12 Laws of RSI: BTC Edition What if everything you’ve been told about “oversold” and “overbought” was statistically backwards? CRYPTO:BTCUSD

Most traders learn RSI as a simple reversal tool: buy when it’s oversold, sell when it’s overbought. But when you actually test RSI behavior across market structure, volatility conditions, volume environments, and forward‑return distributions, a very different picture emerges. The 12 Laws of RSI (BTC Edition) were created to correct the most common misunderstandings traders have about the Relative Strength Index. These laws rely on statistical findings (Due to be released soon) that summarizes the truth about the behavioral characteristics of how this indicator performs on bitcoin daily chart with a 10-day horizon. Instead of treating RSI as a simple “overbought/oversold” reversal tool, these laws reveal how RSI actually behaves in bull markets, bear markets, momentum phases, and periods of weakness. If you want to use RSI intelligently, these 12 laws are the foundation:

Law 1: RSI Is a Continuation Indicator in Bull Markets, not a Reversal Indicator.

• In bullish market structure (price > MA50 > MA200), treat RSI > 70 as a momentum confirmation, not a sell signal.

• When the market is going up, and RSI is high, do not bet against it, it means that the move is strong and its going to keep going for at least 5 days.

• If the market is strongly moving upward, and RSI is in a strong overbought position, that is an indication of double strength, not a warning sign.

Law 2: RSI < 30 is not a buy signal in bear markets.

• Do not aim for long setups with an RSI under 30 in downtrends, treat the oversold condition if the market is bearish as a sign of continuation in the negative direction.

Law 3: RSI > 70 Outperforms RSI < 30 Over 10 day horizons.

• RSI>70 can be used as a trend-strength filter for continuation setups

• This is the first place where RSI behavior produces a real, measurable statistically significant edge.

Law 4: RSI Behavior is Asymmetric, meaning Overbought does NOT equal oversold conditional wise.

• RSI > 70 has stronger, more consistent continuation in bull markets

• RSI < 30 has weaker, inconsistent bounces in bear markets

• This breaks the concept of the “buy when oversold” and “sell when overbought”

Law 5: Oversold means sellers are in control, not that a immediate reversal is incoming.

• Sellers have been beating up price for days

• This is NOT a buy signal

• RSI < 30 means the price is weak, not a discount alert.

Law 6: Oversold moves are very fast and hard, and are not statistically random.

• Bearish moves are very sharp and aggressive, and usually steep negative movements fall with force

• Sharp drops are going to often keep going rather before they stop

• Expect volatility and instability, not a clean bounce

Law 7: Oversold does not prove that positive returns are within a 10 day horizon.

This is because of how violent price can move in an oversold territory.

Law 8: Oversold price reversals are weak, inconsistent and mostly random.

• RSI values below 30 do not indicate a “bottom is in”

Law 9: Buying the “dip” just because the RSI indicator indicates a bottom is statistically a bad idea.

• Never assume that oversold means “Safe to buy”, you should like always, treat values below 30 as a signal to expect more moves to the downside.

Law 10: It’s not smart to pair volatility indicators to see if you can get a statistical edge with even the best oversold setups with the RSI.

• High volatility oversold, and low volatility oversold produce statistically indistinguishable forward returns, and volatility does not make RSI < 30 better or worse in any reliable way.

Law 11: Trend Indicators with low RSI filters do not offer a “fix”.

• Strong downtrends do not make RSI < 30 reversals any stronger

• All the “Oversold works best after a big dump” narratives fail statistically.

• Avoid rules like “buy RSI<30 after a 10 day crash”

Law 12: Prior uptrends do not offer an extra edge

• High RSI + Prior uptrends do not equal major bull runs are about to occur at all, that’s why you should use good risk management and position sizing, and only sacrifice what you can afford to lose

The 12 Laws of RSI make one thing clear: RSI is not a reversal tool, it is a context‑dependent continuation tool.

High RSI in bull markets signals strength, not danger.

Low RSI in bear markets signals weakness, not opportunity.

Oversold reversals are unreliable, inconsistent, and cannot be repaired with volatility indicators, trend indicators, or deep‑decline indicators.

The only meaningful edge comes from understanding RSI’s asymmetry: RSI > 70 has more continuation power than RSI < 30 has reversal power.

If you want to use RSI effectively, you must stop treating it as a bottom‑finder and start treating it as a market structure aware momentum gauge.

Legal Disclaimer

These laws summarize historical behavior and are provided for educational purposes only.

They do not constitute financial advice, trading recommendations, or predictions of future performance. Cryptocurrency markets are volatile and unpredictable; always use proper risk management and consult a qualified financial professional before making investment decisions.

Trading Plan

The Simplest Trading Strategy Nobody Talks AboutOpen charts. Open six timeframes. Start “analyzing.” and end up more confused than when you started. Daily, 4H, 1H, 15M, 5M, even M1… and somehow you still missed the real move?

Its because, you are looking everywhere and nowhere at the same time.

Problem is not having a simple repeatable plan, so you keep searching for certainty. And the more you search, the more anxious you get. Then you start trading feelings instead of data.

Here is a clean and simple framework which allows you check the charts once per day at 9:30 Same process. Same trigger. Same execution.And most importantly: if the market doesn’t do what we waiting for, you don’t trade. Period. No more stress guess work and wasted time on computer.

🧪 Daily Sweep (manipulation)

Levels to Watch - Daily highs / Lows

Execution Timeframe - M15 / M5 / M3

Confirmation: CIOD - M15 / M5

SL Placement: Above / Below manipulated H/L

Target: fixed 2R - No overthinking 2R and get out.

Instruments: NAS100, US500, US30, GER40

Trading time : 9 - 11 CET 💢 This structure removes all the subjective decisions we traders love to make:

No more “maybe it’ll reverse here.”

No more “I think it looks strong.”

No more hunting entries for hours.

🧪 The whole concept is built around three steps:

1. Direction (Daily Bias)

2. Manipulation (Liquidity)

3. Execution (Rule based + fixed target)

🧩 Step 1: Daily Bias

It's not just random buying and selling daily highs and lows. It has to go with the daily / weekly bias based on the liquidity. It's not dificult. Just look how Daily Candles are closing and follow it. I will explain it below.

⁉️Where is the liquidity ? Always follow the Daily / Weekly candle close.

📈 Continuation

If todays daily candle closed above previous days high and its still not reaching the key level, then liquidity is above todays high. Why ? Because people have intentions to sell highs to early, so and price will most likely go there. So we are bullish. Bullish Close 📈 Reversal

If todays candle wicked above previous day high, but closed below , then we can expect liquidity is below Previous days low. Why? Because mostl likely traders entered fake high break out they put SL below days low. It's signs of reversal. 📌Reversal Setup

first lets have a look to the reversal. We want see a candle high being taken and closed below. In that case draw on liquidity is below the daily low. Sign of reversal. So we can position ourselves in a trade as described on the picture, wick above and close inside is not enough for the signifcant HTF reversal. But its enough for our continuation setup,

📌Continuation setup

We want to see bullish candle close above previous days high and not liquidity taken above that wick. Then we can assume that liquidity is still resting above and we want to position ourselves during the LTF reversal in the direction of the HTF liquidity. 📌 Continuation LTF reversal timing

same case now you must already see it bullish close above PDH and that high was not swept so liquidity is still above , next day is inside candle once price dips below inside candle low we cans spot reversal setup on LTF and by creation of order block we enter the position during the NY session manipulation ‼️ Remember : You’re not predicting the future.

You’re following what the market already printed.

🧩 Step 2: Wait for the manipulation of Daily H/L and rejection(

This is where most traders mess up. No manipulation - No trade. We are focusing solely to the US session it comes usually at 9:30 US time. This is only time you are looking for the setups. This prevents you form sitting by charts whole day and give you a momentum to your trades during active hours of NY session.

In other words you want see manipulation of daily Highs. / Lows around 9:30 US time. Thats your strategy. ‼️ Important detail - CIOD: you wait for the close, If it hasn’t closed back inside the range and bellow consecutive up candles that created manipulation then it’s not confirmed.A wick alone is not enough.

I don’t care how “perfect” it looks mid-candle. I want the close.

❌ No sweep, no trade

This is the rule that saves you from overtrading. If price doesn’t raid the swing level and fail, you don’t have your setup. So you stay out.

🧩 Step 3: Drop to lower timeframe only AFTER confirmation

This part changed my execution.Before, I’d bounce between timeframes all day with no reason. I’d see something on 5M, panic, jump to 1M, enter like a maniac, get stopped, then watch it run.

🧪 CIOD - Change in Order flow - Order block

A down-close candle (before an impulsive move up) that acts as the “last sell” before

Or the opposite for shorts. 🛡️ Risk Management - This is key To keep it going long therm.

🧪 Max 2 attempts.

If trade 1 loses, trade 2 uses half risk.

🧪 Your max daily loss is -1.5R

Trade 1: -1R

Trade 2: -0.5R

🧪 Time is important

If you take these setups during dead hours, you’ll convince yourself the model “doesn’t work.” Time filters are part of the strategy, not an optional add-on. 🧪 Daily Processes

1. Mark swing highs and swing lows.

2. Decide your bias for tomorrow: mainly buys or mainly sells.

3. Wait for price to sweep a prior swing level.

4. Require the close back inside the range.

5. Only then go to 5M and execute using your entry model.

6. Fixed RR. Max 2 attempts. Done.

📒 You have a checklist.

And the market either gives it to you or it doesn’t. That’s the point.

Most traders fail because they treat trading like a constant activity.

This turns it into a conditional activity. 📉 Backtesting advice (so you actually trust it)

If you want this to become real for you, don’t just read it and feel motivated.

Go chart by chart and log:

- Market bias (based on swing points)

- Was there a sweep?

- Did it close back inside the range?

- What entry model did you use?

- RR result

- Time of day

💊 After 20–30 examples you’ll start seeing it everywhere.

💊After 100 examples you’ll stop hesitating.

🎯 When you stop hesitating, you stop improvising.

🎯 When you stop improvising, you stop donating money to the market.

I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk 5.png

Why You Keep Losing Money in the Financial MarketsWhy You Keep Losing Money in the Financial Markets 💸

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

One of the main reasons you keep losing money in the financial markets is that this activity is directly associated with turning money into more money.

This blurs the understanding of the value of skill. In any field, the most important thing is skill, while money is merely the reward for the level of that skill.

A simple example.

A person makes chairs. At the beginning of their journey, the chairs are rough and not very attractive — because they are still developing. But as their mastery grows, the quality of the chairs improves, and with it, their price.

The better they do their job, the more they earn.

When people come to the financial markets, they see someone turning $1,000 into $100,000, or someone else turning $50,000 into $250,000 in a single day. This creates the illusion that this is how it will work for everyone.

It’s important to understand:

Financial markets are not a wish-granting machine. They are a zero-sum game.

If someone makes money, someone else must lose. There is no winner without a loser. That’s how the system works.

━━━━━━━━━━━━━━━━━━━━━━

The Path of a Beginner Trader 🧠

Let’s return to the person who has just entered the market and started their journey.

All experienced traders have gone through the stage where, at first, something seems to work — but eventually the entire deposit (or most of it) gets wiped out.

And at that moment, a choice appears:

Either I quit,

or I continue.

Those who choose to continue are strong people.

But it’s crucial not to fall into madness. You cannot keep doing the same things that already led you to losing your deposit. You must change — both internally and in your strategy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

The Main Reasons for Losses ⚠️

1. Chaos

Chaos in trades.

Chaos in thoughts.

Chaos in the market.

First of all, you need to:

calm down,

take a breath,

structure what you already know,

write it down,

start testing your strategy.

Only this way can you remove chaos from your mind and move away from random, impulsive trades.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

2. Emotions and Impulsivity

Impulsive decisions look like this:

A person sees the last candle going up and enters a long.

The price then reverses and goes down.

And on the higher timeframe, the market is actually in a downtrend.

A person opens a new instrument they have never traded before.

They see a setup similar to another asset and enter without understanding the instrument’s specifics.

After losing part of the deposit, instead of taking a pause, the trader tries to “win back” the loss.

All decisions become emotional — and as a result, even more money is lost.

The most important tool against impulsivity is a pause.

Step away from the chart.

Stop talking about the market.

Switch to something that calms you down.

For me, for example, it’s feeding stray animals — it genuinely brings me back into balance. 🐾

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

3. Opening the Chart Not to Analyze, but to Trade

A very common problem:

A trader opens the chart not to analyze, but with an already (subconsciously) made decision to enter a trade.

They convince themselves:

“I’ll just look at the market, analyze the phase, find a setup…”

But in reality, the decision to trade has already been made, and the analysis is only used as justification.

Here it’s important to learn to observe your own thoughts and honestly answer yourself:

Am I analyzing the market right now — or am I looking for an excuse to enter?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

4. Trading as Emotional Compensation

For a beginner trader, an open trade becomes an emotional game:

Price goes against them → anxiety, fear, stress

Price goes in their favor → euphoria, joy, excitement

Over time, this can turn into a way of escaping reality:

a person experiences negative emotions in life and, instead of solving the problem, goes to the market to get emotions through trading.

This is where signs of gambling addiction begin to appear.

And it’s extremely important not to let yourself reach that state.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

5. Lack of Self-Trust

This shows up when people:

subscribe to signal groups,

copy other people’s trades,

fully rely on opinions from chats.

Here you need to ask yourself an honest question:

Why do you think you are worse?

Why have you decided that you won’t succeed?

This is work with fear and self-esteem.

You can only learn to trust yourself when:

you have structured your approach

tested it through backtesting,

seen consistency,

and only then brought it into live trading.

These are the main reasons that prevent traders from becoming profitable.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Write in the comments 💬

What exactly held you back when you were a beginner trader?

Perhaps your experience will help a newcomer find the answer in your words.

Also, if you’re facing any issues that are holding you back from trading, don’t hesitate to share them in the comments — we’ll help you.

Enjoy!

Why Most Traders Spiral After a Loss And How Professionals Don'tRevenge trading is one of the fastest ways to erase progress and it rarely has anything to do with strategy. This three part series breaks down the discipline systems profitable traders use after a loss to protect capital focus and emotional control.

We walk through how to pre define losses so they do not trigger impulsive behavior why time based resets matter more than jumping back into the market and how focusing on a single pair like GBPUSD reduces emotional noise and prevents overtrading.

These lessons are practical repeatable and built for traders who already understand the basics but want to trade with consistency under pressure. This is about controlling decisions after the loss not avoiding losses altogether.

If you are serious about eliminating revenge trading and building long term discipline this series will change how you respond when trades do not work.

For educational purposes only not financial advice

Stop Revenge Trading The Discipline Strategy Profitable Traders Revenge trading is one of the fastest ways to erase progress and it rarely has anything to do with strategy. This three part series breaks down the discipline systems profitable traders use after a loss to protect capital focus and emotional control.

We walk through how to pre define losses so they do not trigger impulsive behavior why time based resets matter more than jumping back into the market and how focusing on a single pair like GBPUSD reduces emotional noise and prevents overtrading.

These lessons are practical repeatable and built for traders who already understand the basics but want to trade with consistency under pressure. This is about controlling decisions after the loss not avoiding losses altogether.

If you are serious about eliminating revenge trading and building long term discipline this series will change how you respond when trades do not work.

For educational purposes only not financial advice

What a Trading Day Actually Looks Like (No Clickbait)This idea breaks down a real trading day from start to finish without highlights or hype. No constant chart watching and no overtrading just structure and intention.

We walk through how the day is organized including when the charts are reviewed how planning is done before price moves and why most of the day is intentionally quiet. This includes non trading routines like meditation gym time and stepping away from the screen so decisions are not made from fatigue or impulse.

The focus is on building consistency through rhythm not intensity. Trading is treated like a professional practice not an all day reaction to every candle.

Key takeaway

If your day has no structure your trading will not either. Discipline outside the charts creates clarity on the charts.

For educational purposes only not financial advice

How to build a resilient mindset and stop losing moneyHow to Build a Resilient Mindset and Stop Losing Money Because of Yourself

Trading is commonly described through strategies, indicators, market models, and macroeconomics. In practice, however, the decisive factor is not analysis, but a person’s ability to act consistently under conditions of uncertainty.

The market does not follow the logic of an individual trader. It is not required to be fair, consistent, or understandable. The only things truly under a trader’s control are their decisions, reactions, and behavior. This is why psychology in trading is not an “additional skill.” It is the foundation.

Why Trading Breaks the Psyche More Than Other Professions

Trading combines several factors that rarely occur together in ordinary work:

1. Direct Connection Between Decisions and Money

Every action is immediately converted into profit or loss. For the brain, money is equivalent to safety, which is why any fluctuation in the account balance is perceived as a threat.

2. Lack of Predictable Outcomes

Even a perfect decision can result in a loss. This destroys the familiar mental model: “If I did everything right, I should be rewarded.”

3. Absence of External Structure

There is no boss, no fixed working hours, no external performance evaluation. The trader is their own regulator.

4. Random Reinforcement

Sometimes rule-breaking leads to profit, while discipline leads to losses. This creates dangerous behavioral distortions.

As a result, trading becomes an environment where the following are activated:

anxiety

impulsivity

perfectionism

the desire for control

fear of missing out

Without conscious psychological work, these factors gradually destroy even a good strategy.

Key Thinking – Error of Most Traders

The most common psychological error in trading is not fear, greed, or lack of discipline.

It is a false cognitive expectation:

“If I analyze well and follow the rules, I should be right.”

This expectation is deeply rooted in how people are conditioned outside of markets. In school, work, and most professions, correct actions are consistently rewarded. Trading violates this model entirely.

The market operates as a probabilistic system, not a deterministic one.

This means that:

Correct decisions can produce negative outcomes

Incorrect decisions can be rewarded

Individual outcomes contain no reliable information about skill

Most traders intellectually understand this, but psychologically they still evaluate themselves trade by trade. This creates constant internal conflict.

The Correct Mental Shift

A trader does not make money on an individual trade.

A trader makes money on a series of trades executed according to the same process.

When a trader becomes emotionally attached to a single trade, that trade stops being a probabilistic event and turns into a psychological one. The outcome begins to matter more than the quality of execution, and decisions are no longer guided by rules, but by emotional reactions to uncertainty.

As price approaches a stop loss, emotional discomfort increases. To avoid the feeling of being wrong, the trader moves the stop, transforming a defined risk into an undefined one. When a position shows a small profit, fear of losing it leads to premature exits, reducing the average win and damaging expectancy.

After losses, emotional pressure builds. The trader may average into losing positions or increase risk in an attempt to restore emotional balance and regain a sense of control. In other cases, losses create hesitation, causing valid signals to be skipped. As a result, losses are fully realized while winners are partially or completely missed.

Only when individual trades lose emotional significance can probability work as intended. Profit and loss become properties of the series, not of a single decision. At this point, the trader stops trying to be right and starts executing a process consistently.

Accepting Losses as the Foundation of Psychological Stability

Accepting losses is not an intellectual concept but an emotional agreement with the inevitability of loss. Many traders believe they have accepted losses because they understand that losses are part of trading. However, their behavior reveals the opposite. After a stop-out they feel anger, attempt to recover the loss immediately, change strategies after a small series of losing trades, or experience a sharp drop in self-confidence. These reactions indicate that losses are still perceived as personal failure rather than as a normal component of a probabilistic process

Practice: Pre-Agreement With Losses

Before the trading week begins, write down:

acceptable weekly drawdown

maximum number of consecutive losing trades

conditions under which trading must stop

If a loss produces a strong emotional reaction, it is a clear signal that the risk was psychologically excessive, even if it was technically correct according to the rules. Psychological stability is not achieved by avoiding losses, but by ensuring that losses remain within limits the trader can emotionally tolerate without altering behavior.

Trading Plan as a Tool for Psychological Stabilization

A trading plan is often perceived as a technical document focused on entries and exits. In reality, its primary function is to reduce cognitive and emotional load. By limiting the number of decisions that must be made in real time, a plan removes the need for constant judgment and interpretation under pressure.

A well-constructed plan minimizes improvisation, lowers anxiety, and protects the trader from impulsive entries driven by emotion rather than logic. It creates a stable framework in which decisions are made in advance, when emotional arousal is low.

From a psychological perspective, a trading plan must clearly define when trading is prohibited, set maximum risk limits per day and per week, enforce mandatory pauses after losing streaks as well as after unusually large profits, and limit the number of trades that can be taken. These constraints are not restrictions on performance, but safeguards for mental stability.

If a plan cannot be followed during periods of emotional stress, it is not a functional plan. A valid trading plan must be designed to operate not only in optimal mental conditions, but also when discipline is most vulnerable.

Trading Journal as a Mirror of Behavior

Without a journal, a trader’s memory becomes selective. Dramatic losses, random successes, and emotionally intense moments dominate recollection, while the majority of trades fade from awareness. This creates a distorted perception of performance and reinforces false conclusions about skill and strategy.

An effective trading journal does not primarily track the market; it tracks the trader. After each trade, recording the emotional state before entry, the level of confidence, the presence of doubt, any urge to break rules, and the emotional state after exit reveals information that price data alone cannot provide.

After twenty to thirty trades, recurring behavioral patterns begin to emerge. Trades taken out of boredom, increased risk following profits, hesitation or avoidance after losses, and premature exits become visible as consistent tendencies rather than isolated mistakes. At this stage, the journal stops being a record of trades and becomes a diagnostic tool.

Working with a journal is not about refining the strategy. It is about understanding and correcting the trader’s own behavior.

Fear of Missing Out (FOMO)

FOMO is one of the most destructive psychological forces in trading. It does not arise from greed, but from the fear of being excluded from a move, the perception that others are profiting while one is not, and the constant pressure created by social media and shared results. These factors distort judgment and create urgency where none objectively exists.

Effective protection against FOMO must be structural, not emotional. The trading plan should strictly limit entries to pre-defined scenarios and explicitly prohibit participation in impulsive moves that lack proper pullbacks or confirmation. These rules remove discretion at moments of emotional vulnerability.

Most importantly, the trader must accept a fundamental reality of markets: they are not designed to allow participation in every move. Their purpose is to offer choices. Sustainable performance comes not from chasing activity, but from disciplined selection.

Emotional Neutrality: Reality and Myths

Complete emotional neutrality is impossible. Emotions are a natural response to uncertainty and risk. The objective of a professional trader is not to eliminate emotions, but to prevent emotions from influencing decisions.

This requires continuous awareness of one’s internal state, the ability to step away at the right moment, and the discipline to avoid decision-making during emotional extremes. Trades taken under heightened emotional arousal are rarely aligned with a structured process.

For this reason, planned pauses are a critical component of psychological stability.

Pause Practice

After a significant profit, a series of losses, or a strong emotional reaction, trading must stop for a predefined period of time. This practice is not a sign of weakness. It is a form of capital protection that preserves both financial and psychological resources.

Fatigue, Burnout, and Hidden Forms of Self-Sabotage

Burnout in trading rarely presents itself as apathy or disengagement. More often, it manifests as increased trading frequency, irritation toward the market, rising position sizes, declining discipline, and a persistent sense of internal pressure. These behaviors are commonly mistaken for motivation or determination, when in fact they signal nervous system overload.

Trading demands sustained concentration and emotional regulation. Continuous exposure to the market without structured recovery gradually exhausts cognitive resources, making disciplined execution increasingly difficult.

Structuring Practice

To prevent this form of self-sabotage, trading must be deliberately structured. Trading must be divided into:

trading days

analysis days

days completely away from the market

Rest is not a reward for profitability; it is an essential component of a sustainable trading process.

The Most Difficult Skill for a Trader

The most difficult skill in trading is the ability to do nothing when conditions are not met. The absence of a trade is not a missed opportunity, but an expression of discipline and adherence to the plan.

To reinforce this behavior, days without trades should be recorded as completed work. Performance must be evaluated by the quality of process execution rather than by short-term profit and loss. This reframes inactivity as a valid and productive outcome.

Sustainable trading is not built on finding perfect entries. It is built on accepting uncertainty, limiting risk, executing a repeatable process with consistency, maintaining discipline, and working continuously with one’s own psychology.

Trading is not a fight with the market. It is a systematic practice of managing how an individual responds to uncertainty, risk, and expectations.

Enjoy!

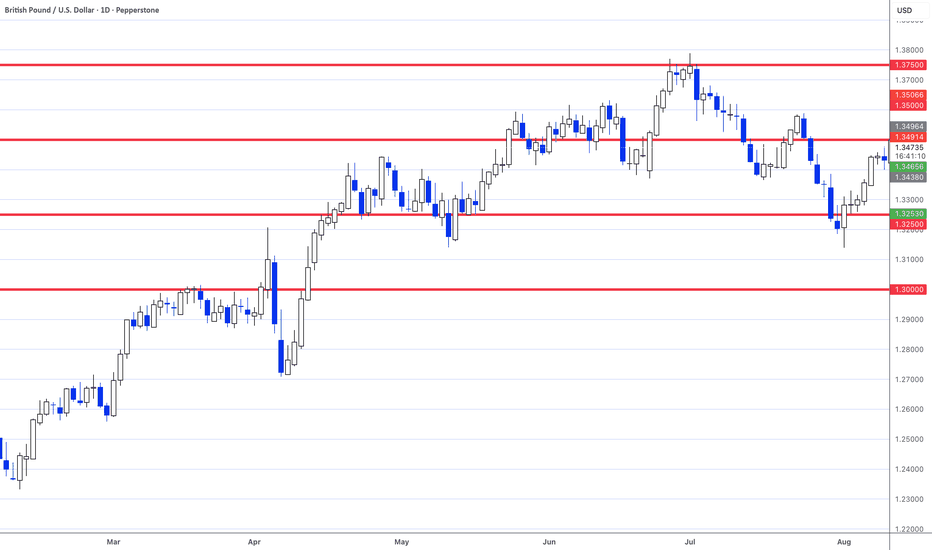

GBPUSD: Fighting the Urge to Interfere with Good TradesLet’s talk about something nobody warns you about when you start trading seriously: trade fatigue.

Right now, GBPUSD hasn’t closed above our stop loss. Technically, the trade is still valid. But price has reversed back into what I call the red zone—that area where nothing productive happens, but everything emotional does.

This is where most traders lose—not on the chart, but in their head.

You start staring at every candle. You refresh the chart like it owes you an explanation. You feel tired, impatient, and strangely irritated. That’s trade fatigue. And it’s dangerous because it makes you want to do something just to feel relief.

Here’s the practical shift:

If price hasn’t invalidated your plan, your job is not to manage the trade—it’s to manage yourself.

This is where alerts save traders. Set an alert at your stop. Set one at your next decision level. Then walk away. Fatigue comes from overexposure, not from drawdown itself.

GBPUSD sitting in the red zone isn’t a problem. You being glued to it is.

CTA: If you’ve ever closed a good trade early just because you were tired of watching it, drop “fatigue” in the comments. I want you to see how common this really is.

Macroeconomic Indicator: Gold-Copper SpreadMacroeconomic Indicator: Gold-to-Copper Spread

The Gold-to-Copper Spread (Gold-to-Copper Ratio) is the ratio between the price of gold and the price of copper, expressed by the formula:

Gold–Copper Ratio = Price of Gold / Price of Copper

This indicator shows how much the price of gold exceeds or lags behind the price of copper at a given point in time. It is often used to analyze market sentiment, assess economic stability, and identify investor preferences.

Gold

Gold is traditionally considered a safe-haven asset. Its price generally rises during periods of economic and financial uncertainty, when investors seek to preserve capital and reduce risk.

Additionally, gold may receive support in the following conditions:

weakening of the US dollar

rising inflation expectations

declining real interest rates

increasing geopolitical risks

growing demand from central banks

Copper

Copper is often called “the doctor of the economy” due to its high sensitivity to industrial production and economic growth. The price of copper typically rises during phases of economic expansion, when demand for commodities and risk assets increases.

The spread reflects only the relationship between the two assets and does not account for other factors such as exchange rates, geopolitics, or changes in monetary policy.

Copper may also rise under the following conditions:

supply deficits (strikes, logistical disruptions, declining production)

structural growth in demand (electric vehicles, energy transition, data centers)

monetary stimulus and growth in global liquidity

weakening of the US dollar

speculative phases in commodity markets

stimulus measures from China

Rising Gold/Copper Ratio

Typically signals:

increase in risk-off sentiment

deterioration in economic expectations

growing demand for safe-haven assets

expectations of recession or slowdown

intensification of geopolitical risks

decline in real interest rates

This is usually accompanied by weakness in equity markets, cyclical sectors, and industrial commodities.

Falling Gold/Copper Ratio

Typically indicates:

strengthening of risk-on sentiment

improving expectations for economic growth

growth in industrial activity

capital inflows into risk assets

the beginning or middle of an economic expansion

It often correlates with rising equity indices, industrial metals (in a “healthy” risk-on regime, copper should rise not alone but together with aluminum, nickel, and zinc), oil, industrial ETFs (XLI), equity indices, PMI, macro data, and bond yields.

The Spread Cannot Be Analyzed in Isolation

Key indicators without which this indicator should not be interpreted:

Real rates

DXY (US dollar)

S&P 500, Russell 2000, Industrial ETF (XLI), oil (WTI, Brent), aluminum, zinc, nickel, CRB Index / GSCI

China: real demand or illusion — declining or growing

Geopolitics

All these metrics can be found on TradingView. It is recommended to create a separate watchlist and monitor them there.

The Spread Is Falling

This means copper is stronger than gold. The base hypothesis is that the market is shifting into risk-on mode. We then verify this using other indicators.

1. Real Rates

Real rates are rising - gold is under pressure, the spread falls for a “healthy” reason.

This confirms that the market truly expects economic growth.

Real rates are falling, but the spread is still falling - copper is rising too aggressively.

This is not a macro growth signal, but rather a sign of copper supply deficit or speculative acceleration.

Conclusion:

If the spread falls while real yields are rising, this is a strong, clean risk-on signal.

If it falls while real yields are declining, distortions are already present.

2. DXY (US Dollar)

DXY is falling - supportive for commodities, copper’s strength looks logical.

This confirms a risk-on environment.

DXY is rising, but the spread is still falling - copper is rising despite currency pressure.

This is often a sign of a local copper deficit or an artificial squeeze.

Conclusion:

A falling spread with a weak dollar is a normal macro scenario.

A falling spread with a strong dollar is a reason to be cautious.

3. What Should Happen in Other Markets

If the decline in the spread reflects true risk-on, typically:

S&P 500 is rising

Russell 2000 is rising faster than S&P (increased risk appetite)

Industrial ETF (XLI) is in an uptrend

Oil (WTI, Brent) is strengthening

Aluminum, zinc, and nickel are rising together with copper

CRB / GSCI commodity indices are moving higher

Key point:

Copper should not rise alone. If you see copper rising, equities flat, oil weak, metals not confirming then this is almost always mean that not macro growth, but a local copper story (supply shock, squeeze, speculation).

4. China: Real Demand or Illusion

Copper is almost impossible to interpret without China.

China PMI rising + credit impulse rising + yuan strengthening

copper growth is fundamentally confirmed

a falling spread = healthy risk-on

China PMI falling + weak economy, but copper rising

this is not macro demand

it is either a supply deficit or speculative flows

Conclusion:

If China does not confirm copper’s move, the decline in the spread loses its macro meaning.

The Spread Is Rising

This means gold is stronger than copper. The base hypothesis is that the market is moving into defense (risk-off). But confirmation is still required.

1. Real Rates

Real rates are falling - gold rising is logical.

If equities and commodities weaken at the same time, this is true risk-off.

Real rates are rising, but gold is still rising - the driver is not monetary.

This is usually geopolitics or fear of systemic risks.

Conclusion:

Rising spread with falling real yields = classic macro risk-off.

Rising spread with rising real yields = the market is genuinely afraid.

2. DXY (US Dollar)

DXY is rising - pressure on commodities, support for gold - the rising spread looks logical.

DXY is falling, but the spread is still rising - gold is rising too strongly.

This is most often a sign of fear, geopolitics, or systemic hedging.

Conclusion:

Rising spread with a strong dollar = standard risk-off.

Rising spread with a weak dollar = a warning signal.

3. What Should Happen in Other Markets

If the rise in the spread reflects true risk-off, typically:

S&P 500 weakens or moves into correction

Russell 2000 falls faster than S&P

XLI (industrial sector) is under pressure

Oil weakens

Industrial metals fall

CRB / GSCI move lower

If instead gold is rising, equities are rising, oil is holding, commodities are not falling, then this is not classic risk-off. It means gold is rising for its own reasons (rates, geopolitics, hedging).

4. China (PMI)

Chinese data weakening + copper falling

the rise in the spread is fundamentally confirmed

the market truly expects a slowdown

Chinese data strong, but copper still weak

the issue is not demand, but other markets

the spread signal is distorted

Geopolitics in the Interpretation of the Gold/Copper Ratio and Markets

Geopolitics is a factor that breaks the normal macro logic of markets.

It is not directly linked to the economic cycle, but it sharply changes capital behavior.

If macro indicators reflect “slow” processes (rates, growth, inflation),

then geopolitics represents shock events that trigger fear, defensive positioning, risk aversion, increased demand for liquidity

That is why it is always considered separately from macroeconomics.

How Geopolitics Affects the Gold/Copper Spread

In most cases, geopolitics, strengthens demand for gold, weakly supports copper, therefore pushes the spread higher

But the key point is:

this is not because the economy is deteriorating,

but because investors are hedging against event risk.

That is why a geopolitically driven rise in the spread often is not confirmed by falling equities, is not accompanied by worsening PMI, does not coincide with changes in interest rates

Enjoy!

“I Was Right” in Trading Has Two Parts, Ego Only Understands OneI’ve written before about the ego trap in trading — how many traders care more about being right than being profitable.

But today, let’s be brutally honest.

Most traders don’t lose money because they lack knowledge.

They lose because they’re addicted to one sentence: “I was right.”

Not “I executed well.”

Not “I managed risk.”

Not “I took profit like a professional.”

Just: “I was right.”

And the most dangerous part is this:

They can lose money…

and still feel successful…

because the chart eventually moved in the direction they predicted.

But trading is not a debate.

Trading is not a prediction contest.

Trading is not an ego competition.

Trading is a performance business.

And if you want brutal clarity, here it is:

✅ “I was right” has TWO components.

And if you only have one of them… you were not right.

The “I Was Right” addiction (and why it destroys traders)

- Being “right” feels good.

- It feeds the ego.

- It gives you the illusion of control.

- It makes you feel smarter than the market.

That’s why traders love saying things like:

- “I called it!”

- “I told you!”

- “Look at price now!”

- “My target got hit!”

But markets don’t reward ego.

Markets reward survival + execution.

So let’s define what “I was right” actually means.

Component #1: The market must move the way you said it would (in the correct order)

This is the part most traders misunderstand.

Because they think being right means: “My target was hit.”

But that’s not what being right means in trading.

Real example (Gold Monday)

Let’s say your Monday analysis looked like this:

“Gold will fill the weekend gap first, and then it will rally to 4850.”

Clean plan.

Clean logic.

Two-step scenario.

Now imagine what actually happens:

- The gap never gets filled

- Price rallies directly

- Gold reaches 4850

And suddenly, people say:

✅ “See? I was right!”

No! You weren’t!

If the entry never happened, you weren’t right

Let’s be brutally clear:

If your plan was gap fill first, and the gap was never filled… then your analysis was wrong.

Even if gold went up.

Even if it went to your target.

Because trading is not about what eventually happens.

Trading is about the path you traded.

Your scenario had a sequence:

- Gap fill

- Rally to 4850

If step 1 fails, the trade idea fails.

The market didn’t follow your plan.

It only coincidentally touched your number.

And coincidence is not skill.

Why this matters (the arguments ego traders hate)

1) A target being hit is meaningless if no trade was triggered

A trade is not a prediction.

A trade is a sequence:

s etup → trigger → entry → execution → exit

If your entry condition never happened, your trade never existed in real life.

So price reaching 4850 doesn’t prove you were right.

It proves only one thing:

Price can hit levels without respecting your logic.

2) You can’t claim correctness without the entry

This is where ego starts cheating.

Instead of saying: “My entry condition failed.”

Ego traders say: “The target was hit, so I was right.”

That’s not analysis.

That’s self-defense.

A forecast without an executable entry is not a trade plan.

It’s a story.

3) If the order of events is wrong, the thesis is wrong

When you say “gap fill first,” you’re implying structure:

- price must retrace

- liquidity must be taken

- imbalance must be resolved

- the market should behave in a specific way

If that doesn’t happen… your read was incorrect.

Price hitting your final level doesn’t fix your thesis.

It only hides the mistake.

4 ) The worst part: it creates fake confidence

And fake confidence is lethal.

Because next time, the trader starts thinking:

“Even if my entry doesn’t happen, my targets are still correct.”

So they begin to:

- chase price

- force entries

- ignore invalidation

- move stops

- overleverage

And that’s how the “I was right” mindset quietly becomes account suicide.

Component #2: Your trade must survive the move (otherwise you were never right)

Now we reach the part that destroys accounts.

Because trading is not forecasting.

- It’s not “October target ideas.”

- It’s not being a chart prophet.

Trading is execution under risk.

And here’s the truth:

✅ The market can move in your direction

❌ and you can still be completely wrong

How?

Because if you didn’t manage risk properly… the market can wipe you out before it proves your target “right.”

Real example: “Gold will reach 4850 said on October” (and you still weren’t right)

Let’s use a real situation.

Imagine it’s October.

Gold is trading around 4300.

And you post confidently:

“Gold will go to 4850.”

Eventually, gold does reach 4850.

And you instantly say:

✅ “I was right!”

But here’s what you ignore — the part that matters:

Before reaching 4850, gold dropped nearly 5000 pips in 6 days

Now let’s speak like adults.

If price moved against you almost 5000 pips in a week… and you were trading margin (not holding physical gold long-term)… then you did “experience volatility.”

Also you experienced something far worse:

✅ you got margin called

✅ you got liquidated

✅ you lost the account

So no — you were not right.

Even if the chart later touched your magical number.

Because trading is not a screenshot.

It’s survival.

The question professionals ask (and ego traders avoid)

When someone says: “Gold will reach 4850”

A professional doesn’t say: “Wow, what a target!”

A professional asks:

- Where is the entry?

- Where is the invalidation?

- Where is the stop loss?

- What’s the position size?

- What’s the maximum tolerated drawdown?

- Can the account survive the path?

Because if you didn’t define the risk… you didn’t make a trading plan.

You made a wish.

And wishes don’t protect accounts.

The difference between analysts and traders

This is where many people get confused.

Analysts want to be correct.

Traders want to get paid.

And you can’t get paid if you treat risk as an optional detail.

That’s why so many people win debates and lose money.

They keep saying:

- “I called it”

- “I was right”

- “check the chart now”

But their account is dead.

And the market does not pay for predictions.

It pays for execution.

The ego trap: “being right” becomes more important than making money

This is the psychological disease behind most retail trading failure.

The ego loves being right because it protects identity.

It allows you to lose money while still feeling smart.

It turns trading into an emotional game where the goal is not profit…

The goal is not being wrong.

But the market doesn’t care about your ego.

There are no grades for “good idea.”

There is no prize for “almost correct.”

There is no trophy for “eventually it happened.”

Only one thing matters:

✅ Did you make money with controlled risk?

If not…

you weren’t right.

The ONLY rule: Right means right in execution, not right in theory

Here’s the rule that destroys the “I was right” addiction:

A prediction is not correctness.

Correctness is profitability with survival.

So yes — “I was right” has two parts:

1) The market moved exactly as expected (including the sequence)

and…

2) Your execution survived the path

Miss either one?

You weren’t right.

You were lucky.

Or reckless.

Or both.

Final message: Stop trying to be right — start trying to be profitable

You don’t need to win against the market or arguments with others.

You need to work with the market.

You don’t need perfect forecasts.

You need:

- clear invalidation levels

- realistic timing

- risk control

- the ability to survive

Because a trader who survives can always come back.

But a trader who blows up while being “right”… will never trade the next opportunity.

And that is the most expensive form of correctness.

The market doesn’t reward conviction and hypothetical targets reached

It rewards execution.

Best Regards!

Mihai Iacob

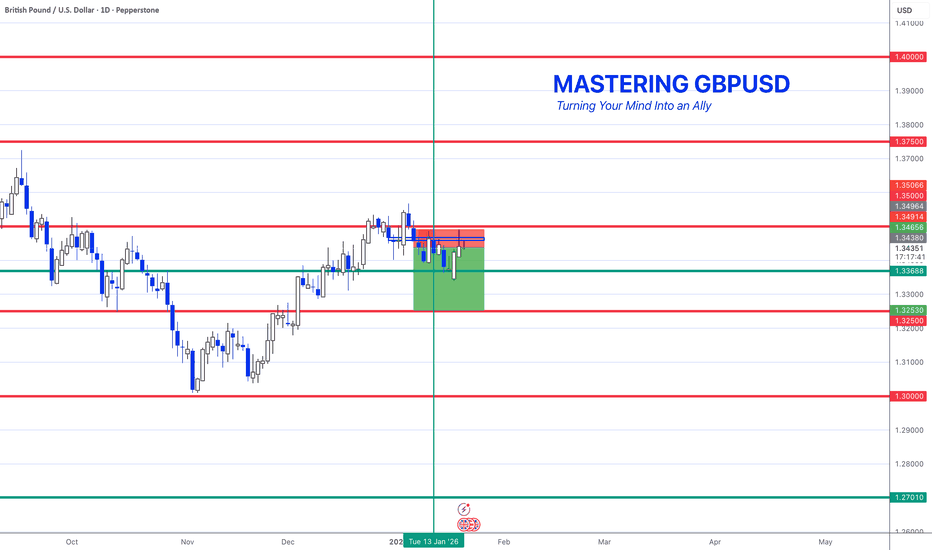

Psychology: Mindfulness in Trading: Your Mind = Your AllyUnlock the secrets to mastering GBPUSD in this three-part series designed for traders ready to level up. Learn how to fight impulsive trading urges, embrace mindfulness to stay calm under pressure, and gain full control by focusing on a single pair. Each video is packed with practical insights, real examples, and actionable strategies you can apply immediately to your TradingView charts.

Discover how to:

Recognize and control trading impulses for better decision-making.

Use mindfulness and alerts to manage drawdowns and avoid stress.

Track GBPUSD like a pro, from lot sizes to price behavior, and build confidence in every trade.

Whether you’re coming back to trading or leveling up your consistency, this series gives you the tools to trade smarter, not harder.

CTA: Watch all three videos, apply the strategies to your charts, and comment below with your biggest takeaway—I’ll respond with tips to help you master your trades even faster.

EDUCATION: Mastering One Pair – Why Less Is More in ForexUnlock the secrets to mastering GBPUSD in this three-part series designed for traders ready to level up. Learn how to fight impulsive trading urges, embrace mindfulness to stay calm under pressure, and gain full control by focusing on a single pair. Each video is packed with practical insights, real examples, and actionable strategies you can apply immediately to your TradingView charts.

Discover how to:

Recognize and control trading impulses for better decision-making.

Use mindfulness and alerts to manage drawdowns and avoid stress.

Track GBPUSD like a pro, from lot sizes to price behavior, and build confidence in every trade.

Whether you’re coming back to trading or leveling up your consistency, this series gives you the tools to trade smarter, not harder.

CTA: Watch all three videos, apply the strategies to your charts, and comment below with your biggest takeaway—I’ll respond with tips to help you master your trades even faster.

PCE — What the market will see on Thursday (22 January 2026)Introduction

On Thursday, January 22, the Core Personal Consumption Expenditures (PCE) Price Index will be released in the United States. Ahead of the release, we decided to take a deeper dive into macroeconomic theory and revisit what PCE is and how its data influence financial markets.

The PCE (Personal Consumption Expenditures) Price Index is a comprehensive measure of inflation that tracks changes in prices for all goods and services consumed by households within the country, regardless of the source of funding. Its conceptual depth lies in the fact that it reflects the actual cost of consumption across the economy, not merely the out-of-pocket expenses of individual consumers.

The Federal Reserve views PCE as its primary gauge of inflationary pressure due to its deeper analytical structure and methodology, which is largely free from certain statistical distortions and explicitly accounts for behavioral aspects of consumer choice.

CPI vs. PCE

While CPI answers the question:

How much more expensive has life become for the average urban consumer?

PCE addresses a broader one:

How much more expensive has total final consumption in the economy become?

This makes PCE more macroeconomically representative. It includes not only household spending, but also expenditures by non-profit institutions serving households.

The core methodological difference between the two indices lies in how they treat consumer behavior.

CPI assumes relative rigidity in consumption habits:

its basket is updated with a lag

its calculation implies that households continue purchasing the same goods even as prices rise, simply paying the higher cost

PCE, by contrast, incorporates rational behavioral flexibility. The Fisher chain-weighted index used in its calculation reweights components on a quarterly basis, reflecting the natural shift in demand toward relatively more affordable substitutes. This substitution effect not only reduces the indicator’s volatility, but also aligns it more closely with real-world consumer spending dynamics, where price changes are a key driver of budget reallocation.

An important clarification regarding the relationship between CPI and PCE:

the two indicators are highly correlated

PCE typically prints slightly lower readings than CPI

this persistent gap is a structural result of methodological differences in how the indices are constructed

What to Focus on in the Release

When CPI data are released, the most reliable way to assess underlying inflation pressure is to focus on Core CPI.

The same logic applies to PCE.

The headline figure (Headline PCE) carries a significant risk of misinterpretation due to its elevated volatility, which can distort the perception of the underlying price trend. Core PCE, stripped of these destabilizing components, serves as a far more reliable compass, pointing to the deeper inflationary forces in the economy — precisely the forces that shape the long-term path of monetary policy.

With this framework in mind, we can move on to a more precise interpretation of the data.

When the report is released, greater emphasis should be placed on the monthly (m/m) Core PCE reading, as it is more sensitive to short-term changes in inflation. Even if inflation accelerates in the current month (a high MoM print), the year-over-year figure may continue to decline for several months due to base effects — comparisons against elevated readings from the prior year.

It is also important to pay close attention to revisions of the previous month’s data.

The market evaluates releases through the lens of trend, which is often just as important — if not more so — than a single data point.

For example, imagine that the current month’s Core PCE comes in exactly in line with consensus at 0.2%. At first glance, this looks benign. However, if the previous month’s figure is revised upward from 0.3% to 0.5%, the picture changes entirely. Such a revision would be inconsistent with the Fed’s 2% inflation target and would undermine the narrative of a smooth and sustained disinflationary trend.

Market Reaction

Market reaction to inflation data is fundamentally driven by expectations of future Federal Reserve actions. A sustained rise in inflation reinforces a hawkish scenario: the Fed is forced to maintain or tighten monetary policy, which leads to higher interest rates, a stronger dollar, rising Treasury yields, and downward pressure on equities.

Conversely, a consistent decline in inflation signals that the Fed’s measures are working and opens a dovish window for potential easing in the future. This implies the prospect of rate cuts, which typically acts as a catalyst for equity markets, while pushing Treasury yields lower and weakening the domestic currency.

However, accurate analysis is impossible without considering the broader macroeconomic context. For instance, if a prevailing trend has already been established by weak labor market data and a soft CPI report, even a neutral PCE release that comes in line with consensus is often interpreted as a confirmation of that trend. In such an environment, the absence of a negative surprise becomes a positive signal in itself, providing additional support for equities.

That said, the key element of analysis remains the probability of a fundamental surprise capable of breaking the existing trend built on earlier releases. Labor market data and CPI set the preliminary direction of expectations, but they do not carry finality. The PCE report, acting as a strategic “closing argument,” carries sufficient weight in the eyes of both the Fed and market participants to trigger a full reassessment of the priced-in scenario. A material deviation from consensus can do more than merely adjust expectations — it can invert the prevailing market logic altogether, leading to a regime shift across currency, bond, and equity markets.

Conclusion

Ultimately, market dynamics are a complex fusion of countless factors whose interactions often defy linear logic. This is precisely why outcomes so frequently diverge from even the most well-reasoned forecasts.

The only way—if not to tame, then at least to comprehend this force—is to develop your own analytical judgment. Critical thinking and the ability to construct an independent view of reality are the most valuable tools in a world with no guarantees and no ready-made solutions. Neither the forecasts of research desks nor the opinions of popular commentators can replace your personal ability to interpret data, weigh risks, and connect fragmented facts into a coherent hypothesis. This is the path from following noise to understanding signal.

Enjoy!

Indices Futures or Forex? The Practical Truth Nobody MentionsToday is not gonna be technical. There is a lot of debate online about whether Indices futures or forex is better, but most of the time this discussion is completely disconnected from real trading life. Im not saying one is better than the other here is just my recent observations.

The real differences are not hidden in some advanced strategy. They are very practical. Spreads, fees, Trading hours, chart quality, and how all of this fits into your daily routine.

From a cost perspective, Indices futures are very transparent. You know exactly what you pay per contract and the spread is usually tight and stable. What you see is what you get.

Forex works differently. Costs are mostly built into the spread and swaps that spread can widen. This does not make forex worse, but it does change how clean your execution feels, especially if you trade intraday.

💊 Trading form US Timezone

I spent the last two weeks in the US, and for the first time I fully felt what it means to miss the London session. Opening the charts straight into New York felt completely different, almost like stepping into the market mid-story. As I perform better in reversal and market manipulations joining continuation setups was not comfortable for me. Why?

Because, during London session is where most of the manipulation and real positioning happens for Forex. That is where liquidity is built, swept this is where Im usually entering for past few years. No saying that New York also cannot make a manipulations and good setups, but trading just New York session felt like having just a half time to trade.

That experience helped me understand why so many US traders focus almost exclusively on the US Indices Futures Day-trading like NQ, ES and YM.

📌 Trading time

US Futures traders getting ready around 9 am. Real move usually starts at after 9:30 manipulation. I believe that we are focusing best in the morning hours, so US day traders can be basically done before the lunch. Then the platform is closed and life continues. That is the point of trading and I can imagine doing that if living in the US.

In Europe, the reality is flipped. Trading US Indices futures means coming to the charts in the afternoon around 3pm, which for me and many people is when focus and energy are already lower. However it can fit to someone who has some job or school and don't have other option.

🧩 Forex Traders

Forex traders usually watch many pairs at the same time on timeframes like W1, D1, H4, M15. for swing trades or intra week trades. If you scalping in and out in the CFD broker you should consider Futures E6 etc... contracts for better fees which can make difference in the your final profitability.

🧩 Futures day traders

Usually specialize to One market. And watches other highly correlated as NASDAQ, S&P, Dow,, which allows traders to use relative strength and SMT between NQ, ES, and YM instead of scanning dozens of charts. Timeframes M1, M3, M5, and levels.H1, H4, D1

📉 Chart quality Futures

Futures Contracts are centralized. One market, one price feed. A NQ chart looks the same on every platform and with every broker. Highs, lows, wicks, and closes are identical. Your analysis is based on the market itself, not on which broker you use.

📉 Chart quality Forex

FX is decentralized. Every broker uses slightly different liquidity sources, and that creates differences in candles. Sometimes small, sometimes big enough to completely change your analysis. One broker shows a clean sweep of a level, another one does not. One candle taps a key level, another misses it by a few pips. If you trade price action or liquidity concepts, this can create hesitation and second-guessing.

So if you ask me whether futures or forex is better, my answer is simple.

Trading let you express yourself like nothing else and you really need to find yourself comfortable in your approach. Trading should adapt to your life and your energy, not force you to adapt your life to the charts. I would say it can depends on:

🧪 1. What kind of trader you are

- Day trader - Entering and Closing multiple trades in a day - Go Futures

- Swing Trader - Watching also cross pairs and holding for days / weeks - CFD is good

🧪 2. Where you are based

- United States - Indices Futures day trading is usually option for most traders, because waking up at 2am for London session is not suitable for everyone. Also at 5PM US time spreads are already widen.

- Europe - You can take advantage of London session which is where mostl of the Forex Market movements starts. If scalper - go with Indices Futures as FDAX, if scalping FX got with futures contracts E6 - EURO etc...

⭕ Summary:

I can not say one is better than the other, go with the one that fits your lifestyle, timezone and your mainly your trading style.

Let me know your experience and what I missed

I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk

TRADING DISCIPLINE — READ BEFORE YOU TRADE!!Every trade must have a reason.

Not a feeling. Not FOMO.

Entry & Exit

You only enter when there is clear confirmation or a specific price level that fits the plan.

Your stop loss is placed at the invalidation level if price reaches it, the idea is wrong.

Take profit is set based on realistic market conditions, not greed.

Once the stop loss is set, it is final. Never widen your stop loss.

What you decide before entering is your responsibility as a disciplined trader.

Risk Management

Risk per trade is 1%. Maximum 2.5% only when using a high win-rate strategy.

You must have daily and weekly loss limits.

When the limit is hit, stop trading! your mindset is no longer objective.

The market will always be here tomorrow, but your capital might not be.

Limit the number of trades per day, because more trades do NOT mean more profit.

Never trade during high-impact news. Trade after the news, when direction is clearer.

Market & Timeframe

Define bias on the higher timeframe.

Execute on the lower timeframe.

Never trade against the higher timeframe context.

Market Conditions

Always understand the environment: bull or bear market.

Identify market structure / trending or ranging.

Avoid unstable or chaotic volatility.

Trade only during your chosen market session: Asian, London, or New York not all sessions.

Psychology

Losses are business expenses.

Wins don’t justify breaking rules.

If you’re tired or emotional, don’t trade.

Discipline over emotion.

Always.

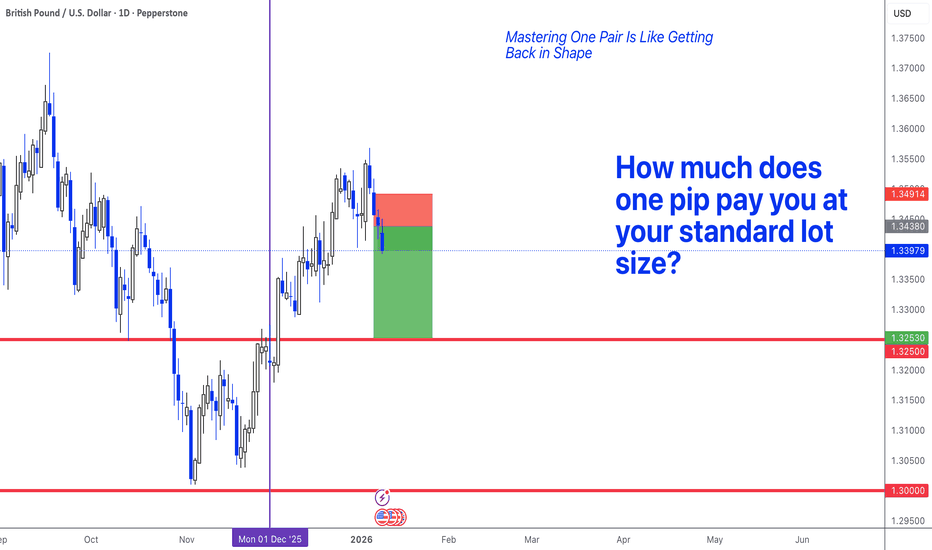

GBPUSD PSYCHOLOGY: Profitability is a Decision, Not a StrategyMost traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

How To Make Macroeconomics Work For YouIntroduction

Trading around news releases is a powerful tool in financial markets.

The ability to identify the direction of the economy and understand market behavior is a skill that requires patience and extensive practice. In this post, we break down the theory behind trading macroeconomic releases and systematically explain how to form a structured view of the market.

Actual vs. Consensus

In almost any economic calendar, you will see a consensus / forecast column. To properly understand released macroeconomic data, it is not enough to simply look at the headline number. The key to interpretation lies in comparing the actual result with the consensus forecast.

This deviation — often referred to as a “surprise” — is the primary driver of volatility in financial markets.

The reason is that the market is a forward-discounting machine. By the time a report is released, asset prices already reflect the prevailing consensus expectations. The market has priced in a specific scenario. When the actual data comes in above or below those expectations, an immediate repricing occurs — the market reassesses future growth, inflation, and central bank policy paths, adjusting prices to reflect the new information.

Therefore, at the moment of the release, the market is not reacting to the number itself, but rather correcting a previously held — and potentially incorrect — expectation. It is this collective and instantaneous adjustment that creates the surge in volatility we observe around economic data releases.

Trend

Trend is the alpha and omega of analysis — the foundation upon which most trading systems are built. This principle fully applies to macroeconomics as well: to correctly interpret a single data release, one must clearly understand the trend in which the economy, or a specific sector, currently operates.

Yes, a trend on its own rarely generates the same explosive volatility as an unexpected deviation from consensus. However, its role is far more fundamental: the trend is what shapes the consensus itself. The dynamics of previous months define the baseline for analysts’ forecasts and market expectations.

Without accounting for the trend, an individual macro indicator becomes just a number in a vacuum. It may point to completely opposite scenarios depending on interpretation. Data must be evaluated in context and over time. A sector may be performing below its long-term averages, but consistent improvement over recent quarters can be a clear signal that central bank policy is having a positive effect. Conversely, a peak reading within a broader downtrend is far more likely to be a statistical anomaly than a genuine turning point.

Historical data serves as a compass for central banks. By understanding what is “normal” for a given sector, policymakers can interpret readings that break away from the trend not as noise, but as structural shifts — a “slowdown in growth” or a “fundamental change in trend.” This is the power of trend analysis: it separates signal from noise, transforming raw data into a coherent picture of the economic cycle.

Context

Accurately understanding the macroeconomic landscape and anticipating market reactions is only possible when data is viewed collectively, not in isolation. Financial markets are complex, interconnected systems, where developments in one sector inevitably ripple through others.

Labor market data directly shape inflation expectations. Central bank decisions and forward guidance impose structural constraints, defining not only the current phase of the cycle but also future conditions across the entire spectrum of assets.

Equally important is the global political and geo-economic backdrop. These forces either introduce a risk premium, increasing volatility, or reduce uncertainty, making outcomes more predictable.

Together, all of this forms the context — the interpretive framework in which numbers exist. Without it, even the most significant deviation from forecast is nothing more than a statistical outlier. Context turns fragmented data into a coherent narrative, allowing us to understand what is truly happening in the economy and where capital is flowing.

The ability to identify this context is the core skill that translates the language of macroeconomic statistics into the language of real market movements.

Federal Reserve Policy

We have reached the key element that determines the development of both individual sectors and the financial market as a whole. Central bank policy is the primary force that sets the rhythm of market movements. Most forecasts and trading strategies ultimately boil down to an attempt to anticipate the regulator’s next steps.

When analyzing a new set of data, the first question we ask is:

what does this mean for the Federal Reserve? What actions will the regulator take to stabilize conditions or support positive momentum?

To do this, the central bank has a set of fine-tuning tools at its disposal. By understanding how each of them works, one can form well-reasoned assumptions about the future direction of financial markets. The central bank’s toolkit includes:

• the policy interest rate

• the interest rate on reserves

• forward guidance

• balance sheet operations

• open market operations

• direct lending facilities

All of these are important, but the central role belongs to the policy rate — the Federal Funds Rate (FFR).

The policy rate is the central bank’s main interest rate. It defines the base cost of money in the financial system and serves as the primary benchmark for all other interest rates in the economy. By adjusting it, the central bank directly influences inflation and economic activity.

Accommodative stance (rate cuts):

The central bank lowers borrowing costs for businesses and households. This expands the money supply and stimulates demand, supporting economic growth, but it also creates inflation risks and may put downward pressure on the national currency.

Restrictive stance (rate hikes):

The central bank makes borrowing more expensive. This cools demand, slows economic activity, and restrains inflationary pressure. In such an environment, the cost of money in the economy rises, often leading to a strengthening of the national currency.

Thus, by monitoring the Fed’s rate decisions, we gain insight not only into the current diagnosis of the economy, but also a clear signal of the environment — accommodative or restrictive — in which all markets will operate in the near future.

Which Data Actually Move the Market?

Having mastered the basic principles of macro analysis, we move on to practice. Now, when looking at an economic calendar, we no longer see just a list of events — we understand their meaning and can anticipate market reactions. To do this, indicators must be grouped by the type of information they provide about the state of the economy.

1. Inflation Indicators

CPI (Consumer Price Index) and especially Core CPI are the primary measures of consumer inflation and directly influence central bank decisions.

2. Labor Market Data

• NFP (Nonfarm Payrolls) and the Unemployment Rate (UR) are key indicators of labor market health.

• AHE (Average Hourly Earnings) reflects wage-driven inflationary pressure.

• JOLTS (Job Openings, Quits) are leading indicators of labor demand and worker confidence.

• Jobless Claims provide a weekly “pulse check” of the labor market.

3. Consumer Demand Indicator

Retail Sales are the main barometer of consumers’ willingness to spend and a key component of GDP.

4. Leading Indicators

PMI (Purchasing Managers’ Index) from ISM and S&P Global is the most important monthly leading indicator, capturing sentiment and the pace of change in the real economy (manufacturing and services).

Beyond these indicators, there are many other important metrics (industrial production, consumer confidence, housing data). However, we focus on the primary market movers — the releases that generate the most volatility and most often reshape the market narrative. Understanding these four categories provides the key to decoding the majority of price movements driven by macroeconomic news.

Inflation Indicators (CPI and Core CPI)

These indices track changes in the cost of living. Imagine a basket that contains everything a typical household buys: food, gasoline, housing costs, clothing, and medical services.