XAUUSD – Weekly Outlook (D1) | Lana...XAUUSD – Weekly Outlook (D1) | Lana 💛

Gold has just confirmed a new All-Time High (ATH) on the daily chart, reinforcing the dominant bullish trend. However, after such an impulsive expansion, the market is now entering a critical decision zone where reactions and rotations are very likely next week.

Market structure – Big picture

The daily bullish structure remains intact with higher highs and higher lows.

ATH has been broken and accepted, which keeps the long-term bias bullish.

That said, price is now trading far from value, so short-term pullbacks are healthy and expected.

This is a classic environment where trend continuation and corrective moves can coexist.

Key zones for next week

🔴 Upper resistance / reaction zone

4610 – 4620

Major supply + psychological round number

Ideal area for profit-taking or short-term sell reactions

Not a reversal signal by itself, but a high-risk area to chase longs

🟢 Buy-on-dip scenarios (preferred)

Primary buy zone:

4377 – 4386

Strong daily structure support

Previous breakout & acceptance area

Good zone to look for bullish confirmation

Deeper value buy:

Around 4250

FVG + former resistance turned support

Strong value area if market corrects deeper

Best risk/reward zone for swing continuation setups

Scenarios to expect

Base case: Price consolidates or pulls back toward 4380 before continuing higher.

Alternative: Shallow pullback, then another push toward 4610–4620 to test liquidity.

Invalidation: Only a clean daily close below 4250 would weaken the current bullish structure.

Lana’s trading mindset ✨

No chasing price at ATH.

Let the market come back into value zones.

Trade reactions, confirmations, and structure — not headlines.

Big trend is bullish, but entries matter more than bias.

Next week is about patience and precision, not prediction.

Smctrading

Smart Money Concepts SMC Detailed Learning Plan

If you want to learn Smart Money concepts, but you don't know what to start with, this article with help.

I will share with you 5-steps Smart Money Concepts learning plan. 5 important topics to study in SMC.

Topic 1:

Market Structure - the analysis of a behaviour of a price on a chart.

In the contest of Smart Money Concepts you should learn:

-SMC structure mapping

-Market trend identification, trend reversal & change

-SMC important events: BoS, CHoCH

Topic 2:

Liquidity Zones - learn to identify the areas on a price chart where liquidity concentrates.

Topic 3:

Imbalance - one of the most accurate signals of the presence of big players / smart money on the market.

Topic 4:

Order Block - the specific areas on a price chart where institutional traders / smart money are placing significant number of trading orders.

Top 5:

Top-Down Analysis - structured and consistent analysis of multiple time frames.

After you study Topic 1, 2, 3, 4, you should learn to apply these knowledge and techniques on multiple time frames, to make informed decisions, following long-term, mid-term, short-term analysis.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Week of 1/11/26: AUDUSD AnalysisPrice has pushed to the extreme swing structure of the 4h and daily chart. 1h structure is bearish, so we are not exactly bullish yet until 1h switches bullish. We're going to wait until price makes its move to the upside or downside for a market structure shift.

Major News:

Tues - CPI

Wed - PPI

Learn How to Identify Trend Reversal With Inducement. Smart Mone

Smart Money Concepts can be applied for the identification of trend reversal in Forex and Gold trading.

In this article, we will discuss how to apply basic SMC techniques: trap and inducement to identify early reversal signs. We will study the important theory and go through real market examples on XAUUSD chart.

Imagine that there is a strong historical resistance on a price chart.

Because the price reacted to that strongly in the past, many sellers will place selling orders on that in future, anticipating a similar reaction.

Placing short trades, their stop losses will lie above the resistance.

In case of a bullish violation of the underlined resistance,

sellers will be stopped out from their short trades and close their positions in loss.

After the violation of a resistance, according to the rules, it should turn into support . Many traders will place their buy orders there, anticipating a bullish continuation.

Bearish violation of such a support will stop out the buyers as well.

Such a price action will be called an inducement and a bullish trap.

With that, smart money grab the liquidity both from the buyers and from the sellers.

After that, with a high probability, the market will drop .

Bullish violation of one of the previous all-time-highs on Gold could easily be a bullish trap.

To confirm that, the price should simply break and close below a broken horizontal resistance.

That would confirm a local bearish reversal.

With a bullish trap and inducement, smart money are quietly placing HUGE SELLING ORDERS, making the retail traders close short trades in loss (buy their positions) and buy from the broken structure, providing them the liquidity.

The ability to recognize the traps will let you understand real intentions of smart money and trade with them.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH M15 HTF FVG Rejection and Bearish Setup📝 Description

On the M15 timeframe, BBG:ETHEREUM is pushing back into a 30m Fair Value Gap (FVG) after a strong impulsive sell-off. The current move higher appears corrective, with price stalling inside prior imbalance rather than showing acceptance above it.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the 30m FVG / 3,100 zone

Preferred Setup:

• Entry: 3,100 (30m FVG tap & rejection)

• Stop Loss: Above 3,105

• TP1: 3,088

• TP2: 3,079

• TP3: 3,072

________________________________________

🎯 ICT & SMC Notes

• Clear displacement created a clean 30m FVG overhead

• Current rally lacks bullish BOS or CHOCH confirmation

• Downside targets align with prior sell-side liquidity and structural lows

________________________________________

🧩 Summary

CRYPTOCAP:ETH is reacting into a higher-timeframe imbalance zone after an impulsive drop. As long as price is capped below the 30m FVG, the structure favors continuation lower toward TP1–TP3, treating the current push as a corrective pullback.

________________________________________

🌍 Fundamental Notes / Sentiment

Broader crypto sentiment remains fragile, with risk appetite still selective. Without a strong risk-on catalyst, rallies into HTF inefficiencies are more likely to be sold, supporting continuation-type setups rather than reversals.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

XAUUSD (H2) – Liam View: Buy the liquidity pullback, re-buy...XAUUSD (H2) – Liam View: Buy the liquidity pullback, re-buy at the 0.618 zone

1) Macro snapshot (Venezuela headlines = faster repricing)

Since Maduro was reportedly detained, Venezuela’s market has reacted aggressively — your note highlights the IBC index surging +74.71% in just two sessions and +156% over 30 days, showing a rapid “repricing” of political risk and expectations.

For gold, this kind of backdrop usually means bigger swings + liquidity sweeps: the market can flip between risk-on bursts and renewed safe-haven demand.

➡️ So the best play today is still level-based execution, not chasing candles.

2) Chart read (H2) – Uptrend intact, but it needs a clean pullback

From your H2 chart:

The broader structure is still bullish, but price is in a short-term pullback after the recent push up.

The key level is the 0.618 Buy Zone: 4414–4417 — a classic re-entry area (liquidity + fib confluence).

Above, we have Buyside Liquidity near the recent highs — that’s the magnet if buyers regain control.

3) Trade plan (clear Entry / SL / TP)

✅ Scenario A (priority): BUY the 0.618 pullback

Buy zone: 4414 – 4417

Stop loss (SL): below 4406 (or safer: below the most recent H2 swing low)

Take profit (TP):

TP1: 4460–4470 (recent rebound high area)

TP2: sweep Buyside Liquidity (above the highs)

TP3: if the breakout holds, continue towards the upper resistance band on your chart

Logic: In a bullish structure, the 0.618 pullback is often the cleanest “re-buy” entry — especially when headlines trigger sharp dips and fast rebounds.

✅ Scenario B: Shallow pullback → buy only with confirmation

If price doesn’t reach 4414–4417 and only dips lightly:

Wait for a lower-TF confirmation (M15/H1 shift / rejection)

Take a smaller continuation buy and aim for a quick 8–12$ move

⚠️ Scenario C (scalp only): SELL after a buyside sweep and rejection

If price runs the highs (buyside liquidity sweep) and then prints a strong rejection:

You can sell scalp back into 4460–4445

SL: above the sweep high

Not a long-term bearish call while the rising structure is still valid.

4) Key note (headline week)

Venezuela headlines can keep volatility elevated, so:

Avoid entering mid-candle

Use zones + confirmation

Reduce size if spreads widen

If I had to pick one clean trade today: wait for the 0.618 buy zone (4414–4417), then buy for a push into buyside liquidity.

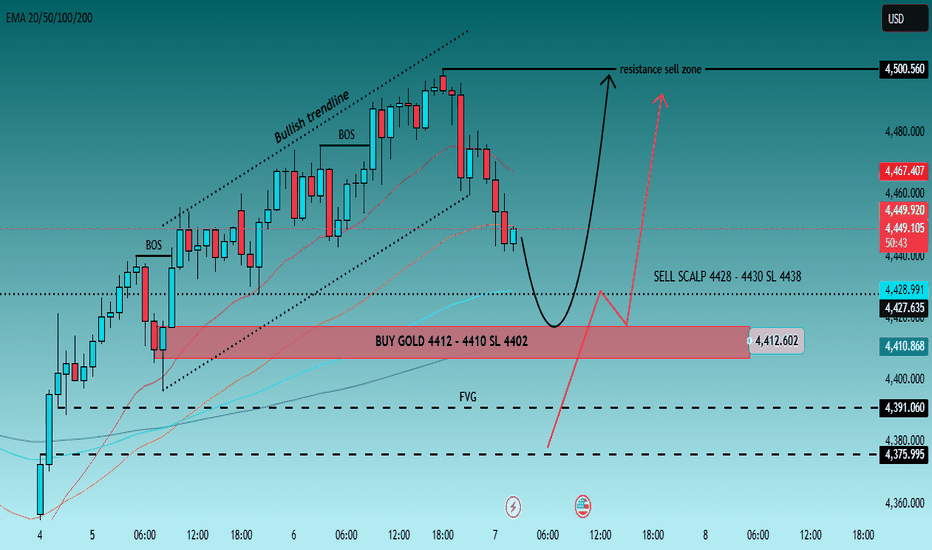

Gold Pauses After Expansion — Rotation, Not Continuation🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (07/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, following a strong impulsive expansion that delivered price deep into premium. However, recent price action signals a transition from expansion into distribution, with Smart Money beginning to engineer corrective rotations rather than chasing continuation.

As the market digests USD flows, U.S. yield sensitivity, and positioning ahead of upcoming U.S. data, Gold is currently rotating between internal liquidity zones. This environment typically favors liquidity sweeps, inducement, and mean reversion, rather than clean directional breakouts.

Today’s session is best approached with level-based execution, patience, and confirmation — not prediction.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with an active intraday corrective leg from premium.

Key Idea:

Expect Smart Money to react at internal supply (4428–4430) for short-term distribution, or at discount demand (4412–4410) for re-accumulation before the next leg.

Structural Notes:

• HTF bullish structure remains intact

• Clear BOS printed during the upside expansion

• Price rejected from premium and is rotating lower

• Internal supply at 4428–4430 acts as sell-sensitive zone

• Demand at 4412–4410 aligns with OB + EMA support + liquidity pocket

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4412 – 4410 | SL 4402

• 🔴 SELL SCALP 4428 – 4430 | SL 4438

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4412 – 4410 | SL 4402

Rules:

✔ Liquidity sweep into discount demand

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4425 — initial reaction

• 4435 — internal liquidity

• 4480–4500 — premium retest if momentum expands

🔴 SELL SCALP 4428 – 4430 | SL 4438

Rules:

✔ Price taps internal supply / EMA resistance

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4418 — first imbalance

• 4410 — demand interaction

• Trail aggressively (scalp setup)

⚠️ Risk Notes

• Premium zones favor stop hunts and fake continuations

• Volatility may expand during U.S. session

• No entries without MSS + BOS confirmation

• Scalp sells require strict risk control

📍 Summary

Gold remains structurally bullish, but today’s edge lies in Smart Money’s intraday rotation:

• A sweep into 4412–4410 may reload longs toward premium, or

• A reaction at 4428–4430 offers a controlled scalp sell back into demand.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD (H2) – Liam View: Buy liquidity pullback.1) Macro snapshot (Venezuela headlines = faster repricing)

Since Maduro was reportedly detained, Venezuela’s market has reacted aggressively — your note highlights the IBC index surging +74.71% in just two sessions and +156% over 30 days, showing a rapid “repricing” of political risk and expectations. For gold, this kind of backdrop usually means bigger swings + liquidity sweeps: the market can flip between risk-on bursts and renewed safe-haven demand.

➡️ So the best play today is still level-based execution, not chasing candles.

2) Chart read (H2) – Uptrend intact, but it needs a clean pullback

From your H2 chart:

The broader structure is still bullish, but price is in a short-term pullback after the recent push up.

The key level is the 0.618 Buy Zone: 4414–4417 — a classic re-entry area (liquidity + fib confluence).

Above, we have Buyside Liquidity near the recent highs — that’s the magnet if buyers regain control.

3) Trade plan (clear Entry / SL / TP) ✅ Scenario A (priority): BUY the 0.618 pullback

Buy zone: 4414 – 4417 Stop loss (SL): below 4406 (or safer: below the most recent H2 swing low) Take profit (TP):

TP1: 4460–4470 (recent rebound high area)

TP2: sweep Buyside Liquidity (above the highs)

TP3: if the breakout holds, continue towards the upper resistance band on your chart

Logic: In a bullish structure, the 0.618 pullback is often the cleanest “re-buy” entry — especially when headlines trigger sharp dips and fast rebounds.

✅ Scenario B: Shallow pullback → buy only with confirmation

If price doesn’t reach 4414–4417 and only dips lightly:

Wait for a lower-TF confirmation (M15/H1 shift / rejection)

Take a smaller continuation buy and aim for a quick 8–12$ move

⚠️ Scenario C (scalp only): SELL after a buyside sweep and rejection

If price runs the highs (buyside liquidity sweep) and then prints a strong rejection:

You can sell scalp back into 4460–4445

SL: above the sweep high

Not a long-term bearish call while the rising structure is still valid.

4) Key note (headline week)

Venezuela headlines can keep volatility elevated, so:

Avoid entering mid-candle

Use zones + confirmation

Reduce size if spreads widen

If I had to pick one clean trade today: wait for the 0.618 buy zone (4414–4417), then buy for a push into buyside liquidity.

XAUUSD (H1) – Bullish channel intact, short pullback...Market context

On January 7, spot gold and silver both saw short-term selling pressure.

Spot gold slipped toward 4450–4455 USD/oz after a recent rally.

Spot silver dropped below 79 USD, reflecting broader short-term profit-taking across precious metals.

This pullback looks technical and corrective, rather than a reversal of the broader bullish trend. The macro backdrop remains supportive: geopolitical risks, long-term central bank demand, and expectations of easier monetary policy continue to underpin precious metals.

Technical view – H1 (Lana’s perspective)

Price is still respecting a rising price channel, showing healthy trend structure despite the current retracement.

Key observations from the chart:

The ascending channel remains valid; higher highs and higher lows are intact.

Price has reacted from the upper half of the channel, triggering short-term selling into sell-side liquidity.

The dotted midline and channel support are acting as dynamic reaction zones.

The recent drop appears to be a liquidity sweep / correction, not a breakdown.

This kind of pullback is common after strong impulsive legs and often provides better positioning for trend continuation.

Key levels to watch

Sell-side reaction (short-term pressure)

Near the channel midline and upper resistance, price may remain choppy.

Expect volatility while sell-side liquidity is being absorbed.

Buy-side interest zones

4458 – 4463: First reaction zone inside the channel.

4428 – 4400: Stronger support aligned with channel base and prior structure.

Acceptance above these zones favors bullish continuation.

Fundamental angle

Short-term weakness in gold and silver is driven mainly by profit-taking after recent highs.

Broader fundamentals remain constructive:

Ongoing geopolitical uncertainty

Strong central bank demand

USD valuation and global risk sentiment

These factors suggest that dips are more likely to be corrective opportunities, not trend-ending signals.

Lana’s trading mindset 💛

Avoid chasing price during pullbacks.

Respect the channel structure and wait for price to come into value.

Look for clear confirmation at support zones before engaging.

As long as the channel holds, the bullish bias remains valid.

This analysis reflects a personal technical view for educational purposes only. Always manage risk carefully.

XAUUSD (H1) – Bullish channel intact, short-term pullback in...XAUUSD (H1) – Bullish channel intact, short-term pullback in progress ✨

Market context

On January 7, spot gold and silver both saw short-term selling pressure.

Spot gold slipped toward 4450–4455 USD/oz after a recent rally.

Spot silver dropped below 79 USD, reflecting broader short-term profit-taking across precious metals.

This pullback looks technical and corrective, rather than a reversal of the broader bullish trend. The macro backdrop remains supportive: geopolitical risks, long-term central bank demand, and expectations of easier monetary policy continue to underpin precious metals.

Technical view – H1 (Lana’s perspective)

Price is still respecting a rising price channel, showing healthy trend structure despite the current retracement.

Key observations from the chart:

The ascending channel remains valid; higher highs and higher lows are intact.

Price has reacted from the upper half of the channel, triggering short-term selling into sell-side liquidity.

The dotted midline and channel support are acting as dynamic reaction zones.

The recent drop appears to be a liquidity sweep / correction, not a breakdown.

This kind of pullback is common after strong impulsive legs and often provides better positioning for trend continuation.

Key levels to watch

Sell-side reaction (short-term pressure)

Near the channel midline and upper resistance, price may remain choppy.

Expect volatility while sell-side liquidity is being absorbed.

Buy-side interest zones

4458 – 4463: First reaction zone inside the channel.

4428 – 4400: Stronger support aligned with channel base and prior structure.

Acceptance above these zones favors bullish continuation.

Fundamental angle

Short-term weakness in gold and silver is driven mainly by profit-taking after recent highs.

Broader fundamentals remain constructive:

Ongoing geopolitical uncertainty

Strong central bank demand

USD valuation and global risk sentiment

These factors suggest that dips are more likely to be corrective opportunities, not trend-ending signals.

Lana’s trading mindset 💛

Avoid chasing price during pullbacks.

Respect the channel structure and wait for price to come into value.

Look for clear confirmation at support zones before engaging.

As long as the channel holds, the bullish bias remains valid.

This analysis reflects a personal technical view for educational purposes only. Always manage risk carefully.

XAUUSD (H2) – Liam View: Geopolitical risks support gold.XAUUSD (H2) – Liam View: Geopolitical risk remains high, gold continues to be supported | Trade the pullback, target ATH liquidity

Quick summary

The latest White House messaging on Venezuela is very direct: officials are signaling Washington will push Caracas to “act in America’s interests,” with Rubio reportedly in contact, while Stephen Miller framed the situation bluntly as “the world runs on power.”

For markets, this kind of rhetoric keeps the geopolitical risk premium elevated — and gold typically benefits as a safe haven when uncertainty increases.

On the chart (H2), gold is holding a bullish recovery structure and is now pushing into a higher-value area. My plan is to stay patient, buy pullbacks into liquidity, and watch for a final push toward ATH liquidity.

1) Macro context (why gold remains bid)

When major powers use strong language around military campaigns and “power-first” policy, traders price in:

Higher headline risk (sudden escalations / sanctions / retaliation)

More demand for safe havens (gold)

Potential volatility in USD and yields, which can create fast spikes and liquidity sweeps

➡️ That’s why the best execution is still level-based: let the price come to liquidity zones and trade the reaction.

2) Technical view (H2 – based on your chart)

Price bounced strongly and is building a clear recovery leg.

The chart highlights a value area / volume node (pink profile) where price is currently accepting — this usually acts like a magnet and a base for continuation.

Upside roadmap on your chart points toward:

a pullback into the mid-zones

continuation into “strong Fibonacci” resistance

then a run into ATH liquidity above

3) Key levels to watch (from the chart)

✅ ATH zone (major liquidity / ceiling)

✅ Strong Fibonacci (upper resistance band)

✅ Mid support zones (stacked demand areas below current price — ideal for pullback buys)

(Your chart marks multiple horizontal demand bands — I’m using them as reaction zones rather than exact-to-the-dollar predictions.)

4) Trading scenarios (Liam style: trade the level)

Scenario A (priority): BUY the pullback (trend continuation)

✅ If price dips into the nearest demand band (below current consolidation):

Buy on reaction (M15–H1 confirmation)

SL: below the demand band

TP1: return to current highs

TP2: Strong Fibonacci zone

TP3: ATH liquidity sweep

Logic: In geopolitical-risk conditions, gold often continues higher but still does “healthy” pullbacks to collect liquidity before the next push.

Scenario B: Breakout continuation (only if price holds above value)

✅ If price holds above the value area and breaks higher cleanly:

Look for a small retrace to re-enter (no chasing)

Targets remain Strong Fibonacci → ATH

Scenario C: Rejection at Strong Fibonacci (short-term scalp)

✅ If price taps the Strong Fibonacci zone and shows clear rejection:

Sell scalp back toward value

SL: above the rejection swing

TP: nearest demand band / value zone

Logic: This is a reaction trade only — not a long-term bearish call while geopolitical premium is active.

5) Risk notes for headline-driven sessions

Expect wicks and fast sweeps — reduce size and avoid market orders at the open.

Wait for confirmation at the zone (rejection/engulf/MSS) before entering.

Don’t overtrade: one clean setup at a key level is enough.

XAUUSD H1 –Liquidity Reaction After Geopolitical SpikeXAUUSD H1 – Liquidity Reaction After Geopolitical Spike

Gold surged strongly at the start of the week as escalating geopolitical tensions boosted safe-haven demand, while expectations of further Fed rate cuts continued to support the broader bullish narrative. From a technical perspective, price is now reacting around key liquidity and Fibonacci zones rather than trending impulsively.

TECHNICAL OVERVIEW

On H1, gold experienced a sharp sell-off followed by a recovery, forming a V-shaped reaction that suggests aggressive liquidity clearing.

Price is currently trading below prior breakdown zones, indicating that supply remains active at higher levels.

The market structure favours sell-on-rallies in the short term, while deeper pullbacks may attract fresh buyers.

KEY LEVELS & MARKET BEHAVIOUR

Upper sell zones (supply & Fibonacci confluence):

4497 – 4500 (FVG sell zone, premium area)

4431 – 4435 (Fibonacci + former support turned resistance)

These zones represent areas where sellers previously stepped in aggressively, making them important reaction levels if price rebounds.

Lower buy-side liquidity:

4345 – 4350 (Value Low / buy-side liquidity zone)

This area aligns with trendline support and prior accumulation, making it a key level to monitor for a bullish reaction if price rotates lower.

EXPECTED PRICE FLOW

Short term: price may continue to consolidate and rotate between resistance and liquidity below, with choppy price action likely.

A rejection from the upper resistance zones could lead to another leg lower toward buy-side liquidity.

If buy-side liquidity is absorbed and defended, the market may attempt another recovery move.

FUNDAMENTAL CONTEXT

Gold’s strength is underpinned by two major factors:

Rising geopolitical risk, which increases demand for safe-haven assets.

Dovish expectations from the Federal Reserve, as markets continue to price in additional rate cuts, reducing the opportunity cost of holding non-yielding assets like gold.

These fundamentals support gold on higher timeframes, even as short-term technical corrections play out.

BIG PICTURE VIEW

Medium-term bias remains constructive due to macro and geopolitical support.

Short-term price action is driven by liquidity and reaction zones rather than trend continuation.

Patience is key—allow price to interact with major levels before committing to the next directional move.

Let the market show its hand at liquidity.

XAUUSD (H2) – Liam View: Geopolitical risk stays hot, gold ...XAUUSD (H2) – Liam View: Geopolitical risk stays hot, gold remains supported | Trade the pullback, target ATH liquidity

Quick summary

The latest White House messaging on Venezuela is very direct: officials are signalling Washington will push Caracas to “act in America’s interests”, with Rubio reportedly in contact, while Stephen Miller framed the situation bluntly as “the world runs on power.”

For markets, this kind of rhetoric keeps geopolitical risk premium elevated — and gold typically benefits as a safe-haven when uncertainty increases.

On the chart (H2), gold is holding a bullish recovery structure and is now pushing into a higher-value area. My plan is to stay patient, buy pullbacks into liquidity, and watch for a final push toward ATH liquidity.

1) Macro context (why gold stays bid)

When major powers use strong language around military campaigns and “power-first” policy, traders price in:

Higher headline risk (sudden escalations / sanctions / retaliation)

More demand for safe-havens (gold)

Potential volatility in USD and yields, which can create fast spikes and liquidity sweeps

➡️ That’s why the best execution is still level-based: let price come to liquidity zones and trade the reaction.

2) Technical view (H2 – based on your chart)

Price bounced strongly and is building a clear recovery leg.

The chart highlights a value area / volume node (pink profile) where price is currently accepting — this usually acts like a magnet and a base for continuation.

Upside roadmap on your chart points toward:

a pullback into the mid-zones

continuation into “strong Fibonacci” resistance

then a run into ATH liquidity above

3) Key levels to watch (from the chart)

✅ ATH zone (major liquidity / ceiling)

✅ Strong Fibonacci (upper resistance band)

✅ Mid support zones (stacked demand areas below current price — ideal for pullback buys)

(Your chart marks multiple horizontal demand bands — I’m using them as reaction zones rather than exact-to-the-dollar predictions.)

4) Trading scenarios (Liam style: trade the level)

Scenario A (priority): BUY the pullback (trend continuation)

✅ If price dips into the nearest demand band (below current consolidation):

Buy on reaction (M15–H1 confirmation)

SL: below the demand band

TP1: return to current highs

TP2: Strong Fibonacci zone

TP3: ATH liquidity sweep

Logic: In geopolitical-risk conditions, gold often continues higher but still does “healthy” pullbacks to collect liquidity before the next push.

Scenario B: Breakout continuation (only if price holds above value)

✅ If price holds above the value area and breaks higher cleanly:

Look for a small retrace to re-enter (no chasing)

Targets remain Strong Fibonacci → ATH

Scenario C: Rejection at Strong Fibonacci (short-term scalp)

✅ If price taps the Strong Fibonacci zone and shows clear rejection:

Sell scalp back toward value

SL: above the rejection swing

TP: nearest demand band / value zone

Logic: This is a reaction trade only — not a long-term bearish call while geopolitical premium is active.

5) Risk notes for headline-driven sessions

Expect wicks and fast sweeps — reduce size and avoid market orders at the open.

Wait for confirmation at the zone (rejection/engulf/MSS) before entering.

Don’t overtrade: one clean setup at a key level is enough.

EURGBP — FRGNT DAILY CHART FORECAST Q1 | D6 | W1 | Y26📅 Q1 | D6 | W1 | Y26

📊 EURGBP — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

GBPUSD — FRGNT DAILY CHART FORECAST Q1 | D6 | W1 | Y26📅 Q1 | D6 | W1 | Y26

📊 GBPUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

XAUUSD (H1) – Inverse Head & Shoulders confirmed, but caution neXAUUSD (H1) – Inverse Head & Shoulders confirmed, but caution near POC 💛

Market overview

Spot gold has pushed above $4,470/oz, extending its strong performance after setting multiple record highs throughout 2025. The broader bullish backdrop remains intact, supported by trade-war concerns, ongoing geopolitical instability, and accommodative monetary policy across major economies. Strong and persistent buying from central banks continues to underpin gold’s long-term outlook into 2026.

Technical view – Inverse Head & Shoulders

On the H1 chart, gold has clearly formed an Inverse Head & Shoulders structure:

Left shoulder: Formed after the initial sharp sell-off

Head: A deeper liquidity sweep with strong rejection

Right shoulder: Higher low, showing sellers losing momentum

Neckline / POC zone: Around the 4460–4470 area, where price is currently reacting

The breakout above the neckline confirms bullish intent. However, price is now trading around a POC (Point of Control), which is often prone to psychological reactions and choppy price action.

Key levels to watch

Bullish continuation zone

Holding above the neckline keeps the bullish structure valid.

A clean acceptance above the POC opens the door for continuation toward higher liquidity and Fibonacci extension targets.

Pullback & risk zone

Liquidity risk: 4333 – 4349

If the market fails to hold above the neckline, a deeper pullback into this liquidity zone is possible before buyers step back in.

Fundamental context

Gold’s recovery is driven by trade-war fears, geopolitical tensions, and expectations of looser monetary policy globally.

Central bank demand remains a key pillar supporting prices.

In 2026, gold performance will continue to be influenced by USD valuation, overall risk sentiment, and central bank policy decisions.

Lana’s trading approach

No chasing near the POC. Expect reactions and fake moves.

Prefer buying pullbacks rather than entering at highs.

If price holds above the neckline with strong structure, bullish continuation remains the main scenario.

If the neckline fails, wait patiently for liquidity to be taken lower before looking for new buy setups.

This analysis reflects Lana’s personal market view and is for study purposes only. Always manage risk carefully. 💛

XAUUSD Smart Money Levels: Demand at 4325, Supply at 4494🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, but current price action reflects a premium-side liquidity operation rather than clean continuation. After a strong upside leg, price is now rotating inside premium where Smart Money typically distributes positions before initiating corrective delivery.

Today’s focus revolves around USD strength, U.S. yield sensitivity, and ongoing Fed rate path speculation, with traders positioning ahead of upcoming U.S. macro releases and Fed commentary. As real yields fluctuate and risk sentiment remains fragile, Gold continues to attract safe-haven flows — but not without engineered pullbacks.

This environment favors liquidity sweeps, false continuation, and inducement above highs, rather than impulsive breakout buying.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish structure with an active short-term corrective leg from premium.

Key Idea:

Expect Smart Money interaction either at internal supply (4492–4494) for distribution, or HTF demand (4327–4325) for re-accumulation before the next expansion.

Structural Notes:

• HTF bullish structure remains valid

• Recent CHoCH confirms corrective rotation

• Buy-side liquidity above highs has been partially tapped

• Supply cluster at 4492–4494 acts as distribution zone

• Demand zone at 4327–4325 aligns with OB + liquidity pool

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4327 – 4325 | SL 4317

• 🔴 SELL GOLD 4492 – 4494 | SL 4500

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4327 – 4325 | SL 4317

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Strong upside BOS with impulsive candles

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4390 — initial displacement

• 4450 — internal liquidity

• 4490+ — premium retest if USD weakens

🔴 SELL GOLD 4492 – 4494 | SL 4500

Rules:

✔ Reaction into premium supply zone

✔ Bearish MSS / CHoCH on lower timeframe

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4455 — first imbalance fill

• 4395 — internal discount

• 4327 — HTF demand sweep

⚠️ Risk Notes

• Premium zones favor fake breakouts and stop hunts

• Volatility may spike around U.S. data and Fed remarks

• No entries without MSS + BOS confirmation

• Stops often triggered before real displacement

📍 Summary

Gold remains structurally bullish, but today’s edge lies in trading Smart Money’s range:

• A sweep into 4327–4325 may reload longs toward 4450–4490, or

• A reaction at 4492–4494 offers a sell opportunity back into discount.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD Smart Money Levels: Demand at 4312, Supply at 4436🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalysts (Fed commentary, U.S. jobs data, Treasury yields), institutional participation is oscillating between liquidity hunts and controlled re-accumulation.

Global risk sentiment and safe-haven bids are intensifying as traders weigh inflation trajectory with central bank pivot expectations — leading Gold to exhibit rotational distribution behavior rather than clean continuation. Controlled swings and sweep-driven moves dominate price progression.

This environment favors engineered liquidity access and inducement, not blind breakout chasing.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

Higher-timeframe bullish bias with short-term corrective displacement.

Key Idea:

Expect structural engagement near HTF demand (~4312–4314) or internal supply liquidity (~4434–4436) before meaningful displacement sequences.

Structural Notes:

• HTF bullish structure remains intact

• Recent CHoCH confirms corrective leg

• Buy-side liquidity above recent highs is targeted

• Supply cluster near 4436 acts as engineered lure

• Demand confluence aligns with institutional accumulation

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4314 – 4312 | SL 4304

• 🔴 SELL GOLD 4434 – 4436 | SL 4444

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → internal supply retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4314 – 4312 | SL 4304

Rules:

✔ Liquidity sweep into HTF demand

✔ Bullish MSS / CHoCH confirmation on M5–M30

✔ Clear upside BOS with impulse candles

✔ Entry via refined demand OB or FVG fill

Targets:

• 4370 — initial displacement

• 4410 — internal supply test

• 4440+ — extended run if USD weakens

🔴 SELL GOLD 4434 – 4436 | SL 4444

Rules:

✔ Reaction into internal supply cluster

✔ Bearish MSS / CHoCH confluence

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4390 — first discount zone

• 4350 — deeper pullback

• 4314 — HTF demand scan

⚠️ Risk Notes

• False breaks favored near thin Asian session volume

• Macro catalysts (U.S. data, Fed speakers) may spike volatility

• Avoid entries without MSS + BOS confirmations

• Stops triggered by engineered liquidity hunts

📍 Summary

Gold remains structurally bullish, but today’s edge lies in disciplined entries and liquidity awareness:

• A sweep into 4312–4314 may reload longs with targets up to 4410–4440, or

• A reaction near 4434–4436 provides a fade opportunity back into discount.

Let liquidity initiate the move. Let structure confirm.

Smart Money sets traps — retail chases them. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAU/USD BULLISH ANALYSIS – PROFESSIONAL TRADE MANAGEMENTThis trade was not luck — it was structure, liquidity, and patience.

🧠 MARKET CONTEXT

Price was coming from a distribution phase, where the market:

• Took buy-side liquidity

• Trapped late buyers

• Prepared the real move

Then we had:

✅ Sell-side liquidity sweep

✅ CHOCH (Change of Character)

✅ BOS (Break of Structure)

This confirmed a clear shift to a bullish bias.

🎯 ENTRY

📍 Buy POI (15M): 4,328

After:

• Fakeout

• Liquidity sweep

• Structural confirmation

🎯 Risk / Reward: 1:3

🟢 TRADE MANAGEMENT

✔️ TP1 mitigated: 4,390

✔️ TP2 mitigated: 4,458

🔒 Stop moved to BE at 4,345

➡️ Capital protected, risk-free trade.

⏳ CURRENT SCENARIO

📌 Price is consolidating above TP2, showing bullish strength.

🎯 Waiting for TP3: 4,521

Area of buy-side liquidity / previous HH.

As long as structure holds:

➡️ Bullish bias remains intact.

GBPUSDPrice is testing the bullish 1W OB, receives a buyer reaction, and forms confirmation in the form of a 1D RB. Based on this, I expect upside continuation toward the 1W FP target.

An additional scenario within the bullish 1D order flow can be considered: 1D OB ➡️ 4H OB ➡️➡️➡️ 1D/1W FP.

A lower-priority scenario is upside continuation via a sweep of the 1D FP (RB) within the 1W OB zone.

Week of 1/4/26: EURUSDEURUSD has been correcting after breaking daily structure. Price at the moment is at the extreme of the 4h and 1h swing. We will be patient and wait for internal 1h structure to either break the swing bearish to follow the bearish trend or for internal structure to turn bullish again in order to have a bullish bias.

Major News:

Mon - PMI

Wed - ADP NFP, PMI, JOLTS

Thu - Unemployment

Fri - Hourly Earnings, NFP, Unemployment Rate, UoM