EURNZD | Trend Continuation or Liquidity Trap?EURNZD is currently transitioning after completing a clear distribution phase marked by a Head & Shoulders structure that triggered a strong bearish repricing, shifting market sentiment from expansion to rebalancing. Following the breakdown, price delivered an impulsive move lower but is now losing downside momentum as it reaches a significant higher-timeframe demand zone where previous institutional participation was visible, suggesting the market is no longer in a pure trend phase but rather in a liquidity redistribution environment. The current price action shows compression and reduced volatility, typically observed when markets pause after aggressive directional moves to rebalance positioning before the next expansion. From a structural perspective, the broader trend remains bearish with lower highs intact, however the efficiency of recent bearish legs is decreasing, indicating exhaustion rather than continuation strength. COT positioning reinforces this narrative as euro futures show reduced bullish conviction while NZD positioning stabilizes after prior weakness, maintaining relative strength but without strong acceleration, which often precedes corrective counter-moves rather than immediate trend continuation. Retail sentiment adds another layer, with the majority of traders positioned short, increasing the probability of a short-term squeeze higher as markets tend to rebalance against crowded positioning before resuming directional intent. Seasonality further aligns with a temporary recovery scenario, as EUR historically stabilizes during this period while NZD momentum tends to soften after the start of the year. Combining structure, positioning, sentiment and seasonality, the most probable scenario is a corrective upside move toward inefficiency and supply zones above current price before the market decides whether to continue the broader bearish trend or initiate a larger reversal phase. Until price reclaims higher supply levels, rallies should be interpreted as corrective within a bearish macro structure, meaning the real decision point for directional continuation will likely occur at higher liquidity areas rather than at current lows.

Strategy

BTCUSD: Strategic Long Positioning | 3-Week Balance & Order FlowMarket Context: Deep Absorption Phase

We are currently navigating a prolonged three-week balance. The recent tape data provides a high-conviction context for the upcoming period. We are observing a significant passive absorption phase: large spot sell-side clips are being blocked by heavy limit-side support (limit buy walls), effectively halting downward momentum.

Order Flow & Structural Nuances

My outlook is supported by a confluence of non-lagging data:

-Passive Absorption & Delta Shifts: Aggressive market sellers are being consistently intercepted. This "sell-side lock" suggests the market is being primed for a liquidity-seeking manipulation.

-Volume Distribution (MP): Analysis of the Value Area and High Volume Nodes (HVN) confirms that the current auction is building energy for a breakout.

-Footprint & Clusters: Cluster analysis reveals aggressive absorption at the lows and localized Delta Divergences, indicating that supply is being exhausted.

Execution & Position Sizing

A "starter" long position has already been established. I am looking to pyramid (increase size) into this trade upon the formation of localized confirmation setups (e.g., proactive buy-side initiation) on the lower timeframe footprint.

-Target 1: $67,900 (Liquidity tap & partial de-risking)

-Target 2: $71,300 (Primary objective / Range expansion)

Invalidation Criteria

The long bias will be completely invalidated if the price achieves a sustained close below $64,200.

Execution should always follow your internal risk-management framework. Trade the plan.

Trading the "News": Why "Buy the Rumor, Sell the News" WorksDiscover the mechanics behind the famous "buy the rumor, sell the news" trading strategy. Learn how to capitalize on market anticipation, avoid the retail trap, and trade major financial events.

In the financial markets, there is a famous adage: "Buy the rumor, sell the news." It highlights a strategy where traders purchase an asset based on the anticipation of forthcoming news and sell once that news is officially announced.

For novice traders, this concept is often baffling. Why would an asset's price crash the exact moment a company announces record-breaking earnings? Why would a currency drop right after an expected interest rate hike is confirmed?

The answer lies in understanding that financial markets are not driven purely by facts; they are powered by sentiment, anticipation, and the mechanics of liquidity. Here is a deep dive into why this phenomenon occurs and how professional traders exploit it.

The Psychology and Mechanics Behind the Strategy

To understand this strategy, you must accept one fundamental truth: Markets are discounting mechanisms. The current price of an asset reflects the market's best current estimate of all the factors that might influence the present value of that security.

When a rumor circulates or forecasts about positive news surface, speculators begin to buy. As more investors become aware of the potential development, the price moves to reflect their enthusiasm. This creates an uptrend powered entirely by expectations.

By the time the actual news is released, the event is already "old" to seasoned traders and priced in. The official announcement serves as a massive liquidity event. "Smart money" and early buyers use the surge of late-arriving retail traders—who are buying because they just saw the headline—as counter-parties to offload their shares. This aggressive profit-taking causes the price to plunge, even if the news is objectively positive.

The Lifecycle of a "News" Trade

A classic "buy the rumor, sell the news" setup generally follows three distinct phases:

1. The Rumor (Accumulation)

Whispers begin to circulate about an upcoming catalyst, such as a major acquisition. Early institutional buyers and astute retail traders start building their positions. The price begins to rise steadily, often on increasing volume.

2. The Anticipation (Markup)

As the event draws closer, mainstream financial media picks up the story. The consensus among analysts builds. FOMO (Fear Of Missing Out) kicks in for the broader market, driving the price up aggressively in a speculative frenzy.

3. The Reality Check (Distribution/The Dump)

The news is officially announced. If the news merely meets expectations, the early buyers instantly sell to realize their gains and adjust to the actual impact. The sudden influx of sell orders overwhelms the late buyers, causing a rapid price drop.

How to Actually Trade It

Trading this phenomenon requires discipline and a clear plan. Here are three professional approaches:

1. Trading the Anticipation (The Safest Route)

This involves entering the market early during the "rumor" phase and exiting right before the news hits.

* Strategy: Buy the asset weeks or days before a scheduled event (like an earnings report or an Apple product launch).

* Execution: Close your position entirely, or take significant partial profits, before the official announcement. You capture the speculative run-up and avoid the volatility of the actual release.

2. Fading the News (The Contrarian Route)

This strategy involves waiting for the news to drop and betting against the initial retail reaction.

* Strategy: Let the news hit the wires. Watch for an initial, irrational spike in price caused by algorithmic bots and retail traders.

* Execution: Wait for 10 minutes after the news is out to evaluate the real market movement before entering, which helps avoid the initial chaotic whipsaw. If the price spikes into a major resistance level but fails to hold, you open a trade in the opposite direction.

3. The Straddle Strategy (Non-Directional Bias)

If you are unsure how the market will react, you can adopt a non-directional bias.

* Strategy: You do not have a bias as to whether the price will go up or down once the news is released. Instead, you place pending orders above and below the current price consolidation right before the release.

* Execution: When the news hits and the price spikes in one direction, it triggers one of your orders. (Note: This carries the risk of severe slippage during high-impact events).

The Hidden Risks

While lucrative, news trading is not without severe risks:

* The "Surprise" Factor: If a data report comes in significantly below or above expectations, massive volatility will follow. If earnings absolutely shatter the highest estimates, the stock might experience a "buy the rumor, buy the news" event, continuing to soar.

* Severe Slippage: During major economic releases, you may be trading at the absolute peak of volatility, when prices are gapping and slippage can occur.

* False Rumors: If you buy based on a rumor that turns out to be entirely false, or if unexpected news outcomes occur, the resulting crash can lead to significant losses.

"Buy the rumor, sell the news" is a masterclass in market psychology. It proves that in trading, expectations are often more powerful than reality. By understanding how the herd reacts to information, you can stop being the liquidity for institutional players and start positioning yourself ahead of the curve. Always prioritize risk management, track scheduled events using economic calendars, and remember that protecting your capital is more important than catching a volatile news spike.

GSAT Globalstar Options Ahead of EarningsAnalyzing the options chain of GSAT Globalstar prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2026-7-17,

for a premium of approximately $3.10

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GBP/USD – The Distribution Has Already StartedOver the past sessions, I’ve been closely monitoring GBP/USD, and the recent price action suggests the market may be transitioning from bullish expansion into a distribution phase. After the impulsive rally toward the 1.38 region, continuation signals have weakened, and price is now struggling to maintain acceptance at premium levels. When a market stops making new highs despite strong prior momentum, it often indicates that larger players are beginning to sell into strength. The break of the local ascending structure and the inability of buyers to regain control reinforce the idea that the auction is shifting from demand-driven to supply-responsive. Redistribution rarely begins with aggressive downside, it typically starts with fading momentum and heavier rallies, which is exactly the behavior currently unfolding.

The latest COT report strengthens this view. Non-commercial traders have reduced long exposure while increasing shorts, signaling a behavioral shift near the highs. What captures my attention is not the absolute positioning yet, but the change in posture from large speculators, as these adjustments often precede broader price rotations. Looking at the dollar side adds further confluence: USD futures positioning is stabilizing, with short exposure being reduced and commercial participants increasing longs, a dynamic that can quietly support the dollar and pressure GBP/USD through relative strength alone.

Seasonality aligns with this developing narrative. February has historically produced softer performance in the pair, with weakness often extending into March before a more constructive second quarter. While I never rely on seasonality in isolation, its alignment with institutional repositioning and fading momentum turns it into a meaningful contextual edge. Retail sentiment adds another contrarian layer, as a majority of traders remain positioned long. The skew is not extreme, but moderate retail optimism typically supports controlled downside rotations rather than sharp reversals.

Technically, the daily Fair Value Gap around 1.3460–1.3490 stands out as a natural magnet if repricing continues, while the liquidity pocket near 1.3350 becomes a logical extension target. That said, I am not interested in chasing weakness, institutions sell premium, not discounts, so my focus remains on how price behaves on potential retracements into supply. Acceptance back above 1.3650–1.3700 would weaken the bearish thesis, but until that happens, rallies appear increasingly vulnerable.

AUDJPY Approaching Distribution? COT Signals Yen StrengthAUDJPY is entering a critical zone where institutional flows suggest a potential medium-term reversal.

The latest COT report shows AUD still net long but losing momentum, while JPY is seeing aggressive long accumulation, often an early signal of currency strengthening.

Seasonality supports this view: February historically favors yen appreciation while the Australian dollar tends to flatten.

Retail sentiment is currently 64% short. While this may appear contrarian, positioning is not yet extreme and aligns with the early stages of institutional distribution.

From a price action perspective, the pair is trading in premium territory, increasing the probability of a liquidity sweep followed by a bearish rotation.

Trading Plan:

Wait for a daily bearish confirmation or a H4 market structure shift before looking for short opportunities.

USD/JPY | Potential Distribution USDJPY appears to be transitioning from a mature bullish trend into a corrective phase, with price currently testing a key institutional demand zone between 152.00 and 152.70. After months of impulsive upside within an ascending channel, the recent break in short-term structure suggests momentum is fading and the market may be shifting toward redistribution rather than staging a simple pullback.

The rejection from the 158.00–159.50 supply zone carries strong technical significance. Sellers defended prior liquidity aggressively, producing a displacement move lower and confirming early structural deterioration with the loss of the internal trendline. Should demand fail to hold, the next liquidity magnet sits near 149.50, followed by the deeper 147.00–148.00 institutional base. On the upside, any retracement into 157.50–158.00 should be viewed cautiously as a potential lower-high formation.

From a positioning perspective, COT data highlights a market approaching an inflection point. Speculators remain net short JPY futures, structurally supportive for USDJPY, yet the simultaneous build-up in both long and short exposure, alongside rising open interest, signals increasingly crowded positioning. Commercial hedging activity on both sides further reflects uncertainty, a backdrop that typically precedes volatility expansion. While this does not confirm a macro top, it materially strengthens the case for a corrective leg before any sustainable continuation higher.

Seasonality adds confluence to the near-term downside risk. Although February tends to show mild USDJPY strength, late Q1 often favors episodes of JPY appreciation, particularly if risk sentiment deteriorates. Historically, extended USD rallies are frequently followed by mean reversion before the broader trend resumes.

Retail sentiment reinforces this view, with traders currently net long (~57%), a contrarian signal that raises the probability of a liquidity sweep below 152.00 before a meaningful bullish attempt can develop.

Tactical Outlook:

The pair is approaching a decision node. The higher-probability scenario favors a rebound into 155.50–157.50, followed by a lower high and a potential extension toward 149.50. Only a decisive reclaim of 158.50 would invalidate the corrective thesis and reopen the path toward 160+.

XAUUSD remains structurally bullishGold remains positioned within a remarkably clean primary uptrend, defined by persistent higher highs and higher lows inside a well-structured ascending channel. The latest impulsive rally pushed the market into overextended conditions, triggering a sharp profit-taking move, a typical reaction when positioning becomes crowded. Crucially, the recent selloff has not damaged the broader structure. Instead, it appears to be a rebalancing phase, guiding price back toward inefficiencies where two-sided participation can rebuild. The key zone lies between 4900 and 5050, best interpreted as a re-equilibration range rather than distribution. A confirmed breakout above 5150 would likely reactivate trend-following flows and open the door to a new impulsive leg. As long as price holds above the dynamic trendline, the tactical approach remains buy-the-dip, while only a daily close below 4700 would begin to challenge the bullish regime.

Positioning data strengthens this view. Non-commercial traders sharply reduced longs (~-37k), while shorts increased only marginally, leaving net positioning firmly positive. This reflects classic position trimming after an extended rally, risk reduction rather than directional reversal. Even more significant is the steep drop in open interest (-78k), signaling long liquidation rather than aggressive short selling. Historically, this type of flow in gold tends to precede consolidation, the formation of accumulation bases, and eventual continuation, suggesting the market is resetting, not topping.

Retail sentiment shows 64% long vs. 36% short. While superficially contrarian, retail often remains net-long during strong macro trends. Sentiment becomes meaningfully bearish only when paired with aggressive short positioning and structural deterioration, neither of which is evident.

Seasonality further supports a constructive outlook. February is moderately positive over longer datasets, and the statistically stronger window for gold typically emerges between late Q1 and early Q2, aligning with a scenario of near-term consolidation followed by expansion.

Bottom line: there is little evidence of a macro top. The broader data favors a continuation framework, likely a pause within an ongoing bull cycle. Institutional bias remains tilted to the upside, provided the 4700 structural floor holds.

Trading Legends: George SorosGeorge Soros: The Philosopher Who "Broke" Central Banks

In the trading world, there are investors who follow the market and those who shape it. George Soros belongs firmly in the second category. To many, he is "the man who broke the Bank of England," but for a TradingView user, Soros is, above all, the master of reflexivity. Here is how his philosophy can redefine how you look at charts.

The Roots: From Philosophy to Profit

Born in Budapest in 1930, Soros didn’t start by studying candlestick patterns. Instead, he spent his time at the LSE reading Karl Popper. From Popper’s theories on "open societies" and human fallibility, Soros derived a conviction that became the backbone of his success:

"Perfect knowledge is impossible. If humans are systematically wrong, then markets (made of humans) must be inherently imperfect."

The Strategic Core: The Theory of Reflexivity

While most traders search for "Fair Value" (equilibrium), Soros looks for chaos. His strategy is based on a feedback loop:

Fallibility: Market participants always have a partial or distorted view of reality.

Reflexivity: These distorted views influence prices, but the prices themselves eventually influence the fundamentals.

Real-world example: If the market believes a company is rock-solid, the stock price rises. This high price allows the company to secure easy credit, which actually improves its fundamentals. Perception has created reality.

The Soros Cycle:

Acceleration: Investor bias pushes the price in one direction.

Reinforcement: The price movement seems to confirm the bias, attracting more capital (FOMO).

Point of Ruin: When reality can no longer sustain the illusion, the loop reverses violently.

Legendary Plays (Global Macro)

Soros doesn't just analyze earnings reports; he views nations as chessboards.

1992 - Black Wednesday: He bet against the British Pound, forcing the UK out of the ERM. Profit: $1 billion in a single day.

1997 - Asian Crisis: He shorted the Thai Baht, anticipating the collapse of the "Asian Tigers."

2013 - Abenomics: He bet on the devaluation of the Yen, netting another billion-dollar win.

The "Biological" Stop-Loss

Soros is famous for his total lack of ego. If the price action doesn't confirm his thesis, he exits instantly. It is said he suffered from severe back pain whenever his positions were wrong. That physical pain was his signal: the market was telling him he was mistaken.

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong."

How to Apply the "Soros Method" Today?

Stop searching for truth: Look for where the crowd's perception diverges from reality.

Ride the bubble: Soros doesn’t short a bubble immediately; he rides it until the trend shows structural cracks.

Cut without mercy: If the pain (or the chart) tells you the thesis has failed, get out. Ego is the enemy of profit.

What’s your take on the Theory of Reflexivity ? Do you believe markets are efficient, or do you agree with Soros that we live in a constant loop of misperceptions?

Let me know in the comments and hit the BOOST button if you want more deep dives into the legends of the game! 👇

Market Outlook: Liquidity Grab & Potential Reversal AnalysisPrice has moved from Accumulation → Manipulation near the swing high, which means buy-side liquidity is likely being created above this range. This small consolidation at the top can be an inducement before a final sweep of highs 📈. If price breaks the swing high and then quickly comes back inside the range, it can trap buyers — confirming a liquidity grab ❌.

Key Points:

Swing High Sweep: If price breaks the swing high and quickly returns inside the range, it can trap buyers, confirming a liquidity grab ❌.

Post-Sweep Distribution: After the sweep, the market may enter Distribution, moving down toward the NY liquidity target 📉.

Imbalance Fill: The drop aims to fill the imbalance left by the strong upward move.

Confirmation: A clear MSS/BOS after the sweep can validate the bearish move toward the 4970 zone 🎯.

Risk Management: Always adhere to proper risk management rules ⚠️

EURGBP: Positioning & Structure AlignAt the moment, EURGBP presents a fairly aligned picture across macro positioning, sentiment, and technical structure. Overall, the bias remains more constructively bullish than bearish.

I always start from positioning, as it represents the primary market context for me. According to the latest COT report, Non-Commercial traders continue to increase their long exposure on the Euro, while the British Pound shows a reduction in longs alongside an increase in short positions. This suggests that speculative flows are gradually favoring EUR over GBP, providing a structural foundation for further upside in the cross.

Adding to this, retail sentiment shows approximately 74% of traders currently positioned short on EURGBP. When positioning becomes this one-sided, I tend to interpret it from a contrarian perspective: markets often continue moving higher while the majority attempts to sell rallies. This is not a timing signal, but it strengthens the directional backdrop.

Seasonality also supports this view, as February historically tends to be a more positive period for EURGBP, adding another probabilistic factor in favor of bullish continuation.

From a technical standpoint, price reacted cleanly from the demand zone between 0.8638 and 0.8670, breaking the short-term bearish structure and exiting the descending channel. For me, this represents the first meaningful change in market character after several weeks of downside pressure.

As long as price holds above the 0.8700–0.8720 area, I continue to favor a buy-the-dip approach rather than looking for aggressive shorts.

Key levels I am monitoring:

0.8756 / 0.8760 → First acceptance zone. Sustained consolidation above this level increases continuation probability.

0.8785 – 0.8820 → Major supply and decision area where reactions and potential slowdown are expected.

0.8830 – 0.8870 → Upper target zone where profit-taking may become more evident.

My preferred scenario is a controlled pullback toward 0.8720–0.8700, followed by support holding and continuation higher. Alternatively, a breakout above 0.8756 with a confirmed retest could open the path toward the 0.88 region.

Bullish invalidation would come from a decisive loss of 0.8700, and especially a break below 0.8685–0.8670, which would weaken structure and increase the probability of a revisit to the 0.8638 demand area.

Don't Trust One Model: The Power of Ensemble TradingOne Model Can Be Wrong. Many Models Are Harder to Fool.

Here's a counterintuitive truth about AI trading:

A collection of "okay" models often outperforms a single "great" model.

This is the power of ensemble methods combining multiple models to create something more robust than any individual component.

What Are Ensemble Methods?

Definition:

Ensemble methods combine predictions from multiple models to produce a final prediction that's more accurate and robust than any single model.

The Core Insight:

Different models make different mistakes. When combined intelligently, errors cancel out while correct predictions reinforce each other.

The Analogy:

Ask 100 people to guess the number of jellybeans in a jar. The average of all guesses is usually more accurate than any individual guess. This is the "wisdom of crowds."

Why Ensembles Work

1. Error Reduction

Individual models have biases and errors

Different models have different errors

Averaging reduces random errors

Systematic errors can be identified and corrected

2. Variance Reduction

Single models can be unstable

Small data changes cause big prediction changes

Ensembles smooth out this variance

More consistent predictions

3. Bias-Variance Tradeoff

Simple models: high bias, low variance

Complex models: low bias, high variance

Ensembles can achieve low bias AND low variance

4. Robustness to Regime Changes

Different models work in different conditions

Ensemble adapts as conditions change

No single point of failure

Types of Ensemble Methods

Type 1: Averaging (Bagging)

Train multiple models on different data samples, average predictions.

How It Works:

Create multiple bootstrap samples of training data

Train separate model on each sample

Average predictions (regression) or vote (classification)

Example: Random Forest

Many decision trees

Each trained on random data subset

Each uses random feature subset

Final prediction = average of all trees

Advantage: Reduces variance, prevents overfitting

Best For: High-variance models (decision trees)

Type 2: Boosting

Train models sequentially, each focusing on previous errors.

How It Works:

Train first model

Identify errors

Train second model to correct those errors

Repeat, combining all models

Examples:

AdaBoost

Gradient Boosting (XGBoost, LightGBM)

CatBoost

Advantage: Reduces bias, improves accuracy

Best For: High-bias models, structured data

Type 3: Stacking

Use predictions from multiple models as inputs to a meta-model.

How It Works:

Train diverse base models

Generate predictions from each

Train meta-model on base model predictions

Meta-model learns optimal combination

Advantage: Learns optimal weighting automatically

Best For: Combining very different model types

Type 4: Voting

Simple combination of model predictions.

Hard Voting:

Each model votes for a class

Majority wins

Soft Voting:

Each model provides probability

Average probabilities

Highest average probability wins

Advantage: Simple, interpretable

Best For: Classification problems

Ensemble Methods in Trading

Application 1: Signal Combination

Combine signals from multiple strategies:

Strategy A: Trend following

Strategy B: Mean reversion

Strategy C: Momentum

Combined signal: Weighted average or vote

Benefit: Smoother equity curve, reduced drawdowns

Application 2: Multi-Model Prediction

Combine predictions from different model types:

Model 1: Random Forest

Model 2: Neural Network

Model 3: Linear Regression

Model 4: XGBoost

Final prediction: Ensemble of all

Benefit: More robust predictions

Application 3: Multi-Timeframe Ensemble

Combine signals from different timeframes:

Daily model prediction

4-hour model prediction

1-hour model prediction

Combined: Weighted by timeframe reliability

Benefit: Captures patterns at multiple scales

Application 4: Multi-Asset Ensemble

Train models on related assets:

Model trained on SPY

Model trained on QQQ

Model trained on IWM

Combined for market direction

Benefit: More robust market regime detection

Building Trading Ensembles

Step 1: Create Diverse Base Models

Diversity is key. Models should be different in:

Algorithm type (tree vs neural net vs linear)

Features used

Training data (different periods or samples)

Hyperparameters

Why Diversity Matters:

If all models are similar, they'll make the same mistakes. No benefit from combining.

Step 2: Validate Individual Models

Each base model should:

Have positive expected value individually

Be validated out-of-sample

Have understood strengths and weaknesses

Don't Include: Models that don't work on their own.

Step 3: Choose Combination Method

Simple Average:

Equal weight to all models

Simple, robust

Good starting point

Weighted Average:

Weight by historical performance

Weight by confidence

Requires careful validation

Meta-Model (Stacking):

Learn optimal weights

Can capture non-linear combinations

Risk of overfitting the combination

Step 4: Validate the Ensemble

The ensemble itself needs validation:

Out-of-sample testing

Compare to individual models

Check for improvement in key metrics

Key Question: Does the ensemble actually improve on the best individual model?

Ensemble Weighting Strategies

Strategy 1: Equal Weights

Each model gets 1/N weight

Simple, robust

Often surprisingly effective

Strategy 2: Performance-Based Weights

Weight by recent Sharpe ratio

Weight by recent accuracy

Adapts to changing conditions

Strategy 3: Inverse Variance Weights

Weight inversely to prediction variance

More confident models get more weight

Statistically optimal under certain conditions

Strategy 4: Regime-Based Weights

Different weights in different market regimes

Trend model weighted higher in trends

Mean reversion weighted higher in ranges

Ensemble Pitfalls

Lack of Diversity Combining similar models provides little benefit. Ensure models are genuinely different.

Overfitting the Combination Optimizing weights on historical data can overfit. Use simple combination methods or validate rigorously.

Complexity Without Benefit More models isn't always better. Each model adds complexity and potential failure points.

Ignoring Correlation Highly correlated model predictions don't add information. Check prediction correlations.

Computational Cost Running many models is expensive. Balance accuracy gains against computational cost.

Measuring Ensemble Effectiveness

Metric 1: Improvement Over Best Single Model

Does ensemble beat the best individual model?

Metric 2: Reduced Variance

Are predictions more stable?

Metric 3: Reduced Drawdown

Is the equity curve smoother?

Metric 4: Robustness Across Regimes

Does ensemble perform consistently across different market conditions?

Practical Ensemble Example

Trading System Ensemble:

Model 1: Trend Following

Moving average crossover

Works in trending markets

Suffers in choppy markets

Model 2: Mean Reversion

RSI oversold/overbought

Works in ranging markets

Suffers in strong trends

Model 3: Momentum

Rate of change signals

Works in momentum regimes

Suffers in reversals

Ensemble Logic:

If 2+ models agree: Take signal

If models disagree: No trade or reduced size

Weight by recent performance

Result: Smoother returns, reduced drawdowns, more consistent performance.

Key Takeaways

Ensemble methods combine multiple models for more robust predictions

Key types: Bagging (averaging), Boosting (sequential), Stacking (meta-model), Voting

Diversity is essential similar models don't add value when combined

In trading: combine strategies, model types, timeframes, or assets

Validate the ensemble itself it can overfit just like individual models

Your Turn

Do you use multiple models or strategies in your trading?

How do you combine signals when they disagree?

Share your ensemble approach below 👇

Price TP vs. Equity TP: What’s the Real Difference?In the world of Pine Script, most retail traders stay glued to the candles. But pros? They watch the equity curve. Here is the ultimate challenge: is it better to exit when the price hits a specific level, or when your account has banked enough profit?

1. Price-Based Take Profit

The standard approach. This is the mindset of a trader who views price as an isolated entity. It's based on the premise that the market moves toward "natural targets" that exist independently of your account balance. Such as key resistance levels, indicator based condition or a simple price percentage move calculated on the entry price.

Logic: "Exit the position when the price increases by percentage value from the entry price."

Pros: Honors technical analysis, market structures (support/resistance), and price action.

Cons: Ignores total portfolio exposure and account volatility.

// PRICE BASED

long_condition = close > open

var float entry_price = 0

percentage_value = 5

if (strategy.opentrades==0 and long_condition)

entry_price := close

strategy.entry("Buy", strategy.long, limit = entry_price)

take_profit = entry_price + ((entry_price * percentage_value)/100)

strategy.exit(id = "Sell", from_entry = "Buy", limit = take_profit)

2. Equity-Based Take Profit

This approach shifts the focus from the chart to the portfolio. The exit is triggered when the trade’s profit reaches a specific percentage of your total capital.

Logic: "Exit the position when this specific trade increases my total equity by 2%."

Pros: Direct capital protection; allows for precise mathematical compounding of gains.

Cons: Risk of "premature exit". You might get knocked out of a strong trend that still has technical momentum.

// EQUITY BASED

long_condition = close > open

var float equity_level = 0

percentage_value = 5

if (strategy.opentrades==0 and long_condition)

equity_level := strategy.equity

strategy.entry("Buy", strategy.long, limit = close)

take_profit = equity_level + ((equity_level * percentage_value)/100)

if (ta.crossover(strategy.equity, take_profit))

strategy.exit(id = "Sell", from_entry = "Buy", limit = close)

Which One is the Better Choice?

There is no single "right" answer, but there is a strategic choice based on your trading style:

Price-Based TP: The Sniper’s Approach

Price-based Take Profit is the tool of choice for those who "read" the tape. In this mode, the target is intrinsically linked to the asset: you are betting that the price will hit a specific mathematical level or key resistance.

Focus on Technical Analysis: This is the natural choice if you trade using chart patterns, Fibonacci levels, or momentum indicators. The trade closes because the asset has completed its expected move, regardless of its weight in your portfolio.

Surgical Precision: It allows for the use of pre-placed Limit Orders. This ensures clean execution and reduces slippage, as the broker knows exactly at which cent to exit.

Ideal for Scalping and Intraday: In fast-paced environments, the market doesn't give you time to calculate equity fluctuations. You need fixed, rapid targets.

Equity-Based TP: The Manager’s Approach

Equity-based Take Profit shifts the focus from "what the asset is doing" to "what is happening to my capital." This is a macroscopic, prudent vision typical of those managing complex portfolios or multi-asset strategies.

Focus on Risk Management: Here, the ultimate goal is the Equity Curve. The exit triggers when the monetary gain reaches a psychological or mathematical threshold that satisfies the risk-reward ratio of the overall portfolio.

Real-time Control: Since equity fluctuates based on all open positions (or specific position sizing), execution requires constant monitoring. This often results in market orders or dynamic calculations that flatten the position as soon as the account value hits the target.

Ideal for Swing Trading and Portfolio Management: Perfect for those looking to protect cumulative gains and prevent a single "runaway" asset from exposing the account to painful drawdowns.

If you are developing on TradingView:

Use Price-Based TP if your strategy relies on chart patterns or technical indicators (e.g., RSI, Support/Resistance).

Use Equity-Based TP if you are managing a fund or if your primary goal is steady equity curve growth with minimal drawdown.

Math always beats emotions. If your script only watches the candles and ignores your portfolio, you’re only trading half the picture.

What’s your preference? Let us know in the comments! 👇

Too Good to Be True? Detecting Overfitted Strategies

That 500% Backtest Return? It's Probably Worthless.

Every trader has been there:

You build a strategy. You backtest it. The results are incredible - 80% win rate, massive returns, tiny drawdowns.

Then you trade it live. And it falls apart immediately.

Welcome to overfitting - the silent killer of trading strategies.

What Is Overfitting?

Definition:

Overfitting occurs when a model learns the noise in historical data rather than the underlying signal.

The Problem:

An overfitted strategy perfectly explains the past but has no predictive power for the future.

The Analogy:

Imagine memorizing the answers to last year's exam. You'd score 100% on that exam. But you'd fail this year's exam because you learned the specific answers, not the underlying concepts.

Why Overfitting Happens

1. Too Many Parameters

Each parameter adds flexibility

Enough parameters can fit any data perfectly

But the fit is to noise, not signal

2. Optimization on Limited Data

Small datasets have random patterns

Optimizer finds these patterns

Patterns don't repeat in new data

3. Multiple Testing

Test 100 strategies, one will look great by chance

Selection bias toward lucky results

No adjustment for multiple comparisons

4. Data Snooping

Looking at data before forming hypothesis

Unconsciously fitting to known patterns

Hypothesis formed to match data, not predict it

Signs of Overfitting

Red Flag 1: Too-Perfect Results

Win rate above 70-80%

Profit factor above 3-4

Sharpe ratio above 3

Almost no losing periods

Reality Check: Professional quant funds target Sharpe ratios of 1-2. If your backtest shows 5+, something is wrong.

Red Flag 2: Many Parameters

Strategy has 10+ adjustable parameters

Each parameter is precisely optimized

Small parameter changes dramatically affect results

Rule of Thumb: More parameters = more overfitting risk.

Red Flag 3: Complex Rules

"If RSI > 67.3 AND price > 1.23 × 17-period MA AND volume > 2.7 × average..."

Highly specific conditions

Rules that seem arbitrary

Question: Why 67.3 and not 70? Why 17 periods and not 20?

Red Flag 4: Performance Cliff

Tiny parameter changes destroy performance

Strategy only works with exact settings

No "neighborhood" of good parameters

Robust strategies: Work across a range of similar parameters.

Red Flag 5: In-Sample vs Out-of-Sample Gap

Amazing results on training data

Poor results on new data

Large performance degradation

This is the definitive test: How does it perform on data it's never seen?

How to Prevent Overfitting

Method 1: Out-of-Sample Testing

Split your data:

Training set (60-70%): Develop strategy

Validation set (15-20%): Tune parameters

Test set (15-20%): Final evaluation

Critical Rule: Never look at test set until final evaluation. Once you've seen it, it's contaminated.

Method 2: Walk-Forward Analysis

Rolling out-of-sample testing:

Train on period 1-100

Test on period 101-120

Train on period 21-120

Test on period 121-140

Continue rolling forward

Advantage: Tests strategy across multiple market conditions.

Method 3: Cross-Validation

Multiple train/test splits:

Split data into K folds

Train on K-1 folds, test on remaining fold

Repeat K times

Average results

Advantage: Uses all data for both training and testing.

Method 4: Simplicity

Fewer parameters = less overfitting risk.

Guidelines:

Start with simplest possible strategy

Add complexity only if clearly justified

Each parameter must have logical reason

Prefer round numbers (20 MA, not 17 MA)

Method 5: Multiple Markets/Timeframes

Test strategy across:

Different assets

Different timeframes

Different market conditions

Robust strategies: Work across multiple contexts, not just one specific setup.

Method 6: Statistical Significance

Ensure results aren't due to chance:

Sufficient number of trades (100+ minimum)

Statistical tests for significance

Confidence intervals on metrics

Question: Could these results have occurred by random chance?

The Overfitting Spectrum

Underfitting:

Model too simple

Misses real patterns

Poor performance on all data

Good Fit:

Captures real patterns

Ignores noise

Similar performance in-sample and out-of-sample

Overfitting:

Model too complex

Learns noise as if it were signal

Great in-sample, poor out-of-sample

The Goal: Find the sweet spot - complex enough to capture real patterns, simple enough to avoid fitting noise.

AI and Overfitting

The Double-Edged Sword:

AI/ML models are powerful but prone to overfitting:

Neural networks can fit any function

More capacity = more overfitting risk

Requires careful regularization

AI Overfitting Prevention:

Regularization: Penalize model complexity (L1, L2, dropout)

Early Stopping: Stop training before overfitting occurs

Ensemble Methods: Combine multiple models to reduce variance

Cross-Validation: Rigorous out-of-sample testing

Feature Selection: Remove irrelevant features

Real-World Overfitting Examples

Example 1: The Super Bowl Indicator

Claimed: Market direction predicted by Super Bowl winner

Reality: Spurious correlation found by data mining

Lesson: Correlation without causation is meaningless

Example 2: The Optimized Moving Average

Claimed: 17.3-period MA is optimal

Reality: 17.3 happened to work on that specific data

Lesson: Precise optimization often means overfitting

Example 3: The Multi-Condition Strategy

Claimed: 15 conditions that perfectly filter trades

Reality: Conditions were added until backtest looked good

Lesson: Adding conditions to improve backtest is curve fitting

Overfitting Checklist

Before trusting any backtest:

Is the win rate/Sharpe ratio suspiciously high?

How many parameters does the strategy have?

Are the parameter values round numbers or suspiciously precise?

Does performance survive small parameter changes?

Has it been tested out-of-sample?

Does it work on multiple assets/timeframes?

Is there a logical reason for each rule?

Are there enough trades for statistical significance?

The Honest Backtest

What to Report:

In-sample AND out-of-sample results

Number of parameters

Number of strategies tested before finding this one

Confidence intervals on metrics

Performance across different market conditions

What to Expect:

Out-of-sample performance will be worse than in-sample

This is normal and expected

A 20-30% degradation is typical

If no degradation, be suspicious

Key Takeaways

Overfitting means learning noise instead of signal - perfect backtests that fail live

Red flags: too-perfect results, many parameters, complex rules, performance cliffs

Prevention: out-of-sample testing, walk-forward analysis, simplicity, multiple markets

AI models are especially prone to overfitting - require careful regularization

Expect out-of-sample performance to be worse than in-sample - that's normal

Your Turn

Have you ever been burned by an overfitted strategy?

How do you validate your strategies before trading them live?

Share your experience below 👇

Alerts on TradingViewAlerts are most effective when they prepare decisions rather than provoke them. Many traders treat alerts as entry signals. When a notification fires, they rush to execute, skip validation, and react emotionally to price movement. A disciplined approach uses alerts as filters. Their role is to narrow attention and bring focus only to situations that deserve evaluation.

The first step is defining what actually matters in your process. Higher-timeframe levels, key liquidity zones, session opens, volatility expansions, or structural boundaries are valid alert triggers. These elements describe context, not execution. An alert should tell you that conditions may be forming, not that a trade should be taken. Its purpose is to invite analysis, not force action.

Alert placement must reflect your system logic. Setting alerts on random prices or short-term fluctuations defeats their purpose. Each alert should be tied to a specific condition that already exists in your playbook. If you cannot explain why an alert exists, it should not exist. This keeps your attention selective and your workflow intentional.

Timing is another critical factor. Candle-close alerts reduce noise and enforce patience by confirming that a condition has actually been accepted by the market. They are well suited for rule-based and higher-timeframe systems. Intrabar alerts provide speed but demand strong discipline and clear rules to avoid impulsive execution. Alert timing should match the pace of your strategy, not your desire to feel active.

Context must be built into every alert. A short description explaining why the level or condition matters anchors your thinking when the notification appears. Instead of reacting, you are reminded of the broader framework. When an alert fires, the correct response is checklist validation: context confirmed, conditions present, risk acceptable. Execution is the final step, not the first.

Alerts also play an important role in risk control. Notifications for daily loss limits, session cutoffs, scheduled market opens, or abnormal volatility shifts turn risk management into a proactive layer. These alerts protect the process by enforcing boundaries before damage occurs.

Well-designed alerts reduce screen time, overtrading, and emotional fatigue. They allow you to stay prepared without being constantly engaged. When alerts are used as decision filters, they support discipline, reinforce structure, and help maintain consistency across changing market conditions.

SEDG SolarEdge Technologies Options Ahead of EarningsIf you haven`t bought the dip on SEDG:

Now analyzing the options chain and the chart patterns of SEDG SolarEdge prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-4-17,

for a premium of approximately $3.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Keysight’s Strategic Leap: SOS Enterprise and the AI Data RevoluThe Technological Pivot: Mastering AI Readiness

Keysight Technologies has redefined its market position with the launch of SOS Enterprise. This platform addresses a critical bottleneck in the semiconductor and electronics industries: dirty data. Engineering teams frequently struggle with fragmented files that stall artificial intelligence adoption. SOS Enterprise automates governance and traceability, converting chaotic design files into "AI-ready" assets. This move signals a decisive shift from pure hardware testing to holistic software solutions. Investors must recognize this as a high-margin, recurring revenue play that creates deep ecosystem stickiness.

Geopolitics and Geostrategy: Navigating the Chip Wars

Global trade tensions heavily influence Keysight's operational landscape. The ongoing US-China semiconductor rivalry necessitates strict intellectual property (IP) control. SOS Enterprise directly mitigates geopolitical risk by offering region-specific compliance and geofencing. Companies can now enforce data sovereignty, ensuring sensitive designs remain within authorized borders. This capability becomes a strategic asset for defense and aerospace clients navigating International Traffic in Arms Regulations (ITAR). Keysight effectively monetizes global instability by selling the shield that protects sovereign tech assets.

Industry Trends: The 6G and AI Convergence

The industry is racing toward 6G and autonomous systems, requiring unprecedented simulation complexity. Traditional manual data management fails under this weight. Keysight capitalizes on this trend by integrating design data management with its dominance in radio frequency (RF) testing. The market demands speed; SOS Enterprise accelerates time-to-market by enabling reliable IP reuse. This alignment with the "speed-to-innovation" megatrend ensures Keysight remains indispensable to top-tier chipmakers like NVIDIA and Qualcomm.

Business Models: The Software Transformation

Keysight is aggressively decoupling its growth from hardware cycles. The introduction of SOS Enterprise exemplifies a transition toward Software-as-a-Service (SaaS) dynamics. Hardware sales are cyclical and capital-intensive; software licenses offer predictable, scalable cash flow. This evolution commands a higher valuation multiple from Wall Street. Analysts project that software-driven workflows will stabilize earnings during hardware inventory corrections. The company is successfully building a "moat" where the cost of switching providers becomes prohibitively high.

Management and Leadership: Visionary Execution

CEO Satish Dhanasekaran demonstrates astute leadership by targeting the "soft spots" of engineering workflows. Management understands that hardware excellence is commoditized without superior data orchestration. Their acquisition strategy and internal R&D now prioritize the digital thread connecting design to test. This foresight positions the company ahead of competitors who remain fixated solely on physical measurement. Leadership’s ability to execute this software pivot without alienating its core hardware base is a testament to disciplined operational governance.

Macroeconomics and Economics: Resilience in Volatility

High interest rates typically dampen capital expenditures in R&D-heavy sectors. However, efficiency tools like SOS Enterprise become essential during economic tightening. Companies adopt automation to reduce headcount costs and error rates when budgets are tight. Keysight’s solution offers a deflationary force for its clients, promising lower operational costs. Consequently, the stock shows resilience against macroeconomic headwinds, as the value proposition shifts from "capacity expansion" to "efficiency optimization."

Cyber Security and Patent Analysis: Protecting the Crown Jewels

In the high-tech sector, a company’s valuation relies heavily on its patent portfolio. SOS Enterprise acts as a vault for this intellectual capital. By tracking the lineage of every design file, Keysight provides a forensic audit trail that deters IP theft. This feature is critical for clients facing cyber espionage threats. From a patent perspective, Keysight continues to file aggressively in EDA (Electronic Design Automation) and signal processing. This legal fortification secures their dominance in the test-and-measurement niche against emerging rivals.

Scientific Innovation: The Physics of Data

Keysight’s roots lie in the hard sciences, physics, and electromagnetics. SOS Enterprise bridges the gap between theoretical physics simulations and real-world empirical data. It ensures that the massive datasets generated by oscilloscopes and network analyzers are usable for machine learning training. This scientific integrity differentiates Keysight from generic IT data firms. They understand the physics of the signals, making their data governance tools scientifically superior for engineering applications.

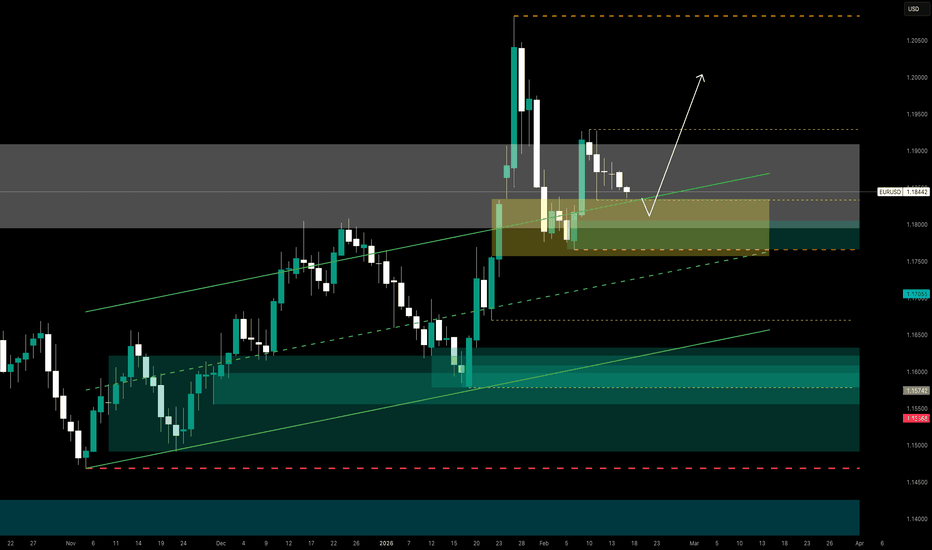

EUR/USD Pullback Into Institutional Demand - Smart Money LongLooking at the latest COT report, I continue to see a structural backdrop that favors the Euro. Non-commercial traders remain heavily net long, with 318,704 long contracts versus 138,399 shorts. More importantly, longs increased by over 16,000 contracts in the latest release, a behavior that reflects accumulation rather than distribution. Commercial players are heavily short, but this is typical during medium-term bullish phases, as institutions hedge currency exposure. At this stage, I do not see positioning extremes that would normally precede a major reversal, which keeps my bias moderately bullish.

The Dollar Index reinforces this view. The market is slightly net short USD, with long contracts declining while shorts remain elevated. This signals a lack of conviction behind any potential dollar strength. When I combine relative Euro strength with fragile USD positioning, the result is an environment that supports further upside in EUR/USD.

From a seasonality perspective, February tends to be neutral to slightly negative, but the intra-month pattern is more telling: the Euro often softens early in the month before stabilizing later on. The current pullback fits perfectly within this framework and appears more like a healthy pause than the start of a reversal.

Technically, the daily chart still shows a clean ascending structure. Price has retraced directly into a demand zone aligned with trendline support, with no structural lower low printed so far. The cooling momentum looks constructive rather than bearish. The 1.1780–1.1820 area stands out as a classic institutional reload zone, and as long as price holds above 1.1700, the broader structure remains intact.

From a trading perspective, I favor a buy-the-pullback scenario, targeting 1.1950 initially, with a possible extension toward 1.2050. Only a decisive break below 1.1700 would shift the outlook and expose a deeper rotation toward 1.1600, but for now, this remains a secondary scenario.

In summary, this is the type of environment where inexperienced traders tend to look for shorts after a visible rejection, while professionals focus on discounted long opportunities. Strong trends rarely reverse abruptly, they correct through time and pullbacks.

At present, nothing across positioning, seasonality, or market structure supports aggressive Euro selling. My bias remains clear: buy the dips until the structure breaks.

U.S. Dollar Index (DXY) – 1H Technical AnalysisU.S. Dollar Index (DXY) – 1H Technical Analysis

Timeframe: 1-Hour Chart

1. Market Structure Overview

The DXY is currently trading around 96.83, following a clear rejection from major higher-timeframe resistance near 97.80–98.00. Price has transitioned from a bullish structure into a short-term bearish phase after:

A double rejection at the main resistance zone

A confirmed breakout failure above prior resistance (~97.20)

A subsequent Change of Character (CHoCH) signaling momentum shift

The broader structure shows distribution at highs and a controlled decline toward key support.

2. Key Technical Zones

🔵 Main Resistance: 97.75 – 98.00

Strong supply zone

Multiple rejections (circled areas)

Likely institutional distribution

Remains valid until clean breakout and sustained acceptance above

🔵 Intermediate Resistance: ~97.20

Prior breakout level turned resistance

Clean rejection after retest

Now acting as short-term upside target

🟢 Main Support: 96.30 – 96.50

Higher-timeframe demand zone

Recent bullish reaction (long lower wick + impulse bounce)

Currently defending downside

3. Smart Money Concepts (SMC) Perspective

FVG (Fair Value Gap) formed during previous bullish leg — later mitigated.

Break of Structure (BOS) occurred to the downside after resistance rejection.

CHoCH confirms short-term bullish attempt after support reaction.

Liquidity likely rests:

Below 96.30 (sell-side liquidity)

Above 97.20 (buy-side liquidity)

Market appears to be in a range compression phase between 96.40 and 97.20 before expansion.

4. Current Price Behavior

Price is consolidating above main support after a sharp rebound. The structure suggests:

Short-term accumulation near support

Potential liquidity sweep toward 96.40 before expansion

Compression pattern often precedes impulsive move

Momentum is neutral-to-slightly bullish on lower timeframe after support defense.

5. Trading Scenarios

🟢 Bullish Scenario (Preferred While Above 96.30)

Potential dip into 96.40–96.50 (liquidity grab)

Bullish confirmation on lower timeframe

Target 1: 97.00

Target 2: 97.20 (range high / resistance)

Extended target: 97.75 (main resistance)

Invalidation: Sustained break and close below 96.30.

🔴 Bearish Scenario

If 96.30 breaks decisively:

Liquidity flush toward 96.00–95.80

Continuation of short-term bearish structure

Broader correction within higher timeframe distribution

6. Conclusion

The DXY is trading inside a defined range between 96.30 (support) and 97.20 (resistance) after rejecting major higher-timeframe supply at 98.00.

Current structure favors a short-term bullish retracement toward 97.20, provided support continues to hold. However, the broader context still reflects distribution near major resistance, meaning upside may remain corrective unless 97.75–98.00 is reclaimed.

Disclaimer

This analysis is provided for educational purposes only and does not constitute financial, investment, or trading advice. The information presented is based on technical analysis and market structure interpretation at the time of writing. Financial markets involve risk, and past performance is not indicative of future results. Always conduct your own research and consult with a licensed financial advisor before making any trading or investment decisions.

Hype in this exact momentHype on 1min on this exact time. Well, not really right now, because it took me 5 minutes to make the screenshots and write. So this is how i keep an open position on 1 min timeframe. I did not see much order flow trading on this platform so i wanted to share how I work. This is managing an open long position and looking at the sell vs buy delta levels if they hold , or we lose that price, to place myself in a better spot for exit. As showed in the screenshots I set the contracts to be a high number of HYPE so the delta green - red becomes that number of high contracts. The faded cyan and purple delta is also delta but with low number of contracts, so im not interested in those levels. If you cant scroll in the chart i will try to put the screenshots in notes at the bottom. If this is helpful please leave a like.

OKB: recovery or further decline? key levels to watch todayOKB. Still recovering from that brutal liquidation crash? After the wipeout and all the talk about compensations and “risk controls” according to industry sources, the market is clearly in trust‑rebuild mode, and OKB is trading like a wounded alt. That’s why this sideways chop here matters a lot: it’s either a base for recovery or just a pause before the next leg down.

On the 4H chart price is stuck under local resistance around 75‑77 with a flat, heavy range and RSI failing to get back above 50. Volume profile shows a fat node right here and a vacuum below, while all the serious supply zones sit much higher near 95‑110. That combo makes me lean to the downside over the next days, expecting sellers to press again once this support gives up.

My base plan: if 72 breaks and flips to resistance, I see room toward 68 and then the green demand area near 60 ✅ I’m watching shorts from the upper edge of the range with a tight invalidation above 80. Alternative: if buyers suddenly reclaim 80 and hold a 4H close, that opens the door for a squeeze into 90‑95 and I step aside or rethink long. I might be wrong, but ignoring risk here is how accounts get flash‑crashed too ⚠️