Bitcoin Breaks Structure — Is a Deeper Correction Unfolding?Bitcoin (BTCUSD) on H1 has shifted from a strong bullish trend into a clear corrective phase. After failing to hold above the 94,000–94,500 resistance zone, price reversed sharply, breaking below key moving averages and confirming that upside momentum has faded.

The market is now respecting a descending trendline, with lower highs forming — a classic sign that sellers have taken short-term control. Price is currently trading below both the fast and slow moving averages, reinforcing the bearish bias.

At present, BTC is approaching a key support zone around 89,200–89,600, which previously acted as a demand base during the prior rally. This area is critical: it may trigger a short-term bounce, but a clean break below would confirm a deeper structural correction.

Bearish scenario: As long as price remains below the descending trendline and fails to reclaim 90,400, continuation toward the 89,200 support zone is likely. A confirmed breakdown would open further downside toward 87,100–86,800.

Bullish scenario: A short-term relief bounce may occur from the support zone. However, only a strong reclaim above 91,200 and acceptance back above the moving averages would invalidate the bearish setup and suggest a trend reset.

For now, Bitcoin is in sell-the-rally mode. Patience and discipline are essential — the highest-probability opportunities will come from trendline rejections or confirmed support breaks, not from chasing volatile bounces.

Technical

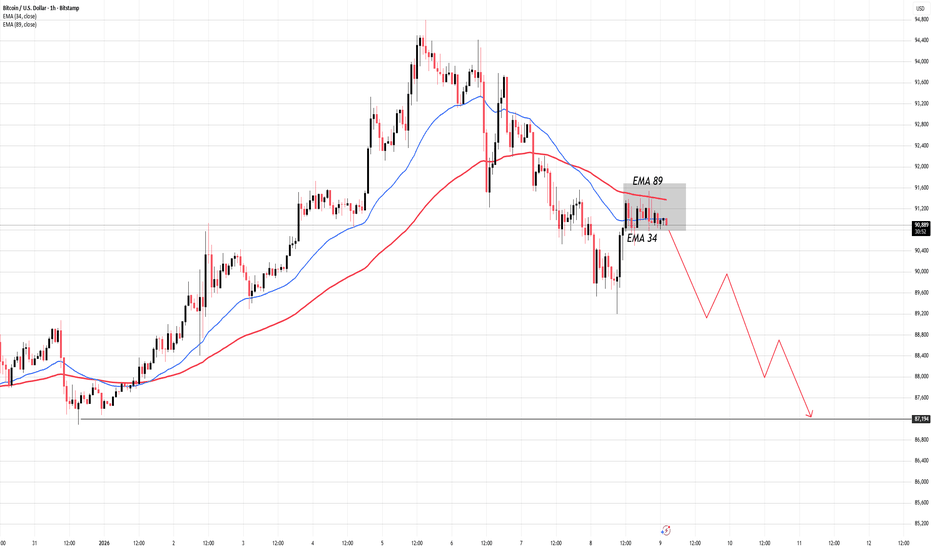

EMA Rejection in Play — Is BTC Setting Up for the Next Bearish Market Context & Structure

Bitcoin is currently trading in a clear bearish market structure on the H1 timeframe. After completing a bullish expansion, price has transitioned into a sustained downtrend, marked by a sequence of lower highs and lower lows. The recent recovery attempts are corrective in nature and have failed to reclaim prior structural levels.

At this stage, price is not showing signs of accumulation. Instead, it is consolidating below key dynamic resistance, indicating that sellers remain in control.

EMA Behavior & Price Action

Price is now reacting directly into the EMA resistance cluster, with EMA 34 acting as short-term resistance and EMA 89 as the higher dynamic ceiling. This EMA alignment is bearish:

- EMA 34 is below EMA 89

- Both EMAs are sloping downward

- Price is trading below both averages

This configuration typically supports a sell-the-rally framework, not a dip-buying environment. The current consolidation near EMA 34 reflects weak bullish momentum, often seen before continuation to the downside rather than a trend reversal.

Repeated failures to close above EMA 34, combined with rejection wicks near EMA 89, strongly suggest that buyers lack strength and that upside moves are being absorbed.

Key Levels

Dynamic Resistance:

- EMA 34 ~ 90,900

- EMA 89 ~ 91,300 (major dynamic resistance zone)

Static Support:

- 89,200 (minor reaction level)

- 87,200 – 87,400 (major downside support / liquidity target)

➡️ Primary Scenario (Bearish Continuation):

Price fails to break and accept above EMA 34–EMA 89 resistance. A rejection from this EMA zone would confirm continuation of the bearish structure, opening the path toward the 89.2k level first, followed by a deeper move into the 87.2k support zone.

This scenario aligns with classic EMA pullback continuation behavior in a downtrend.

⚠️ Risk Scenario:

If price manages a strong bullish close above EMA 89 with follow-through and acceptance, the bearish continuation thesis would be invalidated. In that case, BTC could transition into a broader consolidation or corrective recovery rather than immediate downside continuation.

BTC Coils at a Critical Breakout PointBitcoin remains within a broader bullish market structure, supported by a rising trendline that has guided price action since the impulsive breakout. After printing a local high near the 94.8k area, price has transitioned into a consolidation phase, forming a series of lower highs while still maintaining higher lows a classic compression structure within an uptrend.

This price behavior reflects temporary equilibrium rather than trend exhaustion. The market is digesting prior gains, with volatility contracting as price coils between dynamic support and descending resistance.

The ascending trendline continues to act as structural support, while the descending trendline caps upside attempts, creating a tightening triangle. Price is also hovering around the EMA 50, which has flattened and is acting as short-term balance rather than directional momentum.

This setup typically precedes expansion. As long as price holds above the rising trendline and does Key Levels

Resistance:

Descending trendline near 93.2k–93.6k

Major supply above 94.8k

Support:

Rising trendline / structural support around 92.2k–92.6k

Deeper support near 90.4k (structure invalidation)

EMA / Dynamic Level:

EMA 50 around 92.8k (short-term equilibrium)not break structure to the downside, the bullish bias remains intact.

➡️ Primary Scenario:

Price continues to compress within the triangle before breaking above the descending resistance. A confirmed breakout and acceptance above this trendline would open the path toward the 94.8k high, with potential continuation toward the 96k area as bullish momentum expands.

⚠️ Risk Scenario:

A breakdown below the rising trendline with acceptance under EMA support would invalidate the bullish continuation setup. This would likely trigger a deeper corrective move toward the 90.4k zone before the market attempts to rebuild structure.

The Bullish Counter-Strike: Can EURUSD Break the Shackles Hello everyone,

On the H1 timeframe, the key focus right now is not the volatility seen in the previous sessions, but how EURUSD is reacting after a strong rejection from the lower support zone and its subsequent push into a cluster of intermediate supply levels.

Structurally, the market has transitioned from a sharp impulsive decline into a potential trend reversal phase, marked by a V-shaped recovery off the 1.1670 lows. Currently, price is consolidating just below the 1.1730 mark, attempting to establish a higher low. The most recent candle price action shows a consolidation phase where buyers are absorbing the remaining sell-side pressure before attempting the next leg higher.

Following the aggressive bounce from the primary Support Zone, EURUSD is now rotating toward the first major hurdle around the 1.1742–1.1754 range. This area is technically important: it represents a prior breakdown point where the previous bearish momentum accelerated. The current price action suggests that the bulls are in control of the short-term narrative, but they face a series of "step-like" resistance zones that must be reclaimed to confirm a structural shift.

From a price action perspective, we are observing a classic accumulation pattern. The move higher appears impulsive, while the minor pullbacks are corrective and shallow, which is a hallmark of budding bullish strength. As long as price holds above the newly formed local support at 1.1723, the immediate bias remains skewed toward a breakout.

The projected path on the chart reflects this logic:

- A successful retest of the 1.1723–1.1730 level to confirm a solid base.

- An impulsive breakout through the 1.1750 resistance tier.

- A technical rally toward the primary Resistance Zone near the 1.1790–1.1800 psychological level.

Only a clean breakdown and acceptance back below the 1.1710 support zone would invalidate this recovery scenario and suggest that the bearish trend is resuming. Conversely, a reclaim of the 1.1760 level would be the first definitive signal that the mid-term bearish pressure has faded and a larger recovery is underway.

Until the breakout through the upper resistance tiers occurs, EURUSD is in a rebalancing phase. Patience around these intermediate supply zones remains critical to avoid being caught in a range-bound trap.

Wishing you all effective and disciplined trading.

Mid-Pullback or Momentum Reset? BTC Holds a Critical Bullish Market Context & Structure

Bitcoin remains in a well-defined bullish market structure following a strong impulsive expansion from the prior accumulation phase. The sequence of higher highs and higher lows is still intact, confirming that the broader trend remains constructive despite recent volatility.

After printing a local high near the upper resistance zone, price has transitioned into a corrective phase. This pullback is occurring within structure, not as a reversal signal. Current price action reflects short-term distribution and profit-taking rather than aggressive selling pressure.

Technical Confluence

The recent sell-off failed to break the most critical higher low, indicating that buyers are still defending key structural levels. Price is currently consolidating between a well-defined support zone and overhead resistance, forming a mid-range equilibrium typical after a strong impulse leg.

This consolidation sits above the previous breakout area, suggesting the market is rebalancing before the next directional move. As long as price holds above the structural support zone, the bullish framework remains valid.

Resistance: 94,200 – 94,800 (distribution / rejection zone)

Support:

92,200 – 92,600 (structural demand)

90,400 (major invalidation level)

Scenarios

➡️ Primary Scenario:

Price holds above the 92.2k–92.6k support zone and forms a higher low. A bullish reaction from this area opens the path for continuation toward the 94.8k resistance, with potential extension into new highs if acceptance occurs above supply.

⚠️ Risk Scenario:

A clean breakdown and acceptance below the support zone would invalidate the immediate bullish continuation. In that case, BTC may enter a deeper corrective phase toward the 90.4k level before any meaningful upside attempt resumes.

Bitcoin Compresses Under Descending ResistanceHello Everyone!! Bitcoin (BTCUSD) remains within a broader bullish context after a strong impulsive rally from the lower support region. The sharp expansion leg confirmed aggressive buyer participation and shifted the short-term structure decisively to the upside.

Following this rally, price has transitioned into a descending consolidation structure, forming a clear descending triangle / falling wedge-type compression beneath a downward-sloping resistance line. This indicates that while sellers are pressing from above, buyers continue to defend the 92,200–92,400 support zone, preventing a full breakdown so far.

Price is currently trading around the EMA 50, reinforcing this area as a key short-term equilibrium zone. This mid-structure region carries elevated risk, as liquidity can be swept on either side before the next directional move is confirmed.

Bullish scenario: A clean break and strong close above the descending resistance trendline, followed by a successful pullback hold, would confirm bullish continuation toward 94,500–95,000.

Bearish scenario: A confirmed breakdown below the 92,200 support, with a pullback and rejection, would open downside targets toward 91,000, with extended risk toward 89,500.

At this stage, Bitcoin is compressing and building energy. Patience remains key the next high probability opportunity will come from confirmation, not from anticipating the breakout or breakdown.

Gold Trapped Between Supply & Demand Price is approaching a strong supply zone around 4,500–4,520, where selling pressure has previously entered the market aggressively. The recent upside move shows signs of momentum loss, suggesting this rally may be corrective rather than impulsive.

A clear rejection from the supply zone would favor a pullback toward the 4,450–4,440 area, with further downside continuation likely into the 4,420 demand zone, where buyers previously stepped in.

If the 4,420 demand fails to hold, bearish continuation could extend toward 4,380–4,360. Only a strong breakout and close above the supply zone would invalidate the bearish pullback scenario and shift the bias back to bullish expansion.

Bitcoin Stalls Between Supply and DemandBitcoin continues to trade within a broader bullish context after a strong impulsive advance, but current price action on the H1 timeframe shows clear hesitation as the market compresses between a defined supply zone above and a demand zone below. This type of behavior typically signals a decision phase, where the market is balancing recent buying pressure against emerging profit-taking and short-term distribution.

At present, price is rotating around the 92,800 area, unable to generate sustained momentum toward the upper supply zone near 94,400–94,500. Previous reactions from this region highlight active seller interest, making it a key level that must be reclaimed with acceptance for bullish continuation to unfold. As long as price remains capped below this supply zone, upside attempts are vulnerable to rejection rather than clean continuation.

From a corrective perspective, failure to build acceptance above current levels increases the probability of a pullback toward the 91,400 demand zone. This area previously acted as a strong base before the impulsive rally and is likely to attract responsive buyers on a first test. A clean reaction here would support the view of a healthy higher low within the broader uptrend.

However, if demand around 91,400 fails to hold, the structure opens the door for a deeper retracement toward the 89,500 region. A move into this zone would represent a more significant liquidity sweep and reset, yet would still remain technically corrective rather than trend-breaking, provided the higher-timeframe structure remains intact.

Alternatively, a decisive breakout and sustained acceptance above the 94,500 supply zone would invalidate the corrective outlook. In that scenario, Bitcoin would likely transition back into expansion mode, targeting the 95,500 region and potentially extending further as fresh upside liquidity is unlocked.

EURUSD Defends Demand — Is a Bullish Reversal Setting Up?EURUSD on H1 has been trading under sustained bearish pressure, forming a clear descending trendline that has capped price action over the past sessions. Lower highs remain intact, confirming that sellers are still in control of the broader short-term structure.

However, the recent sell-off has now pushed price into a well-defined support zone around 1.1665–1.1680, where downside momentum has started to slow. The sharp reaction from this area suggests active buyer participation and hints at a potential short-term corrective rebound rather than immediate continuation lower.

At the moment, price is consolidating just above this support zone, while still trading below the descending trendline. This creates a compression scenario: buyers are defending demand from below, while sellers remain positioned at trendline resistance.

This is a key decision area. As long as the support zone holds, the market has room to attempt a recovery toward the upper structure. A failure here, however, would reopen downside risk.

Bullish scenario: If price holds above the 1.1665–1.1680 support zone and breaks above the descending trendline with acceptance, a corrective move toward 1.1720, followed by 1.1760–1.1770, becomes likely.

Bearish scenario: A confirmed breakdown and close below the support zone would invalidate the bullish recovery idea and expose further downside toward 1.1630 and potentially 1.1600.

For now, patience is essential. The market is sitting at a high-impact support level, and the next high-probability trade will come from confirmation, not anticipation.

Gold Completes a Cup and Handle — Is the Market PreparingGold on the H1 timeframe is displaying a textbook Cup and Handle formation within a broader bullish market structure, reinforcing the idea that the recent correction was a process of accumulation rather than trend exhaustion. Following the strong impulsive rally, price entered a deep but controlled pullback, carving out a rounded base above the major higher-timeframe support zone. This rounded recovery reflects a gradual absorption of sell-side liquidity, consistent with the theoretical construction of the cup phase.

As price returned to the prior highs near the 4,495–4,500 resistance area, bullish momentum slowed rather than breaking out immediately. This hesitation led to the development of the handle, visible as a shallow and well-contained pullback that held above the rising moving averages and respected the higher-low structure. From a theoretical standpoint, this handle represents the final consolidation phase where weak longs are shaken out and remaining supply near resistance is absorbed.

Current price action shows Gold stabilizing above the handle low and compressing just beneath the neckline resistance. This behavior aligns closely with Cup and Handle theory, where price action tightens before expansion, signaling that sellers are losing control while buyers remain positioned. The ability to hold above the mid-range and avoid a return toward the lower support zone strengthens the bullish continuation narrative.

A clean breakout and sustained acceptance above the 4,500 neckline would confirm completion of the pattern and signal the transition into a new markup phase. Based on classical measurement theory, upside continuation could extend toward the 4,540–4,560 region, which also aligns with prior higher-timeframe resistance and projected liquidity above the range.

As long as price continues to respect the handle structure and maintain higher lows, the Cup and Handle formation remains valid. Failure to hold the handle support would delay the breakout scenario but would not immediately invalidate the broader bullish bias unless price re-enters the lower support zone decisively. Overall, Gold appears structurally positioned for continuation, with the Cup and Handle formation acting as a clear roadmap for the next potential upside expansion.

Distribution First or Final Shakeout Before Expansion?Gold on the H1 timeframe is currently rotating within a clearly defined range, bounded by a strong supply zone overhead and a well-established demand zone below. After the earlier impulsive rally, price has transitioned into a corrective and distributive phase, where momentum has slowed and two-sided order flow has become increasingly evident. This behavior reflects a market that is no longer trending cleanly, but instead rebalancing liquidity after expansion.

Price recently reacted from the upper supply zone around the 4,490–4,500 area, where selling pressure emerged aggressively and halted further upside progress. Multiple rejections from this region highlight active supply, suggesting that higher prices are being used to offload positions rather than attract fresh breakout buying. As long as price remains capped below this zone, upside attempts remain vulnerable to failure.

From the current position, a corrective rotation toward the lower demand zone near 4,410–4,420 appears structurally reasonable. This area previously acted as a strong base during the prior accumulation phase and represents a key liquidity pool where buyers may attempt to regain control. A controlled move into this zone would be consistent with a healthy pullback rather than a breakdown, especially if price shows signs of absorption and stabilization on arrival.

If demand holds and price produces a strong reaction, Gold could transition back into a higher-low formation, opening the path for a renewed push toward the supply zone and potentially a breakout attempt on the next test. Such a sequence would reflect classic range rotation followed by expansion once liquidity on both sides has been sufficiently absorbed.

However, failure to hold the demand zone would invalidate the range structure and expose the market to deeper downside continuation. Until either boundary is decisively broken, Gold remains in a balance phase, with patience required as the market resolves whether this consolidation serves as distribution before a deeper correction or accumulation ahead of the next bullish leg.

Liquidity Range — Breakout Confirmation or Another Trap?Gold on the H1 timeframe is currently transitioning into a critical decision zone after failing to maintain momentum from the previous bullish leg. Following the rejection from the 4,500 area, price has formed a descending structure, with lower highs developing beneath a clearly defined bearish trendline. This shift signals a pause in upside strength and highlights growing two-sided participation as the market digests prior expansion.

At present, price is rotating around the 4,430–4,440 region, which aligns with a well-defined liquidity price range. This zone has acted as a magnet for price, reflecting balance between buyers and sellers rather than directional commitment. The repeated tests and lack of follow-through suggest that the market is waiting for confirmation before committing to the next impulsive move.

From a bullish perspective, a clean break and sustained acceptance above the descending trendline would be required to invalidate the corrective structure. Such a move would signal a successful liquidity absorption phase and open the path for continuation toward the 4,500 level initially, with further upside potential extending toward the 4,550 region if momentum builds.

Conversely, failure to reclaim the trendline and confirm bullish candlestick structure increases the risk of downside continuation. A clear bearish confirmation from the current range could trigger a liquidity sweep toward the 4,350 support zone, where deeper resting demand is located. This scenario would still be considered corrective within the broader structure unless selling pressure accelerates aggressively.

Overall, Gold remains in a compression phase, with price coiling between structural resistance and liquidity support. The next decisive move will be driven by confirmation rather than anticipation, making this zone a key inflection point for short-term direction.

Scaling a small account is not a strategy problem It is a sequencing and behavior problem. Most traders assume that growth comes from new methods or more trades. The data shows that small accounts grow fastest when they remove the hidden tax that drains them: emotional sizing, poor invalidation placement, and trading inside volatility expansion instead of liquidity alignment.

The most common failure point is position size volatility. When volatility expands, candle ranges widen, liquidity thins, and invalidation distance increases. This is the worst moment to increase size, yet this is when most traders do it—after a streak of wins or boredom-induced impulsive entries. A small account does not fail because the market moved against it. It fails because it increased exposure when the market removed fuel.

Professionals scale differently. They anchor size when volatility expands and only scale when volatility compresses, liquidity is swept cleanly, and structure transitions. This shift protects capital durability first so compounding becomes mathematically possible second.

The framework begins with a volatility budget. Every asset has a typical invalidation distance on each timeframe. BTCUSDT and SOLUSDT behave with wider ranges than mid-cap pairs, and their liquidity pockets are tested more aggressively during overlap sessions. Your account must size exposure based on what the market historically allows a setup to absorb without forcing premature liquidation.

Liquidity mapping is the next step. Equal highs, equal lows, and inefficient consolidation clusters are not entry signals. They are incentives. Price moves there to transact, collect stops, and reposition larger capital. The first proof of intention is the sweep. Price breaches liquidity and reclaims back inside the swing. This tells you that breakout traders provided the orders, not continuation. A small account compounds faster when it waits for the sweep to finish rather than entering into it.

From there, structure must transition. In an uptrend, the market protects higher lows. In a downtrend, it protects lower highs. When price violates the last defended point after liquidity is taken, you have a control handover. This is not a guess. It is a behavioral change in price organization. But structure alone is still incomplete. It requires displacement.

Displacement is momentum proving participation. A structural break followed by thin, drifting candles is not authority. A structural break followed by clean directional movement is participation. This shows urgency from the opposing side. This is where narratives change and capital begins positioning for the next impulse.

The retest becomes the execution filter. Price returns to the broken or swept zone, interacts without hesitation, and respects the new bias built from liquidity and structure. The retest reduces invalidation distance, tightens risk, and improves reward asymmetry naturally without needing to increase leverage or complexity. The best retest is not the fastest one. It is the one that proved permission through sequence.

Micro-scaling compounds edge without compounding risk. Extracting 1–3% per trade on confirmed retests with 2.5:1 or better R:R compounds a small account more efficiently than trying to extract 10% during unconfirmed expansion phases. High-quality trades reduce mistake frequency, which matters more than win rate when capital is small and feedback is fast.

Time is also a filter. Crypto liquidity behaves differently by session. The most stable participation for BTC and SOL historically occurs during London–NY overlap, where bid depth is higher, sweeps are cleaner, and structural transitions show more authority. Dead-zone hours widen noise and compress clarity. Scaling requires knowing when participation is probable, not forcing participation when it is absent.

The final rule is process-first validation. A trade that works without a reason is not scale permission. A trade that works because it followed the sequence is. The market does not reward perfection. It rewards traders who stay calibrated to structure, volatility, and liquidity long enough to compound the value of participation when conditions finally agree.

Scaling is not about catching the entire move.

It is about surviving long enough to participate in the right side of the next move with defined risk and conditional exposure. Small accounts grow when traders stop scaling emotion and start scaling conditions.

Gold Slips Under Descending Pressure — Correction Unfolding Gold on the M30 timeframe is showing clear signs of short-term structural weakness after failing to sustain the previous bullish impulse. Following the strong rally into the recent highs, price has transitioned into a descending structure, characterized by lower highs forming beneath a clearly defined descending trendline. This shift reflects a loss of upside momentum and signals that the market has entered a corrective phase.

Current price action is consolidating around the 4,430 area, a level that previously acted as a key intraday support. Repeated reactions around this zone suggest indecision, but the inability to reclaim and hold above the descending trendline keeps downside pressure dominant. Each rebound attempt has been met with selling interest, indicating that buyers are struggling to regain control in the short term.

As long as price remains capped below the descending trendline, the corrective scenario remains favored. A brief bounce from current levels cannot be ruled out; however, such a move would likely function as a liquidity-driven pullback rather than a genuine reversal. In that case, renewed selling pressure could drive price toward the 4,399 support zone, which represents the first meaningful downside target and a prior reaction area.

If bearish momentum persists and this level fails to hold, Gold could extend lower toward the 4,380 region, where a deeper liquidity sweep is likely to occur. This zone aligns with previous consolidation and may attract stronger buyer interest, potentially marking the point where the correction begins to stabilize.

Despite the current bearish intraday structure, the broader higher-timeframe bias remains constructive unless price decisively breaks below the lower support range. Until that happens, the ongoing decline should be viewed as a corrective pullback within a larger trend, rather than confirmation of a full trend reversal.

EURUSD at Major Support — Hold for Reversal or BreakPrice is testing a well-defined support zone around 1.1670–1.1680, where selling pressure has slowed after an extended bearish move. This area represents a critical decision point for short-term direction.

A strong hold above support could trigger a corrective recovery toward 1.1700–1.1725, with further upside potential toward 1.1740–1.1780 if buyers regain momentum and reclaim the moving average.

However, a clean break and close below 1.1670 would confirm bearish continuation, exposing downside liquidity toward 1.1650 → 1.1630, with extension risk toward 1.1600. Price reaction at this support will define the next directional move.

Gold Is Coiling in a Descending Triangle — Breakdown Risk Market Outlook (XAUUSD – H1)

Price is compressing inside a well-defined descending triangle, with lower highs pressing against a flat support around 4,420–4,430, signaling increasing sell-side pressure. Momentum remains capped below the descending trendline and the EMA, keeping the short-term bias bearish.

A minor bounce toward 4,450–4,460 is likely to act as a corrective retest of triangle resistance rather than a reversal.

A decisive break and close below 4,420 would confirm the pattern breakdown, exposing downside liquidity toward 4,380–4,350. Only a clean breakout above the descending trendline would invalidate the bearish setup and shift the bias back to bullish continuation.

EURUSD Is Compressing Under Trendline — Breakdown Pressure 1. Current Market Structur e

EURUSD is currently trading within a clear bearish structure on the H1 timeframe.

After forming a lower high, price has transitioned into a controlled downtrend, respecting a descending trendline resistance.

Each bullish attempt has been weak and corrective, while bearish legs remain impulsive — a classic sign that sellers are in control.

There is no valid structure break to the upside; instead, price continues to print lower highs and lower lows, confirming trend continuation rather than exhaustion.

2. Key Zones & Market Positioning

Dynamic Resistance (Trendline):

→ Descending resistance acting as a selling zone on every retest

Immediate Resistance Area:

→ 1.1670 – 1.1680

(Current reaction zone under trendline)

Support Zones / Downside Targets:

Target 1: 1.1654

Target 2: 1.1640

Target 3: 1.1620

Price is currently trapped between trendline resistance and horizontal supports, suggesting distribution before continuation.

As long as price remains below the trendline, bearish structure remains intact.

3. Liquidity & Price Behavior

Recent price action shows compressed candles and shallow pullbacks, indicating a lack of strong buyers.

Bullish pushes are quickly absorbed, leaving upper wicks — a clear sign of sell-side dominance.

This behavior reflects a bearish re-distribution phase, where smart money sells into minor retracements rather than chasing price lower.

No accumulation signals are present. Liquidity is building below current price, favoring a downside sweep.

4. Today’s Market Scenario

🔽 Primary Scenario – Bearish Continuation

Expected flow:

Price continues to respect descending resistance

Minor pullbacks fail below the trendline

Breakdown toward 1.1654, then 1.1640

Extension toward 1.1620 if momentum accelerates

Any short-term bounce into the trendline is considered a sell-the-rally opportunity, not a reversal signal.

🔼 Invalidation Scenario

Only if price breaks and closes decisively above the descending trendline, followed by acceptance above 1.1685.

Such a move would invalidate the immediate bearish continuation and force a reassessment toward a deeper correction or range.

5. Trading Perspective

Bias: Sell rallies below resistance

Mindset: Let price come to resistance — do not chase breakdowns

Market Intent: Distribution, not accumulation

The market is not bottoming — it is loading liquidity for the next bearish leg.

Summary

EURUSD is not reversing.

It is compressing under trendline resistance, absorbing buy orders, and preparing for continuation lower.

As long as price stays below the descending trendline, the roadmap remains clear:

Pullback → Rejection → Breakdown → Expansion to the downside 📉

Are Lower Highs Setting Up a Deeper Sell-Off?Hello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Ethereum has transitioned from a previously bullish environment into a clear bearish market structure, defined by a sequence of lower highs (LH) and lower lows (LL). After failing to sustain price above the recent swing highs, sellers stepped in aggressively, forcing a breakdown through multiple structure levels.

The sharp impulsive move lower confirms bearish momentum, while subsequent pullbacks have remained corrective, consistently forming lower highs beneath prior support now acting as resistance. This price behavior reflects a market that has shifted control decisively to sellers.

Key Supply / Structure Resistance:

The 3,130–3,150 region now acts as a critical supply zone, where previous support was broken and sellers have defended retracement attempts. This area is also aligned with the EMA, reinforcing bearish pressure.

Intermediate Resistance:

The 3,090–3,100 level represents a minor structure cap. Any pullback into this zone that fails would likely form another lower high.

Major Downside Demand / Liquidity Target:

The 3,020 area is the next significant demand zone, aligning with projected structure continuation and liquidity resting below recent lows.

Currently, ETH is trading after printing a fresh lower low, placing the market in continuation mode rather than exhaustion. Price is attempting a minor bounce, but as long as retracements remain capped below supply, this move should be treated as bearish corrective price action.

Momentum remains with sellers unless structure is reclaimed.

As long as Ethereum remains below the 3,130–3,150 supply zone, the bearish structure stays valid. Any pullback that stalls below this area is likely to form a lower high, opening the door for continuation toward the 3,020 demand zone and potentially lower if sell-side momentum accelerates.

A structural invalidation would only occur if price reclaims and holds above the broken resistance with strong bullish acceptance. Until then, rallies should be viewed as sell-side corrective moves, not reversals.

For now, the trend is down and controlled by sellers.

Reload for Continuation or Deeper Shakeout First?Hello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure.

Bitcoin remains within a broader bullish market structure, established by a strong impulsive rally that broke above multiple resistance levels. Following that expansion, price entered a distribution-to-correction phase, characterized by lower highs and increasing sell-side pressure.

The recent move lower represents a healthy corrective pullback rather than an immediate trend reversal, as the market is retracing into a high-confluence support area formed during the prior accumulation phase.

Major Demand / Support Zone:

The 88,800–89,200 region is a well-defined demand zone, where previous strong buying activity initiated the bullish expansion. This area also marks the base of the prior range and represents institutional demand.

Intermediate Resistance / Flip Level:

The 91,800–92,000 level acts as a critical structure flip. This level previously supported price and now functions as resistance during the pullback.

Upper Targets (Supply Zones):

If bullish continuation resumes, overhead targets are located at:

93,800–94,000 (prior swing high / liquidity)

94,800–95,000 (upper supply and range high)

These levels define the upside roadmap if demand holds.

Currently, BTC is trading directly above the major demand zone, placing price at a high-probability reaction area. This is where buyers are expected to step in if the broader bullish narrative remains valid.

The rejection from the EMA and structure flip above suggests sellers remain active short-term, but downside momentum is beginning to slow as price approaches demand.

As long as Bitcoin holds above the 88,800–89,200 demand zone, the current move should be viewed as a corrective retracement within a bullish trend. A strong reaction from demand could lead to a push back toward 91,800, followed by continuation toward the 93,800–95,000 target zones.

However, a decisive hourly close below the demand zone would invalidate the bullish continuation thesis. In that case, price could extend the correction toward lower liquidity levels, signaling a deeper structural reset before any sustainable upside attempt.

For now, Bitcoin is testing demand, not breaking trend.

Gold Is at a Decision Point — Break Higher or Deeper Liquidity Price is currently reacting at the key demand zone around 4,430–4,440, where buyers are attempting to defend the EMA support after a rejection from the 4,470–4,480 resistance zone.

A hold and bullish reaction above 4,430 would signal absorption of selling pressure, opening the path for a recovery toward 4,460–4,470, with a potential extension back into the upper resistance zone.

However, a clean break and close below 4,430 would invalidate the short-term bullish attempt and expose the downside toward 4,400, where liquidity and a stronger demand area are likely to be tested before any meaningful continuation.

Exhaustion Low or Pause Before Another Breakdown?GBPUSD on the M30 timeframe is firmly trading within a bearish structure, with price respecting a descending trendline and remaining below the declining EMA, both of which continue to act as dynamic resistance. The transition from the prior bullish impulse into a sustained sequence of lower highs and lower lows confirms that sellers have maintained control of short-term momentum.

Price has now extended lower into a clearly defined horizontal support zone around the 1.3420–1.3430 area. This level previously acted as a reaction base during the earlier upside leg, making it a critical liquidity zone where short-term decisions are likely to occur. The sharp approach into this level suggests bearish momentum remains dominant, but it also increases the probability of a temporary pause or reactive bounce as sell-side liquidity is tested.

If price fails to hold this support zone, bearish continuation remains the higher-probability scenario. A clean break and acceptance below support would open the door for further downside extension, in line with the prevailing trend, as the market searches for deeper liquidity and a new equilibrium lower.

However, if buyers manage to defend this support and generate a strong reaction, a corrective rebound could unfold. In that scenario, price may rotate back toward the 1.3470–1.3490 region, where prior structure and the descending trendline are likely to reassert selling pressure. Any upside move into this area should be viewed as corrective unless price can reclaim and hold above key resistance levels.

Overall, GBPUSD remains structurally bearish, with the current focus centered on whether this support zone produces a meaningful reaction or simply serves as a brief pause before continuation. Confirmation at support, rather than anticipation, will determine the next impulsive move.

Bitcoin Remains Under Pressure — Sellers Still in Full ControlPrice is trending firmly below the descending trendline and the EMA50, confirming a sustained bearish market structure with lower highs and lower lows intact. Recent pullbacks are being sold aggressively, showing no meaningful sign of demand stepping in.

A minor bounce toward the 90,800–91,000 area is likely to act as a corrective retest of structure rather than a reversal, where sellers may re-enter positions.

As long as price remains below the trendline, downside continuation is favored, exposing key liquidity targets at 89,300, followed by 88,800–88,400. Only a strong reclaim and close above 91,300 would invalidate the bearish scenario and signal a shift in short-term momentum.

Gold Is Inside a Bearish Structure — Breakout or BrekdownPrice is respecting a descending trendline and trading below the EMA50, confirming a short-term bearish structure as momentum continues to weaken. The market is currently reacting near the 4,420–4,430 demand zone, where buyers are attempting to slow the sell-off.

A bullish reaction from this zone could trigger a corrective bounce toward 4,445–4,460, aligning with the trendline resistance and prior supply. However, this move is expected to remain corrective unless price can reclaim the EMA and break structure.

A clean break and close below 4,420 would confirm bearish continuation, exposing downside liquidity toward 4,400–4,395. Failure of the demand zone would likely accelerate selling pressure into the lower range before any meaningful reversal attempt.