EURUSD 15M – Smart Money Trap Below Support | Buyers Take ControPrice is inside a clear ascending channel → overall bullish structure intact.

Recent move was a pullback to channel support, not a trend break.

The reaction from the lower boundary shows buyers defending aggressively.

🧠 Key Observation (Circle Area)

You’ve marked a liquidity sweep / stop-hunt below support.

After sweeping lows, price printed a strong bullish impulsive candle → classic smart money entry signal.

This confirms fake breakdown → bullish continuation.

📍 Important Levels

Support zone: 1.1780 – 1.1785 (strong demand + channel support)

Entry area: ~1.1788

Invalidation: Below 1.1780 (clean break & close)

Target: 1.1800 🎯 (near-term)

Extended target: 1.1825 – 1.1830 (upper channel)

📈 Trade Bias

Bias: Bullish continuation

Setup: Buy on pullbacks / bullish candle confirmation

RR: Clean and favorable (structure-based)

⚠️ What to Watch

If price accepts below channel support, bullish idea weakens.

A 15M close above 1.1800 opens the door for the next leg up.

🧾 Summary

Liquidity grab + channel support + bullish displacement

➜ High-probability continuation setup

Tecnhicalanalysis

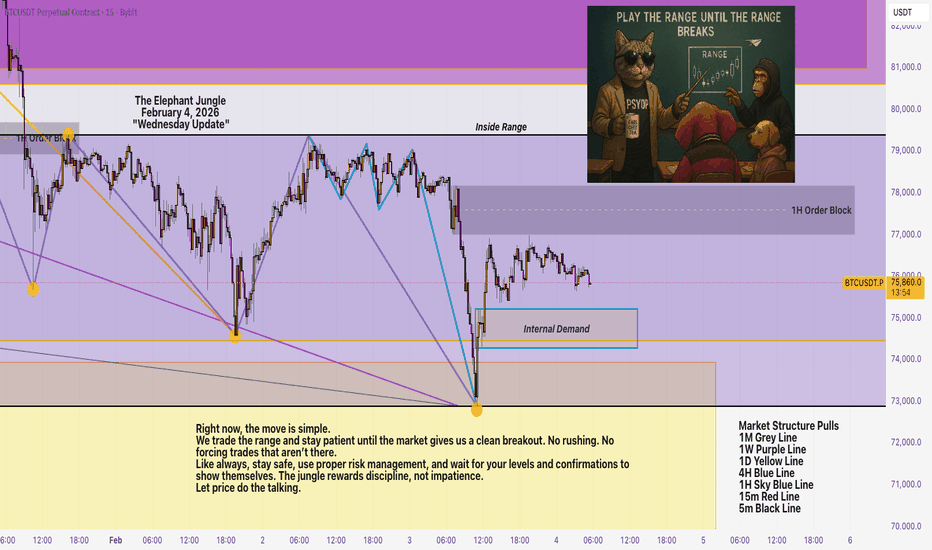

BTCUSD Bearish Continuation | Sell the PullbackMarket Structure

Overall bearish bias remains intact.

Price is respecting a descending trendline from previous highs.

Structure shows lower highs + lower lows, confirming sellers are still in control.

Pattern in Play

Price is moving inside a bearish descending channel.

Current move looks like a pullback toward resistance, not a trend reversal.

The red zig-zag you marked = distribution / rejection zone (very good read).

Key Levels

Resistance Zone (Sell Area):

77,121 – 79,959

Confluence of:

Channel top

Prior support turned resistance

Trendline resistance

Entry Zone:

Around 76,800 – 77,200

Best entries come after bearish confirmation (rejection candle / engulfing).

Downside Target:

72,377

Matches:

Channel low

Measured move (~-5.9%)

Liquidity sweep zone

Trade Idea Logic

📉 Sell the pullback, not the breakdown.

Wait for rejection at resistance, then continuation to the downside.

Risk–reward structure is favorable as drawn.

Invalidation

A strong H1 close above 80,000 would weaken the bearish setup.

Until then → trend-following shorts preferred.

Overall Bias

Bearish continuation ⬇️

Pullbacks = selling opportunities.

Gold (XAUUSD) 15M | Sell Rally Setup from Channel ResistancePrice is moving inside a descending channel → clear bearish trend.

Overall structure shows lower highs & lower lows, so sellers are still in control.

📐 Key Technicals from the chart

Channel resistance rejected price multiple times.

The recent pullback failed near the midline / dynamic resistance of the channel.

Strong bearish impulse after rejection → confirms sell-on-rally behavior.

🎯 Trade Idea (as marked)

Sell entry: around 4900 – 4905

Stop loss: ≈ 4901 – 4910 (above recent structure & channel)

Targets:

TP1: 4860

TP2: 4823 (previous low / demand zone)

🧠 Confluence (why this works)

Descending channel resistance

Break & retest failure

Bearish continuation momentum

RR looks solid (~1:2+)

⚠️ Invalidation

A 15M close above channel resistance + holding above 4910 would weaken the bearish bias.

📌 Bias Summary

Intraday Bias: Bearish 🔴

Prefer sell rallies until channel breaks decisively.

The Elephant Jungle 2/4/26 part 4Right now, the move is simple.

We trade the range and stay patient until the market gives us a clean breakout. No rushing. No forcing trades that aren’t there.

Like always, stay safe, use proper risk management, and wait for your levels and confirmations to show themselves. The jungle rewards discipline, not impatience.

Let price do the talking.

Gold (XAUUSD) Holding Structure | Buy the Dip Opportunity📈 Market Structure

Price is respecting a bullish ascending channel → higher highs & higher lows intact.

Recent move shows healthy consolidation near the channel mid–upper range, not weakness.

Buyers are still in control unless the channel breaks decisively.

🔑 Key Levels

Support zone: 5,052 – 5,015

→ This is the demand + pullback area. As long as price holds here, bullish bias stays valid.

Immediate resistance: 5,080 – 5,100

Target zone: 5,180 – 5,200 (upper channel / liquidity area)

🎯 Trade Idea (Bullish Continuation)

Buy on pullback into the highlighted support box

Invalidation: Clean break & close below 5,015

TP: Previous highs → channel top → ~5,198 (your marked target)

🧠 Price Action Expectation

Small dip / liquidity grab into support

Strong bullish reaction

Continuation move toward the upper channel resistance

⚠️ Risk Note

If price accepts below the channel, expect deeper correction toward lower trendline.

No chasing longs at resistance — wait for pullback confirmation.

Bias: ✅ Bullish

Setup Quality: ⭐⭐⭐⭐☆ (very clean structure)

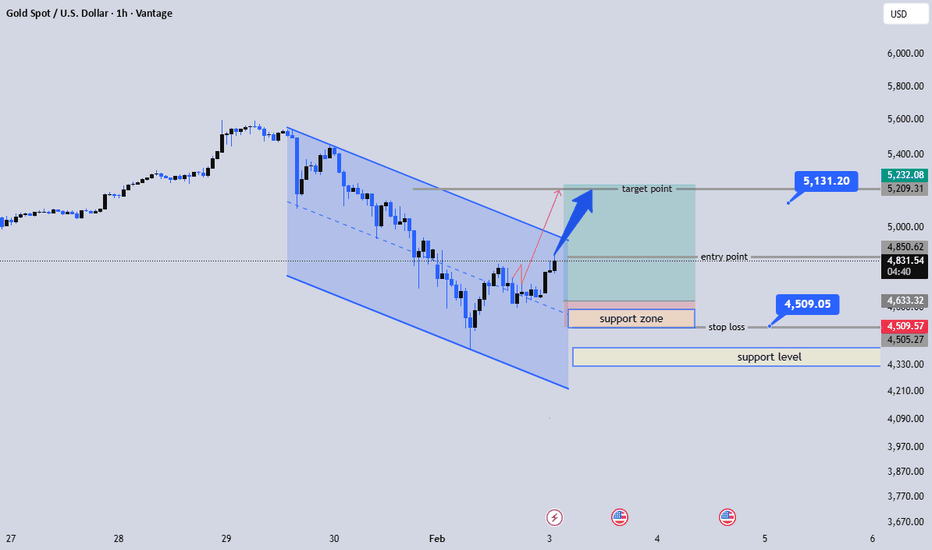

Gold Bullish Reversal from Support ZoneXAUUSD (Gold) – 1H Technical Analysis 🔍

Nice clean chart 👍 Let’s break down what’s happening:

🔹 Market Structure

Price was in a descending channel (clear bearish correction).

We now see a strong bullish breakout from that channel.

Breakout + impulsive candle = shift from bearish to bullish bias on H1.

🔹 Key Levels on Your Chart

Entry zone: ~4,846

Price has broken above structure and is retesting this area.

Support zone: 4,600 – 4,550

Marked demand area where buyers previously stepped in.

Stop loss: 4,509

Below support → logical and technically valid.

Target: 5,131

Previous resistance / supply zone.

Also aligns with measured move after channel breakout.

🔹 Trade Idea Validity

✅ Channel breakout

✅ Higher low formed

✅ Bullish momentum candle

✅ Good risk-to-reward (R:R looks solid)

As long as price holds above the entry level, bullish continuation is favored.

🔹 Invalidation

❌ If price closes below 4,600 on H1

→ bullish idea weakens

→ deeper pullback toward 4,330 support level becomes possible.

🧠 Conclusion

Bias: Bullish continuation

Setup quality: Strong ⭐⭐⭐⭐☆

Best case: pullback → continuation toward 5,131

Be patient with entries and manage risk properly.

If

Gold 30M – Recovery From Support ZoneXAUUSD (Gold) – 30M Technical Analysis 🟡📈

Market Structure: Price is trading inside a descending channel, but recent price action shows bullish recovery from channel support.

Pattern: Formation of a higher low and a short-term bullish correction toward channel resistance.

Bias: Bullish pullback / corrective move while holding above key support.

Key Levels

Support Zone: 4,580 – 4,550

Invalidation (SL): Below 4,551

Target Area: 4,740 – 4,780 (channel resistance & liquidity zone)

Trade Idea

Buy from support zone with confirmation

Aim for channel resistance

Risk is clearly defined below support

Summary:

As long as Gold holds above the marked support zone, price has room to push higher toward the target point. A breakdown below support would resume full bearish continuation.

what do you think about today's gold price?Hello Traders, what do you think about today's gold price?

Today the market will have news related to Unemployment Benefits, so I expect the trading range to be slightly narrow and liquidity relatively low. Please be more cautious in placing orders and managing capital.

Below are the important support – resistance zones I am monitoring today:

🔵 BUY ZONE (Support)

4180 – 4184

4160 – 4165

4150 – 4155

4130 – 4133

➡️ These are strong support zones – prioritize watching for Buy in the Sideway range.

🔴 SELL ZONE (Resistance)

4240 – 4244

4250 – 4255

➡️ These are the upper resistance zones – suitable for watching for Sell when the price rebounds to the range.

👀 NEAREST OBSERVATION ZONE

4217 – 4220

➡️ This is the directional zone, observe price reactions to determine continuation or adjustment forces.

🎯 Trading orientation for the day

Personal style: SL10 price – TP10 price.

Trade within the Sideway range, Buy low – Sell high.

Break any zone, trade that zone, avoid holding orders against the trend.

Low liquidity → trade lightly & manage capital tightly.

⚠️ Note: This is a personal trading plan, not investment advice. Please consider it as reference material.

Wishing you a successful trading day – enter and win! 💹✨

GBP/JPY Rejection at Supply → Next Stop: 204.00 !The GBP/JPY Pair, Price has been trading within a Trendline Breakout on the M30 chart, forming consistent lower highs and lower lows. Price action is now testing the lower boundary of the pattern, signalling a possible breakdown.

✅Market Context:

1️⃣Downward structure building inside the pattern.

2️⃣Sellers are showing strength near support levels.

3️⃣Breakdown below the trendline indicates momentum continuation toward lower zones.

✅Trade Plan :

Entry: Sell after confirmed breakdown below the support (Candle close below trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – major support area identified ahead.

🛑Stop Loss (SL): Above the pattern structure / recent swing high.

✅Psychological Discipline:

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as part of the strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

XAU/USD 4HTechnical Analysis Rising Channel with strong bullish The price action shows:

A parabolic uptrend inside a rising channel (or pitchfork structure).

Recent breakout attempt toward the upper band.

Fibonacci retracements drawn for pullback projections.

This looks like a rising channel / ascending channel with parabolic acceleration.

---

🔹 Targets

From your chart:

Immediate target shown is around 3700 USD (upper channel resistance).

If bullish momentum continues, extension targets are 3750 – 3800 USD.

---

🔹 Stop Loss

A good protective stop is below the mid-channel line, around 3400 – 3450 USD.

A tighter stop could be just under the last breakout zone: 3550 – 3580 USD (aggressive).

---

🔹 Support Levels

1. 3550 – 3580 USD → short-term support.

2. 3450 – 3480 USD → mid support (channel median + Fib zone).

3. 3300 – 3350 USD → strong support (Fib + previous base).

---

🔹 Resistance Levels

1. 3700 – 3720 USD (current key resistance).

2. 3800 USD (upper channel / Fib extension).

3. 4000 USD psychological level (long-term projection).

---

✅ Suggested Trading Plan (swing perspective):

Entry: On dips near 3550–3600 USD or breakout above 3700 USD.

Target: 3720 → 3800 USD.

Stop Loss: Below 3450 USD (swing safe) or 3580 USD (tight).

EUR/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

EUR/CHF is making a bullish rebound on the 17H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.934 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are going short on the GBP/CHF with the target of 1.076 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/JPY BULLISH BIAS RIGHT NOW| LONG

CAD/JPY SIGNAL

Trade Direction: short

Entry Level: 106.355

Target Level: 107.547

Stop Loss: 105.559

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

GBP/NZD pair is trading in a local uptrend which know by looking at the previous 1W candle which is green. On the 2H timeframe the pair is going down. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 2.297 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD BEARISH BIAS RIGHT NOW| SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,377.31

Target Level: 3,327.89

Stop Loss: 3,409.93

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/CHF SHORT FROM RESISTANCE

Hello, Friends!

CAD/CHF pair is in the downtrend because previous week’s candle is red, while the price is evidently rising on the 12H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.579 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CHF SHORT FROM RESISTANCE

Hello, Friends!

NZD/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 12H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.473 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/CHF pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 1.077 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN SHORT FROM RESISTANCE

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 119,125.07

Target Level: 111,573.08

Stop Loss: 124,149.32

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so EUR-CHF is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 0.934.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN SELLERS WILL DOMINATE THE MARKET|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 116,642.13

Target Level: 110,361.95

Stop Loss: 120,813.64

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 7h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/CHF BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

AUD/CHF is making a bullish rebound on the 1D TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.517 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅