When Structure and Volatility Align Again — Will History Rhyme?In the past, an ascending triangle combined with a Bollinger Bands squeeze led to a volatility expansion and the start of a directional move.

Currently, price is consolidating within a horizontal channel while Bollinger Bands are compressing again, suggesting another phase of reduced volatility.

Rather than predicting direction, this observation focuses on how market structure and volatility compression often precede expansion , regardless of outcome. The question remains whether history will rhyme once more — to the upside or the downside.

ETHICAL & EDUCATIONAL NOTICE

This content is presented solely for educational and analytical purposes , based on historical price data.

It does not promote or encourage any specific trading method, financial instrument, gambling, leverage, margin usage, short selling, or interest-based activity .

Readers are encouraged to align any financial activity with their own ethical, legal, and religious principles .

⚠️ DISCLAIMER

This material is strictly educational and informational .

It does not constitute financial advice, investment recommendations, or trading instructions.

The author does not provide personalized guidance.

Any decisions made based on this content are the sole responsibility of the individual.

Tehnicalanalysis

Bitcoin Is Setting a Trap Before the Next ExplosionBitcoin 1H Market Analysis — Liquidity Trap & Expansion Setup

1. Current Market Structure

- Bitcoin is currently trading inside a corrective bearish structure following the previous impulsive move up.

- Price formed a sequence of lower highs, capped by a descending trendline, confirming short-term selling pressure.

However, the most recent drop failed to continue lower and instead produced a strong bullish reaction from the demand zone, signaling potential exhaustion of sellers.

This indicates the market is transitioning from distribution → accumulation on the 1H timeframe.

2. Key Liquidity & Zones

Major Resistance Zone: 90,500 – 90,700

→ Previous supply + trendline confluence

Demand Zone: 87,700 – 88,000

→ Strong buying reaction, liquidity sweep completed

Liquidity Sweep:

The sharp sell-off into demand flushed late longs and trapped breakout sellers, allowing smart money to accumulate at discounted prices.

This is a classic liquidity grab below structure before reversal.

3. Market Scenario (Primary Outlook)

🔼 Bullish Scenario – Preferred

Based on current price behavior:

- Price is likely to retest the descending trendline

- A successful reclaim above 89,300 – 89,600 would confirm a bullish structure shift

- After a shallow pullback, BTC can expand toward:

TP1: 90,500

TP2: 92,000+

Extended Target: 93,500 (range high)

This matches the projected path drawn on your chart.

4. Market Psychology

- Retail traders are reacting emotionally to the sharp drop, assuming continuation lower.

- Smart money used the sell-off to absorb liquidity inside demand.

- The strong bounce shows buyers are in control below 88K.

- This environment favors patience and confirmation, not chasing breakouts blindly.

The market is setting a trap for late sellers before expansion.

5. Trading Guidance

❌ Avoid selling inside the demand zone

✅ Focus on:

- Buy setups after trendline reclaim

- Pullbacks holding above 88,500

- Break-and-retest confirmations

- Risk management is critical — volatility expansion is likely once price leaves this compression.

Summary

Bitcoin has completed a liquidity sweep into demand and is showing early signs of a trend reversal on the 1H timeframe.

As long as price holds above the demand zone, the bias remains bullish toward higher liquidity and resistance targets.

This is not a random bounce it is structured price behavior driven by liquidity and positioning.

ESPR 1W: cholesterol therapy for patients and investors alikeEsperion Therapeutics (ESPR) has broken its long descending trendline and retested the $2.4–$2.6 support area, forming a solid triple bottom with rising volume. The stock is now holding above key moving averages, signaling accumulation. While above $2.5, the technical setup points to a move toward $6.4, aligning with major resistance and the 200-week MA.

Fundamentally, the company enters one of its strongest phases in years. Following earlier liquidity struggles, Esperion has stabilized its operations and regained investor confidence. The core growth driver is Nexletol (bempedoic acid), a non-statin cholesterol-lowering therapy for patients intolerant to statins. In 2025, combined Nexletol and Nexlizet sales jumped over 45% year-on-year, surpassing $170 million for the first nine months. Recent safety data were positive, leading to new approvals across Europe and Japan - expanding partnerships and licensing revenues. Cash position strengthened via milestone payments from Daiichi Sankyo and Viatris, reducing debt and supporting R&D without new dilution. Challenges remain: profitability is still out of reach, as marketing and development expenses stay high, though liquidity provides breathing room. The broader biotech sector’s rebound amid rate-cut expectations adds tailwind to revenue-backed small caps like Esperion.

Tactically, holding above $2.5 keeps the bullish trajectory intact toward $6.4. A weekly close below $2.3 would negate the setup and re-test lower support, though current accumulation favors the upside.

Esperion helps reduce cholesterol - ironic that its chart still raises investors’ heart rate.

LC 1W: When the Market Spreads Its WingsOn the weekly chart of LendingClub (LC) , a “golden cross” has formed - the MA50 crossing above the MA200 from below, confirming a medium-term trend shift in favor of buyers. The current price of 15.30 is trading within the 0.705–0.79 Fibonacci zone (14.54–15.32), which now acts as a key support after the breakout. Structurally, the asset is moving within a broadening ascending channel, suggesting potential for increased volatility and range expansion.

Technically, the market shows strength: the upward impulse was accompanied by an abnormal spike in volume, both MA50 and MA200 are positioned below the price, and the nearest resistance is at 17.26 (1.0 Fibonacci level). A breakout above this area opens the way to the 1.618 extension at 22.95–23.02. The scenario is invalidated if the price closes below 12.65, which would pull it back into the previous descending structure.

Fundamentally, LendingClub benefits from easing tensions in the US debt market and moderate growth in consumer lending. Positive earnings momentum and the resilience of its business model add further confidence to the bulls.

Tactical plan: as long as the price holds above 14.54–15.32, the medium-term growth scenario remains valid, targeting 17.26 and 23.02. The optimal entry would come after confirming the support hold and spotting a local reversal candlestick pattern on the daily timeframe.

As they say, a golden cross isn’t just an indicator - it’s a first-class ticket to the trend league. Just make sure you don’t miss the flight.

DUOL Long The market fears that Duolingo will lose ground to AI and Google, and on top of that, their marketing executive left the company. That’s why the stock has already dropped 52% from its previous high. But don’t think it’s cheap..nope, at the current price it still has a P/E ratio of 65, so there’s room for more downside.

However, I see that it has reached a major support level, and volume is also increasing. I bought 80 shares at $280.

iQIYI: bet on recovery or just another illusion?Fundamentally, iQIYI is often called the “Netflix of China.” In recent years, it has faced heavy pressure from high debt levels, fierce competition from Tencent Video and Bilibili, and slower growth in the Chinese domestic market. However, recent earnings reports show positive shifts: a growing subscriber base, higher ARPU (average revenue per user), and reduced operating losses. With government support for the tech and entertainment sector and signs of consumer recovery, iQIYI has a real chance to strengthen in the mid to long term. If subscriber growth and cost control continue, the company’s market cap could start to recover, making current levels attractive for medium-term investors.

Technically, the stock still trades below the 200 EMA, showing ongoing seller pressure. The key support zone is $2.30–2.40, and holding this area keeps the bullish scenario alive with targets at $3.40 and $5.25. A longer-term recovery could extend toward $10.40, but only if a sustainable uptrend is confirmed. Losing $2.30 would invalidate the bullish case and expose downside toward $1.60–1.80.

This is one of those situations where market expectations diverge from reality. Optimism makes a reversal seem near, but as always, emotions must be put aside — we wait for clear technical signals before entering.

DXY: Dollar’s ready, but the starter pistol’s still silentDXY is holding in the 97.50–97.60 support zone, an area where buyers have stepped in multiple times. Current market structure suggests possible liquidity accumulation before an upside move. The key tactical trigger is a breakout and close above 98.76, opening the path to 100.28, then 101.84 where historical selling pressure has emerged. The long-term target, if all levels break in sequence, is 104.40. While price remains below 98.76, buyers have no confirmed advantage and any rally remains speculative.

Fundamentally , the dollar lacks unconditional support: US macro data is mixed and Fed policy remains uncertain. However, safe-haven demand and cautious risk positioning by large players create a backdrop for a potential upward correction.

Tactical plan: watch 97.50–97.60, a confirmed break above 98.76 activates a move towards 100.28 → 101.84 → 104.40. Failure to break cancels the idea until a fresh impulse emerges.

The dollar right now is like a boxer before stepping into the ring - warmed up, focused, but waiting for the bell.

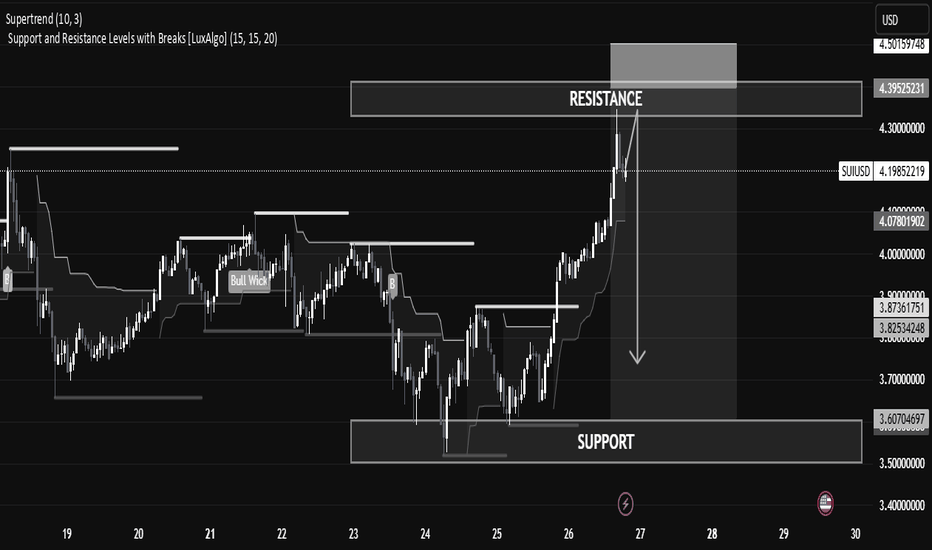

SUI/USD Technical Analysis – Potential Reversal Zone IdentifiedSUI/USD Technical Analysis – Potential Reversal Zone Identified

The current SUI/USD price action shows a strong bullish impulse reaching into a well-defined resistance zone, suggesting a potential pullback or reversal in the short term.

🔍 Key Levels

Resistance Zone: Between 4.30 – 4.39 USD, currently being tested after a strong bullish run. This is a historical supply area where price previously reversed.

Support Zone: Found between 3.60 – 3.70 USD, where price consolidated and accumulated before initiating the current rally.

Current Price: 4.2044 USD, slightly below the resistance zone, showing early signs of rejection.

📊 Technical Indicators & Structure

Supertrend (10,3): Bullish signal still active, suggesting trend strength, though traders should be cautious near resistance.

Break of Structure (BoS): Clean upward breaks suggest buyer dominance, but profit booking or sell-side liquidity may emerge near resistance.

Volume & Momentum: Impulse candles show strength, but volume tapering near resistance could indicate exhaustion.

📘 Educational Perspective

This setup highlights the importance of trading within key zones:

Buying at support, where demand is strong.

Monitoring resistance for signs of exhaustion or reversal patterns like wicks, doji, or bearish engulfing.

Risk Management Tip: In such cases, aggressive traders might short from resistance with tight stops, while conservative traders wait for confirmation (e.g., break and retest of the support or resistance).

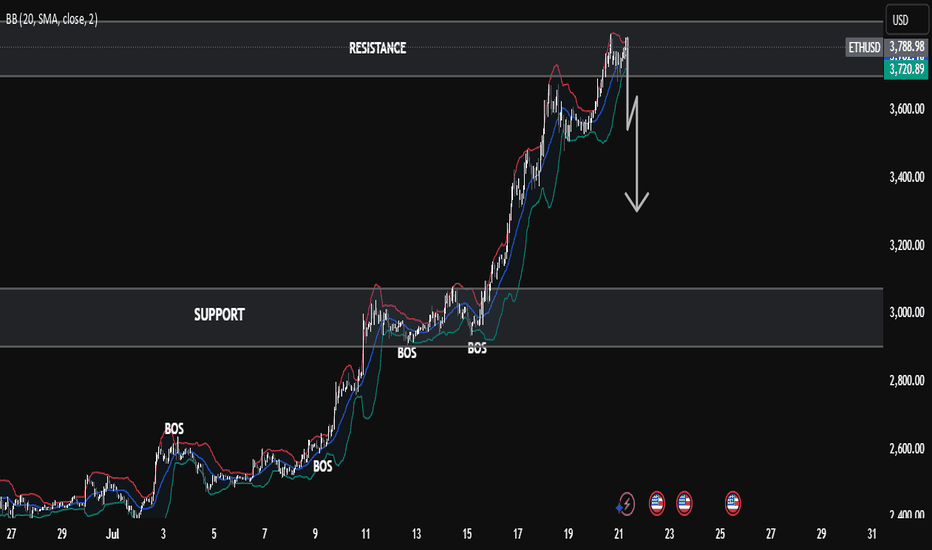

Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?”

Ethereum is currently trading near a key resistance zone around $3,800, as marked on the chart. After a strong bullish rally with clear Break of Structures (BOS) along the way, ETH has now reached an extended point where price may face selling pressure.

The Bollinger Bands are stretched, showing overextension, and the marked arrow suggests a possible correction or pullback from this level. A retest of previous support zones (~$3,400–$3,200) could be expected if the resistance holds.

⸻

Key Levels:

• 🔼 Resistance: ~$3,800

• 🔽 Support: ~$3,400 / ~$3,000

• 🔄 Price Action: Watching for rejection or breakout confirmation

This is a textbook case of price approaching a strong resistance level after a bullish wave, where caution and confirmation are key for the next move.

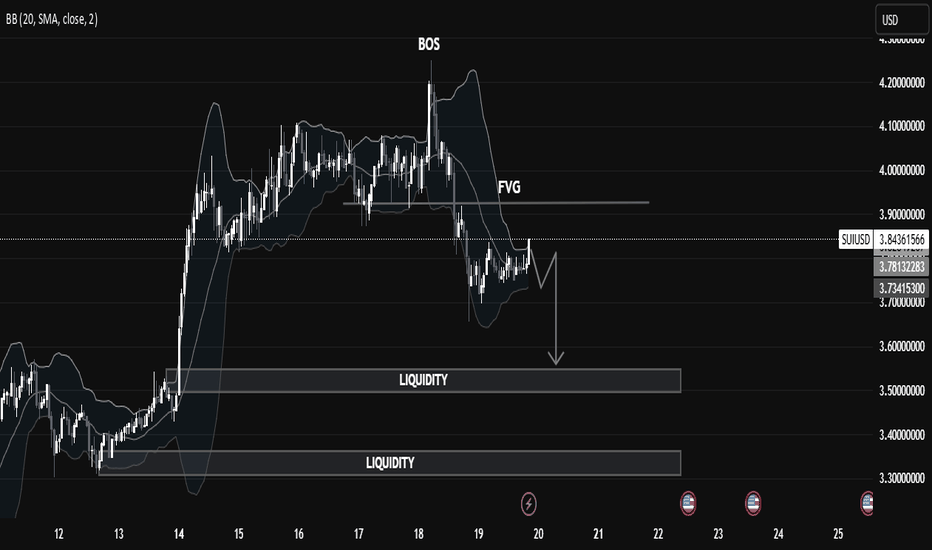

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for a reaction and looking for an entry point.

The post will be adjusted based on changes.

Don't forget to click on the Rocket! =)

GOLD 4H: not all that glitters is bullish...The 4H chart shows a clean descending triangle breakdown. Price failed to reclaim the trendline and was rejected under both MA50 and MA200. The bounce into 3325–3340 was absorbed — classic liquidity sweep and fade. Volume confirms bearish control.

Technically, the breakdown below 3320 opens the way toward $3293 (1.0 Fibo), $3250 (1.272 extension), and final target at $3195 (1.618), where buyers might step in. RSI supports the continuation without signs of reversal. Structure broke — and the market is telling us where it's heading.

Tactical plan:

— Entry at market or on a retest of $3325–3335

— Targets: $3293 → $3250 → $3195

— Stop: above $3340 (above MA50 and broken trendline)

When gold looks shiny, smart traders look deeper. This breakout isn’t golden — it’s a trap for late bulls.

BTCUSD Analysis | Bearish Setup Unfolding?Bitcoin is trading within a descending channel, respecting lower highs and lower lows. The recent price action shows a sharp bounce from the $98,600 support zone, but the bigger picture still hints at potential downside.

🔍 Key Technical Insights:

Descending Channel remains intact – structure suggests bearish continuation.

Price bounced from $98,626 support, but is struggling below key resistance at $108,622.

A possible lower high formation near $106K–$107K could trigger the next drop.

Bearish projection remains valid if price fails to break above the descending trendline.

🟢 Upside Scenario: If bulls manage to break above $109K resistance, we could see a bullish reversal.

🔴 Downside Target: If the bearish setup confirms, we may revisit the $98,000–$99,000 support area once again.

📌 Plan Accordingly:

Wait for price action confirmation near resistance. Patience pays in volatile zones like this!

#BTCUSD #Bitcoin #CryptoAnalysis #TradingView #BTCUpdate #CryptoTrader #TechnicalAnalysis

EUR/USD Biases (Long, Short, and Today’s View)EUR/USD Trading Biases: Navigating Bullish Momentum and Key Resistance Zones

This will be a concise market analysis essay (around 600–700 words) suitable for a financial audience, such as forex traders or analysts. Let me begin:

EUR/USD Trading Biases: Navigating Bullish Momentum and Key Resistance Zones

The EUR/USD pair, one of the most actively traded currency pairs in the forex market, has exhibited strong bullish momentum in recent sessions. As of June 26, 2025, the euro’s ascent against the dollar has brought it to a critical juncture, testing significant technical and psychological resistance levels. Traders are now weighing the potential for continued upside against growing signals of exhaustion and looming fundamental catalysts.

Bullish Outlook: A Technically Supported Advance

From a technical perspective, the bullish case for EUR/USD remains compelling. The pair is entrenched in a sustained uptrend, marked by successive breakouts above prior resistance levels and validated by daily and weekly closes above 1.1600. The current price action is converging on a crucial supply zone located between 1.1700 and 1.1900—an area historically known for triggering reversals but also pivotal in confirming trend continuation if broken convincingly.

Technical indicators further bolster the bullish narrative. The Relative Strength Index (RSI), while approaching overbought territory, is still supportive of higher prices. The Moving Average Convergence Divergence (MACD) displays a widening bullish histogram, and the Average Directional Index (ADX) confirms trend strength. Near-term resistance lies between 1.1680 and 1.1730, with potential for an extension to 1.1800 should the pair breach this upper band.

On the fundamental front, improved German Ifo business sentiment data has injected optimism into the eurozone outlook. Additionally, easing geopolitical tensions and a broader risk-on sentiment in global markets have undercut the dollar's safe-haven appeal. Speculation over potential Federal Reserve rate cuts further dampens dollar strength, creating tailwinds for EUR/USD.

Bearish Considerations: Resistance and Reversal Risks

Despite the encouraging trend, caution is warranted. The area between 1.1700 and 1.1900 represents a major weekly order block (OB) resistance—territory where several past rallies have lost steam. Oscillators such as the Commodity Channel Index (CCI) and RSI are showing signs of overextension, and the market is now vigilant for reversal patterns or signs of exhaustion.

Fundamentally, while the recent Ifo data is encouraging, it remains below the key threshold of 100, reflecting lingering skepticism about the eurozone's full recovery. Moreover, upcoming U.S. economic releases, particularly GDP figures and jobless claims, could act as potential catalysts for a dollar rebound. Hawkish commentary from Federal Reserve officials could also tilt sentiment, especially if it dampens expectations of rate cuts.

If EUR/USD fails to hold above the 1.1700–1.1730 resistance zone, a corrective move toward 1.1530–1.1500 becomes plausible. Deeper pullbacks could extend toward 1.1470 and 1.1390, especially if risk sentiment reverses or economic data surprises in favor of the dollar.

Today’s View: Bullish with a Note of Caution

For today, June 26, the prevailing bias remains bullish, yet increasingly cautious. The pair is testing the lower end of the 1.1700 OB zone. A decisive break and hold above this level would likely unleash further upside toward 1.1730 and 1.1800. However, overbought conditions and proximity to a known resistance zone suggest that traders should remain alert to potential rejection.

Intraday strategies favor buying on dips above 1.1600–1.1635, with stops placed just below 1.1600 and targets set at 1.1700–1.1730. Conversely, short positions should only be considered if there is a clear rejection from the 1.1700–1.1730 area, with downside targets at 1.1530–1.1500 and stops above 1.1800.

Conclusion

The EUR/USD is currently at a pivotal inflection point. While the bullish trend is intact and supported by both technical and fundamental factors, the proximity to a major resistance zone introduces a layer of complexity. Traders must remain agile—ready to ride a breakout higher if confirmed, but equally prepared to pivot if the pair falters and signals a reversal. In markets like these, timing and confirmation are everything.

[INTRADAY] #BANKNIFTY PE & CE Levels(26/06/2025)Today, Bank Nifty is likely to open slightly gap up near the 56,550–56,600 zone, which is a crucial resistance area. A sustained move above this zone can trigger bullish momentum, opening the door for further upside targets of 56,750, 56,850, and potentially 56,950+. Traders can look for buying opportunities in call options above this range with a tight stop-loss, especially if the index breaks out with strong volume and positive sentiment. The zone between 56,600 and 56,950 has acted as a resistance band in recent sessions, so a clean breakout may lead to a directional rally.

On the flip side, if Bank Nifty fails to hold above the 56,450 mark and starts to trade below it, we may see downside pressure in the market. This breakdown could offer a good short opportunity using put options, with downside targets around 56,250, 56,150, and 56,050. The 56,050 level will act as a strong support and could attract buyers again if tested. Traders should remain cautious near resistance and support zones and avoid aggressive positions unless there is clear confirmation. The market may remain volatile in the first half, so a wait-and-watch approach with disciplined risk management is advisable.

MGY: Technical Breakout + Fundamental Momentum = Quiet Winner?Magnolia Oil & Gas (MGY) is showing one of the cleanest technical breakouts in the energy sector — and the market hasn’t priced it in yet. After months of pressure, price has broken above both the 50-day and 200-day moving averages with rising volume, signaling a clear phase shift from distribution to accumulation. Recent candles confirm control shifting to the buyers, with a tight structure, rising lows, and bullish momentum building underneath resistance.

The fundamentals back the technical setup. In the latest earnings report, MGY delivered a 9.7% revenue increase, $110M in free cash flow, and continues to pay dividends with low leverage. UBS upgraded the stock with a $29 target, which aligns precisely with the post-breakout projection. Operationally, the company is expanding in key U.S. basins like Eagle Ford, while seeing growing demand from Australia and Latin America.

With oil prices pushing higher and geopolitical tensions rising, MGY stands out as a stable energy play in a volatile world. Holding above the $24.00–$24.30 zone keeps the breakout valid, with $29+ as a natural magnet for price. Most investors are still asleep on this name — but the structure is already telling a very different story.

EURJPY Sell - May 13, 2025📍Context:

Reaction from Daily Orderblock

Clear 15m BOS

Two Asia lows & a gap in our direction

Entry at 15m OB with 0.5% risk

If price gives a 1m BOS within the OB, I’ll add another 0.5% to go full risk.

Even though there’s a 5m OB above, I’m comfortable taking the trade if we show signs of rejection.

🎯 TP: Targeting Asia lows and continuation down with clean structure.

May 8, 2025 EURUSD Buy📈 Bias: Countertrend Long | Risk: 1% (2 entries)

🎯 Target: Fill Asia range / 15mOB for LH

🧠 Reasoning:

London session opened inside a 5m OB, followed by a BOS in our direction.

Even though it's a countertrend trade, it aligns with the idea of forming a lower high from a strong reaction zone.

Waiting for 2 entries:

🔹 1 at the 5m OB

🔹 1 at a refined 1m OB

May 6, 2025 - EURUSD Sell📉 Bias: Bearish | Risk: 0.5% (+0.5% potential add-on) | 🎯 Targets: 1:3 (75% off), final TP > 1:8

🧠 Reasoning:

Price reacted from Daily Orderblock, broke structure on 15m ⛓️.

Refined entry from 15m OB → 5m OB for more precision on the tap entry🎯.

2x Asia lows below = high-probability targets 🔻.

Looking to add 0.5% if 1m BOS + retracement OB confirm.

⚠️ Note:

There’s unmitigated Asia High & 15m OB above, but too far to affect today’s bearish idea.

May 6, 2025 GBPUSD Sell📉 Bias: Bearish | Risk: 0.5% | 🎯 Targets: 1:3 (take 75%), final target ~1:7

🧠 Reasoning:

Price reacted from a Daily / Weekly Orderblock with confluence from a 15m OB

Asia Low as target provides clean downside structure

Morning Star formed inside the OB → entry taken at the imbalance left behind

10 pip SL covers highs efficiently ✅

XAUUSD. Weekly trading levels 14 - 18.04.2025During the week you can trade from these price levels. Finding the entry point into a transaction and its support is up to you, depending on your trading style and the development of the situation. Zones show preferred price ranges WHERE to look for an entry point into a trade.

If you expect any medium-term price movements, then most likely they will start from one of the zones.

Levels are valid for a week, the date is in the title. Next week I will adjust the levels based on new data and publish a new post.

! Please note that brokers have a difference in quotes, take this into account when trading.

The history of level development can be seen in my previous posts. They cannot be edited or deleted. Everything is fair. :)

----------------------------------------------

I don’t play guess the direction (that’s why there are no directional arrows), but zones (levels) are used for trading. We wait for the zone to approach, watch the reaction, and enter the trade.

Levels are drawn based on volumes and data from the CME. They are used as areas of interest for trading. Traded as classic support/resistance levels. We see the reaction to the rebound, we trade the rebound. We see a breakout and continue to trade on a rollback to the level. The worst option is if we revolve around the zone in a flat.

Do not reverse the market at every level; if there is a trend movement, consider it as an opportunity to continue the movement. Until the price has drawn a reversal pattern.

More information in my RU profile.

Don't forget to like Rocket and Subscribe!!! Feedback is very important to me!

GBPUSD. Weekly trading levels 14 - 18.04.2025During the week you can trade from these price levels. Finding the entry point into a transaction and its support is up to you, depending on your trading style and the development of the situation. Zones show preferred price ranges WHERE to look for an entry point into a trade.

If you expect any medium-term price movements, then most likely they will start from one of the zones.

Levels are valid for a week, the date is in the title. Next week I will adjust the levels based on new data and publish a new post.

! Please note that brokers have a difference in quotes, take this into account when trading.

The history of level development can be seen in my previous posts. They cannot be edited or deleted. Everything is fair. :)

----------------------------------------------

I don’t play guess the direction (that’s why there are no directional arrows), but zones (levels) are used for trading. We wait for the zone to approach, watch the reaction, and enter the trade.

Levels are drawn based on volumes and data from the CME. They are used as areas of interest for trading. Traded as classic support/resistance levels. We see the reaction to the rebound, we trade the rebound. We see a breakout and continue to trade on a rollback to the level. The worst option is if we revolve around the zone in a flat.

Do not reverse the market at every level; if there is a trend movement, consider it as an opportunity to continue the movement. Until the price has drawn a reversal pattern.

More information in my RU profile.

Don't forget to like Rocket and Subscribe!!! Feedback is very important to me!