Trades

KHC (Range Trade)Price closed Friday under $40.50 after almost reaching that same price this week but stalling out near $40.44. This stock tends to move slower than others. $41.50 to me is a safe price range with zeroing out at $42 worst case before we lose money. Daily bar Friday closed under the most recent candle before that as well to note. Wave 3 may lowkey be a wave 5 but not sure. Might wait til the fed decision and cpi reports pass next week to get a second look.

PFE (Range Trade)Since the recent news relative to the authorization this past week, price has been making higher highs and lower lows. Only 6 times this year price played around in the $54 -$56 area. I'm banking on price exhaustion from the recent "good" news this past week. Daily is overbought as well. Maybe we can get a bar close or two this week lower than previous to give us some time. If price reaches this resistance area, we will reassess Might wait til the fed decision and cpi reports pass next week to get a second look.

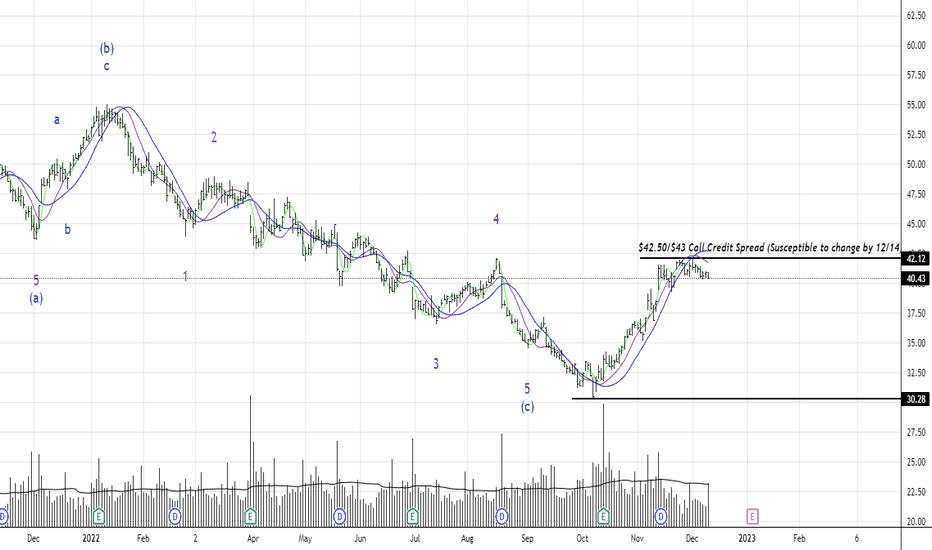

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

GM (Range Trade)$41.48 to $42.36 were two recent noteable highs since September. Price rejected the $41.50 area twice in November. Daily is oversold so we still need to be a bit careful here for the type of range trade we are looking for. Might wait til the fed decision and cpi reports pass next week to get a second look.

S&P500 – TRADES | KW45 | INTRADAYIn today's post I present relevant marks of the S&P500 for the next week, which could support the one or the other, in their own analysis.

= since it is a very short-term time frame, I will not comment further.

= the technical analysis approaches, are shown in individual pictures in the contribution. So that an individual interpretation of the respective - standing alone - is possible.

= the title picture shows an example, of a possible trade. This is one of many possible setups, because the current course is not able to take a clear direction.

The following methods are used and shown in the following:

- SUPPLY&DEMAND ZONES

- FIBONACCI LEVEL

- POINTS OF INTEREST

- TREND LINES

SUPPLY & DEMAND ZONES

"4 hours - time window"

"1 hour - time slot"

FIBONACCI LEVEL

"4 hours - time window"

"1 hour - time window"

POINTS OF INTEREST

"4 Hours - Time Window"

TREND LINES

"4 Hours - Time Window"

"1 hour - time window"

RAW VERSIONS WITHOUT INDENTIFICATION .

"4 Hours - Time Window"

"1 Hour - Time Window"

> Feel free to discuss this in the comments and share our perspectives, I'd be "burning" to hear your take on this.

If this idea and explanation has added value to you, I would be very happy to receive a review of it.

Thank you and happy trading!

GBPNZDI really like this setup here. I started a leg a few moments ago. Price could go a bit lower but the narrative stays the same. Price did not break lower than the start of wave 1 yet. It usually retraces 61% from what I've seen. If price doesn't break the recent low, we could be headed for a wave 3 extension. Not sure if the full impulse wave will play out. However, the rules are fitting thus far. What do you think?

XAUUAS REACHED OUR aimXauusd reached our position in long action from yesterday

But to be honest my first action for buying gold was field but i wrote a comment on my past idea that i will get in at new position for long as you saw in chart but there is NP at this cause all of trading stands on risk management….

Stay tuned for more trades as this (400pips)

Follow for more…