$SPY & $SPX Scenarios — Tuesday, Dec 23, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 23, 2025 🔮

🌍 Market-Moving Headlines

• Heavy delayed macro dump: Markets digest a backlog of growth, manufacturing, and production data all at once.

• Growth vs slowdown check: GDP revision and durable goods help frame whether the economy is cooling into year-end.

• Consumer pulse: Confidence print may influence risk appetite heading into the holiday-shortened week.

📊 Key Data & Events (ET)

8 30 AM

• GDP Q3 (delayed): 3.2 percent

• Durable Goods Orders Oct (delayed): -1.1 percent

9 15 AM

• Industrial Production Oct: 0.1 percent

• Capacity Utilization Oct: 75.9 percent

• Industrial Production Nov: 0.1 percent

• Capacity Utilization Nov: 76.0 percent

10 00 AM

• Consumer Confidence Dec: 91.7

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #GDP #DurableGoods #ConsumerConfidence #macro #markets #trading

Spy!

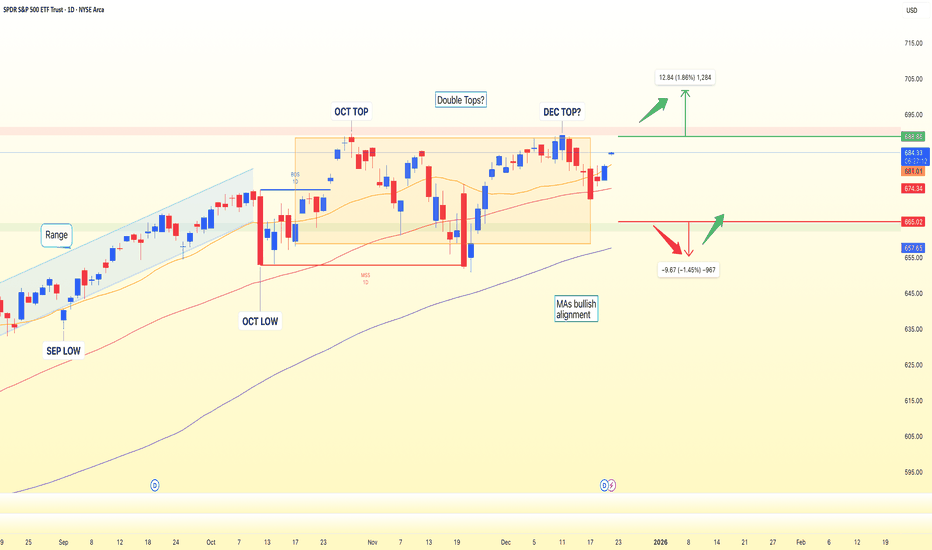

SPY NeutralSPY remains in a clean daily uptrend, still trading above the 60 and 120-period moving averages with bullish stacking intact. But the character has shifted short term: momentum has faded, MACD has flipped bearish, and price is now chopping sideways while leaning on the 20-period MA. With volatility compressed (Squeeze conditions), the market is likely storing energy for the next expansion move rather than trending smoothly from here.

The key battlefield is well-defined. Resistance sits near 688 (recent peak/supply), while buyers have defended the 665 support zone (demand). A potential Double Top at 688 adds downside risk, with the neckline/trough around 673 acting as the first “tell” level—daily acceptance below it increases odds of a deeper pullback.

Primary path: I’m treating this as a range-to-break environment. A 1D close > 688 would invalidate the double-top risk and favors continuation toward 695, then the 706–710 area. Alternative path: a 1D close < 665 confirms breakdown pressure and opens 660 first, then 650, with the tactical bearish play targeting 647 while using 674 as the invalidation reference. Inside the range, a recovery 1D close > 675 can support a bounce attempt back toward 689, but it’s lower conviction while MACD stays heavy. This is a study, not financial advice. Manage risk and invalidations.

Thought of the Day 💡: When volatility compresses, let price prove direction—break-and-hold levels matter more than predictions.

-------------------------

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts!

ES (SPX, SPY) Week-ahead Analysis (Dec 22-26)This week is notably shortened due to the holiday, resulting in thinner liquidity and heightened volatility. Market participants should prepare for an early close on Wednesday, December 24, with the markets remaining shut on Thursday, December 25. Normal trading hours will resume on Friday, December 26.

Investors should approach breakouts with caution, demanding clearer confirmations at critical levels and exercising stricter time stops.

Multi-Timeframe Analysis (ES)

Weekly Overview:

The broader trend remains upward, suggesting that the larger swing is constructive; however, prices are testing a weekly supply cap near recent highs, entering a premium zone. Momentum has tempered from previous peaks, raising the risk of a "grind and fade" scenario rather than a straightforward continuation.

The market is currently experiencing a rebound leg, yet it is now hitting a daily supply band overhead, where previous selling pressure originated. Upside potential is limited by the upper band near prior highs, while downside risk is anchored by the last swing base and value areas below.

The most recent movement displays an impulsive rally from a base, followed by a controlled pause - though it does not indicate a full reversal at this stage. As long as pullbacks remain above the recently established reclaim shelf (mid to high 6800s), current price action is indicative of "healthy digestion." A breach below this shelf could signal a deeper correction.

1-Hour Context (Intraday):

Prices are currently positioned in the upper range of the recent trading day, approaching key overhead levels. This presents a pivotal moment for either a breakout continuation or a potential failure.

Momentum/Oscillator Analysis (Weekly + Daily):

- Weekly Perspective: Momentum is currently in a neutral zone—not excessively overbought, yet not undervalued either - as it has eased from earlier peak levels.

- Daily Perspective: Momentum has improved off the lows and is showing upward curvature, indicating that dips are being supported; however, the presence of overhead supply may lead to rapid stalls in momentum.

The key trend delineation, or "line in the sand," for market observers currently stands at 6760.

For trading positions resting above this benchmark, any pullbacks can still be classified as "corrections within an overarching uptrend." This suggests that the bullish sentiment remains intact as long as the market holds above this critical threshold. Conversely, a decisive move below 6760 - particularly if there’s acceptance level would signal potential damage to the rebound narrative, indicating that the market is showcasing areas of diminished demand.

NQ Intraday Reference Map:

For the Nasdaq (NQ), immediate resistance is noted between 25600 and 25645, aligning with prior highs and current push zones, followed by further resistance at 25800 to 26000, which serves as the next magnet zone for traders.

On the support side, key levels to watch include 25592 to 25568, which represents a value shelf, descending to the levels of 25504, and further extending to 25393 to 25357, marking the prior day’s low pocket. Should the market breach these levels, the overnight low at 25210 will be significant in assessing downward momentum.

Volatility Metrics Overview

VIX Analysis

The VIX has been trading in the mid-teens recently, with a notable decline observed late last week, indicating a growing risk appetite among investors, albeit with a continued sensitivity to market headlines. FRED's latest reported close was at 16.87 on December 18. However, a subsequent market data feed indicated a significant drop on December 19, with a low/close around 14.91. The takeaway here is that a lower VIX tends to support dip-buying strategies; however, sudden spikes in the VIX during a holiday week often result in sharp mean-reversions.

Rates Volatility - MOVE Index

The MOVE index is currently sitting at approximately 59, indicating a low-to-moderate level of stress in the rates market. This suggests that there is no acute funding stress present, which typically supports equities by mitigating the risk of disorderly sell-offs.

Tail Risk Pricing - SKEW Index

The SKEW index remains elevated in the mid-150s range. This suggests that while the market is not experiencing daily panic, investors are willing to pay a premium for crash insurance, indicating a cautious approach to tail risks.

Options and Positioning

The put/call ratios indicate a measured market sentiment, with the total put/call ratio currently at approximately 0.88 (based on a 10-day moving average), suggesting a balanced approach rather than extreme fear. On a daily basis, the total put/call ratio hovers around 0.86, while the equity put/call ratio is more subdued at about 0.59.

From a qualitative perspective, the VIX trading in the mid-teens, coupled with stable put/call ratios, suggests that dealers are likely positioned closer to long gamma in this range, indicating potential for pinning and mean-reversion behavior unless an external macro catalyst disrupts the current balance. This observation, while not rooted in explicit positioning reports, draws from the context provided by volatility and options data.

Market Breadth and Internals

The NYSE breadth snapshot reveals a positive market internal dynamic, with 1,424 advancing issues versus 1,338 declining, yielding a net advance of 86. The McClellan Oscillator stands at approximately +12.8, indicating that market breadth is not experiencing significant deterioration. Current data suggests we are witnessing a “minor wobble/digestion” phase rather than a full-blown distribution cascade.

Credit and Funding Environment

In the realm of credit markets, US high yield option-adjusted spreads (OAS) are around 2.95%, indicating a tight and orderly credit environment. The NAV of HYG is approximately 80.24, while JNK trades close to 96.82. These observations suggest that the credit markets are not currently signaling a risk-off narrative. However, any rapid widening of spreads may be interpreted as an indicator of shifting sentiment toward a more cautious stance.

Sentiment and Crowd Positioning

The latest reading from the AAII survey reflects a balanced sentiment landscape, with about 44% bullish, 23% neutral, and 33% bearish positions. This lack of overwhelming fear suggests reduced potential for a sustained market squeeze driven solely by under-positioning, unless the price action returns decisively above previous highs.

Cross-Asset and Global Risk Tone

In the cryptocurrency markets, Bitcoin is trading around $88,600, while Ethereum is near $3,000. This firmness in crypto typically aligns with a risk-on sentiment but may also serve as a precursor to heightened volatility should macro developments arise.

Lastly, recent trading has showcased strength in the Nasdaq and tech sectors. Should the Nasdaq (NQ) begin to underperform relative to the S&P 500 (ES) at these elevated levels, it may serve as an early warning signal for a potential fade in risk appetite.

MACRO AND DATA-CALENDAR (EVENT RISK)

Key US Economic Releases This Week (ET)

Monday, December 22

No significant economic data scheduled for release.

Tuesday, December 23

- 8:30 AM: Q3 GDP (delayed due to government shutdown)

- 8:30 AM: Durable Goods Orders (also delayed)

- 10:00 AM: Conference Board Consumer Confidence

Wednesday, December 24** *(Early market close at 1:00 PM ET)

- 8:30 AM: Weekly Jobless Claims

Thursday, December 25

Markets will be closed in observance of Christmas.

Friday, December 26

Markets will reopen with normal hours; however, no notable economic data is scheduled for release.

Event Impact Analysis:

- GDP and Durable Goods: Historically, these releases can lead to rapid volatility spikes, potentially mean-reverting if prices remain confined within established ranges. A breakout, however, could serve as fuel for further trends, particularly if it breaks through resistance levels R2/R3 or support levels S3/S4.

Good Luck !!!

- **Consumer Confidence:** This indicator typically influences equity markets based on growth expectations. A key point of analysis will be the NASDAQ index's reaction, which can provide a clearer picture of risk-on sentiment.

- **Jobless Claims on Early-Close Day:** Expect an increase in volatility, as lower liquidity may lead to exaggerated initial moves, potentially setting traps for traders.

As always, we advise close monitoring of these releases for potential market implications and trends.

ES for the Holiday WeekLooking at ES for the holiday week it seems generally bullish. After bouncing off this weekly support they seem to be targeting this untested daily level at 6907. There is also the 4hr sitting at 6912. Confluence of these levels being so close together makes me think they are targeting this area. If they continue to push with momentum 6942 is in play to attack those previous highs.

Trend plotted by TrenVantage LITE

Trades plotted by BreakPoint LITE

$SPY & $SPX Scenarios — Week of Dec 22 to Dec 26, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Week of Dec 22 to Dec 26, 2025 🔮

🌍 Market-Moving Headlines

• Holiday week liquidity: Thin volumes amplify moves, especially around Tuesday’s data dump.

• Delayed macro catch-up: GDP and durable goods hit at once, giving markets a late-cycle growth read before year-end positioning.

• Consumer confidence update: One of the few forward-looking signals in a quiet, holiday-shortened week.

📊 Key Data & Events (ET)

Tuesday, Dec 23

8 30 AM

• GDP Q3 (delayed): 3.2 percent

• Durable Goods Orders (Oct, delayed): -1.1 percent

9 15 AM

• Industrial Production (Oct): 0.1 percent

• Capacity Utilization (Oct): 75.9 percent

• Industrial Production (Nov): 0.1 percent

• Capacity Utilization (Nov): 76.0 percent

10 00 AM

• Consumer Confidence (Dec): 91.7

Wednesday, Dec 24

8 30 AM

• Initial Jobless Claims (Dec 20): 225,000

Thursday, Dec 25

• Christmas Holiday — Markets Closed

Friday, Dec 26

• No major data scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #macro #holidayweek #GDP #durablegoods #consumerconfidence

$SPY: 15m Structural Repair & Dynamic Trend BreakoutWhat I’m Seeing: I am currently observing a confluence on the AMEX:SPY 15-minute chart following the Friday close at $680.59. My Structure Engine shows that price has fully cleared the $679 intraday demand threshold, effectively 'repairing' the liquidity void created during the mid-morning dip. Simultaneously, the Automatic Trend Line script has printed a fresh support level at $679.50, confirming that the short-term trend is now realigned with the larger bullish bias.

Why It Matters: This 15m confluence is a high-confidence signal for intraday expansion. By 'sealing' the void below $679, the market has established a new structural floor. When the Automatic Trend Line engine identifies support right on top of a repaired zone, it indicates that the 'path of least resistance' has shifted upward. It suggests that intraday sellers have been absorbed and momentum is now being guided by the dynamic trend.

What I Expect to See Next: I expect the 15m trend to hold as price targets the immediate pivot high at $681.50. If we see a 15m candle body close above $681.50, the 'void' to the next major resistance at $684.22 (Monday's projected range high) becomes the primary target. I will be watching for the Trend Engine to maintain its slope; a breakdown below the $676.75 support would invalidate this short-term structural repair thesis.

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFTQQQ stock market Forecast

Nvidia Stock NVDA Forecast

Apple Stock AAPL Forecast

Microsoft Stock MSFT Forecast

Google Stock GOOGL Forecast

Amazon Stock AMZN Forecast

Meta Forecast Technical Analysis

Tesla Stock TSLA Forecast

Magnificent 7 stocks forecast

Bitcoin CRYPTOCAP:BTC forecast

SP:SPX NASDAQ:NDX CME_MINI:ES1!

S&P Futures Trading Day 85 — Watching the Market Run Without MeEnded the day +$80 trading S&P Futures. My pre-market analysis spotted a potential breakout from the recent downtrend, with the only major resistance looming ahead at the 6890s. I set my plan to short that resistance and look for longs at the 5-minute MOB. Unfortunately, I was just a step too late on the long entry, and the market ripped higher without filling my order. It’s always frustrating to watch a planned move happen without you, but I stayed disciplined, took the small win on the shorts, and respected the bullish market structure.

📰 News Highlights

S&P 500 CLIMBS AS ONGOING AI-LED REBOUND PUSHES TECH HIGHER

🔔 VX Algo Signals

9:29 AM — MES Market Structure flipped bullish (X3) ✅ 11:20 AM — VXAlgo NQ X1DP Buy Signal ✅ 2:00 PM — VXAlgo ES X3 Sell Signal ✅

3 out of 3 signals worked — 100% accuracy today.

🔑 Key Levels for Tomorrow

Above 6925 = Bullish Below 6900 = Bearish

Santa Rally / V-Shaped Recovery WatchNASDAQ:QQQ continues to respect the 50 & 100 DMA, just like every selloff since July. Momentum indicators are exiting oversold territory, suggesting a familiar upside rotation.

AMEX:SPY confirms.

AMEX:IWM remains structurally bullish on the monthly (cup & handle).

CRYPTOCAP:BTC shows classic oversold mean reversion behavior.

Key risk: loss of 100 DMA.

Bias: upside continuation while support holds.

ES (SPX. SPY) Analysis, Levels, Setups for Fri (Dec 19th)News + schedule

BoJ delivered a 25 bp hike to 0.75% - this can keep early-session volatility elevated via yen/carry-trade unwind and rate moves.

10:00AM Existing Home Sales (Nov), 10:00AM Michigan Consumer Sentiment (final).

ES is currently bracketed by a solid support level between 6820 and 6824 and a formidable resistance zone ranging from 6863 to 6872. Until either side manages to establish dominance with a convincing 15-minute close outside these boundaries, we can anticipate continued fluctuations and volatility within the midpoint range of 6840 to 6855.

A++ Setup 1 - LONG (Sweep-reclaim at the bottom)

Trigger (15/5/1): 15m sweep under 6820.50-6823.50 and close back above 6823.50 - 5m holds above 6823 - 1m first pullback that holds.

Entry: 6824.00-6826.00

Hard SL: 6810.75

TP1: 6854.50

TP2: 6863.00

TP3: 6872.00

A++ Setup 2 - SHORT (Rejection from the cap)

Trigger (15/5/1): 15m push into 6863-6872 and close back below 6863 - 5m fails to reclaim 6863 - 1m lower-high entry.

Entry: 6860.50-6862.50

Hard SL: 6870.75

TP1: 6842.25

TP2: 6823.25

TP3: 6811.75

Good Luck !!!

$SPY & $SPX Scenarios — Friday, Dec 19, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Dec 19, 2025 🔮

🌍 Market-Moving Headlines

• Housing + sentiment check: Existing home sales and consumer sentiment close out the week, offering a read on demand resilience after a heavy CPI and labor stretch.

• Light macro, positioning matters: With no inflation or labor surprises today, flows, OPEX dynamics, and technical levels take priority.

📊 Key Data & Events (ET)

10 00 AM

• Existing Home Sales (Nov): 4.1 million

• Consumer Sentiment, Final (Dec): 53.5

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #housing #consumer #trading #stocks

Santa Rally Setup: Why I Think Markets Rip Into 2026Santa Rally Setup: Why I Think Markets Rip Into 2026

Looking at NASDAQ:QQQ across 2H/D/W/M:

• 2H: breaking downtrend → measured move toward ~$640

• Daily: curling out of oversold + volume shelf suggests $621 magnet

• Weekly: divergence risk = key “line in the sand” (lose lows = pain train)

• Monthly: pullback still looks “normal” within broader uptrend

AMEX:IWM remains the most bullish: 4-year cup & handle breakout + retest behavior.

₿ CRYPTOCAP:BTC : oversold conditions, watching downside toward ~70k if weakness continues.

Not financial advice.

What are you watching: QQQ / SPY / IWM / BTC?

ES (SPX, SPY) Analysis, Key Levels, Setups for Thu (Dec 18)TOMORROW EVENT STACK (ET)

07:00 - Bank of England rate decision + statement

04:00 - Norges Bank rate decision (Norway)

08:15 - ECB policy statement release

08:30 - CPI (Nov) + Real Earnings (Nov)

08:30 - Initial Jobless Claims

08:30 - Philly Fed Manufacturing (Dec)

08:30 - ECB press conference begins (adds FX noise, CPI still dominates ES)

High-impact window: The peak whip risk occurs from 08:30 to 08:45 ET. After the market opens at 09:30, it often either continues the 08:30 trend or reverses back to fair value.

October CPI Release and Its Implications

The absence of the October CPI data from the Bureau of Labor Statistics (BLS) introduces significant complexity to the upcoming November CPI release. Notably, the November figures will omit certain one-month percent changes due to the missing October data. This gap is likely to lead to increased volatility in market reactions, as traders may rely more heavily on year-over-year comparisons and overarching narratives. It's important to emphasize that this presents a data-quality risk rather than a straightforward price forecast.

Current projections from Reuters indicate a CPI rise of 0.3% month-over-month, with a year-over-year increase of 3.1%. Additionally, core CPI is expected to mirror this 0.3% monthly change, while the year-over-year core figure is anticipated to remain at 3.0%. These benchmarks represent the market's baseline, and any significant deviation—either a miss or beat—could trigger a pronounced market reaction.

Navigating Market Dynamics: A Practical Guide for E-mini S&P Traders

- Hot Scenario: A core CPI increase of 0.4% or more, or any unexpected data that raises inflation concerns, is likely to drive yields upward. In this case, E-mini S&P futures may see selling pressure on initial rebounds, as traders react to renewed inflation fears and test support levels.

- Cool Scenario: Conversely, if the core CPI prints at 0.2% or below, or if there’s a clear downside surprise against expectations, we might witness a drop in yields. This scenario could facilitate a breakout for E-mini S&P futures, allowing for upward progression through resistance levels as shorts are squeezed.

- In-Line Scenario: The market may react chaotically to the initial news, but typically, direction stabilizes upon the first pullback following the 09:30 cash market open.

To ensure effective trading during the CPI release, adhere to the following guidelines:

1. Avoid initiating new positions in the final 60 seconds leading up to the 08:30 release.

2. Establish four key reference points: the high and low of the pre-CPI trading range (08:20-08:29) and the high and low resulting from the CPI spike (08:30-08:33). These levels frequently serve as pivotal points for price action during the first 30 to 90 minutes of trading post-release.

By keeping these dynamics in mind, traders can better navigate the potentially tumultuous waters of the upcoming CPI announcement.

Market Analysis: Short-Term Outlook

In the broader context, the recent trading action suggests a failure to maintain momentum after reaching the upper resistance band. The most recent price structure indicates a downward trend, with the market currently trading below key resistance levels. For upcoming sessions, this is critical; any attempts at upward movement will need to overcome the 6821-6835 range to signify a genuine reversal rather than mere corrective action.

On the 4-hour timeframe, we observe a distinct sell-off followed by a consolidation phase. There are several resistance zones left untested from the recent decline, which could hinder any potential rallies. The immediate resistance is located between 6812 and 6821, with a higher barrier at 6835. Should the price exceed 6835, it might have the potential to rally toward the 6865-6882 range.

The 1-hour perspective reveals a classic pattern characterized by a sharp decline followed by a basing phase. Notably, trading volume surged during the sell-off before tapering as prices stabilized near the close. This dynamic sets the stage for either a rebound toward immediate resistance levels or a further decline if the established support fails.

The oscillator is currently in a deeply oversold position, registering in the low teens and beginning to show signs of a potential upward turn. This development suggests some bounce potential, although it does not guarantee a trend reversal on its own. A credible shift in trend will require the price to reclaim the R1 resistance and maintain levels above R2.

Overnight Market Outlook: NY Session Forecast

Base Case Scenario (Pre-CPI): Anticipate a period of rotational trading between support level S2 at 6775.50 and resistance range R1 at 6812-6821.

Bullish Scenario: Should the market hold at S2, a reclaim of R1 would be crucial. A successful transition of R2 (6835) from a resistance level to a support floor could propel prices toward R3 (6865-6871), with the potential to reach 6882.50 if bullish momentum remains strong.

Bearish Scenario: Conversely, if the market slips below S2 and fails to reclaim the 6775.50 level, we could see a decline towards S3 at 6762, with a further slide to 6733.50 if selling pressure intensifies.

A++ Setup 1 - Short Position (Rejection at Resistance Level 1)

Entry Criteria: Monitor the market for a minimum of 30 minutes. The ideal entry is between 6816.00 and 6821.00.

- Stop Loss (SL): 6838.00

- Take Profit (TP) Targets:

- TP1: 6775.50

- TP2: 6762.00

- TP3: 6733.50

**Invalidation Point:** The setup will be invalidated if price sustains above 6835.00.

A++ Setup 2 - Long Position (Continuation through Resistance Level 2)

Entry Criteria: Again, monitor for a duration of at least 30 minutes. The target entry range is between 6830.00 and 6836.00.

- Stop Loss (SL): 6818.50

- Take Profit (TP) Targets:

- TP1: 6871.25

- TP2: 6882.50

- TP3: 6936.25

Invalidation Point: The trade will be considered invalid if there is a decisive drop back below 6821.50 after the reclaim action.

Good Luck !!!

4H Long Term $SPY Wyckoff Distribution StructureThis idea is an updated and more simplified chart to show current structure that has build out on the 4H chart from the multi-timeframed chart I had in a previous idea -

As the title states, we have a Wyckoff distribution method/pattern in play here on the chart.

So far the set up and pattern has been pretty on-point if you take a look and analyze Wyckoff Methods from www.wyckoffanalytics.com

.

I don't have a ton of additional analysis to add here. I am only analyzing the chart and indicators I have. However, I'd love to hear some additional feedback for contrasting opinions or agreeing opinions for some confluence.

I'll add that two weeks later from the original idea, the structure, important support / resistance zones, and volume at those areas in the structure strengthens my opinions on validity of what is forming here.

This is still too early in the pattern / structure to play any moves based solely on this idea. In my opinion we are likely in the latter half of Phase B and this will take some patience to play out if you find conviction in it.

I am being patient and playing what the market gives me on an intra-day and intra-week basis while keeping this chart in the back of my mind.

I'm still early in my trading and TA journey (began January of this year) and I'm still learning but I thought I'd share an idea with the TV community that I have been keeping my eye on and trying to learn more about.

Thanks for your time and as stated in my other idea, it is always great to hear feedback for contrasting opinions or agreeing opinions for some confluence.

Long Term Wyckoff Distribution In-PlayAs the title states, we have a Wyckoff distribution method/pattern in play here on the chart.

So far the set up and pattern has been pretty on-point if you take a look and analyze Wyckoff Methods from www.wyckoffanalytics.com .

I don't have a ton of additional analysis to add here. I am only analyzing the chart and indicators I have. However, I'd love to hear some additional feedback for contrasting opinions or agreeing opinions for some confluence.

Have a great day TV gang and I hope you have a great December.

$SPY & $SPX Scenarios — Thursday, Dec 18, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Thursday, Dec 18, 2025 🔮

🌍 Market-Moving Headlines

• 🚨 CPI Day — inflation is back in focus with November CPI and Core CPI printing together. This is the primary macro catalyst for rates, equities, and the dollar.

• 📉 Labor cooling check: Jobless claims add confirmation or pushback to the disinflation narrative.

• 🏭 Regional growth signal: Philly Fed survey gives a real-time read on manufacturing momentum into year-end.

📊 Key Data & Events (ET)

8 30 AM — Major Inflation Print

• Consumer Price Index, CPI (Nov): 0.3 percent

• CPI Year over Year: 3.1 percent

• Core CPI (Nov): 0.3 percent

• Core CPI Year over Year: 3.0 percent

• Initial Jobless Claims (Dec 13): 225,000

• Philadelphia Fed Manufacturing Index (Dec): 3.6

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #CPI #inflation #macro #rates #markets #trading #stocks

$PLTR ShortInitially shorted

PLTR from 175s on 17th

Nov. Closed my position around 153 and bought back for a bounce around 155.

Medium term I am bearish on & PLTR, we can clearly see a failed high at around 209. If price wanted to stay bullish it should have consolidated or stayed above the previous high at around 189 but this to me is a trap price pushing above 189 and coming back down.

I have closed my longs here and will be looking for LH now, might even go to 185 around the 0.618 Flb level but nothing changes for me I will be looking for swing shorts.

Put this post earlier but it was restricted for some reason so posting it again now. Now the price has started to halt near the 0.618 level and we might get the down move now. Let’s see

ES (SPX, SPY) Analysis, Key Zones, Setups for Wed (Dec 17th)Market Update: ES Faces Critical Decision Point

The ES market is currently navigating a narrow “decision pocket” between 6850 and 6865, following a significant selloff and a subsequent bounce that has yet to establish a definitive trend. The situation is clear: buyers must defend the lower range of 6834 to 6817 to maintain market stability within this range. Conversely, sellers are focusing on the upper threshold between 6880 and 6892. With the Consumer Price Index report scheduled for release on Thursday morning, traders are likely to become more reactive, potentially taking profits swiftly and responding sensitively to any news regarding interest rates.

What can move ES tomorrow (high-impact catalysts, ET)

7:00 MBA Mortgage Applications - usually a modest mover, but it can nudge rates early.

8:15 Fed Governor Waller (Economic Outlook) - big rates sensitivity; ES can whip on any change in tone.

9:05 NY Fed President Williams - opening remarks at an NY Fed conference; still headline-capable.

10:30 EIA Weekly Petroleum Status Report - can move crude and inflation expectations, which can leak into ES.

11:00 Treasury buyback details (eligible bonds list) - rates pulse risk.

1:00 20Y Treasury auction (competitive bids) - one of the bigger intraday “rates steering wheel” moments.

1:40-2:00 Treasury buyback operation window - can add another yields swing in the early afternoon.

Macro and News Themes to Watch Ahead of Tomorrow’s Market

In the current environment, interest rates are proving to be the primary driver of market dynamics. Any increase in long-term yields exerts downward pressure on the equity markets, particularly when key indices like the S&P 500 are hovering near critical resistance levels.

The Federal Reserve's messaging remains notably inconsistent. While some officials are emphasizing the importance of maintaining inflation credibility and adopting a cautious stance towards future rate cuts, others suggest that monetary policy is already positioned effectively and anticipate a gradual cooling of inflation. This divergence creates a volatile atmosphere, leading to heightened market reactions surrounding Fed speeches.

On the geopolitical front, oil prices are responding to ongoing developments, particularly concerning Venezuela, which has raised supply-risk concerns. This uptick in crude prices has the potential to reinforce inflation narratives and influence equity market sentiment.

Additionally, the looming Bank of Japan (BOJ) meeting, where a rate hike is expected, adds another layer of complexity. Even ahead of this anticipated move, shifts in foreign exchange and global rates could significantly impact U.S. index futures and overall market positioning.

Overnight NY Market Forecast

Base Case Scenario: The market is expected to trade within a range of 6832.75 to 6880.50. Watch for potential retracements towards the 6849.00-6849.75 level, which appears to be a pivotal support point.

Bullish Scenario: Should the index manage to sustain a position above 6880.50, a decisive break above 6892.00 would likely drive prices towards 6936.25, a key resistance level.

Bearish Scenario: Conversely, a confirmed drop below 6817.50 would pave the way for a test of 6800.00 initially. If sellers maintain their grip on the market, further declines to 6767.75 and 6733.75 may follow.

A++ Setup 1 (Rejection Fade short from the upper shelf)

Entry: 6887.00-6891.75

Hard SL: 6896.25

TP1: 6863.50

TP2: 6849.75

TP3: 6834.50

A++ Setup 2 (Acceptance Continuation short under PDL)

Entry: 6814.50-6817.25

Hard SL: 6823.75

TP1: 6800.00

TP2: 6767.75

TP3: 6733.75

Good Luck !!!

$SPY & $SPX Scenarios — Wednesday, Dec 17, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 17, 2025 🔮

🌍 Market-Moving Headlines

• Very light macro day: No major inflation, labor, or growth data scheduled.

• Post-data digestion: Markets continue to digest Tuesday’s delayed jobs, retail sales, and PMI releases.

• Fed speakers are secondary: With CPI and employment already out, commentary matters only if tone shifts meaningfully.

📊 Key Data & Events (ET)

• No top-tier economic data scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #trading #macro #stocks

Opening (IRA): SPY January 30th 605/615/730/740 Iron Condor... for a 1.25 credit.

Comments: Structuring the setup such that the credit received is about 1/10th the width of the wings which results in the short option legs being at about their respective 10 delta strikes.

Metrics:

Max Profit: 1.25 ($125)

Max Loss/Buying Power Effect: 8.75 ($875)

ROC at Max: 14.28%

ROC at 50% Max: 7.14%

Will generally look to adjust on side test or on side approaching worthless. Am looking to take profit at .25, resulting in a 1.00 ($100) realized gain.