XAG/USD 15M Consolidation Below TrendlineThis chart shows XAG/USD on the 15-minute timeframe consolidating near a previously tested support zone while price remains below a descending trendline. The highlighted area represents a key reaction region where price has slowed after a strong decline. The drawn paths are for visual reference to show possible reactions based on historical structure and volatility, not a forecast.

Silver

XAG/USD 15M Price Reaction at Support ZoneThis chart shows XAG/USD on the 15-minute timeframe approaching a well-defined support area after a strong bearish move. Price is currently reacting near this zone while remaining below a descending trendline, which indicates overall selling pressure. The marked paths illustrate possible reactions based on previous structure and market behavior. All levels are shared for technical observation only.

Silver (XAG/USD) 15M Structure and Key Price ZonesThis chart highlights the recent price movement of XAG/USD on the 15-minute timeframe. Price is currently reacting near a previously tested support zone after a strong downward move. A descending trendline is visible, showing overall pressure, while the marked area represents a key reaction zone where price has shown consolidation. Future movement will depend on how price behaves around these highlighted levels. This view is based on technical structure only.

Asahi Holdings - Gold and Precious Metals Recycler Running.

Asahi Holdings Inc has been an absolute powerhouse over the last year, putting up a gain of nearly 100% . Based in Japan, this company isn't your household brand, but they are a massive player in recycling precious metals like gold, silver, and palladium from electronics and dental materials. When commodities run hot, companies that refine and sell them tend to follow suit, and this chart shows exactly that kind of steady, aggressive buying pressure.

Fundamentally, the story here is all about the underlying metal prices. Today’s earnings report confirms that high gold and palladium prices are boosting their margins, but the immediate reaction on the chart suggests the good news was already priced in and the dip in Silver and Gold caught them out as well as the rest of the industry. We saw a gap up at the open followed by a fade, which is a classic "sell the news" event. Traders are taking profits after a long run, even if the business itself and its revenues remains solid.

Technically, the trend is still very much intact despite today's red candle. The price has dipped under the 20-day SMA (the green line), which has acted as reliable support throughout this entire uptrend. The RSI is cooling off from overbought territory, dropping back into the mid-50s, which gives the stock some room to breathe and attract investors who might have felt they missed out. The MACD is flattening out, indicating that the immediate buying frenzy is pausing, but it hasn’t collapsed. Now that we are past earnings and got a green candle back on the board it will be interesting to see if it runs again.

Could be one to keep an eye on - especially if we see a recovery in Gold and Silver.

..................................................

PLEASE NOTE: Nothing I post is trading advice. All investing involves risk, and past performance doesn’t predict future results. Trends can and do end. For 2026 , my goal is to try and post one new asset each day. Something outside the usual gold, silver, BTC, or big tech names. I like to find stocks worldwide showing steady trends with some good gains, a recent pullback, and signs of renewed strength. I don’t necessarily hold positions in these. They are simply companies I find interesting at the time of posting. I’ll often revisit them within a week to see how they went and share any updates. If you enjoy these posts, please BOOST and FOLLOW ME to discover more under-the-radar stocks and businesses from around the world. ..................................................

XAGUSD Price Action: Liquidity Grab at Key LevelsSilver (XAGUSD) experienced a strong bullish phase, respecting multiple demand zones and higher-low structures. Price recently reached a major resistance area, where selling pressure increased aggressively, leading to a sharp bearish impulse and a clear shift in short-term market structure.

Key Technical Observations

🔴 Resistance Rejection & Distribution

Price reacted strongly from a higher-timeframe supply zone, signaling institutional distribution.

Multiple upper-wick rejections confirm sellers’ dominance at premium prices.

📉 Bearish Impulse & Market Structure Break

The steep bearish leg shows strong displacement, breaking previous demand zones.

This confirms a temporary bearish market structure, often seen before liquidity is fully collected.

🧱 Liquidity Sweep Scenario

Price is moving toward lower liquidity pools, targeting sell-side stops below previous lows.

Such moves are commonly used by smart money to rebalance positions before a trend continuation or reversal.

🟢 Potential Accumulation at Discount

The projected path suggests a possible final dip into deeper demand.

After liquidity absorption, price may stabilize and reverse, targeting higher inefficiency zones above.

Projected Price Path

📉 Short-Term

Continued downside or volatile sweeps toward lower support levels.

📈 Mid-Term

A bullish reaction from demand could initiate a corrective rally back toward the highlighted resistance / imbalance zone.

🎯 Upside Target Zone

Prior structure highs

Unmitigated supply

Fair value imbalance area

Trading Bias

Bias: Bearish short-term → Bullish corrective after confirmation

Confirmation to Watch:

Bullish engulfing candles

Break of minor structure

Strong bullish displacement from demand

⚠️ Disclaimer

This analysis is for educational purposes only. Always wait for confirmation and apply proper risk management.

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 4769.128

💰TP: 3896.954

⛔️SL: 5034.135

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Gold prices are stabilizing in the 4500-4800 range and will likely trade within this range, with a potential move toward 5000. However, for now, the main selling trend is seen as favorable, and for this to happen, the price must remain within this range. We'll likely receive more data during today's US session, and if all goes according to plan, selling could be considered today or tomorrow, with a target of 3800-4000.

Thanks for your support 🚀

Profits for all ✅

Gold/Silver Ratio: Gold To Outperform Silverthis setup never gets old, so i’m sharing the long-term chart of the gold vs silver ratio

focus on the 40-year range that started back in 1986, when the ratio hit the 80 oz level and reversed lower

most of the time, the 47–80 oz range managed to contain the ratio

last year, silver outperformed gold as the ratio dropped like a fallen knife

when it recently hit the lower boundary of the range, it stalled there

the idea is simple: when the ratio reaches the bottom, one can expect a move toward the opposite side near 80 oz from the current 58 oz

this implies gold appreciating significantly against silver

this can happen through less weakness versus the dollar, or more strength versus the dollar, compared to silver since this is a pure comparative relationship between the two metals

The Historic Rally and the Impending Cliff: A Battle for SilverThe Historic Rally and the Impending Cliff: A Battle for Silver's Soul

Silver's explosive ascent past $100 per ounce represents a watershed moment in commodity markets, marking the culmination of a historic, multi-faceted rally. However, this unprecedented price action has cleaved the investment community into two camps: those who see a new paradigm of structural scarcity and those, like JPMorgan's former chief strategist Marko Kolanovic, who see a classic speculative bubble on the verge of a violent correction. The metal now sits at a precipice, caught between the potent forces of fundamental supply deficits and the unpredictable whims of speculative capital.

The JPMorgan Bear Thesis: A Prescription for a 50% Crash

Marko Kolanovic’s stark warning—forecasting a collapse back to $50 per ounce in 2026—is rooted in technical analysis, market psychology, and historical precedent. His argument is built on several interlocking pillars:

Parabolic Exhaustion and Speculative Mania: The rally's sheer velocity—a 264% gain year-over-year and a 54% surge in January alone—exhibits the textbook characteristics of a parabolic blow-off top. Kolanovic attributes this not to disciplined investment, but to "meme traders attempting to take over the market," suggesting the price has been hijacked by retail speculation and momentum-chasing capital disconnected from physical realities.

The Inevitability of Mean Reversion: Silver is notoriously volatile. Kolanovic posits that a 50% retracement is a historically normal, even predictable, outcome following such an extreme move. He draws a direct parallel to the 1970s gold market, which saw a 50% crash after its initial surge, shaking out weak-handed speculators before resuming its historic bull run to $800. This view frames the predicted crash not as the end of the story, but as a necessary and painful "psychological trap" to reset the market.

Silver's Inherent Volatility vs. Gold's Stability: A critical distinction in Kolanovic's analysis is that "silver is not gold." While both are precious metals, silver trades with significantly higher beta—it amplifies both greed and fear. Its smaller market and dual identity make it more susceptible to liquidity-driven distortions. A crash, therefore, would be a function of its inherent character as a "leveraged macro instrument" rather than a failure of its underlying story.

The "Broken Market" Thesis: When Fundamentals and Price Diverge

Kolanovic’s view is amplified by a broader sentiment among analysts that the market's pricing mechanism has become dysfunctional or "broken." This perspective highlights a dangerous divergence:

The Disconnect: Analysts like Nicky Shiels of MKS PAMP point to "unheard-of volatility" driven not by physical supply/demand flows, but by "wild liquidity flows." Maximilian Tomei of Galena Asset Management notes that a 200% rally cannot be explained by fundamentals alone, stating, "The way silver is behaving is exaggerated... The market is broken."

The Source of Distortion: Silver's dual nature is at the heart of the chaos. On one hand, it is an industrial metal with record demand from solar photovoltaics, electronics, and the energy transition. On the other, it is a monetary metal acting as a high-beta, "poor man's gold" safe haven. The current price likely reflects a flood of speculative capital betting on the latter narrative, creating a massive overlay on top of the former's steady, structural deficit.

The Unyielding Bull Case: "This Time Is Different"

Despite the warnings, a formidable bull case argues that the paradigm has fundamentally shifted, making historical comparisons incomplete.

The Structural Deficit Argument: This is the cornerstone of the bullish thesis. Institutions like HSBC forecast the structural supply deficit widening to 1.2 million ounces in 2024. This isn't a cyclical shortage but a secular trend driven by the global energy transition. Solar panel demand alone is consuming ever-larger portions of annual mine supply, creating a physical floor under the market that did not exist in previous speculative eras.

The Electrification Super-Cycle: Silver is the most conductive metal on earth, and its role in electrification (from EVs to grid infrastructure) is irreplaceable in the near term. Bulls contend this creates a "right-hand tail" of demand growth for years to come, potentially absorbing supply and justifying higher equilibrium prices.

Institutional and Official Validation: The market stress is becoming palpable. The U.S. Mint's temporary removal of some silver coin products for pricing review is a tell-tale sign of a physical market straining under price-discovery failure. This administrative action underscores the tension between paper speculation and physical availability.

Synthesis and Strategic Implications

The market is engaged in a high-stakes battle between Fear (speculative mania) and Physics (structural deficit).

The Kolanovic/JPMorgan Scenario ($50 Target): This plays out if/when the speculative froth is wiped out. A catalyst could be a shift in Fed policy, a resolution of geopolitical tensions, or simply a loss of momentum that triggers cascading liquidations in leveraged positions. The price would crash toward levels that reflect its industrial fundamentals, purging the "meme trader" influence.

The Bullish Scenario (Continued Secular Strength): This prevails if the structural deficit is so profound that any price crash is met with insatiable physical buying from industry and long-term investors. In this view, a correction would be a buying opportunity, akin to the 1970s shakeout that preceded gold's largest gains.

Investor Takeaway: Navigating the Dichotomy

For investors in vehicles like the iShares Silver Trust (SLV), the decision hinges on timeframe and conviction:

Short-Term Traders: The risk is overwhelmingly to the downside. Kolanovic's warning is a clear signal of extreme overbought conditions. The market is prone to a sharp, sentiment-driven correction.

Long-Term Investors: The decision is more nuanced. They must decide if they believe the structural deficit narrative is powerful enough to withstand a 50% speculative purge. If so, any crash could represent a historic buying opportunity. If not, they risk catching a falling knife.

In conclusion, silver is not merely a commodity at a high price; it is a theater of war between two compelling but contradictory narratives. Kolanovic’s forecast is a bet that market psychology and historical patterns will overwhelm new fundamental realities. The coming months will test whether silver's breakout is the start of a new era or one of the most spectacular mean reversions in modern financial history.

The Backtesting Mindset: Why Strategies Really FailWhy Backtesting, Defaults, and Market Conditions Decide Strategy Survival

Most trading strategies don’t fail because the logic is wrong.

They fail because traders trust them outside the conditions they were ever tested for.

This post ties together three core ideas every trader eventually learns the hard way.

Why Backtesting Matters (Before You Trust Any Strategy)

Backtesting is not about proving a strategy works.

It’s about finding where it breaks.

One profitable backtest only shows survival under one set of assumptions. Markets rotate. Volatility changes. Behavior shifts.

Backtesting across parameters, symbols, and timeframes reveals whether performance is structural or accidental.

If you don’t know worst drawdown, recovery behavior, and normal variance, you don’t know the strategy.

→ Read the full lesson

Why Default Strategy Settings Fail Across Markets

Default indicator settings feel safe because they’re familiar.

That doesn’t make them universal.

Defaults were never designed to work across all symbols, timeframes, or market conditions. A strategy that works on one chart says very little about robustness.

Small parameter changes often expose whether performance is stable or fragile.

Testing replaces assumptions with behavior.

→ Read the full lesson:

Why Market Conditions Expose Strategy Weakness

Strategies rarely stop working overnight.

They degrade as market regimes rotate.

Trends, ranges, volatility, and liquidity change. A strategy can struggle simply because it’s operating in the wrong environment.

Backtesting over long periods shows performance clustering. Profits and drawdowns align with specific conditions.

This doesn’t eliminate losses.

It explains them.

→ Read the full lesson:

Final Thought

Backtesting doesn’t predict the future.

It defines boundaries.

It replaces:

This should work

With:

This is how it behaves

That shift is the difference between trading and guessing.

Real Silver Value is still extremely high + 30 min. Chart looksShort conclusion:

With physical delivery to Germany, 1 oz of silver currently costs around €93–€100 including VAT at reputable dealers.

Prices below €90 including VAT are essentially not achievable at the moment due to Germany’s 19% VAT and dealer premiums.

Thats the reality today...

If you are looking at the Chart, notice the huge diffrents in looks at the 30 min. timeframe.

Maybe we drop further around the 50 level?

Maybe we shoot up again?

Who knows!

Chart Action changed drasticly tho and you should be aware of that fundamental change...

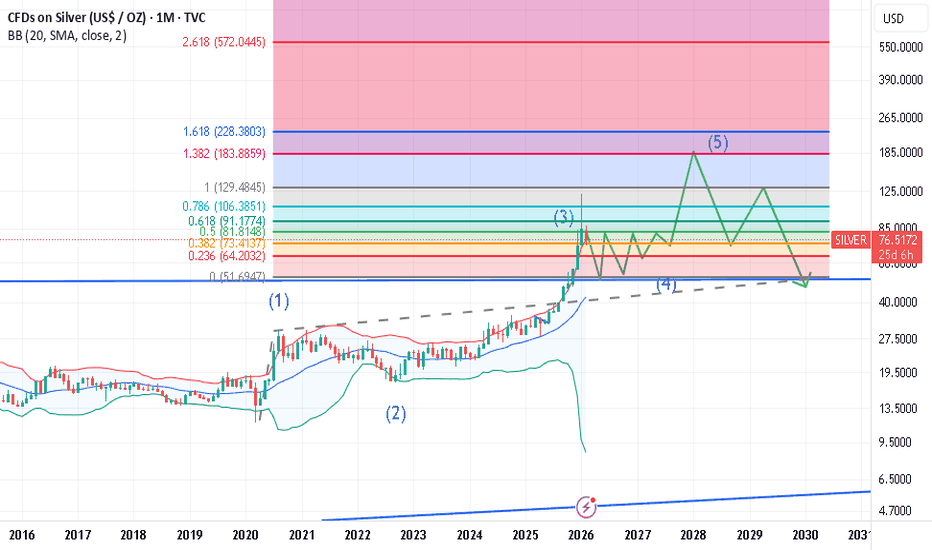

Silver – Elliott Wave: Long Consolidation Before $180 Rally?After completing the previous impulsive structure (as analyzed earlier), Silver appears to have achieved its near-term wave target. The current price action suggests that the larger impulsive move has matured, and the market may now be entering a prolonged corrective or accumulation phase.

The impulsive wave cycle seems complete.

Silver may trade within a broad consolidation zone between $60 – $100.

This range could persist for an extended period — potentially months to even years — as the market builds energy for the next macro move.

Once the corrective structure completes, the next major impulsive wave could target the $180 region, aligning with a higher-degree wave extension.

⚠️ This is a macro perspective based on Elliott Wave theory. Sideways markets can be complex and volatile internally, so proper risk management is essential.

APGO - Trend Intact, Pullbacks Are Opportunities!In the previous update, we highlighted APGO’s transition out of long-term accumulation and into early markup.

Zooming into the Daily timeframe, now price is doing exactly what strong trends tend to do next: pause, reset, and offer structure-based entries.

📊 Technical Analysis

TSXV:APGO remains inside a rising price channel , confirming that the long-term trend is still bullish.

⚔️The current retracement is unfolding toward a confluence support zone, what I call “TRIO RETEST” , where multiple technical factors align:

- The lower boundary of the rising channel

- The rising EMA , acting as dynamic support

- The $5 round-number , now acting as a key structural level

This area represents a classic trend-following zone , where buyers typically look for continuation opportunities rather than reversals.

As long as price holds above channel support and above the $5 level, the technical bias remains to the upside.📈

🧠 Structure Perspective

In strong trends, price rarely moves vertically.

Pullbacks are part of the process, they reset momentum and reinforce structure before the next impulse.📈

📌 Bottom Line

APGO remains in a bullish technical structure , with the current pullback unfolding as a normal correction within an established uptrend.

From a fundamental standpoint, Apollo Silver is directly leveraged to silver🥈 , a metal at the core of energy transition, AI infrastructure, and defense applications.

With one of the largest undeveloped silver resources in the U.S. , and additional exposure to critical minerals like barite and zinc🗻, the company sits at the intersection of macro demand and strategic supply constraints.🔎

As long as price holds above key structure, the combination of trend alignment and supportive fundamentals keeps the focus on continuation rather than distribution.

⚠️ Always do your own research and speak with your financial advisor before investing.

📚 Stick to your trading plan, entry, risk management, and execution.

All strategies are good; if managed properly.

~ Richard Nasr

Disclaimer: I have been paid $900 by CDMG, funded by Apollo Silver Corp., to disseminate this message.

SILVER BULLS ARE STRONG HERE|LONG

Hello, Friends!

SILVER pair is in the downtrend because previous week’s candle is red, while the price is obviously falling on the 4H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 10,123.0 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Precious Metals | Structural Bull Case Intact After Speculative PRECIOUS METALS | Structural Bull Case Intact Despite Speculative Unwind

The longer-term structural case for precious metals remains intact, even after the sharp pullback from record highs. Gold and silver retreated following President Trump’s nomination of Kevin Warsh as Fed Chair, which reduced expectations for aggressive monetary easing and triggered a speculative unwind.

Current price levels are now sitting just above zones typically associated with pure uncertainty hedging, suggesting that much of the speculative excess has already been flushed out. While this leaves metals vulnerable to positioning-driven pullbacks if macro sentiment turns decisively risk-off, the broader structural backdrop still allows room for a modest near-term recovery.

Technical Outlook

Price is currently consolidating between 80.13 and 85.40, awaiting a directional break.

A 15min or 1H candle close below 80.13 would confirm bearish continuation toward 76.89, followed by 71.38 and potentially 66.70.

On the upside, a break and hold above 85.40 would support a recovery toward 87.81, with further upside toward 91.00.

Key Levels

• Pivot: 80.13

• Support: 76.89 – 71.38 – 66.70

• Resistance: 85.40 – 87.81 – 91.00

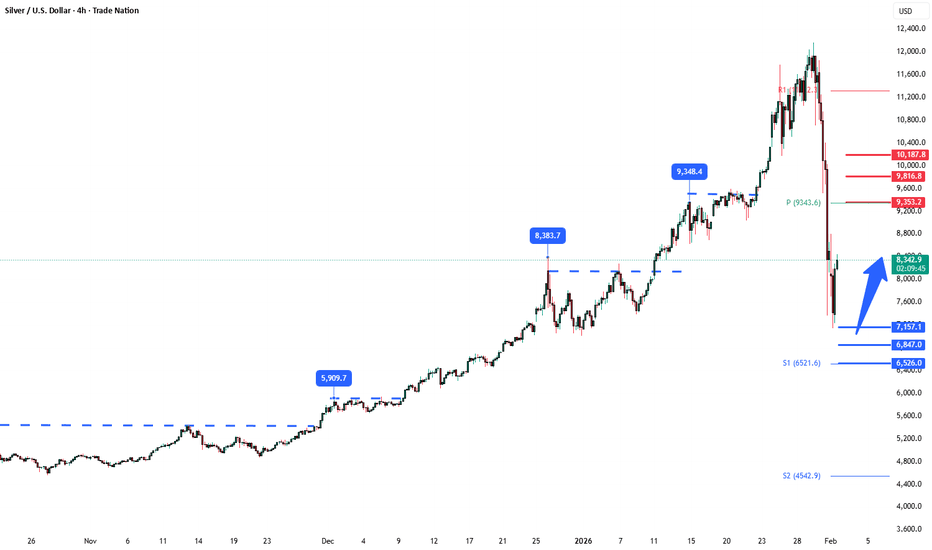

Silver overbought correction 7157 support retestThe silver remains in a neutral trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7157 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7157 would confirm ongoing upside momentum, with potential targets at:

9363 – initial resistance

9816 – psychological and structural level

10187 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7157 would weaken the bullish outlook and suggest deeper downside risk toward:

6850 – minor support

6526 – stronger support and potential demand zone

Outlook:

Neutral bias remains intact while the Silver trades around pivotal 7157 level. A sustained break below or abve this level could shift momentum.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SILVER TO REACH 650$ BEFORE END OF 2027Hello,

Not long a go I posted Silver targets of 2680$ but when I dig deeper, I would say that 650$ is very important milestone of measured move comparing previous and this century moves..

I believe 650$ should come VERY RAPIDLY given the steepness of monthly price action, we are on the road to hit much much higher prices and 650$ is key to take profits and run as fast as you can until serious correction of 77% comes into play :)

AT THE TIME OF THIS POST SILVER PRICE IS 83.95$ per 1oz of silver. Monthly chart might close much higher and give wrong understanding of when this chart was posted :)

Trading here IS NOT ADVISED as we might have very much volatility on the way up.

Not a financial advise. Stay safe!

#EURUSD , Gonna be Nice with us ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup as well . Don't rush on it

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Chart Analysis & Trade Idea (Micro Silver – 1H)Price was moving inside a consolidation / range (blue box).

A strong bearish breakout occurred from the range, showing seller dominance.

After a sharp drop, price has reached a demand zone (green box).

Demand Zone Insight:

Buyer interest is visible inside the demand zone.

Strong rejection from the lows indicates selling pressure is weakening.

A possible liquidity sweep (SL hunt) below the lows followed by stabilization suggests reversal potential.

Trade Idea (Bullish Reversal Setup):

Entry: Buy from the demand zone or after bullish confirmation

Stop Loss: Below the demand zone / recent low

Targets:

TP1: 90.00

TP2: 95.00

TP3: 100.00 (next supply / resistance area)

Confirmation Signals:

Bullish engulfing or strong bullish close on 1H / 15M

Break of minor structure (higher high) for confirmation.

02/02/26 Weekly OutlookLast weeks high: $90,610.47

Last weeks low: $75,706.32

Midpoint: $83,158.39

With January of the new year wrapped up it's been quite the opening month for Bitcoin and the broader market in general.

The loss of the yearly open ($87,500) confirmed the bears remain in control and as such, with the help of an enormous crash in metals, pushed Bitcoins price back towards 2025's Yearly low of $74,500. Now in the early hours of the weekly open that exact level has been traded with a perfect double bottom on the HTF chart. Does this mean BTC is now safe to move back up?

A relief bounce may be on the cards from here, my targets would be the inefficiency zones at 0.25 ($80,000) and if the bounce has real backing maybe $86,000. However I am not yet satisfied that the April Low has been effectively traded just yet...

For more confirmation of a bottom being in I would like to see the demand zone swept with sellers continuing to pour in but buyers soaking up the volume resulting in very little price movement. In effect this would be forced sellers (liquidations) moving their BTC to high conviction buyers in the market. I am not yet satisfied that we have had this play out.

The fear and greed index sits at 14, the same score as the Covid crash but interestingly it's a higher score than the sell-off in November of last year at a score of 11. This gives us an interesting divergence similar to that of the end of the bear market in 2022. It's also significantly lower than the April low of last year at a score of 24.

This week is about seeing where/if BTC finds strength, with BTC strength alts will follow. Also Tradfi and specifically the metals market is something to keep a eye on. It's not everyday an asset loses $4T in value in 3 days like silver did!

Detailed analysis for GOLD & SILVER : 2nd Feb 2026All the levels for buy/sell strategy has been clearly explained in this video so watch it till the end.

Silver: Still not on the bullish front. Careful with resistance levels.

Gold: It has been taking 2025 high as support. Other levels are also mentioned.

monday Silver (XAGUSD) – Price Reaction from Demand with RecoverSilver (XAGUSD) has reached a key lower demand zone after a strong bearish impulse. The highlighted area shows where price previously reacted, suggesting the presence of active buyers at these levels.

Following the rejection from lower prices, the market is forming a short-term base. If price continues to hold above the demand zone, a corrective recovery toward the upper marked area may develop.

The previous structure and broken trendline indicate that momentum is still mixed, and price may experience consolidation before any extended move. The upper highlighted region acts as a potential reaction area where price behavior should be monitored closely.

Overall, the market is transitioning from strong bearish momentum into a possible corrective phase, with key levels clearly marked for observation.

monday Silver (XAGUSD) – Pullback into Structure with Downside CSilver (XAGUSD) remains under bearish pressure after a strong sell-off from the higher supply zone. Price is currently reacting from a short-term retracement area, highlighted by the marked zone, which aligns with previous structure resistance.

The recent move shows a corrective pullback within a broader bearish trend. As long as price stays below the highlighted resistance region, the overall structure favors downside continuation.

The lower highlighted zone represents an important demand area where price may react or consolidate temporarily. A sustained move below this level would indicate further weakness and continuation of the prevailing trend.

Market participants should focus on price behavior around the marked zones and wait for confirmation through structure and momentum before anticipating the next move.