1.36 billion +14%

Daily Active Users (DAU) 460 million +9%

Monthly Active Users (MAU) 900 million+

Net Loss $140 million -54% (improved)

Adjusted EBITDA $108 million +137%

Operating Cash Flow $152 million +72%

Free Cash Flow $114 million +202%

SNAP strong fundamental performance in Q1 2025, marked by accelerating revenue growth, expanding user engagement, sharply improving profitability, and robust cash flow generation, sets a solid foundation for a potential stock rally this year.

The company’s innovation in AR, diversified revenue streams, and healthy balance sheet further support a bullish outlook. Investors focusing on fundamentals can view Snap as a growth stock with improving financial health and significant upside potential in 2025.

My price target is $14.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.