They lied to you about Bitcoin to take your money !You Invested your life savings into Bitcoin because they told you its the supercycle !

At the first few weeks ..you gained a small profit and everytime you turn on the news or social media you saw everyone cheering and posting new ATH targets for Bitcoin..some of them said 200k and others said its going to a million Dollars !

These people had thousands of followers and everyone was grateful and positive in their replies but guess what ! It was all FAKE lol...that's right each and everyone of them is a scammer and 99% of their followers are fake bots !

If you look closely to their accounts you'd see that all of their posts were bullish at the top and bearish at the bottom, their whole accounts are dedicated to give false hopes and deceiving charts in order to trap their followers in a dead trade that provides the real trading whales with exit liquidity !

Look at Jim Cramer .. he's the text book example of a trading scammer and investors actually gained money by inversing his financial advices lol..and he's not alone, most of the social media influencers are exactly like him and the more followers they have the more evil they are.

Now Bitcoin crashed to 70k in a matter of days ... 50% of your wallet is gone ! so are you going to sell now ? But market might recover soon and 70k might be the bottom !

If you check the social media right now everyone is saying a different story and you are confused and lost between the moon boys and the realistic investors.. what are you going to do now ? Are you gonna accept your losses and save the rest of your money or are you going to hold to Zero and fullsend it ?

Come let me help you my friend .. your first mistake was that you believed and trusted other people with your money .. people who gain profit only if you lose your money !

Second mistake was that you didn't do your own research ... You had no idea where the market is going and you risked everything with zero knowledge or experiance.

So how to fix this ? The answer is damage control !

Market has been going down for a while now and the chart seems to be forming a Head & shoulders so as soon as the price goes up to form the right shoulder you need to get the hell out and save yourself from the real crash!

Second step which is a very important step for now and the future is that you unfollow and block everyone who told you its the supercycle ! Once you get those parasites out of your social media feed then you should start looking for real investors who were calling the top at 100k + and were telling their followers to take profit and get out.

Third step is that you need to learn how to read charts .. read about candles patters and find your own buy & sell signals, DO NOT LISTEN TO ANYONE AT ALL including myself !

You can use paper trading in Trading view app to learn how to trade with fake money and once you master a technique stick to it and implement it to real trading.

Above is my expectation for Bitcoin so 2026 should be very interesting and I would be honored if you check my other posts for more ideas and please like and follow my account to support me.

Stay safe out there friends ! Thank you and best regards,

Silver

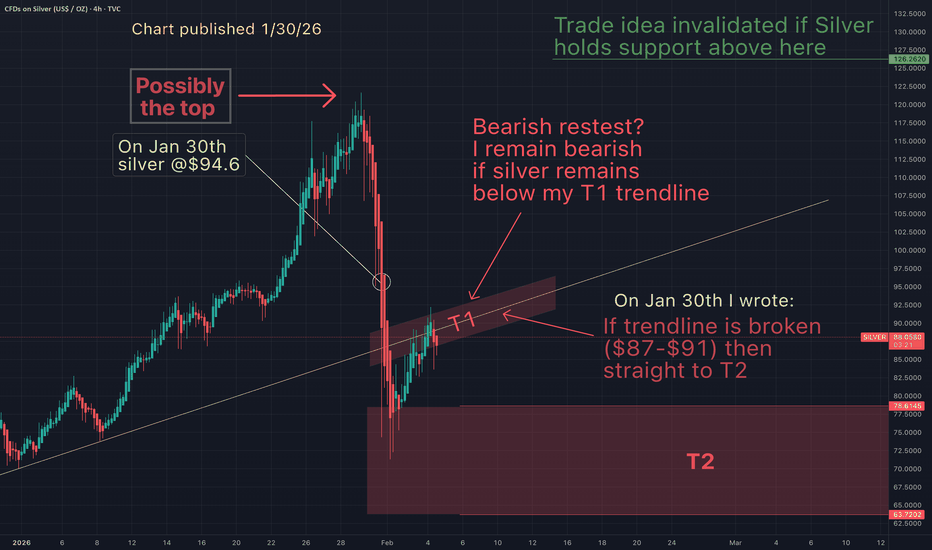

You will ask yourself, "how did he know silver would do that"?On Fri Jan 30th, I suggested that the top was in for silver and it was soon about to dump further into my bearish target (T2). Silver was $94.6 at that time, and there were no news narratives suggesting a crash. By Monday it dumped to $71 and now the news platforms and influencers have "reasons" why it did. "Show me the chart and I'll tell you the news"

TA works!

May the trends be with you.

SILVER FREE SIGNAL|LONG|

✅SILVER taps into a key demand PD array after a sharp sell-off, followed by bullish displacement. Structure shift suggests smart money defending discounted levels, targeting buy-side liquidity above recent highs.

—————————

Entry: 86.00$

Stop Loss: 82.67$

Take Profit: 90.30$

Time Frame: 1H

—————————

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Silvers easy path back to triple digitsSilver recently experienced a massive bearish move, plunging nearly 25% in just two days and catching many traders off guard. After an extended bull run that built up heavy speculation and overleveraged positions, the market finally snapped, triggering aggressive sell-offs and forced liquidations. This sharp correction wiped out weak hands and reset sentiment almost overnight. During this volatility, Corp capitalized on the move by methodically liquidating short positions accumulated throughout the prior rally, turning the extreme price action into an opportunity rather than a setback. The move highlights how quickly momentum can shift in commodity markets and how disciplined positioning can pay off when volatility spikes. The chart provided shows a clear and easy path for silver to reclaim $100. The liquidation points are easy swing highs that should be achievable within the next month.

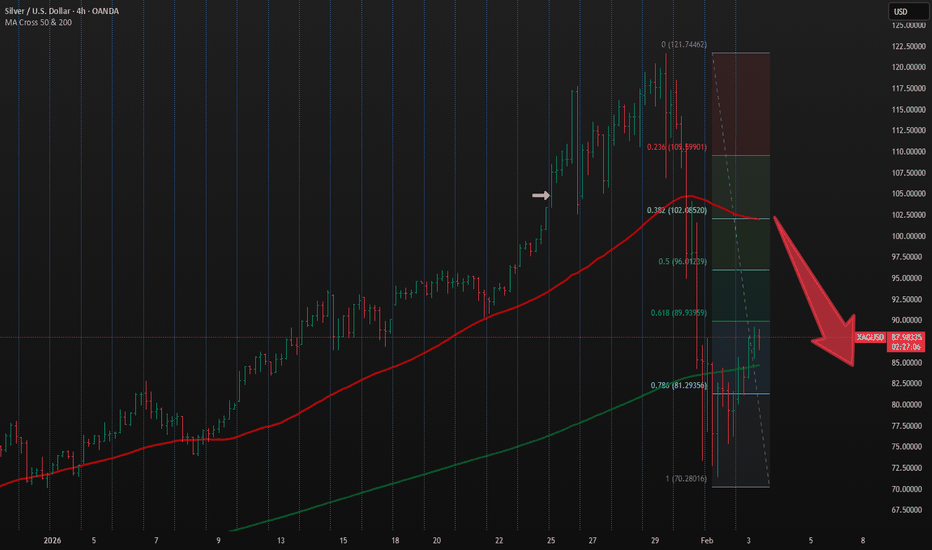

Silver doing a dead cat bounceSilver and the Liquidity Trap

Financial markets often operate on the principle of memory, where price action leaves behind a digital footprint of human emotion and institutional intent.

Most traders look at a single indicator, but the real power lies in confluence. We are currently witnessing a rare alignment where historical resistance, mathematical Fibonacci ratios, and high-volume accumulation intersect at the exact same price coordinate.

It is a statistical bottleneck that often precedes a violent expansion.

The psychology here is fascinating.

After an aggressive rally that defied standard expectations, Silver experienced a sharp correction that flushed out late buyers.

The current bounce has carried price back to the 50% Fibonacci retracement level , which sits precisely at the site of previous resistance . When an old resistance becomes a new resistance again, it suggests that the supply overhang has not been fully absorbed.

Adding weight to this scenario is the Volume Profile visible on the right.

The large volume accumulation at this level indicates a massive exchange of hands. This zone acts as a magnet for profit-taking and fresh selling interest. We also see a rising wedge pattern forming on the 1h timeframe. This price squeeze suggests that the momentum of the bounce is exhausting, as buyers struggle to push higher against a wall of institutional sell orders.

It is worth noting that Gold has already led the way by breaking down from a similar structure.

In the world of precious metals, Silver often acts as the high-beta sibling, trailing behind before making an even more volatile move. The nuance here is that patterns are probabilistic maps, not certainties. A rising wedge is a bearish leaning structure, but it remains a "potential" until the lower support line is decisively breached.

The scenario for invalidation is clear. If Silver manages to close above this high-volume cluster and reclaims the 0.618 Fibonacci level , the bearish thesis loses steam. However, given the current exhaustion, the probability favors a retest of the recent floor. We wait for a confirmed break of the wedge support (around $85,5) to validate the next leg of the correction.

👇 WANT MORE?

🚀 Hit the rocket, read my profile and follow so we can find each other again.

Silver Outlook as Hawkish Stances EmergesOne of the key reasons for the sell-off in precious metals on 30 January was the US president’s nomination of Kevin Warsh as the next Fed chairman.

We then saw headlines such as: ‘Silver dropped 26% in under 20 hours; gold saw its worst day since the 1980s — driven by Warsh’s hawkish image.’

How might Warsh’s hawkish stance impact precious metals and their outlook in the coming months? Are precious metals still bullish – 30 Jan sell off as retracement for mor upside,

or are they turning bearish, now is a retracement for more selling ahead?

100-Ounce Silver Futures

Ticker: SIC

Minimum fluctuation:

0.01 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

#Microfutures

www.cmegroup.com

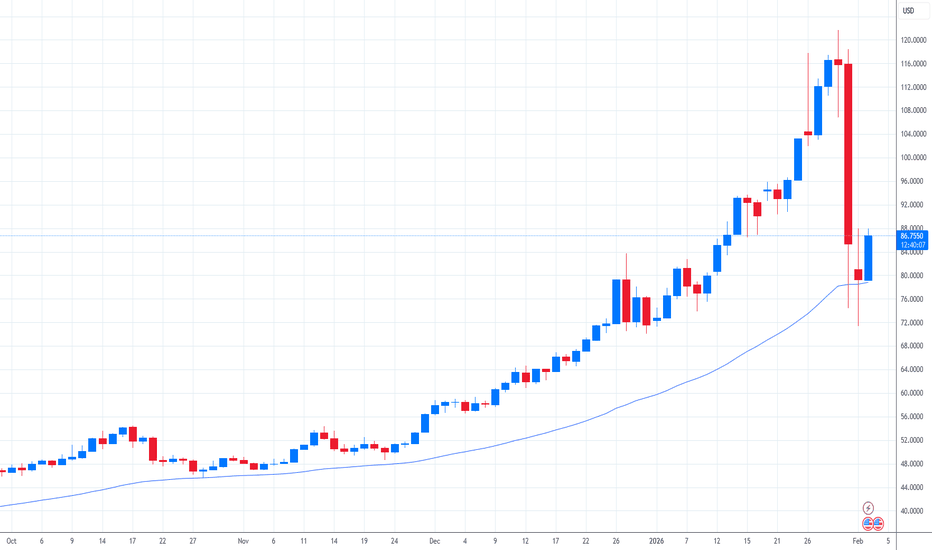

SILVER | Rebounds After Dramatic Two-Day SelloffSILVER | Rebounds After Sharp Two-Day Selloff

Silver prices rebounded above $89 per ounce, recovering part of the losses after a dramatic two-day selloff that erased nearly 40% from recent record highs. The rebound comes as markets reassess positioning after an extreme unwind.

The broader rally in precious metals earlier this year was supported by geopolitical and economic uncertainty, currency debasement concerns, and rising tension around Federal Reserve independence. In silver, a structural supply deficit and strong investment inflows, particularly from Chinese speculators, further amplified volatility.

Technical Outlook

Silver maintains a bullish structure while trading above the 85.40 pivot.

As long as price holds above 85.40, upside momentum is expected toward 91.00, followed by 95.44 and 99.11.

A 1H candle close below 85.40 would invalidate the bullish bias and shift momentum bearish, opening downside targets at 80.13, followed by 76.90 and 71.40.

Key Levels

• Pivot: 85.40

• Support: 80.13 – 76.90 – 71.40

• Resistance: 91.00 – 95.44 – 99.11

USDCHF: retest 0.76000🛠 Technical Analysis: On the H4 timeframe, USDCHF remains in a clear bearish structure after the “global bearish signal,” with price continuing to trade below the key moving-average cluster. The rebound into the highlighted resistance area (around 0.7755–0.7790) looks like a classic retest after the breakdown, where sellers may defend and resume the downtrend. Price is currently below the SMA 50 and well below the SMA 100/200, confirming that rallies are still corrective. The upper resistance zone near 0.7890 remains the larger supply ceiling and aligns with the higher MA resistance. If price gets rejected from the current resistance band, the next bearish leg is projected toward the marked support at 0.7594. A sustained break and hold above 0.7830–0.7850 would weaken the bearish setup and shift focus to the higher resistance zone.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on rejection from 0.7755–0.7790 (around 0.77355)

🎯 Take Profit: 0.75942

🔴 Stop Loss: 0.78299

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Near Important Support Zones! Wait for Confirmation!Gold Analysis

Closed at 4890.29 (30-01-2026)

The blue shaded area is a Very Strong Support Zone.

Multiple Strong Green Candles may confirm HL in this

zone & Gold may print new highs after crossing 5600.

Breaking 4500 may drag the price towards 4300 - 4400.

Wait for HL to print!SILVER Analysis

Closed at 85.169 (30-06-2026)

74 - 76 is an important Support zone.

if this level is sustained, we may witness Higher Low

printed around this level & the uptrend may continue.

Crossing 121 - 122 may expose new Highs.

However, Breaking 70 may bring the price towards 62 - 63 which

is the next Important Support level.

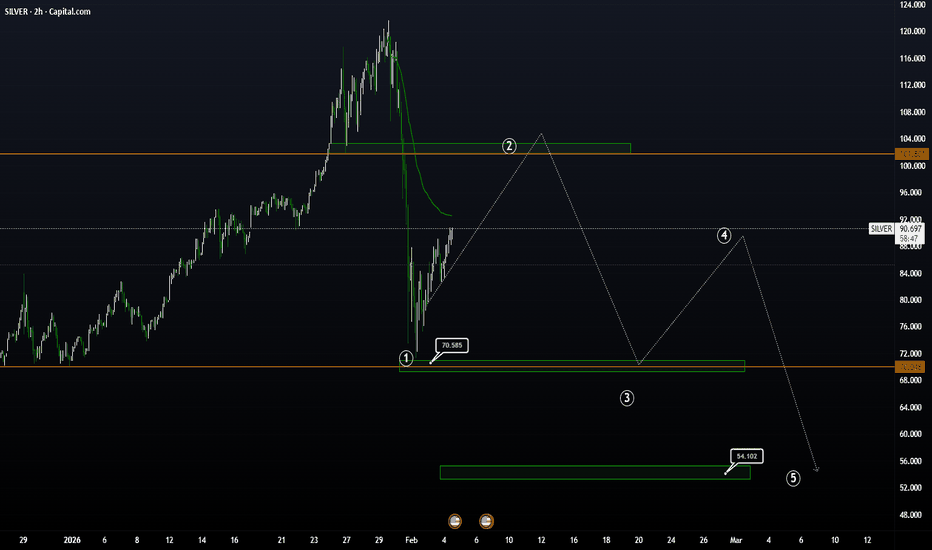

SILVER Potential MoveXAG Update: Riding the Elliott Wave 🌊

let's talk about #XAG. As I mentioned, Silver is continuing its downward move exactly as predicted. It's tough to see, but with everything happening in the background right now, the market sentiment is struggling to stay afloat.

I’m currently tracking an Elliott Wave theory (as shown in the chart) that suggests this correction could play out over a longer timeframe.

We are following the wave structure to the downside as liquidity dries up.

This theory is only invalidated if we see a strong reclaim of the $100 level.

Stay patient and don't fight the trend. The market doesn't care about feelings it cares about levels.

Silver’s Historic Rebound: Is the $100 Target Next ?Silver (XAGUSD)

📅 Date: February 4, 2026

📰 Fundamental News (Today’s Highlights)

Massive Rebound: After a historic 40% sell-off last week, Silver has jumped over 5% today. Dip-buyers and institutional investors are returning to the market, viewing current prices as a major value opportunity.

Geopolitical Safe-Haven: Tensions have spiked following reports that the US Navy intercepted an Iranian drone in the Arabian Sea. This has reignited the "safe-haven" bid for Silver.

Industrial Anchor: Demand from the solar energy sector remains a structural support. With global solar capacity projected to hit record highs in 2026, silver’s industrial deficit continues to prevent a total price collapse.

📈 Bullish Scenario

As long as the price holds above the Pivot Point of 79.00, the recovery trend is intact:

Target 1: 92.50

Target 2: 95.90

Long-term Target: 101.20

📉 Bearish Scenario

A break and close below 79.00 would signal a return to the downward correction:

Downside Targets: 74.70 and 71.30.

Bullish reversal for the Silver?The price has bounced off the support level, which is a pullback support, and could potentially rise from this level to our take profit.

Entry: 83.81

Why we like it:

There is a pullback support level.

Stop loss: 74.24

Why we like it:

There is a multi-swing low support level.

Take profit: 103.53

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacc retracment.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Stop!Loss|Market View: NZDUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the NZDUSD currency pair☝️

Potential trade setup:

🔔Entry level: 0.60799

💰TP: 0.59906

⛔️SL: 0.61334

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Short-term weakening of the US dollar is still expected in the coming days, but medium-term buyers' of the USD is quite confident. Therefore, NZDUSD can expect a strengthening to 0.61 today/tomorrow, from where, if the same false breakout or bearish divergence forms, a reversal to 0.6 and 0.59 is expected.

Thanks for your support 🚀

Profits for all ✅

Why Silver Crashed and What's Next?I was a buyer of TVC:SILVER well before it traded around $25/oz, when inflation was grinding higher and money printing hadn’t let up. The narrative was everywhere years ago, yet silver continued to lag gold. Then the switch flipped and price went parabolic driven by geopolitical tension and excessive leverage.

The nomination of new Fed Chairman (Kevin Warsh) is known having a hawkish sentiment and market interpreted it as more hawkish on rates, this boosted the US dollar which then puts pressure in commodities such as silver and gold.

Silver’s 30% drop wasn’t random. It was a textbook correction after an overextended run, profit-taking kicked in, the dollar strengthened on Fed news, gold rolled over, and leverage was forced out. Once momentum flipped, the blow-off top unwound fast and that’s exactly what the chart is showing now.

Also higher trading cost (CME raised the margin requirements on silver futures) pushed some trades out of leveraged position, thus amplifying selling pressures when price of the silver turned.

My bullish thesis doesn't change.

I will wait for the buy zone to be built again. I will wait to retest that lows again ($70-71 level) volatility to get compressed at that level and price hold for a few sessions. We want that price action to become boring again, just like before, that boredom is where accumulation happens.

So for those who wants to add in their positions, stay patient.

For those who missed the recent bull run, be patient.

There will be another one.

Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Silver. Just please wait for bearish confirmation.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

SILVER (XAG/USD) | Market Update & Technical Outlook

Date: February 3, 2026

Current Price: 86.66

📰 Fundamental Market News (Today’s Highlights)

Industrial Demand Surge: Reports today indicate a significant rise in silver demand within the "Green Energy" sector, specifically for solar panel manufacturing. This industrial backing provides a solid floor for silver prices.

Inventory Depletion: Global silver inventories (notably COMEX) show a steady decline in available physical stocks. This supply-side tightness is a key driver for the current upward pressure.

Resilience Against USD: Despite the recent strength of the U.S. Dollar, silver has shown remarkable resilience. Investors are increasingly viewing it as a dual-purpose asset: an industrial essential and a hedge against inflation.

📈 Bullish Scenario (Primary Trend)

As long as the price remains above the Pivot Point of 79.00, the momentum is strongly bullish:

Target 1: 92.50

Target 2: 95.90

Long-term Target: 101.20

📉 Bearish Scenario (Alternative Case)

A break and stabilization below the 79.00 level would invalidate the bullish view Downside Targets: 74.70 followed by 71.30.

📝 Technical Comment

The RSI (Relative Strength Index) is losing its bearish momentum, suggesting that sellers are exhausted. This technical shift indicates that buyers are regaining control of the market trend.

Pure Halucinations Spaghetti Rainbow Vomit Silver chartComplete esoteric third eye guidance throwing all the fib tools that i like. the pattern clearly points to the 23rd of February 2026 as Pivotal Day. fall back to 50 Dollar silver we shrink into a microcosm again. overcome the amber goo rainbow stripe and we unlock a new dimension. whatever you do always check your risk. this is kinda recreational just want to keep it here as reference. thanks for reading.

Fundamental Note: XAUUSD (Gold) 02 Feb 2026Gold is extending a sharp metals selloff that started late last week, with forced liquidations and margin-driven deleveraging still spilling over across precious metals. The trigger was a sudden repricing in US rates and the USD after Kevin Warsh was named as the next Fed Chair, which pushed markets to reassess the medium-term policy path and term-premium risks. The move then accelerated as CME margin requirements were raised for metal futures, amplifying margin calls and “sell-what-you-can” behavior. Geopolitics remains a key swing factor: any easing in major flashpoints can quickly drain the safe-haven premium, while renewed escalation can stabilize bids even in a risk-off liquidation tape. This week’s main macro catalyst is US Non-Farm Payrolls on Friday (06 Feb), which matters because it can either validate a cooling labor market (USD-negative, gold-supportive) or revive “higher-for-longer” pricing (USD-positive, gold-negative). Markets will be laser-focused not just on headline payrolls, but also unemployment and wage growth, plus any revisions that could change the narrative. In the very short term, gold is trading more like a leveraged positioning unwind than a pure macro hedge—so volatility remains elevated and rebounds can be sharp but fragile.

Bottom line: fundamentals are mixed, but price action is dominated by deleveraging and USD/yields until NFP resets expectations.

🟢 Bullish factors:

Any NFP downside surprise or softer wages → lower US yields / weaker USD support gold.

Geopolitical escalation risk can quickly restore safe-haven demand.

Oversold conditions after liquidation waves can trigger sharp short-covering rallies.

🔴 Bearish factors:

Ongoing margin-call deleveraging across metals keeps downside pressure active.

Firmer USD / higher real yields after Fed repricing is a direct headwind for gold.

Any geopolitical de-escalation removes part of the risk-premium that supported the prior rally.

🎯 Expected targets: Bearish-to-volatile while below 4,800–4,900, with near-term downside risk toward 4,600–4,500 if liquidation persists. If gold stabilizes and NFP comes in soft, a rebound toward 4,850–4,950 is likely; a clean recovery above 5,000 would signal the unwind is largely done and opens 5,200–5,350 again.

Silver Frenzy Ending? Key Support at USD 75 in FocusSilver has come under pressure after an impressive rally, with the recent surge now showing clear signs of exhaustion. A stronger U.S. dollar has been the main driver behind the latest sell-off, reducing demand for precious metals and triggering broad profit taking as January draws to a close.

Adding to the weakness, exchanges in both the U.S. and China have raised margin requirements, forcing leveraged traders to reduce positions. This move has increased volatility and accelerated selling, contributing to the sharp pullback from recent highs.

Technically, the market has started to stabilize around the USD 75 level, which is now acting as an important support zone. This area previously served as resistance and is currently being tested as a potential floor. A successful defense of this level could allow silver to rebound and consolidate higher.

However, upside momentum may remain limited. Sentiment has shifted, and the recent squeeze dynamics appear to be fading. If USD 75 fails to hold, the market could enter a new washout phase, opening the door to a deeper correction.

For now, this technical zone is critical. If it lasts, silver may regain footing and attempt a recovery. If it breaks, further downside pressure is likely in the sessions ahead.

SILVER (XAG/USD) – BUYSILVER (XAG/USD) – BUY

The recent crash was a liquidity event, not a fundamental shift. Over-leveraged speculators were "washed out" by rising costs to hold positions.

The Trend: * Short-Term: Bearish/Neutral. The parabolic structure is broken. We are now in a "repair phase" where the market is looking for a new floor.

Long-Term: Strongly Bullish. Industrial demand from solar, EVs, and AI—combined with a structural supply deficit—remains the backbone of the 2026 silver thesis.

Key Support: $81.00 – $83.00 (Immediate "Must-Hold" zone). If this fails, the next stop is the Monday low of $71.20.

Key Resistance: $90.50 (0.382 Fibonacci level) and $96.20 (former support-turned-resistance).

Indicators: * RSI: Sitting at 29.3 (Extremely Oversold). Statistically, an RSI this low often precedes a sharp "mean reversion" bounce.

Volatility: Off the charts. Expect $5–$10 swings within minutes if the NFP or central bank news surprises.

Because the sell-off was so extreme, the "rubber band" is stretched too far. The high-probability play is a tactical Long for a recovery toward $90, while keeping a tight stop in case the "Warsh" dollar strength persists.

Direction: LONG (Buy)

Entry Price: $85.00 – $87.00 (Current market area).

Take Profit 1 (TP1): $90.40 (Heavy resistance/Fib level).

Take Profit 2 (TP2): $95.80 (Major psychological gap-fill).

Stop Loss (SL): $78.50 (Placed below the recent consolidation to avoid getting stopped out by "noise").

Probability of Success: 55% - 60%.

Why? While the technicals scream "Buy the Bounce," the fundamental environment (Fed Chair nomination) is currently pro-USD. If the Non-Farm Payrolls (NFP) on Friday are strong, this Long setup could be invalidated quickly.

Note: Please ensure proper risk management before entering any trade. We are not responsible for any profit or loss—trading involves risk and decisions are solely yours

SILVER at Resistance — Liquidity Trap or Breakout to 97.79?

Silver is approaching a key resistance zone after a steady bullish climb, but price is now entering a decision area where reactions matter more than predictions.

🔍 Market Structure:

• Rising move into resistance = potential liquidity sweep

• Trendline liquidity building below price

• Market sitting between breakout continuation and rejection

📉 Primary Scenario (Rejection):

If resistance holds (84.46 – 87.97), I expect a sell reaction targeting the liquidity pool below → potential move toward 74.00 support.

📈 Alternative Scenario (Breakout):

If price breaks and accepts above resistance, bearish bias becomes invalid and continuation toward the next resistance near 97.79 becomes likely.

No guessing tops.

No emotional bias.

Only reaction → confirmation → execution.

👉 Like if you trade liquidity, not hype

👉 Comment your bias on Silver here

👉 Follow for structured, clean metals analysis