Structure

Market Re-cap and structure of the dayMarket Type: Breakout → Trend Day Up

Bias: Bullish once PDH reclaimed

Result: + $128 | 4W / 1L

Key Levels I respected

PDH: 25,844.75

NY AM High: ~25,880

POI ladder acted as clean targets + reaction zones (POI4/5/6 area)

What price did today (simple)

Early AM was choppy / ORB filters blocked some entries (good… no forced trades).

Once price reclaimed PDH, it confirmed buyers.

Breakout pushed into NY AM High, then we got continuation candles = the edge window.

Later in the day, entries started showing “too late / low volume” → that’s the sign momentum is extended and risk increases.

My best trades / why they worked

✅ Took longs after PDH reclaim + strength candles

✅ Used POIs as targets, not hope

✅ Stayed with the trend during the best time window

The mistake (and the lesson)

❌ One late trade = reduced edge (post push / extension / “too late” conditions)

Rule reminder: If the system is warning “too late,” either size down or shut it down.

What I’m focused on next session

Wait for PDH reclaim + pullback continuation

Don’t chase after big candles

Trade the clean window, protect the green

Zcash: Mapping the Multi-Layer Retest | Path to Trendline RetestZcash will enter a critical decision phase if price falls and holds under $491, which suggests a potential shift in momentum that places us in a consolidation range. We would then be operating within a consolidation box potentially. My focus is on the multi-layered support structure below us.

Near-Term Bullish Structure: We must hold the $473–$479 area. A bounce and break back above the 490s here keeps the immediate momentum intact.

The Fake-out Risk: Watch $468 closely. "Prior highs become support" logic suggests a bounce point, Could be a potential fake-out zone to catch late shorts chasing a trendline breakdown—don't get trapped.

The Mid-Layer: Below the potential fake-out zone, we have a secondary structural layer encompassing the prior and secondary highs.

The Macro Target: The actual trendline retest—and the highest-probability entry—sits in the $432–$435 confluence zone. This is the 3rd layer where the full breakout logic is truly tested.

⚠️ Risk Management & Invalidation

While the outlook remains constructive above the trendline, we must respect the downside risk:

The Red Flag: If price falls and closes under $425, the bullish retest thesis is under significant pressure.

Structural Breakdown: A break under the $390–$405 zone would suggest that the probability of a further breakdown has increased significantly.

The "C-Wave" Scenario: Losing the $390 level could trigger a major C-Wave correction, potentially leading to a deep retracement as low as the mid-$200s.

AUDCAD - HTF Bullish | Engineered Pullback | Speculation PhaseBias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Manipulation → Correction → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

AUDCAD remains bullish on the higher timeframe, keeping the expectation for continuation valid.

⸻

Mid-Term Structure & Liquidity

Price first swept mid-term inducement, then mitigated into a mid-term order block, ultimately rotating into the orange HTF order block located on the left side of the chart.

From that zone:

• Accumulation began to form

• Buyers stepped in

• Price delivered a clean expansion

⸻

Market Cycle Behavior

Following expansion, price transitioned into a distribution phase, accompanied by manipulative behavior.

At this stage, I’m waiting for price to:

• Exhaust the manipulation

• Sweep internal liquidity

• Potentially clear external liquidity

• Rotate back into the accumulation area

This aligns with how the market often engineers continuation within a bullish structure.

⸻

Forward Expectation

If price returns into accumulation and holds:

• I’ll be looking for a corrective phase

• Followed by delivery in line with the HTF bullish bias

Execution will depend on confirmation, not assumption.

⸻

Mindset

This remains speculation mode.

Patience is the key.

Tracking is the edge.

Structure engineers the move.

Until price confirms, we stay patient and let the market do the work.

Let’s go. 📈🔥

USDCAD - HTF Bullish | Liquidity Sweeps Complete | Tracking Bias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Correction → Delivery

State: Tracking / Speculation

Execution: Conditional

⸻

Higher Timeframe Context

USDCAD remains bullish on the higher timeframe.

Although price has traded into the mid-term range, this is acceptable within a bullish framework — this is why we track, not rush.

⸻

Liquidity & Market Work

Price has already:

• Swept internal dealing range (IDM) liquidity

• Cleared external range liquidity

• Taken HTF minor liquidity

This is advanced market work, and it’s exactly why patience and tracking are the edge — the market is doing the heavy lifting.

⸻

Price Behavior & Cycle Read

From a higher-timeframe perspective, price delivered a wick tap, signaling reaction at a key level.

From there, we observed:

• Accumulation

• Followed by expansion

• Transition into distribution

Price is now correcting, positioning itself for the next delivery phase.

⸻

Forward Outlook

At this stage, I’m not forcing a bias on execution.

I’ll continue to track how price unfolds over the coming sessions, allowing structure and liquidity to confirm the next move.

⸻

Mindset

This is speculation territory.

Patience is the key.

Tracking is the edge.

Let the market do the work.

We’ll see how it develops this week.

Let’s go. 📈🔥

USDCHF - HTF Bullish | Range Behavior | Conditional ContinuationBias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Correction → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

USDCHF remains bullish from previous weeks, with the higher timeframe structure holding firm.

Price continues to trade within a defined range, respecting the broader bullish framework.

⸻

Mid-Term Structure & Reaction

Price previously accumulated and mitigated into a mid-term order block (orange zone, left of chart), where buyers showed up with a clean bullish reaction.

From that zone:

• Accumulation formed

• A strong bullish push followed

• Leading into a clear expansion phase

⸻

Distribution & Current Behavior

Following expansion, price transitioned into a distribution phase.

Selling pressure pushed price lower, but it quickly bounced back into the accumulation area, forming what now appears to be a correction zone, not a reversal.

This behavior suggests rebalancing, not structural failure.

⸻

Execution Scenarios

From here, I’m watching two potential paths:

Scenario 1 — Deeper Correction

• Price sweeps sell-side liquidity on lower timeframes

• Trades into the green accumulation / pivot order block

• Buyers step in, leaving clear bullish footprints

• Buy opportunities considered from that zone

Scenario 2 — Strength Continuation

• Price shows strong momentum

• Fully breaks the mid-term lower high

• Confirms bullish realignment without deeper discount

In both cases, liquidity must be taken before execution is considered.

⸻

Mindset

This is still speculation territory.

Patience is the key.

Tracking is the edge.

Structure leads execution.

Until confirmation prints, we wait.

Let smart money show the hand. Let’s go. 📈🔥

EURUSD - HTF Bullish|Patience Over Prediction|Tracking The CycleBias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Mitigation → Delivery

State: Tracking / Speculation

Execution: Conditional

⸻

Higher Timeframe Context

EURUSD remains bullish on the higher timeframe, and this has not changed.

This is why I consistently stress one thing across every post:

Tracking is the edge. Patience is the key.

A lot of traders got burned here — not because structure failed, but because they rushed the phase.

⸻

Market Cycle Read

Price has clearly fallen out of the distribution phase, something that was visible early for those tracking structure instead of chasing moves.

We saw:

• A clean expansion out of the accumulation area

• Confirmation that buyers were still active

• Proof that the higher-timeframe bullish narrative remained intact

Fast hands paid the price. Patient hands followed the footprints.

⸻

Mid-Term Structure Alignment

Mid-term structure rotated exactly where it was meant to:

• Into the HTF internal framework structure order block

• A lower high was broken, confirming bullish realignment

• A new high was printed, followed by a minor reaction

This reaction is information, not weakness.

⸻

Current Focus

From the recent accumulation → expansion → distribution, price is now disputing away, suggesting the market is preparing for its next corrective phase.

What I want to see next:

• Full mitigation back into the accumulation zone

• Additional timeframe confirmation

• Alignment before targeting higher highs

No chasing. No guessing.

⸻

Mindset

Beginners react late.

Professionals follow clues and footprints.

Patience is the key.

Tracking is the edge.

Structure never lies.

Until price gives confirmation, we wait.

Let smart money lead. Let’s go. 📈🔥

EURGBP - HTF Bullish Structure | Mitigation into Accumulation |EURGBP — HTF Bullish Structure | Mitigation into Accumulation | Speculation Phase

Bias: Bullish (Higher Timeframe)

Model: Accumulation → Expansion → Distribution → Mitigation → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

EURGBP remains bullish on the higher timeframe, with overall mappings unchanged from previous weeks.

Structure continues to hold bullish, keeping the directional bias intact.

⸻

Mid-Term Behavior

On the mid-term, price has shown distribution behavior, clearly marked in red, which has disrespected the prior internal cycle and cleared the path for rebalancing.

This move is viewed as a corrective phase, not a reversal.

⸻

Market Theory & Point of Interest

From a bullish auction theory perspective, price is rotating back into a higher-timeframe internal framework structure order block — the same accumulation area that previously fueled expansion.

This zone remains the key point of interest.

⸻

Execution Plan

Once price achieves full mitigation into this test area, I’ll be looking for:

• Stabilization within the POI

• A corrective reaction to the upside

• Conditions aligning for continuation delivery higher, in line with the HTF bullish bias

Lower timeframes must show bullish realignment before execution.

⸻

Mindset

For now, this remains speculation only.

Patience is needed.

Tracking is the edge.

Let structure lead.

Until then, we wait for confirmation — not prediction.

Let’s go. 📈🔥

HTF Bullish | AMD in Play | Speculation PhaseBias: Bullish (Higher Timeframe)

Model: Accumulation → Manipulation → Distribution → Mitigation → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

As price is visualized on the higher timeframes, the market remains in a bullish phase, with structure continuously breaking to the upside.

Price has expanded aggressively and is currently holding near the highs, reinforcing bullish control.

⸻

Market Cycle Read

Although price appears to be in a distribution zone following expansion, the structure aligns cleanly with an AMD model:

• Accumulation formed at the base

• Manipulation cleared liquidity

• Distribution delivering price lower

This suggests the current pause is part of a healthy cycle, not exhaustion.

⸻

Framework & Point of Interest

If price distributes back into the internal framework structure / order block area, that zone becomes the focus.

From there, I’ll be watching for:

• Stabilization and mitigation

• A corrective phase

• Conditions aligning for continuation of delivery within the broader bullish cycle

⸻

Execution Conditions (LTF)

Lower timeframes must show bullish realignment before participation:

• Bullish reaction from the POI

• Bearish structure invalidation (lower high break)

• Pullback forming a new accumulation buy zone

⸻

Mindset

For now, this is speculation only.

Patience is the key.

Tracking is the edge.

Let smart money lead.

Until then, we wait for confirmation — not prediction.

Let’s go. 📈🔥

GBPJPY - HTF Bullish | High-Range Consolidation | Distribution Bias: Bullish (Higher Timeframe)

Model: Consolidation → Distribution → Mitigation → Realignment → Delivery

State: Speculation / Tracking

Execution: Conditional

⸻

Higher Timeframe Context

GBPJPY remains bullish on the higher timeframe, showing strong continuation characteristics.

Structurally, this setup closely mirrors AUDJPY, with price currently holding near the highs.

⸻

Current Phase

Price is consolidating at premium levels, which increases the probability of a distribution phase.

From here, I’m anticipating a potential move lower to fill inefficiencies resting beneath price.

This would be a healthy corrective move, not a bearish shift.

⸻

HTF / Mid-Term Point of Interest

Below current price:

• Liquidity rests above and around key levels

• Order blocks sit underneath that liquidity

• Clear inducement present

If price drops into this zone and mitigates cleanly, that area becomes the focus for continuation.

⸻

Lower Timeframe Plan (Realignment)

Within the accumulation area, I’ll be watching lower timeframes for bullish realignment:

Required confirmations:

• A bullish reaction from the POI

• A lower high being broken (bearish structure invalidation)

• A pullback on the bullish leg, forming a new accumulation buy zone

➡️ This would open the door for the next delivery leg higher.

⸻

Invalidation

If price:

• Fails to show bullish reaction

• Continues to respect bearish structure

• Does not break the lower high

➡️ No longs taken. Price likely seeks deeper discount.

⸻

Mindset

Currently in speculation mode.

Patience is the key.

Tracking is the edge.

Structure leads execution.

Until then — we wait and let price confirm. Let’s go. 📈🔥

AUDJPY - HTF Bullish | Distribution * Mitigation Watch Bias: Bullish (Higher Timeframe)

Model: Expansion → Distribution → Mitigation → Delivery

Execution: Conditional

State: Patience / Tracking

⸻

Higher Timeframe Context

AUDJPY remains bullish on the higher timeframe, with structure consistently printing higher highs.

Directional bias remains intact — no HTF structural damage at this stage.

⸻

Current Phase

After expanding into the highs, price has entered a distribution zone, showing signs of manipulative behavior.

This suggests price may dispute lower to rebalance inefficiencies before the next move.

⸻

Mid-Term Point of Interest

I’m watching for a potential move into a mid-term order block / point of interest.

From this zone, I want to see:

• Stabilization and holding behavior

• A clean correction phase

• Conditions forming for the next delivery leg higher

⸻

Lower Timeframe Conditions

If on the lower timeframes:

• Structure fails to hold

• A lower high is broken

• Bullish confluences do not print

➡️ Then this becomes a no-trade environment.

In that case, price is likely seeking deeper liquidity and more discounted territory before continuation.

⸻

Mindset

Currently in speculation mode.

Patience is the key.

Tracking is the edge.

Structure leads.

That’s the money lead.

Until then — we let price show its hand. 📈🔥

USDJPY - Bullish Continuation | HTF Control | Patience PhaseBias: Bullish

Structure: Higher Timeframe Continuation

Timeframes: HTF / Mid-Term / LTF

⸻

Higher Timeframe Context

USDJPY remains bullish, with higher-timeframe mappings unchanged from previous weeks.

Price continues to respect and trade within HTF structure, confirming directional control remains intact.

⸻

Mid-Term Perspective

On the mid-term, price completed a clean mitigation, which has been held since last week, followed by continued expansion.

This reinforces that buyers remain in control and that the broader bullish narrative is still valid.

⸻

Current State

Price continues to press toward highs, maintaining bullish momentum.

No structural damage has occurred — this is continuation, not reversal.

⸻

Lower Timeframe Plan

At the moment, I am waiting for a second-entry opportunity.

Execution plan:

• Allow price to distribute

• Look for a return into a prior accumulation area

• Once mitigation is complete, buy points will be considered

This will be the operating mood for the upcoming week.

⸻

Mindset

Currently in speculation mode.

No chasing. No forcing.

Patience is the key. Tracking is the edge.

Let price come to us. 📈🔥

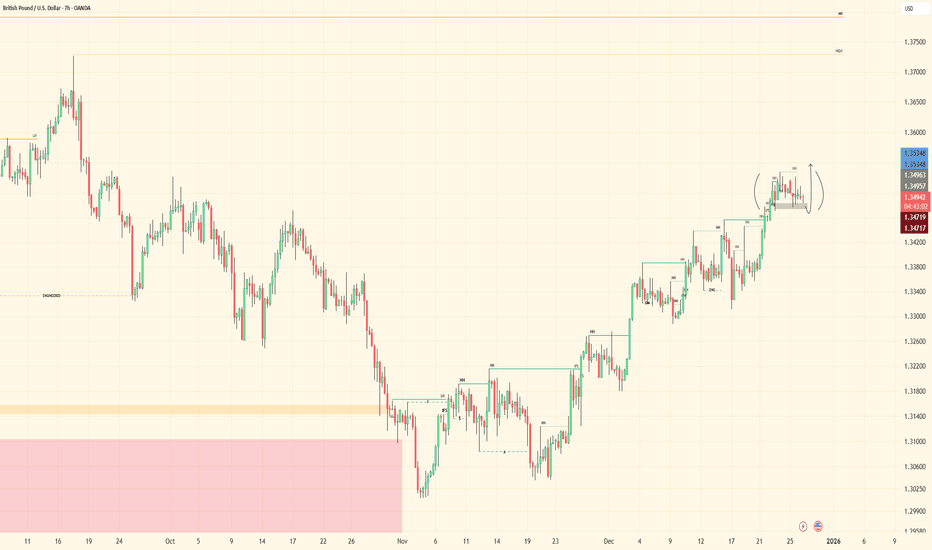

GBPUSD - Bullish Structure | HTF POI Alignment | Patience PhaseBias: Bullish

Model: Accumulation → Delivery → Mitigation → Expansion

Timeframes: Daily / 4H / 30M / 5M

⸻

HTF Context (Daily)

GBPUSD remains in bullish market structure, with a major Daily high broken, confirming higher-timeframe continuation.

The red order flow provides directional confluence, and price has already shown a clean bullish reaction from this HTF point of interest.

Following that reaction, we observed accumulation forming, which successfully delivered price higher — validating bullish intent.

⸻

Mid-Term Structure (4H / 30M)

From an internal perspective (blue micro structure), price respected internal structure, accumulated, and then broke out, confirming participation from buyers.

Buyers accumulated from a key pivot, delivered expansion, and distributed, before price mitigated back into the origin of orders — a classic revisit of a higher-timeframe POI.

Zooming out to the mid-term perspective, a lower high was taken, followed by a manipulative push, leading to redistribution into the orange POI.

This orange zone aligns with:

• Daily HTF POI

• Mid-term reaction zone

• Internal accumulation (blue)

➡️ Triple confluence zone = stronger probability accumulation area.

⸻

Current State (Execution Phase)

From this aligned accumulation zone, price has already shown a strong expansion, confirming buyers are active.

At the moment:

• Price is in a pause / corrective phase

• I am waiting for minor sell-side liquidity to be taken

• Looking for full mitigation into a minor accumulation area

This is not entry time yet — this is tracking time.

⸻

LTF Plan (5M Execution)

Once price completes mitigation:

• I’ll look for 5M structure confirmation

• Entry will be based on accumulation → expansion logic

• Targeting continuation toward higher highs

Until then:

Patience is the edge. Tracking is the work.

⸻

Final Notes

I’m currently in speculation mode, allowing price to show its hand before committing.

No rushing. No forcing. Letting structure do the talking.

4H → 30M → 5M execution model in play.

Let it come to us. 💪📈

FJET - Gaps, Demand & the Next Decision Point!📊Markets don’t move randomly... they react to unfinished business.

📈After the explosive post-listing move , Starfighters Space AMEX:FJET left a clear price gap above ($23 - $24 area), followed by a controlled pullback into a well-defined demand zone around the $8 – $9 area.

Since then, price has been compressing inside a descending channel, reflecting short-term bearish pressure rather than structural weakness.

What matters now is context 👇

This pullback is happening after an impulse.

📈 What's Next?

FJET is approaching the lower end of the falling channel while sitting on higher-timeframe demand.

This creates a classic decision zone:

– Hold demand → structure shifts bullish

– Lose demand → deeper correction before continuation

A critical factor will be how price reacts near the lower channel boundary. A reclaim of structure would open the door for a rotation higher, with the gap zone above acting as a price magnet. 🧲

A sustained break above the falling channel (marked in red) would signal a transition in momentum from bearish to bullish.📉📈

💡 Why This Matters

Gaps often act like unfinished chapters in the market. When structure stabilizes, price tends to revisit them, not because of hope, but because of order flow mechanics.

The plan is to wait for price confirmation and then follow the trend.

⚠️ Disclaimer: This is not financial advice. Always do your own research and speak with your financial advisor before investing.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~ Richard Nasr

Disclaimer: I have been paid $1,000 by CDMG, funded by Starfighters Space, to disseminate this message.

BTCUSD.P — Wick Above High ≠ Bullish Break of Structure📌 BTCUSD.P — Wick Above High ≠ Bullish Break of Structure

Timeframe: 15m

Market: BTC Perpetual (Bybit)

🧠 Key Observation

Price did not break structure bullishly here.

Although BTC wicked above the prior high, there was no full-bodied close above the previous high’s wick. That distinction matters.

A wick alone shows reach.

Structure requires acceptance.

🔍 What This Means

The prior high was tested and liquidity was taken

Buyers failed to secure a close above resistance

Price immediately stalled rather than expanding

This behavior is consistent with a liquidity sweep, not a confirmed bullish shift in market structure.

⚠️ Why Early Longs Are Dangerous Here

Entering long on the first touch or wick break:

Assumes continuation before confirmation

Exposes the trade to a sweep-and-reverse scenario

Treats intent as fact

In this context, an early long can easily become exit liquidity.

✅ What a Real Bullish Break Would Require

For this to qualify as a valid Bullish BoS:

A decisive candle body close above the previous high’s wick

Follow-through or acceptance above the level

No immediate reclaim back below resistance

Until then, structure remains unbroken.

🧭 Execution Guidance

Patience > prediction

Let the market prove acceptance

If price reclaims the level with strength, bias can flip

If price rejects, the sweep thesis gains validity

Structure is not about being early.

It’s about being right after confirmation.

🧾 Final Thought

Wicks hunt liquidity.

Bodies establish control.

Knowing the difference keeps you solvent.

❗ Disclaimer

Educational purposes only.

Not financial advice.

GBPUSD - Bullish ContinuationHTF structure remains bullish with price respecting higher-timeframe flow. The market continues to hold strength, and the overall narrative hasn’t changed — buyers remain in control.

Two positions are currently active, both aligned with the prevailing structure. I’m now simply waiting for continuation delivery as price works through its next phase. No rush, no forcing entries — just letting the market unfold as intended.

Structure is respected, bias remains intact, and momentum favors continuation.

Patience is key.

Tracking is the edge.

Let’s go. 🔥

AUDCAD - Bullish BiasHTF (4H) remains within a bullish range, consolidating near highs with strong volume support favoring continuation.

On the 30M, the OB has been mitigated from the marked zone, and we’re seeing LTF reaction off that area.

LTF (5M): still tracking alignment — waiting for a clean sweep into the OB before executing. Once that happens, I’ll look for confirmation to enter.

Patience is key.

Tracking is the edge.

Let’s go. 🔥

USDCAD - Bullish BiasHTF (4H) structure remains bullish. I’ve mapped it from the Daily to get a broader perspective — liquidity has been taken, leading price into a strong OB after the trap was set.

On the 30M, I’m watching for a midterm market structure shift. Once that confirms, I’ll define the internal OB and prepare for execution.

LTF (5M): after midterm alignment, I’ll wait for price to mitigate the zone, then look for a clear MSS and pullback into demand to take buy entries.

Until then, patience is key.

Tracking is the edge.

Let’s get it. 🔥

USDCHF - Bullish BiasHTF (4H) structure remains bullish, printing the same tape as last week — nothing has changed. Bulls remain in control as price was driven into a strong internal structure OB after taking out major IDM.

On the 30M, price has mitigated the OB with strong reaction off the wick, showing respect for the zone and confirming participation through volume.

LTF (5M): market structure shifts are forming, but after the initial sweep, probability isn’t fully aligned yet. I’m watching for deeper discounted territory and cleaner alignment across timeframes before engaging. All prior OBs have been mitigated — now it’s about patience and confirmation.

Until everything syncs up, I’m waiting.

Patience is key.

Tracking is the edge.

Let’s go. 🔥