Market Structure - The Chart analysis (simplified!!!)Using Market Structure to identify entries in the FX market has been a life changing technique for me. Through this video, i described my process of entering trades using MS without a single indicator in sight!!!

You'll see the following :

1. How to draw support and resistance.

2. How to identify the trends in a market ? What is a Break of Structure ?

3. Avoiding fake outs using the Law of 2's (by waiting for two consecutive HH's and HL's | LH's and LL's).

4. What is a Major Level ? Is it really useful to my analysis?

5. How to determine Take Profit using MS.....etc

Support and Resistance

Market Structure - Mastering the basics P1Hi Guys!!!

Let's talk about Market Structure in FX Trading. Taking in these concepts could be daunting for beginners but i was extremely lucky to learn from the best. Through these videos, i hope to simplify complex trading concepts.

In this video, you'd quickly learn how to identify trends and a special trick called the "Law of 2's ", useful for avoiding fakeouts in the market .

#Ladytrader

How To Trail Stop Loss Effectively | Capture All day's ActionMaximise your Day Trading Profits 5X | Apply this trade management system to hold trades all day without much effort

In this video I'm going to share with you a trade management idea which would allow you to trade and hold the trade from the start to the end of the day trading session.

The Chart I'm using is US30 / DOW30. The Time frame for day trading would be the five minute chart.

The idea is to make entries on the 5 minute chart and then use a few swings to add on.

This can become part of your Trade Plan and you can apply to any time frame or symbol of your choice. It's a great way to maximise your profits using nothing but the data provided by the market itself.

Price Action is surely The King!!! I bow....

Optimized strategy is here + Midweek outlook! part 1 Hello, in this video I go over the optimized strategy and explain my thought process when entering a trade with this smooth like butter method of trading haha.

If you're planning on trading with my strategy, feel free to ask for help and listen closely. There are key details in this video, take notes if you have to, I note in the video what is important and what is minor knowledge! thank you for watching.. please refer to part 2!

Trading the ES on 4/5/2021In this video I show you how I used the Opening Range and Initial Balance indicator to predict price.

There was one real opportunity today to catch the rally of the ES. The pullback to the top of the Initial Balance at 8 am PST was a textbook long entry.

*** I may have said NQ in the video. I meant the ES.

Drawing Support and Resistance Using Multiple Time FramesHi all,

Here is a quick tutorial on how I draw support and resistance lines. A few things to keep in mind are use multiple time frames to get a more comprehensive understanding of trend and to determine which lines are more significant than others. Also, by using these lines you can set more accurate limit orders and save money by not having to pay extra fees for market orders. It is important to NOT enter long positions as we near areas of strong resistance. We should be taking profits at those levels and entering longs when approaching lines of support. Additionally, this allows you to set a tighter stop loss because if the line of support is rejected then it invalidates the idea that the asset is increasing in value. Of course, you need to use indicators and do a more comprehensive analysis but this should be a helpful tool to help you manage risk. I plan to make more of these videos laying out trend lines, dynamic lines of support and resistance, fibonacci retracements and spiderlines etc. If there is anything you want me to provide a tutorial on please leave a comment and I will get around to it as time permits.

Best,

Brad

April 1, 2021 - Opening Range-Initial Balance Trading the NQIn this video I will show you how I took a very common setup with the OR/IB indicators. The setup is to fade the first touch of the IB range, after the range has been set. As you can see, price rejected at the IB high and came down to tag the Overnight High (the magenta line).

This trade netted about 50 points on the NQ.

HOW-TO: What happens after a completed Elliott 5 Wave sequenceIn this "How To" video, we take a look at typically what happens after a completed Elliott 5 Wave sequence, using the MTP Elliott Wave Script.

First, we must stress that finding the end of an Elliott Wave 5 sequence is inherently dangerous, because a Wave 5 is the "end of a trend", so very often overruns. So, the only time we would ever consider trying to pick the end of a Wave 5 is when there are other reasons for a possible trend reversal, for example higher time frame support / resistance. This is what we demonstrated in this example, where the market was also at Daily (higher time frame) Decision Point (using the MTP DP Script), resistance. There was also divergence in the MTP Trend oscillator (not shown specifically in the video), thus showing weakness was entering the market. As such, this should really only be used by the more experienced Advanced Traders, who have more experience with Analysing the markets. Remember, no matter how good a setup "may" look at the time, markets can, and will, go in the opposite direction, so losses can and will unfold. That is why is is vital that Stops are in the market and any inevitable losses are kept small.

Having sad that, once the Wave 5 is complete (and this is the purpose of this "How-To" Video), the market then tends to retrace to the Decision Point (using the MTP DP Script), from the prior Wave 4 swing. I.e., this is the "initial target" following the completion of the Wave 5 Swing.

Then, "if" the initial DP is exceed (as in this example), the next target would then be the Decision Point (using the MTP DP Script), from the start of the 5 wave sequence. I.e. the market then retraces the whole of the prior 5 wave sequence.

I hope this has been helpful, and shown how the more experienced Traders among you could develop your own trade setup in and around this. For example, trading off the MTP coloured reversal bar (using the MTP Analysis Script), at the Wave 5 high (which is also at higher time frame DP), with an "initial target" of the DP from the prior Wave 4. We have not shown this in this video as we wanted to keep things simple and just show the "typical" tendency of what happens after a completed 5 wave sequence.

Please note: this is not a trade recommendation, you should all perform your own Analysis. Losses can and will unfold when Trading, please always use Stops and keep your losses small.

How to Draw Support & Resistance Lines for StocksIn this video I use simple easy to learn processes to mark out support and resistance levels. And importantly analyse if buyer or sellers are currently in control of the market.

If you have found this useful then please like the post, follow my page and share with any friends you think will find it useful.

HOW-TO Multi Time Frame analysis with the MTP ScriptsIn this "How To" video, we take a look at how to use multi time frame analysis with the MTP Scripts to uncover possible trade setups.

We realize that using 15/3 min is usually a shorter time frame than most posts on TradingView, but we wanted to show that TradingView can be used on shorter time frame charts, so we are including this example on the YM. As you can see from the video, the idea is that you use the higher time frame to project your DP (MTP Decision Point) zones onto your chart. These can be placed on the chart in advance. Then when (if) the Market makes a reversal at these levels, then we deem that the Picture is clear, and that determines the larger degree trend.

We then go to the shorter time frame to then look for setups that fall in this larger degree trend direction.

Please remember that markets will be random (not in a clear pattern) just over 50% of the time, so the idea is that you only work with markets that are making reversals at the anticipated zones, ie only when the picture is clear.

Once on the shorter time frame you look for clear trade setups in the new trend direction.

As shown in the video, even when the picture is clear looses can and will unfold, that is why it is important to use Position Sizing to keep the losses small when they unfold.

I hope this video has been helpful to show how to use multi time frame analysis to uncover possible trade setups.

Please note: this is not a trade recommendation, you should all perform your own Analysis. Losses can and will unfold when Trading, please always use Stops and keep your losses small.

PS, if any of you eagle eyed viewers spotted that one of the green "MTP history triangles" disappeared later in the video, and that worried you, it was just because I had "hidden" the standard MTP trade setups script in the video to show the MTP Advanced trade setup more clearly.

STOCHASTIC LONG & RESISTANCE BECOMING SUPPORTIn this short Toot , we are using STOCHASTIC 25 ,3,3 as our main idea in culmination with RESISTANCE & SUPPORT.

* Some observations not mentioned in the vid are that these are ENTRY point observations on a time frame 4 hours and BELOW AFTER observing 4 hour time frames and ABOVE.

* Indicators are just that , they indicate possible areas of a trade / purchase. They are to be used together with other visual on chart observations like

Candle patterns , Candle Volume trend lines , Res and Supp . Never ever use an indicator as a stand alone entry .

* The stochastic is an oscillator type indicator that creates a sine wave between 0-100. The area's above 80 and below 20 are technically NOT over bought or over sold , they are over oscillated

if that makes sense .

I hope to make some more of these toot's and appreciate feedback on how I can improve them . Unfortunately I don't have a radio announcers voice so that cannot be change but

I would appreciate if they are too long/short , Too much information or too little or any questions concerning the toot . Really appreciate any newbies with questions or any pros with constructive feedback . Let's try to build a good learning space here guys , what do you think ?

How to Understand Price StructureI have put together the basics of how to read a chart without indicators.

This is a key skill for anyone who wants to become a profitable trader. Clearly theres much more that goes into reading charts than just what is here but this is the key foundations of reading how price works and how to make trade entries with a good chance of profitability.

If you have found it helpful then please Like the post / Share it with anyone you think it might help / Follow my profile so you get updated the next time I post

Basics of Chart reading and drawing support/resistances lines. Hey guys, I had people ask me how to draw support and resistance lines and also the basics of just reading a stock chart. Always work your way from outside to inside. You want to see the whole picture and not trade in a vacuum. Some people call it supply and demand zone. When I started day trading and swing trading, I started out with drawing out these lines. This is part of technical analysis. Trust me, this is one skill you will want to have and it can be very profitable if you find the right stock ticker to swing trade. I can it rinse and repeat. If you do it right, you can actually make someone's yearly pay check or even yours.

So usually I would record off my Ipad but it makes so much time to edit and upload to facebook. I'll just try this on tradingview and post on Youtube for my friends who are interested in learning the basics. If the quality of this sucks, I will use my iPad next time with cartoon Me and post on YouTube. Posting on FB takes way too long.

Next time, I will go over the basics on how RSI, Simple moving averages (SMA), and Exponential Moving Averages (EMA) works. How to read them on a chart to see if the stock is on an uptrend or downtrend. This will eliminate FOMO.

Enjoy.

HOW-TO What to look for in the MTP Volume (VS) Trade SetupIn this help Tutorial, we take a look at using the VS or Volume Spike trade setup in the MTPredictor Advanced trade setups script.

The Volume Spike or VS setup is designed to find a "fake out" when the market fails to follow though on the break of an important prior swing high or low. The idea is that professional traders look to accumulate a position in the opposite direction to the amateur traders who then get caught as the market moves sharply in the opposite direction. The MTP Decision (DP) script is used to find the level at which the reversal often occurs.

Position Sizing is used to keep the losses (and there will always be losing trades) small at -1R (one risk unit), when compared to the potential profit at the target. The profit target for the trade setup is the MTP Decision Point (DP) level from the prior swing pivot. The entry trigger is the MTP coloured reversal bar (available in the MTP Analysis script), blue for a potential buy, red for a potential sell.

The VS setup should unfold when the market "fails to follow though" to new highs or lows, after a break of a "prior important high or low", and not from a prior minor swing in the same direction.

Ideally this should unfold when the MTP Trend colour is in agreement, ie Grey, to show that the larger degree trend is in the process of making a reversal.

Please note: this is not a trade recommendation, you should all perform your own Analysis. Losses can and will unfold when Trading, please always use Stops and keep your losses small.

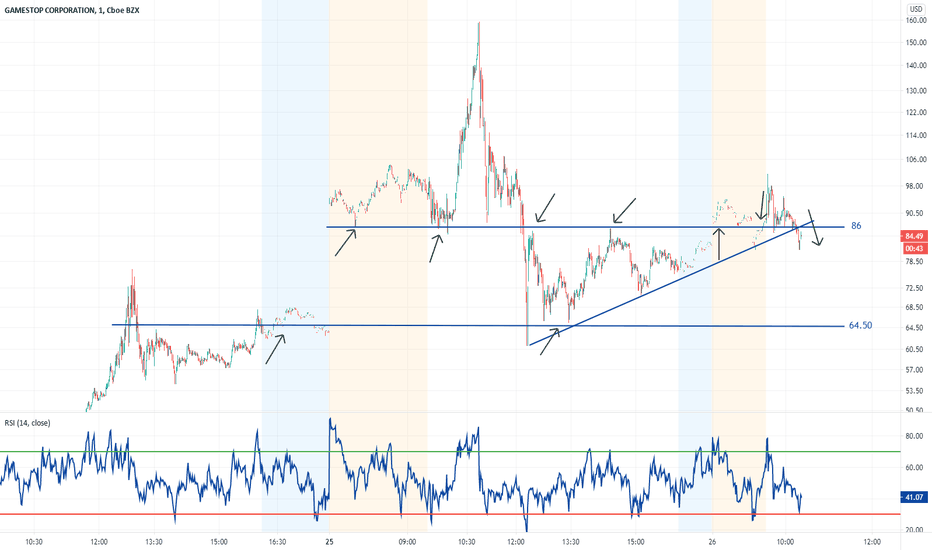

How To Correctly Draw Support And Resistance LinesWelcome Traders!

In today's trading episode, you will learn how to identify support and resistance levels on your chart. These are places where the price can do one of three things: hesitate, bounce, or breakout.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

Trading Mean Reversion & Rangebound MarketsIn this video, I outline the characteristics of environments where I'm looking for mean reversion and rangebound trades. I define what constitutes a rangebound market and how I should trade these setups from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.