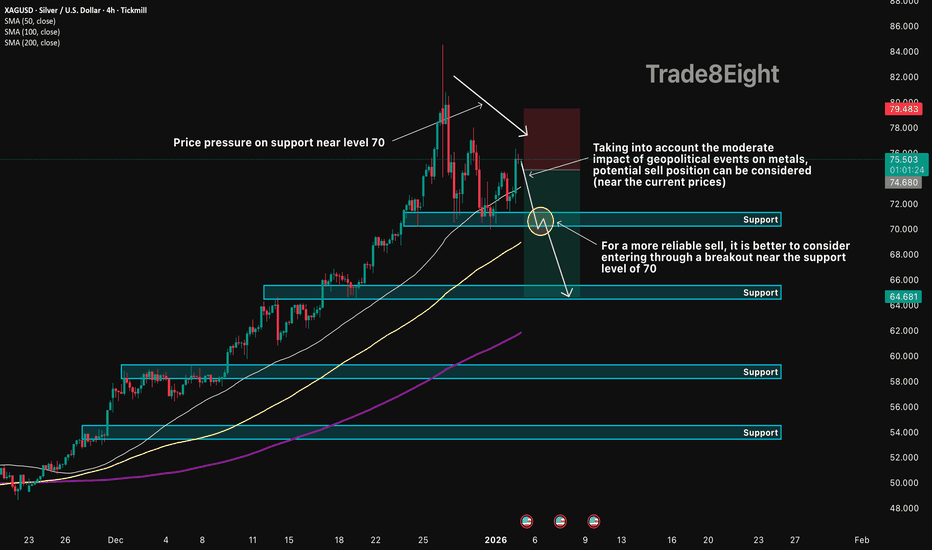

XAGUSD: pressure on $70 support🛠 Technical Analysis: On the 4-hour (H4) timeframe, Silver (XAGUSD) is showing a structural shift toward a corrective phase. Despite the broader uptrend, the price is currently exerting "pressure on the support in the 70 area".

While the long-term trend remains bullish, the "moderate influence of geopolitical events on metals" is currently favoring a pullback. For a "more reliable sell," the strategy recommends waiting for a confirmed breakdown of the 70.00 support zone, which would signal a move toward deeper liquidity levels.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Current market price ($75.498) or on a break of 70.00

🎯 Take Profit: 64.681 (Support)

🔴 Stop Loss: 79.483

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Silver

GOLD: The "Reconstruction" Supercycle (Cup & Handle Breakout)The headlines are focused on the "Oil" aspect of the US-Venezuela news. They are missing the bigger picture. Rebuilding a nation requires massive capital expenditure. Whether it's printed or borrowed, it adds liquidity to the system.

The Thesis: The "Silent Takeover" Phase 2 As we discussed in my previous idea ( Gold: The Silent Takeover) , Smart Money has been rotating out of fiat/tech and into Hard Assets for months. The "Venezuela Reconstruction" is just the latest catalyst in a broader Capital Rotation Supercycle.

1. THE STRUCTURE:

Textbook Continuation 📉 I marked up the Daily Chart (attached) to show the pure geometry of this move.

The Pattern: We have formed a massive Cup & Handle continuation pattern (the purple curve). This is one of the most reliable bullish structures in technical analysis.

The Breakout: Price has broken above the key $4,380 Resistance (Red Line) and is now holding it as support.

The Channel: We are strictly respecting the Blue Ascending Channel. As long as we stay inside this blue zone, the trend is mathematically up.

2. THE CATALYST:

Inflationary Geopolitics 🌍 Why is Gold pushing ATHs while the Dollar is strong? Because the market is pricing in the cost of the US intervention in Venezuela.

Reconstruction = Spending: The US administration has pledged to "invest billions" to rebuild Venezuela's energy grid.

The Hedge: Institutional capital uses Gold to hedge against the currency debasement required to fund these geopolitical moves.

3. THE TARGET:

The "TP" Zone 🎯 The technical measured move of this Cup & Handle aligns perfectly with the "TP" circle marked on the chart. If this channel holds, we are looking at a structural target in the $4,800 - $5,000 region as the Supercycle accelerates.

👇 The "Hard Asset" Rotation List:

If this Supercycle is real, it's not just Gold. Check my previous analysis on Silver (The 1980 Curse Broken) to see how the whole sector is moving together.

TVC:GOLD , TVC:SILVER , CAPITALCOM:COPPER

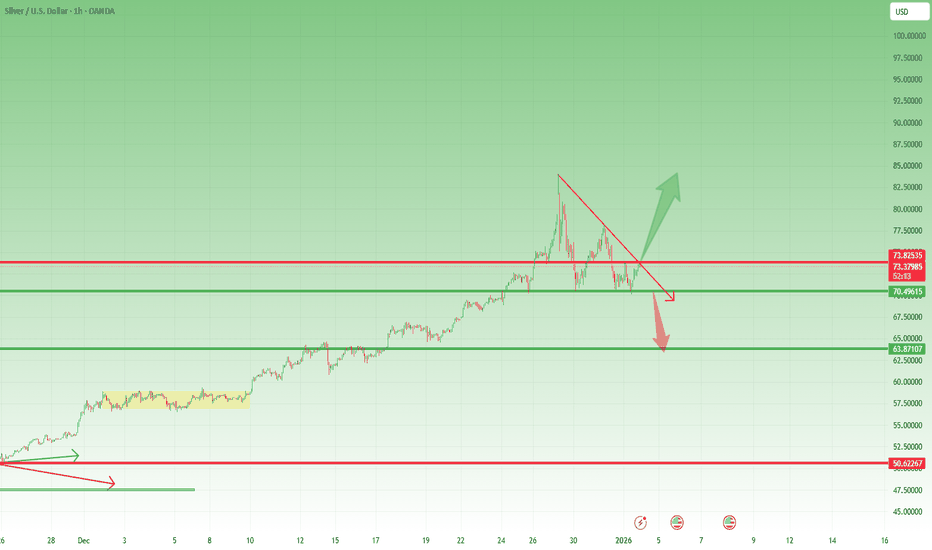

Silver — Strong Bull Trend, but Is the Correction Really Over?After the explosive rally to a new all-time high near the 84 zone, OANDA:XAGUSD experienced a sharp correction, dropping nearly 15,000 pips — a natural reaction after such an extended move.

Buyers eventually regained control just above the 70 zone, where the market established a solid floor.

However, the first rebound produced a lower high, and the following high was also lower — which currently shapes what appears to be a potential descending triangle structure (still unconfirmed at this stage).

❓ Key Question: Is the Correction Finished?

From a long-term perspective, there is no doubt about the dominant trend — Silver remains strongly bullish over the macro horizon.

But the short-term issue remains:

👉 Has the correction already ended, or is there more downside risk ahead?

Right now, the answer depends on two critical levels.

⚖️ Decision Levels to Watch

1️⃣ 74 Resistance Zone

A clean breakout above 74 would

✔️ invalidate the current corrective structure

✔️ confirm bullish continuation

✔️ open the door toward further upside extensions

2️⃣ 70 Support Zone

A breakdown below 70 would

⚠️ strengthen the descending-triangle scenario

⚠️ expose Silver to a deeper correction

➡️ potentially toward the 63 zone

📌 Trading Stance for Now

Given today’s low-liquidity environment, the prudent approach is:

👉 wait for confirmation rather than forcing a position

Price action around 70 and 74 will likely provide the next major directional clue. Until then — patience remains the best strategy. 🚀

SILVER (XAGUSD): More Growth is Coming?!

Silver had a very bullish opening today.

The market violated a minor intraday horizontal resistance

with a buying imbalance candle.

I think that the price has great potential to rise more.

Next resistance is 77.5

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Technical Breakdown – Silver (XAGUSD)Market Structure

Price is currently correcting after a strong impulsive leg.

The higher timeframe bias remains bullish, while the current move is a short-term correction.

The structure suggests a controlled pullback rather than trend reversal.

Chart Patterns

• Falling Trendline: Price is respecting a descending corrective trendline.

• Corrective Structure: Classic impulse → correction setup is forming.

• Demand Reaction: Strong reaction from the 72.0–71.9 demand zone.

Liquidity & Key Levels

• Sell-side liquidity has been swept below recent lows (~72.0).

• Buy-side liquidity is resting above 75.80 and 76.75 (prior highs / rejection zones).

Trade Idea (Bullish Continuation Scenario)

1% (High Risk)

🎯 Targets:

TP1: 75.80

TP2: 76.75

❌ Invalidation:

– Acceptance below 71.90

📝 Summary

As long as price holds above demand and reclaims structure, this move is considered a corrective pullback within a larger bullish framework.

This is not financial advice. Always manage risk.

CVX: The Perfect Storm (Macro Catalyst + Massive Channel)The news cycle is obsessed with the politics of the US & Venezuela, but the smart money is focused on the supply chain.

I created this chart to visualize how a massive fundamental catalyst (The Flags) is colliding with a decade-long technical structure (The Channel).

1. The Fundamental Catalyst (The Flags 🇺🇸🇻🇪) While the headlines are about "deals," the reality for the energy sector is about Market Access. Chevron ( NYSE:CVX ) is the primary US major with the "keys to the kingdom"—active OFAC licenses and operational Joint Ventures on the ground.

The Moat: While competitors are years away from navigating new contracts, CVX has a "Turnkey" advantage. The infrastructure is there. The pipes are connected.

The Shift: This opens the door to immediate heavy crude reserves for US Gulf Coast refineries, a massive tailwind for margins.

2. The Technical Structure (The Blue Channel)

📉 Politics is noise; Price is truth. Look at the geometry in the chart:

The Channel: Price has respected this massive Blue Ascending Channel for years. It defines the institutional trend.

The Coil: We have been compressing in a tight Triangle Consolidation (white lines) right at the breakout point.

The Target (TP Circle) : If we break out of this triangle, the standard technical measured move targets the upper rail of the channel. This aligns with the "TP" zone marked on the chart, projecting a move toward "Blue Sky" territory.

3. The Verdict Rarely do you see a "Perfect Storm" where a Macro Event (Venezuela reopening) aligns this cleanly with a Technical Setup (Triangle Breakout). The structure suggests the market is pricing in a "Supercycle" return for American energy access.

👇 The "Venezuela Reconstruction" Watchlist:

If the Venezuela thesis plays out, it's not just Chevron that moves. Here is the basket of related Energy, Services, and Refining stocks I am tracking for this cycle:

Majors: NYSE:CVX , NYSE:COP

Services (Boots on the Ground): NYSE:SLB , NSE:HAL , AMEX:OIH

Refiners (Heavy Crude Beneficiaries): NYSE:VLO , NYSE:MPC , NYSE:PSX , NYSE:DINO , NYSE:PBF

Sector ETF: AMEX:XLE

Which of these is your top pick for the reconstruction trade? Let me know in the comments!

Disclaimer: This analysis is for educational purposes regarding market reaction to geopolitical events. It is based on technical chart geometry and public news. Not investment advice.

What's next for Legendary Silver?The algorithm is currently engineering a Macro Market Maker Sell Model to reprice towards the Discount Arrays and Sell Side Liquidity residing at 64.00. The present action within the 72.00 to 74.00 price level is a Distribution Phase into a Bearish Breaker designed to trap late longs before the primary liquidation leg begins.

Entry: 73.50 (126 points higher)

Stop loss: 77.20 (370 points from entry)

Take profit: 64.00 (950 points from entry)

Risk to reward ratio: 2.56R

The absolute truth at the center of this chart is that the parabolic expansion on the Monthly timeframe has reached a Terminal Velocity and is now undergoing a violent mean reversion.

You are witnessing the aftermath of a Blow Off Top where the algorithm delivered price into a deep Premium to induce maximum retail euphoria before slamming the door.

The massive rejection wick on the Monthly candle is not just volatility it is the footprint of Institutional Distribution.

The Smart Money has offloaded their long inventory into the buy stops of breakout traders above the 80.00 level.

The subsequent displacement lower on the Daily and 8 Hour charts has created a definitive Market Structure Shift to the downside confirming that the Order Flow has inverted.

The Draw on Liquidity is no longer the highs.

It is the vast chasm of inefficient price action left behind during the ascent.

The market is currently retracing into a Premium Array specifically the Bearish Breaker Block and Fair Value Gap region between 73.00 and 75.00.

This is the "Right Shoulder" of the reversal pattern or in ICT terms the Smart Money Reversal entry.

The entry logic is predicated on the algorithm's necessity to mitigate the inefficiency created by the rapid decline from the 84.00 highs.

Price is being drawn back up into the 73.50 region not to resume the trend but to rebalance the Premium and trap bulls who view this dip as a buying opportunity.

The "Weekly Bias Level" marked on your chart acts as the fulcrum.

The algorithm is holding price below this level to build a ceiling.

We are looking to short the failure at this ceiling.

The temporal window for this entry is the beginning of the new week or the New York session where the manipulation of the daily range typically occurs.

You are selling to the "Buy the Dip" crowd who are oblivious to the fact that the trend has changed.

The invalidation of this thesis is a decisive daily close above the 77.20 swing high.

If the algorithm displaces above this level it indicates that the current decline was merely a complex correction in a still valid bull market and price will likely attack the 84.00 highs again.

However the sheer magnitude of the monthly rejection makes this the low probability outcome.

The Primary Antithetical Chain would require a fundamental shift in the macro landscape that forces a panic bid for hard assets.

But technically the chart is screaming distribution.

The 8 Hour chart shows a clear sequence of lower highs and lower lows.

Until that structure is broken to the upside the path of least resistance is gravity.

Target 1: 68.00 | Type: Internal SSL / Daily Support | Probability: 85% | ETA: Short Term

Target 2: 64.00 | Type: Equilibrium / Volume Imbalance | Probability: 70% | ETA: Medium Term

Target 3: 58.00 | Type: Deep Discount / Order Block | Probability: 55% | ETA: Long Term

A 30% probability exists for the antithetical reality: a Consolidation at Highs.

In this scenario the market refuses to break down and instead chops between 70.00 and 80.00 for several months to digest the move.

This reality is confirmed if price reclaims 75.00 and holds it as support.

If this occurs the trade is scratched and we await a new expansion signal.

But for now the knife is falling.

Do not try to catch it.

Wait for the bounce to resistance and then push it down.

Silver is in the Bullish directionHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Commodity Supercycles Don’t Start Where Most People LookOne thing I have learned over the years:

🥇Gold is usually first. (already done)

Not because the economy is booming, but because something feels off. Wars... Inflation... you name it. Gold reacts before the story is clear.

🥈Then silver starts waking up. (happening)

That’s usually when attention shifts from protection to opportunity. Silver doesn’t just follow gold, it magnifies it. It is cheaper and more convenient especially for those who missed gold's move!

🥉After that, the industrial metals come into play.

Copper, palladium, platinum. This is where the cycle starts to feel real. Demand is no longer theoretical. Growth shows up on the charts. (this feels just like altcoin season in crypto lol)

🛢Oil and gas tend to move later.

Not last by accident. By then, expansion is obvious and inflation pressures are already building.

🔄Most traders get this backwards.

They chase what’s already moving instead of asking why it’s moving.

The edge isn’t guessing the top or bottom.

It’s understanding what stage the market is in and positioning accordingly.

Honest question...⁉️

Are you reacting to what already moved… or paying attention to what’s just starting?

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAGUSD ON 2026Following our previous silver analysis — which reached its projected target sooner than expected — we now turn our attention to the potential trend of this attractive metal for 2026.

The bullish trend in silver may continue into the new year, possibly with slightly reduced momentum, but still intact. Over a 3 to 6-month horizon, a move toward the $100 level can be considered a realistic scenario.

Key and high-probability support zones for potential entries have been marked on the chart. However, it’s important to note that there is no guarantee price will revisit these levels, and they should only be considered in the event of a corrective move.

++++ Silver at $70 shows strong similarities to Bitcoin in late 2019.

Manage your silver positions carefully and make the most of the opportunity.

Gold/Silver Ratio AnalysisSince 2007, the Gold/Silver ratio has been moving in certain patterns. Although the ratio generally tends to rise, we can see significant volatile deviations from time to time. These deviations present us with good opportunities. We are currently experiencing one of these opportunities.

The overall uptrend in the chart means that gold has generally outperformed silver. The sharp increases in 2008 and 2020 also point to periods when gold significantly outperformed silver.

In 2010, the second half of 2020 and the period we are currently experiencing, silver has significantly outperformed gold, causing the chart to fall.

But there is a common point in both periods. After every period of extreme volatility, the Gold/Silver ratio tends to converge towards the average. This will likely be no different now. So what does this indicate?

As we all know, silver has gained significant momentum, pushing the Gold/Silver ratio up to 60. While there's a possibility the ratio could fall back to 50 in the coming months with continued momentum, a Hodrick Prescott filter shows a significant negative deviation from the normal average. This means that the time for convergence with the average is slowly approaching. So how will this convergence scenario unfold? In two ways:

1. Either silver won't experience a decline, but gold will rise significantly with buying pressure and momentum.

2. Or, while gold remains stable or continues its uptrend slightly, silver will fall significantly.

I particularly think the scenario where silver falls due to profit-taking (and it's pretty overbought) more likely. During this period, gold may continue its gradual rise, which could bring the Gold/Silver ratio back into an overall trend free from volatility.

COPPER - The Metal No One Is Talking About… YetCopper just did something important, it broke above its previous all-time high. That alone puts it back on the radar from a macro perspective.

Structurally, the trend is clearly bullish. Price is respecting the rising trendline, and what we are seeing now is a normal post-breakout reaction, not weakness.

The plan from here is simple: 👇

i will be watching the intersection of the rising trendline and the prior structure zone. That confluence is where risk becomes defined and where trend-following longs make the most sense.

As long as price holds above structure and respects the trendline, the bullish thesis remains intact.

📊 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

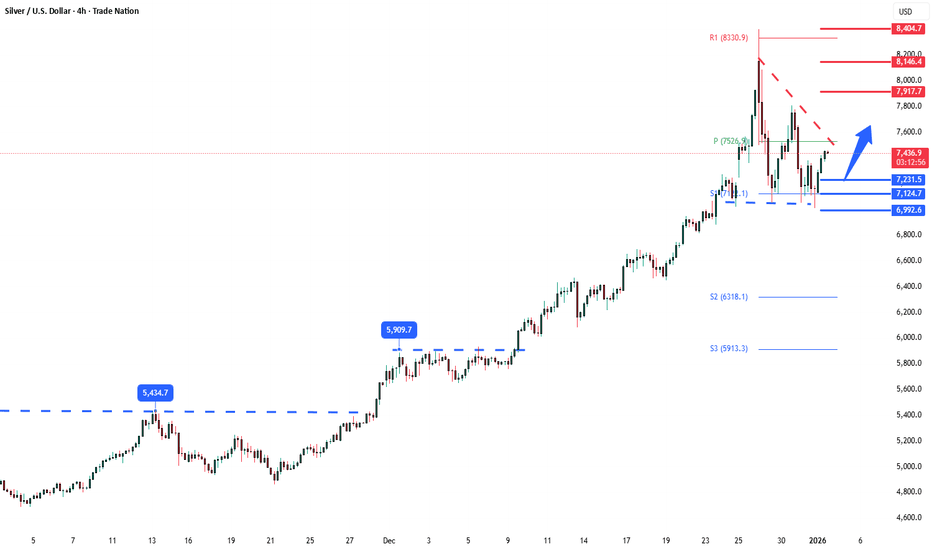

Silver coiling price action = Energy build up! The Silver remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7230 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7230 would confirm ongoing upside momentum, with potential targets at:

7926 – initial resistance

7154 – psychological and structural level

7397 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7230 would weaken the bullish outlook and suggest deeper downside risk toward:

7126 – minor support

6984 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 7230. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver Analysis (XAG/USD)CAPITALCOM:SILVER

Chart Structure

From December 6 to 26, the price followed a strong uptrend.

On December 27, silver peaked near $84 and then corrected sharply.

A strong support zone around $70 formed after the drop.

The current price is $74.53, and a recovery appears to be forming with bullish candles.

Key Support & Resistance Levels:

Level | Price

Resistance 1 | ~$76.5

Resistance 2 | ~$80

Support 1 | ~$72

Support 2 | ~$70 (major)

Patterns & Price Behavior:

Higher Lows are forming → indicating bullish structure.

A V-shape recovery pattern is visible → suggesting a strong rebound.

Buyers are stepping in aggressively after the pullback.

Fundamental Analysis

Factor | Status | Impact on Price

Global Inflation | Still elevated | Bullish for silver

Fed Interest Rate Outlook | Expected cuts in early 2026 | Bullish for silver

Geopolitical Tensions | Ongoing risks in ME/EU | Increases safe haven demand

Industrial Demand for Silver | Stable or increasing | Supports price

China’s Economic Recovery | Gradually improving | Boosts industrial demand

Conclusion: The fundamental outlook supports bullish continuation for silver.

Momentum Analysis

Strong bullish momentum after bouncing off the $70 support.

Recent candles show high volume and strong green bodies, signaling fresh buying interest.

If momentum holds, resistance at $76.5 could be tested and potentially broken.

XAG/USD Price Forecast

Timeframe | Expected Move

Short-Term | Likely move to $76.5–$78

Medium-Term | If resistance breaks, $80–$82 target

Long-Term (Weeks) | $88–$92 possible with strong fundamentals

Warning:Any losses are entirely your own responsibility. This is solely an analysis and **not** a recommendation to buy or sell.

Why Silver XAGUSD should be considered as portfolio good part?

📌 Why Silver Is Getting So Much Attention Right Now?

Silver is not just for jewelry anymore. It is becoming super important for technology and clean energy.

🌍 1. China and Silver Supply

China 🇨🇳 is the 2nd biggest silver miner in the world.

It is also the largest silver refiner globally.

About 60% of the world’s refined silver exports come from China.

Starting Jan 1, 2026, China will limit silver exports, so almost 60% of Chinese silver will stay inside China.

This means less silver will be available in the world market.

💡 2. Silver Is Already in Short Supply

For the past 5 years, silver demand has been higher than supply.

In 2025:

• Demand: 1.2 billion ounces

• Supply: 1.05 billion ounces

This means the market is already short, and the China export rules will tighten supply even more.

⚡ 3. Silver Use in New Technology

Tesla car batteries need silver, and Elon Musk even mentioned he is worried about silver prices (27 Dec 2025 tweet).

Samsung + BMW are making a battery using 1 kg of silver, which can charge 1000 km in 9 minutes and last 20 years.

Silver is also used in solar panels, AI data centers, EVs, and computer chips.

• Solar power is growing fast all over the world.

• EV sales and charging needs are expanding.

• AI and digital infrastructure need more silver every year.

📈 4. Silver Outperforming Gold

In 2025, silver prices rose 160%, while gold only rose 75%.

This shows silver’s strong demand and real-world value are driving prices higher.

📊 5. Demand Is Bigger Than Supply

For many years, the world has been using more silver than is being mined. This creates a shortage situation.

✅ In Short:

Global silver supply is tight.

China export limits make supply even smaller.

Industrial and tech demand is growing fast.

Silver prices are rising faster than gold.

Silver is Probably Over... For NowI have been watching the most interesting price action of the end of 2025: COMEX:SI1! (Silver). On the swing timeframes price is completing a fractal of the price action from December 28th:

-Big Selloff

-Attempted Retest of High

-HOLD of the 50% Retracement

-FAILURE to retest/break the high

This type of price action seriously dents momentum especially in such a volatile Rise In Price (RIP).

Fractal Price Action

What is interesting is that this is a fractal continuation of the price action from the Weekly open on Sunday night. The same pattern:

-Big Selloff

-Attempted Retest of High

-HOLD of the 50% Retracement

-FAILURE to retest/break the high

I noted saw this Sunday and wanted to put out a short but options markets were not open and I did not feel like putting down $10,000+ margin risk on Silver. I just noted it to group chats where I have a good friends who are Silver bugs that have been diligently HODLing for over a decade as a warning. I hope they took heed.

The Bubble

At this point in the standard bubble model complacency has been given over to anxiety. This is still a very short term, swing timeframe, pattern at the moment however.

In the long term the most probably pattern will be a full pullback on the Daily. Support may be found at multiple points along the RIP including the 50% Retracement of the recent yeet (65), the Volume Profile node (58), or the Breakout Pivot (53). Then as we get into Q1 2026 we will see the wider move playout. It may not be "over" entirely but definitely for 2025!

Happy New Year!

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 (4H)Since the previous weekly outlook on NYSE:CDE , price has moved pretty much in line with the expectation, with wave (3) and wave (4) playing out. The pull back in wave (4) was more aggressive and deeper than I would have liked, but wave (2) was fairly flat, so based on the guideline of alternation it does suggest a sharper correction in wave (4), it did run just beyond the 50% fib retracement which is getting a little deep.

In this interpretation I have the chart moving higher in wave (5) with red wave 1 underway. I'll add a caveat, there are alternative wave counts available and should we see an aggressive sell off in silver, then CDE may get hit alongside it. in that scenario this recent up move from $13.55 may instead be a corrective wave, which would mean more consolidation in wave (4), and potentially a break below $13.55 (which is the invalidation level for red 1), unless a triangle pattern forms and we instead go sideways.

SILVER'S PRICE WITHIN BUYERS' LEVELSilver has declined to the buyers' level...

N.B!

- XAGUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#silver

#xagusd

COPPER IS PRIMED AND READYSo this decade precious metals have finally shown volatility. Gold and Silver have been a highlight especially with the past Administration boasting EV, GREEN-NEW DEAL, and now with AI; Precious metals are showing that people as of right now prefer a physical safe haven asset rather than “code” like cryptocurrency. Even now with the Trump administration, space exploration and the ongoing need and increasing demand for more precious metals is obviously making these assets worth looking at BUT one metal that stands out the most but no one is talking about, is COPPER (CU)!

COPPER is by far primed and ready to show what its really made of. Often overlooked, with pennies being disclosed as being “worthless,” it takes more to produce 1 penny than what its actual value is, with only 2-4% of modern day pennies being made of Copper (CU) and 96%+ being zinc and other over supplied metals. Why?

By 2026 the US Government will stop printing pennies, and any 1 cents transactions will now be rounded to the nearest Nickel.

Gold and Silver showed similar chart patterns, and experienced almost the same innovations that lead to its increase demand thus leading to price being bullish as well. One thing that leads me to believe COPPER IS VERY UNDERVALUED is the FACT that silver mining and gold mining can be done by basically any individual with an increased appetite to fund a business venture of 1mil+, and in this day and age thats more common than you think. But copper mining takes at least 10times more money, and it takes at least 15 years to get a Copper Mine up and ready before you start to dig your first ore. With that being said, and the fact that most copper mines if not all of them up to unow, are starting to show depletion…. its TIME.

Technical analysis is easy here, basic trend and resistance/support and price action on the monthly outlook. This asset will be like when your daddy or great granddaddy bought gold cheap!

Every President TermThe president’s influence is real — but limited.

Markets are forward‑looking. They price in expectations months or years ahead. So even if a president announces a policy, the market may have already reacted long before it becomes reality.

Below numbers are taken from Year Starting January until December of finishing Year.

During Trump 1st Term 2017-2020

SP500 is up 67%

Gold is up 57%

Silver is up 54%

US M2 is up 43%

During Biden Term 2021-2024

SP500 is up 52%

Gold is up 45%

Silver is up 19%

US M2 is up 11%

During Trump 2nd Term 2025-2028 (Dated until 2025 Dec 30)

SP500 is up 19%

Gold is up 50%

Silver is up 130%

US M2 is up 3%

I would expect by the end of Trump Term, SP500 will be moving close to Gold Gains,

May be 30% up from here making SP500 close to 10000

I will look back this post on 2028 January to see if I need to correct my thesis

Silver Already Showed The Playbook – Bitcoin Might Be Next!When you compare OANDA:XAGUSD and COINBASE:BTCUSD side by side, the similarity in structure is hard to ignore. Silver spent time consolidating, respected its higher lows, absorbed supply, and then expanded aggressively once the structure was confirmed. Bitcoin now appears to be in a very similar phase.

At the moment, Bitcoin is trading around $88,000. The previous all-time high sits near $126,000. The most recent major November low was formed around $80,700.

Importantly, price has not violated the $74,000 macro support, which remains a key level. This alone keeps the higher-timeframe structure intact and bullish.

What we are seeing right now is not panic or distribution. Pullbacks are corrective, momentum remains controlled, and price continues to hold above key demand zones. This behavior suggests compression and energy build-up, not exhaustion.

Silver already executed this sequence cleanly. Bitcoin has not broken down yet, and structurally, it is still behaving like an asset preparing for continuation rather than reversal.

There is, however, a macro risk that cannot be ignored. Rising geopolitical tensions, especially the risk of escalation between Iran and Israel with potential U.S. involvement, could change market dynamics very quickly. Events like these can override any technical structure.

That said, this analysis is based strictly on current price action and confirmed data, not on hypothetical scenarios. As long as price respects structure, the technical bias remains valid.

From a long-term perspective, if Bitcoin continues to respect its macro supports and resumes expansion, the broader upside zone I am watching lies between $200,000 and $280,000.

This is not a buy or sell signal. This is a structural comparison and a technical roadmap.

The market often looks uncertain right before the next major leg begins.

The real question is simple:

Does Bitcoin follow Silver’s playbook, or does macro risk step in first?

Let me know your view below.