BTCUSD – Bearish Channel Breakdown | Target 66KKey Levels

Major Resistance Zone:

80,700 – 81,000 (previous support → now resistance)

90,300 (upper channel / strong supply)

Current Price: ~78,500

Key Support / Target:

66,200 – 66,500 (channel projection + previous demand)

🔄 Price Scenario

A pullback toward 80.7k is possible (retest of resistance).

If BTC fails to reclaim and hold above 81k, continuation downward is likely.

The projected move aligns with a ~17% downside, targeting 66k.

🧠 Trading Bias

Bias: Bearish continuation

Best Sell Area: 80k–81k (on rejection confirmation)

Invalidation: Daily close above 90.3k (break of channel)

⚠️ Notes

Expect volatility near support.

Confirmation from volume or bearish candles (engulfing / rejection wicks) will strengthen the setup.

Tecnicalanalysis

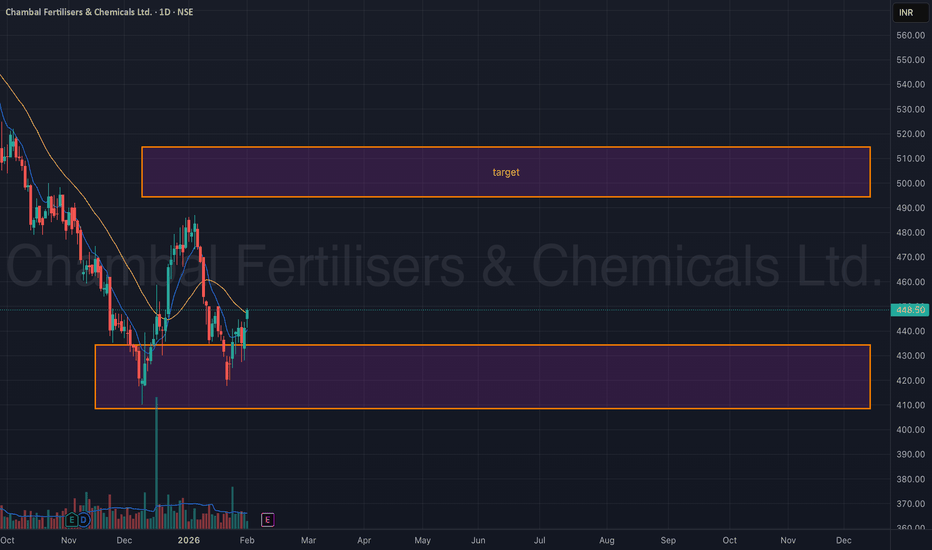

Chambal Fertilisers & Chemicals Ltd | Daily Chart | StructureChambal Fertilisers is currently trading inside a well-defined higher-timeframe demand zone after a prolonged corrective phase. Price action suggests the stock is attempting to stabilise after distribution, with clear levels now in place.

The stock was in a strong downtrend, marked by lower highs and lower lows.

Price has now entered a broad demand zone (~₹410–₹430) where buyers have historically stepped in.

Recent candles show base-building behaviour, indicating selling pressure is reducing.

This phase is best described as early accumulation / reaction phase, not a confirmed reversal yet.

Key Price Zones

Major Demand Zone: ₹410 – ₹430

→ Strong historical support

→ High-volume reaction seen earlier

Immediate Resistance / Supply: ₹455 – ₹470

→ Price has reacted here in the past

→ Needs a clean breakout to change bias

Upside Target Zone: ₹490 – ₹515

→ Previous supply area

→ Acts as logical mean reversion target if trend improvesShort-term EMA has started flattening, suggesting loss of downside momentum.

Final View

Chambal Fertilisers is no longer trending down aggressively, but it is not trending up yet.

The stock is in a high-impact structural zone, where patience matters more than prediction.

📌 Demand holding = opportunity building

📌 Breakout confirms strength

📌 Breakdown invalidates the setup

Educational analysis only. Not a buy/sell recommendation.

US100: Swing Trading & Technical Analysis

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the US100 pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support

USDCHF: Short Signal Explained

USDCHF

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell USDCHF

Entry - 0.7730

Stop - 0.7744

Take - 0.7699

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

BTCUSD: Bullish Continuation is Expected! Here is Why:

The price of BTCUSD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry - 1.1850

Sl - 1.1824

Tp - 1.1902

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

APPLE The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 259.34

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 254.61

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

QQQ Trading Opportunity! BUY!

My dear friends,

Please, find my technical outlook for QQQ below:

The instrument tests an important psychological level 621.70

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 626.73

Recommended Stop Loss - 618.93

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

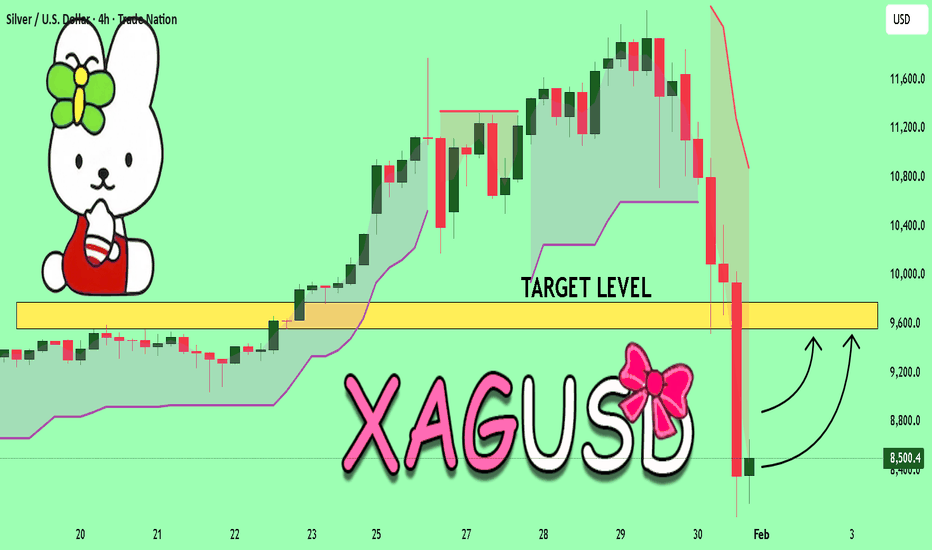

SILVER What Next? BUY!

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 8500.4

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 9562.0

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD 30M – Bearish Channel, Buy from Key Support

Got it — you want a clean chart title for this EURUSD setup. Here are strong TradingView-style title options (pick your vibe 👇):

🔹 Simple & Professional

EURUSD – Descending Channel | Support Bounce Setup

🔹 Trader-Focused

EURUSD 30M – Bearish Channel, Buy from Key Support

🔹 Educational / Clean

EURUSD – Price Reacting at Channel Support (Potential Rebound)

🔹 More Attractive for TradingView

EURUSD 30M | Channel Support → Upside Correction

🔹 Short & Sharp

EURUSD – Channel Support Reaction

If you want, I can:

Match the title with a full analysis caption

Rewrite it for more likes & visibility on TradingView

Make it beginner-friendly or pro-level

Just tell me 👍

analysis

Alright, let’s do a clear, structured analysis for this EURUSD 30-minute chart 👇

📊 EURUSD – Technical Analysis (30M)

🔍 Market Structure

Price is moving inside a descending channel → overall bearish trend

Continuous lower highs & lower lows confirm seller control

Current price is reacting at the lower channel boundary

📉 Key Technical Zones

Support Zone: 1.1845 – 1.1855

Confluence:

Channel lower trendline

Previous demand area

Stop Loss: 1.1840 – 1.1842

Below structure low (trend invalidation)

Resistance / Target Zone: 1.1888 – 1.1900

📈 Trade Idea (Counter-Trend)

Setup Type: Support bounce (corrective move)

Entry: Buy confirmation from support

Bullish candle / rejection wick preferred

Targets:

TP1: 1.1865

TP2: 1.1885

TP3: 1.1900 🎯

⚠️ This is a pullback trade, not a trend reversal.

🧠 Bias & Expectations

Short-term bias: Bullish correction 🟢

Higher-timeframe bias: Bearish 🔴

Best strategy after target:

Watch for sell setups near channel mid / top

❌ Invalidation

Strong candle close below 1.1840

Breakdown of channel support = continuation lower

XAUUSD – D1 Mid-Term OutlookXAUUSD – D1 Mid-Term Outlook: Volatility Reset Before the Next Structural Move | Lana ✨

Gold has just experienced a sharp and aggressive sell-off from the highs, marking a clear shift from expansion into a volatility reset phase. While the broader bullish trend has not been fully invalidated, price action now suggests the market is entering a medium-term rebalancing process, where liquidity and structure will play a decisive role.

At this stage, the focus moves away from short-term noise and toward key daily levels that will define the next swing direction.

📈 Higher-Timeframe Structure (D1)

The strong vertical rally has been followed by a deep corrective candle, indicating distribution and profit-taking at premium levels.

Price has broken below short-term momentum support but is still trading above major higher-timeframe trend structure.

This behavior is typical after an extended rally, where the market needs time to absorb supply and reset positioning before choosing the next medium-term direction.

The current structure favors range development or a corrective swing, rather than immediate continuation to new highs.

🔍 Key Daily Zones to Watch

Major Resistance Zone: ~5400 – 5450

This area represents strong overhead supply. Any recovery into this zone is likely to face selling pressure and should be treated as a reaction zone, not a breakout zone.

Strong Liquidity Level: ~5100

A key magnet for price. Acceptance above or rejection below this level will heavily influence medium-term bias.

Sell-Side Liquidity Zone: ~4680 – 4700

This is a critical downside target where stops and unfilled liquidity are resting.

High-Liquidity Buy Zone: ~4290

A major higher-timeframe demand area. If price reaches this zone, it would complete a deep correction within the broader bullish cycle and open the door for medium-term accumulation.

🎯 Medium-Term Trading Scenarios

Scenario 1 – Corrective Recovery, Then Sell Pressure (Primary):

Price may attempt a rebound toward 5100 or even the 5400–5450 resistance zone. As long as price remains below this resistance, rallies are more likely to be corrective, offering opportunities to reassess shorts or reduce long exposure.

Scenario 2 – Continuation of the Correction:

Failure to reclaim 5100 increases the probability of a continued move lower toward 4680–4700, where sell-side liquidity is resting.

Scenario 3 – Deep Reset and Structural Buy:

If downside momentum accelerates, a move toward the 4290 high-liquidity zone would represent a full medium-term reset. This area is where stronger buyers may re-enter and where the next swing-long narrative could begin to form.

🌍 Market Context (Medium-Term View)

Such sharp daily moves often occur during periods of macro repricing and sentiment shifts, forcing the market to rebalance expectations. In these environments, gold tends to oscillate between liquidity zones, rather than trend cleanly in one direction.

This makes patience and level-based execution more important than prediction.

🧠 Lana’s Perspective

The market is no longer in a “buy-every-dip” phase.

This is a transition environment, where gold needs to finish its liquidity work before the next sustained move develops.

Lana stays neutral-to-cautious in the medium term, focusing on reactions at daily liquidity zones, not emotional bias.

✨ Let the structure reset, let liquidity clear, and wait for the market to show its hand.

XAUUSD (H4) – Liam Weekly OutlookXAUUSD (H4) – Liam Weekly Outlook

Uptrend under pressure, but not broken | Focus on retests and reactions

Quick summary

Gold has experienced a sharp corrective move after an extended bullish run. The recent sell-off has broken the steep short-term uptrend, but price has not confirmed a full trend reversal on H4.

At this stage, the market is transitioning into a rebalancing phase. For the coming week, the edge is not in predicting direction, but in trading reactions at key structure, Fibonacci, and FVG levels.

Market structure overview

The prior bullish trend has lost momentum after a vertical expansion.

Price has broken below the aggressive trendline, signaling trend exhaustion, not automatic reversal.

Current price action suggests a corrective structure with potential for range development or trend resumption after liquidity is rebalanced.

➡️ Bias remains neutral-to-bullish, conditional on how price reacts at key levels.

Key technical zones for the week

Primary buy-on-retest zone: trendline retest area around 4850 – 4900

This area has already shown reaction and acts as the first decision point for buyers.

Fibonacci 0.618 / key reaction zone: 5030 – 5050

A pivotal mid-range level. Acceptance above favors continuation; rejection keeps price corrective.

FVG + Fibonacci confluence: 5235 – 5260

This is a major imbalance zone. If price rallies into this area, expect strong reaction and two-sided trade.

Lower liquidity / value zone: 4540 area

This remains the deeper downside objective if higher levels fail to hold and the correction expands.

Weekly scenarios (Liam style: trade the level)

Scenario A – Trendline retest holds (bullish continuation)

If price continues to hold above the trendline retest zone and builds higher lows:

Look for bullish continuation toward 5030 → 5235

Break and acceptance above the FVG zone would reopen upside continuation potential.

Logic: This confirms the move as a healthy correction within a broader bullish structure.

Scenario B – Rejection from mid-range (extended correction)

If price fails to reclaim and hold above 5030 – 5050:

Expect choppy, corrective price action

Risk shifts toward a deeper pullback into 4540

Logic: Failure to hold the 0.618 zone keeps the market in rebalancing mode.

Scenario C – FVG test and rejection

If price rallies aggressively into 5235 – 5260:

This zone favors reaction and profit-taking

Acceptance above is required for any sustained bullish continuation.

Logic: FVG zones after strong sell-offs often act as distribution or reaction points before direction is decided.

Key notes for the week

Volatility remains elevated after the sell-off — expect false breaks.

Avoid mid-range trades without confirmation.

Let price prove acceptance or rejection at levels before committing.

This is a week for patience and execution, not conviction.

Weekly focus:

Will gold hold the trendline retest and rebuild higher, or fail at the 5030–5050 zone and rotate deeper into value?

— Liam

CADJPY Massive Short! SELL!

My dear friends,

Please, find my technical outlook for CADJPY below:

The price is coiling around a solid key level - 113.78

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 113.01

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDJPY Under Pressure! SELL!

My dear followers,

I analysed this chart on USDJPY and concluded the following:

The market is trading on 154.22 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 153.74

Safe Stop Loss - 154.53

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD: Bullish Forecast & Bullish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD: Bearish Continuation & Short Signal

NZDUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NZDUSD

Entry Point - 0.6058

Stop Loss - 0.6068

Take Profit - 0.6039

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD My Opinion! BUY!

My dear friends,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 5130.2 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 5240.1

Recommended Stop Loss - 5071.0

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD – Bearish Pullback from Channel Resistance (1HKey Levels on Your Chart

Resistance Zone: 82,900 – 83,500

Price already reacted here

This zone aligns with channel resistance + previous structure

Stop Loss: ~83,600

Above resistance → invalidates the bearish setup

Target Zone: 79,400 – 79,300

Strong demand / liquidity area

Near previous lows

📊 Trade Bias

Primary Bias: BEARISH (Sell on rejection)

Sell Idea:

Entry: From resistance zone (82.9k–83.5k) after bearish confirmation

SL: Above 83.6k

TP: 79.4k / 79.3k

Risk–Reward: Very clean & favorable ✅

🧠 What to Watch Before Entry

Bearish candle confirmation (engulfing / rejection wick)

Weak volume on bullish candles

No strong bullish breakout above 83.6k

⚠️ Invalidation

A strong close above the channel + 83.6k

This would shift bias to short-term bullish / range behavior

📌 Summary

Trend: Bearish

Setup: Pullback sell

Structure: Descending channel

Execution: Wait for confirmation, don’t rush

If you want, I can:

XAUUSD – M15 Technical Outlook XAUUSD – M15 Technical Outlook

Sideways to bearish correction | Liquidity clearing phase

Gold has shifted from expansion into a sideways-to-bearish corrective phase on M15. After the prior impulsive leg, current price action no longer supports immediate continuation. Instead, the market is rotating and compressing, signaling a liquidity-seeking environment, likely to the downside.

This is not a trend-following setup. The focus here is liquidity behavior and reaction zones, not anticipation.

Market Structure

Price is trading within a descending corrective channel, reflecting short-term bearish pressure.

Momentum has slowed significantly, with compressed candles and weak follow-through.

Price is consolidating below prior highs, a structure that often precedes a stop sweep rather than a breakout.

The structure favors further downside exploration before any meaningful stabilization.

Key Technical Zones

Upper supply / strong volume zone: 5460 – 5480

This area previously attracted heavy volume and remains a rejection zone on any bounce.

Sell FVG: 5324 – 5330

As long as price remains below this zone, rallies are corrective and favor sell-side reactions.

Current consolidation range: 5150 – 5220

This range represents indecision and liquidity build-up, not accumulation.

Primary downside liquidity target: 4900 – 4906

This zone aligns with higher-timeframe structure and represents a natural area for sell-side liquidity to be cleared.

Intraday Scenarios

Primary scenario – Liquidity sweep lower

As long as price is capped below 5324–5330, the path of least resistance remains lower. A break of the current range opens the door toward 4900–4906 to complete the liquidity objective.

Secondary scenario – Corrective bounce

Short-term rebounds may occur from the range, but unless price reclaims and holds above the sell FVG, these moves remain corrective only.

Stabilization scenario

If price reaches 4900–4906, monitor closely for absorption and structural change. Only a clear shift here would suggest the correction is complete.

Liam’s Take

This is liquidity cleanup, not trend failure.

Compression phases punish early entries and reward patience.

Let price do the work.

Wait for liquidity to be taken, then reassess structure.

— Liam

XAUUSD – H2 Technical OutlookXAUUSD – H2 Technical Outlook: Short-Term Sell Pressure as Liquidity Gets Cleared | Lana ✨

Gold is showing signs of short-term weakness after an aggressive upside expansion. Price action suggests the market may continue to move lower in the near term, not as a trend reversal, but as a liquidity-driven correction within a broader bullish structure.

At this stage, the focus shifts from continuation to how price behaves while liquidity is being taken below structure.

📈 Market Structure & Price Behavior

The recent vertical rally has left the market overextended, making a corrective phase technically healthy.

Price has broken below short-term support and is now trading under a descending corrective trendline, signaling short-term bearish pressure.

This type of structure often develops when the market needs to clean buy-side positions before rebuilding for the next leg.

While the higher-timeframe trend remains bullish, the intraday bias has shifted to corrective / bearish until liquidity objectives are met.

🔍 Key Liquidity Zones on the Chart

Short-term sell zone: the descending trendline near current price

As long as price reacts below this trendline, rallies are more likely to be sold.

Scalping buy liquidity: around 5050–5070

This area may generate temporary bounces, but reactions here should be treated as short-term only.

Key bullish order block: 4825 – 4830

A critical zone where stronger buyer participation may appear if the sell-off extends.

Major swing liquidity zone: 4613 – 4625

This is a high-confidence liquidity pocket where the market could complete a deeper correction and reset the broader bullish structure.

🎯 Trading Scenarios

Primary scenario – Continuation of the pullback:

As long as price remains below the descending trendline, gold may continue to move lower to sweep liquidity below recent lows. This favors sell-on-rallies rather than buying strength.

Secondary scenario – Temporary reaction:

Short-term bounces may occur around the 5050–5070 area, but without structural reclaim, these moves are more likely corrective than trend-changing.

Structural defense scenario:

If price reaches the 4825–4830 or 4613–4625 zones, watch closely for signs of stabilization and absorption, which would signal that the liquidity objective has been completed.

🧠 Lana’s View

This move lower is best seen as liquidity cleanup, not panic selling.

Lana stays patient during corrective phases, avoiding early longs and waiting for price to reach clear liquidity zones before reassessing bullish continuation.

✨ Let the market take what it needs, then look for structure to rebuild.

XAUUSD – Brian | 30M – Value Shift After XAUUSD – Brian | 30M – Value Shift After a Sharp Volatility Move

Gold has just experienced a significant volatility event, with price selling off aggressively from the highs before rebounding sharply. The market is now trading around a newly formed value area, a typical behaviour when price transitions from expansion into a rebalancing phase. In this environment, value and POC levels tend to guide price more effectively than individual candles.

Macro Context (Brief)

Market sentiment remains sensitive to macro risks, including commodity volatility, geopolitical tensions and monetary policy expectations. Gold ETF holdings have shown no meaningful change recently, suggesting no clear signs of institutional liquidation. The current volatility therefore appears more consistent with a positioning adjustment rather than a broader trend reversal.

Technical Analysis from the Chart (30M)

Following the sharp sell-off, price is now forming a well-defined trading range, with value areas acting as key reference points:

1) Upper Supply / Reaction Zones

POC – SELL: 5,531–5,526

The previous high-value zone, where selling pressure may re-emerge if price retraces higher.

Sell VAH: 5,365–5,369

The value area high, typically a reaction zone if distribution pressure remains present.

2) Current Balance Area

The 5,180–5,200 region is currently acting as a balancing zone after the volatility. Acceptance and consolidation above this area would increase the probability of a move back towards the VAH.

3) Lower Demand / Support Zones

POC Buy (scalping): 5,187

A short-term support area for technical reactions.

Buy VAL – Support: 5,058–5,064

The most important lower support zone. If a deeper liquidity sweep occurs, this area is likely to attract attention for potential absorption and short-term reversal.

Price Scenarios (Structure-Based)

Scenario A (Preferred if value holds):

Price holds above 5,180–5,200 → recovery towards 5,365–5,369 (VAH).

Scenario B (Rejection from above):

Price retraces into the VAH zone but faces clear rejection → rotation back towards the 5,187 / 5,180 area.

Scenario C (Deeper liquidation):

Loss of 5,180 → liquidity sweep into 5,058–5,064 (VAL) before attempting to rebuild.

Key Takeaway

In a rebalancing phase, value acceptance matters more than directional prediction. Focus on how price behaves around 5,180–5,200, the reaction at 5,365–5,369, and whether deeper support at 5,058–5,064 attracts meaningful buying interest.

Refer to the chart for detailed POC, VAH and VAL levels.

Follow the TradingView channel to receive early structure insights and join the discussion.

GBPNZD: Bulls Will Push

The recent price action on the GBPNZD pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF: Great Trading Opportunity

GBPCHF

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy GBPCHF

Entry - 1.0574

Stop - 1.0561

Take - 1.0595

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️