Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Silver. Just please wait for bearish confirmation.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Silver

Silver XAG/USD - Breakout + Retest Signals Upside Continuation📝 Description🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD is forming a well-defined Triangle Breakout pattern on the M30 timeframe.

After a strong bullish move, price consolidated with lower highs and higher lows, compressing volatility — a classic sign of an upcoming expansion.

Price has now broken above the triangle resistance and is showing a healthy breakout & retest, supported by EMA and holding above the structure.

This favors a bullish continuation scenario.

📍 Support & Resistance

🟨 Support Zone: 104.70 – 106.00

🟢 1st Resistance: 123.90

🟢 2nd Resistance: 130.00 – 130.20

⚠️ Disclaimer

This analysis is for educational purposes only.

Commodities are volatile — always use proper risk management and position sizing.

💬 Support the Idea👍 Like if you’re bullish on Silver

💬 Comment: Clean breakout or fake move?🔁 Share with traders watching XAG/USD

#XAGUSD #Silver #CommodityTrading #TriangleBreakout #PriceAction #TechnicalAnalysis #TradingView #Kabhi_TA_Trading

SILVER | Pullback as Precious Metals Rally PausesPRECIOUS METALS MINERS | Pullback as SILVER Rally Pauses

European precious metals miners opened lower as investors took profits after the recent strong rally in TVC:GOLD and TVC:SILVER . The pause in bullion momentum weighed on mining equities, which tend to amplify moves in underlying metal prices.

In early London trade, Fresnillo and Hochschild fell around 3.2% and 2.5%, respectively, while losses extended beyond precious-metals-focused miners, reflecting a broader risk-off tone at the open.

Technical Outlook

The price maintains a bearish structure while trading below the 112.91 pivot.

As long as price remains below 112.91, downside pressure is expected toward 110.40.

A confirmed 1H close below 110.40 would strengthen bearish continuation toward 107.46, followed by 103.35.

On the upside, bullish momentum would only be activated with a 1H close above 112.91, opening the way toward 117.19 and 119.83.

Key Levels

• Pivot: 112.91

• Support: 109.41 – 107.47 – 103.40

• Resistance: 115.00 – 117.20 – 119.84

Everyone is staring at silver 🤯 Everyone is staring at silver. As if silver just woke up one morning and decided to go vertical.

Nope.

This isn’t just silver.

🥇 Gold

🥈 Silver

🥉 Platinum

All three started moving together back in May 2025 and in the first weeks of 2026, they didn’t trend. They snapped vertical.

Here’s the illusion that needs to die first ☠️

This is not calm long-term investing.

This is not pension money patiently buying for the next 20 years.

If it were, the charts wouldn’t look like they were drawn after three espressos and zero sleep ☕️📈

When an entire metals complex goes vertical at once, it’s rarely about “confidence.”

It’s about pressure 🔥

Positioning.

Crowding.

And someone stuck on the wrong side, watching exits disappear.

The daily and weekly candles look… beautiful. Almost too beautiful 👀

And that’s usually where risk hides, not where it disappears.

Moves like this don’t fade gently.

They end one of two ways ⬇️⬆️

Either a final blow-off where everyone suddenly believes this is the new normal…

Or a sharp deflation, where weeks of progress vanish in one or two sessions 💨

This isn’t bearish.

It’s not bullish.

It’s just how markets behave.

Metals aren’t meme stocks 🤡

They don’t need hype.

But when they start acting like meme stocks, something is being squeezed hard 🧨

So the real question isn’t:

“Where is silver tomorrow?” ❌

It’s:

What happens when this pressure releases? ⚠️

Because vertical charts aren’t gifts 🎁

They’re stress tests.

And markets reward those who know when not to fall in love with a chart ❤️🔥📉

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That performance puts silver ahead of nearly every major commodity and even ahead of gold, the traditional anchor of the precious-metals complex. Momentum has been relentless, headlines have grown louder, and price action has moved from steady to explosive.

When markets accelerate this quickly, attention follows. So does risk.

🪙 Gold Climbs with Purpose

Gold OANDA:XAUUSD has also started 2026 in strong form, trading above $5,100 an ounce for the first time in history. The move builds on a powerful rally that delivered a 60% gain in 2025, driven by familiar macro forces that continue to shape investor behavior.

Compared with silver’s all-over-the-place sprint, gold’s climb looks measured and deliberate. That difference highlights the contrasting roles the two metals play in portfolios. Gold behaves like a heavyweight asset, absorbing large flows with relative calm. Silver responds more sharply to changes in sentiment and positioning.

⚙️ Silver’s Fundamental Case Gains Strength

Silver’s story extends beyond safe-haven demand. Industrial use now forms the backbone of the market. As one of the most efficient conductors of electricity, silver plays a central role in electronics, solar panels, circuit boards, and energy infrastructure.

According to Metals Focus, industrial demand now accounts for around 60% of total silver consumption, up significantly from a decade ago. That shift has aligned silver with long-term trends in electrification and renewable energy investment.

Supply dynamics add further pressure. Roughly three-quarters of new silver supply comes as a byproduct of mining other metals such as copper and zinc. Production responds slowly to price signals, and demand has exceeded supply every year since 2018. Last year’s deficit reached nearly 20%, with another shortfall expected in 2026.

📈 Speculation Takes the Wheel

But also, price behavior suggests fundamentals alone no longer explain silver’s trajectory. Speculative positioning has become a dominant force.

The silver market carries a total value of roughly $5.3 trillion, far smaller than gold’s $33 trillion footprint. That size difference amplifies volatility and accelerates moves when capital flows surge.

Intraday swings have grown aggressive. Moves of several dollars within minutes have become common, shifting hundreds of billions of dollars in market value in short bursts. Traders accustomed to slower commodity cycles have found themselves navigating price action that resembles high-beta equities.

🌍 Politics Add Energy to the Trade

Geopolitical tension is adding support for another leg up. President Donald Trump’s renewed trade and military rhetoric toward Europe, including commentary around Greenland , has reinforced demand for real assets.

At the same time, the administration clarified that tariffs on silver and other critical minerals remain off the table. That clarification did little to slow momentum, raising questions about how much of the rally rests on positioning rather than policy.

🥇 Gold’s Rally Follows Familiar Lines

On the other hand, gold’s advance reflects a broader macro backdrop. Elevated inflation, a weaker US dollar , and continued central-bank buying have supported demand.

Expectations for further Federal Reserve rate cuts in 2026 strengthen the case, as lower yields reduce the appeal of fixed-income alternatives. (Make sure you watch the economic calendar to catch any surprise announcements.)

Gold also benefits from deep scarcity. According to the World Gold Council, total gold mined throughout history amounts to approximately 216,265 tons, enough to fill just about four Olympic-size swimming pools.

The US Geological Survey estimates another 64,000 tons remain underground, though production growth is expected to level off as accessible deposits diminish. That constraint continues to anchor gold’s role as a long-term store of value.

⚖️ Valuation Questions Surface

Debate has shifted toward valuation. Very few analysts expect silver to revisit the $20-to-$30 range last seen in late 2022. Structural demand and supply dynamics suggest a higher baseline.

Prices above $100, however, place silver in rare territory where momentum and leverage exert significant influence. In such environments, price discovery becomes less orderly and reactions grow sharper.

🎁 The Takeaway

Silver and gold are rising for different reasons and behaving in distinct ways. But one thing unites them. Right now, it’s more about speculation than anything else.

Off to you : Are you sleeping on the rally or you’ve bet on either of these metals? Share your approach in the comments!

Silver Breaks $110 — Time to Rotate Out? Silver just printed a new all-time high at $110.25 — a clean Fibonacci extension rally that’s now entering major resistance zones :

• $111.40

• $116.98

• $134.95

The move from $50 to $110 has been explosive. But parabolic advances don’t last forever , and this chart now outlines a potential local top formation .

We could see a rejection at $111–116 and a retest of key zones below :

• $103.86 (previous resistance)

• $92 and $86 if things accelerate

📺 All of this was broken down in the full macro video — along with why Bitcoin might be next in line to move:

🔗 Silver $110, Gold $5K — Bitcoin Pump Next?

Silver bulls have feasted. Now it’s time to ask — are you late to the party, or early to the rotation?

Perspective Shift 🔄

Every rally ends with FOMO — and that’s often your exit cue. Silver's rally is historic, but the rotation clock is ticking. With BTC sitting on macro support , this could be the last leg before capital flows shift.

Disclaimer: I'm not a financial advisor — I'm a master of Prognosis. These are my personal views. I read charts like a poet reads the stars. You still gotta trade at your own risk. 🧠💥

One Love,

The FXPROFESSOR 💙

Gold Weekly Levels: Break above 5055/5065 → 5210/5220🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Bulls remain in control as price pushes toward overhead liquidity

🟡 Key unlock level: 5055–5065 — a clean break and acceptance above opens continuation fuel

🚀 Breakout continuation objective: 5210–5220 primary upside objective and overshoot zone

🧲 Fresh overhead sell-side liquidity: 5055–5065 then 5210–5220 high-probability magnet zones

🔄 Expectation after 5210–5220: profit-taking wave and corrective rotation lower into fresh buy-side pools

🛡 Transition pivot: 5210–5220 where longs should be exiting and reversal stalking begins

⚠️ Bears’ post-extension objectives: 4875–4885 then 4775–4785 — fresh buy-side liquidity targets below

🎯 Strategy this week: trade the breakout into 5210–5220, then shift mindset to correction timing

🏦 Core play: don’t chase highs inside 5210–5220; scale out into target, then stalk confirmed reversal

🗳️ Gold Weekly Scenarios — What’s Your Play?

Which path do you have for XAUUSD next week?

🅰️ Hold above and accept through 5055–5065 → breakout triggers → run to 5210–5220

🅱️ Early-week stall at 5055–5065 → brief pullback → reclaim and acceptance → squeeze into 5210–5220

🅲 Direct drive into 5210–5220 → reversal confirmed → correction targets 4875–4885 then 4775–4785

🅳 Your key level: 5055–5065

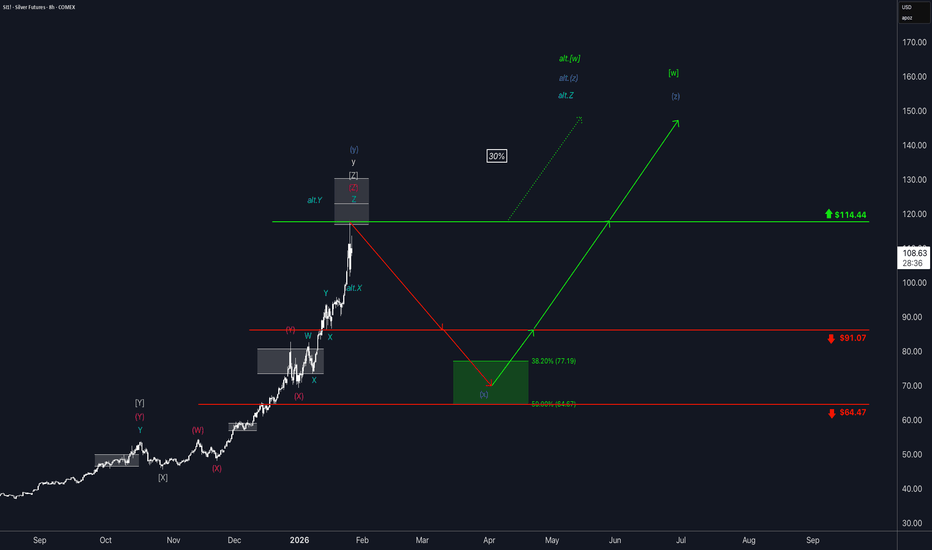

Silver: Finally Topped Out?Silver futures start the trading week with extreme volatility, reaching our now deactivated and therefore greyed-out short target zone (coordinates: $116.91 – $130.31).

If a short position was already initiated within this zone, it may now be appropriate to trail existing stop-loss levels.

At this stage, the primary assumption is that only the high of blue wave (y) has been completed within this area. Under our primary scenario, a more pronounced corrective move is considered imminent. We expect the termination of the corresponding wave (x) within our green long target zone (coordinates: $77.19 – $64.67), where we also anticipate the start of the final upward leg of green wave .

Alternatively, silver may have recently formed the high of wave alt.Y, while the latest counter-move established the local low of alt.X. This would argue in favor of a direct continuation of the bullish advance within green alt. , extending beyond the resistance level at $114.44.

SILVER(XAGUSD): Price Heading Towards $109! Dear Traders,

Silver has made a slight correction and then reversed nicely. Now we’re seeing a significant surge in market volume. There’s only one take-profit and entry point. The stop-loss can be placed below our blue-marked entry box. This move could be substantial if it goes our way.

This trade could be completed within this week or next, assuming the volume remains constant.

Team Setupsfx_

GBPUSD: consolidation at 1.37🛠 Technical Analysis: On the H1 chart, GBPUSD remains bullish after a strong impulse move and is now compressing beneath the marked resistance zone around 1.37000. Price is holding inside a rising structure, with the steep trend channel still intact and suggesting continuation if buyers defend the pullbacks. The moving averages are angled higher and sit below price, reinforcing the upward bias. A clean push above the resistance area opens the way toward the next upside target, while a drop back below the consolidation base would signal a deeper retracement into the nearest support zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.36872

🎯 Take Profit: 1.37532

🔴 Stop Loss: 1.36438

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

SILVER Will Go Lower! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 11,161.4.

Taking into consideration the structure & trend analysis, I believe that the market will reach 10,315.0 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Literally 50-years-old pattern that you can't miss

The Cup & Handle pattern formation in OANDA:XAGUSD is now fully completed. As clearly shown on the chart, price has already advanced by approximately +124% following the breakout.

I'm not trying to be too optimistic and fall to the overall market sentiment towards silver. My only goal here is to understand the scale of this trend and how we might act.

The previous comparable formation in silver developed over 106 years. The breakout phase began in 1973, launching a 6-year bull market that gained approximately +820% versus the USD.

This is a 3-month timeframe chart, and of course there will be a huge pullbacks along the way. The full realisation of this analysis may take years. This setup should therefore be approached as a long-term investment thesis, with strategy construction aligned to a multi-year horizon.

Key structural support is now located in the $47–71 per ounce range, where a Fair Value Gap (FVG) from Q4 2025 is present. This zone acts as a critical demand area and potential base for further continuation.

If the upside is similar to the 'Handle', silver could extend toward $224 per troy ounce.

Do you think my projections are true? Can wу get $220+ per ounce of silver? Should I run to the nearest bank department?

#silver #investing #longterm #tariffs

XAU/USD: Bearish Continuation and Liquidity Hunt PhaseGold (XAU/USD) continues to show signs of structural weakness on the 15-minute timeframe. Following a strong rejection from the institutional supply zone (upper purple box), the price action is now confirming a transition into a deeper corrective cycle. The market is actively seeking out lower liquidity levels to rebalance the recent impulsive upward move.

Technical Breakdown:

Trendline Breakdown: The price has decisively lost its primary ascending support, turning the previous bullish structure into a series of lower highs and lower lows. This shift confirms that sellers are now in control of the intraday trend.

Supply Zone Defense: The resistance zone near 5,110 - 5,120 has proven to be a formidable barrier. Each attempt to reclaim this area has been met with aggressive selling pressure, reinforcing the bearish sentiment.

Forecasted Path: As indicated by the black forecast lines, we anticipate a "Break and Retest" sequence. The market is likely to consolidate or minorly pull back before a sharp expansion toward the downside.

Key Targets:

Primary Objective: 4,912 – This remains the main target for take-profit, aligning with a significant structural demand zone (lower purple box).

Secondary Objective: 4,880 – A deeper extension to clear out the remaining sell-side liquidity resting at the base of the previous rally.

Risk Management: The bearish setup is invalidated if the price produces a strong 15-minute candle close above the 5,154 peak. Until then, any rallies should be viewed as potential selling opportunities.

Conclusion: This setup is a classic example of market distribution. Traders should remain patient and look for bearish confirmation near the minor resistance levels to join the move toward the major demand zones below.

THE DOLLAR IS CRACKING | HISTORIC 4-YEAR LOWS 🚨 THE DOLLAR IS CRACKING | HISTORIC 4-YEAR LOWS 🚨

The TVC:DXY (USD Index) has officially reached a critical tipping point. We haven't seen these levels in 4 years, and the global markets are feeling the heat. This is the definition of a "Make or Break" zone.

📉 THE CRITICAL LEVEL: 94

The dollar is currently hovering at 96. If we see a weekly candle close below 94, the dollar officially enters a structural breakdown.

* If it breaks: It will be "hard" to ever recover that ground.

* The Result: A massive capital flight into hard assets—most notably GOLD.

💰 MARKET SNAPSHOT (TODAY):

* 💵 USD Index: 96.00

* 🟡 GOLD: $5,266

* ⚪️ SILVER: $115.2

* 📈 Nasdaq: 26,210

* 💷 GBP/USD: 1.3812

* 🇦🇪 XAU/AED: 19312

THOUGHTS: The inverse correlation is screaming. As the Dollar loses its grip, Gold and Silver are entering a new era of price discovery. This week's close determines the next decade of macro trends.

Stay sharp. Stay hedged. 🛡

---

✨ ✨

The pulse of the markets.

Silver Bells, Silver Bells, Silver all the way...Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Dashing through the snow

"In a One Horse" open sleigh

Over the hills we go

Laughing all the way

Bells on Bobtails ring

Making spirits bright

What fun it is to ride and sing

A Silver song tonight...

Happy Silver New Year!

AGQ projects to $405 SILVER 2X ETFYet to breakout from this W pattern.

What Is the W Pattern?

The W Pattern is a bullish harmonic pattern found on most stock charts at some point in time. Think of the letter “W” and imagine what this pattern might look like. It is characteristic of a bounce and retest of a key support area, commonly referred to as a double-bottom formation.

When this pattern forms on a chart, it usually indicates a trend reversal. Between the two bottoms, there is a level of resistance about halfway between the two tops. As a result, this is key, as it indicates a retest of the bottom support before rising higher into the newly formed uptrend.

Now you see it.

What do you think of this chart pattern and price targets?

Silver Inflation AdjustedHow much is the market willing to pay in real (inflation-adjusted) terms?

Roughly 20 times its historical real average ($3), which puts silver around $60 inflation-adjusted.

That means silver can still double from here—and do it faster than most expect.

Would I hold the entire position to those levels? No.

Would I let a small runner ride using house money? Yes.

Here are other Valuation metrics I have posted for your review.

That’s how you participate in upside without turning a trade into a belief system

If you enjoy the work: 👉 Drop a solid comment. Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Short on Silver CFDTVC:SILVER

Short on Silver

Technicals:

- oscillators like RSI and other on weekly and monthly timeframes are in extreme overbought territory, signaling an imminent need for a correction.

- large institutional players (Smart Money) typically begin taking profits at peaks, and the current environment presents an ideal window for this.

- price neared 3.618 on fibo (120$ per OZ), whereas asset prices rarely breakout this level.

- target 0.382 on fibo

- scenario invalidated if two bars close above 122.00

Fundamentals:

- the massive influx of retail investors and extreme market hype often precede a "flush out" of positions and a sharp collapse.

- commodity has shown anomalous growth, gaining about 150% in 2025 and another 40% in the first weeks of 2026; however, no rally can last forever.

- high asset prices will trigger an increase in secondary market supply (scrap/recycling), which will ultimately lead to a cooling of demand and price suppression.

⚠️ Signal - Sell ⬇️

✅ Entry Point - 112.75

🛑 SL - 122.34

🤑 TP - 84.62

⚙️ Risk/Reward - 1 : 3.2 👌

⌛️ Timeframe - 3 months 🗓

Good Luck! ☺️

Silver (XAG/USD): Bearish Reversal Potential at Parallel ChannelSilver filwaqt 15-minute timeframe par aik mazzboot ascending channel ke andar trade kar raha hai, lekin price action ab exhaustion (thakawat) ke signs dikha raha hai. Market ne channel ki upper boundary ko touch kiya hai jo ke aik major resistance zone hai, aur yahan se aik bearish reversal ka imkan nazar aa raha hai.

Technical Analysis & Strategy:

Channel Resistance: Price ne channel ki oopri satah (upper rail) par resistance li hai. Ye area buyers ke liye thora mushkil sabit ho raha hai kyunke yahan supply mazzboot hai.

Projected Bearish Path: Black arrows se wazeh hota hai ke market aik "Lower High" structure banane ki koshish kar rahi hai. Agar price channel ki midline ko break karti hai, to ye niche ki taraf aik barri move ka signal hoga.

Key Targets:

TP 1: 106.000 (Internal support level)

TP 2: 102.500 (Major structural demand zone)

Risk Management: Setup tab tak valid hai jab tak price halia swing high yaani 112.500 ke niche rehti hai. Is level ke ooper closing bullish trend ko dubara activate kar degi.

Market Sentiment: Filwaqt sellers control gain karne ki koshish kar rahe hain. Trendline ka breakdown is setup ki confirmation ke liye zaroori hai.

I am now Long PUTS IN SLV and Silver 2027 lateThe wave structure is now complete as into the cycle high and fib relationship The US$ is about to Bottom in wave B low we should then see a huge rally in DXY and a sharp decline in all metals and the sp 500 is in wave c up in wave 5 of the diagonal 5th wave all coming into the 5 spirals due 2/9 event best of trades WAVETIMER

XAG/USD: Assessing Distribution Phase and Potential Trendline BrSilver (XAG/USD) ki halia price action 15-minute timeframe par aik mazzboot "Ascending Channel" ke andar trade karne ke baad ab aik critical junction par khari hai. Price ne channel ki oopri satah (resistance) se mazzboot rejection li hai, jo ke market mein buyers ki thakawat (exhaustion) ko zahir karti hai. Hum ab aik "Distribution Phase" dekh rahe hain jahan sellers control dobara haasil karne ki koshish mein hain.

Key Technical Observations:

Channel Exhaustion: Price action ne channel ki upper boundary ko multiple times test kiya hai lekin wahan hold karne mein nakam rahi hai. Ye aik classic sign hai ke market ab ooper jane ke liye mazeed liquidity dhoond rahi hai.

Structure Shift: Black path se wazeh hota hai ke hum aik "Lower High" formation ki tawaqqo kar rahe hain. Agar price channel ki lower trendline ko decisively break karti hai, to ye market structure ka bullish se bearish mein tabdeeli (Change of Character) ka signal hoga.

Liquidity Targets: Niche ki taraf hamara pehla target 106.000 ka level hai, jo aik intermediate base hai. Agar bearish momentum barkaraar rehta hai, to price mazeed niche 102.500 ke major support area tak gir sakti hai taaki purani liquidity ko clear kiya ja sakay.

Risk Parameters: Ye bearish view tab tak valid hai jab tak Silver 112.500 ke halia peak ke niche trade kar raha hai. Is level se ooper ki closing is setup ko invalidate kar degi aur trend continuation ka ishara degi.