Sell-Side Liquidity Was the ObjectiveCAPITALCOM:US100 Yesterday’s analysis played out clean and technical, with price respecting higher timeframe supply and failing to hold premium levels.

As i have shared on monday this week, the short side idea remains valid as long as price stays capped below key resistance.

📌 Higher Timeframe Context VANTAGE:NAS100 (Daily)

• Price remains inside a daily premium supply zone

• No daily acceptance above resistance

• Overall structure still range to bearish

• Recent upside move shows weak continuation characteristics

➡️ Daily Bias: Bearish below 26,000

📉 Intraday Structure (1H)

• Clear failure at equal highs

• Distribution forming below resistance

• Price rejected from mid-range equilibrium (BB / balance area)

• Discount PD array below remains unfilled

Liquidity has been taken on the upside, and price is now rotating back into range.

🔴 Short Scenario (Primary)

• Sell zone: 25,750 – 25,900

• Conditions:

• Price remains below resistance

• No strong bullish displacement

• Targets:

• 25,650 (range low)

• 25,400 (discount / liquidity)

• Extended: 25,250

This aligns with the short idea shared earlier this week and remains the higher probability path.

🟢 Long Scenario (Secondary / Conditional)

• Valid only if price reclaims and accepts above 25,900

• Requires:

• Strong bullish displacement

• Holding above prior highs

• Upside targets:

• 26,000

• 26,050+

⚠️ No conviction longs while price trades below supply.

❌ Cancellation / Invalidation Levels

• Short bias invalidated if:

• 1H close above 26,050

• Acceptance above daily supply

• Long bias invalidated if:

• 1H close below 25,600

🎯 Final Expectation

Market continues to respect premium supply, confirming that patience at higher prices pays.

As long as price remains below daily resistance, Sell-Side reactions are favored , with liquidity resting lower.

Patience at premium. Execution at reaction.

Not financial advice.

Risk management is mandatory.

Technical Analysis

USOUSD TRADE IDEA USOUSD is moving in an uptrend, repecting an upward channel. currently in an impulsive phase to the upside. It has just broken above a key level. A correction to test the level will be a confirmation of a break out and retest, giving us an opportunity to enter a long position before the continuation

XAUUSD – Pullback Completed, Focus on Buy the DipMarket Context (H1)

After a strong impulsive rally, gold has entered a technical pullback phase and is now showing signs of completing liquidity absorption. The recent decline is corrective in nature and does not indicate a trend reversal.

From a fundamental standpoint, the macro backdrop remains supportive for gold as expectations of a cautious Fed stance persist and safe-haven demand continues. As a result, short-term downside moves are viewed as opportunities to rejoin the primary bullish trend.

Structure & Price Action

H1 structure remains bullish, with key swing lows still intact.

Price has reacted at short-term demand zones, aligned with Fibonacci retracement and prior balance areas.

No confirmed bearish CHoCH so far → bullish continuation remains the preferred view.

Upper resistance zones act as liquidity targets.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Focus on BUY setups only after price shows clear bullish reactions and structure protection.

Preferred BUY zones:

BUY zone: 4,596 – 4,580 (demand + Fibonacci confluence)

Deeper BUY zone: 4,578 – 4,570 (structure low / strong support)

Note: Enter trades only with confirmation. Avoid FOMO in the middle of the range.

Upside Targets:

TP1: 4,610

TP2: 4,630

TP3: 4,670 (upper resistance / extension area)

Alternative Scenario

If price does not pull back deeply and instead breaks and holds above 4,630, wait for a retest before looking for continuation BUY opportunities.

Invalidation

If an H1 candle closes below 4,570, the short-term bullish structure is invalidated. Pause BUYs and wait for a new structure to form.

Summary

Gold’s primary bias remains bullish. The current pullback is corrective, not a reversal. The MMF approach favors patience and buying at discounted zones, trading in alignment with higher-timeframe flow rather than chasing price.

AUDJPY: Unstoppable Bulls 🇦🇺🇯🇵

I see another confirmed BoS on AUDJPY.

The price now heading towards the 107.5 level.

Look to buy after a pullback.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$SPY & $SPX — Market-Moving Headlines Wednesday Jan 14, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Wednesday Jan 14, 2026

🌍 Market-Moving Themes

📉 Inflation Shock Fallout

Stocks sell off after hot CPI as soft-landing narrative gets challenged

🏦 Bank Earnings Tension

Financials stay under pressure ahead of JPM earnings amid rate uncertainty

💻 Tech Rotation Signal

Adobe downgraded as capital rotates from software toward chips and power

⚛️ Nuclear Super Cycle Focus

Oklo remains center stage after Meta deal despite broad market weakness

🟡 Anti-Fiat Crosscurrents

Gold and Bitcoin stay firm as inflation limits Fed flexibility

📊 Key U.S. Economic Data Wednesday Jan 14 ET

8:30 AM

- Retail Sales Nov delayed: 0.4%

- Retail Sales ex Autos: 0.3%

- PPI Nov delayed: 0.3%

- PPI YoY: 2.7%

- Core PPI YoY: 2.9%

10:00 AM

- Existing Home Sales Dec: 4.22M

2:00 PM

- Federal Reserve Beige Book

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #RetailSales #PPI #Inflation #Macro #Fed #Markets #Trading #Stocks #Options

EUR/USD: When Every Pullback Becomes an Opportunity for SellersAs we move into mid-January 2026 , EUR/USD is clearly reflecting the internal contradiction within the European economic narrative : short-term bright spots exist, yet long-term structural risks remain a major headwind . When this macro backdrop is placed onto the current H4 chart, the bearish trend is being reinforced both fundamentally and technically.

From a news perspective , the market is not focusing on the improvement in quarterly growth. Instead, attention remains on negative structural factors: annual GDP growth slowing, energy costs still several times higher than in the US, and persistent competitiveness constraints. These elements are not strong enough to justify fresh EUR buying in the short term, while the USD continues to hold a relative advantage . As a result, capital flows are leaning toward defense rather than aggressively bottom-fishing the euro .

From a technical standpoint , the bearish structure is clearly visible on the H4 timeframe . Price remains below the Ichimoku cloud, repeatedly rejected at the descending trendline and the 1.1680–1.1700 resistance zone . Recent rebounds have been purely technical, failing to break the lower-high structure. This confirms that sellers remain firmly in control. Under the current scenario, EUR/USD may attempt a minor rebound into resistance, but is likely to resume its decline toward 1.1630, or even lower if selling pressure accelerates.

In summary, with fundamentals failing to support the euro and the chart maintaining a clear bearish structure , the most rational short-term approach remains selling in line with the trend, rather than anticipating a premature reversal.

FANG 5M Aggressive Short DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ biggest volume 2Ut-

+ weak test

+ very strong resumption?

+ first bearish bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

1H CounterTrend

"- long impulse

+ volumed TE / T1

+ resistance zone

+ weak approach

+ volumed manipulation bar"

1D Trend

"+ short impulse

- manipulated T2 level

+ resistance zone

+ 1/2 correction"

1M Trend

"+ short impulse

- resisting bar below BUI level

+ resistance zone

- strong approach

+ 1/2 correction

+ volumed Ut

+ test"

1Y CounterTrend

"- long impulse

- neutral zone 2

- 1/2 correction"

Monero Breaks All-Time Highs As Bullish Structure Points HigherMonero (XMRUSD) is now aggressively breaking into new all-time highs, in line with expectations. On the monthly chart, price action continues to suggest significant room for further upside. Monero may be unfolding a five-wave bullish impulse, or alternatively, breaking out from a larger bullish triangle formation. In both scenarios, the technical picture supports much higher levels.

On the weekly timeframe, we are still tracking a projected extended wave (5) of wave 3. Fibonacci cluster targets continue to point toward the 1000 area before a higher-degree wave 4 correction is expected to unfold. At the moment, price appears to be rising within subwave 3 of an ongoing five-wave bullish impulse for wave (5). This suggests that additional gains are likely in the near term.

That said, traders should remain aware of a potential subwave 4 pullback, which would be a normal part of the structure, before a renewed bullish continuation in subwave 5 of wave (5) of 3.

XAUUSD H1: Premium Zone RejectionGold H1 Analysis:

Gold is currently in the Premium Zone + Supply 4600. Price has shown rejection there, signaling a short-term downtrend. MACD also shows a bearish crossover, confirming the momentum.

Targets: Equilibrium Zone 4525, Discount Zone 4425

Entry: Wait for price confirmation of rejection from the Premium Zone.

FOMO When Gold Explodes: The Trap Most Traders Fall IntoIf you’ve ever chased a strong gold rally, entered a trade out of fear of “missing the move,” and then watched price reverse and stop you out minutes later — you’re not alone.

That’s FOMO (Fear of Missing Out), and it is one of the most dangerous psychological traps when trading XAUUSD.

How FOMO shows up when gold moves aggressively

Gold is a market known for speed, volatility, and expansion.

When price starts printing large bullish candles, the trader’s mind often reacts instinctively:

“Price is running, if I don’t enter now I’ll miss it”

“Everyone is buying, it must keep going”

“I’ll just enter quickly and use a tight stop”

The problem is simple: you’re reacting emotionally, not executing a plan.

In many cases, those strong impulsive moves you see are:

- The late-stage expansion of a trend

- A liquidity push designed to trigger late buy orders

- Or the area where institutions begin distributing positions

By the time FOMO kicks in, the best part of the move is often already over.

Why FOMO is especially dangerous in gold trading

Unlike many forex pairs, gold:

- Creates sharp spikes and deep pullbacks

- Frequently produces false breakouts around key levels

- Sweeps both sides before committing to the real direction

When you trade with FOMO:

- Stops are placed too tight

- Entries are made at expensive prices

- A normal technical pullback is enough to take you out

Price may still move in the direction you expected — just without you in the trade.

Signs you’re trading with FOMO (even if you don’t realize it)

Ask yourself:

- Did I enter because of my plan, or because price was moving too fast?

- Am I trading outside my pre-marked zones?

- Am I ignoring market structure because I’m afraid of missing out?

If the answer is yes, FOMO is likely driving your decision.

How to avoid the FOMO trap when gold is running

1. Trade levels, not candles

Large green candles are not signals. Zones are.

If price has already left your area, accept the missed opportunity.

2. Ask one key question: “Who is entering here?”

If you buy after a strong expansion, you’re often buying from traders who are taking profit.

3. Accept missing trades as part of the game

No professional trader catches every move.

Missing a trade is cheaper than forcing a loss.

4. Wait for reactions, not movement

The market always offers a second chance — pullbacks, consolidations, or clearer structure.

SOLUSDT – Daily Follow-Up UpdatePrice is reacting well after bouncing from daily support.

We’re now pushing into a key resistance zone that previously acted as support.

Bullish scenario:

A clean daily close above resistance + successful flip into support opens the door for a move toward the daily FVG around 170–176.

That level is the main upside target.

Bearish scenario:

Failure to hold this resistance could lead to a rejection and a move back toward daily support / lower FVG.

Bias stays neutral → bullish, but confirmation is required.

No breakout = no trade.

👉 Do you expect SOL to flip this level and continue higher, or will we see another rejection?

MrC

DXY Daily: Bullish Bias Building Ahead of CPI Hello Traders!

After a long weekend, we're back and focusing on the US Dollar Index (DXY) on the Daily timeframe.

Key observations:

Price has already reached the discount area (50% Fibonacci retracement) relative to the current dealing range — a classic zone where buyers often step in.

The equilibrium area was respected perfectly, followed by a clean retracement higher.

We now see relative equal highs forming, with buy-side liquidity pooled around 100.4. This level could act as a magnet if momentum builds.

Technical indicators are leaning bullish on DXY at the moment. However, today brings a major catalyst: the US CPI release. We’re positioned for upside potential, but the news will ultimately dictate the next directional move.

Waiting for the CPI print to confirm direction. Until then, the technical setup favors bulls.

What’s your take? Bullish continuation post-CPI, or expecting a reversal? Drop your thoughts below!

#DXY #USD #CPI #Forex #TechnicalAnalysis #Fibonacci #DollarIndex

No Rush. No FOMO. Just Levels!CAPITALCOM:US100 Price is currently trading inside a higher timeframe premium supply zone, where previous distribution occurred. Despite the recent bounce, market structure remains heavy, and upside continuation is still questionable at these levels.

📌 Higher Timeframe VANTAGE:NAS100 (Daily)

• Price is reacting inside a daily resistance / supply zone

• Overall structure remains range to bearish 🐼

• No clean daily close above resistance yet

• Volume does not confirm strong continuation📈

➡️ HTF Bias: Neutral to Bearish below 26,000

📉 Intraday Structure (1H)

• Strong impulsive move up already delivered

• Current price consolidating inside a 1H distribution range

• Upside momentum is slowing

• Liquidity resting both above equal highs and below range lows

🔴 Short Scenario (Primary)

• Sell zone: 25,850 – 26,000

• Looking for:

• Weak push into highs

• Rejection or displacement failure

• Targets:

• 25,650 (range low)

• 25,400 (liquidity + demand)

• Extended: 25,250

🧠 This remains the preferred scenario as long as price stays capped below supply.

🟢 Long Scenario (Secondary / Scalp Only)

• Valid only if price holds above 25,650

• Requires:

• Strong bullish acceptance

• Clean displacement + continuation

• Upside targets:

• 25,900

• 26,000 (major reaction zone)

⚠️ Counter trend longs only. No swing conviction here.

❌ Cancellation / Invalidation

• Shorts invalidated:

• 1H close above 26,050

• Acceptance above daily supply

• Longs invalidated:

• 1H close below 25,600

🎯 Final Expectation

Market is likely building liquidity before the next expansion.

As long as price remains below daily supply, sell side reactions are favored.

Patience at premium levels > reaction > execution.

Not financial advice.

Risk management is mandatory.

XAU/USD – The bullish momentum is firmly supportedAs we move into the new trading week, gold is once again demonstrating its role as a safe-haven asset, benefiting strongly from the current macroeconomic backdrop. The fact that gold prices surged nearly 2% and reached a record high during the Asian session is not merely a short-term reaction, but rather reflects a clear shift in monetary policy expectations and global risk sentiment.

From a fundamental perspective , the latest U.S. labor market data released at the end of last week acted as a key catalyst. Nonfarm payrolls increased by only 50,000 jobs , significantly below expectations, signaling a clear cooling in the U.S. labor market . This development has reinforced expectations that the Federal Reserve may soon enter a rate-cutting cycle this year, weakening the U.S. dollar and bond yields — an ideal environment for gold to remain well supported and continue to be repriced higher.

At the same time, heightened geopolitical risks have added another layer of support. Rising instability in the Middle East, particularly the prolonged unrest in Iran, alongside ongoing tensions between the U.S. and Venezuela, continues to drive demand for gold as a defensive hedge against uncertainty.

On the technical side, the structure of XAU/USD fully supports a bullish continuation scenario. The 4,550 zone is currently acting as immediate support , where buying interest consistently emerges on pullbacks. As long as this support remains intact, any retracement should be viewed as technical and corrective , offering opportunities for trend continuation rather than signaling reversal. To the upside, the psychological resistance at 4,650 stands as the next key target, where price may temporarily pause before potentially extending the rally further.

Wishing you successful and disciplined trading ahead!

SILVER (XAGUSD): Confirmed Breakout

As I predicted yesterday, Silver successfully violated a key

horizontal resistance cluster.

It turned into a support now.

I will expect a bullish continuation from that.

Next resistance - 88.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$SPY & $SPX — Market-Moving Headlines Tuesday Jan 13, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Tuesday Jan 13, 2026

🌍 Market-Moving Themes

⚖️ Fed Pressure Shock

DOJ probes Powell and Trump floats 10 percent credit card rate cap → financials react

🟡 Anti-Fiat Bid

Gold pushes to record highs amid political pressure on the Fed

⚛️ AI Nuclear Trade

Oklo pulls back on insider selling after Meta deal → nuclear for AI remains in focus

🏠 Housing Momentum

Mortgage bond buying narrative keeps homebuilders extended

🧠 AI Commerce Expansion

Alphabet crosses 4 trillion market cap on AI shopping partnerships

📊 Key U.S. Economic Data Tuesday Jan 13 ET

🚩 CPI DAY

6:00 AM

- NFIB Optimism Index Dec: 99.0

8:30 AM

- CPI Dec: 0.3%

- CPI YoY: 2.7%

- Core CPI Dec: 0.3%

- Core CPI YoY: 2.8%

10:00 AM

- New Home Sales Oct: 710K

2:00 PM

- U.S. Budget Deficit Dec: -150.0B

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #CPI #Inflation #Macro #Fed #Markets #Trading #Stocks #Options

MNQ - Ascending Channel Range Play | FVG Zones Holding

Hey TradingView community! 👋

NASDAQ futures are in classic range mode right now. Let me break down what I'm seeing on the 45-minute chart.

The Setup

MNQ1! is trading at 25,941 inside an ascending channel, currently sitting right in the upper FVG zone around 25,880-25,920. Price has been respecting this channel beautifully - bouncing between the upper and lower boundaries like clockwork.

This is a range-bound market. Until we get a decisive breakout, expect more of the same: test resistance, pull back to FVG, bounce, repeat.

Why I'm Neutral Here

Ascending channel intact - but price is RANGING, not trending

Two FVG zones acting as magnets - price keeps retesting them

S&P 500 at record highs but NASDAQ lagging slightly

Fed pressure headlines creating uncertainty (Powell vs Trump drama)

CPI data Tuesday could be the catalyst for breakout

Bank earnings starting this week (JPM Tuesday)

The News Context

Mixed signals keeping the market choppy:

S&P 500 hit record high Friday - but NASDAQ underperforming

Trump vs Powell drama - DOJ threatening Fed Chair over "renovation" testimony

Credit card rate cap proposal hitting bank stocks hard

Soft jobs data (50K vs 60K expected) - but unemployment dropped to 4.4%

Banks pushing back rate cut expectations after jobs report

Walmart joining Nasdaq-100 on Jan 20 - could bring passive fund flows

CPI report Tuesday - this is the big catalyst to watch

Key Levels I'm Watching

Resistance:

26,000 - Psychological level / upper channel

26,280 - Major resistance (near 52-week high)

26,399 - 52-WEEK HIGH

Support:

25,880-25,920 - Upper FVG zone (current)

25,800-25,860 - Lower FVG zone

25,600 - Channel midline support

25,320 - Lower channel support

My Game Plan

Range scenario (MOST LIKELY): Price continues to oscillate within the ascending channel. Expect retests of the FVG zones. Trade the range - buy at lower FVG, sell at upper channel resistance. This is a scalper's market until we get a breakout.

Bullish scenario: If CPI comes in soft and we break above 26,000 with volume, next target is 26,280, then 26,399 (52-week high). Walmart joining Nasdaq-100 on Jan 20 could bring passive buying.

Bearish scenario: If CPI comes in hot or Fed drama escalates, we could break below 25,600 and test 25,320 lower channel support. Watch bank earnings for sentiment.

The Bottom Line

I'm NEUTRAL here. The channel is intact but we're just ranging. No clear trend until we break out. The FVG zones are acting as support/resistance - trade the range or wait for the breakout.

CPI Tuesday is the key. That's likely the catalyst that decides direction.

What do you think? Breakout or more chop? Let me know in the comments! 👇

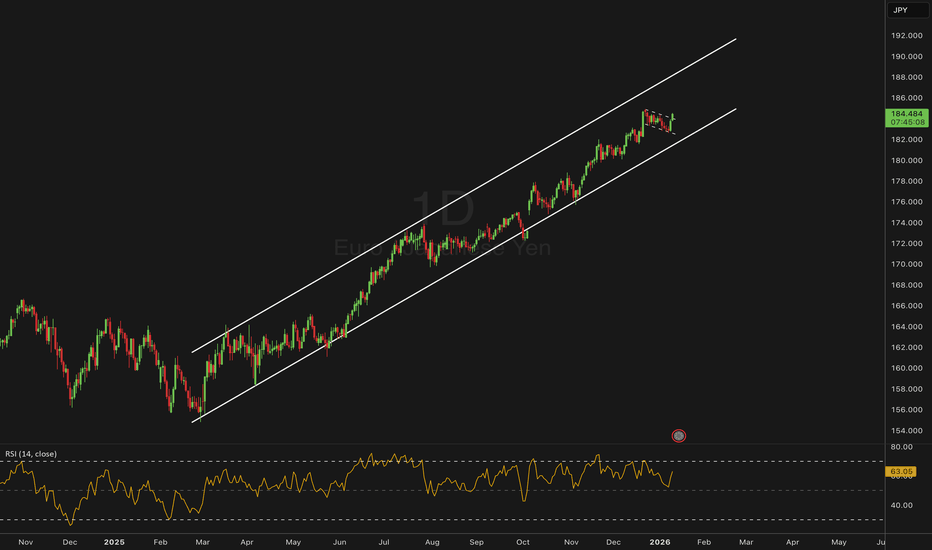

EUR/JPY | Rising Channel Extension – Momentum vs RiskEUR/JPY continues to benefit from a wide EUR–JPY policy divergence, but the pair is increasingly exposed to volatility should yen sentiment shift via BOJ communication, inflation data, or broader risk-off conditions.

Technical Lens (Daily):

Price remains firmly within a well-defined rising channel, respecting higher highs and higher lows. The broader trend structure is intact, but momentum indicators are flashing caution — RSI remains elevated, signalling increasingly stretched conditions rather than immediate trend failure. At current levels, price sits in what is effectively “no man’s land”: trend-following structure holds, but upside efficiency is diminishing.

Lower Timeframe Note (H1):

On the intraday chart, a short-term flag structure has resolved to the upside, aligning with the broader daily trend. While this supports near-term continuation, it does not materially reduce the higher-timeframe correction risk at these elevated levels.

Scenarios:

If channel support continues to hold → the trend can extend further, but upside progress may slow and become more volatile as momentum cools.

If channel support breaks → scope opens for a corrective pullback toward prior channel midline and structural support zones.

Catalysts:

BOJ rhetoric or policy signalling

Japanese inflation data

Broader risk sentiment shifts impacting JPY demand

Takeaway:

The trend is intact, but elevated positioning increases correction risk — this is a continuation structure with declining margin for error.

Q1 2026 Bias:

Trend continuation remains the base case, but with elevated vulnerability to corrective phases if yen strength emerges.

AUDUSD is Nearing an Important Support!Hey Traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.66600 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.66600 support and resistance area.

Trade safe, Joe.

USDCAD Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDCAD for a selling opportunity around 1.38900 zone, USDCAD was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.38900 support and resistance zone.

Trade safe, Joe.

GBPJPY: Breaking Another High 🇬🇧🇯🇵

GBPJPY is breaking another high after a consolidation

and accumulation within a horizontal channel on a daily.

The market will most likely continue rising.

The next strong resistance will be 213.5.

For extra confirmation, I recommend waiting for a daily

candle close above the underlined structure before you buy.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.