SOLUSD

DeGRAM | SOLUSD will rebound to $135📊 Technical Analysis

● SOL/USD continues to respect a long-term descending dynamic resistance, but price has stabilized above a well-defined demand zone around 120–125, forming higher lows after a prolonged decline.

● The structure shows base-building following multiple triangle consolidations, with bullish divergence implied by compression near support, suggesting accumulation ahead of a potential breakout.

💡 Fundamental Analysis

● Improving sentiment in the crypto market and growing Solana ecosystem activity support long-term recovery expectations once macro risk stabilizes.

✨ Summary

● SOL holds above a major support area.

● A long-term bullish reversal is favored, with upside potential toward 143–170 if support near 120 remains intact.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Crypto SILVER - LTCIn the world of traditional finance, Gold (XAU) and Silver (XAG) provide the ultimate blueprint for what we are seeing in the crypto markets today.

While Bitcoin (Digital Gold) has been busy smashing all-time highs and capturing the world's attention, Litecoin (Digital Silver) has been quietly ignored, stuck in a massive range for years.

If this feels familiar, it’s because we’ve seen this movie before in the metals market.

On the charts, we are witnessing a rare technical phenomenon: a high-conviction accumulation phase exceeding 1,300 days.

The 1,300+ Day Accumulation : We are currently mid-way through 2026, and LTC has been building a base for over 1,300 days.

The "Forgotten" Asset : For nearly 8 years, LTC has largely moved sideways against the macro trend. It has been called "boring" and "forgotten" by the retail crowd—the exact sentiment usually found at a generational bottom.

Network Integrity : Despite the price stagnation, LTC recently hit record-high network activity and has maintained 100% uptime for over 14 years. Institutional accumulation is happening in the dark while the public looks away.

Drop in comments bellow - Are You holding Litecoin?

SOLUSD KEY AREASolana is entering a danger zone after double-topping while also forming a head-and-shoulders structure.

That combination matters.

The chart has already cracked once. That’s your warning shot.

If you’re not in SOL yet and you’re bullish:

This is the only area where a long makes sense—with a clearly defined stop. No stop, no trade.

If you’re bearish and looking to short:

Don’t front-run it. Wait for the next crack and trade against this level once it fails.

If you already own SOL and are inhaling hopium:

You do not want to see this level break. If it does, downside can accelerate fast.

Lastly, why are Cryptos down -50% and the $ down -10% +?

This is where discipline matters.

Don’t FAFO.

If you enjoy the work: 👉 Drop a solid comment. Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

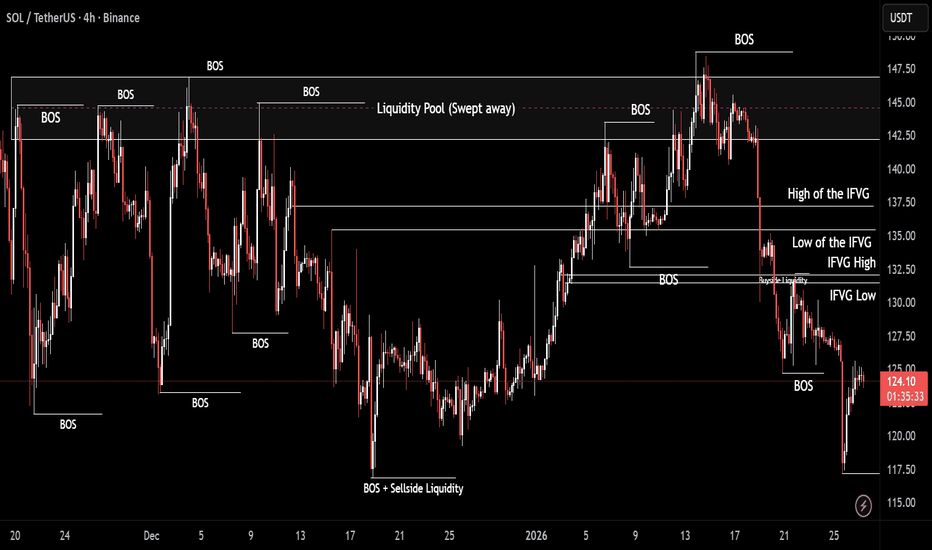

SOL/USDT | Sweeping the Liquidity Pools! (READ THE CAPTION)SOLUSDT made it all the way to 148.74 and swept away the liquidity there and then it dropped massively all the way to 117.15, and is currently being traded 124.00. I'd like to see Solana sweep away the sellside and buyside liquidity that are pinpointed in the chart.

For the time being, bearish targets for SOL are: 123.50, 121.50, 119.50, 117.50 and 117.00.

Bullish Targets are: 125.50, 127.50 and 129.50.

DeGRAM | SOLUSD is testing the support area📊 Technical Analysis

● SOL/USD broke below the key rising support trendline (former channel base), with the breakdown confirmed by a strong impulsive candle, signalling loss of upward structure and a shift toward bearish control.

● Price failed to hold above the horizontal support near ~$134.00–$130.00 and now trades below both dynamic support and the former rising channel, increasing probability of continuation toward the next structural levels near ~$123.6 and lower.

💡 Fundamental Analysis

● Broader crypto risk sentiment remains fragile as tighter liquidity conditions persist and speculative flows pull back from high-beta tokens like Solana, reinforcing short positioning bias.

✨ Summary

● Breakdown confirmed below rising support and ~$134.00.

● Downside targets: ~$123.6 → lower key support ~119.3.

● Trend shift to bearish while below former support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

1W SOL update: Volatility is back, but structure mattersWe’re seeing another dump reaction across the majors, and Solana isn’t immune. That said, this still looks like reactionary selling within a broader structure, not random collapse.

On SOL specifically:

• Price broke down from a steep corrective channel

• Momentum flushed quickly, which is typical late in corrections

• The $100 area lines up with the top of the prior trend / major HTF support

• A sweep into that zone would still be structurally healthy

A move toward ~$100 would likely be a retest, not a failure. That’s where you’d expect:

• Sellers to exhaust

• Late shorts to press

• Potential for relief or rotation back into the range

If $100–105 holds with acceptance, a relief bounce back toward $125–140 is very reasonable. If it doesn’t, then we reassess. Simple.

Same theme as BTC and ETH:

Volatility is shaking confidence, not invalidating the higher-timeframe picture yet. Let price come into real levels before jumping to conclusions.

Don’t Panic With SOL – The Market Is Offering an OpportunitySOLUSDT currently looks like a deep correction within a broader uptrend, rather than a trend reversal. Recent news has mainly created short-term psychological pressure across the crypto market, while Solana’s fundamentals remain solid: institutional capital has not exited aggressively, staking levels stay high, and the ecosystem continues to show healthy activity.

On the chart, the recent drop came from a strong rejection at the descending trendline and the upper edge of the Ichimoku cloud. The key point, however, is that after the breakdown, price did not continue to collapse. Instead, it quickly formed a clear consolidation zone around 125 USDT — a sign that selling pressure is fading and buyers are starting to absorb supply.

The 125 area now acts as a critical support zone. As long as price holds above this level, I favor a scenario where SOL continues short-term fluctuations to build a base, followed by a recovery toward the 132–136 zone.

Overall, SOLUSDT is still following the textbook structure of a healthy uptrend: a sharp drop, base formation, consolidation, and recovery. For me, this is a phase that requires patience, because the market tends to reward those who wait for proper structure — not those who rush in.

Coinranger|SOLUSDT. Potential reversal to 135🔥News

🔹The International Economic Forum continues. US GDP is at 16:30 (UTC+3). US PCE data for November and October will be released at 18:00 (UTC+3) – this is still important due to possible recalculations for later months.

🔥SOL

🔹Time to update the Solana chart:

1️⃣A potential set of upward wave markers has appeared above: 133, 135, 138.

2️⃣Below, 124 and 122 remain significant levels. They could still play out during a potential flat phase.

For now, the priority is a continued upward pullback. There is also a possibility of a flat at 131 - 124, but not yet.

-------------------

Share your opinion in the comments

My Crypto Convictions - BTC | ETH | ADA | SOL | XLMBitcoin (BTC): Bitcoin is the world's first and most well-known cryptocurrency, created in 2009 by an unknown individual or group using the pseudonym Satoshi Nakamoto. Bitcoin operates on a decentralized ledger technology called blockchain, which allows for secure and transparent transactions without the need for intermediaries such as banks. Bitcoin's price is known for its volatility, often experiencing sharp rises and declines in short periods of time. As of September 2021, Bitcoin has a market capitalization of over $800 billion and a circulating supply of 18.8 million coins.

Ethereum (ETH): Ethereum is a decentralized blockchain platform that enables developers to build and deploy decentralized applications (dApps). The platform's native cryptocurrency is Ether, which is used to pay for transactions and computational services on the network. One of Ethereum's most significant contributions to the cryptocurrency world is the introduction of smart contracts, which are self-executing contracts that can automate the negotiation and enforcement of contract terms. Ethereum currently has a market capitalization of over $400 billion and a circulating supply of over 117 million coins.

Cardano (ADA): Cardano is a blockchain platform that operates on a proof-of-stake (PoS) consensus algorithm. The platform was created by Charles Hoskinson, one of the co-founders of Ethereum, and aims to provide a more sustainable and scalable alternative to existing blockchain networks. Cardano's native cryptocurrency is ADA, which is used to pay for transactions and fees on the network. The platform has gained attention for its focus on academic and scientific research, with a strong emphasis on the development of practical use cases for blockchain technology. Cardano has a market capitalization of over $80 billion and a circulating supply of over 32 billion coins.

Solana (SOL): Solana is a high-performance blockchain platform that aims to provide faster and cheaper transactions compared to other existing blockchain networks. The platform's native cryptocurrency is SOL, which is used to pay for fees and transactions on the network. Solana is built on a unique consensus algorithm called Proof of History (PoH), which helps to optimize the processing of transactions and reduces network congestion. In August 2021, Solana experienced a surge in popularity and price, briefly becoming one of the top 10 largest cryptocurrencies by market capitalization before experiencing a correction. As of September 2021, Solana has a market capitalization of over $35 billion and a circulating supply of over 300 million coins.

Stellar Lumens (XLM): Stellar Lumens is a blockchain platform that enables fast and secure cross-border transactions. The platform's native cryptocurrency is XLM, which is used to facilitate transactions and pay for fees on the network. Stellar was created by Jed McCaleb, one of the co-founders of Ripple, and aims to provide a more inclusive and accessible financial system by leveraging blockchain technology. One of Stellar's notable partnerships is with IBM, who has been working with the platform to develop blockchain solutions for the financial industry. As of September 2021, Stellar has a market capitalization of over $8 billion and a circulating supply of over 23 billion coins.

SOL - you won’t like this idea.Greetings! You’re looking at the analysis from Financier Monitors, which means you’re in for some high-quality analytics.

Today we’ll take a look at SOL.

1) The asset has been truly impressive this cycle. Not even so much in terms of its price growth as a coin, but in terms of growth as a project. All these memes, tons of projects, and overtaking ETH — that’s significant.

It also started growing together with Bitcoin, and for 749 days it managed to do this quite successfully. However, the ATH may be nothing more than a possible last high for Solana over the next 1.5–2 years.

2) Sentiment.

So far, I don’t see bearish scenarios. Either people lost money on 11.10 and are hoping to recover it and sell their spot altcoins, or they simply didn’t get the multiples (x’s) they were expecting — overall, who knows.

The verdict is simple: the crowd and major influencers have been deep in alts since 2021, deep in longs, believing in altseason, etc.

We have no right to judge them, because there’s always a chance that I’m the one who’s wrong. For now, I’ll base my view purely on the chart, so let’s move on to it.

3) Chart.

On the weekly timeframe, SOL has entered a range. But is it just a range? No. In the PSY and BC zones, the first volume spikes appeared — position profit-taking.

Next, we see a not entirely classic Wyckoff distribution, because it lacks a UTAD (another higher high after the UT). However, this is normal when buyers simply don’t have enough strength to counteract selling from large investors.

A nice rise within an ascending channel in LPSY, followed by a breakdown of that channel.

Overall, I’ve attached the schematic, so this is roughly what I expect.

Subscribe.

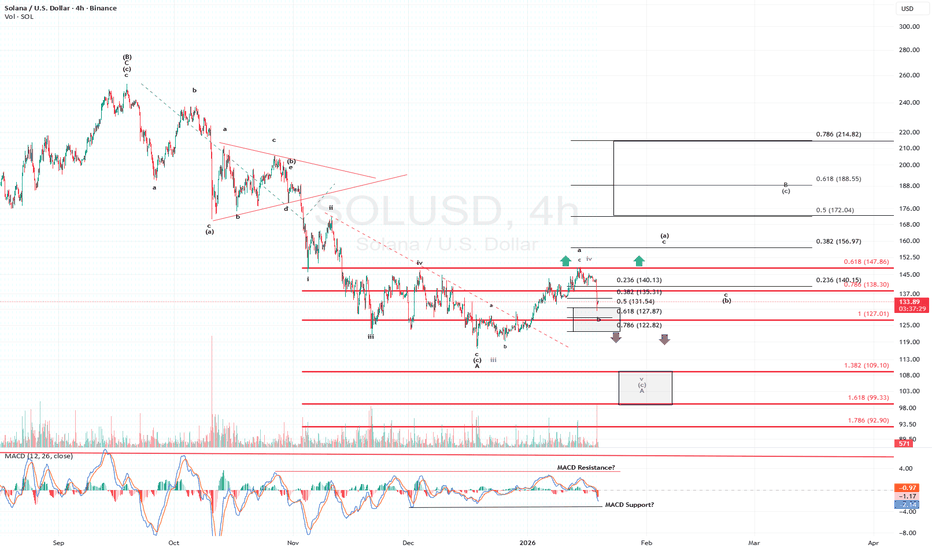

Solana's Price Action reflects some Short-Term AmbiguityPrice now appears to be operating within the b-wave portion of the corrective pattern. While I acknowledge we could see marginally lower prices from here, my base case remains that price recovers and continues to subdivide as depicted in my chart in the black pathway. What remains less clear is whether we are still subdividing to new local lows under the purple alternate, or if the retracement instead continues in a more standard fashion into my target box.

The uncertainty stems from the fact that SOL’s price never decisively traded above the $147–$148 region we have been monitoring for some time. That failure keeps the purple count viable.

However, what lends slightly more confidence to my black primary count over the purple alternate, specifically with respect to Solana, is Bitcoin. BTC has managed to trade above a level that can reasonably be interpreted as the wave iv of a lesser degree. If that interpretation proves correct, it becomes increasingly difficult to envision Bitcoin continuing its corrective advance without exerting upward influence on Solana as well.

As always, time and structure will resolve this short-term ambiguity.

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 132. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 133.50

First Target: 134.93

Second Target: 137.30

Third Target: 140.25

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

SOL - Descending Wedge Rejection at $145 | FVG Retest Incoming

What's up traders! 👋

SOLUSD is setting up for a key move. We've got a symmetrical wedge pattern with price respecting the descending resistance perfectly - hitting it and getting rejected. Let me break down what I'm seeing on the 45-minute chart.

The Setup

SOL is trading at $144.85 on the 45-minute timeframe. Price is inside a symmetrical wedge pattern - descending resistance on top (lower highs) and ascending support on bottom (higher lows). The key here: price just hit the descending resistance near $145-$147 and got REJECTED.

This is textbook wedge behavior. Price respects the trendlines until breakout. Right now, it's following the wedge DOWN toward the FVG zone.

Why I'm Leaning Bearish (Short-Term)

Price rejected from descending resistance at $147

Failed to clear $150 resistance - sellers defending

Dropped below $146 and $145 - now below 100-hour SMA

Hourly RSI below 50 - bearish momentum

MACD showing bearish pressure

Long/short ratio at 0.7569 - traders leaning short

$10.5M in liquidations - $7.7M were longs

3M performance: -20.40% | 1Y: -29.60% - macro downtrend

The Wedge Structure

DESCENDING RESISTANCE (Top): Lower highs forming - sellers capping rallies at $145-$147

ASCENDING SUPPORT (Bottom): Higher lows forming - buyers defending around $138-$140

CURRENT ACTION: Price hit descending resistance and rejected

FVG ZONE: $140-$142 is the next target for retest

TREND: Following the wedge DOWN until breakout

The News Context - January 16, 2026

Mixed signals but leaning bearish short-term:

SOL failed to hold above $146 - entered short-term correction

Price below 100-hour simple moving average

Broke below 61.8% Fib retracement of $138-$149 move

$10.5M liquidations - mostly longs ($7.7M)

Long/short ratio 0.7569 - traders positioning short

RSI below 50, MACD bearish

Bullish Catalysts (Watch For Breakout)

Solana ETF inflows $23.57M - highest in 4 weeks

Forward Industries building largest SOL treasury (6.9M SOL)

Alpenglow upgrade coming - transaction finality 100-150ms (from 12.8s)

RWA ecosystem hit $1.15B record valuation

Network processed $1.6T in 2025 trading volume

68M active addresses (up 14%) - most used network

Open Interest jumped from $6.8B to $8.8B

"Clarity Act" could ease SEC requirements for SOL

Key Levels I'm Watching

Resistance:

$145.50 - Day's high / immediate resistance

$146 - First major resistance

$148.29 - MAJOR RESISTANCE (breakout level)

$150 - Psychological round number

$155 - Next target if breakout

$162 - Extended bullish target

$200 - Analyst target (if network growth continues)

Support:

$144.85 - Current price

$141 - Bullish trendline support

$140-$142 - FVG ZONE (key retest target)

$140.23 - MAJOR SUPPORT (76.4% Fib)

$138 - Swing low

$137.72 - CHANNEL BOTTOM

$132 - Next support if breakdown

$124 - Extended bearish target

Two Scenarios

BEARISH CONTINUATION (PRIMARY):

Price continues following the descending wedge. After rejecting from $145-$147 resistance, SOL drops to retest the FVG zone at $140-$142. If FVG fails to hold, continuation to $137.72 channel bottom.

First target: $141 (trendline support)

Second target: $140.23 (major support / 76.4% Fib)

Extended target: $137.72 (channel bottom)

Breakdown target: $132, then $124

Triggers: Continued rejection at descending resistance, break below $140, risk-off sentiment, no major bullish catalyst.

BULLISH BREAKOUT (ALTERNATE):

Big news hits and price breaks above the descending wedge resistance. SOL clears $148.29 with volume and targets higher levels.

First target: $150 (psychological)

Second target: $155 (next resistance)

Extended target: $162, then $173

Moon target: $200 (if network growth accelerates)

Triggers: Break above $148.29 with volume, major ETF news, Alpenglow upgrade hype, institutional buying.

My Take - BEARISH BIAS (Short-Term)

I'm leaning BEARISH here. Here's why:

1. Price respecting descending resistance - SOL hit the wedge top at $147 and got rejected. This is textbook - follow the trend until breakout.

2. Technical indicators bearish - RSI below 50, MACD bearish, below 100-hour SMA. Momentum favors sellers.

3. Liquidation data bearish - $7.7M in long liquidations vs $2.8M shorts. Longs getting squeezed.

4. Long/short ratio bearish - At 0.7569, traders are positioning short. Smart money leaning bearish.

5. Macro structure weak - Down 20.40% in 3 months, down 29.60% in 1 year. Still well below $295 ATH.

BUT - Watch for the Breakout

The bullish catalysts are real:

ETF inflows strongest in 4 weeks

Alpenglow upgrade is massive (100ms finality)

Institutional adoption growing (Forward Industries)

Network fundamentals strong (68M addresses, $1.6T volume)

If big news hits, SOL could spike above $148.29 and invalidate the bearish thesis. But until that happens, I'm following the wedge DOWN.

Trade Plan

Bearish Entry (PRIMARY):

Entry: Rejection at $145-$146 resistance OR break below $141

Stop: Above $148.29 (above major resistance)

Target 1: $141 (trendline)

Target 2: $140.23 (major support)

Target 3: $137.72 (channel bottom)

R:R: ~1:2

Bullish Entry (if breakout):

Entry: Break above $148.29 with volume

Stop: Below $144

Target 1: $150 (psychological)

Target 2: $155

Target 3: $162

R:R: ~1:2.5

The Bottom Line

SOLUSD is respecting the symmetrical wedge perfectly. Price hit descending resistance at $147 and got rejected - now heading toward the FVG zone at $140-$142 for a retest.

Short-term, I'm BEARISH. Follow the wedge until it breaks. The FVG zone at $140-$142 is the next target. If that fails, $137.72 channel bottom is in play.

Long-term, the fundamentals are strong (ETF inflows, Alpenglow upgrade, institutional adoption). But technicals say DOWN until we break above $148.29.

Watch the FVG zone. That's your tell.

What do you think? Continuation down or breakout up? Drop your thoughts below! 👇

Support and Resistance Area: 140.88-146.69

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(SOLUSDT 1D Chart)

SOLUSDT is entering a new phase with the emergence of the DOM(60) and HA-High indicators.

Accordingly, the key question is whether the price can rise while gaining support near the 140.88-146.69 level.

If not, it could fall below the 128.66-133.39 level and set a new low.

A decline below the M-Signal indicator on the 1M chart is highly likely to trigger a downtrend, so caution is advised when trading.

Therefore, we should set a buy point when the price rises above the M-Signal indicator on the 1M chart and maintains its level.

Since BTCUSDT's volatility period is around January 20th, we should monitor whether the price can rise above the M-Signal indicator on the 1M chart after this period.

-

To continue the uptrend by breaking above a key point or level, the StochRSI, TC, and OBV indicators must show upward trends.

If possible,

1. The StochRSI indicator should not have entered an overbought zone. 2. The TC indicator should remain above the 0 level.

3. The OBV indicator should remain above the High Line.

Looking at the current auxiliary indicators, we can see that the conditions for a sustained uptrend are not met.

Therefore, we should examine whether the conditions for a sustained uptrend can be met around the 140.88-146.69 range.

-

Thank you for reading to the end.

We wish you successful trading.

--------------------------------------------------

#SOL/USDT Final Liquidity Zone Before Expansion ?#SOL

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 142.67, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 145.00

First Target: 145.80

Second Target: 147.77

Third Target: 150

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

SOLUSDT M30 HTF FVG Rejection and Bearish Continuation Setup📝 Description

BINANCE:SOLUSDT has reacted into a clear M30 HTF FVG zone and failed to sustain upside momentum. The recent bounce appears corrective after a strong selloff, with price now stalling below imbalance resistance.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains capped below the M30 FVG

Preferred Setup:

• Entry: 144.50

• Stop Loss: Above 145.10

• TP1: 143.90

• TP2: 143.20

• TP3: 142.40 (lower HTF FVG / liquidity)

________________________________________

🎯 ICT & SMC Notes

• Rejection from M30 FVG indicates weak bullish follow-through

• Move up classified as pullback, not structural shift

• Bearish continuation favored toward stacked imbalances below

________________________________________

🧩 Summary

As long as CRYPTOCAP:SOL trades below the highlighted M30 FVG, downside continuation toward lower liquidity pools remains the higher-probability scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

No immediate bullish catalyst is present, keeping sentiment neutral-to-bearish and aligned with technical downside pressure.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

DeGRAM | SOLUSD seeks to the $160 level📊 Technical Analysis

● SOL/USD formed a base after a prolonged decline, with multiple consolidations and a triangle breakout from the dynamic support line, signaling a medium-term trend reversal.

● Price is now holding above the ascending structure, while pullbacks remain corrective below the dynamic resistance, suggesting continuation toward higher targets.

💡 Fundamental Analysis

● Solana remains supported by renewed network activity and improving sentiment across major altcoins, reinforcing capital inflows into high-beta Layer-1 assets.

✨ Summary

● Bullish structure confirmed. Holding above dynamic support favors continuation toward the 155–160 zone, while 135 remains the key invalidation level.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

SOL 1D Update: Looking to establish new uptrendSOL update.

SOL is now establishing a new short-term uptrend after spending months inside a descending channel. The key shift is structural: price has broken out of the downtrend and is no longer making lower lows. Instead, it’s holding above former support around the $125 level and building higher lows, which is exactly what you want to see in an early trend transition.

The move higher toward the $140–145 area has been more controlled and constructive than prior bounces. Instead of sharp relief moves that fade immediately, SOL is grinding higher and holding gains, suggesting real demand rather than just short covering.

This strength is also starting to show up across the Solana ecosystem. Several SOL meme coins are attempting to break out of their own basing structures, which typically happens when SOL itself stops trending down and begins to lead. That kind of breadth is important and often precedes stronger continuation if it sustains.

Key levels to watch:

As long as SOL holds above $125, the uptrend structure remains intact.

Acceptance above $145 opens the door for a move toward the $160–180 region, where heavier resistance sits.

A failure back below $125 would invalidate the breakout and shift this back into range behavior.

Overall, SOL’s character has changed from sell-the-rip to buy-the-dip. It’s still early and likely to be choppy, but the market is finally starting to lean in the right direction. If this structure holds, both SOL and its meme ecosystem have room to expand further.

SOLANA ANALYSISSOL has successfully breached a critical trendline and reclaimed the 50-day Simple Moving Average (SMA), validating a structural shift in momentum. This confluence of technical breakouts suggests a probability continuation toward the $183 supply zone, provided support levels hold firm.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading cryptocurrency involves significant risk; please conduct your own due diligence before making investment decisions.

SOLANA — Absorption at HTF Resistance | Downside Risk IncreasingTraders,

CRYPTOCAP:SOL pushed into resistance and stalled. Not aggressively. Not weakly either.

What we are seeing now is absorption, and the market is quietly deciding what to do next.

The question is not “bullish or bearish.”

The question is where the real decision gets made.

Right now, the chart gives us a very clean structure.

1. What happened

SOL rallied back into a higher-timeframe resistance zone around $142–145.

This area is important because:

It previously acted as distribution

It aligns with a harmonic exhaustion level

Liquidity is clearly resting above

Price did not reject immediately.

Instead, it slowed down.

That already tells us something.

2. What price is doing now

On the 1H, price is pushing higher in small steps:

Push

Pause

Shallow pullback

Push again

Each high looks constructive, but none are being accepted cleanly.

This is not breakout behavior.

This is price being worked inside supply.

Liquidity above is visible.

Yet price hesitates just below it.

3. Momentum in strength, not divergence

RSI is not aggressively diverging here.

Instead:

RSI stays elevated

Each push higher produces less expansion

Momentum rolls over inside strength

That usually means effort is being absorbed, not rewarded.

When momentum stalls at resistance without breaking down, it often reflects absorption inside strength, not weakness.

4. Spot flow tells the real story

Spot CVD continues to rise.

On both the 1H and the 4H, spot CVD is making clear higher highs. Buyers are not hesitating. Market orders keep hitting the ask, and spot demand is persistent across timeframes.

On the surface, that looks bullish.

But price is not responding.

Despite spot CVD printing higher highs, price remains capped beneath resistance and fails to gain acceptance. Each attempt higher is absorbed rather than extended.

That mismatch matters.

When spot demand increases across multiple timeframes and price fails to move, it usually means one thing:

Supply is sitting above the market

Sellers are passive and patient

Buyers are doing all the work

This is classic absorption behavior.

The important detail here is that this is not a single-timeframe signal. The fact that spot CVD is making higher highs on both the 1H and 4H strengthens the read. Real buyers are present, but they are being met by consistent supply.

That is not how breakouts start.

That is how distribution hides.

5. Futures are not confirming

While spot keeps buying:

Stablecoin-margined futures CVD trends lower

Perp traders are selling into strength

Leverage is not chasing this move

Coin-margined futures remain net negative, suggesting longer-horizon participants are still distributing.

Different groups, same message: less appetite for higher prices here.

6. Open interest adds tension

Open interest remains elevated.

Price is not expanding, yet positions are being added.

That creates pressure.

Crowded markets don’t drift.

They eventually move, and usually fast.

7. The higher-timeframe context

On the daily, accumulation and distribution remains pointed lower.

Rallies continue to be used to offload supply.

This move fits that pattern.

Push into resistance.

Effort from buyers.

No acceptance.

8. The decision zone

The area around $142–145 is the key checkpoint.

This is where supply has been active before, and it is where the market has to prove it can do more than just absorb.

If price:

Pushes slightly higher

Sweeps the liquidity sitting in the blue box

But fails to hold or shows weakening spot follow-through

Then this area becomes a distribution and take-profit zone, not a breakout.

A sweep without acceptance is often the final act before rotation.

If sellers remain patient here, downside opens quickly.

9. Downside focus

Below the current range, the structure is thin.

There is unfinished business lower, and price has not spent enough time there to build support.

Target zone: $94–100

This area stands out because:

It previously acted as acceptance

Liquidity is concentrated there

It represents a clean mean reversion for the entire move

If price starts to roll from the current region, this zone becomes the primary magnet.

Moves like this rarely stop halfway.

10. How to read it in real time

A push into the blue box followed by stalling price and slowing spot CVD → distribution

Spot CVD still rising but price failing to hold → absorption, not strength

Spot CVD rolling over at highs → rotation starting

The market does not need to break down immediately.

It only needs to stop rewarding buyers.

When that happens, the path lower opens fast.

------------------------------------------

The market is leaning into supply.

It may take one more push into liquidity before the real move starts, but the risk remains skewed lower as long as buyers are not being rewarded.

Let price do the talking.

If this analysis helped you see the structure more clearly, a like is always appreciated.

Feel free to share your thoughts or alternative scenarios in the comments.

Thanks for reading.

Solana ~ TRADE The CHOP: 3 Ways to Make ATLEAST +15%Choppy markets are identified by low volume and sideways trading / range trading. It seems uninteresting in most cases, but you don't have to sit around and wait for the next big impulse wave!

Here are three plays YOU can take during choppy markets:

1) 4H : Short Resistance

Chop trading can be a blessing - the price often touches the same support zone and the same resistance zone 2 - 3 times, before breaking out either way. This means that if you spot your zone early, you could take a short timeframe swing trade. Another way to find a trade is to look for gaps in the candles, for example:

2) 4H : Long Support

South Africa is in a time of turbulence, and the Rand is unpredictable as the effects of G20 settle in. During these times, and this counts for all markets, placing a low risk leveraged long on support is a way to trade the chop:

3) Daily : SPOT Hold to TP Zone

Nothing like a classic low risk trade - but you may need some patience with it! If you're not willing to look at charts all day, or have alarms wake you up at 2:30am to take a trade then this is your style., for example:

What do you do during choppy markets?