Snap

LONG SPOTIFYCompany showing solid Y/Y growth. We are testing long time overhead resistance. Wait for a break and long to $168. 13-15% upside. Coming off a good ER and bouncing off critical support.

Y/Y

Revenue 1.73B 28.03%

Net income 241M 460.47%

Diluted EPS 0.36 56.52%

Net profit margin 13.92% 337.74%

SNAP YOUR FINGERSConsolidation inside the ribbon is at his end.

Now volatility is expected. Impression is that the bullish outcome is to prefere.

As we are on the lower range of consolidation risk/reward ratio is good for an entry. Target 20 dollars. Close under 13.6 dollars activate h&s pattern.

BIO

Zuckerberg is Bottle-Necking The Entire Collective ConsciousnessI post all these well researched and unique articles all over Facebook groups, but all of them get blocked...

This Fascistic Orwellian censorship is bottle-necking the entire human collective consciousness, and the damage Zuckerberg and his Big Tech Cartel Cohorts are doing to the human collective consciousness is incalculable, and they should be tried in the Hague for crimes against humanity.

Zuckerberg has given the Poynter Institute access to their algorithms so they can decide what is real and what is fake, yet they have shown time and time again that they are just as biased as every other media organization -- maybe even more, and this was displayed clearly for all the world to see when they refused to cover Bloomberg's recent decision not publish investigative reports about Democrats. According to the Poynter Institutes "Fake News Codex", which I am about to show you in the list below, this would warrant labeling Bloomberg as a highly biased news organization, which should result in up to 80% reduced sharability

We should be terrified by the world these Tech Companies are trying to create; a world where the average man and woman will be completely powerless to the ruling elites hypocrisy, fraud, and lies. For awhile, the internet was a tool that enabled unprecedented hyper inter-connectivity, giving the masses a tool to fight back against corruption, but now those days are over. Today, anything that contradicts the mainstream narrative will be deboosted, or even outright blocked, and your account will be banned. Today, if the government says it's true, it is just true, and we will have no way to counter their lies.

The Poynter Institutes "Fake News Codex"

bias: OpenSources: "Extreme Bias: Sources that come from a particular point of view and may rely on propaganda, decontextualized information, and opinions distorted as facts."

conspiracy: OpenSources: "Conspiracy Theory: Sources that are well-known promoters of kooky conspiracy theories."

clickbait: OpenSources: "Clickbait: Sources that provide generally credible content, but use exaggerated, misleading, or questionable headlines, social media descriptions, and/or images."

fake: Fake News Codex: "Sites that are fake,… A site doesn't need to exclusively publish fake content to qualify. In fact, many publish a great deal of authentic material, though it’s typically presented in a biased and tawdry fashion. This 'real' content serves as cover for the fake."

OpenSources: "Fake News: Sources that entirely fabricate information, disseminate deceptive content, or grossly distort actual news reports."

Politifact: "Fake news sites: There's little consistency of content or style among fake news sites — the common thread appears to be that they distribute fabricated content, but the reasons aren’t always apparent."

Politifact: "News imposter sites: Adding to the fog of fake news online, several websites appear to try to confuse readers into thinking they are the online outlets of traditional or mainstream media sources."

Snopes: "Fake News Sites and hoax purveyors… spreading fake news and outlandish rumors" and "false, disruptive claims" that "regularly fabricate salacious and attention-grabbing tales."

satire: Fake News Codex: "Sites that are not necessarily intended to mislead (such as The Onion and its legion of imitators), but that can be misunderstood by naive readers." OpenSources: "Satire: Sources that use humor, irony, exaggeration, ridicule, and false information to comment on current events."

Politifact: "Parody or joke sites: Many of the deliberately false or fake news stories we see in social media feeds begin on websites that attempt to parody real news — imagine the humor website The Onion, but without the name recognition (or often the comedic writing talent)."

unreliable: FactCheck.org: "Websites that have posted deceptive content." Fake News Codex: Sites that are "extremely misleading… We do not include sites that merely have a clear political or ideological bias."

OpenSources: "Hate News: Sources that actively promote racism, misogyny, homophobia, and other forms of discrimination."

OpenSources: "Junk Science: Sources that promote pseudoscience, metaphysics, naturalistic fallacies, and other scientifically dubious claims."

OpenSources: "Rumor Mill: Sources that traffic in rumors, gossip, innuendo, and unverified claims."

OpenSources: "State News: Sources in repressive states operating under government sanction."

OpenSources: "Unreliable/Proceed With Caution: Sources that may be reliable but whose contents require further verification."

Politifact: "Sites that contain some fake news: Finally, some websites appear to get duped like the rest of us."

LONG TWTRTWTR has been a buy under $30 ever since 2018, twtr stock was punished for missing last ER, and I believe as a result it has presented us a buying opportunity to ride it back to 35 which computes a 15% upside from the current levels. This company has established its place among the social media giants. It is not going anywhere and will continue to grow. Buy anything under $30.

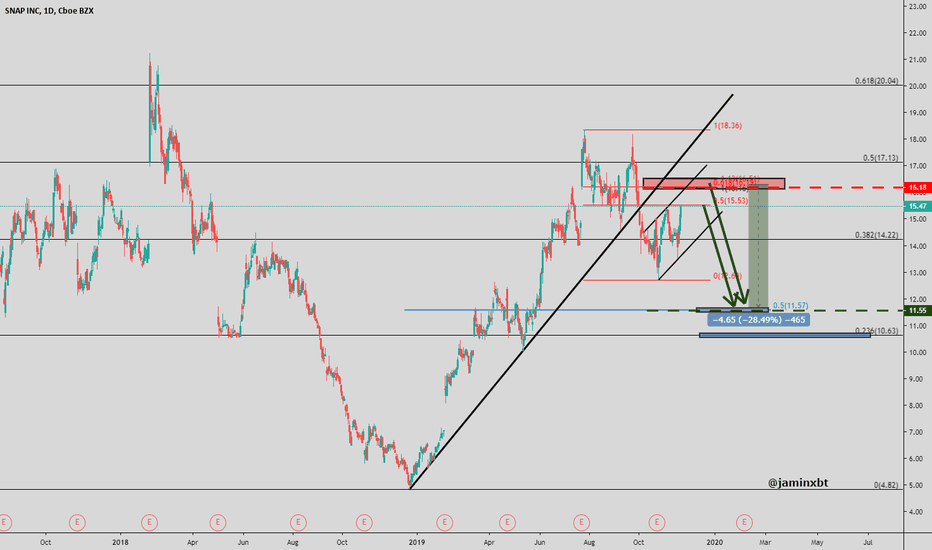

SNAP - Is it?We have a clear double top with declining volume on the second top. While this is happening we have a bearish divergence with the RSI indicator. Even with being conservative & stating that the neckline was broken around $15 we still get a minimum price target of $11.49 which I moved up slightly to $11.60 where there are some previous support/resistance levels.

I should note that SNAP just had earnings & received a couple of upgrades today from JP Morgan & Needham. Not to mention they had an upgrade a few days ago, prior to earnings, from Bank of America/Merrill Lynch. Always risky with earnings/upgrades but the pattern is the pattern.

Snap long before further downsideNot really much to say here, pretty simple long playing the bounce in a very bearish looking chart. I would be surprised if there is no bounce off of the .5 fib to retest the .382 as resistance. Stop-loss is just under the previous wick, should be safely hidden. Overall still bearish on the weekly chart.

If you enjoyed this analysis, and or like cookies, be sure to like and follow for more content. :)

Snap Chat SNAP stock analysis and forecast. Short opportunitiesShort opportunities are being created on Snap Chat SNAP stock.

New weekly supply is being created on Snap Chat on the weekly timeframe around $16 per share. The stock has been doing nothing for a few weeks and it's now dropping strongly creating new weekly supply imbalance and lower timeframe imbalances. No longs are allowed. Price action and supply and demand

Weekly price action analysis is telling us than bearish impulses are stronger than bullish impulse so it would be suicidal to open short positions on Snap Chat stop. As per the supply and demand analysis, only shorts are possible, that is, selling the stock or use stock options to trade all the way down as there is a lot of room for price to drop with no important obstacles.