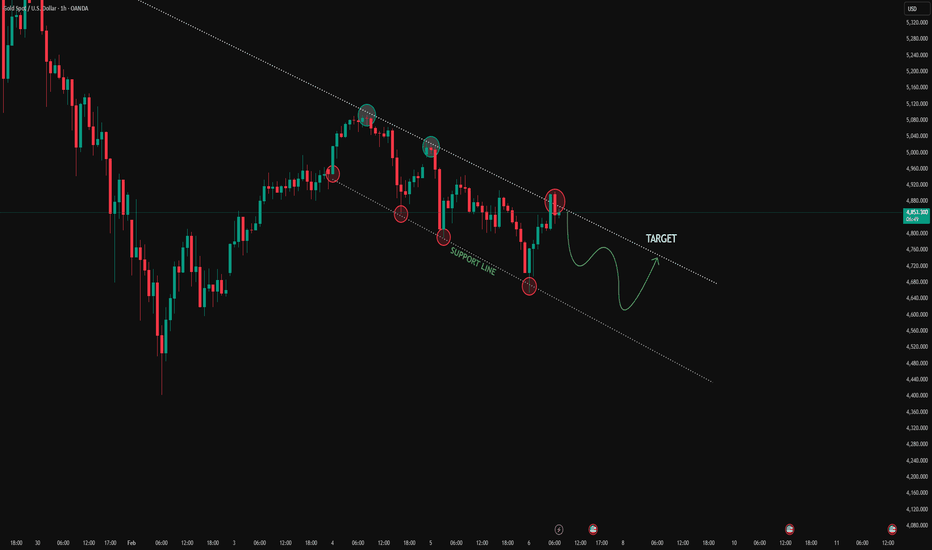

Silver Is Selling Rallies Inside a Descending Channel On the H1 timeframe, Silver remains firmly trapped inside a well-defined descending channel, confirming that the broader short-term structure is bearish. The previous sell-off was impulsive and aggressive, breaking multiple supports and establishing clear downside momentum. Since then, price has respected the channel boundaries, continuing to print lower highs and lower lows.

The recent rebound into the marked supply zone should be viewed as a corrective rally rather than a reversal attempt. Price failed to reclaim the supply area and was quickly rejected, showing that sellers are still active at premium levels. This behavior is consistent with a classic sell-the-rally environment, where upside moves are capped and used for distribution.

From a structural perspective, the primary scenario favors continued downside. As long as price remains below the supply zone and inside the descending channel, further rotation lower toward TP1 and TP2 is likely, with the full target aligned near the lower boundary of the channel. Any minor bounces along the way should be treated as corrective pullbacks within the bearish trend.

The alternative scenario only comes into play if price can break above the supply zone and exit the descending channel with strong momentum and acceptance. Without that confirmation, there is no technical evidence of a trend shift.

In summary, Silver is not bottoming it is redistributing inside a bearish channel. The structure favors patience and trend following rather than countertrend speculation.

Trade the channel. Sell rallies. Let structure do the talking.

Traders

Gold Is Bouncing Inside a Bearish Channel — Relief Rally or TrapGold remains structurally bearish on the 1H timeframe, trading inside a clearly defined descending channel. Recent price action shows repeated rejections from the channel resistance, confirming that sellers are still defending lower highs. The current bounce is coming from the channel support line, where price has reacted multiple times in the past, making a short-term rebound technically reasonable.

However, this upside move should be viewed as corrective, not impulsive. There is no clean break above the descending channel or a confirmed shift in market structure yet. As long as price stays below the channel top and fails to hold above prior swing highs, bullish momentum remains limited and vulnerable to renewed selling pressure.

The key decision area lies at the channel resistance ahead. A rejection there would reinforce the bearish continuation narrative, while only a decisive breakout and hold above the channel would invalidate the downtrend. Until then, this is a market to trade reactions and levels not to assume a trend reversal.

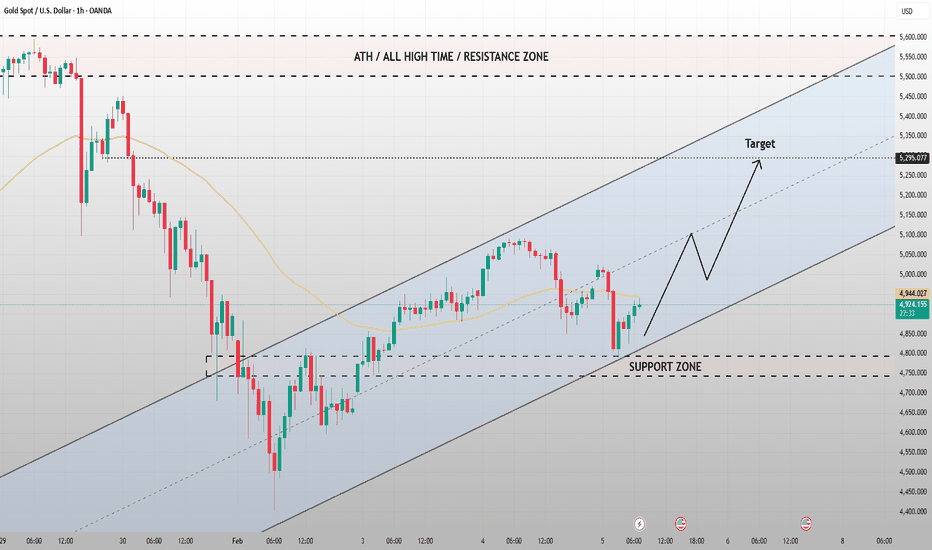

This Still Looks Like a Corrective Range, Not a Breakout SetupOn the H1 timeframe, Gold remains capped well below the ATH / All-Time-High resistance zone, which continues to define the broader upside limit. After the impulsive sell-off from the highs, price transitioned into a recovery phase but has since evolved into a sideways-to-lower corrective structure rather than a renewed bullish expansion.

From a structural perspective, price is currently forming lower highs beneath a descending trendline, while repeatedly testing a clearly defined support zone below. This behavior signals balance and compression, not accumulation. The EMA has flattened and price is oscillating around it, reinforcing the idea that the market is in a corrective range rather than trending with strength.

Price action further supports this view. Each attempt to push higher has been met with selling pressure before any meaningful follow-through can develop. At the same time, the support zone continues to attract buyers, preventing immediate breakdown. This back-and-forth suggests distribution within a range, where both sides are active but neither has taken control yet.

The primary scenario favors continued range rotation or a gradual downside resolution. If price fails to break above the descending trendline and loses acceptance above support, a clean breakdown below the support zone would likely trigger a deeper bearish leg toward the next lower demand area.

The alternative scenario only becomes valid if Gold can break above the descending trendline and reclaim it with acceptance. Such a move would signal that sellers are losing control and could open the door for a broader recovery toward higher resistance levels. Until that happens, upside moves should be treated as corrective.

In summary, Gold is not preparing for a breakout yet. The market remains below ATH resistance and stuck in a corrective range, where patience and confirmation are essential.

Trade the range. Respect ATH resistance. Let structure decide.

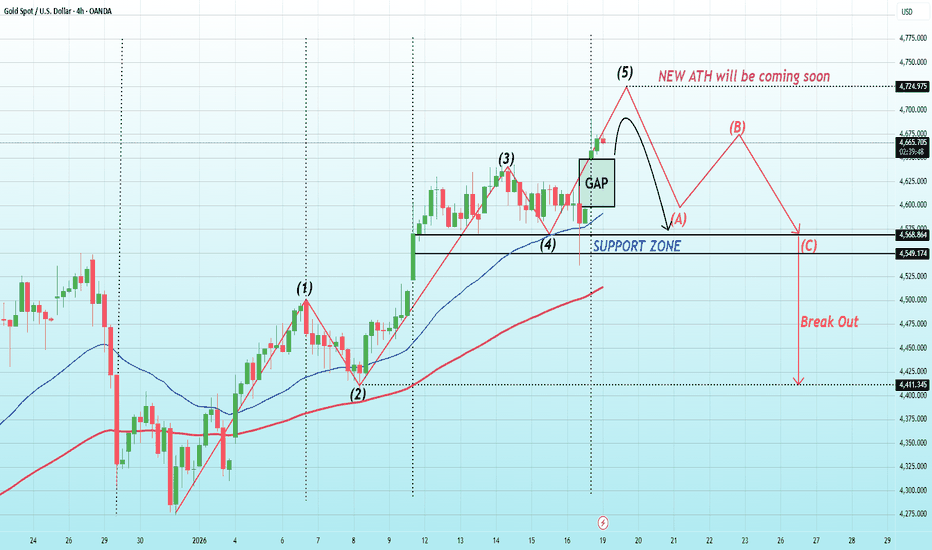

Gold Is Correcting — Structure Still Points to a Larger Upside Gold on the H4 timeframe has completed a sharp impulsive sell-off from the all-time high, followed by a clear five-wave corrective decline into the lower demand zone near 4,400. The rejection from that low was decisive, confirming downside exhaustion rather than trend continuation. Since then, price has transitioned into an ABC corrective recovery, with buyers stepping in around the EMA cluster a typical behavior after a liquidation phase.

From a structural perspective, the current price action is best classified as a counter-trend recovery within a higher-timeframe range, not a full bullish continuation yet. The market is consolidating around the 0.5–0.618 Fibonacci retracement zone, where supply has previously been active. The recent pullback toward ~4,880–4,900 looks corrective in nature, forming a higher low above the EMA 89 a constructive sign as long as this level continues to hold.

If this higher low is respected, the preferred scenario remains a continuation toward the upper range, with a projected path targeting prior supply and liquidity near 5,350–5,600. A clean reclaim of the mid-range resistance would strengthen the bullish case. However, failure to hold above the EMA structure would delay this scenario and reopen the possibility of deeper consolidation. Until invalidated, the bias favors buying pullbacks within structure trade confirmation, not anticipation.

Gold Is Bouncing From Support — But ATH Ceiling Controls GameGold on the H1 timeframe remains in a corrective recovery phase after the sharp selloff from the all-time-high resistance zone. Price is now trading inside a well-defined ascending channel, with recent pullbacks being absorbed cleanly above the highlighted support zone around 4,750–4,800. This behavior suggests stabilization and controlled buying, not panic covering. As long as this support holds, the short-term structure favors continuation within the channel rather than a breakdown.

From a structural perspective, the current advance is still countertrend relative to the prior impulse down, meaning upside moves should be treated as rotations inside the channel, not a confirmed bullish breakout yet. The EMA acts as dynamic balance, and price is oscillating around it — typical of a corrective market seeking equilibrium. The projected path shows a measured push toward the mid-to-upper channel, where liquidity and prior reactions align near 5,140–5,300.

Key invalidation is clear: a decisive loss of the support zone and channel base would negate the bullish rotation and reopen downside risk. On the flip side, a clean break and hold above the channel midline increases the probability of a test toward the upper channel and the ATH supply zone. Until that happens, the correct mindset remains neutral and reactive. Let structure lead trade confirmation, not anticipation.

Gold Is Respecting an Ascending Channel On the H1 timeframe, Gold is trading inside a clearly defined ascending channel, which indicates that the short-term market structure remains bullish. After the impulsive sell-off from the previous high, price found strong demand and transitioned into a controlled recovery, establishing higher lows along the channel’s support line. This confirms that buyers are still actively defending structure.

From a price action perspective, the recent rejection at the channel resistance is important but not bearish by itself. Price failed to break through resistance on the first attempt and rotated lower, which is a normal corrective behavior inside a healthy ascending channel. Notably, the pullback has been contained within the channel, and selling pressure has not expanded aggressively suggesting this is rotation, not distribution.

The primary scenario favors continuation. As long as price holds above the channel support and does not show acceptance below it, the market remains in a bullish environment. A stabilization followed by a higher low would set the stage for another push toward the upper boundary of the channel, aligning with the projected target zone. This would be a textbook “buy-the-dip within structure” setup.

The alternative scenario only activates if price breaks below the channel support with strong momentum and acceptance. Such a move would invalidate the bullish channel and signal a shift into a deeper corrective or bearish phase. Until that happens, downside moves should be treated as corrective pullbacks rather than trend reversals.

In summary, Gold is not failing it is rotating within an ascending channel. The structure remains constructive, and patience is required to let price confirm whether the next move is continuation toward the channel highs or a genuine structural breakdown.

Trade the structure. Let the channel decide.

Gold Is Climbing — But ATH Still Caps the UpsideGold is recovering within a well-defined ascending channel after the sharp sell-off from the all-time high (ATH). The rebound from the lower boundary of the channel was impulsive, showing strong buy-side reaction and confirming that the $4,850–$4,900 support zone remains structurally valid. This tells us the current move is not random — it is a technically controlled recovery driven by short-term demand.

From a structural perspective, price is respecting the channel neatly, printing higher highs and higher lows while holding above the channel midline and EMA support. The recent pause around $5,050–$5,100 looks like a consolidation rather than rejection. As long as price holds above the support zone and stays inside the channel, pullbacks should be viewed as corrective pauses within a bullish recovery phase, not trend failure.

However, upside expectations must remain disciplined. The ATH / major resistance zone around $5,500–$5,560 is still the dominant supply area. Until price decisively breaks and accepts above that zone, any rally should be treated as a structured advance within resistance context. In short: bullish momentum is building, but confirmation only comes with acceptance above ATH. Trade the structure — let resistance prove itself before assuming expansion.

Gold Is Bouncing Inside a Corrective ChannelFrom a technical standpoint, gold is currently staging a reactionary recovery after an aggressive sell-off, with price now developing inside a well-defined ascending channel on the 1H timeframe. The sharp decline from the prior swing high was impulsive and structurally bearish, signaling a markdown phase rather than healthy consolidation. The rebound from the lows is orderly and overlapping, which is typical of a corrective move, not renewed bullish control. Price is now trading around $4,929.00, having reclaimed short-term momentum above the rising channel support. This structure suggests that buyers are active, but mainly in a mean-reversion context following downside exhaustion, rather than in a trend-expansion phase.

Technical Structure & Key Levels

- Gold is respecting an ascending corrective channel after the sell-off

- The recovery leg originated from the downside exhaustion near $4,400.00

- Current price is holding above the channel’s support trendline

- Upside momentum remains corrective as long as price stays below prior supply

Primary Scenario (Corrective Continuation)

As long as the ascending channel holds:

Price can continue rotating higher toward the upper boundary of the channel

A measured corrective target aligns near $5,401.80

This area coincides with prior structural interaction and overhead liquidity

Any move into this zone should be treated as corrective relief, not trend confirmation.

Invalidation / Risk Scenario

The bullish corrective view weakens if:

Price breaks decisively below the channel support

Or fails to hold above $4,860.00 – $4,880.00

A breakdown would signal renewed selling pressure and potential continuation of the broader bearish structure.

Key Takeaway

Gold is recovering by position, but still corrective by structure.

Until price reclaims major resistance and holds above $5,400.00, upside moves remain countertrend.

Trade the channel, manage expectations, and let structure not hope guide execution.

Gold Is Bouncing Inside a Rising ChannelGold on the 30-minute timeframe is rebounding inside a clearly defined ascending channel, following a sharp and impulsive sell-off. This price behavior suggests a corrective recovery, not a full trend reversal. The bounce from the $4,470 – $4,398 support zone indicates that selling pressure has paused, but the broader structure still reflects recovery within a prior bearish impulse rather than renewed bullish control.

From a structural perspective, price is forming higher lows within the channel, with the midline acting as dynamic support. However, upside progress remains constrained by overhead resistance near $5,243, which aligns with previous structure and resting liquidity. As long as price remains below this level, any upward movement should be treated as mean reversion rather than trend continuation.

The primary path forward favors continued rotation inside the channel toward the upper boundary, followed by a potential rejection. Failure to hold above $4,470 would weaken the recovery and increase the risk of a deeper pullback toward $4,398. Only a sustained break and acceptance above $5,250+ would shift the bias away from corrective and toward a more constructive bullish structure.

Gold Just Printed a Buying Climax at All-Time High — Distributio📊Technical Analysis (XAUUSD – 1H)

Gold has just completed a textbook Wyckoff cycle into a new all-time high, and the structure now suggests the market is transitioning from Markup into Distribution, not continuation. The impulsive rally from the demand zone / gap around 5,000 was clean and aggressive, confirming strong institutional accumulation. Price then performed a clear Jump Across the Creek (JAC), followed by a successful test, validating the breakout and triggering the final markup phase.

However, as price reached the 5,580 – 5,600 area, we saw signs of Buying Climax (BC):

- Large bullish candles

- Expansion into fresh highs

- Immediate loss of momentum after ATH

- Tight overlapping candles near the top

This is not consolidation for continuation, it is distribution behavior.

🧠 Wyckoff Logic Breakdown

Phase A–B: Accumulation

- Long base built between ~5,020 – 5,120

- Absorption of supply

- Volume compression

Phase C–D: Markup

- Clean breakout + JAC

- Strong impulsive candles

- No deep pullbacks

- Momentum-driven advance

Phase E: Distribution (Current)

- Buying climax at ATH

- Sideways range with volatility

- Smart money selling into strength

- Retail chasing highs

The market is now deciding whether this range resolves into continuation or markdown and current structure favors distribution → markdown.

🟥 Supply, Demand & Key Levels

🔴 Supply / Distribution Zone

- $5,560 – $5,600

- Repeated rejection wicks

- Failed continuation attempts

🟢 Demand / Liquidity Magnet

- $5,420 – $5,400 (first reaction level)

- $5,300 – $5,250 (range low / breakdown target)

- $5,000 – $5,050 (major demand zone & gap fill)

📉 Probable Scenarios

🔴 Bearish Scenario (High Probability)

- Failure to reclaim and hold above 5,560

- Breakdown below 5,420

- Acceptance below distribution range

- Price accelerates into markdown, targeting prior demand and gap

🟢 Bullish Invalidation

- Strong impulsive break and acceptance above 5,600

- Follow-through with volume

- No upper wicks / no rejection

- Only then continuation toward higher expansion

Until that happens, bullish continuation is NOT confirmed.

🌍 Macro Context

- Gold has already priced in geopolitical risk, rate uncertainty, and USD weakness

- Late-stage buyers are entering after an extended rally

- Institutions typically distribute at ATH, not accumulate

- Liquidity above highs has been cleared — next target is below

This is classic “buy the rumor, sell the peak” behavior.

✅ Trader’s Conclusion

Gold is not weak it is late.

After a full Wyckoff markup into ATH, the market is showing distribution mechanics, not trend continuation.

Until price reclaims ATH with strength, rallies are distribution not opportunity.

Let liquidity decide. Let structure confirm.

BTCUSD Institutional Levels: Sell Premium 97 500–102 000🔱 BTCUSD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Bitcoin positioned in a late-cycle distribution structure with elevated bull trap risk

🔴 Primary sell-side liquidity magnet reclaimed at 97 500 confirms seller interest

🔄 Current price action shows upside probes without sustained acceptance

🧱 Institutional sell zones stacked above market

• 100 000 psychological magnet

• 102 000 technical overshoot and bull trap extension

🟡 Reaction resistance zone at 97 500

📉 Bearish-to-neutral bias remains valid below 102 000

🎯 Downside liquidity objectives

• First buy-side liquidity pocket at 85 000

• Major accumulation and max pain zone at 80 000

⬇️ Market structure shows expansion up without follow-through followed by fast rejection risk

⏳ Expect upside attempts to be sold into rather than accepted

⚠️ Invalidation requires sustained acceptance and consolidation above 102 000

🎯 Strategy Sell strength into premium zones Buy only after liquidity sweep into discounts

🏦 Larger accumulation favored only after buy-side liquidity is cleared below 85 000 to 80 000

🧠 BTC MARKET LOGIC — INSTITUTIONAL READ

• Sellers active at psychological and technical round numbers

• Upside extensions used to distribute inventory

• 97 500 acts as a pivot between distribution and acceleration

• Acceptance above 100 000 required to flip bias

• Failure near highs increases probability of fast drawdown into liquidity pools

• Downside targets represent value zones not momentum trades

🗳️ BTC WEEKLY SCENARIOS — WHAT’S YOUR PLAY?

Which path do you expect for BTC next?

🅰️ Rejection at 97 500 to 100 000 → breakdown toward 85 000

Classic distribution into sell-side liquidity

🅱️ Spike into 100 000 to 102 000 → sharp rejection → fast drop to 80 000

Textbook bull trap and liquidity sweep

🅲 Range below 97 500 → compression → expansion lower into 85 000

Slow build before acceleration

🅳 Your level Drop ONE BTC price you are watching most this week 👇

Gold Short/Long trade analysis on FridayI am looking for gold/XAUUSD short trade if the areas I marked taped and created a nice bear candles. Else I will look for a buy if the support holds. The center in which market now is for traps so avoid that for high probability setup look at the levels I have marked thanks.

It’s Consolidating Strength for the Next DecisionHello traders,

Gold remains firmly embedded within a well-defined ascending channel, with price currently trading near five thousand two hundred eighty after a sharp impulsive advance. The recent expansion leg was clean and directional, signaling strong initiative buying rather than short-term speculation. Importantly, price has stayed above the rising channel support, preserving the broader bullish structure.

The highlighted demand zone near five thousand continues to act as the technical anchor of this move. Previous reactions from this area were swift and constructive, reinforcing the view that pullbacks into this zone are structural retests, not signs of distribution. As long as price remains above this demand, downside movement should be viewed as corrective consolidation rather than trend failure.

From a structural perspective, the path of least resistance still points higher. However, the market is entering a phase where tempo matters more than direction. Rather than pushing vertically into new highs, price is more likely to rotate within the channel, allowing momentum to reset before the next attempt toward the all-time high region near five thousand four hundred. This behavior would align with healthy trend mechanics, not exhaustion.

Invalidation remains clear and objective. A sustained break below the demand zone and channel support would challenge the current bullish bias and force a reassessment of the broader structure. Until that occurs, the trend remains supported and intact.

Gold is not in a rush it is positioning. Let structure lead, and let price confirm.

Gold (XAU/USD) – Bullish Signal Buy Setup Entry: ~5,266 (Demand Zone after full retracement complete on 5m chart)

Target: ~5,290–5,300 (next resistance area)

Invalidation: Sustained break below 5,254

Reason: Price completed retracement into strong demand zone — buyers defending this level for potential continuation higher. Wait for bullish confirmation before entry.

#Gold #XAUUSD #Trading #DemandZone #GoldTrading #Investing #PreciousMetals #InvestorNot financial advice — Technical observation only. Trading carries high risk of loss. DYOR and manage risk properly.

TODAY'S LIMITED STRATEGY JAN 261.Current Market Context

Gold remains in a strong bullish structure on the H1 timeframe, respecting the rising trendline and staying above key EMA (34/89/200) support.

Price has broken above the previous resistance zone (4989–4999) with momentum and is now trading at extended levels.

The market is approaching a high-risk zone, where continuation is possible, but short-term pullbacks are also likely.

2.Key Technical Observations

Strong impulse leg just completed → price is temporarily stretched from the mean.

Stochastic remains in overbought territory, signaling potential short-term correction or consolidation.

Structure still bullish: higher highs & higher lows remain intact as long as price holds above the trendline and dynamic EMAs.

3.Scenarios for Today

Primary Scenario (Bullish Continuation):

If price holds above the broken resistance (4989–4999) and forms a healthy pullback with confirmation, gold can continue its markup toward the next upside target around 5146.

Secondary Scenario (Corrective Pullback):

Failure to hold above the breakout zone may trigger a technical retracement back toward the trendline / EMA support area to rebalance momentum before the next move.

📌 Trading Strategy

Avoid FOMO buying at extended highs.

Preferred BUY setup:

Wait for a pullback into the broken resistance zone (now support) or trendline, then enter only with clear confirmation (price action / momentum reset).

Risk management is critical — market is strong but sensitive at current levels.

Short-term sells are counter-trend only, suitable for scalping with strict stops.

Summary

The broader trend remains bullish and healthy, but price is currently in an extension phase. Today’s focus should be patience and precision—let the market come to your levels. Trade with structure, not emotion.

Trend first. Confirmation always. Discipline above all.

Gold at the Edge of Decision: Blow-Off Top or Bullish Reset OANDA:XAUUSD is currently trading at a critical inflection point, where short-term exhaustion signals are colliding with a still intact higher timeframe bullish structure. This is no longer a simple trend following environment. it is a transition phase, and how price reacts around current levels will define the next multi session move.

1. Technical Structure – Elliott Wave Context

From a structural perspective, Gold has completed a clear 5 wave impulsive sequence:

- Wave (1) → (3): Strong expansion with shallow pullbacks, confirming institutional accumulation

- Wave (4): Controlled correction that respected the rising EMA structure

- Wave (5): Final extension into New All-Time Highs (ATH), accompanied by momentum deceleration

The rejection from Wave (5) is technically healthy. Markets rarely continue vertically after a full impulse they must rebalance liquidity.

At this stage, price behavior strongly suggests a corrective ABC structure:

- (A): Sharp pullback from ATH

- (B): Potential corrective rebound (lower high)

- (C): Final corrective leg into stronger demand

This does not imply a trend reversal yet it implies trend digestion.

2. Support Zone, GAP & EMA Confluence

The highlighted support zone (~4,560 – 4,590) is technically significant because it aligns with:

- Prior breakout base

- EMA dynamic support (blue EMA)

- Structural Wave (4) region

- Unfilled price gap, which markets statistically like to revisit

This creates a high-probability reaction zone, not a blind buy area confirmation is required.

If price holds and stabilizes here, it sets the foundation for a higher low, keeping the macro bullish structure intact.

3. Break Scenario vs Hold Scenario

🔴 Bearish Continuation (Correction Extension)

If price breaks and accepts below the support zone, the correction likely extends toward: ~4,410 (next major liquidity pocket)

This would complete the ABC correction and flush late longs before continuation.

🟢 Bullish Reset Scenario (Preferred if Support Holds)

If price defends the support zone and reclaims momentum, the structure favors:

- A corrective (B) rally

- Followed by consolidation

- Then continuation toward new ATH expansion

The dotted path illustrates this reset → continuation logic.

4. Market Psychology & Liquidity Logic

This phase is where:

- Late breakout buyers panic

- Early trend participants take partial profits

- Smart money looks to rebuild long exposure at discount

Strong trends do not end with clean tops they end after complex corrections that shake confidence.

5. Macro Overlay – Why Gold Is Still Structurally Bullish

From a macro perspective, Gold remains supported by multiple long-term drivers:

- Global monetary easing expectations: Markets are increasingly pricing in rate cuts across major economies in 2026.

- Real yields under pressure: Falling or stagnant real yields historically support Gold strength.

- Geopolitical risk premium: Persistent geopolitical tensions keep Gold bid as a hedge asset.

- Central bank accumulation: Ongoing reserve diversification continues to underpin long-term demand.

These macro forces suggest that pullbacks are corrective, not distributive unless macro conditions materially change.

Gold is not breaking down it is rebalancing.

- The impulse structure is complete

- A corrective phase is unfolding

- Key support will determine whether this correction becomes a launchpad or a deeper reset

Patience is critical here. The highest-probability opportunities emerge after the correction completes, not in the emotional middle.

In strong macro trends, the best trades come after fear not after euphoria.

Is the Market Preparing for a New All-Time High?📊 Market Structure & Price Behavior (H1)

Gold has just delivered a textbook structural shift on the H1 timeframe. After spending an extended period consolidating inside a clearly defined accumulation range, price executed a strong impulsive breakout to the upside, confirming that buyers have taken control of the market. This breakout was not random. The accumulation zone acted as a base where liquidity was absorbed, volatility compressed, and smart money positions were built. Once that process was complete, price expanded aggressively, leaving little overlap a classic sign of markup initiation.

🟢 Support Flip & Resistance Test

Following the breakout, the former range high has now flipped into a support zone, highlighted by the shaded area. Price is currently holding above this support, which is a constructive bullish signal. As long as this level remains intact, the breakout structure is valid.

Above current price, Gold is approaching a short-term resistance zone around 4,690, where we can already see some hesitation and minor consolidation. This behavior is healthy markets often pause to rebalance orders before the next expansion leg.

🔄 Pullback vs Continuation Logic

From a price action perspective, there are two important insights:

- The move up was impulsive, while the current pullbacks are corrective.

- There is no structural damage yet no lower low, no acceptance back into the old range.

This suggests that any pullback into the support zone is more likely to be a retest for continuation, not a reversal.

🧠 Key Scenarios Ahead

Primary (Bullish continuation):

Price holds above the support zone.

Breaks and accepts above the 4,690 resistance.

Opens the path toward a new all-time high (ATH) as marked on the chart.

Alternative (Deeper pullback):

A temporary retracement back into the support zone to collect liquidity.

As long as price stays above the accumulation range, the broader bullish bias remains intact.

🎯 Final Takeaway

Gold is transitioning from accumulation → expansion, and the structure currently favors higher prices. The market is showing strength, patience, and clean price action all characteristics of a healthy bullish environment.

As long as support holds, dips are corrective, and the path of least resistance remains upward.

Trade the structure, respect the levels, and manage risk accordingly.

EURUSD Breaks the Downside Channel — Is the Retest the EntrYEURUSD has just delivered a clear structural shift on the H1 timeframe, breaking out of a well-defined descending price channel that had controlled price action for multiple sessions. This channel was respected cleanly on both sides, confirming it as a valid downside structure rather than random consolidation. The breakout itself is impulsive, with strong bullish candles pushing price decisively above the channel low, the internal swing structure, and the EMA cluster. This type of expansion signals short-covering and fresh demand entering the market, not merely a technical bounce. However, from a professional trading perspective, the breakout alone is not the optimal entry. Price is now approaching a critical retest zone, where the former channel resistance and dynamic EMA resistance converge. This area is technically significant:

- If price pulls back and holds above the broken trendline, it confirms a bear to bull transition.

- Acceptance above this level would validate the move and open the path toward 1.1660, followed by the higher liquidity target near 1.1695–1.1700.

On the flip side, a failure at the retest, especially with bearish rejection wicks or strong bearish closes back inside the channel, would invalidate the bullish scenario and warn of a false breakout, potentially dragging price back toward 1.1580–1.1550.

➡️ Bias: Bullish continuation only if the retest holds

➡️ Key focus: Reaction quality at the broken channel

➡️ Market state: Transition phase patience is critical here

This is no longer a chase trade it’s a reaction trade.

GOLD Weekly Levels: Buy/Hold 4270/4300 Target 4500/4633 🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Gold in wave-4 accumulation after extended impulse

🟡 Primary impulse complete: 3910 → 4500 (H2/H4)

🔄 Current pullback: 4500 → 4268 = corrective, not reversal

🧱 Accumulation zone: 4300–4268 (buy dips only)

📈 Trend remains bullish while above 4210

🚀 Wave-5 target: 4630–4650 price discovery zone

⏳ Expect consolidation before expansion

⚠️ Invalidation: acceptance below 4210

🎯 Strategy: buy & hold dips, don’t chase highs

🏦 Final leg likely followed by larger consolidation

🗳️ Gold Weekly Scenarios — What’s Your Play?

Which path do you have for XAUUSD next week?

🅰️ Hold 4,27x–4,30x → continuation toward 4,500+ / wave-5 extension

🅱️ Dip into 4,25x–4,26x, then rotate higher (accumulation before breakout)

🅲 Acceptance > 4,380 → squeeze confirms upside continuation

🅳 Your level: drop one price you’re watching most next week

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 Swing High / Swing Low

$4,500 → $4,268 — controlled pullback from the wave-3 peak following an extended impulse. The decline into the $4,26x area shows overlap, compression, and reduced momentum, consistent with a wave-4 corrective phase rather than trend reversal. Weekly structure remains constructive while price holds above key invalidation.

📈 Trend

Higher-timeframe:

Primary trend remains bullish following a completed 5-wave impulse on H2/H4, with wave-3 extension from $4,000 → $4,500 confirming strong trend participation.

Tactical:

Current price action fits a wave-4 accumulation / consolidation phase:

Shallow pullback relative to wave-3

Overlapping ranges

Compression above prior breakout structure

As long as price holds above $4,210, the tape favors continuation into wave-5 rather than deeper correction.

🛡 Supports – Accumulation / Buy-Side Zones

$4,300–$4,270 🟢 Accumulation zone

Primary wave-4 basing area. This zone represents:

Prior minor breakout structure

Overlapping corrective price action

Area of strongest dip-buying interest

Preferred zone for buy-the-dip positioning, not aggressive chasing.

$4,250–$4,230:

Secondary support shelf and intraday defense zone. Acceptance below this area would increase corrective risk but does not yet invalidate the bullish structure.

$4,210 🔑 Structural invalidation

Loss and acceptance below $4,210 invalidates the wave-5 continuation thesis and signals a deeper corrective phase instead of immediate trend extension.

🚧 Resistances – Upside Objectives / Expansion Targets

$4,380–$4,400:

First upside resistance and near-term liquidity magnet. A clean reclaim and hold above this zone would confirm wave-4 completion.

$4,500:

Prior high and breakout trigger. Acceptance above $4,500 opens the door for wave-5 price discovery.

$4,630–$4,650 🎯 Wave-5 target zone

Projected wave-5 expansion objective based on prior impulse proportions. This zone represents the final upside leg of the current impulse sequence before a larger-degree consolidation becomes likely.

🧭 Bias Next Week

Primary bias: buy dips within the accumulation zone, do not chase highs.

The market structure favors:

Continued consolidation early week

Holding above $4,250–$4,210

Breakout attempt toward prior highs later in the week

As long as price remains above $4,210, upside continuation remains the dominant scenario.

⚖️ Base Case Scenario

Early week:

Price continues to range within $4,270–$4,330, maintaining compression and absorbing supply from late longs.

Mid-week:

Sustained holding above the accumulation zone invites renewed upside momentum toward $4,380–$4,400.

Expansion phase:

Acceptance above $4,500 triggers wave-5 continuation toward $4,630+, with momentum-driven price discovery.

🚀 Breakout / Invalidation Triggers

Bullish confirmation:

Daily acceptance above $4,500 confirms wave-5 in progress and shifts focus to higher expansion targets.

Bullish invalidation:

A clean break and acceptance below $4,210 invalidates the wave-5 thesis and signals a deeper corrective structure instead of continuation.

🔓 Bull / Bear Structural Lines

Bull structure line:

Above $4,210 — impulse structure intact, dips are corrective and buyable.

Bear expansion line:

Below $4,210 — bullish continuation delayed; opens scope for a deeper retracement toward lower demand zones before any renewed upside.

🧭 Recommended Strategy — Buy & Hold Dips (Accumulation Phase)

⚠️ Illustrative framework, not financial advice. Manage risk according to your own rules.

1️⃣ Primary Strategy — Accumulate Pullbacks

Focus on $4,300–$4,270 for staged long exposure

Avoid chasing strength near highs

Use acceptance and structure confirmation for entries

Risk management / invalidation:

Tactical invalidation: sustained acceptance below $4,210

Upside objectives:

First objective: $4,380–$4,400

Breakout objective: $4,500

Expansion target: $4,630–$4,650 (wave-5 projection)

GOLD Near the Final Push? Breakout Above the Gap Could Open ATHOn the H4 timeframe, Gold is trading within a strong bullish macro structure, and the current price action suggests the market is transitioning into a late-stage expansion phase rather than distribution. The overall trend remains firmly bullish, with price holding well above the rising medium and long-term moving averages a key sign that buyers still control the higher timeframe flow.

From a structure perspective, Gold has already completed a clean impulsive advance from the previous base, forming a classic higher-high / higher-low sequence. The recent consolidation just below the highs is constructive, not weak. Price is compressing above a well defined support zone (around 4,55x–4,56x) while respecting the EMA, showing that sellers are unable to push price meaningfully lower.

A critical technical detail is the unfilled GAP zone above current price. This gap aligns with the upper resistance band and acts as a liquidity magnet. Historically, in strong trending markets like this, gaps are often revisited before any deeper correction occurs. This supports the idea of one more bullish leg toward the highs.

The projected structure on the chart reflects two clear scenarios:

Primary scenario (bullish continuation):

If price holds above the support zone and reclaims momentum, Gold is likely to push through the gap and challenge the previous high, completing the final impulsive leg. A clean breakout and acceptance above this area would strongly increase the probability of a new All-Time High (ATH) in the coming sessions.

Alternative scenario (corrective pullback):

If price fails to hold the support zone, a corrective ABC-style pullback could unfold. In this case, the (A)-(B)-(C) structure would target deeper liquidity below, with the 4,41x area acting as the next major downside support. This would still be considered a correction within a broader bullish trend, not a trend reversal, unless key higher-timeframe supports are decisively broken.

Key Takeaways:

– Trend: Bullish (H4)

– Market state: Consolidation after impulse

– Bullish trigger: Hold support + break above the gap

– Bullish target: Retest highs → New ATH potential

– Bearish risk: Loss of support → deeper corrective leg

📌 Conclusion:

Gold is not showing signs of distribution yet. This is a high level consolidation under resistance, often seen before continuation. As long as the support zone holds, the market is building energy not topping out.